Update on ASEAN Infrastructure Fund Limited AFCDM-WG 14 February 2022

18 Slides3.52 MB

Update on ASEAN Infrastructure Fund Limited AFCDM-WG 14 February 2022

CONTENTS I. Background II. Key Activities 2021 AIF Background Information Financials and Portfolio ACGF Operations and Mainstreaming 2

1.ASEAN Infrastructure Fund: Background 3

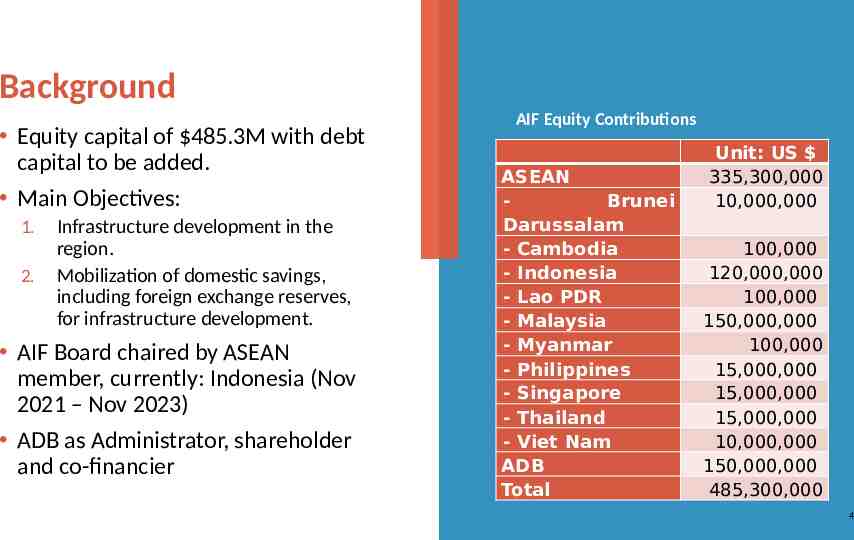

Background Equity capital of 485.3M with debt capital to be added. Main Objectives: 1. 2. Infrastructure development in the region. Mobilization of domestic savings, including foreign exchange reserves, for infrastructure development. AIF Board chaired by ASEAN member, currently: Indonesia (Nov 2021 – Nov 2023) ADB as Administrator, shareholder and co-financier AIF Equity Contributions ASEAN Brunei Darussalam - Cambodia - Indonesia - Lao PDR - Malaysia - Myanmar - Philippines - Singapore - Thailand - Viet Nam ADB Total Unit: US 335,300,000 10,000,000 100,000 120,000,000 100,000 150,000,000 100,000 15,000,000 15,000,000 15,000,000 10,000,000 150,000,000 485,300,000 4

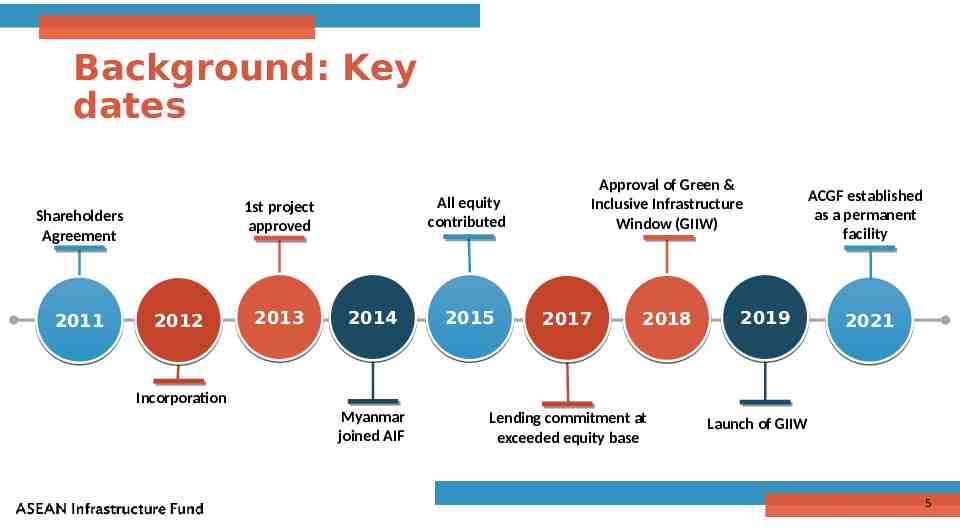

Background: Key dates Shareholders Agreement 2011 All equity contributed 1st project approved 2012 2013 2014 2015 Approval of Green & Inclusive Infrastructure Window (GIIW) 2017 2018 2019 ACGF established as a permanent facility 2021 Incorporation Myanmar joined AIF Lending commitment at exceeded equity base Launch of GIIW 5

2. Summary of Key Activities in 2021 A. Financials and Portfolio 6

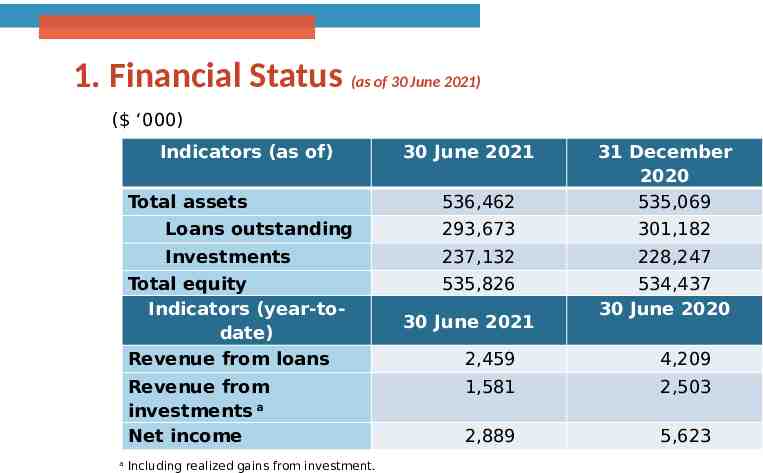

1. Financial Status (as of 30 June 2021) ( ‘000) Indicators (as of) Total assets 536,462 31 December 2020 535,069 Loans outstanding 293,673 301,182 Investments 237,132 228,247 Total equity Indicators (year-todate) Revenue from loans Revenue from investments a Net income a 30 June 2021 Including realized gains from investment. 535,826 30 June 2021 534,437 30 June 2020 2,459 4,209 1,581 2,503 2,889 5,623

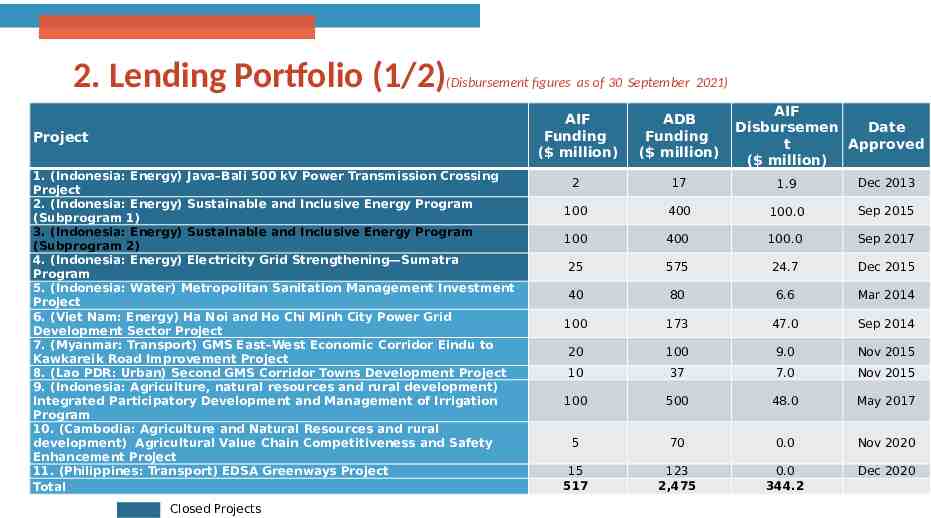

2. Lending Portfolio (1/2) (Disbursement figures as of 30 September 2021) Project 1. (Indonesia: Energy) Java–Bali 500 kV Power Transmission Crossing Project 2. (Indonesia: Energy) Sustainable and Inclusive Energy Program (Subprogram 1) 3. (Indonesia: Energy) Sustainable and Inclusive Energy Program (Subprogram 2) 4. (Indonesia: Energy) Electricity Grid Strengthening—Sumatra Program 5. (Indonesia: Water) Metropolitan Sanitation Management Investment Project 6. (Viet Nam: Energy) Ha Noi and Ho Chi Minh City Power Grid Development Sector Project 7. (Myanmar: Transport) GMS East–West Economic Corridor Eindu to Kawkareik Road Improvement Project 8. (Lao PDR: Urban) Second GMS Corridor Towns Development Project 9. (Indonesia: Agriculture, natural resources and rural development) Integrated Participatory Development and Management of Irrigation Program 10. (Cambodia: Agriculture and Natural Resources and rural development) Agricultural Value Chain Competitiveness and Safety Enhancement Project 11. (Philippines: Transport) EDSA Greenways Project Total Closed Projects AIF Disbursemen Date t Approved ( million) AIF Funding ( million) ADB Funding ( million) 2 17 1.9 Dec 2013 100 400 100.0 Sep 2015 100 400 100.0 Sep 2017 25 575 24.7 Dec 2015 40 80 6.6 Mar 2014 100 173 47.0 Sep 2014 20 100 9.0 Nov 2015 10 37 7.0 Nov 2015 100 500 48.0 May 2017 5 70 0.0 Nov 2020 15 517 123 2,475 0.0 344.2 Dec 2020

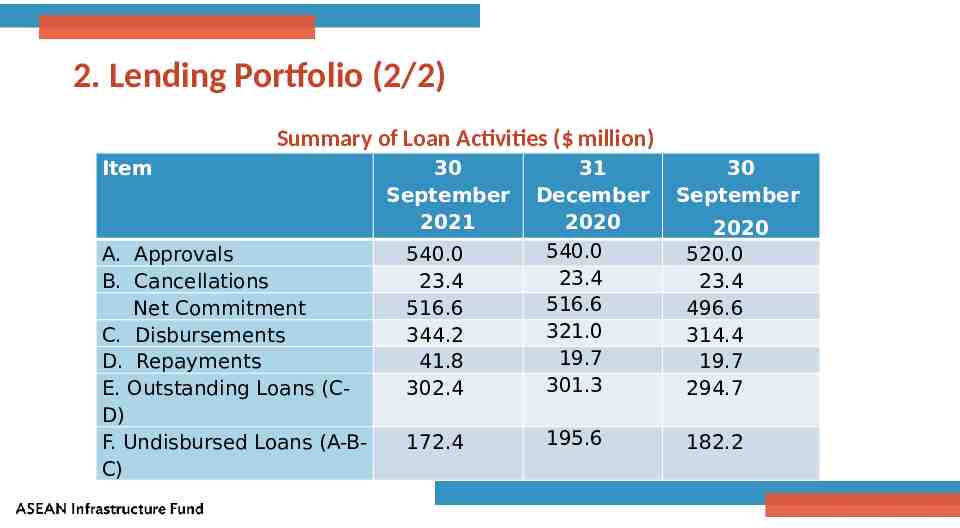

2. Lending Portfolio (2/2) Summary of Loan Activities ( million) Item A. Approvals B. Cancellations Net Commitment C. Disbursements D. Repayments E. Outstanding Loans (CD) F. Undisbursed Loans (A-BC) 30 September 2021 540.0 23.4 516.6 344.2 41.8 302.4 172.4 31 December 2020 540.0 23.4 516.6 321.0 19.7 301.3 195.6 30 September 2020 520.0 23.4 496.6 314.4 19.7 294.7 182.2

2. Summary of Key Activities in 2021 B. ACGF Operations and Mainstreaming 10

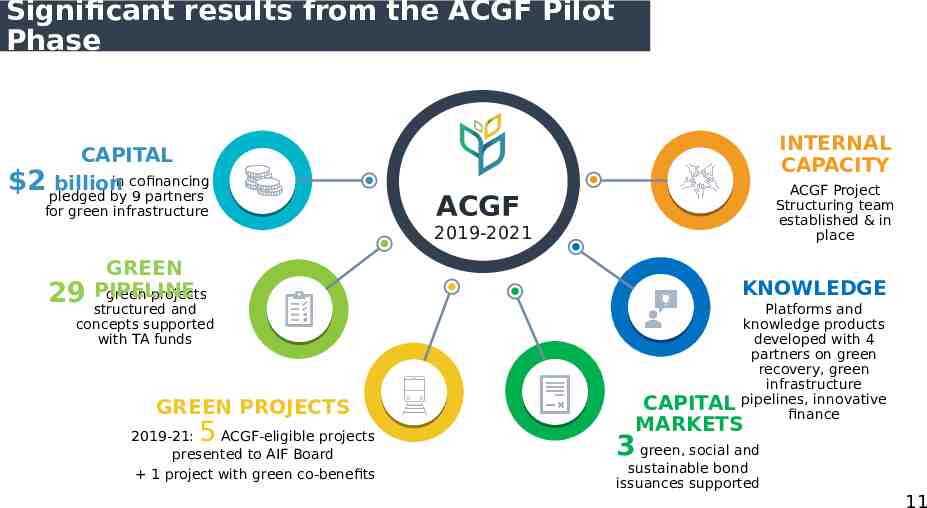

Significant results from the ACGF Pilot Phase CAPITAL billion in cofinancing 2 2billion pledged by 9 partners for green infrastructure INTERNAL CAPACITY ACGF Project Structuring team established & in place ACGF 2019-2021 GREEN green projects 2929PIPELINE structured and concepts supported with TA funds GREEN PROJECTS 5 2019-21: ACGF-eligible projects presented to AIF Board 1 project with green co-benefits KNOWLEDGE Platforms and knowledge products developed with 4 partners on green recovery, green infrastructure pipelines, innovative finance CAPITAL MARKETS 3 green, social and sustainable bond issuances supported 11

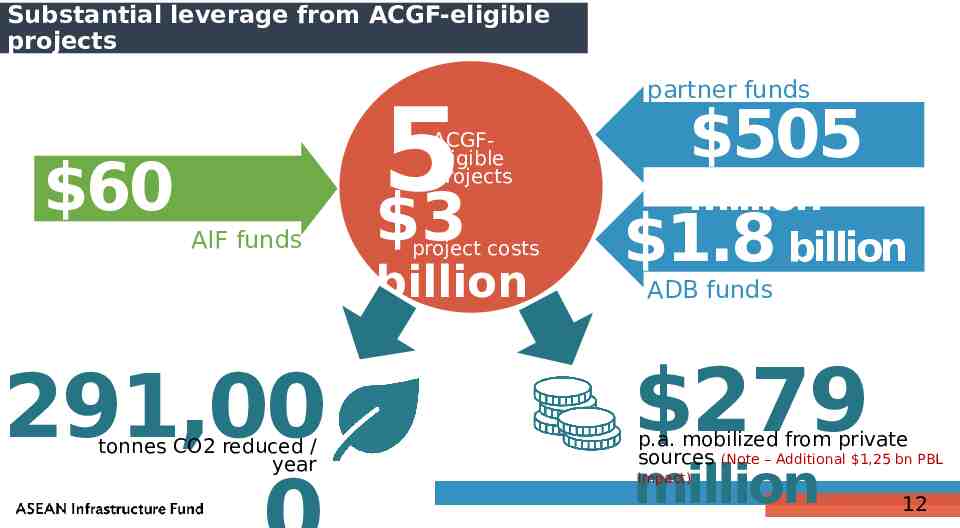

Substantial leverage from ACGF-eligible projects 60 million 5 3 ACGFeligible projects AIF funds 291,00 tonnes CO2 reduced / year project costs billion partner funds 505 million billion 1.8 ADB funds 279 p.a. mobilized from private sources (Note – Additional 1,25 bn PBL million impact) 12

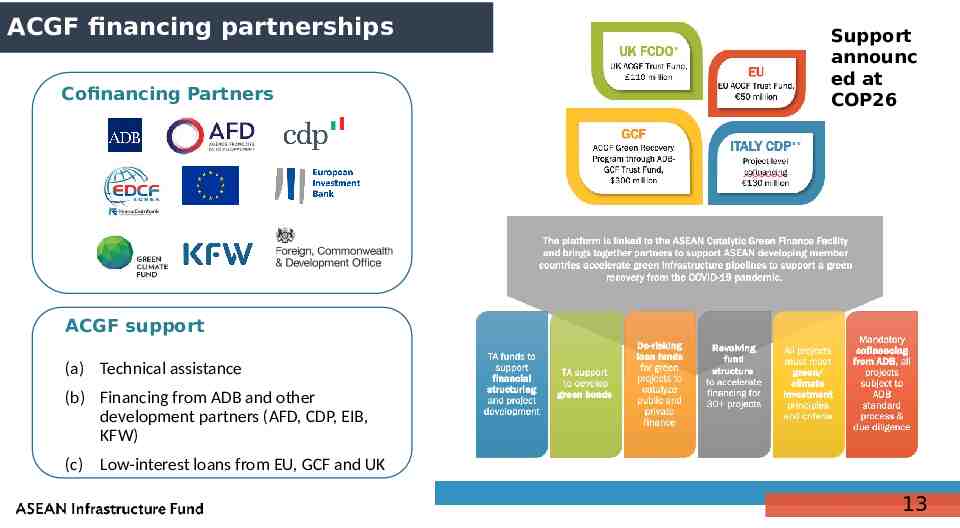

ACGF financing partnerships Cofinancing Partners Support announc ed at COP26 ACGF support (a) Technical assistance (b) Financing from ADB and other development partners (AFD, CDP, EIB, KFW) (c) Low-interest loans from EU, GCF and UK 13

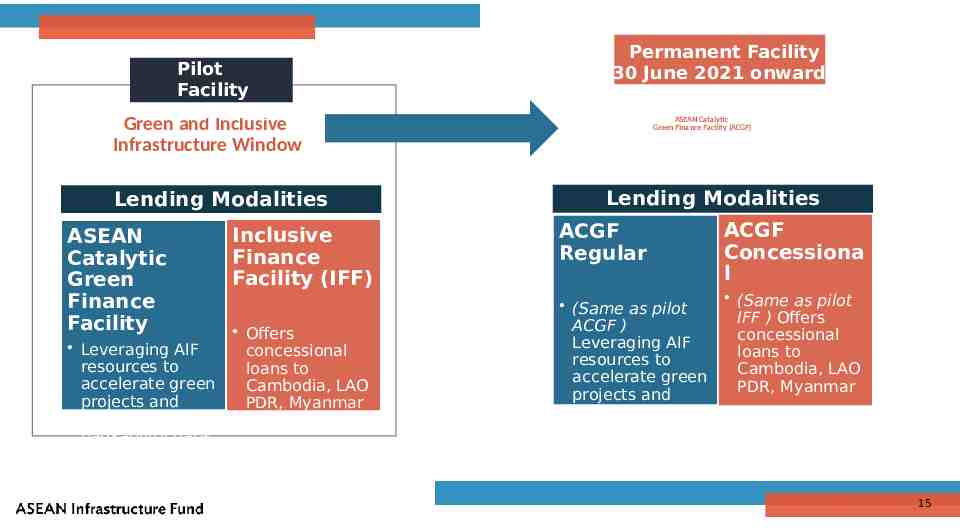

June 2021: AIF Board approved mainstreaming of GIIW into permanent ACGF, with the following considerations: Sustain momentum from the pilot to meet long-term objectives Robust demand for ACGF financing and technical support Climate change vulnerabilities of ASEAN countries Green recovery under a post-pandemic scenario Continue to strengthen and build relationships with partners 14

Pilot Facility 2019-2021 Permanent Facility 30 June 2021 onwards Green and Inclusive Infrastructure Window Lending Modalities ASEAN Catalytic Green Finance Facility Leveraging AIF resources to accelerate green projects and bridge bankability gaps Inclusive Finance Facility (IFF) Offers concessional loans to Cambodia, LAO PDR, Myanmar ASEAN Catalytic Green Finance Facility (ACGF) Lending Modalities ACGF Regular ACGF Concessiona l (Same as pilot ACGF ) Leveraging AIF resources to accelerate green projects and bridge bankability gaps (Same as pilot IFF ) Offers concessional loans to Cambodia, LAO PDR, Myanmar 15

Next Steps: 2022 and beyond Strengthen partnerships and financing arrangements Proactive project origination and structuring through the 6 Champions initiative Expand access to green capital markets; engagement with governments for GSS bond issuances Continue training and knowledge work to build awareness and capacity Expand communications to position ACGF as a frontrunner in green finance Strengthen internal implementation arrangements Members’ continued strong support for the AIF to develop the pipeline and support the mainstreamed ACGF is requested 16

Thank you! For inquiries: Alfredo Perdiguero AIF Administrator [email protected] www.adb.org/aif Anouj Mehta ACGF Facility Manager [email protected] www.adb.org/acgf 17

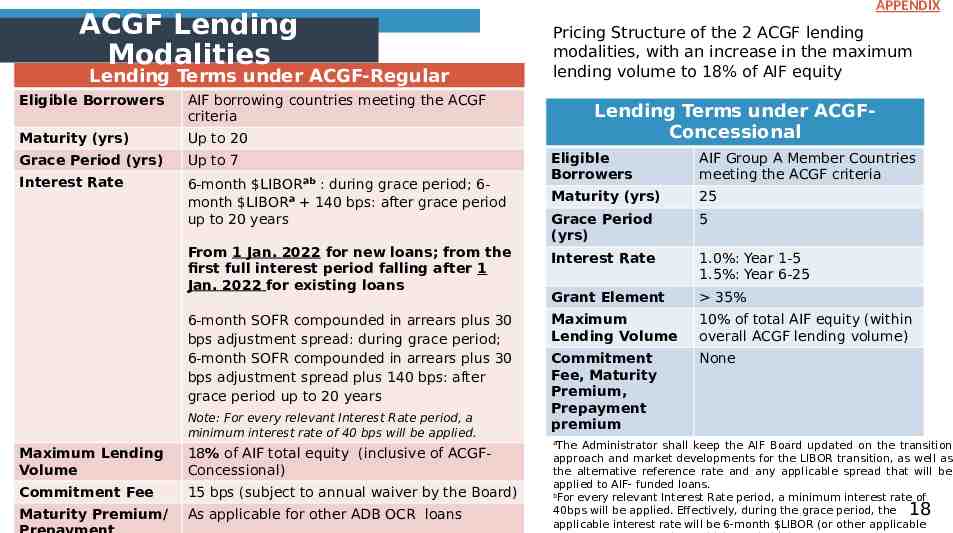

ACGF Lending Modalities Lending Terms under ACGF-Regular Eligible Borrowers AIF borrowing countries meeting the ACGF criteria Maturity (yrs) Up to 20 Grace Period (yrs) Up to 7 Interest Rate 6-month LIBORab : during grace period; 6month LIBORa 140 bps: after grace period up to 20 years APPENDIX Pricing Structure of the 2 ACGF lending modalities, with an increase in the maximum lending volume to 18% of AIF equity Lending Terms under ACGFConcessional Eligible Borrowers AIF Group A Member Countries meeting the ACGF criteria Maturity (yrs) 25 Grace Period (yrs) 5 From 1 Jan. 2022 for new loans; from the first full interest period falling after 1 Jan. 2022 for existing loans Interest Rate 1.0%: Year 1-5 1.5%: Year 6-25 Grant Element 35% 6-month SOFR compounded in arrears plus 30 bps adjustment spread: during grace period; 6-month SOFR compounded in arrears plus 30 bps adjustment spread plus 140 bps: after grace period up to 20 years Maximum Lending Volume 10% of total AIF equity (within overall ACGF lending volume) Commitment Fee, Maturity Premium, Prepayment premium None Note: For every relevant Interest Rate period, a minimum interest rate of 40 bps will be applied. Maximum Lending Volume 18% of AIF total equity (inclusive of ACGFConcessional) Commitment Fee 15 bps (subject to annual waiver by the Board) Maturity Premium/ As applicable for other ADB OCR loans The Administrator shall keep the AIF Board updated on the transition approach and market developments for the LIBOR transition, as well as the alternative reference rate and any applicable spread that will be applied to AIF- funded loans. b For every relevant Interest Rate period, a minimum interest rate of 40bps will be applied. Effectively, during the grace period, the applicable interest rate will be 6-month LIBOR (or other applicable a 18