Steve Stelzman

13 Slides2.16 MB

Steve Stelzman

Reverse Mortgage The Pitch Stop Making Payments – Instead Receive a Monthly Payment

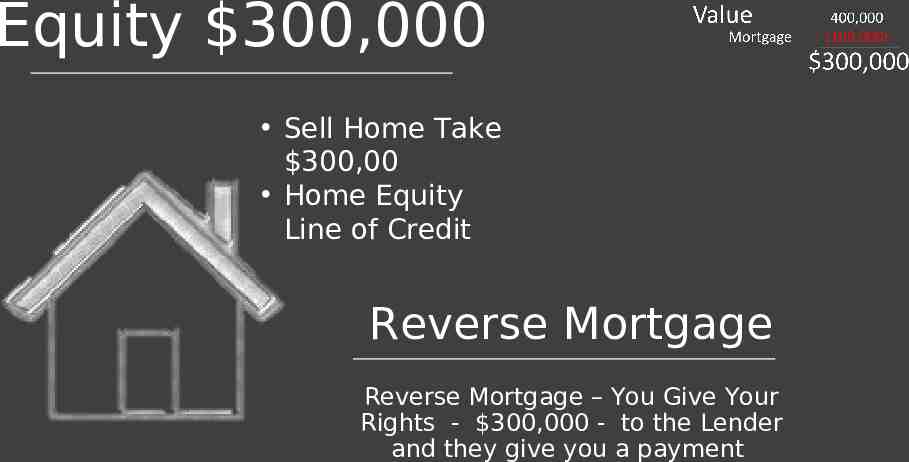

quity in Your Home Value Mortgage Equity 400,000 (100,000) 300,000

Equity 300,000 Sell Home Take 300,00 Home Equity Line of Credit Reverse Mortgage Reverse Mortgage – You Give Your Rights - 300,000 - to the Lender and they give you a payment

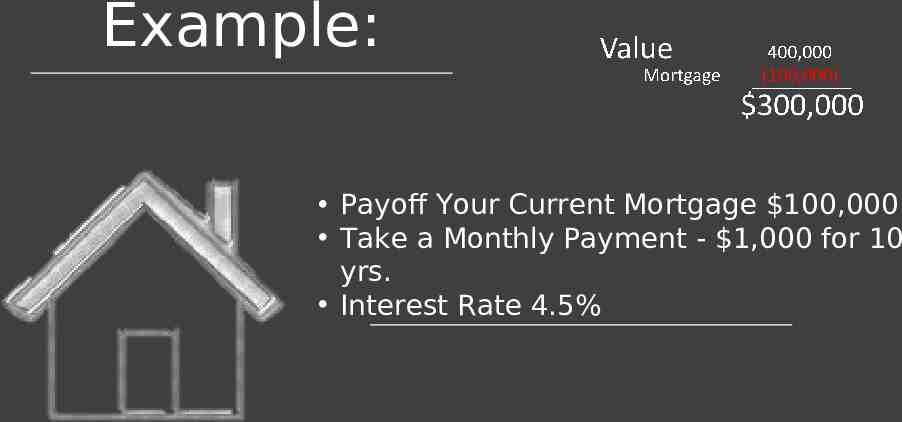

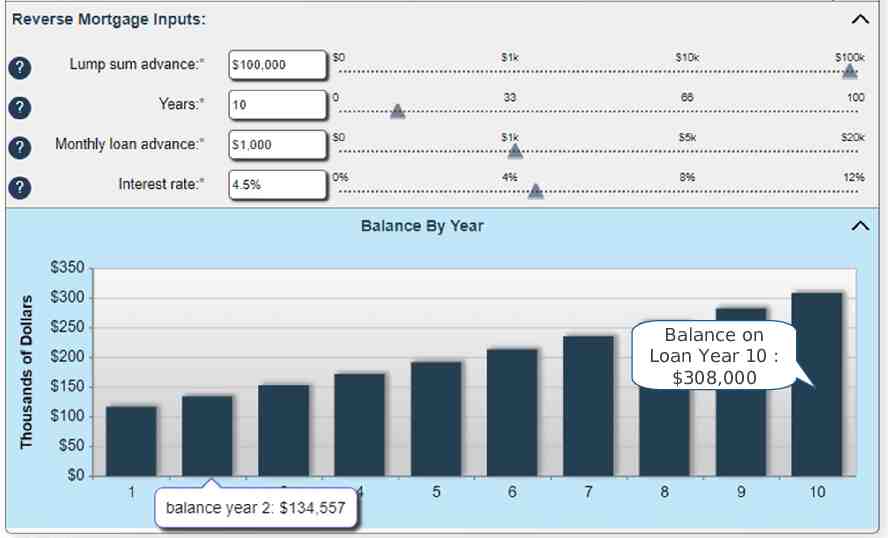

Example: Payoff Your Current Mortgage 100,000 Take a Monthly Payment - 1,000 for 10 yrs. Interest Rate 4.5%

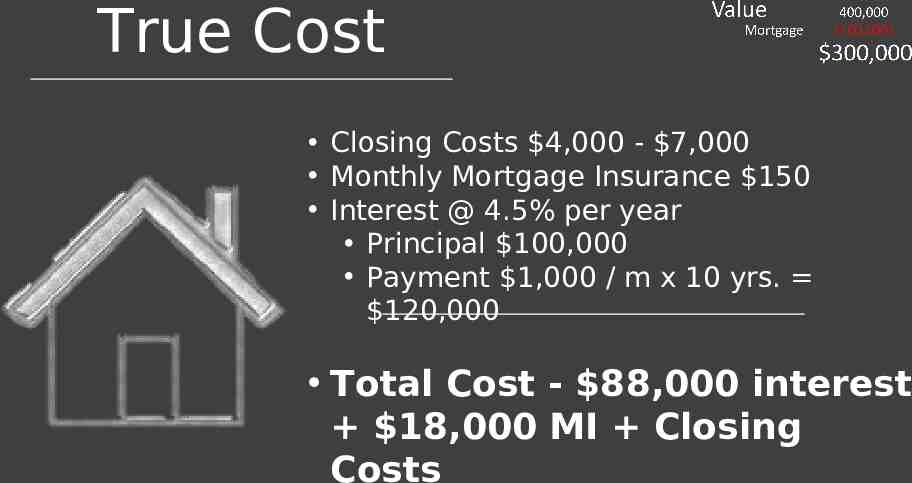

rue Cost 300,000 Closing Costs 4,000 - 7,000 Monthly Mortgage Insurance 150 Interest @ 4.5% per year Principal 100,000 Payment 1,000 / m x 10 yrs. Balance on 120,000 Loan Year 10 : 308,000 Total Cost - 88,000 interest 18,000 MI Closing Costs Reverse Mortgage

True Cost Closing Costs 4,000 - 7,000 Monthly Mortgage Insurance 150 Interest @ 4.5% per year Principal 100,000 Payment 1,000 / m x 10 yrs. 120,000 Total Cost - 88,000 interest 18,000 MI Closing Costs

Year 10 ? You Owe 308,000 100,000 Mtg 1,000 mo (120,000) 88,000 Interest & Closing Fees Value at Start 400,000 Appreciation 3% for 10 yrs. 537,000 Sell & Proceeds 229,000

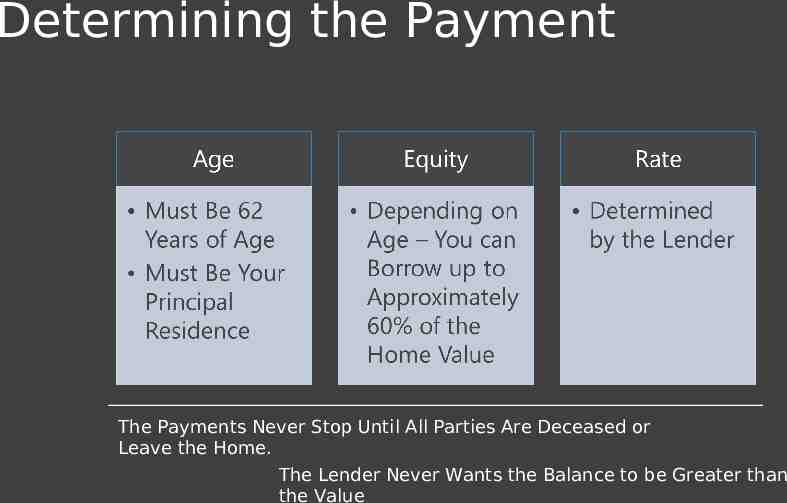

Determining the Payment The Payments Never Stop Until All Parties Are Deceased or Leave the Home. The Lender Never Wants the Balance to be Greater than the Value

Mortgages

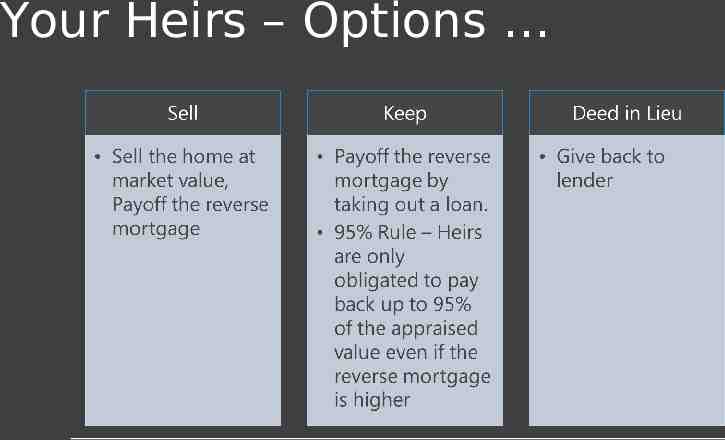

Your Heirs – Options

Good Deal / Bad Deal ? It’s a Loan There Will Be a Lien Against the Home Heirs ? Reduces Inheritance You Will Not Be Able to Borrow More Than 60% of Your Equity (never be upside down) Appreciation Should Offset Your Loss Allows you to access “equity” Without Selling Home or Increasing Monthly Debt

Thank You