TRANSAMERICA ANNUITY PRODUCT TRAINING TRANSAMERICA SECURE

37 Slides5.95 MB

TRANSAMERICA ANNUITY PRODUCT TRAINING TRANSAMERICA SECURE RETIREMENT INDEX ANNUITY FIXED INDEX ANNUITIES ISSUED BY TRANSAMERICA LIFE INSURANCE COMPANY, CEDAR RAPIDS, IOWA, 123251R2 For Agent Use Only. Not for use with the Public. 06/23

SALES TRAINING KNOW YOUR CUSTOMER A FIXED INDEX ANNUITY IS NOT A SECURITY, and fixed index annuity policies are not an investment in the stock market or in the indexes. Index account interest is based, in part, on index performance. Past performance of an index is not an indication of future index performance. There is no guarantee that the index interest rate will be greater than zero percent. There is no guarantee that the Company will declare an interest rate greater than the guaranteed minimum effective interest rate. Do a complete fact-finding, which includes reasonable efforts to obtain the customer's age, income, net worth, tax status, insurance needs, financial objectives, liquidity needs, time horizon, risk tolerance, and any other applicable information necessary for a purchase recommendation. Recommend only those products that meet your customer's needs and fully disclose product benefits, limitations, fees, penalties, etc. The Transamerica Secure Retirement Index Annuity credits interest based on a fixed interest rate and/or on the change of a selected index(es) value(s). The Transamerica Secure Retirement Index Annuity offers a variety of features to address common retirement needs. Let’s take a look at the features of our fixed index annuity product. All guarantees of the Transamerica Secure Retirement Index Annuity, including optional benefits such as the Transamerica Income Plus , are based on the claims paying ability of Transamerica Life Insurance Company. Transamerica Secure Retirement Index Annuity is issued by Transamerica Life Insurance Company. Not available in Montana and New York. For Agent Use Only. Not for use with the Public. 2

SALES TRAINING TRANSAMERICA SECURE RETIREMENT INDEX ANNUITY TRANSAMERICA SECURE RETIREMENT INDEX ANNUITY CAN PROVIDE: For Agent Use Only. Not for use with the Public. 3

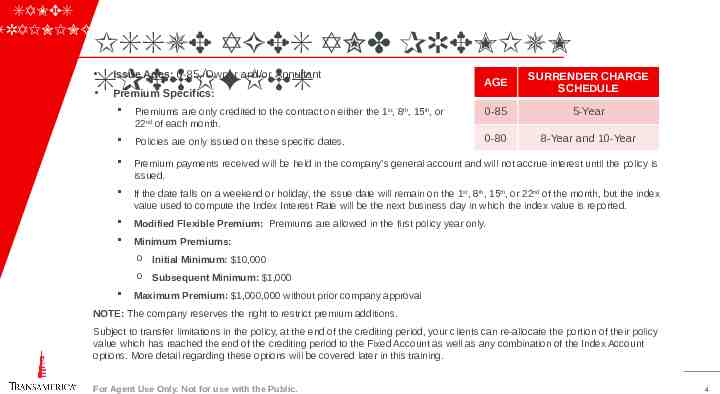

SALES TRAINING ISSUE AGES AND PREMIUM SPECIFICS Issue Ages: 0-85, Owner and/or Annuitant Premium Specifics: AGE SURRENDER CHARGE SCHEDULE Premiums are only credited to the contract on either the 1st, 8th, 15th, or 22nd of each month. 0-85 5-Year Policies are only issued on these specific dates. 0-80 8-Year and 10-Year Premium payments received will be held in the company’s general account and will not accrue interest until the policy is issued. If the date falls on a weekend or holiday, the issue date will remain on the 1st, 8th, 15th, or 22nd of the month, but the index value used to compute the Index Interest Rate will be the next business day in which the index value is reported. Modified Flexible Premium: Premiums are allowed in the first policy year only. Minimum Premiums: o Initial Minimum: 10,000 o Subsequent Minimum: 1,000 Maximum Premium: 1,000,000 without prior company approval NOTE: The company reserves the right to restrict premium additions. Subject to transfer limitations in the policy, at the end of the crediting period, your clients can re-allocate the portion of their policy value which has reached the end of the crediting period to the Fixed Account as well as any combination of the Index Account options. More detail regarding these options will be covered later in this training. For Agent Use Only. Not for use with the Public. 4

SALES TRAINING DEATH BENEFIT OPTIONS AND ANNUAL SERVICE CHARGE Death Benefit If the annuitant passes away before the income payments begin, we pay the death benefit of the annuity to the beneficiary. The amount of the death benefit will be the greater of the Policy Value or the Minimum Required Cash Value. If the annuitant passes away after the income payments start, depending on the type of income option chosen, we pay the remaining guaranteed income payments, if any, to the beneficiary. Annual Service Charge An annual service charge may be deducted from the policy value. For Agent Use Only. Not for use with the Public. 5

PREMIUM ENHANCEMENT When we receive the premium payment, a premium enhancement will be added to the policy value and is treated as earnings for tax and surrender charge calculation purposes. The premium enhancement percentage varies based upon the surrender charge schedule chosen. Your client will have the option to choose between three different Surrender Charge Schedules: 5-Year, 8-Year or 10-Year Not all options may be available - See the Statement of Understanding for more information on withdrawals and surrender charges If the annuity is cancelled in the free look period, no premium enhancement is paid. In addition, during the surrender charge period, for withdrawals that exceed the surrender charge-free amount, a premium enhancement recapture applies. Premium enhancement percentages will never be less than 0.25%. These percentages are only applicable to the initial premium and may vary for subsequent premiums and by state. The overall expenses for the policy may be higher or the interest credited on the policy may be lower than a policy that does not pay a premium enhancement. Over time, the value of the premium enhancement could be more than offset by the higher charges or lower interest credited. The premium enhancement is not intended to reimburse surrender charges on an annuity replacement. For Agent Use Only. Not for use with the Public. 6

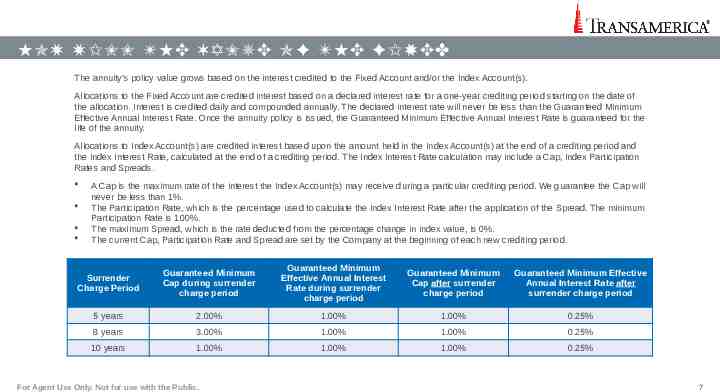

HOW WILL THE VALUE OF THE FIXED INDEXED ANNUITY GROW? The annuity’s policy value grows based on the interest credited to the Fixed Account and/or the Index Account(s). Allocations to the Fixed Account are credited interest based on a declared interest rate for a one-year crediting period starting on the date of the allocation. Interest is credited daily and compounded annually. The declared interest rate will never be less than the Guaranteed Minimum Effective Annual Interest Rate. Once the annuity policy is issued, the Guaranteed Minimum Effective Annual Interest Rate is guaranteed for the life of the annuity. Allocations to Index Account(s) are credited interest based upon the amount held in the Index Account(s) at the end of a crediting period and the Index Interest Rate, calculated at the end of a crediting period. The Index Interest Rate calculation may include a Cap, Index Participation Rates and Spreads. A Cap is the maximum rate of the interest the Index Account(s) may receive during a particular crediting period. We guarantee the Cap will never be less than 1%. The Participation Rate, which is the percentage used to calculate the Index Interest Rate after the application of the Spread. The minimum Participation Rate is 100%. The maximum Spread, which is the rate deducted from the percentage change in index value, is 0%. The current Cap, Participation Rate and Spread are set by the Company at the beginning of each new crediting period. Surrender Charge Period Guaranteed Minimum Cap during surrender charge period Guaranteed Minimum Effective Annual Interest Rate during surrender charge period Guaranteed Minimum Cap after surrender charge period Guaranteed Minimum Effective Annual Interest Rate after surrender charge period 5 years 2.00% 1.00% 1.00% 0.25% 8 years 3.00% 1.00% 1.00% 0.25% 10 years 1.00% 1.00% 1.00% 0.25% For Agent Use Only. Not for use with the Public. 7

HOW WILL THE VALUE OF THE FIXED How will the value of theANNUITY fixed indexed annuity grow? GROW? INDEXED The Index Interest Rate is the lesser of (1) or (2) shown below: (1) The Cap declared on the first day of the crediting period, if applicable, or (2) The rate determined by [(A/B)-C-1]xDxE, where: A the Index Value on the last day of the crediting period or, if the GLWB is elected, the Index Value on the day (1) of the withdrawal or (2) the Benefit Fee is deducted; B the Index Value on the first day of the crediting period; C the Spread declared on the first day of the crediting period; D the Participation Rate declared on the first day of the crediting period; and E the Index Interest Vesting Percentage. Example: Index Interest Rate calculation at the end of a crediting period (1) Cap Rate 2%; (2) A Ending Index Value 1,100; (2) B Beginning Index Value 1,000; (2) C Spread 0%; (2) D Participation Rate 100%. Index Interest Rate lesser of 2%, or [(1100/1000) – 0% - 1] x 100% lesser of 2% or 10% 2%. The 2% Index Interest Rate will be multiplied by the Index Account value at the end of the crediting period to determine the credited interest to the Index Account. Example: Index Interest Rate for Benefit Fees withdrawn prior to the end of the crediting period, assuming there are 2-3 years remaining in the crediting period: (1) Cap rate 2%; (2) A Ending Index Value 1,050; (2) B Beginning Index Value 1,000; (2) C Spread 0%; (2) D Participation Rate 100%; (2) E Index Interest Vesting Percentage 80%. Index Interest Rate lesser of 2%, or [(1050/1000) – 0% - 1] x 100% x 80% lesser of 2% or 4% 2%. The 2% Index Interest Rate will be multiplied by the Benefit Fee at the time it was assessed and will be credited to the Index Account at the end of the crediting period. If you elect an optional GLWB rider, the Index Interest Rate is computed similarly for withdrawals up to the Benefit Withdrawal Amount. For Agent Use Only. Not for use with the Public. 8

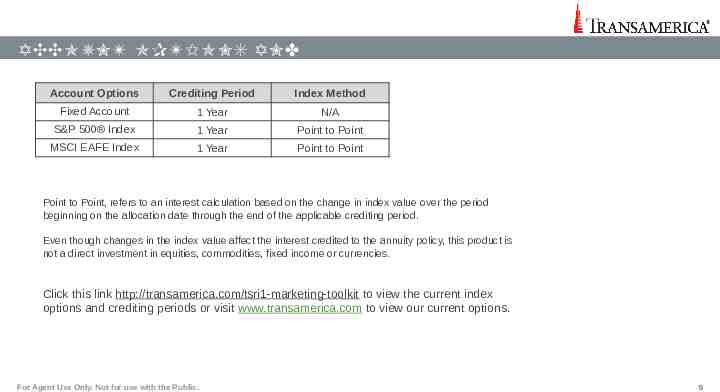

ACCOUNT OPTIONS AND CREDITING PERIODS Account Options Crediting Period Index Method Fixed Account 1 Year N/A S&P 500 Index 1 Year Point to Point MSCI EAFE Index 1 Year Point to Point Point to Point, refers to an interest calculation based on the change in index value over the period beginning on the allocation date through the end of the applicable crediting period. Even though changes in the index value affect the interest credited to the annuity policy, this product is not a direct investment in equities, commodities, fixed income or currencies. Click this link http://transamerica.com/tsri1-marketing-toolkit to view the current index options and crediting periods or visit www.transamerica.com to view our current options. For Agent Use Only. Not for use with the Public. 9

INDEX DESCRIPTIONS The S&P 500 Index – The S&P is a commonly recognized index made up of large-cap stocks and features 500 industry-leading companies with the objective of the index to measure the U.S. economy and overall market. Index growth, if any, does not include any portion from dividends. The MSCI EAFE Index – The MSCI EAFE (Europe, Australasia and the Far East) Index has the objective of measuring developed markets equity change in value. The index contains the stocks of 21 developed markets outside of the U.S. and Canada including Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, United Kingdom, Israel, Australia, New Zealand, Singapore, Hong Kong, and Japan. Index growth, if any, does not include any portion from dividends For Agent Use Only. Not for use with the Public. 10

TRANSAMERICA INCOME PLUS BENEFIT Transamerica Income Plus , is an optional living benefit available for an additional fee that can be added to Transamerica Secure Retirement Index Annuity to provide guaranteed income protection. SM Guarantees lifetime withdrawals regardless of the interest credited and the policy value. Guarantees annual lifetime withdrawals up to the Benefit Withdrawal Amount. The client must wait until the benefit year after they turn age 50 to begin withdrawals permitted under the benefit. If the benefit is purchased prior to age 50, the living benefit fee will still apply. For Agent Use Only. Not for use with the Public. 11

TRANSAMERICA INCOME PLUS BENEFIT Benefit Fee: The benefit fee is deducted at the end of each benefit quarter as a percentage of the Withdrawal Base (WB) divided by four. A pro rata fee is assessed at benefit termination. Click this link for the current living benefit fee http://transamerica.com/tsri1-marketing-toolkit or visit www.transamerica.com. The maximum living benefit fee is .75% more than the initial living benefit fee. Election: Your client may add the living benefit as long as the annuitant is younger than 86. For joint life version, annuitant’s spouse must also meet this issue age criteria. Cancellation: Your client may cancel the living benefit before midnight of the thirtieth calendar day after they receive it and no Benefit Fees will be assessed. Termination: The Transamerica Income Plus Living Benefit will terminate upon the earliest of: The date the policy to which this benefit is attached terminates and no benefit will be payable. The date a change in ownership or assignment violates the Owner and Annuitant relationship requirement as stated in the contract. For single-life version, the date of the Annuitant’s death; and for the joint-life version, the later of the date of the Annuitant’s or Annuitant spouse’s death. The date your client elects to receive annuity payments under your client’s policy. The date your client notifies us in writing to terminate the benefit (the date of notification must be after the fifth Benefit Anniversary). The date an Excess Benefit Withdrawal reduces your client’s Policy Value to zero. For Agent Use Only. Not for use with the Public. 12

TRANSAMERICA INCOME PLUS BENEFIT Withdrawal Base (WB): This is used to calculate your client’s guaranteed benefit withdrawal amount and Benefit Fee. In any benefit year that a withdrawal is not taken: The Withdrawal Base may increase on benefit anniversaries by the Growth Component Base multiplied by the Growth Rate Percentage. The Withdrawal Base will not decrease for the withdrawals taken in a benefit year that are less than or equal to the Benefit Withdrawal Amount. Excess withdrawals will reduce the Withdrawal Base which will reduce the Benefit Withdrawal Amount. The Withdrawal Base does not represent a cash value or an amount available for death benefits. The Growth Component Base is equal to A B – C, where: A Initial WB less any premium enhancements subject to recapture, if any, on the benefit issue date. B Total premium payments after the benefit issue date. C Total Excess Benefit Withdrawal adjustments after the benefit issue date. For Agent Use Only. Not for use with the Public. 13

TRANSAMERICA INCOME PLUS BENEFIT Growth Rate Percentage: During the first 10 benefit years and as long as the annuitant is (or for the joint version, the annuitant and joint annuitant are), at least 50 years old, and in any benefit year that a withdrawal is not taken, the WB will increase on benefit anniversaries by the Growth Component Base multiplied by the Growth Rate Percentage. For the joint life option, the Growth Rate percentage is based on the younger of the annuitant or annuitant's spouse on the benefit anniversary. The Growth Rate Percentage is not interest credited to the policy value. *Growth Rate does not apply until annuitant reaches age 50, even if the living benefit is purchased before age 50. Annual Withdrawal Percentage: The Withdrawal Percentage locks in at the time of the first withdrawal based on the annuitant's age. For the joint version, the younger of the annuitant or annuitant's spouse at that time. The annual withdrawal percentage is applied to the WB. The annual withdrawal percentage will reset anytime an Automatic Step-Up occurs and will be based on the annuitant's age. For the joint version, the younger of the annuitant or annuitant's spouse attained age on the date of the automatic stepup. For Agent Use Only. Not for use with the Public. 14

TRANSAMERICA INCOME PLUS BENEFIT Benefit Withdrawal Amount The Benefit Withdrawal Amount is the maximum amount that can be withdrawn from the policy each Benefit Year without causing an Excess Benefit Withdrawal under this benefit and thus reducing the Withdrawal Base. The Benefit Withdrawal Amount will change if the Withdrawal Base changes. The Benefit Withdrawal Amount is determined by multiplying the annual withdrawal percentage and Withdrawal Base. For tax qualified contracts, if required minimum distributions are required for the policy, the Benefit Withdrawal Amount will at least equal the required minimum distribution attributable to the policy. Benefit Withdrawal Amounts not taken in a benefit year cannot be carried over to subsequent benefit years. Excess Benefit Withdrawals Withdrawals taken in a benefit year greater than the Benefit Withdrawal Amount are Excess Benefit Withdrawals. Excess Benefit Withdrawals will reduce the Withdrawal Base and the Growth Component Base by an amount which may be more than the dollar amount of the excess benefit withdrawal. Excess withdrawals will reduce, and may terminate, the Transamerica Income Plus Benefit. Any withdrawals, including withdrawals up to the Benefit Withdrawal Amount, reduce your client's annuity’s policy value, death benefits and other values. Withdrawals don't reduce the Withdrawal Base unless they are excess benefit withdrawals. Withdrawals may be subject to surrender charges. If an Excess Benefit Withdrawal causes the policy value to reach zero, the Transamerica Income Plus Benefit and policy will terminate. For Agent Use Only. Not for use with the Public. 15

TRANSAMERICA INCOME PLUS BENEFIT To view the current withdrawal percentages for the Transamerica Income Plus Benefit select this link http://transamerica.com/tsri1-marketing-toolkit or go to www.transamerica.com. Index Interest on benefit fees and withdrawals that are not considered excess benefit withdrawals will be credited at the end of the crediting period. Index Interest for these amounts will be calculated based on the change in index values between the first day of the crediting period and the time the Benefit fee or withdrawal is taken from the index account, subject to the vesting percentage. Withdrawals of up to the Benefit Withdrawal Amount: Will not be assessed premium enhancement recaptures. Will not be assessed a surrender charge. Even if greater than the surrender charge free amount. For Agent Use Only. Not for use with the Public. 16

TRANSAMERICA INCOME PLUS BENEFIT Automatic Step-Up On the benefit anniversary if the policy value is greater than the WB, it will automatically step-up so that the WB equals the policy value. Upon an automatic step-up, the Benefit Fee percentage and Withdrawal Percentage may change. If the Benefit Fee percentage increases, the owner may reject the step-up and the associated fee percentage increase. The owner has 30-days following an automatic step-up to reject the step-up. If the owner rejects the automatic step-up: The Benefit Fee percentage and Withdrawal Base will revert to their prior amounts. Future automatic step-ups may apply. During the first 10 benefit years, the withdrawal base continues to be eligible for increases based on the Growth Rate Percentage. Because the benefit fee is a percentage of the WB the amount of the fee will fluctuate as the WB increases or decreases. For Agent Use Only. Not for use with the Public. 17

SURRENDER CHARGE FREE WITHDRAWAL OPTIONS The surrender charge-free amount each policy year is equal to 10% of the total premium payments, less the total surrender charge-free amount or earnings previously withdrawn in the same policy year. A surrender charge will not be assessed against earnings withdrawn from your client’s policy. Withdrawals of earnings will reduce the surrendercharge-free amount on a dollar-for-dollar basis. Any surrender-charge-free amount not taken in a policy year cannot be carried over to subsequent policy years. In addition to the surrender-charge-free amount, your client may withdraw an amount without charges from the policy value when: 1) Taken to satisfy required minimum distribution (RMD). If this annuity is purchased in connection with an IRA, partial withdrawals can be taken to satisfy RMD regarding this annuity under Section 401(a)(9) of the Internal Revenue Code. 2) Your client or your client’s spouse has satisfied the Nursing Care or Terminal Condition Waiver* requirements. If the diagnosis of a terminal condition occurs after the policy date, then beginning in the first policy year, your client may surrender or withdraw a portion of the policy value. A terminal condition is a condition resulting from an accident or illness which, as determined by a physician, has reduced life expectancy to not more than 12 months. The withdrawal request and proof of eligibility must be provided to us no later than one year following the diagnosis of the terminal condition. Additionally, the minimum amount which may be withdrawn under this option is 1,000; or beginning in the first policy year, if confined in a nursing facility, your client may withdraw a portion of the policy value subject to the following requirements: Confinement must begin in the first policy year, and Confinement must be for a period of at least 30 consecutive days. For Agent Use Only. Not for use with the Public. 18

SURRENDER CHARGE FREE WITHDRAWAL OPTIONS (CONTINUED) 3) Your client or your client’s spouse has satisfied the Unemployment Waiver** requirements. Beginning in the first policy year, your client may elect to surrender or withdraw a portion of the policy value. In order to qualify your client (or spouse) must have been: Employed full-time for at least 2 years prior to becoming unemployed; Employed full-time on the policy date, and Unemployed for at least 60 consecutive days at the time of withdrawal. NOTE: The minimum withdrawal under this waiver is 1,000. *CA and CT: The Nursing Care or Terminal Condition Waiver and the Unemployment Waiver are not available. **FL: The Unemployment Waiver is not available. Systematic Payout Option A Systematic Payout Option (SPO) is a series of pre-scheduled withdrawals. Beginning in the first Policy Year, a SPO is available on a monthly, quarterly, semi-annual, or annual basis. At the time an SPO is made, each such payout must be at least 50. Monthly and quarterly SPOs must be sent through electronic funds transfer (EFT) directly to a checking, savings, or other similar financial account. Your client may stop SPO payouts at any time with a 30-day written notice sent to our Administrative Office. For Agent Use Only. Not for use with the Public. 19

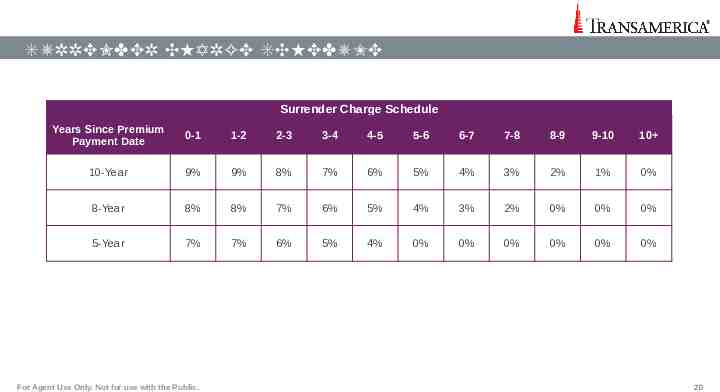

SURRENDER CHARGE SCHEDULE Surrender Charge Schedule Years Since Premium Payment Date 0-1 1-2 2-3 3-4 4-5 5-6 6-7 7-8 8-9 9-10 10 10-Year 9% 9% 8% 7% 6% 5% 4% 3% 2% 1% 0% 8-Year 8% 8% 7% 6% 5% 4% 3% 2% 0% 0% 0% 5-Year 7% 7% 6% 5% 4% 0% 0% 0% 0% 0% 0% For Agent Use Only. Not for use with the Public. 20

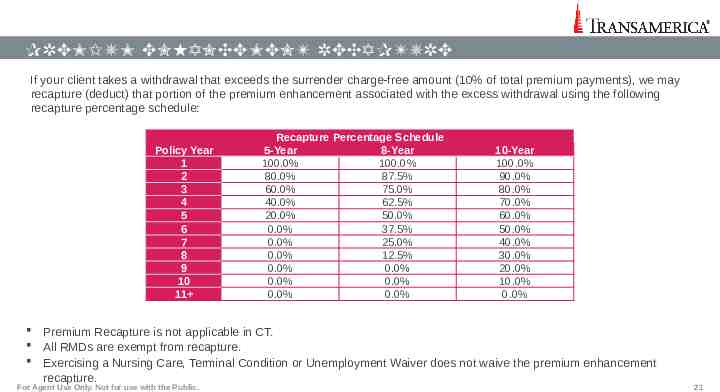

PREMIUM ENHANCEMENT RECAPTURE If your client takes a withdrawal that exceeds the surrender charge-free amount (10% of total premium payments), we may recapture (deduct) that portion of the premium enhancement associated with the excess withdrawal using the following recapture percentage schedule: Policy Year 1 2 3 4 5 6 7 8 9 10 11 Recapture Percentage Schedule 5-Year 8-Year 100.0% 100.0% 80.0% 87.5% 60.0% 75.0% 40.0% 62.5% 20.0% 50.0% 0.0% 37.5% 0.0% 25.0% 0.0% 12.5% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 10-Year 100.0% 90.0% 80.0% 70.0% 60.0% 50.0% 40.0% 30.0% 20.0% 10.0% 0.0% Premium Recapture is not applicable in CT. All RMDs are exempt from recapture. Exercising a Nursing Care, Terminal Condition or Unemployment Waiver does not waive the premium enhancement recapture. For Agent Use Only. Not for use with the Public. 21

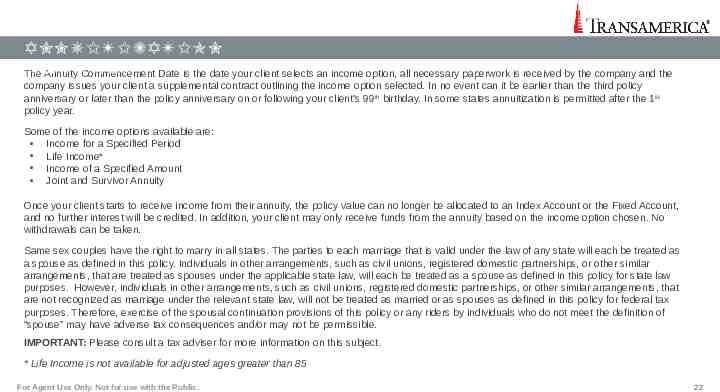

ANNUITIZATION OPTIONS The Annuity Commencement Date is the date your client selects an income option, all necessary paperwork is received by the company and the company issues your client a supplemental contract outlining the income option selected. In no event can it be earlier than the third policy anniversary or later than the policy anniversary on or following your client’s 99th birthday. In some states annuitization is permitted after the 1st policy year. Some of the income options available are: Income for a Specified Period Life Income* Income of a Specified Amount Joint and Survivor Annuity Once your client starts to receive income from their annuity, the policy value can no longer be allocated to an Index Account or the Fixed Account, and no further interest will be credited. In addition, your client may only receive funds from the annuity based on the income option chosen. No withdrawals can be taken. Same sex couples have the right to marry in all states. The parties to each marriage that is valid under the law of any state will each be treated as a spouse as defined in this policy. Individuals in other arrangements, such as civil unions, registered domestic partnerships, or other similar arrangements, that are treated as spouses under the applicable state law, will each be treated as a spouse as defined in this policy for state law purposes. However, individuals in other arrangements, such as civil unions, registered domestic partnerships, or other similar arrangements, that are not recognized as marriage under the relevant state law, will not be treated as married or as spouses as defined in this policy for federal tax purposes. Therefore, exercise of the spousal continuation provisions of this policy or any riders by individuals who do not meet the definition of “spouse” may have adverse tax consequences and/or may not be permissible. IMPORTANT: Please consult a tax adviser for more information on this subject. * Life Income is not available for adjusted ages greater than 85 For Agent Use Only. Not for use with the Public. 22

FORM NUMBERS All policies, riders, and forms may vary by state, and may not be available in all states: ICC14 FIA0214, NIC14 FIA0214(FL), ICC14 RGMB470214(IS), ICC14 RGMB470214(IJ), NIC14 RGMB470214 (IS)(FL), NIC14 RGMB470214 (IJ)(FL), ICC14 RDR50214 For Agent Use Only. Not for use with the Public. 23

DISCLOSURES The S&P 500 Index is a product of S&P Dow Jones Indices LLC (SPDJI), and has been licensed for use by Transamerica Life Insurance Company (TLIC). Standard & Poor’s , S&P , and S&P 500 are registered trademarks of Standard & Poor’s Financial Services LLC (S&P); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by TLIC. The Transamerica Secure Retirement Index Annuity is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, any of their respective affiliates (collectively, S&P Dow Jones Indices). S&P Dow Jones Indices makes no representation or warranty, express or implied, to the owners of the Transamerica Secure Retirement Index Annuity or any member of the public regarding the advisability of investing in securities generally, or in Transamerica Secure Retirement Index Annuity particularly, or the ability of the S&P 500 Index to track general market performance. S&P Dow Jones Indices’ only relationship to TLIC with respect to the S&P 500 Index is the licensing of the Index and certain trademarks, service marks and/or trade names of S&P Dow Jones Indices or its licensors. The S&P 500 Index is determined, composed, and calculated by S&P Dow Jones Indices without regard to TLIC or the Transamerica Secure Retirement Index Annuity. S&P Dow Jones Indices have no obligation to take the needs of TLIC or the owners of Transamerica Secure Retirement Index Annuity into consideration in determining, composing or calculating the S&P 500 Index. S&P Dow Jones Indices is not responsible for and has not participated in the determination of the prices and amount of Transamerica Secure Retirement Index Annuity, or the timing of the issuance or sale of Transamerica Secure Retirement Index Annuity, or in the determination or calculation of the equation by which Transamerica Secure Retirement Index Annuity is to be converted into cash, surrendered, or redeemed, as the case may be. S&P Dow Jones Indices has no obligation or liability in connection with the administration, marketing, or trading of Transamerica Secure Retirement Index Annuity. There is no assurance that investment products based on the S&P 500 Index will accurately track index performance or provide positive investment returns. S&P Dow Jones Indices LLC is not an investment advisor. Inclusion of a security within an index is not a recommendation by S&P Dow Jones Indices to buy, sell, or hold such security, nor is it considered to be investment advice. Notwithstanding the foregoing, CME Group Inc. and its affiliates may independently issue and/or sponsor financial products unrelated to Transamerica Secure Retirement Index Annuity currently being issued by TLIC, but which may be similar to and competitive with Transamerica Secure Retirement Index Annuity. In addition, CME Group Inc. and its affiliates may trade financial products which are linked to the performance of the S&P 500 Index. S&P DOW JONES INDICES DOES NOT GUARANTEE THE ADEQUACY, ACCURACY, TIMELINESS, AND/OR THE COMPLETENESS OF THE S&P 500 INDEX OR ANY DATA RELATED THERETO OR ANY COMMUNICATION, INCLUDING BUT NOT LIMITED TO, ORAL OR WRITTEN COMMUNICATION (INCLUDING ELECTRONIC COMMUNICATIONS) WITH RESPECT THERETO. S&P DOW JONES INDICES SHALL NOT BE SUBJECT TO ANY DAMAGES OR LIABILITY FOR ANY ERRORS, OMISSIONS, OR DELAYS THEREIN. S&P DOW JONES INDICES MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIMS ALL WARRANTIES, OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE OR AS TO RESULTS TO BE OBTAINED BY TLIC, OWNERS OF THE TRANSAMERICA SECURE RETIREMENT INDEX ANNUITY, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE S&P 500 INDEX OR WITH RESPECT TO ANY DATA RELATED THERETO. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT WHATSOEVER SHALL S&P DOW JONES INDICES BE LIABLE FOR ANY INDIRECT, SPECIAL, INCIDENTAL, PUNITIVE, OR CONSEQUENTIAL DAMAGES INCLUDING BUT NOT LIMITED TO, LOSS OF PROFITS, TRADING LOSSES, LOST TIME OR GOODWILL, EVEN IF THEY HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES, WHETHER IN CONTRACT, TORT, STRICT LIABILITY, OR OTHERWISE. THERE ARE NO THIRD PARTY BENEFICIARIES OF ANY AGREEMENTS OR ARRANGEMENTS BETWEEN S&P DOW JONES INDICES AND TLIC OTHER THAN THE LICENSORS OF S&P DOW JONES INDICES. The products referred to herein are not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such funds or securities or any index on which such funds or securities are based. The statement of understanding contains a more detailed description of the limited relationship has for with Transamerica Life Insurance Company and any related products. For Agent Use MSCI Only. Not use with the Public. 24

ANTI-MONEY LAUNDERING USA PATRIOT ACT The USA PATRIOT Act (the “Act”) was enacted by U.S. Congress and signed into law by President George W. Bush on October 26, 2001. The Act is an acronym for Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism. This law, enacted in response to the terrorist attacks of September 11, 2001, strengthens our nation’s ability to combat terrorism and prevent and detect money-laundering activities. COVERED PRODUCTS In 2006, the U.S. Treasury Department mandated that all insurance companies implement an AML Compliance program for the company’s “covered products.” Covered products include any permanent life insurance policy (other than group), any annuity contract (other than group), or any other insurance product with features of cash value or investment. SUSPICIOUS ACTIVITY REPORTS (“SAR”). Insurers are required to file Suspicious Activity Reports (SAR) the purpose of which is to assist law enforcement in the detection and prevention of money laundering and terrorist financing. The type of transactions this rule pertains to are those transactions that an insurance company knows, suspects or has reason to suspect involve funds that are derived from an illegal activity. Other transactions may include those designed to evade reporting requirements or has no business or apparent lawful purpose and involves the use of the insurance company to facilitate criminal activity, including terrorist financing. For Agent Use Only. Not for use with the Public. 25

ANTI-MONEY LAUNDERING TRANSAMERICA’S POLICY It is Transamerica’s policy to comply with all laws and regulations designed to prevent the laundering of proceeds from illegal or criminal activity through legitimate financial institutions. Transamerica has established policies and procedures designed to reasonably prevent the laundering or facilitating of laundering of money from criminal activity. Transamerica monitors transactions for suspicious activity, which may indicate the existence of a crime. Transamerica must file reports to assist the government in investigating and prosecuting money laundering and terrorist financing activities. SALES AGENTS ROLE You play an important role in our prevention efforts by ensuring that we secure the proper information from applicants and by remaining alert for any signs that the applicants are engaging in money laundering or terrorist financing activities. Failure to comply with laws prohibiting money laundering or terrorist financing may result in significant criminal, civil or regulatory penalties or reputation harm that could ensue from any association with money laundering or terrorist financing activities. For Agent Use Only. Not for use with the Public. 26

ANTI-MONEY LAUNDERING MONEY LAUNDERING AND TERRORIST FINANCING DEFINED Money laundering is a process through which the proceeds from illegal activity are ‘washed’ to legitimize them or disguise their true source. There are two basic definitions of money laundering within the federal government and the IRS: Taking the proceeds from an illegal activity and making them appear to be from a legal activity. Taking the proceeds from an illegal activity and hiding them or placing them beyond the reach of the government. Terrorist financing involves the use of money, which may be lawfully obtained, to fund illegal activities. Because the transactions often have a legitimate origin and can often involve small amounts of money, terrorist financing can be more difficult to identify than money-laundering activities. However, an effective anti-money laundering program can help prevent the use of legal funds for terrorism activities. For Agent Use Only. Not for use with the Public. 27

ANTI-MONEY LAUNDERING THREE STAGES OF MONEY LAUNDERING The basic money laundering process is accomplished via a three-stage method. These stages are known as placement, layering, and integration. 1) Placement Stage During the placement stage of money laundering, the proceeds from illegal activity are first introduced into the financial system. The criminal or accomplice may make a single deposit, perhaps into a single premium life insurance policy or single premium deferred annuity, may pay premiums for a policy a year or more in advance, or break up large amounts of cash into less conspicuous smaller sums, typically less than 10,000. A series of monetary instruments (cashier checks, money orders, etc.) or a combination of cash and monetary instruments may also be deposited into an account at a financial institution or used to purchase a policy. 2) Layering Stage The layering stage takes place after the funds have entered the financial system. In this stage the criminal or his accomplice tries to separate or distance the proceeds of the criminal activity from their origin through the use of complex financial transactions, such as converting cash into traveler’s checks, money orders, wire transfers, letters of credit, stocks, bonds or by purchasing valuable assets, such as art or jewelry. 3) Integration Stage The integration stage involves the use of apparently legitimate transactions to disguise the illicit proceeds, allowing the laundered funds to be disbursed back to the criminal. At this stage, the funds are moved back into mainstream economic activities. Following are three types of transactions typically used to accomplish integration: Loans or withdrawals from a life insurance or annuity; Surrendering of a life insurance or annuity; Cancellation of a life insurance policy during the free look period, especially where the policy was paid for with cash or a cash equivalent (money order, cashier’s check, travelers check, or credit card). For Agent Use Only. Not for use with the Public. 28

ANTI-MONEY LAUNDERING MONEY LAUNDERING AND TERRORIST FINANCING EXAMPLES Insurance companies can be used in all phases of money laundering schemes. The following are examples of money laundering and terrorist financing. Example 1 A successful businessman contacted an insurance agent and stated that he owned a restaurant and had recently inherited a large sum of money from his grandmother. The businessman did not express a particular interest in the product features but promised the agent substantial future business. Communication with the businessman was difficult because he was not available on the cell phone number he provided, and he always had to return the agent’s call. When pressed, the businessman was reluctant to provide information such as his personal address. To open the account the businessman stated that he would have the funds wired to the insurance company. The insurance company received a wire for 2,200,000 to fund a life insurance policy and three variable annuities. Two weeks later the insurance company received a request for a full surrender of the life insurance and annuities with the funds to be wired to another bank. Example 2 Local police authorities were investigating the placement of cash by an illegal drug trafficker. The funds were deposited into several bank accounts and then transferred to an offshore account. The drug trafficker then purchased a 75,000 life insurance policy. Two separate wire transfer payments were made into the policy from the offshore accounts. The funds used for payment were purportedly the proceeds of overseas investments. At the time of the drug trafficker’s arrest, the insurance company had received instructions for an early surrender of the policy. Example 3 A terrorist group may establish a charity as a front for financing terrorist activity and open an annuity or key employee life contract with the charity as the owner. Funds can be moved in and out of the contracts under the guise of an investment for the charity, while funds are really being channeled towards a terrorist operation. For Agent Use Only. Not for use with the Public. 29

ANTI-MONEY LAUNDERING ANTI-MONEY LAUNDERING PROGRAM REQUIREMENTS The AML compliance program, at a minimum, must include the following: 1. Incorporate policies, procedures, and internal controls based upon Transamerica’s assessment of the money laundering and terrorist financing risks associated with its covered products; 2. The designation of an AML Compliance Officer who will be responsible for ensuring that the AML program is being implemented effectively, including monitoring compliance of its agents and brokers, that the AML program is updated, and appropriate persons are educated and trained regarding AML issues; 3. Provide for ongoing training of appropriate persons (including employees and independent agents/brokers) concerning their responsibilities under the program; and 4. Provide for independent testing to monitor and maintain an adequate program. CASH AND CASH EQUIVALENT TRACKING, MONITORING AND REPORTING Cash and cash equivalents can be used to launder money from illegal activities. The government can often trace this laundered money through the reports of cash and cash equivalents required of businesses. Cash is defined as U.S. coin or currency. Cash equivalents are defined as cashier’s checks, bank drafts, traveler’s checks, or money orders having a face amount of 10,000 or less, that is received either in a “designated reporting transaction” or in any transaction in which the recipient knows that the instrument is being used to avoid reporting of the transaction. Transamerica maintains a database where payment by cash equivalents are entered and monitored for suspicious activity and reported to FinCEN via a SAR if appropriate. For Agent Use Only. Not for use with the Public. 30

ANTI-MONEY LAUNDERING OFFICE OF FOREIGN ASSETS CONTROL The Office of Foreign Assets Control (“OFAC”) of the U.S. Department of Treasury administers and enforces economic and trade sanctions against targeted foreign countries, terrorism sponsoring organizations and international narcotics traffickers based on U.S. foreign policy and national security goals. All U.S. persons or "persons subject to the jurisdiction of the U.S.” must comply with OFAC regulations. This includes: 1) U.S. citizens and lawful permanent residents, wherever they are located; 2) People, companies, and other entities located in the U.S. (including foreign branches, agencies and offices of overseas companies located in the U.S.); and 3) All US companies (including insurance companies, broker-dealers, reinsurers, investment companies and other financial institutions), including their foreign branches. Some of the existing sanctions (such as those pertaining to Trading with the Enemy Act), also require compliance by all foreign subsidiaries of US companies. OFAC regulations provide that all insurance contracts, securities accounts or assets in which there is a direct/indirect interest by Specially Designated Nationals (“SDN”), blocked persons, or individuals/entities from countries covered by applicable sanctions must be “blocked” or “frozen” against further withdrawals, transfers, changes in beneficiary, etc. “Blocked” accounts must be segregated by the broker-dealer or held in a separate account from the general account of an insurer, reported to Treasury within 10 days of discovery and, going forward, credited interest at a rate comparable to an interest-bearing account at a bank with a similar deposit and duration. Rights in these policies may not be transferred without authorization from OFAC this includes changes in beneficiaries, assignments or pledges of an insured's interest under a blocked policy. For Agent Use Only. Not for use with the Public. 31

ANTI-MONEY LAUNDERING CRIMINAL AND CIVIL LIABILITY FOR MONEY LAUNDERING It is a crime to knowingly conduct a “financial transaction” with proceeds of “specified unlawful activity” with intent to: Conceal/disguise proceeds Promote the “specified unlawful activity Evade taxes Evade reporting requirements “Specified unlawful activity” is defined to include, on a list of more than 170 crimes including: drug trafficking bribery of federal officials tax evasion counterfeiting terrorism environmental crimes murder for hire For Agent Use Only. Not for use with the Public. theft, embezzlement by a bank employee fraudulent loan or credit applications fraud by or against a foreign bank hostage taking mail theft gunrunning 32

ANTI-MONEY LAUNDERING WILLFUL BLINDNESS The government must prove only that the person who conducted the transaction knew that the property involved was derived from an unlawful activity, not that the person who conducted or facilitated the transaction knew that the money derived from one of the specified unlawful activities or even from which criminal activity the money was derived. The standard of knowledge required is “actual knowledge” which, in many jurisdictions includes “willful blindness.” Willful blindness is the deliberate avoidance of knowledge of a crime, especially by failing to make a reasonable inquiry about suspected wrongdoing despite being aware that it is highly probable. Persons who ignore warning signs or “red flags” can be charged with and convicted of money laundering. PENALTIES The penalties associated with money laundering are severe. Fines may be twice the amount of the transaction up to 1 million. Property involved in the transaction may also be subject to seizure and forfeiture. Employees of financial institutions can be fined individually and sentenced to up to 20 years of imprisonment for knowing or being willfully blind to the fact that the transaction involved illegal funds. For Agent Use Only. Not for use with the Public. 33

ANTI-MONEY LAUNDERING EXAMPLES OF SUSPICIOUS ACTIVITY When working with prospective clients you should be on the alert for any signs of unusual activity which might indicate intent to launder money. Here are examples of “red flags” that you should report: Customers exhibiting unusual concern with Transamerica’s obligations to file reports of certain transactions with U.S. government agencies, or refusal to provide information required to prepare such reports. Large overpayment of premiums not consistent with the customer’s past payments. This is particularly suspicious if the customer requests a disbursement shortly after the payment. Customers who request that a transaction be processed in such a manner so as to avoid Transamerica’s normal documentation requirements. Customers who make multiple payments, followed shortly thereafter by a request to surrender the policy. Customers who provide suspect or unverifiable identification or are hesitant to supply identifying information. Customer policy purchased in amounts considered beyond customer’s apparent means. Customers who provide incomplete or confusing descriptions of the nature of their business. Customers who wish to purchase multiple policies or who indicate funds will be deposited from multiple sources. For Agent Use Only. Not for use with the Public. Payments submitted by an unrelated thirdparty. Customers who have an association with, or have accounts in, a country identified as a haven for money laundering require extra due diligence. 34

ANTI-MONEY LAUNDERING WHERE TO REPORT SUSPICIOUS ACTIVITY You may report suspicious activity to your Manager or directly to the Transamerica Financial Crimes toll free hotline number: (866) 622-5004. For Agent Use Only. Not for use with the Public. 35

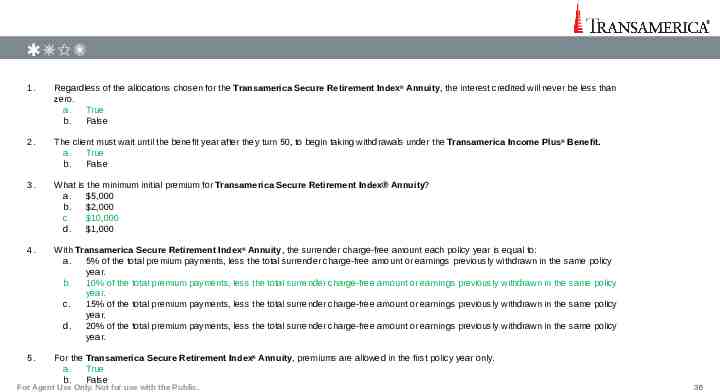

QUIZ 1. Regardless of the allocations chosen for the Transamerica Secure Retirement Index Annuity, the interest credited will never be less than zero. a. True b. False 2. The client must wait until the benefit year after they turn 50, to begin taking withdrawals under the Transamerica Income Plus Benefit. a. True b. False 3. What is the minimum initial premium for Transamerica Secure Retirement Index Annuity? a. 5,000 b. 2,000 c. 10,000 d. 1,000 4. With Transamerica Secure Retirement Index Annuity, the surrender charge-free amount each policy year is equal to: a. 5% of the total premium payments, less the total surrender charge-free amount or earnings previously withdrawn in the same policy year. b. 10% of the total premium payments, less the total surrender charge-free amount or earnings previously withdrawn in the same policy year. c. 15% of the total premium payments, less the total surrender charge-free amount or earnings previously withdrawn in the same policy year. d. 20% of the total premium payments, less the total surrender charge-free amount or earnings previously withdrawn in the same policy year. 5. For the Transamerica Secure Retirement Index Annuity, premiums are allowed in the first policy year only. a. True b. False For Agent Use Only. Not for use with the Public. 36

THANK YOU 2023 Transamerica 37