SSUSH 17: The student will analyze the causes and consequences of

18 Slides3.85 MB

SSUSH 17: The student will analyze the causes and consequences of the Great Depression. Element A: Describe the causes, including overproduction, under consumption, and stock market speculation that led to the stock market crash of 1929 and the Great Depression. Causes of the Great Depression

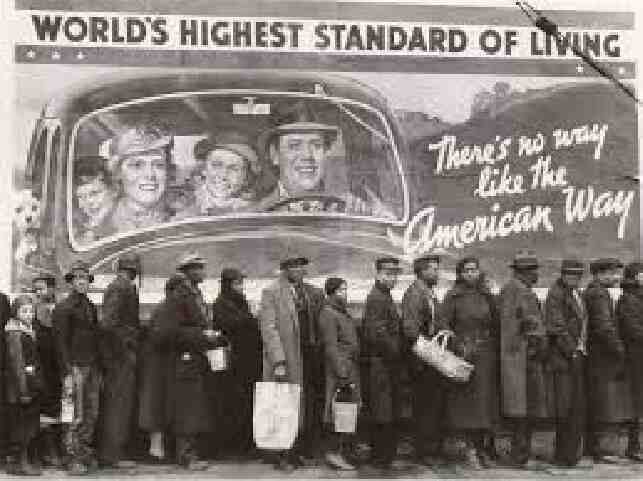

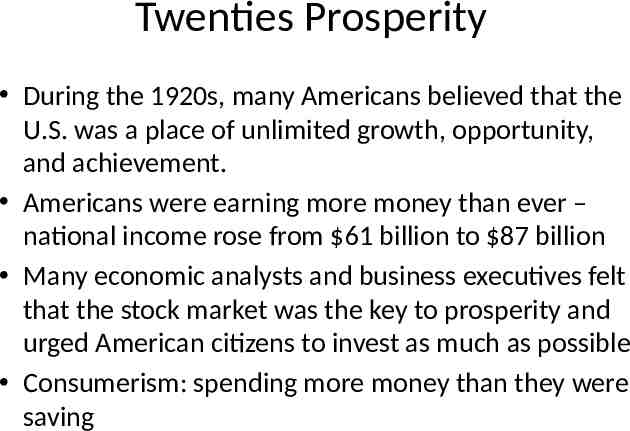

Twenties Prosperity During the 1920s, many Americans believed that the U.S. was a place of unlimited growth, opportunity, and achievement. Americans were earning more money than ever – national income rose from 61 billion to 87 billion Many economic analysts and business executives felt that the stock market was the key to prosperity and urged American citizens to invest as much as possible Consumerism: spending more money than they were saving

Depression foreshadowed By late 1929, cracks were beginning to show in the U.S. economy unemployment was on the rise, farmers were losing their land, and stock prices were dropping. Five key factors: 1. Unchecked stock speculation 2. Weak and unregulated banking institutions 3. Overproduction of goods 4. The decline of the farming industry 5. Unequal distribution of wealth

Cause #1: Speculation and “Buying on Margin” The practice of speculation-in which a person or organization makes a risky investment in the hope of making a quick, large profit-was widespread in the 1920s. – Many investors speculated on real estate Purchasing stock on margin: paying a fraction of its worth with a promise to pay the rest once the stock was sold aka borrowing money to purchase stocks – People overextended themselves to buy cars, homes, and stocks This works if the stock price goes up, but is disastrous if the stock price falls -Many speculators of the 1920s borrowed 90% of the stock’s value (If a stock cost 100, you would borrow 90. If the stock price began to fall, you would then have to pay back the money you borrowed-which many speculators didn’t have!)

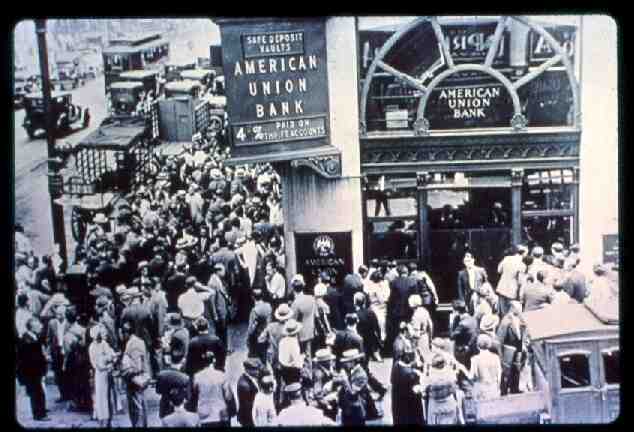

Cause #2: Stock Market Crash/ Banking Industry Collapse Analysts’ warnings that the bull market (a market in which prices are constantly rising) could not continue indefinitely made some investors nervous. Oct 28, 1929, investors rushed the stock exchange and sold their stocks at a loss of over 4 billion. On Oct 29, known as “Black Tuesday” orders to sell at any price swamped over the stock market.

Unregulated Banking Institutions The stock market crash triggered a collapse of the U.S. banking industry, which had grown increasingly unable over the course of the 1920s. This instability was due in part to banks’ over-extension of credit to stock investors and brokers. Bank reserves depleted quickly and as the Depression deepened, many banks had no assets, no cash reserves, and no new money coming in. Hundreds of banks immediately closed their doors after the market crashed, and by 1932 one fourth of the nation’s banks had closed—almost 6,000 banks

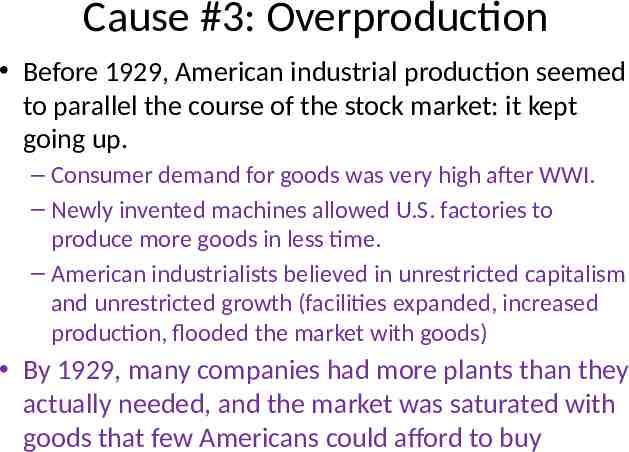

Cause #3: Overproduction Before 1929, American industrial production seemed to parallel the course of the stock market: it kept going up. – Consumer demand for goods was very high after WWI. – Newly invented machines allowed U.S. factories to produce more goods in less time. – American industrialists believed in unrestricted capitalism and unrestricted growth (facilities expanded, increased production, flooded the market with goods) By 1929, many companies had more plants than they actually needed, and the market was saturated with goods that few Americans could afford to buy

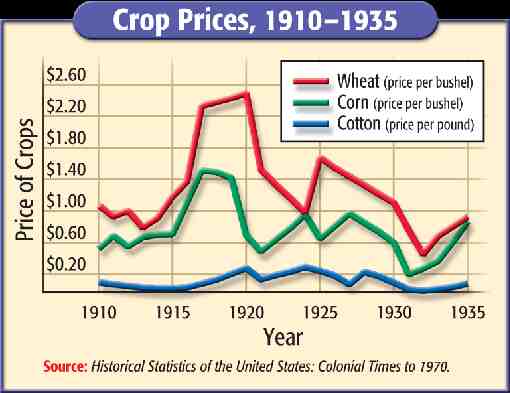

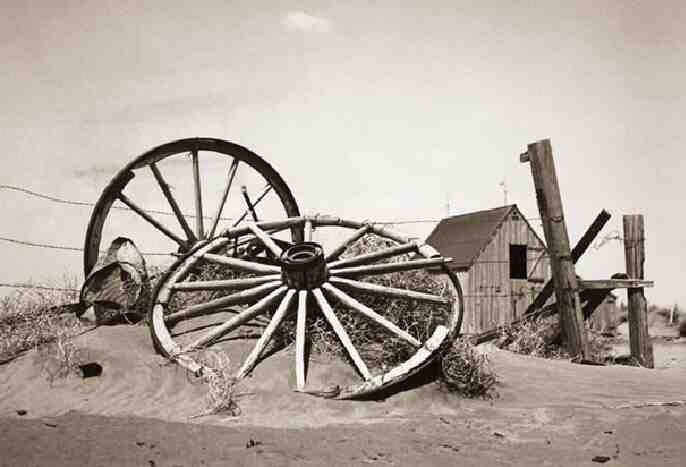

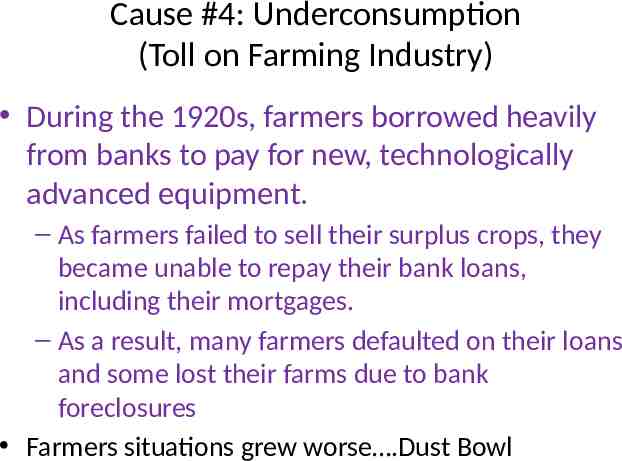

Cause #4: Underconsumption (Toll on Farming Industry) During the 1920s, farmers borrowed heavily from banks to pay for new, technologically advanced equipment. – As farmers failed to sell their surplus crops, they became unable to repay their bank loans, including their mortgages. – As a result, many farmers defaulted on their loans and some lost their farms due to bank foreclosures Farmers situations grew worse .Dust Bowl

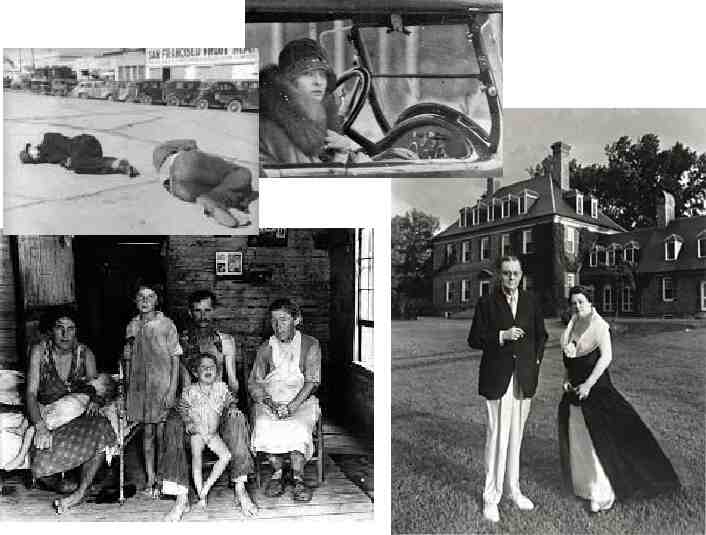

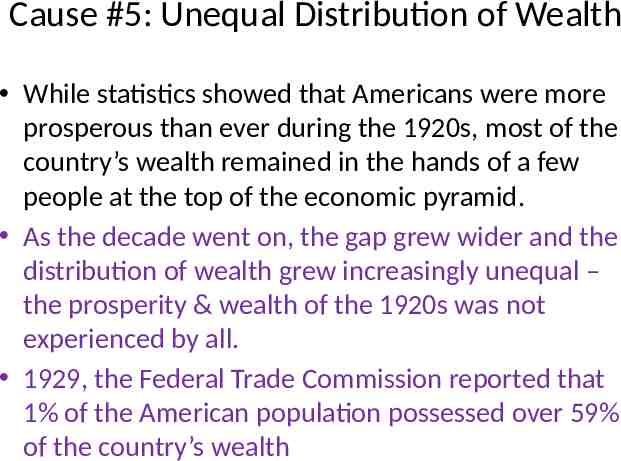

Cause #5: Unequal Distribution of Wealth While statistics showed that Americans were more prosperous than ever during the 1920s, most of the country’s wealth remained in the hands of a few people at the top of the economic pyramid. As the decade went on, the gap grew wider and the distribution of wealth grew increasingly unequal – the prosperity & wealth of the 1920s was not experienced by all. 1929, the Federal Trade Commission reported that 1% of the American population possessed over 59% of the country’s wealth

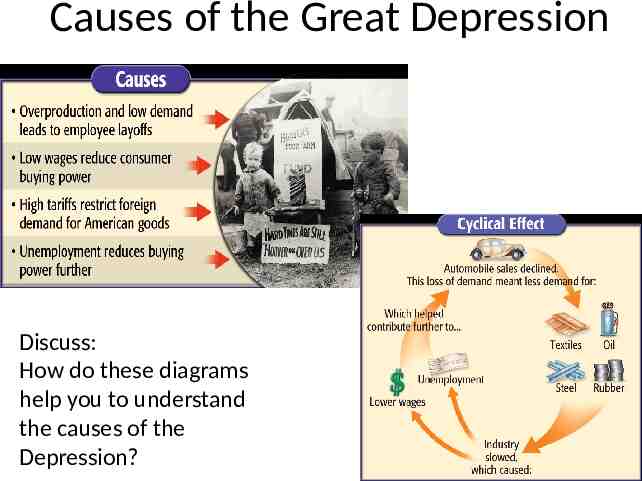

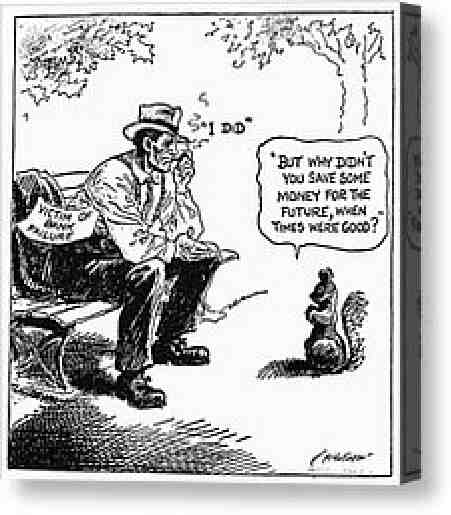

Causes of the Great Depression Discuss: How do these diagrams help you to understand the causes of the Depression?