Benefit Package School District of New Richmond

15 Slides2.75 MB

Benefit Package School District of New Richmond

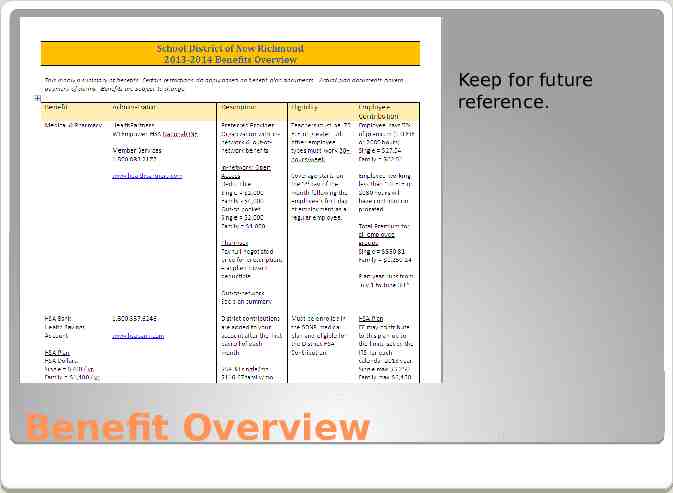

Keep for future reference. Benefit Overview

Medical/Dental Enrollment Form WI Public Employers Group Life Insurance Program HSA Enrollment Form Flexible Spending Account Enrollment Forms to complete and return to HR

HealthPartners Plan Benefits HSA Bank Information Group Long-term Disability The Wisconsin Public Employers Group Life Ins. Program Your Benefit Handbook (etf) Family Means Booklets in your folder

Included in this booklet is your medical plan summary. As a new hire, you have the Health & Wellbeing Program Requirement Achieved Plan. Prescriptions – toward deductible Dental Plan (Teachers, support staff have Plan 1) Where to go for help, discounts and hints to help save time and money. HealthPartners Medical & Dental

New Hires and all employees (including spouse) if covered by the District’s medical insurance will be required to take an on-line assessment and complete one program. Opens July 1st and closes February 28, 2014 (Frequent Fitness by 1/31/14). Program must be complete. Benefit – your deductible remains at the current rate If you do not complete the assessment and program your deductible increases 250 per year for single and 500 per year for family. Health and Wellbeing

Your HSA (Health Savings Account) The District contributes 58.33 monthly for single or 116.66 monthly for family. Use for deductible and medical, dental and vision expenses. When you leave the District the account goes with you. You receive one debit card. Can request additional cards – 2 free. Complete a beneficiary form. HSA Bank

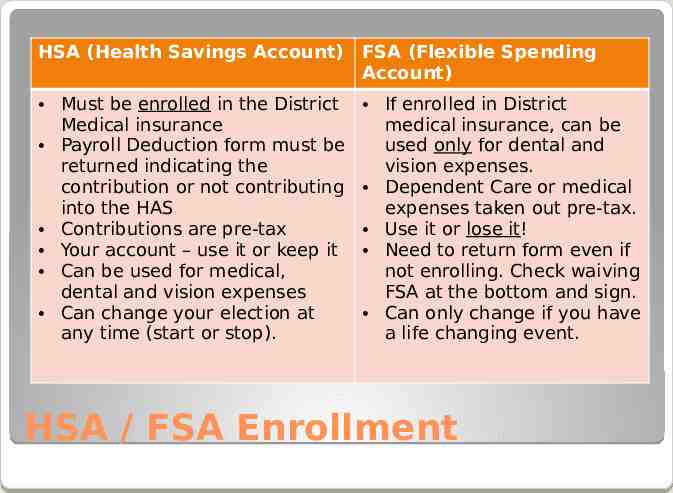

HSA (Health Savings Account) FSA (Flexible Spending Account) Must be enrolled in the District Medical insurance Payroll Deduction form must be returned indicating the contribution or not contributing into the HAS Contributions are pre-tax Your account – use it or keep it Can be used for medical, dental and vision expenses Can change your election at any time (start or stop). If enrolled in District medical insurance, can be used only for dental and vision expenses. Dependent Care or medical expenses taken out pre-tax. Use it or lose it! Need to return form even if not enrolling. Check waiving FSA at the bottom and sign. Can only change if you have a life changing event. HSA / FSA Enrollment

Form for additional cards HSA Forms Beneficiary Designation Payroll Deduction Authorization Forms on District web page

Eligible for benefits after 90 days of disability. Pays 90% of salary Long-Term Disability

District pays for basic coverage One time annual salary Can purchase an additional 2 times annual salary. Max is 3 times annual salary. District does not offer spouse or dependent coverage. Group Life Insuance

You are enrolled in the WRS upon hire if you work more than 880 hours per school year. You will receive annual notices of your account. Make sure you complete and send to ETF your beneficiary designation. You can make changes at any time. Forms available in HR. Employee Trust Funds (WI Retirement System)

The District pays for up to 3 counseling sessions for a variety of issues. Completely confidential Quarterly information newsletters sent to building lounge and on the District’s web page. This service is available to employee and immediate family (spouse and children). Employee Assistance Program (EAP)

The District offers 3 different options to invest for the future. WEA Trust – Is a lower cost option for employees. They offer phone and email support. The Standard is offered through J. A. Counter here in New Richmond for face-to-face meetings Roth is available from both vendors. Enrollment packets are available in HR. Just ask. Wisconsin Deferred Compensation Program is a voluntary supplemental retirement savings program for all local government and school district employees. 403(b) Plan / 457 Plan

www.newrichmond.k12.wi.us District Web Page