dwp.gov.uk Official – Sensitive COMMERCIAL DIRECTORATE 1

45 Slides1.70 MB

www.dwp.gov.uk Official - Sensitive COMMERCIAL DIRECTORATE 1

Commercial Agreement for the provision of Employment and Health Related Services (CAEHRS) Kevin Keenan Market Engagement /ITT Event Official - Sensitive 2

Welcome/Domestics Welcome to today’s event. Please ensure you are on mute for the session. Today’s event is for information/listening only – there will be various avenues/forums to raise questions at a later date. All today’s slides have/will be shared. We will share details of all who have attended this event to assist in networking/relationship-building. Official - Sensitive 3

Introduction/Purpose of the Session How did Market Engagement shape the design of CAEHRS? Provide full details of CAEHRS and it’s design. Provide full details of the Invitation to Tender process, including Qualification, Technical, and Commercial Envelopes. Provide key information around Financial and Security requirements. Provide forward look - key timeline dates. Recap and next steps. Official - Sensitive 4

Working with DWP Official - Sensitive 5

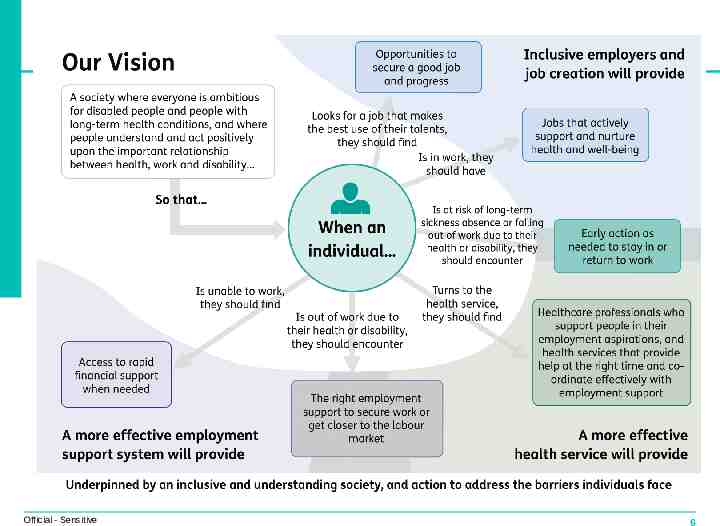

Official - Sensitive 6

What we do Employment Programmes are designed to support and complement Jobcentre Plus delivered support and to: Support people into or to stay in work, focusing on some of the hardest to help customer groups; Support manifesto commitments of 1m more people with health and disability into work; DWP Mission Deliver a modern, fair and affordable welfare system that makes a positive difference to citizens’ lives by extending opportunity, strengthening personal responsibility and enabling fulfilment of personal potential. A transforming welfare system with services delivered in a sustainable and effective way whilst reducing costs and achieving value for money for UK taxpayers. Lift people out of poverty through work; Reduce dependency on benefits and the cost to the exchequer and society as a whole; Allow and enable everyone to compete to gain meaningful employment. Official - Sensitive 7

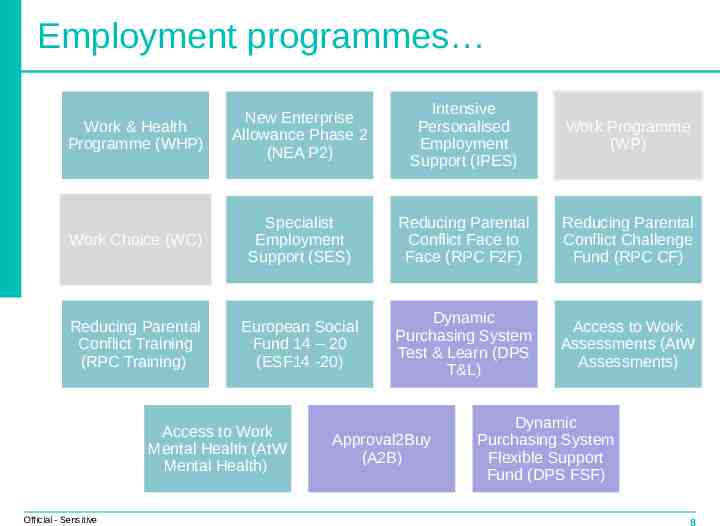

Employment programmes Work & Health Programme (WHP) New Enterprise Allowance Phase 2 (NEA P2) Intensive Personalised Employment Support (IPES) Work Programme (WP) Work Choice (WC) Specialist Employment Support (SES) Reducing Parental Conflict Face to Face (RPC F2F) Reducing Parental Conflict Challenge Fund (RPC CF) Reducing Parental Conflict Training (RPC Training) European Social Fund 14 – 20 (ESF14 -20) Dynamic Purchasing System Test & Learn (DPS T&L) Access to Work Assessments (AtW Assessments) Access to Work Mental Health (AtW Mental Health) Official - Sensitive Approval2Buy (A2B) Dynamic Purchasing System Flexible Support Fund (DPS FSF) 8

What is a good supplier? A number of key characteristics we expect when working with DWP. Good understanding of the strategic direction of our support and needs of our key customer groups (relative to the regional lot). Need to be flexible, with the capability to manage change and work with the Category to adapt their delivery models in line with these priorities. Responsibility to steward and develop the market to support the growth and expertise of SMEs to build the market base and expertise available for our customers. Demonstrate a set of values and behaviours that is essential for healthy, highperforming supply chains and the culture we expect from partners. To continuously improve, test new approaches, develop effective practice and share what works and what does not. Commitment to increase and improve digital services as part of DWPs ambition to be the most effective and efficient delivery organisation in the public sector. DWP will seek to work closely with Suppliers, and will use the principles of strategic Supplier Relationship Management (SRM) as a basis to collaborate. Official - Sensitive 9

How did Market Engagement shape the design of CAEHRS? Held a Pre-market Supplier Engagement Event held on the 30th October 2019 where we invited suggestions on initial design of CAEHRS We then undertook a ‘deep dive’ on the evaluation and feedback from the event around our initial design. Supplier Survey issued on the 10th December 19 which closed on 20th December 19, to gain input on new design proposal. As a result, changes were made to the design based on market feedback Official - Sensitive 10

What is CAEHRS? Oliver Adams DWP Commercial Directorate Official - Sensitive 11

Driver for using CAEHRS The vehicle of choice for DWP Employment Category to deliver more effective, efficient, consistent and quicker procurements. To ensure suppliers have the minimum standards expected for a DWP (and government) contracted programme. Supports more focused procurements with “right” suppliers engaged and waiting to respond to DWP requirements. To support strategic alignment with market and better cooperation (with both the DWP and other providers). To support improvement in supplier capability, understanding and ultimately delivery to our customers. The DWP can drive better value by allowing Providers to build on existing footprints in an area, provide economies of scale, allowing them to foster local and specialist partnerships and increase local knowledge. Critically this is not only available to the DWP but will enable future contracted provision to be called off by other contracting authorities including the Scottish Government, Local Authorities, Devolved Deal Areas, Local Government Partnerships, Other Government Departments and Arm’s Length Bodies. Official - Sensitive 12

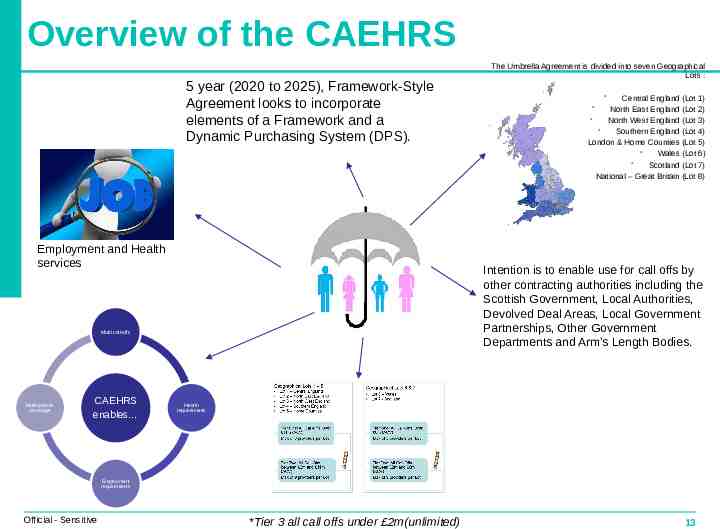

Overview of the CAEHRS 5 year (2020 to 2025), Framework-Style Agreement looks to incorporate elements of a Framework and a Dynamic Purchasing System (DPS). Employment and Health services CAEHRS enables Central England (Lot 1) North East England (Lot 2) North West England (Lot 3) Southern England (Lot 4) London & Home Counties (Lot 5) Wales (Lot 6) Scotland (Lot 7) National – Great Britain (Lot 8) Intention is to enable use for call offs by other contracting authorities including the Scottish Government, Local Authorities, Devolved Deal Areas, Local Government Partnerships, Other Government Departments and Arm’s Length Bodies. Multi call-offs Multi-partner coverage The Umbrella Agreement is divided into seven Geographical Lots : Health requirements Employment requirements Official - Sensitive *Tier 3 all call offs under 2m(unlimited) 13

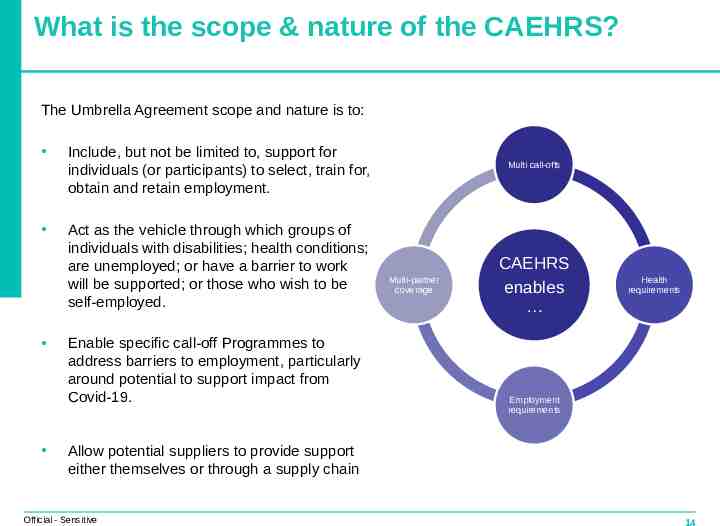

What is the scope & nature of the CAEHRS? The Umbrella Agreement scope and nature is to: Include, but not be limited to, support for individuals (or participants) to select, train for, obtain and retain employment. Act as the vehicle through which groups of individuals with disabilities; health conditions; are unemployed; or have a barrier to work will be supported; or those who wish to be self-employed. Enable specific call-off Programmes to address barriers to employment, particularly around potential to support impact from Covid-19. Multi call-offs Multi-partner coverage CAEHRS enables Health requirements Employment requirements Allow potential suppliers to provide support either themselves or through a supply chain Official - Sensitive 14

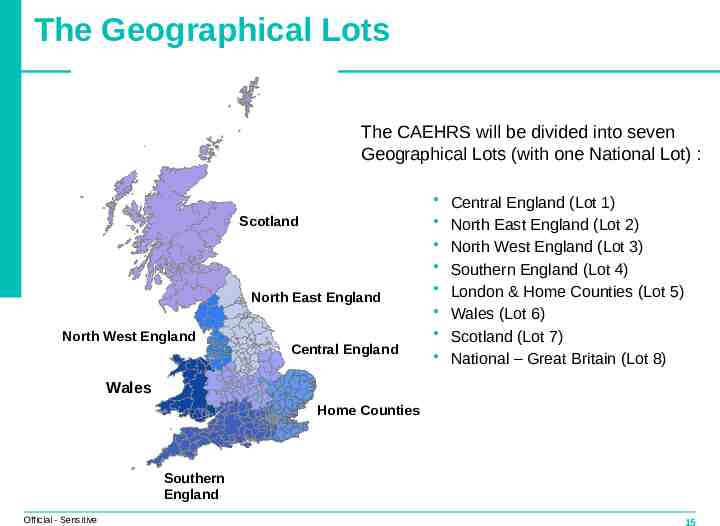

The Geographical Lots The CAEHRS will be divided into seven Geographical Lots (with one National Lot) : Scotland North East England North West England Central England Central England (Lot 1) North East England (Lot 2) North West England (Lot 3) Southern England (Lot 4) London & Home Counties (Lot 5) Wales (Lot 6) Scotland (Lot 7) National – Great Britain (Lot 8) Wales Home Counties Southern England Official - Sensitive 15

Why the Lot Structure? Research and analysis prior to Work and Health Programme and Umbrella Agreement I design identified the structure within England and Wales. – This aligns with the DWP programmes ensuring consistency of approach. – This is the preferred default position for future employment provisions. – The Market Feedback was that you supported this for tiers 1 and 2. – Drives better value by: Building on existing footprints Economies of Scale Enabling local focus/specialist knowledge Enables Department to support collaboration/creation of new entrants Effective Contract Management Official - Sensitive 16

CAEHRS Tiering Geographical Lots 1 – 5 Lot 1 – Central England Lot 2 – North East England Lot 3 – North West England Lot 4 – Southern England Lot 5 – London & Home Counties Official - Sensitive Geographical Lots 6 & 7 Lot 6 – Wales Lot 7 - Scotland 17

Why a Tiered Approach? Allows greater opportunity to grow the market and attract new suppliers. Avoids monopolistic effects on the market. Allows greater flexibility and adaptability to market changes, provider activity and performance. Supports collaboration, continuous improvement and delivery of programme of supplier relationship management. Enables robust financial viability assessment, proportionate to future contract delivery whilst allowing more inclusivity. Maintains a manageable and more diverse market. Official - Sensitive 18

Tier Values Commercial Finance Colleagues conducted an analysis of all Employment Provision contract value from 2010 to date. The analysis took into account the complexity of provision, average annual contract values, average total contract value and Supplier Accreditation and Passporting data analysis. Market Engagement and Testing conducted in respect of proposed values showed strong agreement to the proposed values. Supports proposed procurement processes. Enables Financial Viability evaluation in line with Cabinet Office guidelines to be conducted in an efficient manner. Official - Sensitive 19

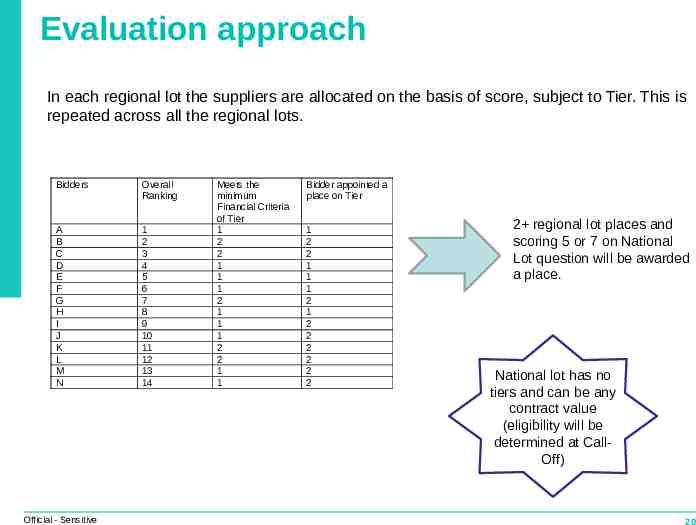

Evaluation approach In each regional lot the suppliers are allocated on the basis of score, subject to Tier. This is repeated across all the regional lots. Bidders Overall Ranking A B C D E F G H I J K L M N 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Official - Sensitive Meets the minimum Financial Criteria of Tier 1 2 2 1 1 1 2 1 1 1 2 2 1 1 Bidder appointed a place on Tier 1 2 2 1 1 1 2 1 2 2 2 2 2 2 2 regional lot places and scoring 5 or 7 on National Lot question will be awarded a place. National lot has no tiers and can be any contract value (eligibility will be determined at CallOff) 20

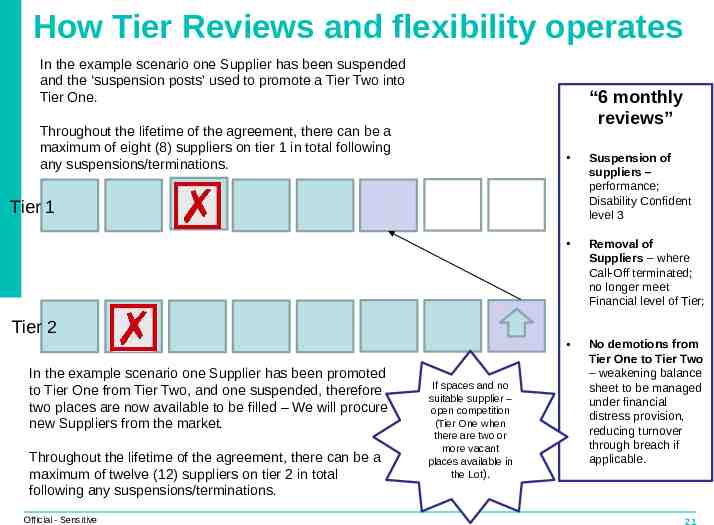

How Tier Reviews and flexibility operates In the example scenario one Supplier has been suspended and the ‘suspension posts’ used to promote a Tier Two into Tier One. “6 monthly reviews” Throughout the lifetime of the agreement, there can be a maximum of eight (8) suppliers on tier 1 in total following any suspensions/terminations. Suspension of suppliers – performance; Disability Confident level 3 Removal of Suppliers – where Call-Off terminated; no longer meet Financial level of Tier; No demotions from Tier One to Tier Two – weakening balance sheet to be managed under financial distress provision, reducing turnover through breach if applicable. Tier 1 Tier 2 In the example scenario one Supplier has been promoted to Tier One from Tier Two, and one suspended, therefore two places are now available to be filled – We will procure new Suppliers from the market. Throughout the lifetime of the agreement, there can be a maximum of twelve (12) suppliers on tier 2 in total following any suspensions/terminations. Official - Sensitive If spaces and no suitable supplier – open competition (Tier One when there are two or more vacant places available in the Lot). 21

Tier Review – Key Points Suspension of a supplier from Tier One could occur if at the six-monthly review point, a Supplier no longer meets the performance requirements within a current contract prior to review. Termination of a supplier from the Agreement could occur if any DWP/CAEHRS contract held by the supplier is terminated. Where a Tier One provider is terminated or suspended then we will review all Tier Two suppliers and, subject to meeting financial criteria, promote into the available space in Tier One. Where there is no suitable organisation on Tier Two that meets Tier One criteria then a new Tier One organisation may be procured from the market. We will only procure from the open market for Tier One when there are two or more vacant places available in the Lot. There will be no demotions from Tier One to Tier Two – weakening balance sheet to be managed under financial distress provision, reducing turnover through breach if applicable. Where one or more Tier Two providers in a Lot are terminated/suspended, or are promoted to Tier One, we will look to run a open-procurement competition to fill the additional places within the Lot. Official - Sensitive 22

The Commercial Envelope and Financial Requirements Jennifer Barnes DWP Commercial Finance Official - Sensitive 23

What is the basis for the financial assessment? The standard finance Acid test ratio is calculated to determine the risk rating of organisations. Average of last 3 years annual turnover for the organisation. Based on the acid test ratio calculated a score will be allocated which will indicate the percentage of turnover to be used in the calculation of the indicative contract, value up to a maximum of 75%. Ultimate parent company’s accounts will also be assessed and their risk rating can be used providing a Parent Company Guarantee Official - Sensitive 24

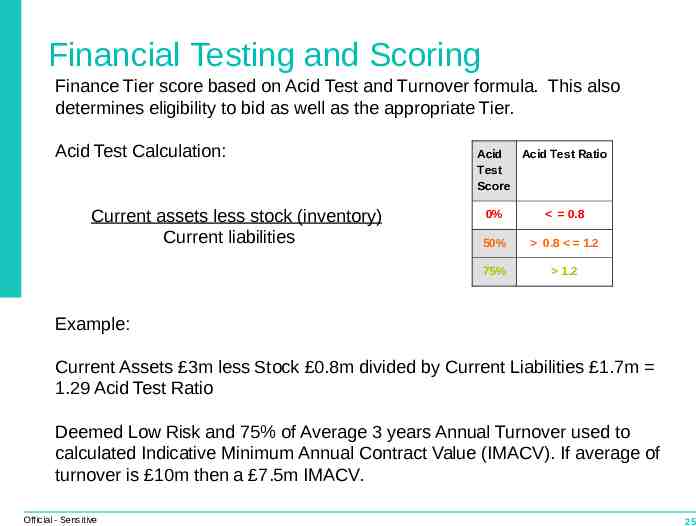

Financial Testing and Scoring Finance Tier score based on Acid Test and Turnover formula. This also determines eligibility to bid as well as the appropriate Tier. Acid Test Calculation: Current assets less stock (inventory) Current liabilities Acid Acid Test Ratio Test Score 0% 0.8 50% 0.8 1.2 75% 1.2 Example: Current Assets 3m less Stock 0.8m divided by Current Liabilities 1.7m 1.29 Acid Test Ratio Deemed Low Risk and 75% of Average 3 years Annual Turnover used to calculated Indicative Minimum Annual Contract Value (IMACV). If average of turnover is 10m then a 7.5m IMACV. Official - Sensitive 25

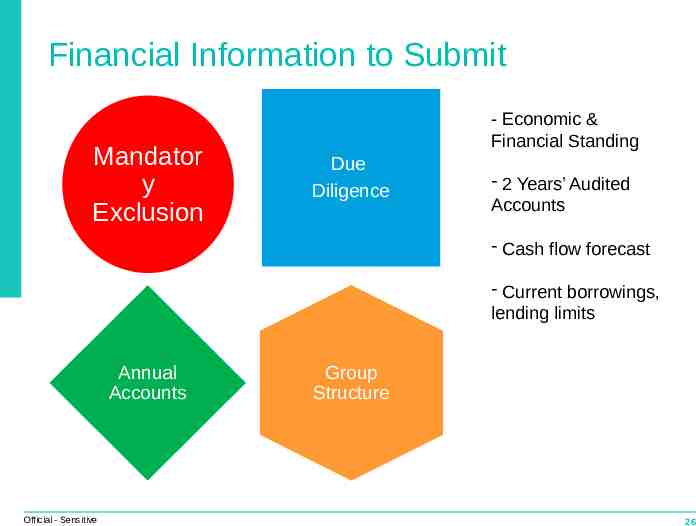

Financial Information to Submit Mandator y Exclusion - Economic & Financial Standing Due Diligence - 2 Years’ Audited Accounts - Cash flow forecast - Current borrowings, lending limits Annual Accounts Official - Sensitive Group Structure 26

Financial Information to Submit Where bidders are deemed high or medium risk based on the acid test ratio further information may be submitted to DWP for further review. DWP may then consider whether there is sufficient evidence to justify amending the indicative minimum annual contract value. A bidder can provide additional evidence for example a parent company guarantee or evidence of substantial change to the Balance Sheet for further review. Official - Sensitive 27

CAEHRS Webinar Pre- Contract Supplier Security Assurance June 2020 ONE DWP SECURITY

Supplier Security Assurance: Overview DWP has legal and regulatory obligations to verify that the suppliers we work with have a reasonable standard of security in place to protect Authority data and assets. DWP is committed to the protection of its information, assets and personnel and expects the same level of commitment from its suppliers (and sub-contractors if applicable). In order to protect the Department appropriately, DWP have recently reviewed its Security Supplier Assurance process and requirements and have made the applicable changes in line with industry good practice. 1. Supplier security assurance process: CAEHRS onboarding: An overview of DWP Security Supplier Assurance process and requirements for the onboarding of Suppliers onto the CAEHRS agreement. 2. Supplier security assurance process: Call off contracts: An overview of DWP Security Supplier Assurance process and requirements for the letting of individual call off contracts. Department for Work & Pensions 29

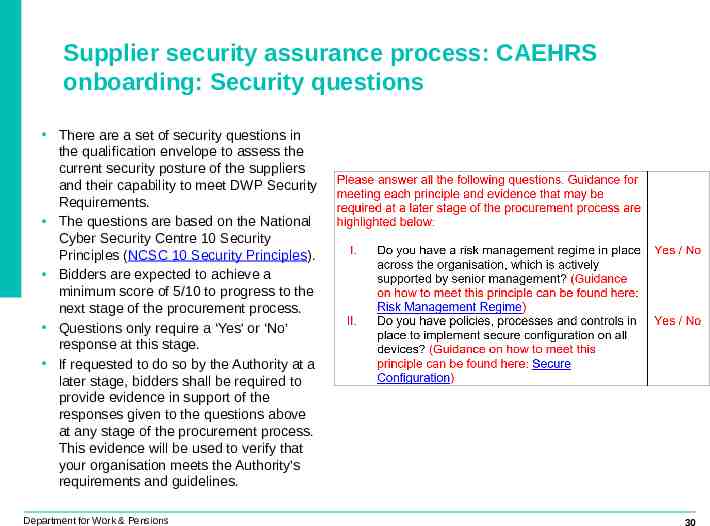

Supplier security assurance process: CAEHRS onboarding: Security questions There are a set of security questions in the qualification envelope to assess the current security posture of the suppliers and their capability to meet DWP Security Requirements. The questions are based on the National Cyber Security Centre 10 Security Principles (NCSC 10 Security Principles). Bidders are expected to achieve a minimum score of 5/10 to progress to the next stage of the procurement process. Questions only require a ‘Yes’ or ‘No’ response at this stage. If requested to do so by the Authority at a later stage, bidders shall be required to provide evidence in support of the responses given to the questions above at any stage of the procurement process. This evidence will be used to verify that your organisation meets the Authority’s requirements and guidelines. Department for Work & Pensions 30

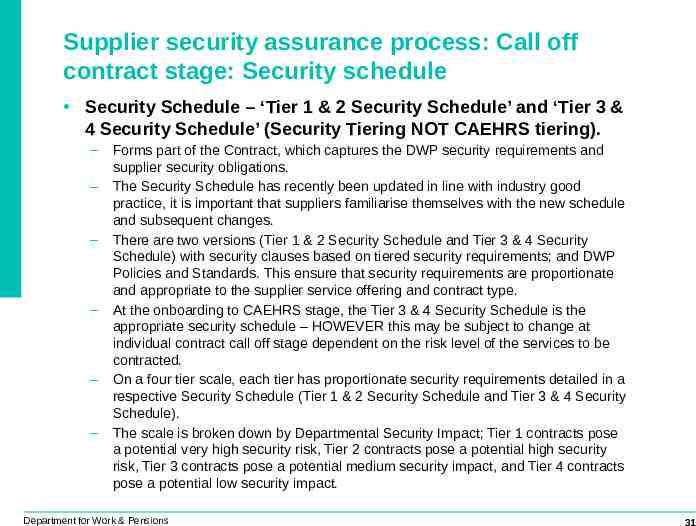

Supplier security assurance process: Call off contract stage: Security schedule Security Schedule – ‘Tier 1 & 2 Security Schedule’ and ‘Tier 3 & 4 Security Schedule’ (Security Tiering NOT CAEHRS tiering). – – – – – – Forms part of the Contract, which captures the DWP security requirements and supplier security obligations. The Security Schedule has recently been updated in line with industry good practice, it is important that suppliers familiarise themselves with the new schedule and subsequent changes. There are two versions (Tier 1 & 2 Security Schedule and Tier 3 & 4 Security Schedule) with security clauses based on tiered security requirements; and DWP Policies and Standards. This ensure that security requirements are proportionate and appropriate to the supplier service offering and contract type. At the onboarding to CAEHRS stage, the Tier 3 & 4 Security Schedule is the appropriate security schedule – HOWEVER this may be subject to change at individual contract call off stage dependent on the risk level of the services to be contracted. On a four tier scale, each tier has proportionate security requirements detailed in a respective Security Schedule (Tier 1 & 2 Security Schedule and Tier 3 & 4 Security Schedule). The scale is broken down by Departmental Security Impact; Tier 1 contracts pose a potential very high security risk, Tier 2 contracts pose a potential high security risk, Tier 3 contracts pose a potential medium security impact, and Tier 4 contracts pose a potential low security impact. Department for Work & Pensions 31

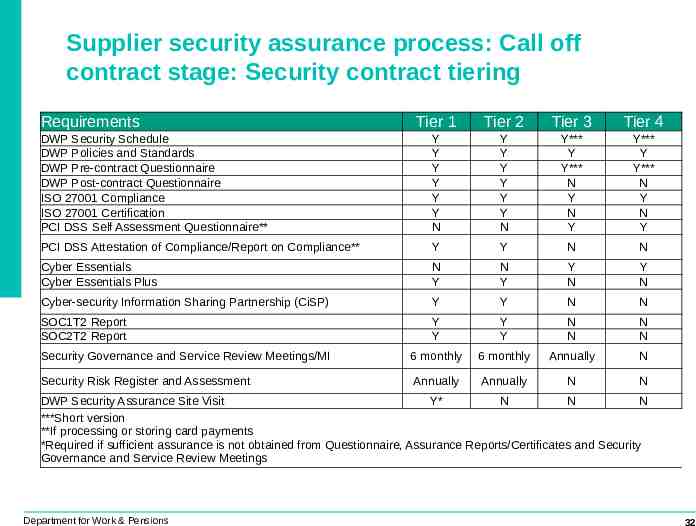

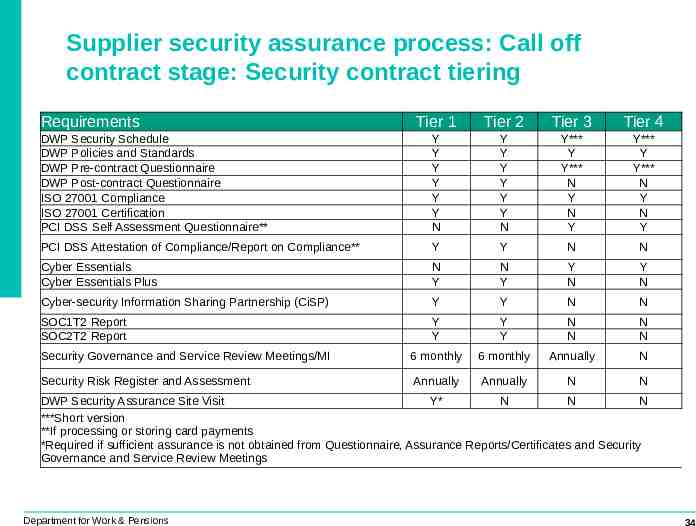

Supplier security assurance process: Call off contract stage: Security contract tiering Requirements Tier 1 Tier 2 Tier 3 Tier 4 DWP Security Schedule DWP Policies and Standards DWP Pre-contract Questionnaire DWP Post-contract Questionnaire ISO 27001 Compliance ISO 27001 Certification PCI DSS Self Assessment Questionnaire** Y Y Y Y Y Y N Y Y Y Y Y Y N Y*** Y Y*** N Y N Y Y*** Y Y*** N Y N Y PCI DSS Attestation of Compliance/Report on Compliance** Y Y N N Cyber Essentials Cyber Essentials Plus N Y N Y Y N Y N Cyber-security Information Sharing Partnership (CiSP) Y Y N N SOC1T2 Report SOC2T2 Report Y Y Y Y N N N N Security Governance and Service Review Meetings/MI 6 monthly 6 monthly Annually N Security Risk Register and Assessment Annually Annually N N DWP Security Assurance Site Visit Y* N N N ***Short version **If processing or storing card payments *Required if sufficient assurance is not obtained from Questionnaire, Assurance Reports/Certificates and Security Governance and Service Review Meetings Department for Work & Pensions 32

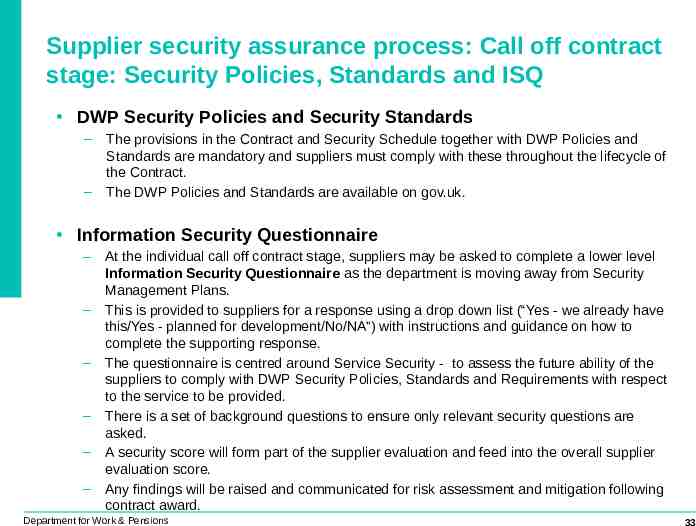

Supplier security assurance process: Call off contract stage: Security Policies, Standards and ISQ DWP Security Policies and Security Standards – – The provisions in the Contract and Security Schedule together with DWP Policies and Standards are mandatory and suppliers must comply with these throughout the lifecycle of the Contract. The DWP Policies and Standards are available on gov.uk. Information Security Questionnaire – – – – – – At the individual call off contract stage, suppliers may be asked to complete a lower level Information Security Questionnaire as the department is moving away from Security Management Plans. This is provided to suppliers for a response using a drop down list (“Yes - we already have this/Yes - planned for development/No/NA”) with instructions and guidance on how to complete the supporting response. The questionnaire is centred around Service Security - to assess the future ability of the suppliers to comply with DWP Security Policies, Standards and Requirements with respect to the service to be provided. There is a set of background questions to ensure only relevant security questions are asked. A security score will form part of the supplier evaluation and feed into the overall supplier evaluation score. Any findings will be raised and communicated for risk assessment and mitigation following contract award. Department for Work & Pensions 33

Supplier security assurance process: Call off contract stage: Security contract tiering Requirements Tier 1 Tier 2 Tier 3 Tier 4 DWP Security Schedule DWP Policies and Standards DWP Pre-contract Questionnaire DWP Post-contract Questionnaire ISO 27001 Compliance ISO 27001 Certification PCI DSS Self Assessment Questionnaire** Y Y Y Y Y Y N Y Y Y Y Y Y N Y*** Y Y*** N Y N Y Y*** Y Y*** N Y N Y PCI DSS Attestation of Compliance/Report on Compliance** Y Y N N Cyber Essentials Cyber Essentials Plus N Y N Y Y N Y N Cyber-security Information Sharing Partnership (CiSP) Y Y N N SOC1T2 Report SOC2T2 Report Y Y Y Y N N N N Security Governance and Service Review Meetings/MI 6 monthly 6 monthly Annually N Security Risk Register and Assessment Annually Annually N N DWP Security Assurance Site Visit Y* N N N ***Short version **If processing or storing card payments *Required if sufficient assurance is not obtained from Questionnaire, Assurance Reports/Certificates and Security Governance and Service Review Meetings Department for Work & Pensions 34

The Invitation to Tender Process Chris Sears DWP Commercial Directorate Department for Work & Pensions 35

Commercial Timeline – Key Dates Activity Date Publication of the Contract Notice/OJEU Monday 29th June Publication of ItT to all Potential Suppliers Monday 29th June @ 10am Question & Answer Log (Q&A) - Set up and run an online/electronic Q&A facility Thursday 25th June Deadline for submission of questions Monday 27th July @ 10am Final Q&A Log issued Tuesday 28th July @ 5pm Deadline for return of ItT Response (10am) Monday 3rd August Notification issued to successful and unsuccessful Suppliers. August Contract Award August/September Official - Sensitive 36

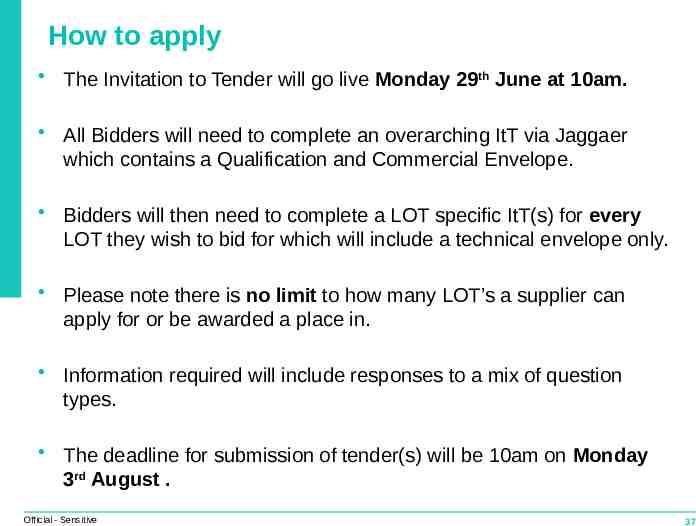

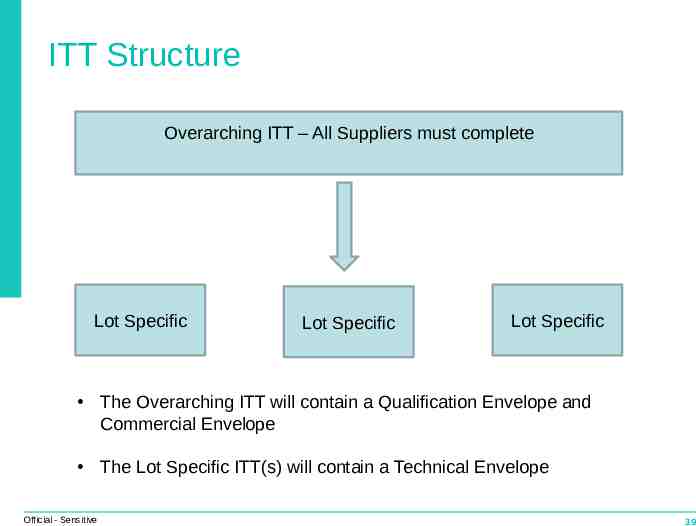

How to apply The Invitation to Tender will go live Monday 29th June at 10am. All Bidders will need to complete an overarching ItT via Jaggaer which contains a Qualification and Commercial Envelope. Bidders will then need to complete a LOT specific ItT(s) for every LOT they wish to bid for which will include a technical envelope only. Please note there is no limit to how many LOT’s a supplier can apply for or be awarded a place in. Information required will include responses to a mix of question types. The deadline for submission of tender(s) will be 10am on Monday 3rd August . Official - Sensitive 37

Bidder Checklist - Important Information Please ensure all instructions are read thoroughly. Please ensure your response to each section does not exceed the prescribed page count and all bullet points are covered within your responses Please ensure all answers are self contained with no crossreferencing. Please do not send brochures, glossy leaflets etc. as these will not be used. Please ensure your response per LOT is submitted through Jaggaer by 10.00am on Monday 3rd August Official - Sensitive Negotiation work stream 38

ITT Structure Overarching ITT – All Suppliers must complete Lot Specific Lot Specific Lot Specific The Overarching ITT will contain a Qualification Envelope and Commercial Envelope The Lot Specific ITT(s) will contain a Technical Envelope Official - Sensitive 39

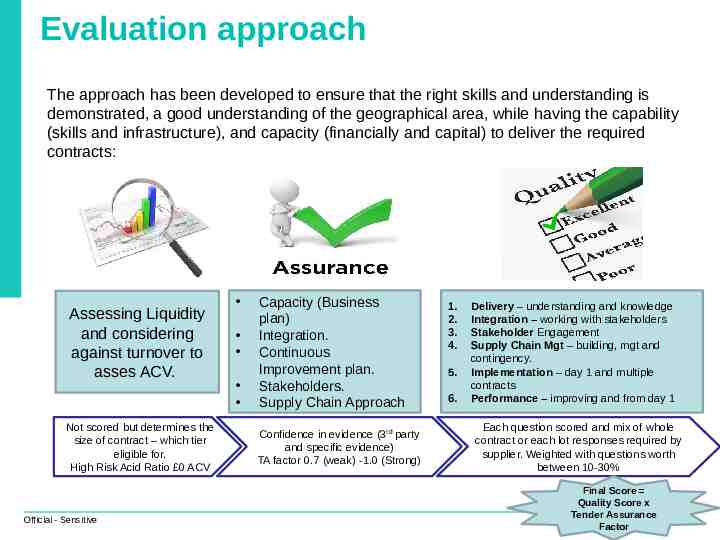

Evaluation approach The approach has been developed to ensure that the right skills and understanding is demonstrated, a good understanding of the geographical area, while having the capability (skills and infrastructure), and capacity (financially and capital) to deliver the required contracts: Assessing Liquidity and considering against turnover to asses ACV. Not scored but determines the size of contract – which tier eligible for. High Risk Acid Ratio 0 ACV Official - Sensitive Capacity (Business plan) Integration. Continuous Improvement plan. Stakeholders. Supply Chain Approach Confidence in evidence (3rd party and specific evidence) TA factor 0.7 (weak) -1.0 (Strong) 1. 2. 3. 4. 5. 6. Delivery – understanding and knowledge Integration – working with stakeholders Stakeholder Engagement Supply Chain Mgt – building, mgt and contingency. Implementation – day 1 and multiple contracts Performance – improving and from day 1 Each question scored and mix of whole contract or each lot responses required by supplier. Weighted with questions worth between 10-30% Final Score Quality Score x Tender Assurance Factor 40

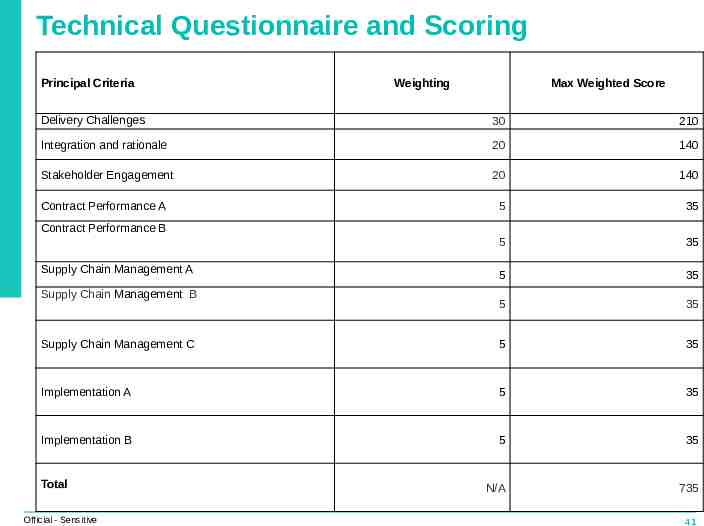

Technical Questionnaire and Scoring Principal Criteria Weighting Max Weighted Score Delivery Challenges 30 210 Integration and rationale 20 140 Stakeholder Engagement 20 140 5 35 5 35 5 35 5 35 Supply Chain Management C 5 35 Implementation A 5 35 Implementation B 5 35 N/A 735 Contract Performance A Contract Performance B Supply Chain Management A Supply Chain Management B Total Official - Sensitive 41

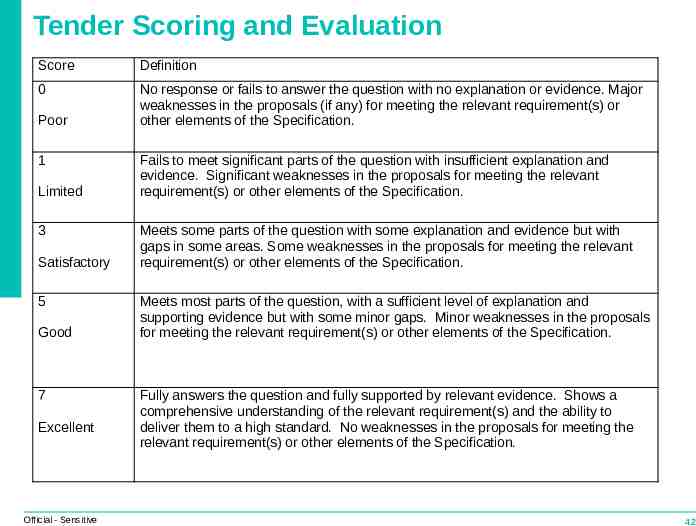

Tender Scoring and Evaluation Score Definition 0 No response or fails to answer the question with no explanation or evidence. Major weaknesses in the proposals (if any) for meeting the relevant requirement(s) or other elements of the Specification. Poor 1 Limited 3 Satisfactory 5 Good 7 Excellent Official - Sensitive Fails to meet significant parts of the question with insufficient explanation and evidence. Significant weaknesses in the proposals for meeting the relevant requirement(s) or other elements of the Specification. Meets some parts of the question with some explanation and evidence but with gaps in some areas. Some weaknesses in the proposals for meeting the relevant requirement(s) or other elements of the Specification. Meets most parts of the question, with a sufficient level of explanation and supporting evidence but with some minor gaps. Minor weaknesses in the proposals for meeting the relevant requirement(s) or other elements of the Specification. Fully answers the question and fully supported by relevant evidence. Shows a comprehensive understanding of the relevant requirement(s) and the ability to deliver them to a high standard. No weaknesses in the proposals for meeting the relevant requirement(s) or other elements of the Specification. 42

What is Tender Assurance? – Key Aims To provide DWP with confidence in the ability for any potential supplier to deliver Call-Off Services, in line with their CAEHRS Tender. To manage delivery risk in the delivery of services under the Call-Off Contracts; as part of the procurement process. Designed to test generic aspects of the delivery of Call-Off Services, that may be procured through the CAEHRS. CAEHRS Bidders will be asked, as part of the Tender Assurance Questions, to provide assurance from third party organisations that the examples provided, of previous or existing service delivery contracts, similar to the Call-Off Contracts that may be awarded under CAEHRS, in the response to the CAEHRS ItT Qualitative Evaluation Questions, are an accurate representation of their experience. Official - Sensitive 43

Q&A – Important Information If you wish to raise any questions after the event please submit them to DWP using the Jaggaer website messaging facility. We are also looking to run Focus Group Sessions over the coming weeks on key specialist areas, so please regularly access Jaggaer for more information and to book a place. Final date/time to raise questions is 27th July – 10am. Further information including Question and Answer logs will be published on the Jaggaer website at regular intervals. Official - Sensitive Negotiation work stream 44

Next Steps and Recap The Invitation to Tender will active from Monday 29th June at 10am. The deadline for submissions will be Monday 3rd August at 10am. The Q&A facility is available via the Jaggaer messing facility. Please look out for further details of Focus Group Sessions when they become available. Official - Sensitive 45