Time Value of Money Jim Bice

18 Slides194.00 KB

Time Value of Money Jim Bice

Activity Plan Overview Equations and the math behind it Activity – Instructions – Reminder on Excel – Group activity Summary and Homework

Examples of Time Value of Were the Indians cheated in the purchase of Manhattan Island. – Given 100 worth of trinkets in 1626 – What if they banked it at 7% interest They would have over 13,000,000,000,000 or 13 trillion dollars today.

What does this mean Would you rather have 100 today or 100 in Why? a year? What if you could not What would you do with spend it? it? Would you give me Why or why not? 100 today if I would give you 200 in 20 years?

Time value of money Time value of money - Money has the ability to increase over time (if it is invested) Interest - The amount of money that is earned over a certain time period Interest rate - The rate interest is earned

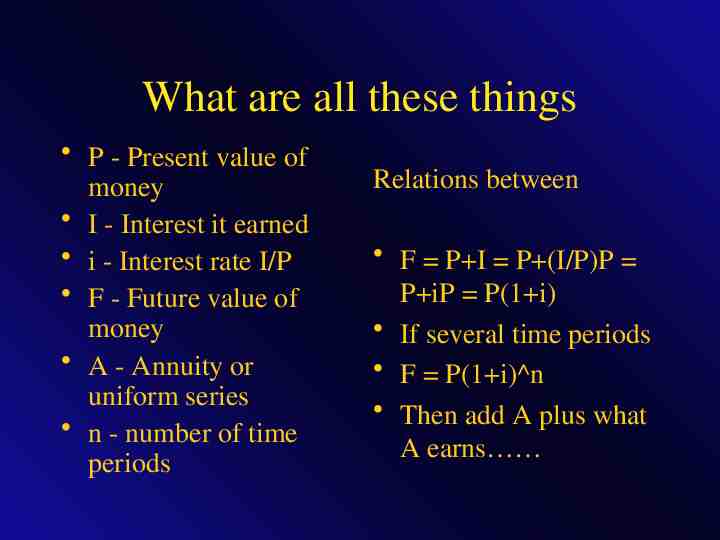

What are all these things P - Present value of money I - Interest it earned i - Interest rate I/P F - Future value of money A - Annuity or uniform series n - number of time periods Relations between F P I P (I/P)P P iP P(1 i) If several time periods F P(1 i) n Then add A plus what A earns

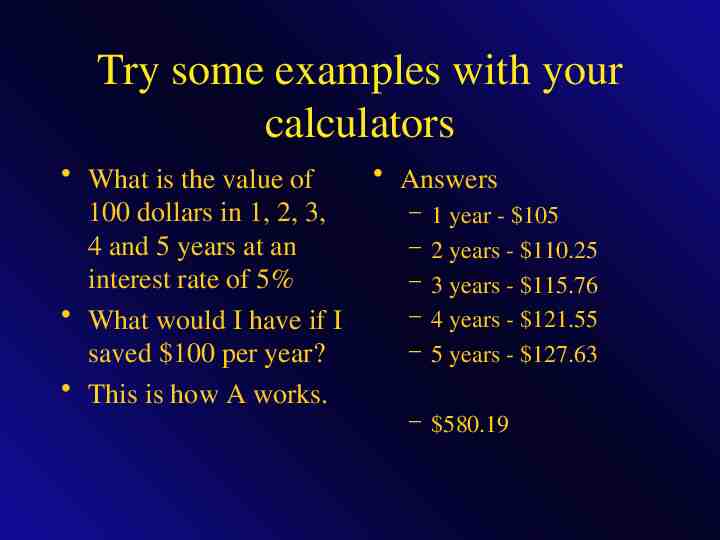

Try some examples with your calculators What is the value of 100 dollars in 1, 2, 3, 4 and 5 years at an interest rate of 5% What would I have if I saved 100 per year? This is how A works. Answers – – – – – 1 year - 105 2 years - 110.25 3 years - 115.76 4 years - 121.55 5 years - 127.63 – 580.19

What real life thing uses all this Banks – Savings and CD’s – Car loans – House loans Life Insurance Investors Loan Sharks Terms Interest rate, Inflation rate, Loan rate all are forms of I P is used for the value of the car or house etc. Payments on a loan are examples of A

Assignment Get in your assigned groups of 3 Grab a computer Put together an Excel spreadsheet that shows what happens over time Answer the questions I will post once you start.

Reminder on how Excel works Formulas start with They are relational unless you fix the cell with Drag the formulas down to copy them

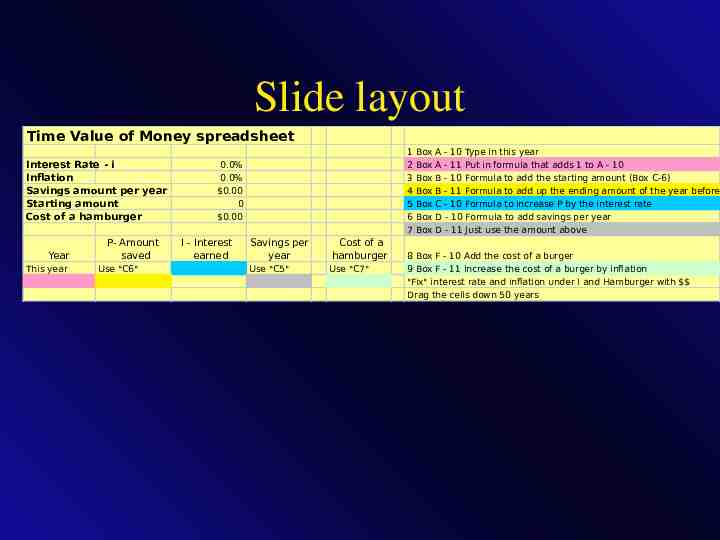

Slide layout Time Value of Money spreadsheet Interest Rate - i Inflation Savings amount per year Starting amount Cost of a hamburger Year This year P- Amount saved Use "C6" 1 2 3 4 5 6 7 0.0% 0.0% 0.00 0 0.00 I - Interest earned Savings per year Use "C5" Cost of a hamburger Use "C7" Box Box Box Box Box Box Box A - 10 Type in this year A - 11 Put in formula that adds 1 to A - 10 B - 10 Formula to add the starting amount (Box C-6) B - 11 Formula to add up the ending amount of the year before C - 10 Formula to increase P by the interest rate D - 10 Formula to add savings per year D - 11 Just use the amount above 8 Box F - 10 Add the cost of a burger 9 Box F - 11 Increase the cost of a burger by inflation "Fix" interest rate and inflation under I and Hamburger with Drag the cells down 50 years

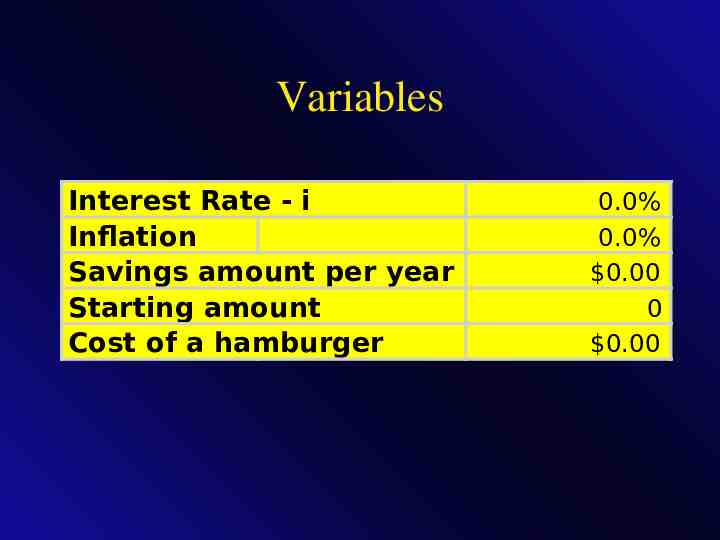

Variables Interest Rate - i Inflation Savings amount per year Starting amount Cost of a hamburger 0.0% 0.0% 0.00 0 0.00

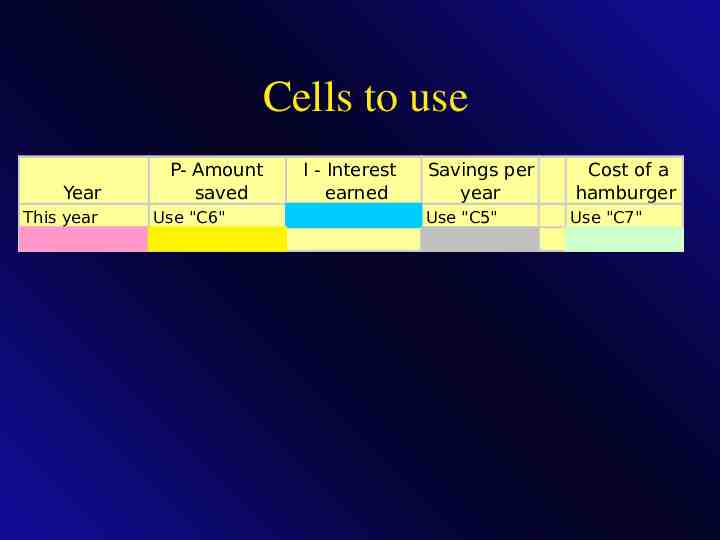

Cells to use Year This year P- Amount saved Use "C6" I - Interest earned Savings per year Use "C5" Cost of a hamburger Use "C7"

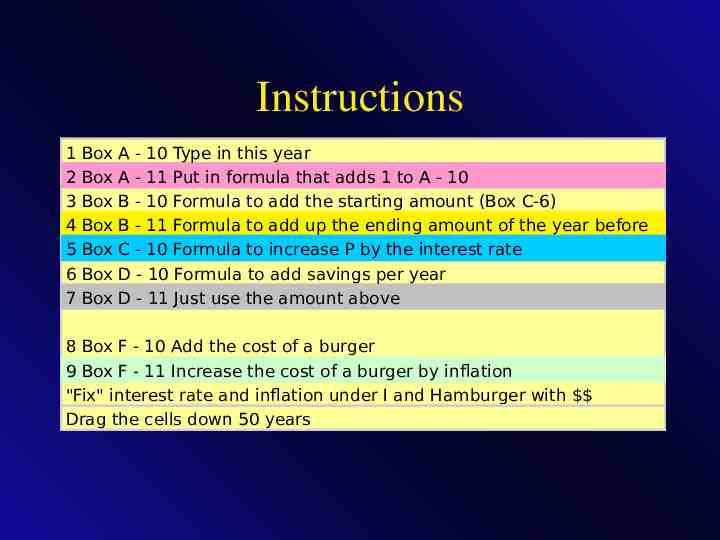

Instructions 1 2 3 4 5 6 7 Box Box Box Box Box Box Box A - 10 Type in this year A - 11 Put in formula that adds 1 to A - 10 B - 10 Formula to add the starting amount (Box C-6) B - 11 Formula to add up the ending amount of the year before C - 10 Formula to increase P by the interest rate D - 10 Formula to add savings per year D - 11 Just use the amount above 8 Box F - 10 Add the cost of a burger 9 Box F - 11 Increase the cost of a burger by inflation "Fix" interest rate and inflation under I and Hamburger with Drag the cells down 50 years

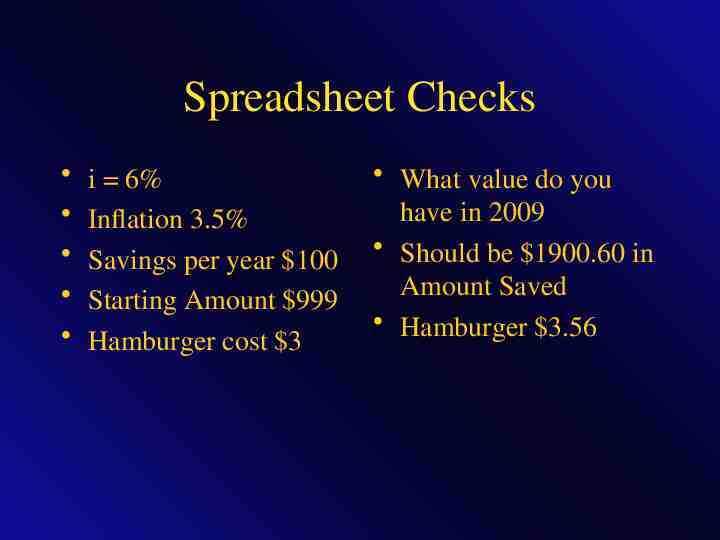

Spreadsheet Checks i 6% Inflation 3.5% Savings per year 100 Starting Amount 999 Hamburger cost 3 What value do you have in 2009 Should be 1900.60 in Amount Saved Hamburger 3.56

Now try these To save a million dollars in 50 years how much would you have to save per month at 8% interest? What if you had 100 under you mattress, how many burgers could you buy today? In 20 years? To have a million dollars in 50 years how much would you need now at 6% interest? – 8% (bonds) – 10% (stocks) Now try saving different amounts at different times

Estimation and error Rule of 70 - the number of years it will take to double is n 70/i When estimating future inflation or savings rates these are only best guesses. You can develop a range by taking the high and low rates.

Follow-up The important equation is F P(1 i) n You can derive everything else from this. The future value of A is F A(1 i) n/i Internet homework