Hosted PBX: A Viable IP PBX Alternative? July 2005

30 Slides4.45 MB

Hosted PBX: A Viable IP PBX Alternative? July 2005

Agenda – State of the market – Hosted PBX vs. IP PBX – TCO: hosted vs. premises – Case studies – Co-existence – Future trends 2

State of the Market 3

Hosted Voice: State of the Market Large players are deployed –E.g., Verizon, MCI, BellSouth, SBC, Telstra, Singtel, T-Systems CLECs expand –E.g., US LEC, McLeod, XO, CBeyond, BroadWing 100 others Residential distracts enterprise deployments (temporarily) –The Vonage effect Hosted voice follows IP PBX deployment path –Trials, branch offices, HQ Big names deploying –E.g., US EPA, State of Minn., U Kentucky, GMAC, Coca Cola, Texas A&M 4

Which Service Providers? Examples Incumbent Carriers Competitive Carriers Managed SPs / SIs 5

Hosted PBX 6

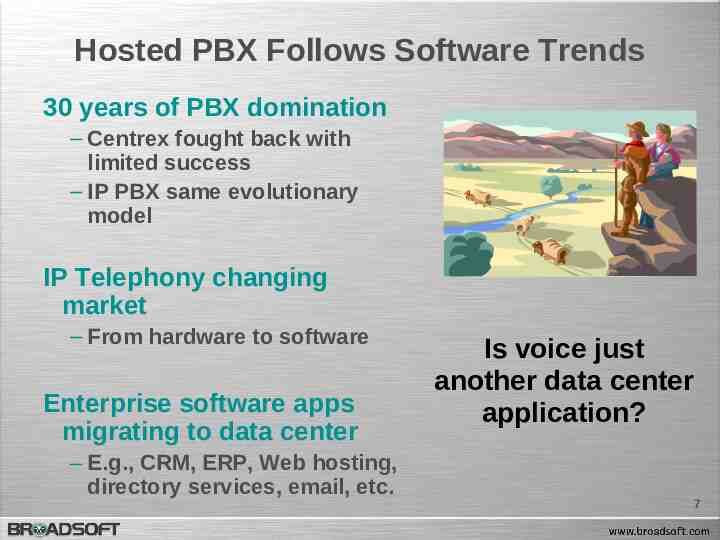

Hosted PBX Follows Software Trends 30 years of PBX domination – Centrex fought back with limited success – IP PBX same evolutionary model IP Telephony changing market – From hardware to software Enterprise software apps migrating to data center – E.g., CRM, ERP, Web hosting, directory services, email, etc. Is voice just another data center application? 7

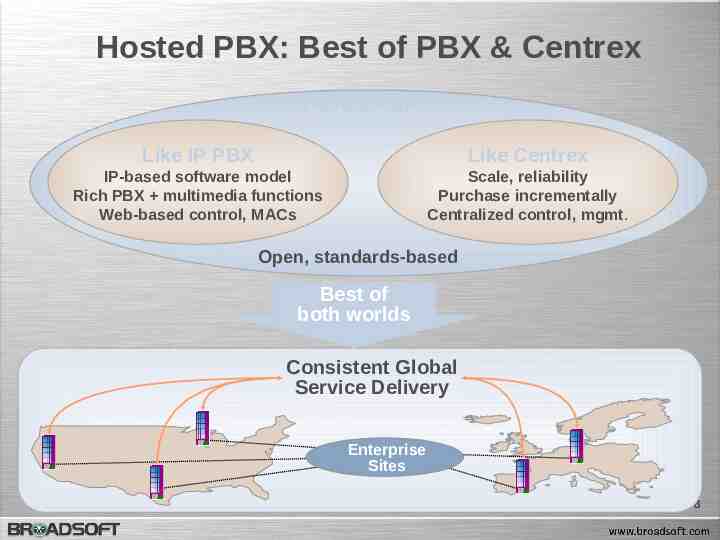

Hosted PBX: Best of PBX & Centrex Hosted PBX Like IP PBX Like Centrex IP-based software model Rich PBX multimedia functions Web-based control, MACs Scale, reliability Purchase incrementally Centralized control, mgmt. Open, standards-based Best of both worlds Consistent Global Service Delivery Enterprise Sites 8

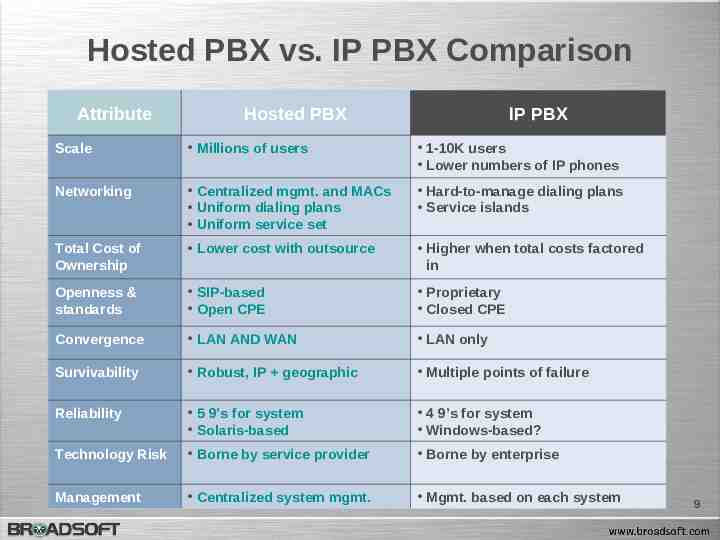

Hosted PBX vs. IP PBX Comparison Attribute Hosted PBX IP PBX Scale Millions of users 1-10K users Lower numbers of IP phones Networking Centralized mgmt. and MACs Uniform dialing plans Uniform service set Hard-to-manage dialing plans Service islands Total Cost of Ownership Lower cost with outsource Higher when total costs factored in Openness & standards SIP-based Open CPE Proprietary Closed CPE Convergence LAN AND WAN LAN only Survivability Robust, IP geographic Multiple points of failure Reliability 5 9’s for system Solaris-based 4 9’s for system Windows-based? Technology Risk Borne by service provider Borne by enterprise Management Centralized system mgmt. Mgmt. based on each system 9

Hosted PBX Economics 10

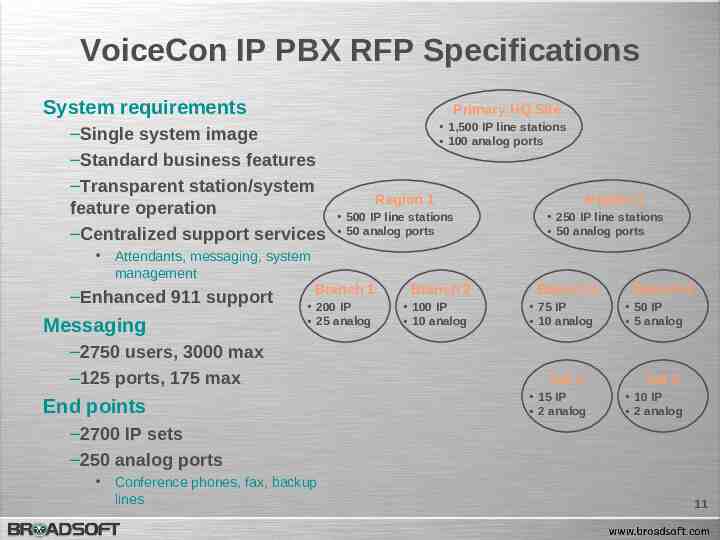

VoiceCon IP PBX RFP Specifications System requirements Primary HQ Site –Single system image –Standard business features –Transparent station/system feature operation –Centralized support services 1,500 IP line stations 100 analog ports Region 1 500 IP line stations 50 analog ports Region 2 250 IP line stations 50 analog ports Attendants, messaging, system management –Enhanced 911 support Messaging Branch 1 Branch 2 Branch 3 200 IP 25 analog 100 IP 10 analog 75 IP 10 analog –2750 users, 3000 max –125 ports, 175 max End points Branch 4 50 IP 5 analog Sat 1 Sat 2 15 IP 2 analog 10 IP 2 analog –2700 IP sets –250 analog ports Conference phones, fax, backup lines 11

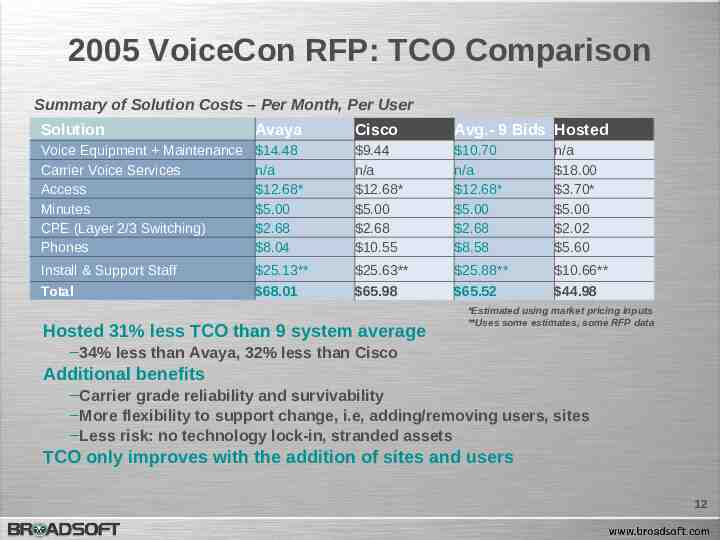

2005 VoiceCon RFP: TCO Comparison Summary of Solution Costs – Per Month, Per User Solution Avaya Cisco Avg.- 9 Bids Hosted Voice Equipment Maintenance Carrier Voice Services Access Minutes CPE (Layer 2/3 Switching) Phones 14.48 n/a 12.68* 5.00 2.68 8.04 9.44 n/a 12.68* 5.00 2.68 10.55 10.70 n/a 12.68* 5.00 2.68 8.58 n/a 18.00 3.70* 5.00 2.02 5.60 Install & Support Staff 25.13** 25.63** 25.88** 10.66** Total 68.01 65.98 65.52 44.98 Hosted 31% less TCO than 9 system average *Estimated using market pricing inputs **Uses some estimates, some RFP data –34% less than Avaya, 32% less than Cisco Additional benefits –Carrier grade reliability and survivability –More flexibility to support change, i.e, adding/removing users, sites –Less risk: no technology lock-in, stranded assets TCO only improves with the addition of sites and users 12

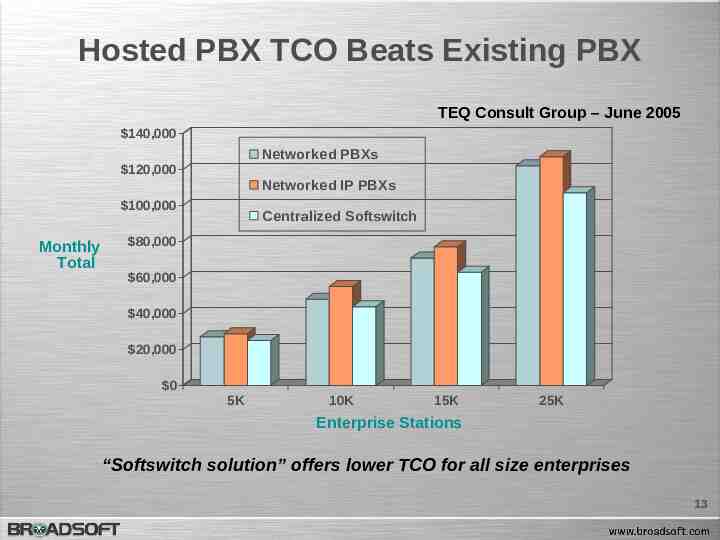

Hosted PBX TCO Beats Existing PBX TEQ Consult Group – June 2005 140,000 Networked PBXs 120,000 Networked IP PBXs 100,000 Monthly Total Centralized Softswitch 80,000 60,000 40,000 20,000 0 5K 10K 15K 25K Enterprise Stations “Softswitch solution” offers lower TCO for all size enterprises 13

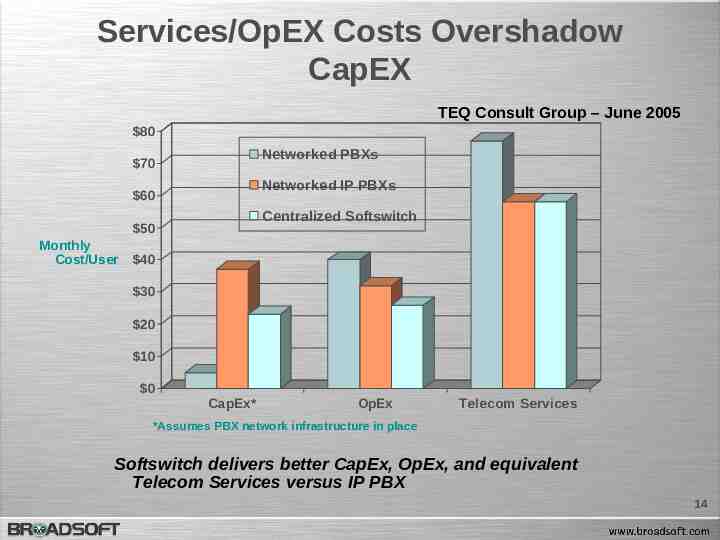

Services/OpEX Costs Overshadow CapEX TEQ Consult Group – June 2005 80 Networked PBXs 70 Networked IP PBXs 60 Centralized Softswitch 50 Monthly Cost/User 40 30 20 10 0 CapEx* OpEx Telecom Services *Assumes PBX network infrastructure in place Softswitch delivers better CapEx, OpEx, and equivalent Telecom Services versus IP PBX 14

Case Studies 15

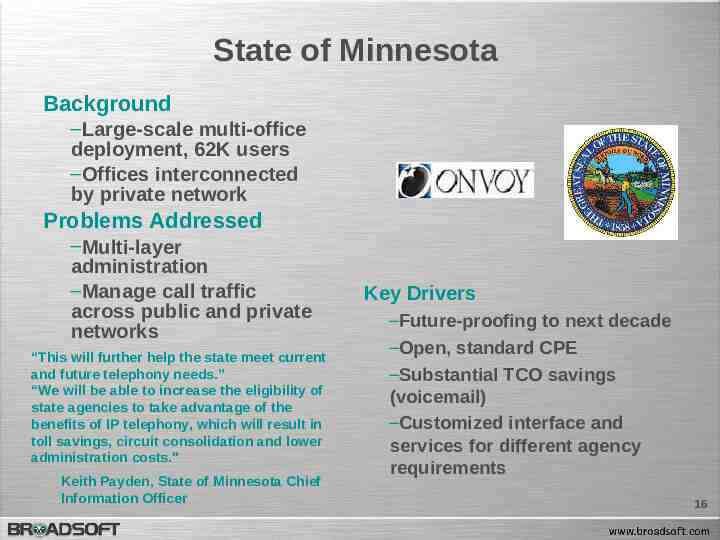

State of Minnesota Background –Large-scale multi-office deployment, 62K users –Offices interconnected by private network Problems Addressed –Multi-layer administration –Manage call traffic across public and private networks “This will further help the state meet current and future telephony needs.” “We will be able to increase the eligibility of state agencies to take advantage of the benefits of IP telephony, which will result in toll savings, circuit consolidation and lower administration costs." Keith Payden, State of Minnesota Chief Information Officer Key Drivers –Future-proofing to next decade –Open, standard CPE –Substantial TCO savings (voicemail) –Customized interface and services for different agency requirements 16

University of Kentucky Background –18K students –Unsatisfied with Cisco Call Manager deployment Problems Addressed –Networking existing equipment, IP PBXs, hosted users –IP PBX scalability Deployment Key Drivers –Reuse of existing Cisco IP phones, switches, routers –Able to meet scalability needs E.g., Solaris vs. Windows –Carrier-grade service offering –Reloading Cisco phones with SIP for BroadWorks –Delivered by Lucent & Alltel 17

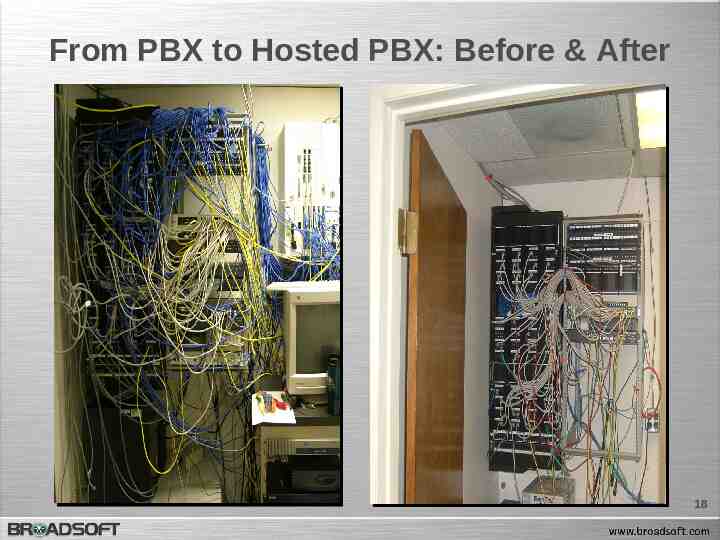

From PBX to Hosted PBX: Before & After 18

IP PBX Interworking 19

Hosted and IP PBX: Coexistence SIP Trunking – Provide connectivity to IP PBXs – Save on capex: no need for PRI gateway Virtual Services for Existing PBXs and IP PBXs – E.g., Click-to-dial, auto attendant, attendant console, Enterprise-wide voice mail, ACD/call center, voice VPN 20

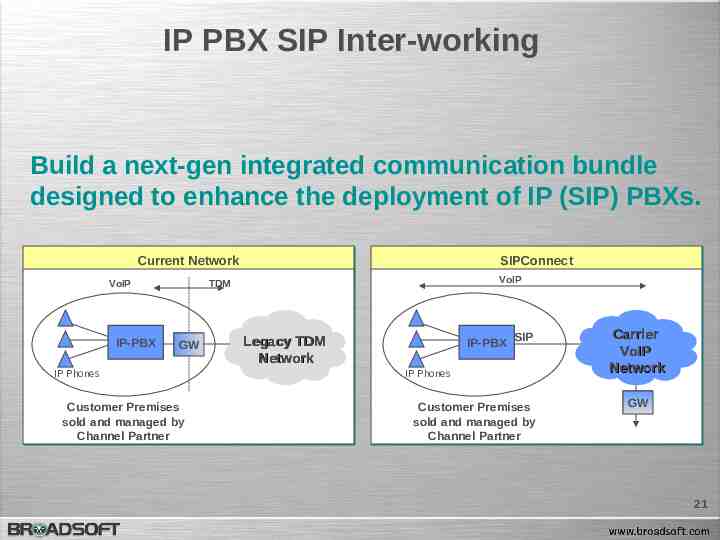

IP PBX SIP Inter-working Build a next-gen integrated communication bundle designed to enhance the deployment of IP (SIP) PBXs. Current Network VoIP IP-PBX SIPConnect VoIP TDM GW IP Phones Customer Premises sold and managed by Channel Partner IP-PBX SIP Legacy TDM Network IP Phones Customer Premises sold and managed by Channel Partner Carrier VoIP Network GW 21

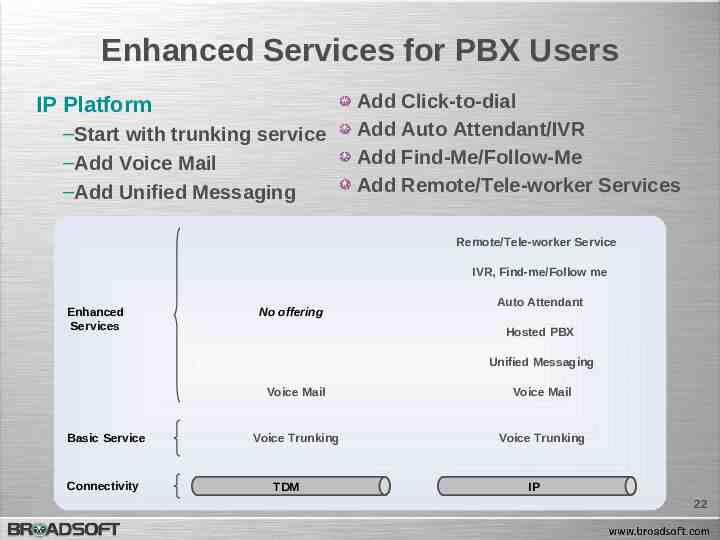

Enhanced Services for PBX Users IP Platform –Start with trunking service –Add Voice Mail –Add Unified Messaging Add Click-to-dial Add Auto Attendant/IVR Add Find-Me/Follow-Me Add Remote/Tele-worker Services Remote/Tele-worker Service IVR, Find-me/Follow me Enhanced Services No offering Auto Attendant Hosted PBX Unified Messaging Basic Service Connectivity Voice Mail Voice Mail Voice Trunking Voice Trunking TDM IP 22

SIPConnect Overview Partnership Specification – Open source: www.sipconnect.info Availability – From Cbeyond today – Additional carriers adding service 23

Future 24

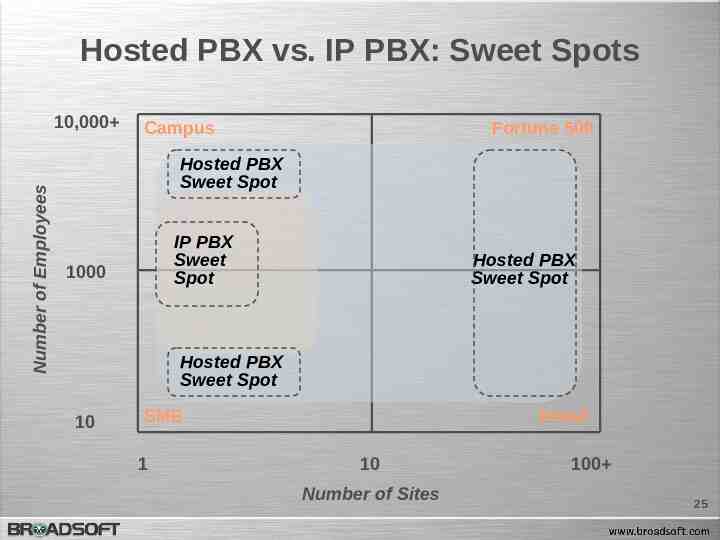

Hosted PBX vs. IP PBX: Sweet Spots Number of Employees 10,000 Campus Fortune 500 Hosted PBX Sweet Spot IP PBX Sweet Spot 1000 Hosted PBX Sweet Spot Hosted PBX Sweet Spot 10 SME 1 Retail 10 Number of Sites 100 25

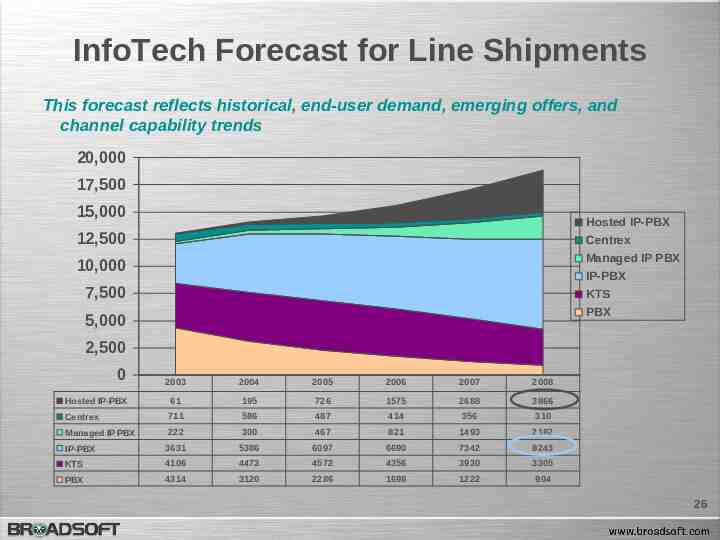

InfoTech Forecast for Line Shipments This forecast reflects historical, end-user demand, emerging offers, and channel capability trends 20,000 17,500 15,000 Hosted IP-PBX 12,500 Centrex 10,000 Managed IP PBX IP-PBX 7,500 KTS 5,000 PBX 2,500 0 2003 2004 2005 2006 2007 2008 Hosted IP-PBX 61 195 726 1575 2688 3866 Centrex 711 586 487 414 356 310 Managed IP PBX 222 300 467 821 1493 2182 IP-PBX 3631 5386 6097 6690 7342 8243 KTS 4106 4473 4572 4356 3930 3305 PBX 4314 3120 2286 1698 1222 904 26

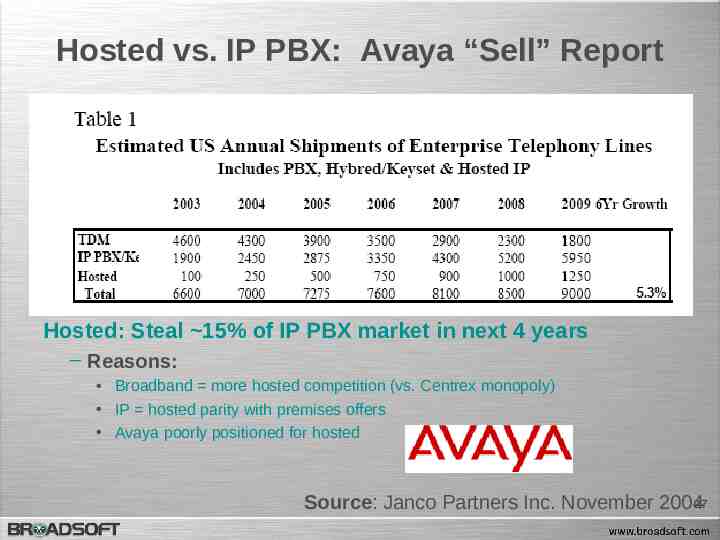

Hosted vs. IP PBX: Avaya “Sell” Report Hosted: Steal 15% of IP PBX market in next 4 years – Reasons: Broadband more hosted competition (vs. Centrex monopoly) IP hosted parity with premises offers Avaya poorly positioned for hosted Source: Janco Partners Inc. November 200427

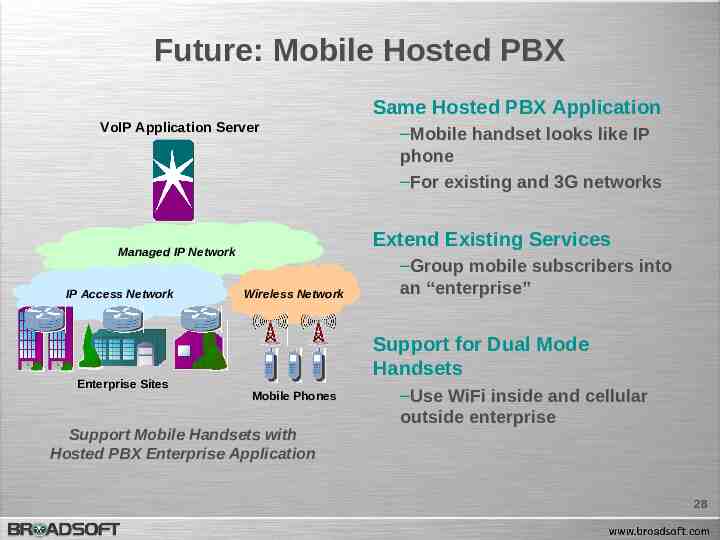

Future: Mobile Hosted PBX Same Hosted PBX Application VoIP Application Server Extend Existing Services Managed IP Network IP Access Network Enterprise Sites –Mobile handset looks like IP phone –For existing and 3G networks Wireless Network –Group mobile subscribers into an “enterprise” Support for Dual Mode Handsets Mobile Phones Support Mobile Handsets with Hosted PBX Enterprise Application –Use WiFi inside and cellular outside enterprise 28

Summary –The Hosted PBX market is moving into the mainstream –Large carriers, enterprises are embracing Hosted PBX globally –Hosted PBX can have significant TCO savings vs. an IP PBX –Hosted PBX has lower TCO vs. doing nothing –Future SIP inter-working, mobile integration –Hosted PBX can provide a great alternative to an IP PBX 29

For More Information Scott Wharton, VP Marketing 220 Perry Parkway Gaithersburg, Maryland 20877 USA 1.301.977.9940 [email protected] www.broadsoft.com 30