SEBI (PROHIBITION OF INSIDER TRADING) REGULATIONS, 2015 March 07, 2022

29 Slides416.17 KB

SEBI (PROHIBITION OF INSIDER TRADING) REGULATIONS, 2015 March 07, 2022 CS Sachin Jain 1

What is the Intent of Prohibition of Insider Trading Regulation? To maintain securities Market at level playing field; To prevent the misuse of Unpublished Price Sensitive Information (UPSI) To keep check by SEBI on any malpractice by investors 2

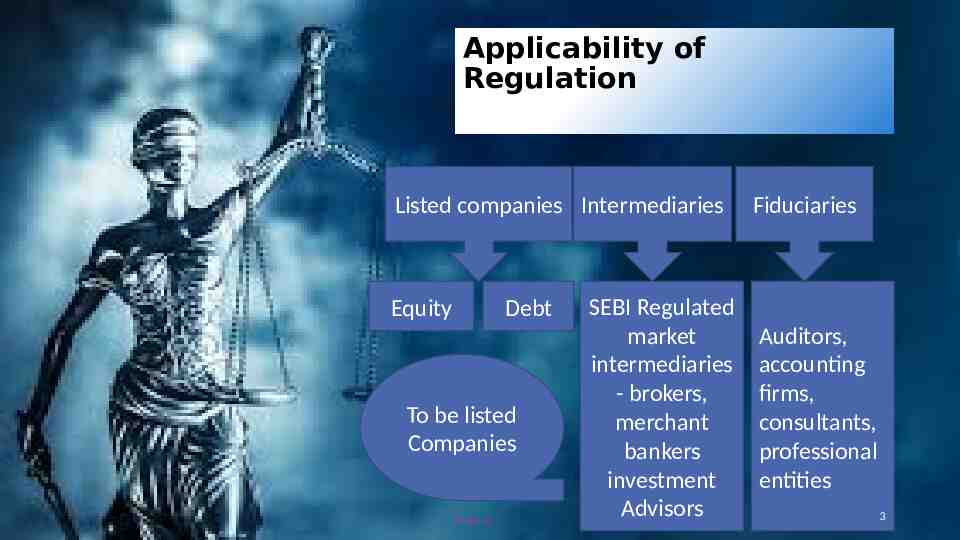

Applicability of Regulation Listed companies Intermediaries Equity Debt To be listed Companies PUBLIC SEBI Regulated market intermediaries - brokers, merchant bankers investment Advisors Fiduciaries Auditors, accounting firms, consultants, professional entities 3

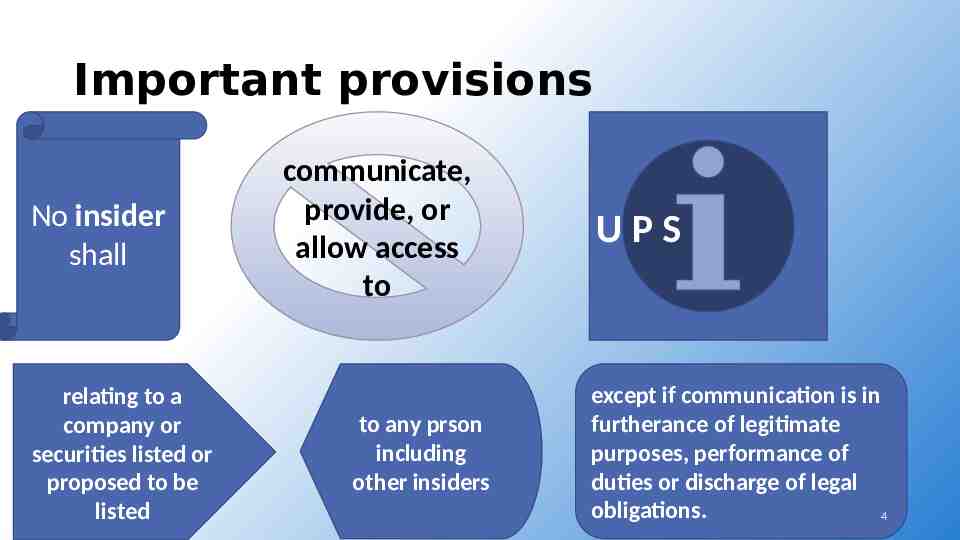

Important provisions No insider shall relating to a company or securities listed or proposed to be listed communicate, provide, or allow access to to any prson including other insiders UPS except if communication is in furtherance of legitimate purposes, performance of duties or discharge of legal obligations. 4

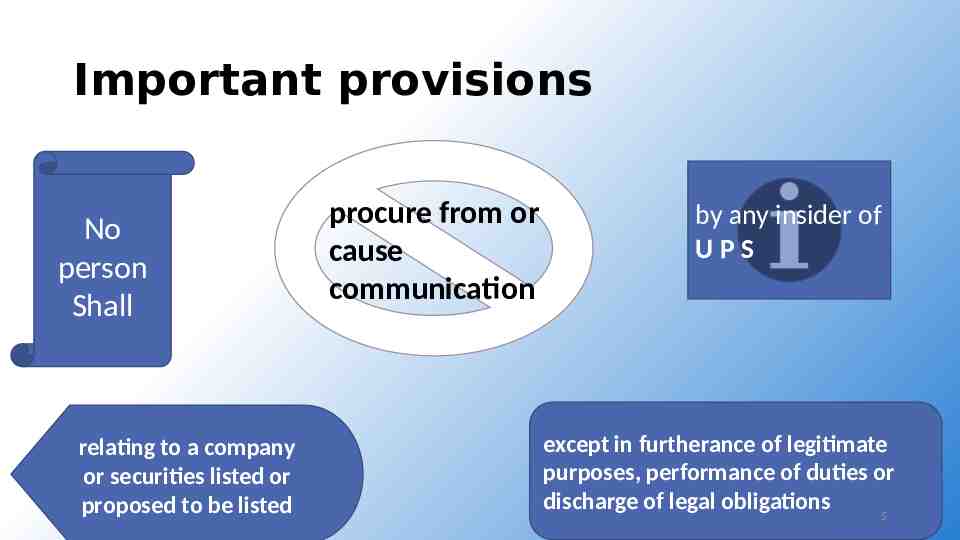

Important provisions No person Shall relating to a company or securities listed or proposed to be listed procure from or cause communication by any insider of UPS except in furtherance of legitimate purposes, performance of duties or discharge of legal obligations 5

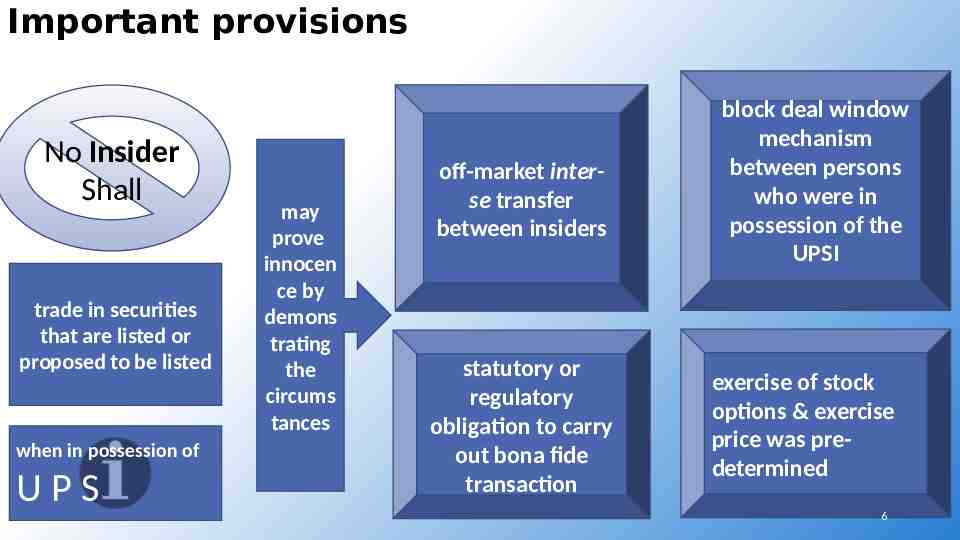

Important provisions No Insider Shall trade in securities that are listed or proposed to be listed when in possession of UPS may prove innocen ce by demons trating the circums tances off-market interse transfer between insiders statutory or regulatory obligation to carry out bona fide transaction block deal window mechanism between persons who were in possession of the UPSI exercise of stock options & exercise price was predetermined 6

Disclosure Requirement Régulation 6 Disclosure shall be in specified Format Trading by Immediate relative of person to be disclosed Trading in derivative also need to include, if permitted Disclosure to be maintained by Company for a Minimum Period of 5 years 7

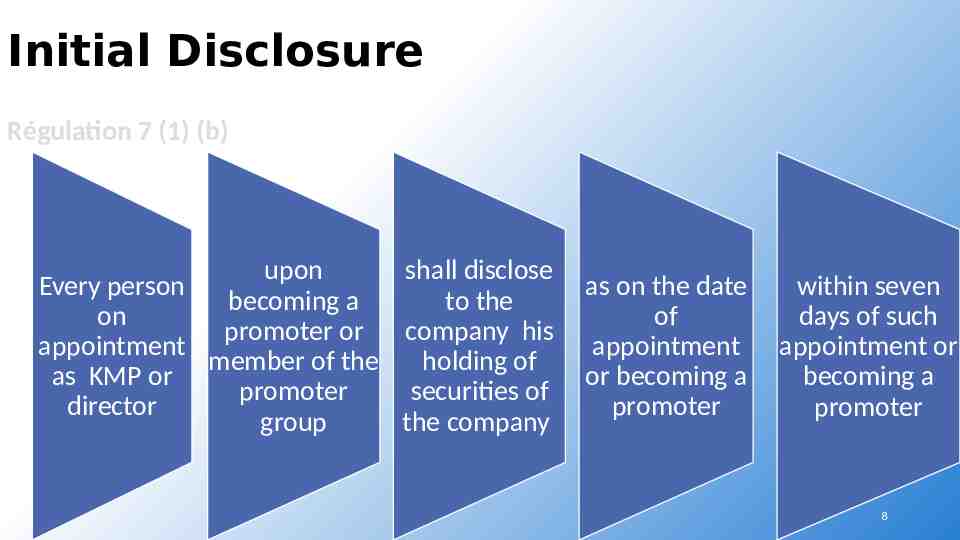

Initial Disclosure Régulation 7 (1) (b) upon shall disclose Every person becoming a to the on promoter or company his appointment member of the holding of as KMP or promoter securities of director group the company as on the date of appointment or becoming a promoter within seven days of such appointment or becoming a promoter 8

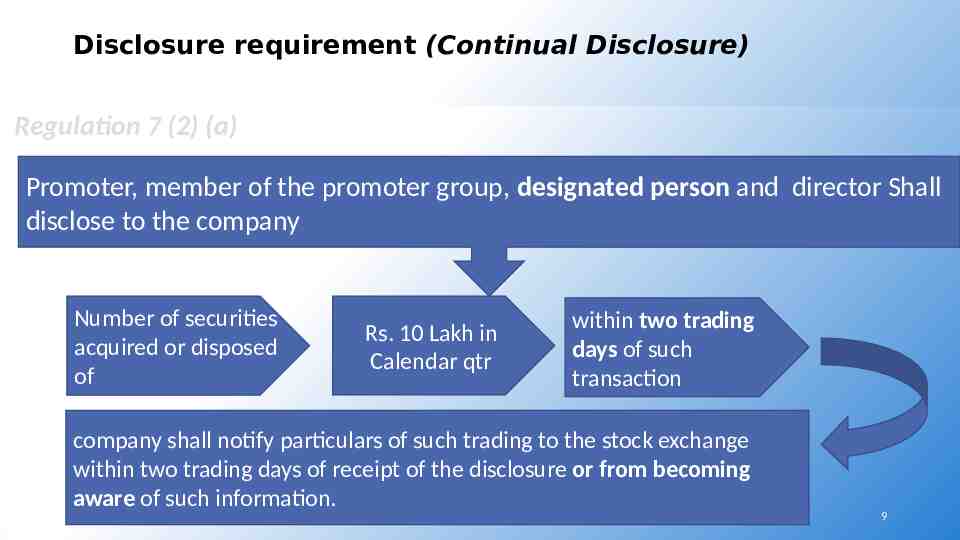

Disclosure requirement (Continual Disclosure) Regulation 7 (2) (a) Promoter, member of the promoter group, designated person and director Shall disclose to the company Number of securities acquired or disposed of Rs. 10 Lakh in Calendar qtr within two trading days of such transaction company shall notify particulars of such trading to the stock exchange within two trading days of receipt of the disclosure or from becoming aware of such information. 9

PIT Insider Connected Person UPSI 10

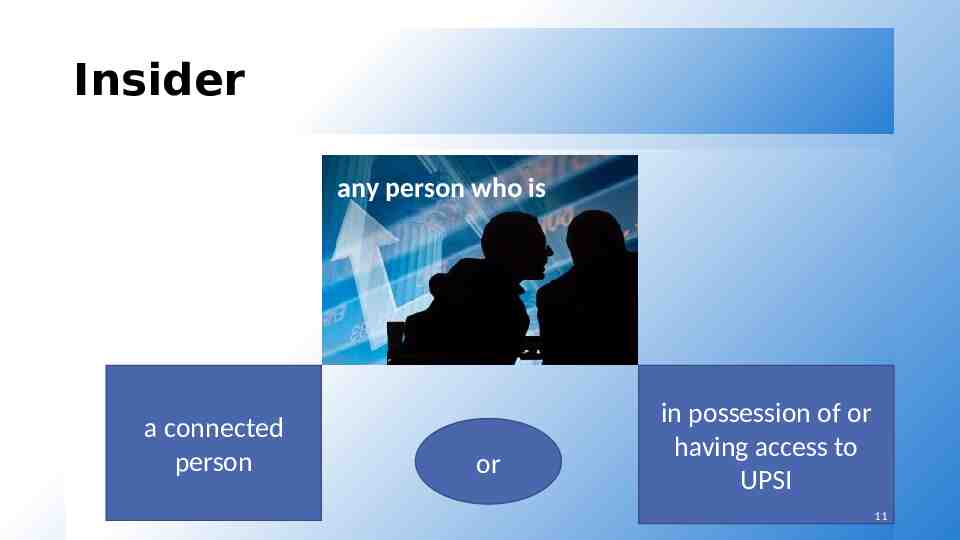

Insider any person who is a connected person or in possession of or having access to UPSI 11

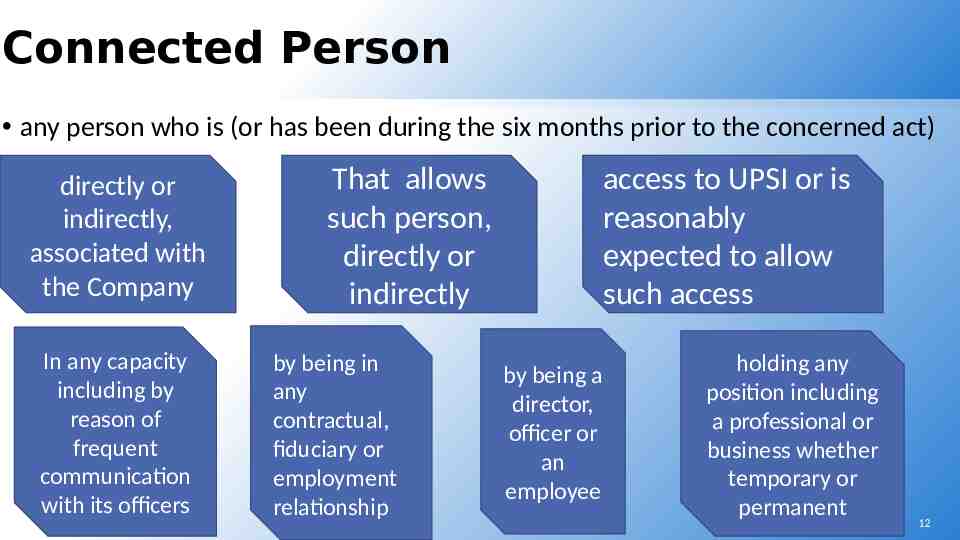

Connected Person any person who is (or has been during the six months prior to the concerned act) directly or indirectly, associated with the Company In any capacity including by reason of frequent communication with its officers That allows such person, directly or indirectly by being in any contractual, fiduciary or employment relationship access to UPSI or is reasonably expected to allow such access by being a director, officer or an employee holding any position including a professional or business whether temporary or permanent 12

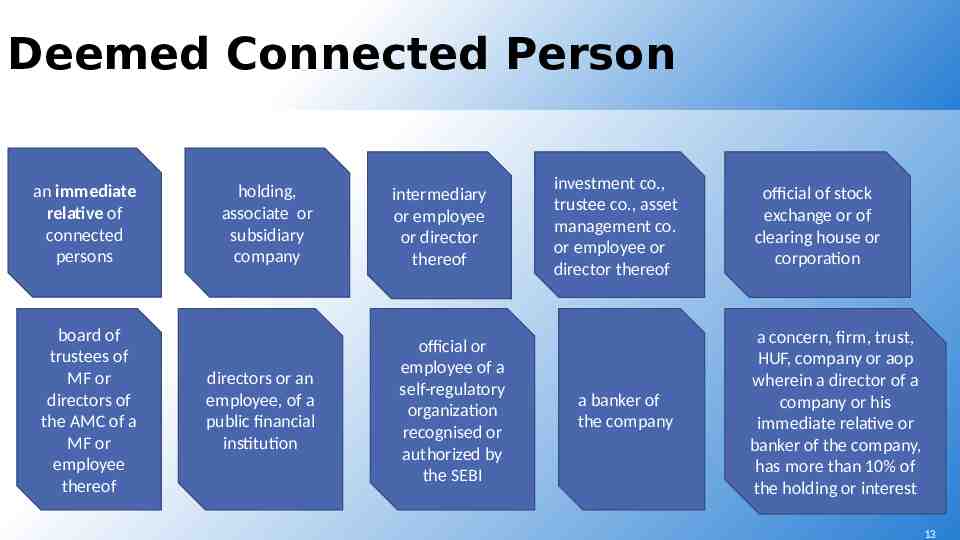

Deemed Connected Person an immediate relative of connected persons board of trustees of MF or directors of the AMC of a MF or employee thereof holding, associate or subsidiary company directors or an employee, of a public financial institution intermediary or employee or director thereof official or employee of a self-regulatory organization recognised or authorized by the SEBI investment co., trustee co., asset management co. or employee or director thereof a banker of the company official of stock exchange or of clearing house or corporation a concern, firm, trust, HUF, company or aop wherein a director of a company or his immediate relative or banker of the company, has more than 10% of the holding or interest 13

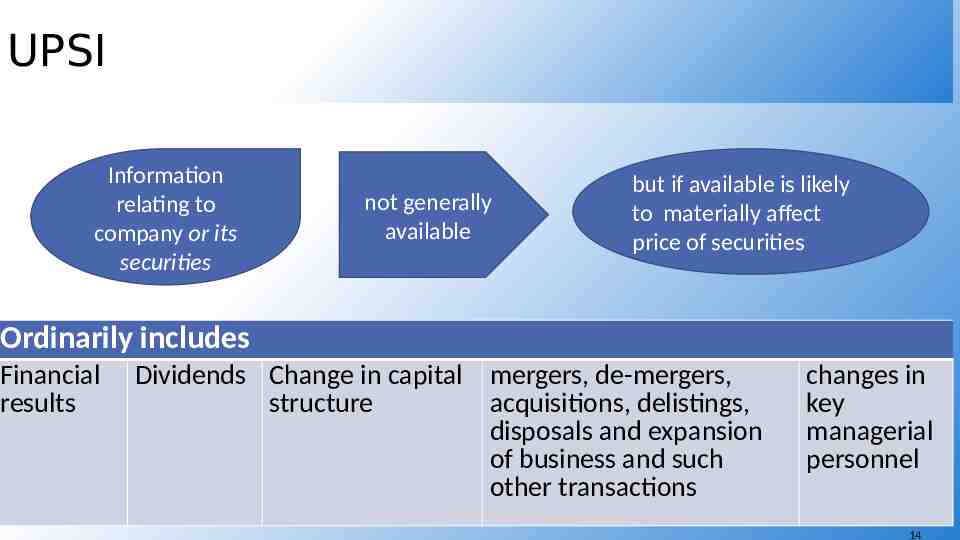

UPSI Information relating to company or its securities not generally available but if available is likely to materially affect price of securities Ordinarily includes Financial results Dividends Change in capital mergers, de-mergers, structure acquisitions, delistings, disposals and expansion of business and such other transactions changes in key managerial personnel 14

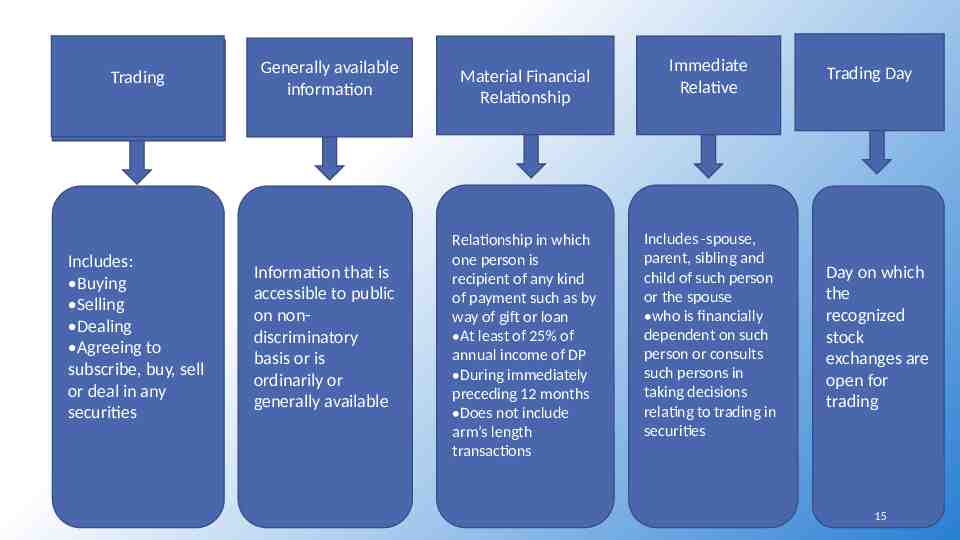

Trading Includes: Buying Selling Dealing Agreeing to subscribe, buy, sell or deal in any securities Generally available information Information that is accessible to public on nondiscriminatory basis or is ordinarily or generally available Material Financial Relationship Relationship in which one person is recipient of any kind of payment such as by way of gift or loan At least of 25% of annual income of DP During immediately preceding 12 months Does not include arm’s length transactions Immediate Relative Includes -spouse, parent, sibling and child of such person or the spouse who is financially dependent on such person or consults such persons in taking decisions relating to trading in securities Trading Day Day on which the recognized stock exchanges are open for trading 15

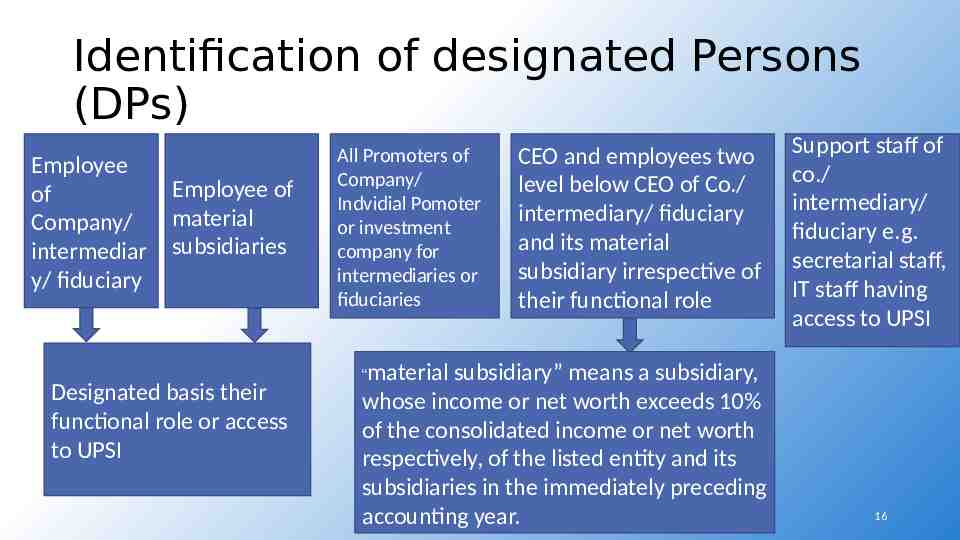

Identification of designated Persons (DPs) Employee of Company/ intermediar y/ fiduciary Employee of material subsidiaries Designated basis their functional role or access to UPSI All Promoters of Company/ Indvidial Pomoter or investment company for intermediaries or fiduciaries CEO and employees two level below CEO of Co./ intermediary/ fiduciary and its material subsidiary irrespective of their functional role subsidiary” means a subsidiary, whose income or net worth exceeds 10% of the consolidated income or net worth respectively, of the listed entity and its subsidiaries in the immediately preceding accounting year. Support staff of co./ intermediary/ fiduciary e.g. secretarial staff, IT staff having access to UPSI “material 16

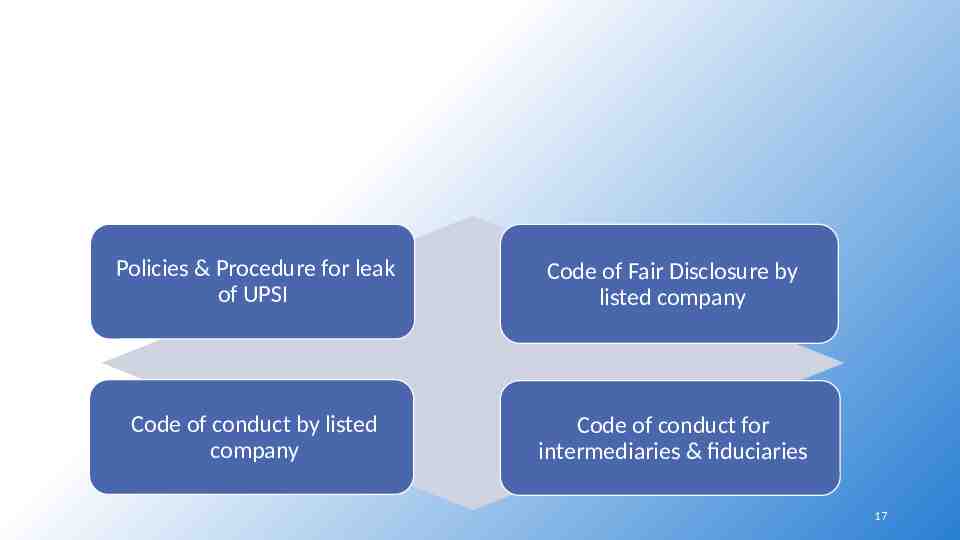

Policies & Procedure for leak of UPSI Code of Fair Disclosure by listed company Code of conduct by listed company Code of conduct for intermediaries & fiduciaries 17

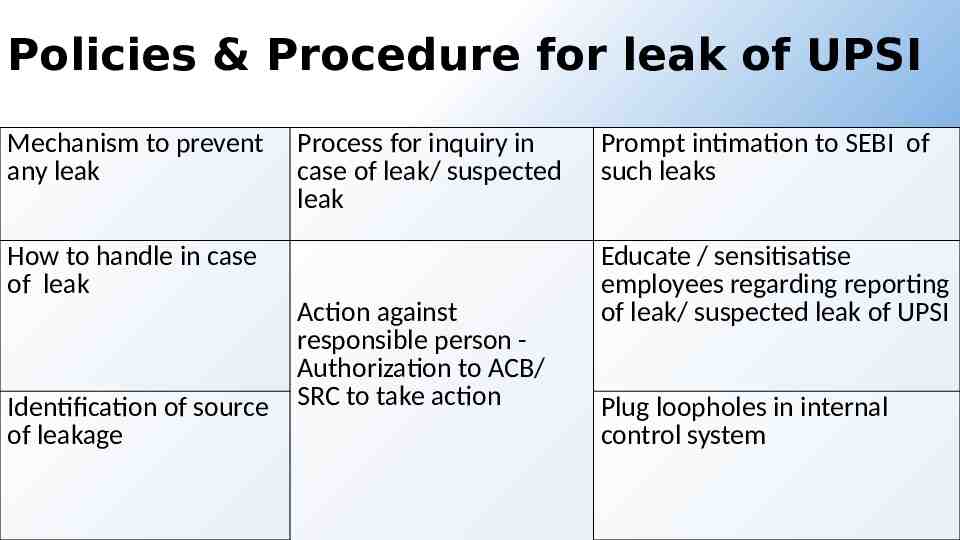

Policies & Procedure for leak of UPSI Mechanism to prevent any leak Process for inquiry in case of leak/ suspected leak How to handle in case of leak Identification of source of leakage Action against responsible person Authorization to ACB/ SRC to take action Prompt intimation to SEBI of such leaks Educate / sensitisatise employees regarding reporting of leak/ suspected leak of UPSI Plug loopholes in internal control system

Code of Fair Disclosure by listed company To be uploaded on the website of the Company framework and policy for fair disclosure of events and occurrences that could impact price discovery of securities and maintain the uniformity, transparency and fairness in dealings with all stakeholders. Handling of UPSI on need to know basis policy for determination of “legitimate purposes Process of handling and verification of market rumors Senior officer to be designated as Chief Investors Relations Officer to deal with dissemination of information & disclosure of UPSI 19

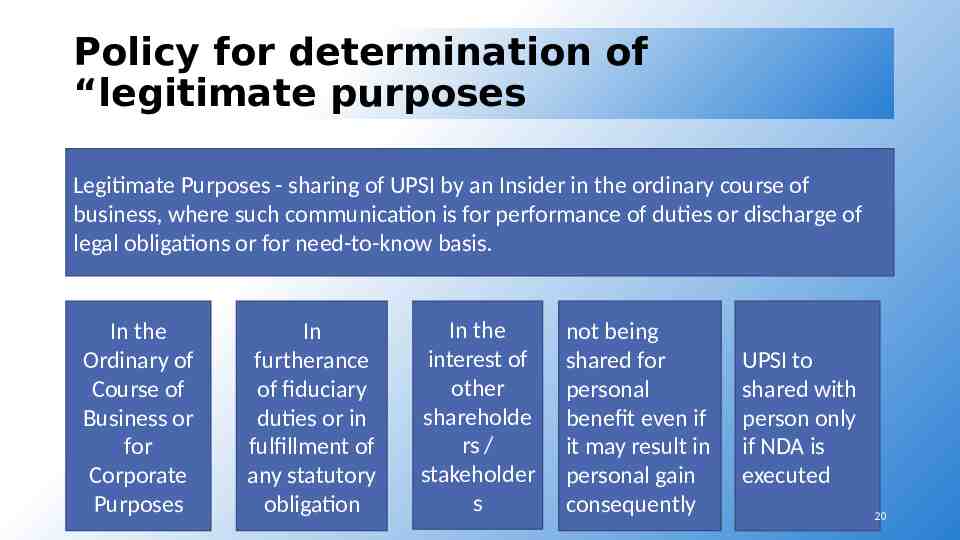

Policy for determination of “legitimate purposes Legitimate Purposes - sharing of UPSI by an Insider in the ordinary course of business, where such communication is for performance of duties or discharge of legal obligations or for need-to-know basis. In the Ordinary of Course of Business or for Corporate Purposes In furtherance of fiduciary duties or in fulfillment of any statutory obligation In the interest of other shareholde rs / stakeholder s not being shared for personal benefit even if it may result in personal gain consequently UPSI to shared with person only if NDA is executed 20

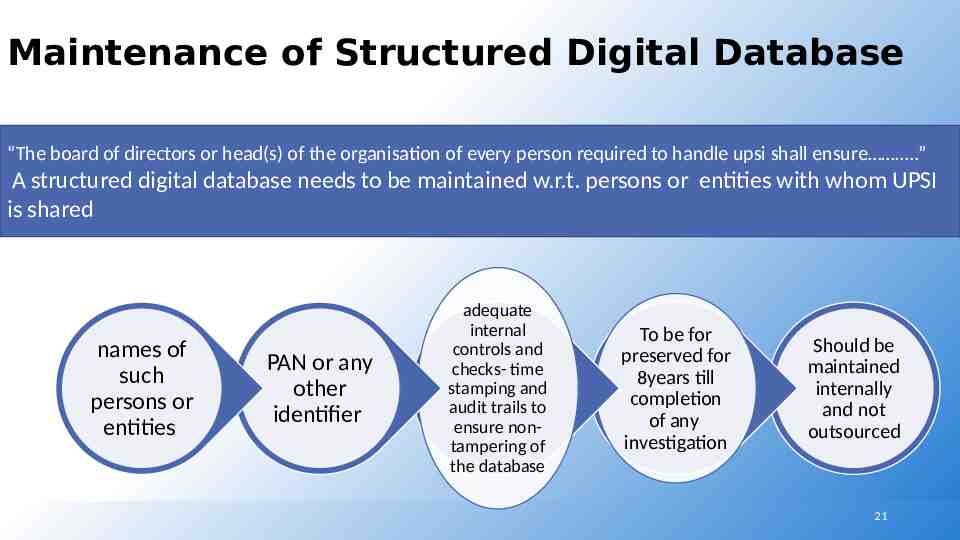

Maintenance of Structured Digital Database “The board of directors or head(s) of the organisation of every person required to handle upsi shall ensure .” A structured digital database needs to be maintained w.r.t. persons or entities with whom UPSI is shared names of such persons or entities PAN or any other identifier adequate internal controls and checks- time stamping and audit trails to ensure nontampering of the database To be for preserved for 8years till completion of any investigation Should be maintained internally and not outsourced 21

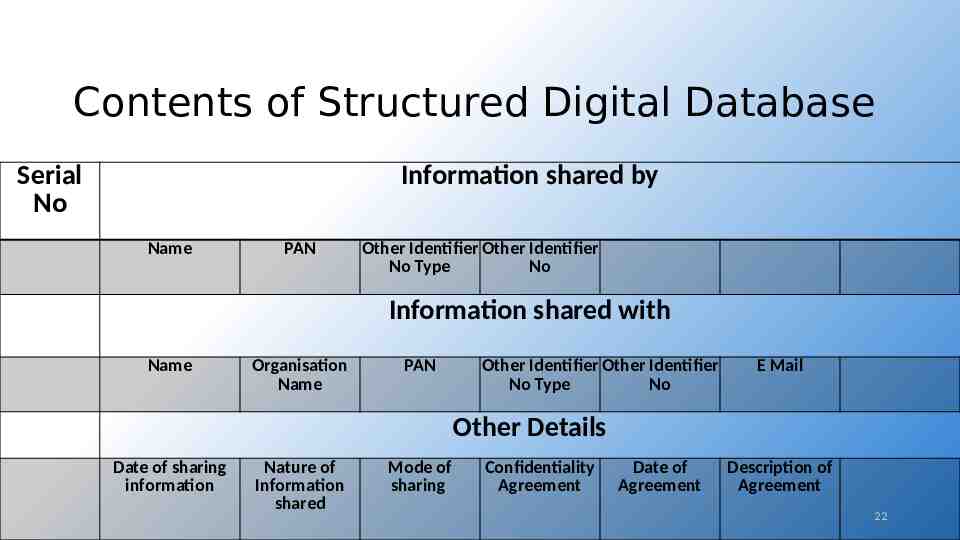

Contents of Structured Digital Database Serial No Information shared by Name PAN Other Identifier Other Identifier No Type No Information shared with Name Organisation Name PAN Other Identifier Other Identifier No Type No E Mail Other Details Date of sharing information Nature of Information shared Mode of sharing Confidentiality Agreement Date of Agreement Description of Agreement 22

Code of conduct by listed company The board of directors formulate a code of conduct to regulate, monitor and report trading by DPs & immediat e relatives of DPs adopting the minimum standards set out in Schedule B, without dilution identify and designate a complianc e officer to administe r the code of conduct and other requireme nts 23

Code of conduct by listed company CO shall report of BoDs, provide report to ACB chairman / Board chairman periodically but not less than once in a year Information to be handled need to know basis contain norms for appropriate Chinese Walls procedures, and processes DPs / immediate relatives not to trade when trading window is closed Trading widow to be closed from the end of every quarter till 48 hours after the declaration of financial results. 24

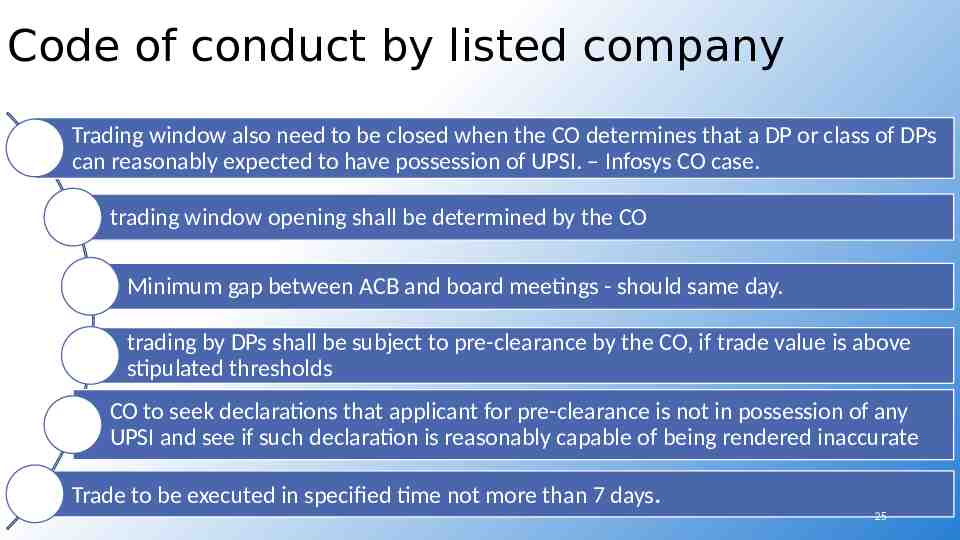

Code of conduct by listed company Trading window also need to be closed when the CO determines that a DP or class of DPs can reasonably expected to have possession of UPSI. – Infosys CO case. trading window opening shall be determined by the CO Minimum gap between ACB and board meetings - should same day. trading by DPs shall be subject to pre-clearance by the CO, if trade value is above stipulated thresholds CO to seek declarations that applicant for pre-clearance is not in possession of any UPSI and see if such declaration is reasonably capable of being rendered inaccurate Trade to be executed in specified time not more than 7 days. 25

Code of conduct by listed company (Reg.9) No contra trade in six months from last trade. CO empowered to grant relaxation from contra trade provisions contra trade be executed, inadvertently or otherwise, profits from such trade shall be liable to be disgorged for remittance to SEBI IPEF. Contra trade not applicable on exercise of Stock Options. Formats to be specified sanctions and disciplinary actions, including wage freeze, suspension, recovery, etc., that may be imposed to be stipulated for the contravention of the code of conduct 26

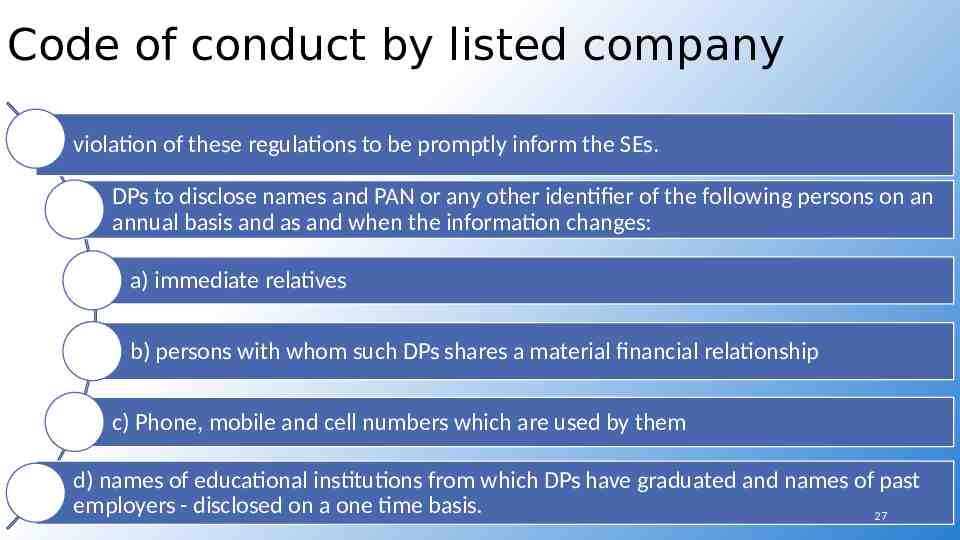

Code of conduct by listed company violation of these regulations to be promptly inform the SEs. DPs to disclose names and PAN or any other identifier of the following persons on an annual basis and as and when the information changes: a) immediate relatives b) persons with whom such DPs shares a material financial relationship c) Phone, mobile and cell numbers which are used by them d) names of educational institutions from which DPs have graduated and names of past employers - disclosed on a one time basis. 27

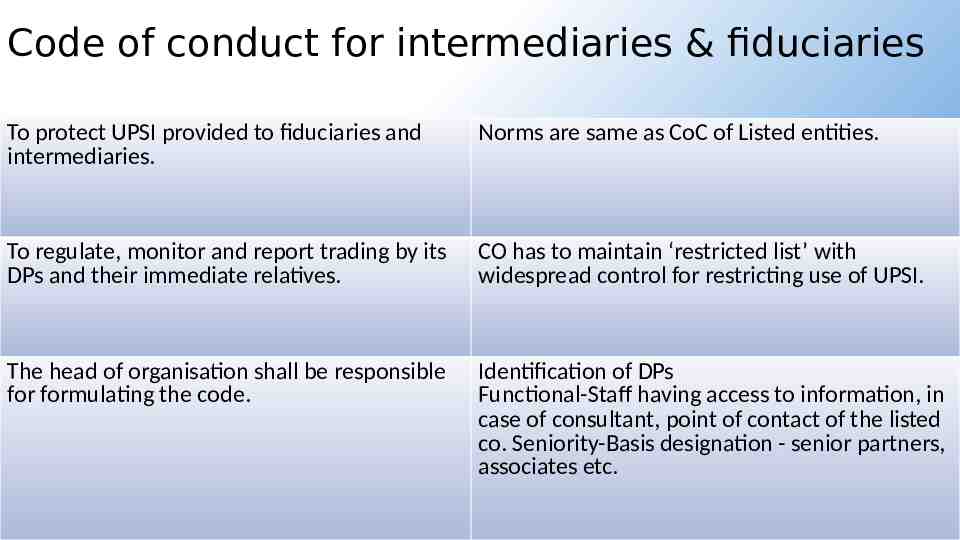

Code of conduct for intermediaries & fiduciaries To protect UPSI provided to fiduciaries and intermediaries. Norms are same as CoC of Listed entities. To regulate, monitor and report trading by its DPs and their immediate relatives. CO has to maintain ‘restricted list’ with widespread control for restricting use of UPSI. The head of organisation shall be responsible for formulating the code. Identification of DPs Functional-Staff having access to information, in case of consultant, point of contact of the listed co. Seniority-Basis designation - senior partners, associates etc. 28

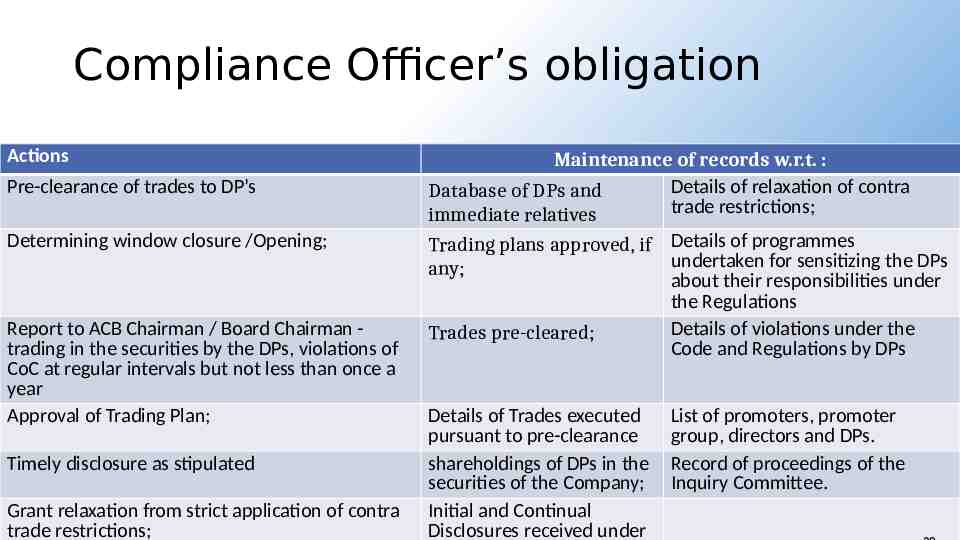

Compliance Officer’s obligation Actions Pre-clearance of trades to DP’s Determining window closure /Opening; Report to ACB Chairman / Board Chairman trading in the securities by the DPs, violations of CoC at regular intervals but not less than once a year Approval of Trading Plan; Timely disclosure as stipulated Grant relaxation from strict application of contra trade restrictions; Maintenance of records w.r.t. : Details of relaxation of contra Database of DPs and trade restrictions; immediate relatives Trading plans approved, if Details of programmes undertaken for sensitizing the DPs any; about their responsibilities under the Regulations Details of violations under the Trades pre-cleared; Code and Regulations by DPs Details of Trades executed pursuant to pre-clearance shareholdings of DPs in the securities of the Company; Initial and Continual Disclosures received under List of promoters, promoter group, directors and DPs. Record of proceedings of the Inquiry Committee.