Reporting process: contributions Retirement Benefits Training Fiscal

12 Slides6.25 MB

Reporting process: contributions Retirement Benefits Training Fiscal year 2023

Employer reporting representatives PEBA’s Member Account Services has staff assigned to each employer to help with: Monthly deposits; Quarterly payroll reports; Service credit and contract lengths; and Supplemental reports. Select EES Assistance in EES for your representative’s name and contact information. 2

Employer and member contributions Both employers and members are required to contribute to SCRS, PORS and State ORP. Employers will contribute based on members’ earnable compensation. Members will contribute a portion of their earnable compensation. Contribution rates for employers are subject to change each July 1. Currently, member contributions are fixed by statute and not scheduled to change. 3

Fiscal year 2023 employer contributions Employers are required to remit contributions based on compensation for: Contributing SCRS and PORS members. State ORP participants. Return-to-work SCRS and PORS retired members. Incidental death benefit coverage, if covered. Accidental Death Program coverage, if covered (PORS only). State agencies, public higher education institutions, public school districts and charter schools that participate in retirement are required to pay insurance surcharge to share the cost of retiree insurance. Employer contributions are not placed in member accounts. 4

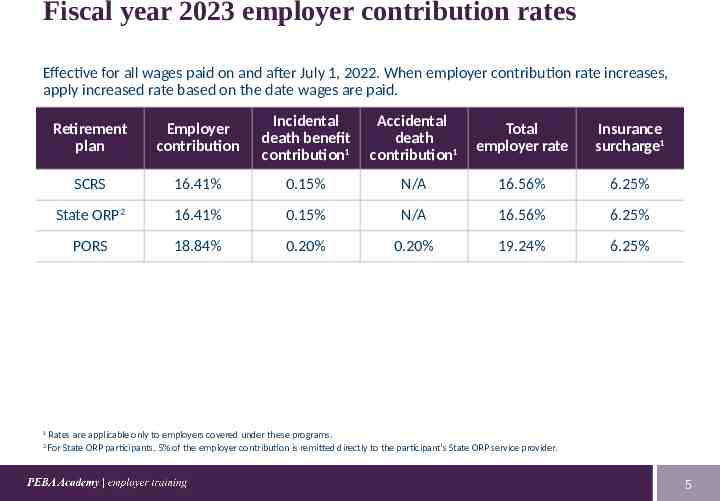

Fiscal year 2023 employer contribution rates Effective for all wages paid on and after July 1, 2022. When employer contribution rate increases, apply increased rate based on the date wages are paid. 1 2 Retirement plan Employer contribution Incidental death benefit contribution1 Accidental death contribution1 Total employer rate Insurance surcharge1 SCRS 16.41% 0.15% N/A 16.56% 6.25% State ORP2 16.41% 0.15% N/A 16.56% 6.25% PORS 18.84% 0.20% 0.20% 19.24% 6.25% Rates are applicable only to employers covered under these programs. For State ORP participants, 5% of the employer contribution is remitted directly to the participant's State ORP service provider. 5

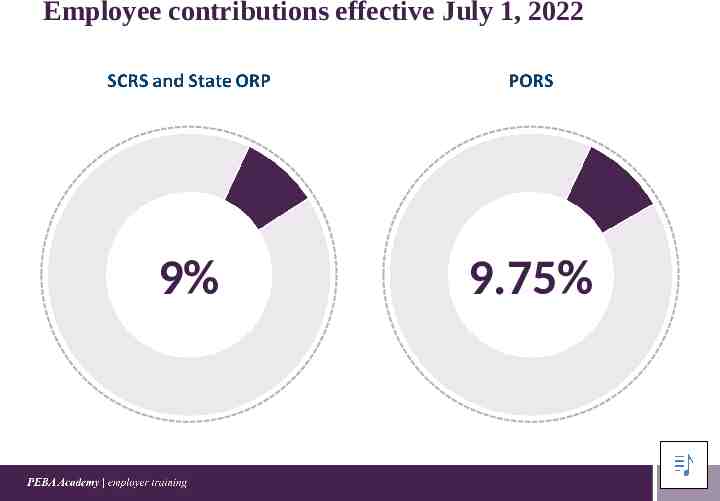

Employee contributions effective July 1, 2022 9% 9.75% 6

Employee contributions Contributions are tax-deferred. Member contributions credited to member’s account. In retirement, monthly payments continue even when member’s account is exhausted. Refund of unexhausted contributions payable only if there is no survivor benefit due. If monthly survivor benefit is payable, there is no refund of contributions. 7

Return-to-work retired member contributions Retired member contributes same rate as active member. Retired member does not accrue additional service credit. Contributions must be made to system from which the member retired. Retired member receiving both SCRS and PORS benefit: Remit contributions to the system to which an active member in his position would contribute. Refer to Working Retiree Contributions training document in EES. 8

Limit on wages subject to contributions Applies to employees who became members after December 31, 1995. Limit on compensation subject to contributions for 2022 is 305,000. Any compensation over the limit cannot be reported to PEBA. Do not remit employer or member contributions. These members fall into a special reporting category to ensure earned service is credited to their account. See Contract Length 20 in the Reporting section of the Covered Employer Procedures Manual. 9

Wages subject to contributions Gross salary or wages: Before taxes withheld; and Before other deductions. Wages paid while on sick, annual and general leave. Overtime/compensatory time (must be employer-mandated for SCRS). Authorized, approved overtime pay is considered employer-mandated and earnable compensation for AFC purposes. As such, the employer will deduct and remit retirement contributions. Unused annual leave (Class Two members only): Contributions deductible for up to and including 45 days of termination pay for unused annual/general leave. Payment at retirement is included in average final compensation. 10

Wages not subject to contributions Termination pay for more than 45 days of unused annual leave (Class Two members only). Termination pay for unused annual leave (Class Three members only). Special payments: One-time bonus and incentive-type payments; and Retirement incentive payments. Lump-sum payments for unused sick leave. Long-term disability benefits. 11

Disclaimer This presentation does not constitute a comprehensive or binding representation of the employee benefit programs PEBA administers. The terms and conditions of the employee benefit programs PEBA administers are set out in the applicable statutes and plan documents and are subject to change. Benefits administrators and others chosen by your employer to assist you with your participation in these employee benefit programs are not agents or employees of PEBA and are not authorized to bind PEBA or make representations on behalf of PEBA. Please contact PEBA for the most current information. The language used in this presentation does not create any contractual rights or entitlements for any person. 12