Florida Real Estate Principles, Practices & Law 43rd Edition Unit 5:

64 Slides349.17 KB

Florida Real Estate Principles, Practices & Law 43rd Edition Unit 5: Real Estate Brokerage Activities and Procedures

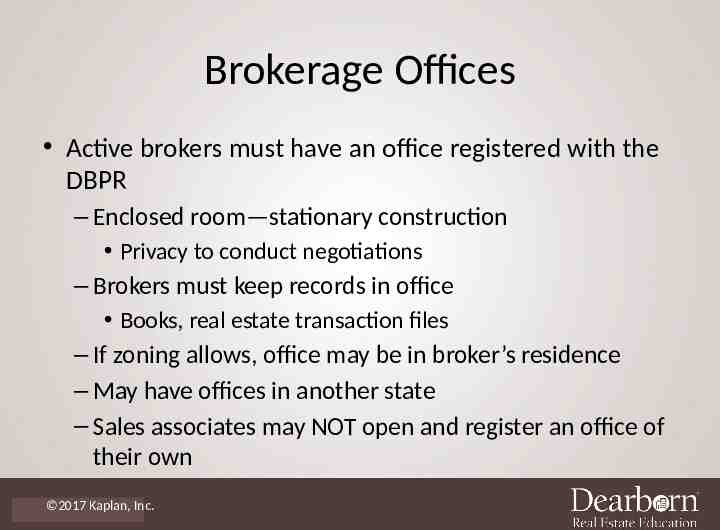

Brokerage Offices Active brokers must have an office registered with the DBPR – Enclosed room—stationary construction Privacy to conduct negotiations – Brokers must keep records in office Books, real estate transaction files – If zoning allows, office may be in broker’s residence – May have offices in another state – Sales associates may NOT open and register an office of their own 2017 Kaplan, Inc.

Branch Office Broker must register each branch office – Branch office registrations NOT transferable Cannot be moved to a new location – Temporary shelter NOT a branch office unless sales associates are permanently assigned or sale transactions are closed at that location 2017 Kaplan, Inc.

Office Signs Little Mo Realty Murl H. Crawford Licensed Real Estate Broker Trade name (if used) Broker’s name Words “Licensed Real Estate Broker” or “Lic. Real Estate Broker” 2017 Kaplan, Inc.

Associates Names on Entrance Sign Names of sales associates and broker associates are optional – If included Associate names must be below names of brokers Include license type next to each name, such as sales associate Line or space must separate associate names from broker names 2017 Kaplan, Inc.

Brokerage Entity Signs Kellogg Real Estate, Inc. Sandi M. Kellogg Licensed Real Estate Broker If the brokerage entity is a partnership, corporation, or limited liability partnership/company sign must contain – Name of firm or corporation – Name of at least one active broker – Words, “Licensed Real Estate Broker” 2017 Kaplan, Inc.

Advertising Advertising must inform people they are dealing with a licensee or a brokerage firm – Broker is responsible for all advertising Must include name of brokerage firm 2017 Kaplan, Inc.

Team Advertising The name or logo used by one or more licensees who represent themselves to the public as a team or group Team concept allows broker associates and sales associates to join forces to serve a wider group of customers more efficiently Teams must advertise in the name of the brokerage firm 2017 Kaplan, Inc.

Team Advertising Team must file with employing broker the name of the licensee whom the team designates to be responsible for ensuring team advertising complies with license law Registered broker must at least monthly maintain a record of team members Teams must advertise in the name of the brokerage firm The team name in ads must be no larger than the name of the registered broker 2017 Kaplan, Inc.

Blind Advertisement Advertising that fails to disclose name of the brokerage firm and includes only a PO box, telephone number and/or street address Blind advertising is illegal If a sales associate creates promotional materials, the materials must include the brokerage name 2017 Kaplan, Inc.

Names of Licensees in Advertising Licensees may include personal name in ads – Must use last name as registered with FREC when including personal name in an ad – Yard signs and classified ads must include registered name of the brokerage firm – Promotional materials Name of brokerage firm Sales associate’s name may also appear 2017 Kaplan, Inc.

False Advertising False, deceptive, or misleading information in advertisements for real estate is illegal Second degree misdemeanor Licensee cannot use an association’s name or designation unless currently a member in good standing 2017 Kaplan, Inc.

Internet Advertising Point of contact information is the means to contact the brokerage firm or a licensee including – Mailing address – Street address – Email address – Telephone or fax number Brokerage name must appear adjacent to or immediately above/below point of contact information 2017 Kaplan, Inc.

Licensee Selling Property By Owner Licensees may sell their own property “by owner” – Can advertise property and include personal contact information – Should disclose that seller is licensed before beginning negotiations and in the contract 2017 Kaplan, Inc.

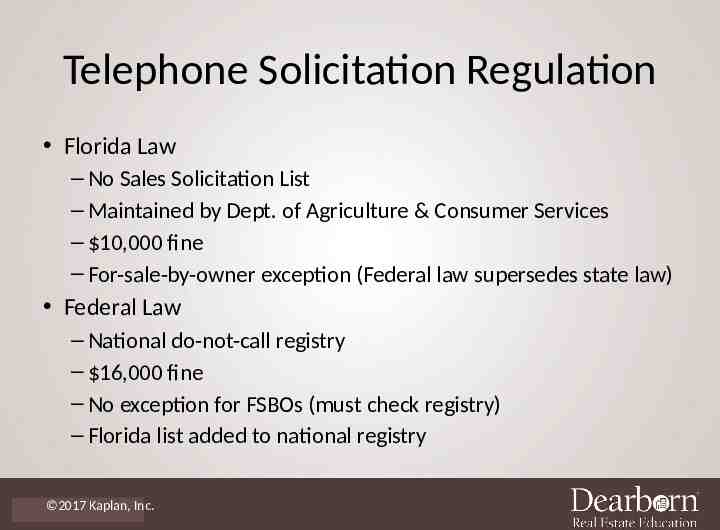

Telephone Solicitation Telephone solicitation is the initiation of a call for the purpose of encouraging purchase or investment in property, goods or services Making telephone calls to obtain listings or buyers is telephone solicitation Regulated by state and federal law – Calling hours restricted 2017 Kaplan, Inc.

Telephone Solicitation Regulation Florida Law – No Sales Solicitation List – Maintained by Dept. of Agriculture & Consumer Services – 10,000 fine – For-sale-by-owner exception (Federal law supersedes state law) Federal Law – National do-not-call registry – 16,000 fine – No exception for FSBOs (must check registry) – Florida list added to national registry 2017 Kaplan, Inc.

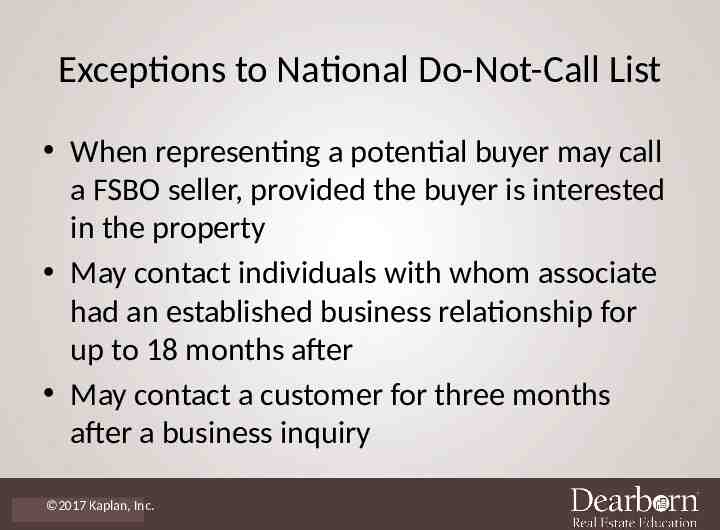

Exceptions to National Do-Not-Call List When representing a potential buyer may call a FSBO seller, provided the buyer is interested in the property May contact individuals with whom associate had an established business relationship for up to 18 months after May contact a customer for three months after a business inquiry 2017 Kaplan, Inc.

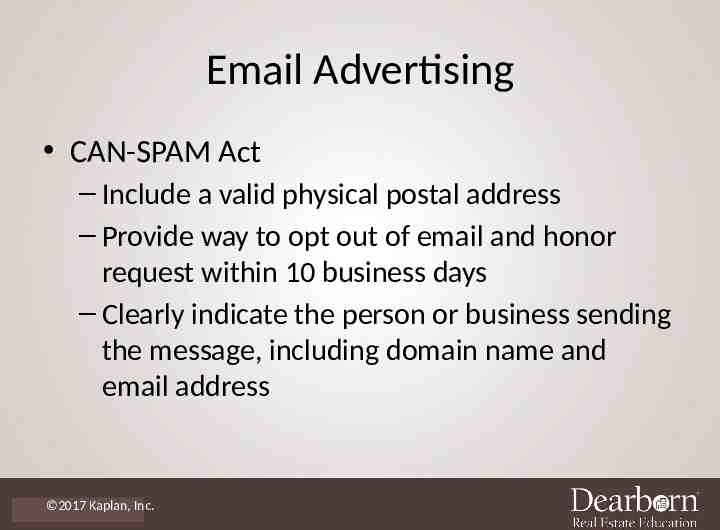

Email Advertising CAN-SPAM Act – Include a valid physical postal address – Provide way to opt out of email and honor request within 10 business days – Clearly indicate the person or business sending the message, including domain name and email address 2017 Kaplan, Inc.

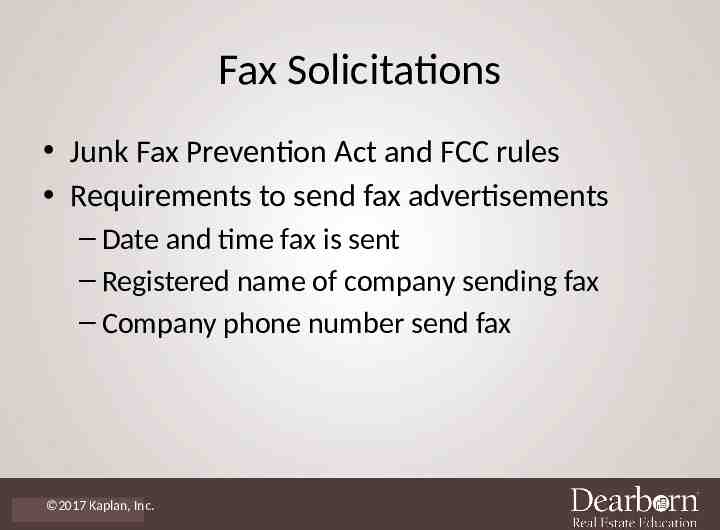

Fax Solicitations Junk Fax Prevention Act and FCC rules Requirements to send fax advertisements – Date and time fax is sent – Registered name of company sending fax – Company phone number send fax 2017 Kaplan, Inc.

Escrow or Trust Accounts Escrow (trust) account – An account for the deposit of money the broker holds in trust for others Deposit – Money delivered to a licensee in connection with a real estate transaction – Earnest money deposit can be cash or anything that can be converted into money 2017 Kaplan, Inc.

Acceptable Depositories Broker-held escrow accounts – Florida commercial bank – Florida credit union – Florida savings (and loan) association Florida-based title company or Florida attorney (broker is not the escrow agent) 2017 Kaplan, Inc.

Immediately Defined Sales Associates and Broker Associates – Deliver to employing broker no later than end of the next business day Brokers – Deposit in escrow account no later than end of the third business day after associate receives check – Broker’s time starts after sales associate or employee of brokerage receives the deposit 2017 Kaplan, Inc.

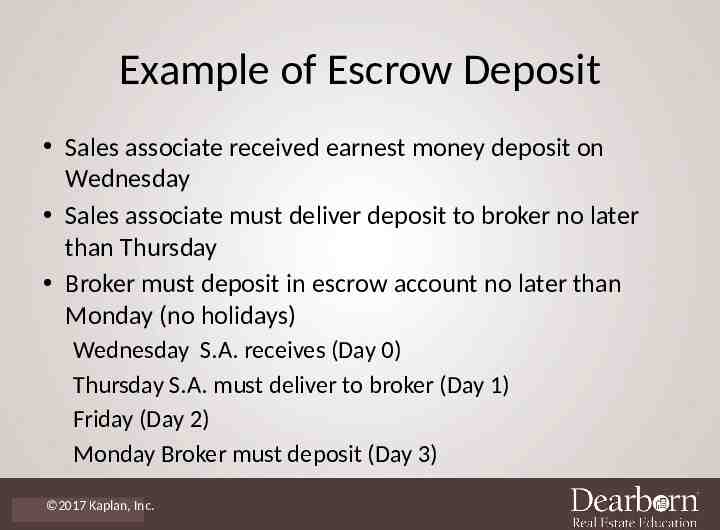

Example of Escrow Deposit Sales associate received earnest money deposit on Wednesday Sales associate must deliver deposit to broker no later than Thursday Broker must deposit in escrow account no later than Monday (no holidays) Wednesday S.A. receives (Day 0) Thursday S.A. must deliver to broker (Day 1) Friday (Day 2) Monday Broker must deposit (Day 3) 2017 Kaplan, Inc.

Escrow Check Payable to Sales Associate Instruct buyer to write check payable to broker’s escrow account If check is made out to sales associate personally, have buyer write a new check If not practical endorse check and write, “For deposit only to (name of escrow)” Photo copy check and endorsement 2017 Kaplan, Inc.

Postdated Checks and Insufficient Funds Obtain seller’s approval before accepting Broker must secure check until payable and then immediately deposit in escrow Checks returned for insufficient funds – Broker is not responsible if the broker made a timely deposit 2017 Kaplan, Inc.

Broker-Held Escrow Accounts Broker must be a signatory on escrow account – Additional persons (e.g., bookkeeper) may also be a signatory Escrow accounts must be reconciled each month Broker must review, sign and date monthly reconciliation 2017 Kaplan, Inc.

Interest-Bearing Escrow Accounts Written permission from all parties before placing in interest-bearing account Written authorization who is entitled to interest Broker, if authorized, may receive interest earned 2017 Kaplan, Inc.

Misappropriation of Escrow Funds Commingling is mixing escrow funds with a broker’s personal or business funds Conversion is illegal use or retention of another person’s personal property (funds) 2017 Kaplan, Inc.

Money to Maintain Escrow Account Brokers may place 1,000 personal or brokerage funds in a sales escrow account Brokers may place 5,000 personal or brokerage funds in property management escrow account 2017 Kaplan, Inc.

Recordkeeping Brokers must keep business records, books, and accounts in compliance and available for DBPR audit Must preserve records for five years and two years beyond court proceeding 2017 Kaplan, Inc.

Title Company/Attorney Escrow Accounts Indicate title company (or attorney) name, address, and telephone number on contract Within 10 business days after deposit is due, buyer’s broker must make written request to title company (attorney) for verification of receipt of deposit Within 10 business days after broker made written request, provide seller’s broker with a copy of written verification 2017 Kaplan, Inc.

Notice and Settlement Procedures Broker must not disburse escrow funds until transaction closes or with agreement of the parties Broker has conflicting demands – When buyer and seller make demands regarding disbursing of escrow funds that are inconsistent with each other and cannot be resolved 2017 Kaplan, Inc.

Conflicting Demands Must notify FREC in writing within 15 business days of receiving conflicting demands Begin settlement procedure within 30 business days of receiving conflicting demands Time periods run concurrently 2017 Kaplan, Inc.

Settlement (Escape) Procedures Mediation Informal, neutral party, negotiated settlement Arbitration Binding judgment by third party (prior consent of parties) Litigation – Interpleader – broker has no financial claim – Declaratory judgment – judge declares each party’s rights to funds Escrow disbursement order (EDO) 2017 Kaplan, Inc.

Escrow Disbursement Order (EDO) Commission issues a determination of who is entitled to disputed funds Funds must be held in brokerage escrow account Must inform FREC within 10 business days if dispute is settled or it goes to court 2017 Kaplan, Inc.

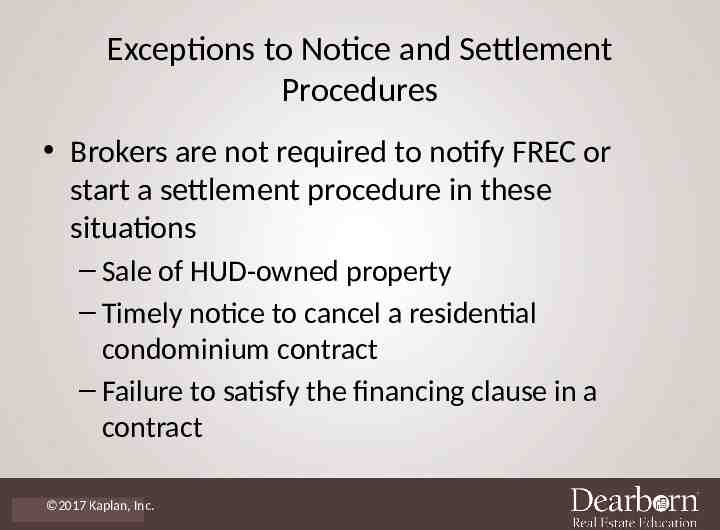

Exceptions to Notice and Settlement Procedures Brokers are not required to notify FREC or start a settlement procedure in these situations – Sale of HUD-owned property – Timely notice to cancel a residential condominium contract – Failure to satisfy the financing clause in a contract 2017 Kaplan, Inc.

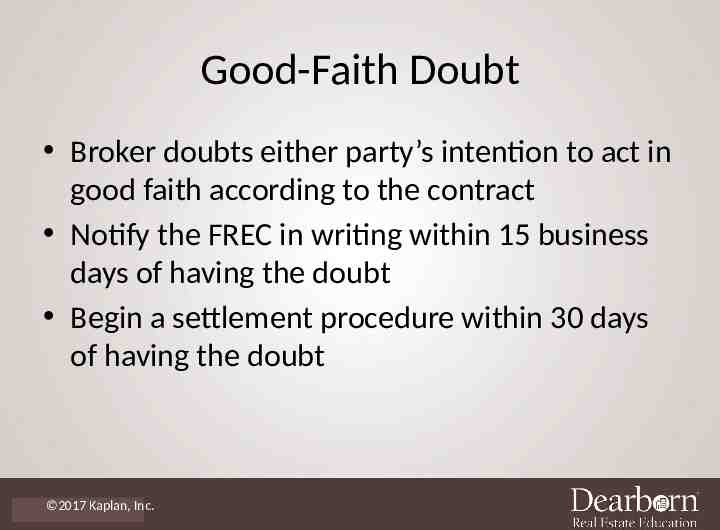

Good-Faith Doubt Broker doubts either party’s intention to act in good faith according to the contract Notify the FREC in writing within 15 business days of having the doubt Begin a settlement procedure within 30 days of having the doubt 2017 Kaplan, Inc.

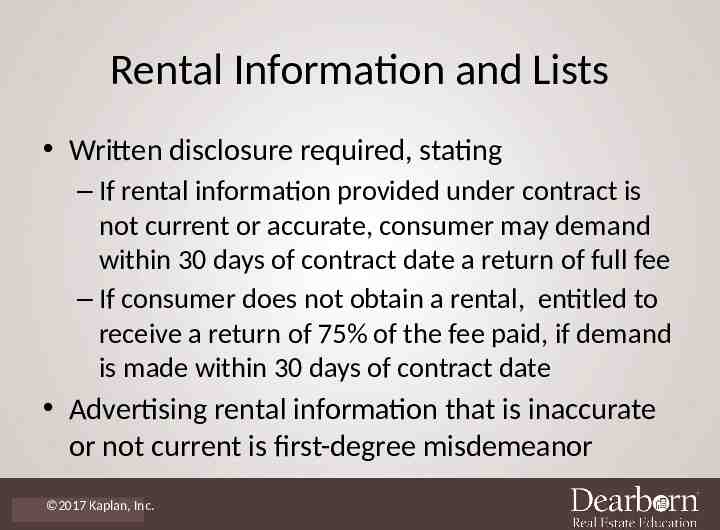

Rental Information and Lists Written disclosure required, stating – If rental information provided under contract is not current or accurate, consumer may demand within 30 days of contract date a return of full fee – If consumer does not obtain a rental, entitled to receive a return of 75% of the fee paid, if demand is made within 30 days of contract date Advertising rental information that is inaccurate or not current is first-degree misdemeanor 2017 Kaplan, Inc.

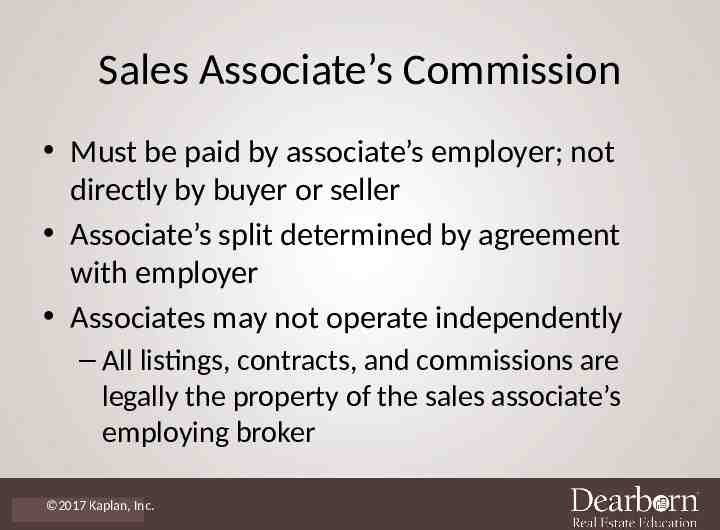

Sales Associate’s Commission Must be paid by associate’s employer; not directly by buyer or seller Associate’s split determined by agreement with employer Associates may not operate independently – All listings, contracts, and commissions are legally the property of the sales associate’s employing broker 2017 Kaplan, Inc.

Broker’s Commission Established by agreement between broker and party who agrees to pay – Negotiable State of Florida does not regulate commission rates or fees Licensees may share their commission with the buyer or seller in that transaction (with full disclosure) 2017 Kaplan, Inc.

Antitrust Laws Antitrust laws protect competition and ensure against restraint of trade – Sherman and Clayton Antitrust Acts – Federal Trade Commission Act It is illegal to – Fix commissions or fees for services (price-fixing) – Conspire to split up market areas to avoid competition (market allocation) 2017 Kaplan, Inc.

Liens on Real Property for Unpaid Sales Commission Only brokers (not associates) can seek compensation from buyers or sellers Liens on residential property for nonpayment of commission – Only allowed if broker is given that authority in a listing contract – Otherwise seek civil judgment May not encumber the title to real property 2017 Kaplan, Inc.

F.S. 475, Part III Commercial Real Estate Sales Gives broker lien rights on seller’s net proceeds from sale of commercial property Not lien rights on the real property Brokerage agreement (listing contract) must clearly state broker’s lien rights 2017 Kaplan, Inc.

F.S. 475, Part IV Commercial Real Estate Leasing Commission Lien Act Gives broker lien rights for commission earned for leasing commercial real estate – If landlord agreed to pay commission, lien is against landlord’s interest in the real property – If tenant agreed to pay commission, lien is on tenant’s leasehold estate 2017 Kaplan, Inc.

Kickbacks, Rebates, Unearned Fees Referral fees for non-real estate services – Buyer and seller must be fully informed – Must not violate RESPA (Illegal for closing services, title searches, appraisals, etc.) – Person receiving kickback must be properly licensed if applicable (e.g., mortgage loan originator license) 2017 Kaplan, Inc.

Referral Fees for Real Estate Services Licensees may share their commission with the buyer or seller in that transaction (with full disclosure) May not share commission with any other unlicensed person May not pay an unlicensed person for referral of real estate business (finder’s fee of up to 50 to a tenant exception) 2017 Kaplan, Inc.

Brokerage Business Entities Chapter 475 defines broker to include anyone who is general partner, officer or director of brokerage partnership or corporation Chapter 475 prohibits a person licensed as a sales associate or broker associate from registering as a general partner, officer or director of a brokerage entity 2017 Kaplan, Inc.

Business Entities That May Register as Real Estate Brokers Sole Proprietorship General Partnership Limited Partnership Limited Liability Partnership (LLP) Corporation Limited Liability Company (LLC) 2017 Kaplan, Inc.

Sole Proprietorship Owned by one person Owner liability Owner must hold active broker license Register under own name or trade name 2017 Kaplan, Inc.

General Partnership Two or more persons engaging in business together Created by written, oral, or implied agreement Each is liable for partnership debts and can bind other partners in contracts 2017 Kaplan, Inc.

Real Estate Brokerage General Partnership Register partnership with the DBPR At least one partner must be an active broker Partners who deal with public and perform real estate services must be active brokers Sales associates may not be general partners 2017 Kaplan, Inc.

Limited Partnership Created by written instrument filed with Florida Department of State One or more general partners and one or more limited partners Limited partners make investment of cash or property – not services Limited partners have limited liability 2017 Kaplan, Inc.

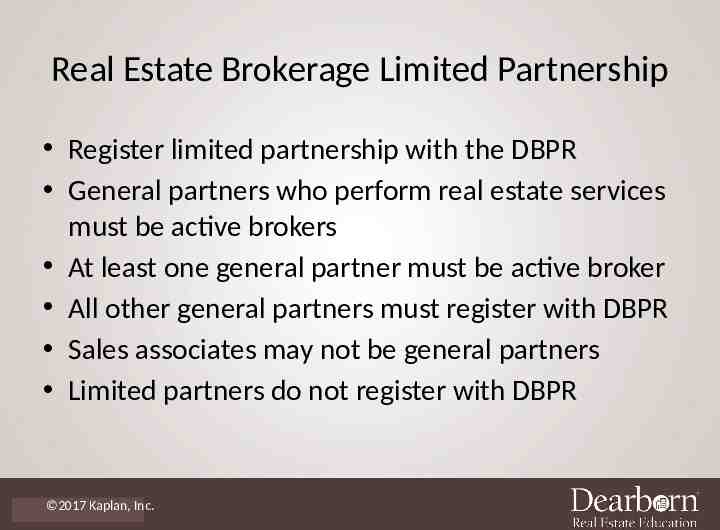

Real Estate Brokerage Limited Partnership Register limited partnership with the DBPR General partners who perform real estate services must be active brokers At least one general partner must be active broker All other general partners must register with DBPR Sales associates may not be general partners Limited partners do not register with DBPR 2017 Kaplan, Inc.

Ostensible Partnership Prohibited Quasi partnership When the actions of two or more persons create the appearance that a partnership exists – Each may be liable for other person’s debts and torts Subject to license suspension 2017 Kaplan, Inc.

Limited Liability Partnership (LLP) Protection from personal liability Partners are not subject to limitations imposed on limited partners in a traditional limited partnership Name of registered limited liability partnership must include in name – Registered limited liability partnership or LLP at end of name 2017 Kaplan, Inc.

Corporations (Inc.) An artificial person or legal entity created by law – File articles of incorporation with FL Dept. of State – Foreign corporation is organized under laws of another state; may do business in Florida – Domestic corporation incorporated in Florida – Managed by board of directors & officers – May be for profit or non-profit 2017 Kaplan, Inc.

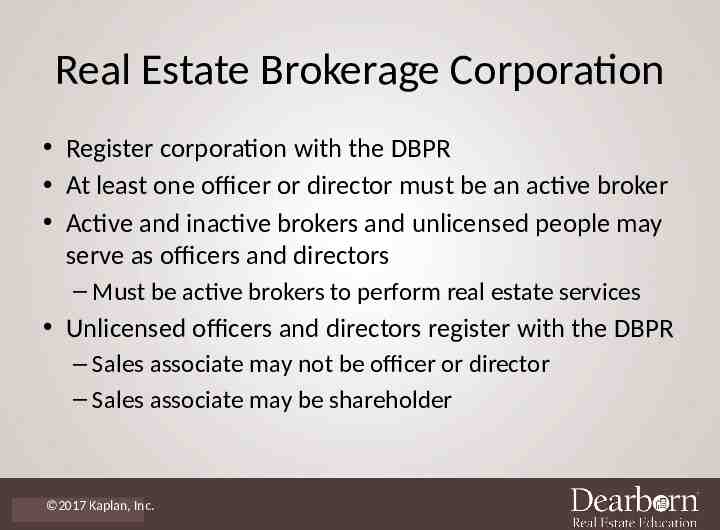

Real Estate Brokerage Corporation Register corporation with the DBPR At least one officer or director must be an active broker Active and inactive brokers and unlicensed people may serve as officers and directors – Must be active brokers to perform real estate services Unlicensed officers and directors register with the DBPR – Sales associate may not be officer or director – Sales associate may be shareholder 2017 Kaplan, Inc.

Limited Liability Company (LLC) Best features of a corporation and a partnership – Protection from personal liability – IRS treats LLC as a partnership for tax purposes – Income is taxed only once, as in a partnership 2017 Kaplan, Inc.

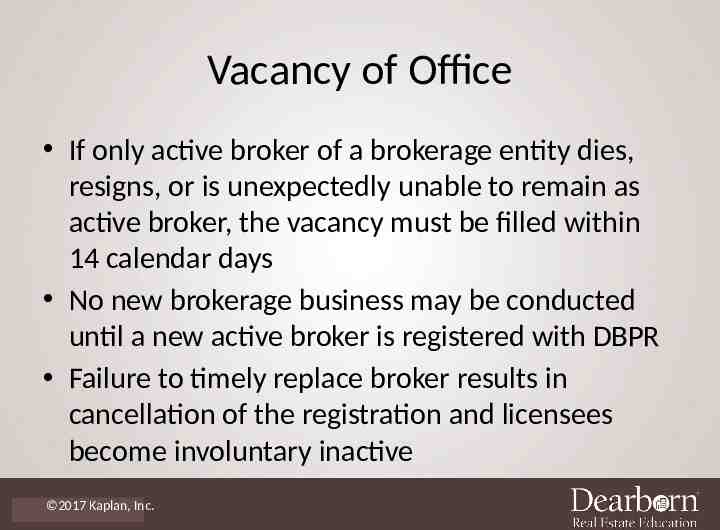

Vacancy of Office If only active broker of a brokerage entity dies, resigns, or is unexpectedly unable to remain as active broker, the vacancy must be filled within 14 calendar days No new brokerage business may be conducted until a new active broker is registered with DBPR Failure to timely replace broker results in cancellation of the registration and licensees become involuntary inactive 2017 Kaplan, Inc.

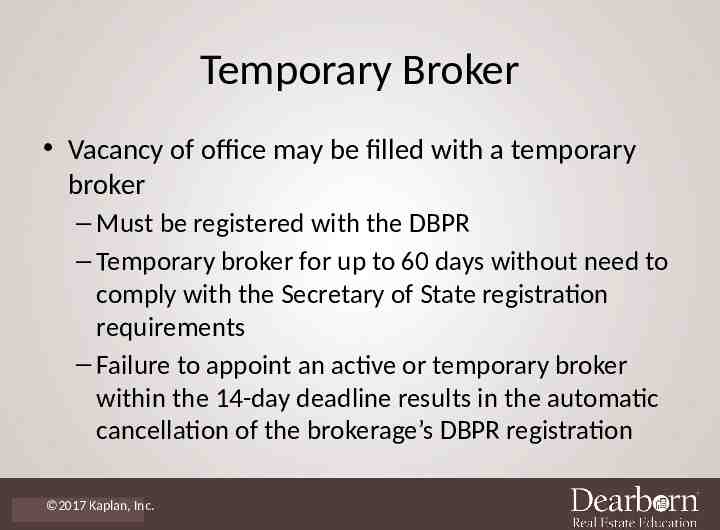

Temporary Broker Vacancy of office may be filled with a temporary broker – Must be registered with the DBPR – Temporary broker for up to 60 days without need to comply with the Secretary of State registration requirements – Failure to appoint an active or temporary broker within the 14-day deadline results in the automatic cancellation of the brokerage’s DBPR registration 2017 Kaplan, Inc.

Business Entities That May Not Register Corporation sole – church (religious) organization Joint venture – temporary business arrangement Two separately registered brokers may conduct real estate business as a joint venture Business trust – involves entity’s own property Cooperative association – involves own property Unincorporated association – example is property owners in a subdivision 2017 Kaplan, Inc.

Trade (Fictitious) Names Business name other than the legal name of the person doing business T/A (trading as) D/B/A (doing business as) Fictitious name refers to the name registered with the DOS Brokers who operate under trade names must also register trade name with DBPR Associates must have licenses issued in their legal names (not under a trade name) 2017 Kaplan, Inc.

Forming a Professional Association in Associate’s Legal Name Sales associates and broker associates may organize themselves in a type of professional association in their legal name only Register with DOS Provide DBPR proof of DOS registration and then can be issued license in sales associate name with professional designation – Professional corporation (PA) – Limited liability company (LLC) – Professional limited liability company (PLLC) 2017 Kaplan, Inc.

Personal Assistants Unlicensed – Administrative tasks – May not perform duties requiring a license – May not be paid a commission – Licensee who employs unlicensed assistants Must comply with state and federal employment laws Licensed – Can perform services of real estate – Must be registered with employing broker – Broker must pay licensed assistant for brokerage activities 2017 Kaplan, Inc.