PEOPLE Parent Professional Development Saturday, November 6, 2021 | 10

63 Slides8.48 MB

PEOPLE Parent Professional Development Saturday, November 6, 2021 10 – 11:30 AM College Expectations for Students and Parents Financial Aid: What do I need to know?

Today’s Agenda Welcome Presentation from Goodson Vue, Assistant Director, PEOPLE College Knowledge Check Q/A with Goodson Vue Presentation from Martina Diaz, Senior Advisor, UW Madison Knowledge Check Q/A with Martina Diaz Closing

PEOPLE College Program

The PEOPLE College Team Goodson Vue Assistant Director Pao Thao College Advisor Jorge Zuniga College Advisor

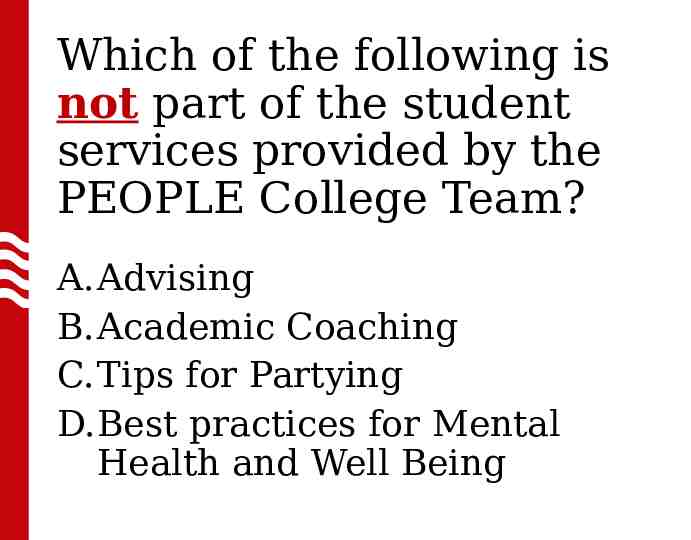

What We Do Advising Academic Coaching Mental Health & Well Being

Family Educational Rights & Privacy Act of 1974 (FERPA) a federal law that governs the privacy of student education records, access to those records, and disclosure of information from them FERPA rights apply to anyone who is currently or was ever enrolled for classes at and attended UW–Madison. FERPA coverage begins on the first day of the first term for which students have enrolled for classes Respecting the privacy of students’ education records and supporting the principles of FERPA are requirements for all employees of UW–Madison More information here: https://studentprivacy.ed.gov/

Health Insurance Portability & Accountability Act (HIPAA) a federal law that required the creation of national standards to protect sensitive patient health information from being disclosed without the patient's consent or knowledge

S ummer C ollegiate E xperience Required for all PEOPLE/ITA students attending UW-Madison for Academic Year 2022/2023 June 18 - July 29, 2022 At least one 3 Credit Course Residential

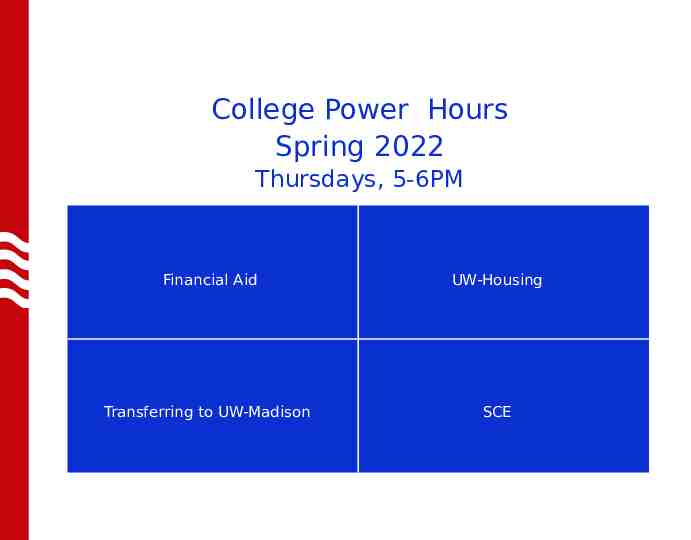

College Power Hours Spring 2022 Thursdays, 5-6PM Financial Aid UW-Housing Transferring to UW-Madison SCE

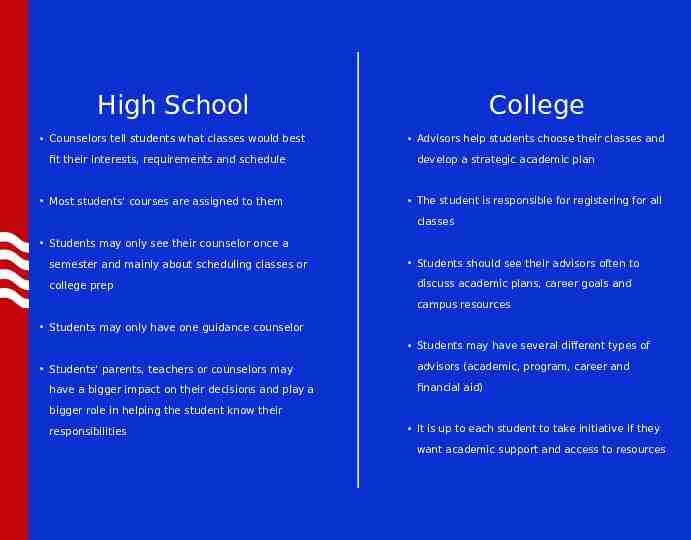

High School College Counselors tell students what classes would best Advisors help students choose their classes and fit their interests, requirements and schedule Most students' courses are assigned to them develop a strategic academic plan The student is responsible for registering for all classes Students may only see their counselor once a semester and mainly about scheduling classes or college prep Students should see their advisors often to discuss academic plans, career goals and campus resources Students may only have one guidance counselor Students may have several different types of Students' parents, teachers or counselors may have a bigger impact on their decisions and play a advisors (academic, program, career and financial aid) bigger role in helping the student know their responsibilities It is up to each student to take initiative if they want academic support and access to resources

Thank You

Knowledge First person to put the correct Check response in the chat wins a Prize!

Which of the following is not part of the student services provided by the PEOPLE College Team? A.Advising B.Academic Coaching C.Tips for Partying D.Best practices for Mental Health and Well Being

True or false? PEOPLE students who choose not to attend UW Madison do not have to attend SCE. A.True B.False

Questions for Goodson Vue?

Financial Aid Next Steps 2022/2023

Goal of Financial Aid To assist students in paying for college. To provide opportunity and access to higher education. This Photo by Unknown Author is licensed under CC BY-ND

Agenda Free Application for Federal Financial Aid – FAFSA Verification? What is the Family Contribution? What Is the cost of attendance? UW Student Center & Financial Aid Offer What does financial aid consist of? Scholarships and other resources Additional information

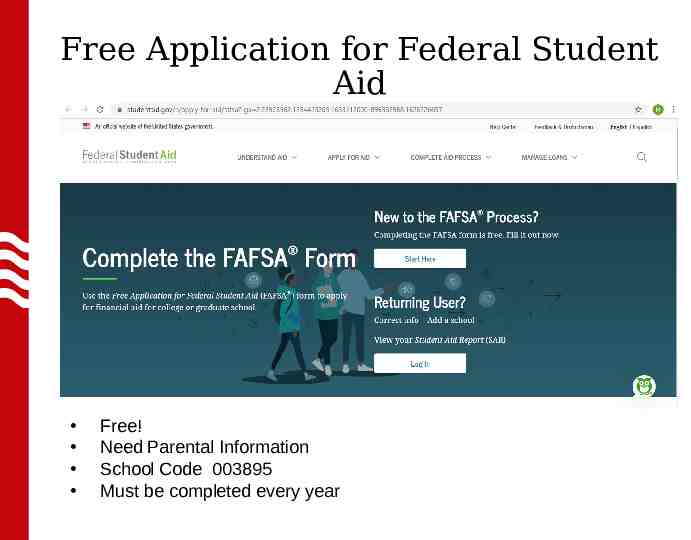

Free Application for Federal Student Aid FAFSA Free! Need Parental Information School Code 003895 Must be completed every year

Who is eligible to Apply Citizen by birth (born in the US or abroad to US citizens) Citizen by naturalization Permanent resident (eligible for citizenship) Three questions on the FAFSA Yes, I am a US citizen No, I am an eligible noncitizen (need registration Number) No, I am not a citizen or eligible noncitizen Families in mixed statuses, parents will need to enter zeros in the social security field.

Free Application for Federal Student Aid Free Application for Federal Student Aid FAFSA https://studentaid.ed.gov/sa/fafsa October 1 To sign the FAFSA electronically you will need to get an FSA ID https://studentaid.gov/fsa-id/create-account/launch All the schools that you have listed on the FAFSA will receive your financial information. UW Madison priority date is December 1.

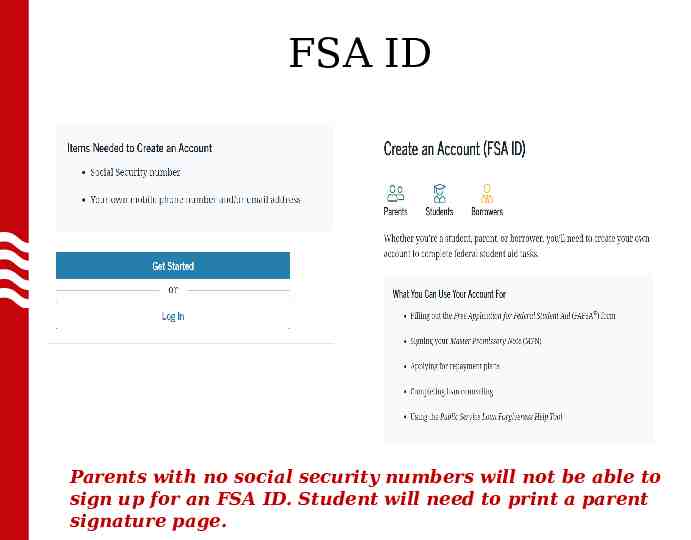

FSA ID Parents with no social security numbers will not be able to sign up for an FSA ID. Student will need to print a parent signature page.

IRS Data Retrieval The 2021-2022 IRS Data Retrieval Tool (IRS DRT) will be available. You will need the 2019 income information to complete the 2021-2022 FAFSA. That means you can use the IRS DRT right away! The IRS Data Retrieval Tool allows students and parents to access the IRS tax return information needed to complete the Free Application for Federal Student Aid (FAFSA) and transfer the data directly into their FAFSA from the IRS Web site. (Note: There are several scenarios in which you might not be given the option to use the IRS Data Retrieval Tool, including if you are not eligible to use it.) To use the IRS Data Retrieval Tool within the application on the student or parent finances pages:

Student Aid Report Student Aid Report SAR will be sent to the students email address or by U.S. mail. The SAR summarizes the information you provided on the FAFSA and indicates the Expected Family Contribution (EFC). Review and read SAR comments carefully. If any corrections are necessary, go to www.fafsa.ed.gov and select ‘Make Corrections to a processed FAFSA’.

Verification UW Madison may request additional information from you and/or your parents. Please respond to all request in a timely manner. Information that may be requested; Federal Tax Return Transcript W-2’s Child Support Received Business Information Number of people in the household and in college.

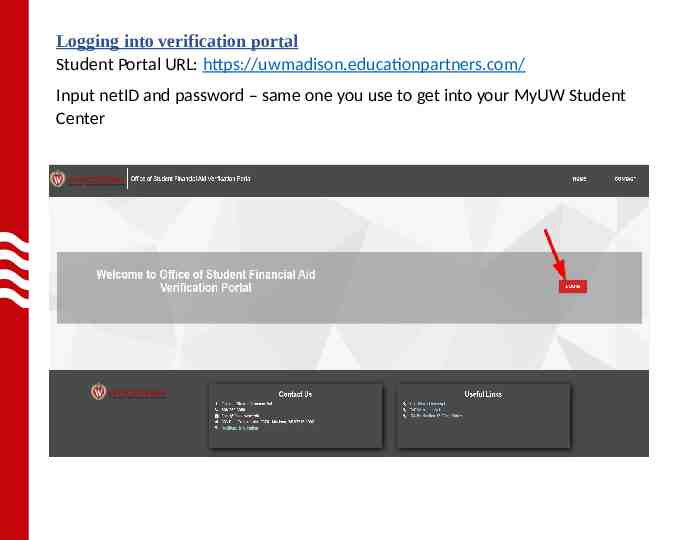

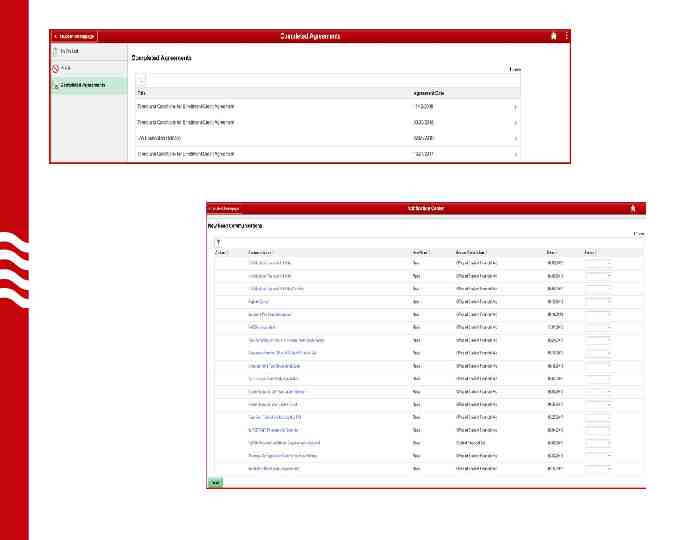

Logging into verification portal Student Portal URL: https://uwmadison.educationpartners.com/ Input netID and password – same one you use to get into your MyUW Student Center

Expected Family Contribution What is the “expected family contribution EFC”? This is the amount that a family can be expected to contribute to the student's college cost. How is the EFC determined? The EFC is all the information that has been entered on the FAFSA. The FAFSA information runs through a federal formula and the output is the EFC.

FAFSA tips to know Divorced- which parent do I use? What if student is paying for everything, do you still need parental information? My financial circumstance is different than it was when I filled out the FAFSA/tax information from 2 years ago IRS Data Retrieval Tool Lowers chance of being selected for verification Sometimes it’s glitchy- plan ahead Chat function helpful Use 0’s if parent(s) don’t have social security number FSA ID tips- don’t use your high school e-mail, save it!

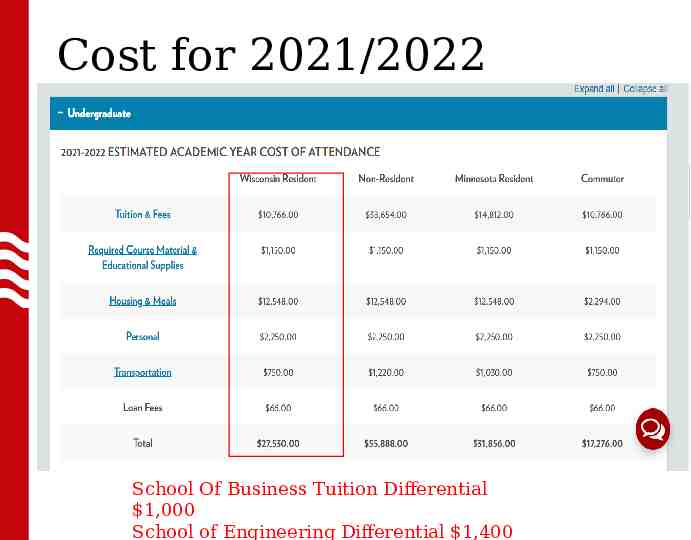

Cost for 2021/2022 School Of Business Tuition Differential 1,000 School of Engineering Differential 1,400

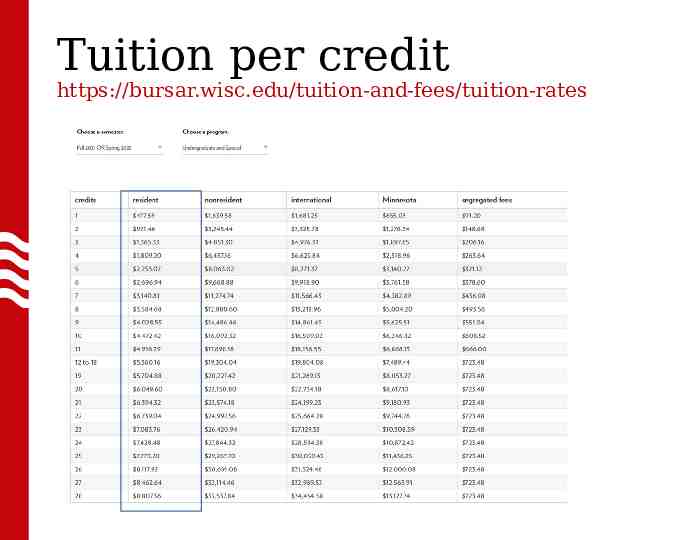

Tuition per credit https://bursar.wisc.edu/tuition-and-fees/tuition-rates

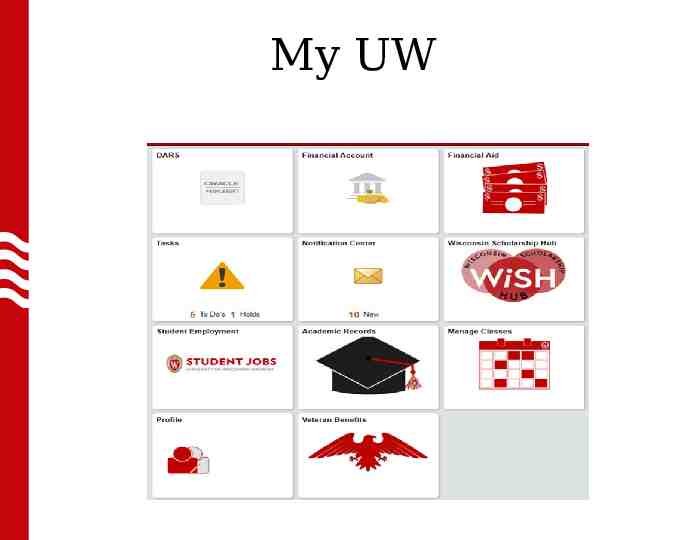

My UW

Financial Aid

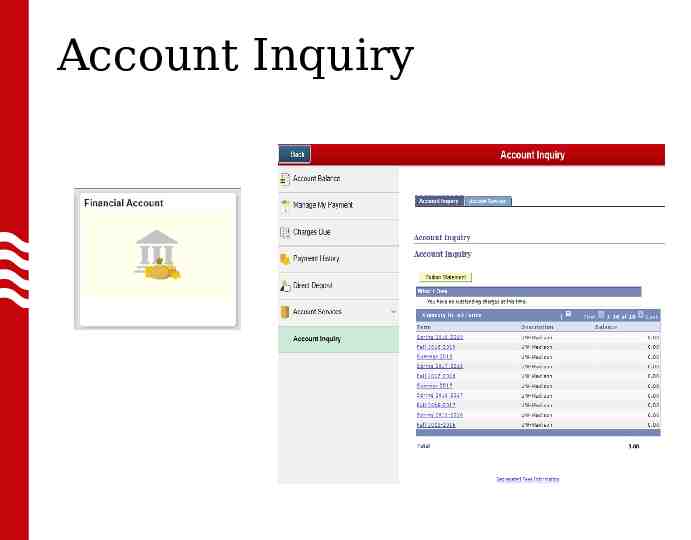

Account Inquiry

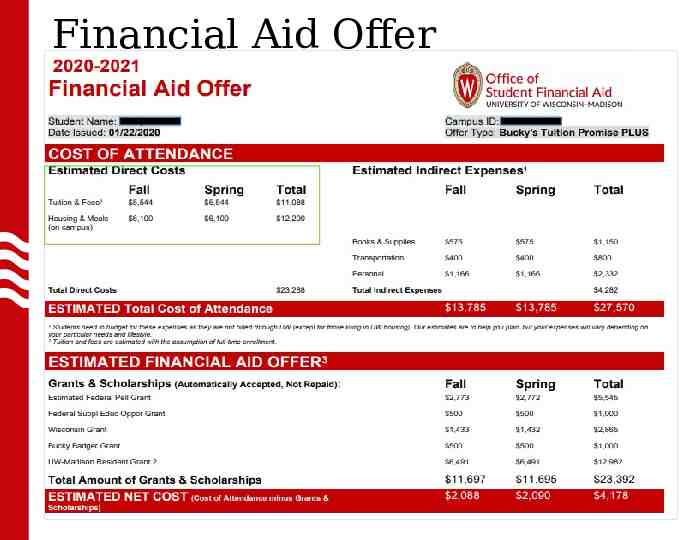

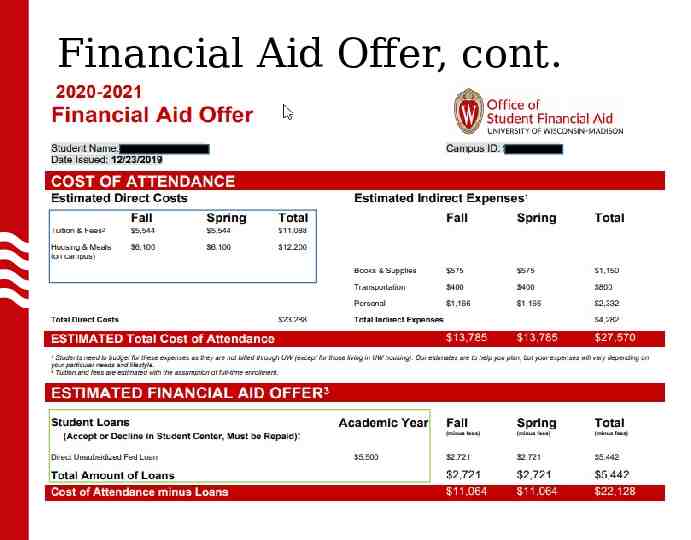

Financial Aid Offer

Financial Aid Offer, cont.

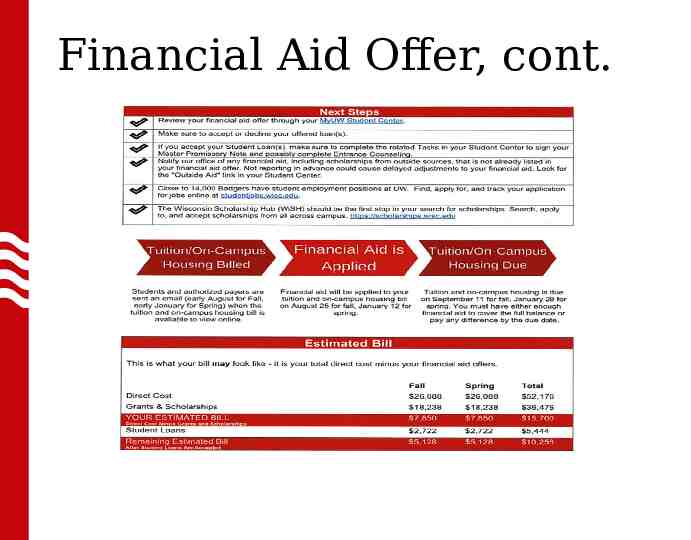

Financial Aid Offer, cont.

Housing University Residence Halls charges will be billed by semester. Due dates for tuition and University Residence Halls charges are: Fall Spring University Residence Halls charges will appear on the same University bill as tuition charges! Financial aid will pay tuition and University Residence Halls charges directly prior to refunding excess funds to the student. The current authorized payer process will be simplified. The existing BadgerPay Payment Plan will be available for both tuition and University Residence Halls charges There are 3 Dinning Plans; Tier 1 1,500, Tier 2 2,000, and Tier 3 2,900. If you have any additional housing questions, please contact them at (608) 262-2522. If help is needed with your housing deposit, please email [email protected]

What Does Financial Aid Consist Of? Grants Work study Loans Scholarships

Grants Grants are considered free money and are need based. Pell grant Supplemental Educational Opportunity grant Other state and institutional grants Free Free

Work Study It is need based aid and students need to work in order to earn the funds. You can earn money for educational and miscellaneous expenses. This a good way to earn money and get work experience in your field of study.

Job Center Https://studentjobs.wisc.edu/

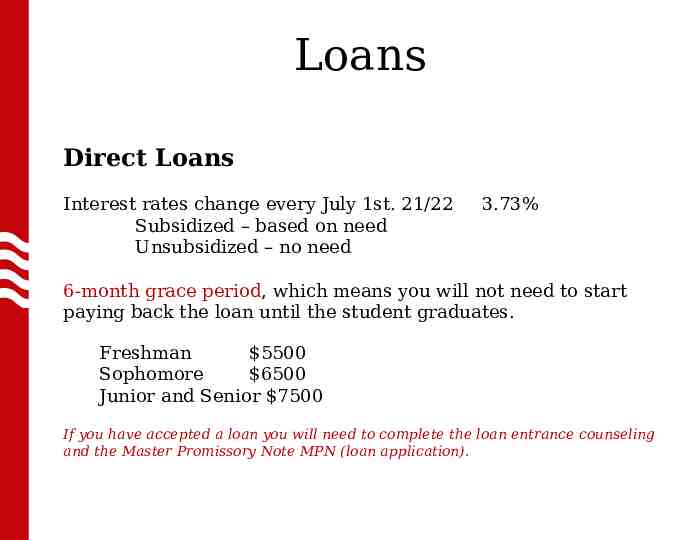

Loans Direct Loans Interest rates change every July 1st. 21/22 Subsidized – based on need Unsubsidized – no need 3.73% 6-month grace period, which means you will not need to start paying back the loan until the student graduates. Freshman 5500 Sophomore 6500 Junior and Senior 7500 If you have accepted a loan you will need to complete the loan entrance counseling and the Master Promissory Note MPN (loan application).

UW Madison Scholarships For institutional scholarships – Check out: https://wisc.academicworks.com/

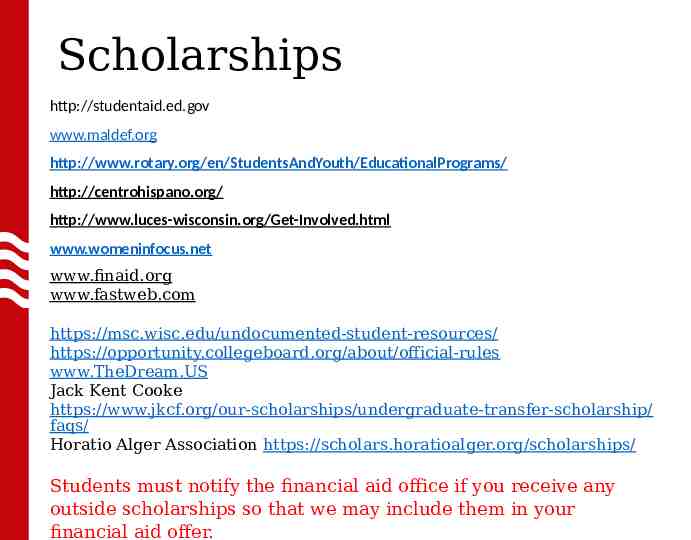

Scholarships http://studentaid.ed.gov www.maldef.org http://www.rotary.org/en/StudentsAndYouth/EducationalPrograms/ http://centrohispano.org/ http://www.luces-wisconsin.org/Get-Involved.html www.womeninfocus.net www.finaid.org www.fastweb.com https://msc.wisc.edu/undocumented-student-resources/ https://opportunity.collegeboard.org/about/official-rules www.TheDream.US Jack Kent Cooke https://www.jkcf.org/our-scholarships/undergraduate-transfer-scholarship/ faqs/ Horatio Alger Association https://scholars.horatioalger.org/scholarships/ Students must notify the financial aid office if you receive any outside scholarships so that we may include them in your financial aid offer.

Save and Budget Where is your money going? Be realistic: Keep track of what you actually spend not what you think you spend. Be specific: put your monthly expenses in categories you will have a much better idea of where you are spending your money.

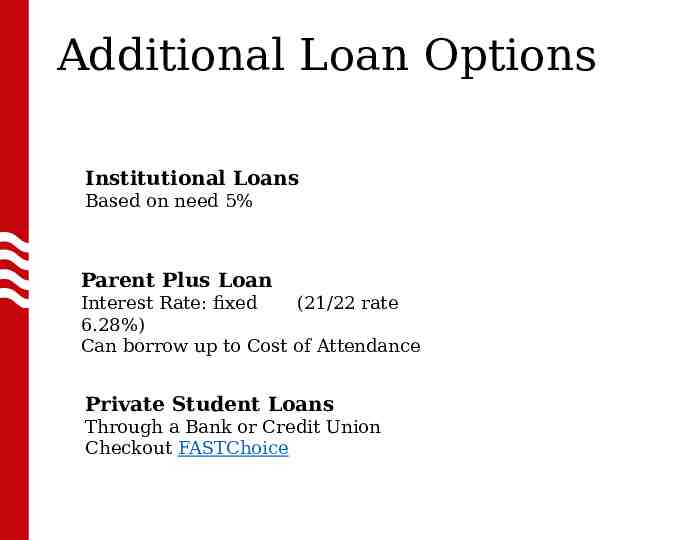

Additional Loan Options Institutional Loans Based on need 5% Parent Plus Loan Interest Rate: fixed (21/22 rate 6.28%) Can borrow up to Cost of Attendance Private Student Loans Through a Bank or Credit Union Checkout FASTChoice

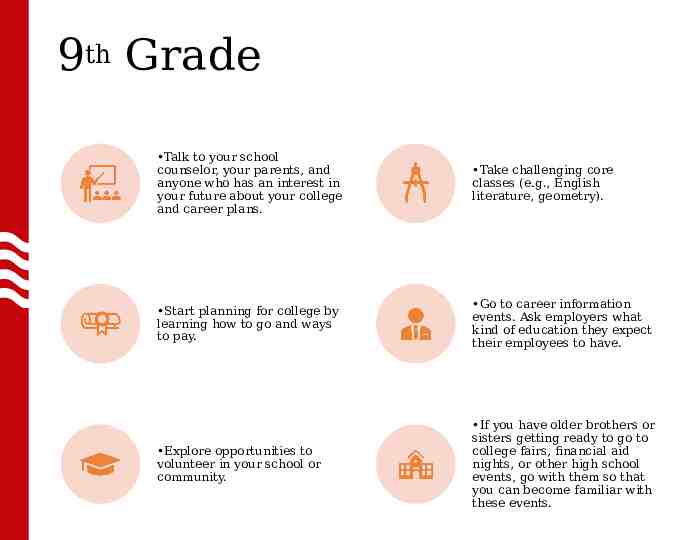

9th Grade Talk to your school counselor, your parents, and anyone who has an interest in your future about your college and career plans. Take challenging core classes (e.g., English literature, geometry). Start planning for college by learning how to go and ways to pay. Go to career information events. Ask employers what kind of education they expect their employees to have. Explore opportunities to volunteer in your school or community. If you have older brothers or sisters getting ready to go to college fairs, financial aid nights, or other high school events, go with them so that you can become familiar with these events.

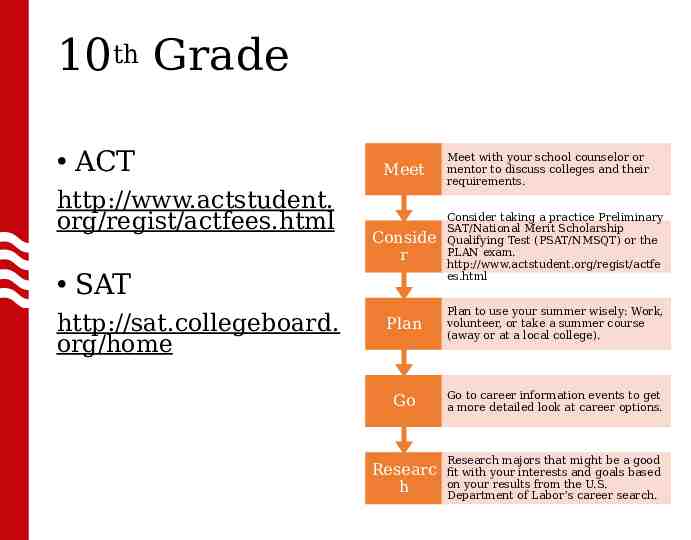

10th Grade ACT http://www.actstudent. org/regist/actfees.html Meet Conside r Consider taking a practice Preliminary SAT/National Merit Scholarship Qualifying Test (PSAT/NMSQT) or the PLAN exam. http://www.actstudent.org/regist/actfe es.html Plan Plan to use your summer wisely: Work, volunteer, or take a summer course (away or at a local college). Go Go to career information events to get a more detailed look at career options. Researc h Research majors that might be a good fit with your interests and goals based on your results from the U.S. Department of Labor’s career search. SAT http://sat.collegeboard. org/home Meet with your school counselor or mentor to discuss colleges and their requirements.

11th Grade Explore careers and their earning potential in the Occupational Outlook Handbook. Or, for a fun interactive tool, try the U.S. Department of Labor’s career search. Learn about choosing a college and find a link to our free college search tool. Fall Spring Take the Preliminary SAT/National Merit Scholarship Qualifying Test (PSAT/NMSQT). You must take the test in 11th grade to qualify for scholarships and programs associated with the National Merit Scholarship Program. Register for and take exams for college admission. The standardized tests that many colleges require are the SAT, the SAT Subject Tests, and the ACT. Check with the colleges you are interested in to see what tests they require. Go to college fairs and college-preparation presentations by college representatives. Use the U.S. Department of Labor’s scholarship search to find scholarships for which you might want to apply. Some deadlines fall as early as the summer between 11th and 12th grades, so prepare now to submit applications soon.

Summer before 12th Grade Narrow down the list of colleges you are considering attending. If you can, visit the schools that interest you, in person or online. Contact colleges to request information and applications for admission. Ask about financial aid, admission requirements, and deadlines. Decide whether you are going to apply under a particular college’s early decision or early action program. Be sure to learn about the program deadlines and requirements. Use the FAFSA4caster financial aid estimator, and compare the results to the actual costs at the colleges to which you will apply. To supplement any aid FAFSA4caster estimates you might receive, be sure to apply for scholarships. Your goal is to minimize the amount of loan funds you borrow. https://studentaid.ed.gov/sa/fafsa/estimat e

Grad Ready How well do you know your financial wellness? Information on videos, quizzes and budgeting.

Additional Information To receive financial aid, you must be enrolled in at least 6 credits per term. Students must meet satisfactory academic progress SAP rules as set by the federal government. You must maintain at least a 2.0 cumulative GPA You must maintain a successful rate of completion You may not enroll in more than 150% of the number of degree credits needed to complete an academic program. Students must notify the financial aid office if you receive any outside scholarships so that we may include them in your financial aid offer. Special Circumstances Loss of income Parent's separation/divorce medical expenses

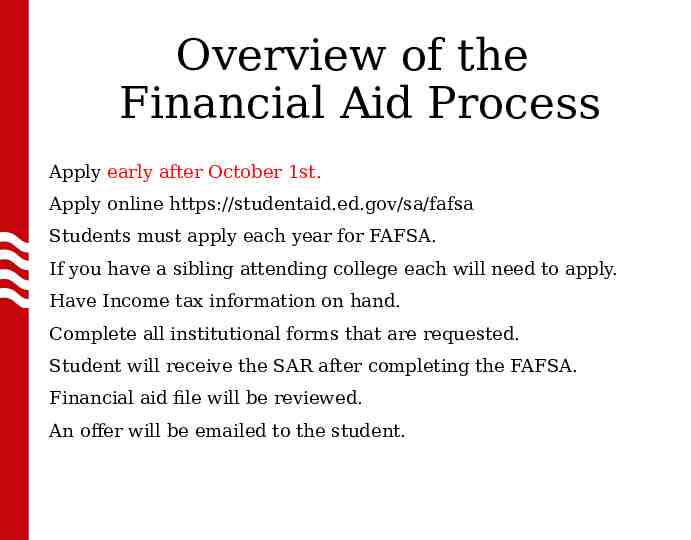

Overview of the Financial Aid Process Apply early after October 1st. Apply online https://studentaid.ed.gov/sa/fafsa Students must apply each year for FAFSA. If you have a sibling attending college each will need to apply. Have Income tax information on hand. Complete all institutional forms that are requested. Student will receive the SAR after completing the FAFSA. Financial aid file will be reviewed. An offer will be emailed to the student.

www.https://financialaid.wisc.edu/

Questions Martina S. Diaz Senior Advisor University of Wisconsin Madison Office of Student Financial Aid 333 East Campus Mall #9701 Madison WI, 53715 608-262-3060 608-262-4448 Fax 608-262-9068 [email protected] Financial Aid Office Email: [email protected] www.collegegoalwi.org

Thank You. www.financialaid.wisc.edu @UWMadFinAid @UWMad FinAid

Knowledge First person to put the correct Check response in the chat wins a Prize!

Which of the following does financial aid not of consist of? A.Insurance B.Grants C.Work Study D.Loans

True or false? I shouldn’t apply for other scholarships because the PEOPLE scholarship pays for everything. A.True B.False

Questions for Martina Diaz?

Thank you for attending! Don’t forget to click the link in the chat so that we may record your attendance and collect your feedback!