PATIENT PROTECTION & AFFORDABLE CARE ACT (PPACA) Angela Moore Indiana

30 Slides908.50 KB

PATIENT PROTECTION & AFFORDABLE CARE ACT (PPACA) Angela Moore Indiana State Library Intern June 26, 2013

Presenter Introduction Rising 2nd year law student Not a lawyer Summer legal intern at ISL Former librarian at Berne Public Library 2

Disclaimer This is legal information, not legal advice I cannot apply the law to your specific situation 3

PPACA: An Overview 900 pages of legislation Focus today on employer requirements 4 Shared Responsibility for Employers Automatic Enrollment Requirement SHOP Exchange Reporting Requirements Notice Requirement Some issues are still awaiting regulation

Shared Responsibility for Employers PPACA § 1513; effective after Dec. 31, 2013 You’ve heard about employer penalties, right? Technically, there is no “penalty” for not providing insurance 5 PPACA falls under Congress’s taxing power But you may have to make a “shared responsibility payment” No employer is “required” to provide insurance You can still choose to not provide insurance, PPACA just shifts the cost-benefit analysis

Shared Responsibility for Employers An Employer’s Choice 1. 2. Provide adequate, affordable insurance, or Risk being liable for making payments It’s not a penalty, but it’s still taking your money You are not breaking the law if you choose to not provide insurance 6

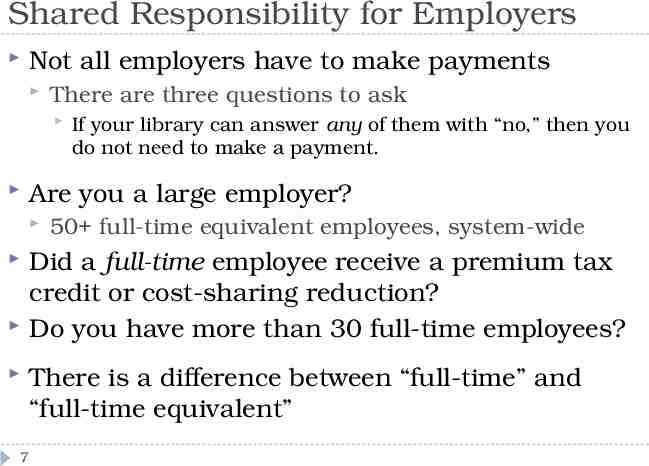

Shared Responsibility for Employers Not all employers have to make payments There are three questions to ask Are you a large employer? 7 If your library can answer any of them with “no,” then you do not need to make a payment. 50 full-time equivalent employees, system-wide Did a full-time employee receive a premium tax credit or cost-sharing reduction? Do you have more than 30 full-time employees? There is a difference between “full-time” and “full-time equivalent”

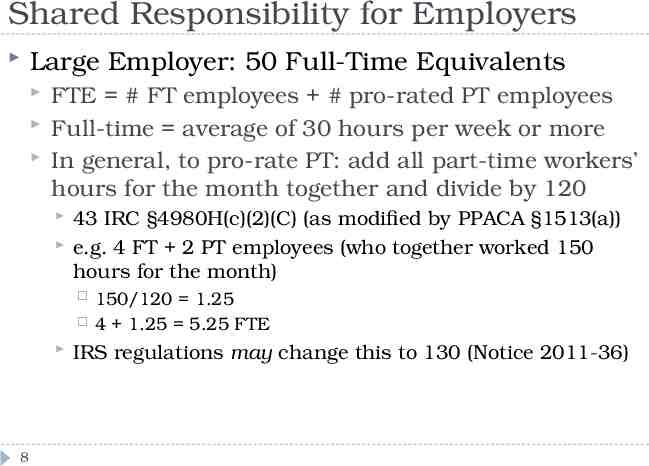

Shared Responsibility for Employers Large Employer: 50 Full-Time Equivalents FTE # FT employees # pro-rated PT employees Full-time average of 30 hours per week or more In general, to pro-rate PT: add all part-time workers’ hours for the month together and divide by 120 43 IRC §4980H(c)(2)(C) (as modified by PPACA §1513(a)) e.g. 4 FT 2 PT employees (who together worked 150 hours for the month) 8 150/120 1.25 4 1.25 5.25 FTE IRS regulations may change this to 130 (Notice 2011-36)

Shared Responsibility for Employers Large Employer: 50 Full-Time Equivalents The calculations can become more complex and very specific. If you’re on the bubble, you may want to consult a lawyer. 9

Shared Responsibility for Employers Two things before we move on: 1. Remember, if you are under 50 full-time equivalent employees, you will not be liable for any payments. 2. From this point on, forget about full-time equivalents. We are only looking at full-time employees now. 10

Shared Responsibility for Employers Our three questions: Are you a large employer? Did a full-time employee receive a premium tax credit or cost-sharing reduction? Do you have more than 30 full-time employees? 11

Shared Responsibility for Employers Premium Tax Credit/Cost-sharing Reduction FT employee has to apply for and receive a PTC or CSR for employer payments to be triggered It is ok to just offer insurance to full-time employees If the employer does not offer insurance Generally eligible if household income is between 100% and 400% of the federal poverty level 12 Dept. of Health and Human Services releases annually Federal poverty level poverty guidelines Dependent on household size 2013 levels: http://aspe.hhs.gov/poverty/13poverty.cfm

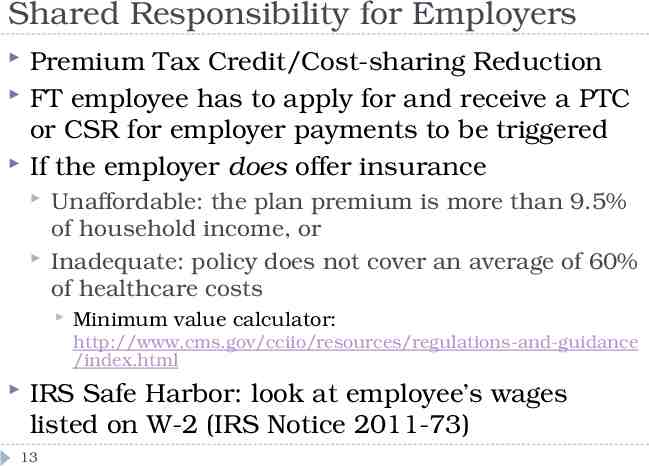

Shared Responsibility for Employers Premium Tax Credit/Cost-sharing Reduction FT employee has to apply for and receive a PTC or CSR for employer payments to be triggered If the employer does offer insurance Unaffordable: the plan premium is more than 9.5% of household income, or Inadequate: policy does not cover an average of 60% of healthcare costs Minimum value calculator: http://www.cms.gov/cciio/resources/regulations-and-guidance /index.html IRS Safe Harbor: look at employee’s wages listed on W-2 (IRS Notice 2011-73) 13

Shared Responsibility for Employers Our three questions: Are you a large employer? Did a full-time employee receive a premium tax credit or cost-sharing reduction? Do you have more than 30 full-time employees? 14

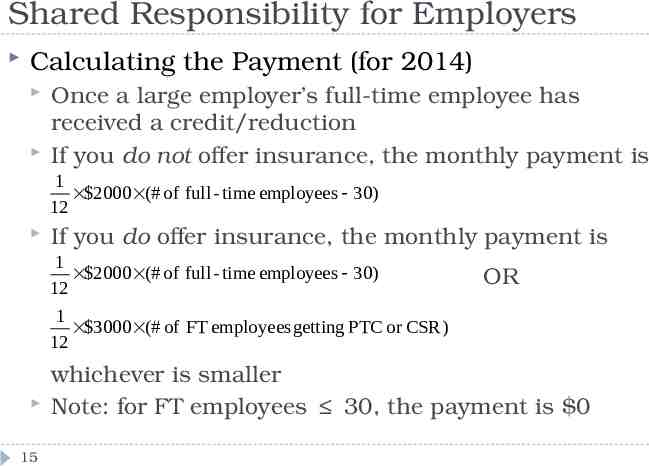

Shared Responsibility for Employers Calculating the Payment (for 2014) Once a large employer’s full-time employee has received a credit/reduction If you do not offer insurance, the monthly payment is 1 2000 (# of full - time employees 30) 12 If you do offer insurance, the monthly payment is 1 2000 (# of full - time employees 30) 12 1 3000 (# of FT employees getting PTC or CSR ) 12 15 OR whichever is smaller Note: for FT employees 30, the payment is 0

Shared Responsibility for Employers Recap: Payments do not apply to small employers 16 Large, but with 30 or fewer FT employees: payment 0 A full-time employee needs to actually receive a credit or reduction to trigger a payment

Shared Responsibility for Employers Determining Full-Time with IRS Safe Harbors On-going employees: 17 Measurement period: 3-12 months Administrative period: up to 90 days Stability period: 6-12 months (no shorter than measurement period) You can rely on this method, at least through cycles beginning before the end of 2014 IRS Notice 2012-58:

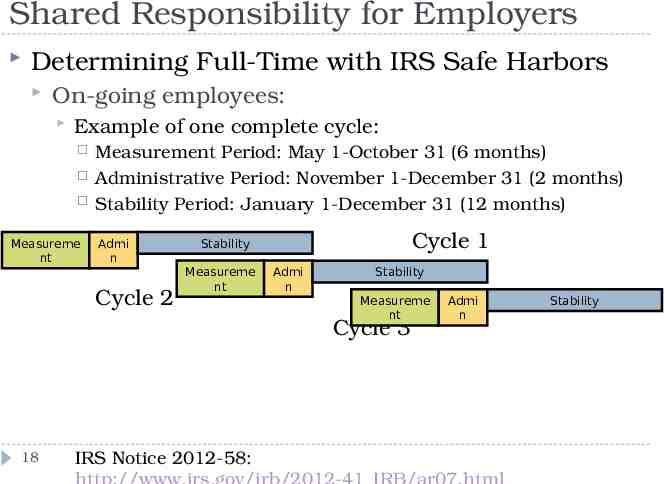

Shared Responsibility for Employers Determining Full-Time with IRS Safe Harbors On-going employees: Example of one complete cycle: Measureme nt Measurement Period: May 1-October 31 (6 months) Administrative Period: November 1-December 31 (2 months) Stability Period: January 1-December 31 (12 months) Admi n Cycle 2 Cycle 1 Stability Measureme nt Admi n Stability Measureme nt Cycle 3 18 IRS Notice 2012-58: Admi n Stability

Shared Responsibility for Employers Determining Full-Time with IRS Safe Harbors New Employees: reasonably expected to work fulltime 19 Offer at, or before, conclusion of initial 3 calendar months IRS Notice 2012-58: http://www.irs.gov/irb/2012-41 IRB/ar07.html

Shared Responsibility for Employers Determining Full-Time with IRS Safe Harbors New Variable Hour and Seasonal Employees 20 A little more complicated Initial measurement period: 3-12 months, no shorter than one month less than initial stability period Initial administrative period: up to 90 days Initial stability period: same length as for ongoing employees, no more than 1 month longer than IMP IMP IAP cannot extend beyond end of calendar month beginning on or after employee’s one-year work anniversary Once they have worked an entire standard MP, determine full-time status along with other on-going employees IRS Notice 2012-58: http://www.irs.gov/irb/2012-41 IRB/ar07.html

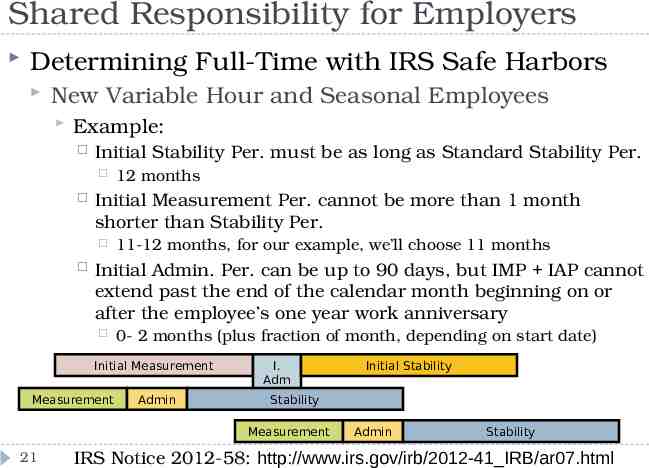

Shared Responsibility for Employers Determining Full-Time with IRS Safe Harbors New Variable Hour and Seasonal Employees Example: Initial Stability Per. must be as long as Standard Stability Per. Initial Measurement Per. cannot be more than 1 month shorter than Stability Per. 12 months 11-12 months, for our example, we’ll choose 11 months Initial Admin. Per. can be up to 90 days, but IMP IAP cannot extend past the end of the calendar month beginning on or after the employee’s one year work anniversary 0- 2 months (plus fraction of month, depending on start date) Initial Measurement Measurement Admin I. Adm Stability Measurement 21 Initial Stability Admin Stability IRS Notice 2012-58: http://www.irs.gov/irb/2012-41 IRB/ar07.html

Shared Responsibility for Employers Being Assessed, Making a Payment The IRS will contact you if you are potentially liable If you are found liable for payment, IRS will send a notice and demand for payment 22 Will not happen until after employees’ tax returns are due You will have opportunity to respond Notice will include instructions

Shared Responsibility for Employers You have a choice (are not breaking the law) You may be exempt from payments Only full-time (30 or more hours/week) employees trigger payments Full-time can be calculated with cycles The IRS will contact you about payments if you need to make them 23

Automatic Enrollment Requirement PPACA § 1511 For employers with 200 or more full-time employees If employer offers insurance coverage, new fulltime employees must automatically be enrolled in the coverage Employees may opt out of coverage Still awaiting regulations from Dept. of Labor, intended completion before 2014 24

SHOP Exchange Small business Health Options Program Beginning in 2014, eligible small businesses will be able to purchase insurance through the SHOP No obligation to purchase through exchange Side-by-side policy comparisons Premiums cannot be set by employees’ health or medical history Businesses with up to 100 employees are eligible, although until 2016 states may further limit eligibility to only businesses with up to 50 employees. Look for more information in October 2013 Coverage begins January 2014 25 http://www.healthcare.gov/news/factsheets/2011/07/

Reporting Requirements PPACA § 9002: W-2s Cost of employer-sponsored insurance Still awaiting IRS guidance, meanwhile, see http://www.irs.gov/uac/Form-W-2-Reporting-ofEmployer-Sponsored-Health-Coverage PPACA § 1514: large or insuring employers First reports will be due in 2015 (for 2014 info) To IRS To Employees 26 Basic information regarding whether insurance was provided. Full-time employees whose info was reported to the gov’t Still waiting for IRS regulations, reporting might be coordinated with other required reports

Notice Requirement: PPACA § 1512 Applies to all employers (regardless of size) To be given at time of hiring (plus initial distribution to current employees) Model language if you offer insurance: Model language if you do not offer insurance: http://www.dol.gov/ebsa/pdf/FLSAwithplans.pdf http://www.dol.gov/ebsa/pdf/FLSAwithoutplans.pdf Originally effective March 31, 2013, delayed until October 1, 2013 27 DOL Technical Release No. 2013-02: http://www.dol.gov/ebsa/newsroom/tr13-02.html

PPACA In Review Shared Responsibility for Employers Automatic Enrollment Small Employers Reporting Requirements Very Large Employers SHOP Exchange Large Employers Large or Insuring Employers Notice Requirement 28 All Employers

Resources Dept. of Labor – Employee Benefits Security Administration Dept. of Health and Human Services www.healthcare.gov Includes full text of the PPACA IRS www.dol.gov/ebsa/healthreform www.irs.gov/aca UCLA Law School Library 29 libguides.law.ucla.edu/ppaca

Questions For questions about this presentation, contact: Angela Moore: [email protected] At ISL until July 31st, 2013 For questions about how PPACA specifically affects your library, contact your library’s attorney. 30