EDI HOLDINGS ANNUAL REPORT (2006/7) PRESENTATION TO THE PARLIAMENTARY

42 Slides2.42 MB

EDI HOLDINGS ANNUAL REPORT (2006/7) PRESENTATION TO THE PARLIAMENTARY PORTFOLIO COMMITTEE ON MINERALS AND ENERGYCAPE TOWN PHINDILE NZIMANDE CEO: EDI Holdings

Table of Contents Corporate Governance Performance Against Business Strategy Lessons from RED ONE Transformation Equity Performance Annual Financial Statements Plans for the Future Acknowledgements 31 October 2007 Slide 2

CORPORATE GOVERNANCE 31 October 2007 Slide 3

CEO’s Report: Introduction The Annual Report is presented in compliance with the Public Finance Management Act (Act No. 1 of 1999): Fairly presents the state of affairs of the company, Its business, Its performance against predetermined objectives, and Its financial position at the end of the year in terms of Generally Accepted Accounting Practice (GAAP) The annual financial statements are the responsibility of the Accounting Authority, i.e. the Board of Directors of EDI Holdings The office of the Auditor-General has audited EDI Holdings’ financial statements and issued an unqualified audit report 31 October 2007 Slide 4

CEO’s Report: Mandate of EDI Holdings Our mandate is premised on the White Paper on Energy for South Africa (1998), the Blue Print on EDI Reform (2001) and subsequent Cabinet decisions . The mandate of EDI Holdings is to restructure the electricity distribution industry and invest in financially viable independent REDs in South Africa in accordance with national Govt policy in order to ensure a more effective and efficient electricity distribution industry capable of providing affordable and accessible electricity to consumers. [Memorandum & Articles of Association of EDI Holdings (Pty) Ltd, 2003] 31 October 2007 Slide 5

CEO’s Report: Corporate Governance ( 1) The Board of Directors is established as the Accounting Authority Annual Financial Statements presented in terms of Generally Accepted Accounting Practice (GAAP) EDI Holdings Board direct and guide the business in compliance with applicable legislation and has instituted the necessary policies and monitoring procedures to give effect thereto, through the following Board Committees: Audit and Risk Management Committee Human Capital and Remuneration Committee Finance and Procurement Committee Programme Management Board Committee Communication and Advocacy Committee Ad Hoc Committee on Policy and Strategy 31 October 2007 Slide 6

CEO’s Report: Corporate Governance ( 2) EDI Holdings maintains world class systems of corporate governance by: subscribing to the principles of good governance; adhering to and encouraging good governance practices and the highest ethical behaviour; continuing to comply with the broad principles set out in the King II Report; and assessing its systems of governance for improvement on an ongoing basis. EDI Holdings endeavours to observe all principles of sound corporate governance in all dealings with its stakeholders Regular compliance submissions are made to relevant authorities EDI Holdings complied with corporate governance, shareholder, statutory and treasury requirements in all its dealings 31 October 2007 Slide 7

RESTRUCTURING POLICY ENVIRONMENT 31 October 2007 Slide 8

CEO’s Report: Policy Environment DECISION ON INDUSTRY STRUCTURE Having considered technical submissions on: The financial viability of the different RED models; The institutional and governance arrangements for the REDs; and How the various models respond to the restructuring policy objectives. The Cabinet (on 25 October 2006) approved the following: That 6 wall to wall REDs be implemented; That the REDs be established as public entities and be regulated according to the PFMA and the Electricity Regulation Act; That Eskom becomes a shareholder in the respective REDs for a transitional period and that they reduce their shareholding over time; That DME, through EDI Holdings, will oversee and control the establishment of the REDs; That a roadmap will be put in place to move from the current scenario into the future industry structure That a strategy needs to be developed to deal with capital investment requirements for the REDs That EDI Restructuring legislation will be introduced; and That a National electricity pricing system will be developed. 31 October 2007 Slide 9

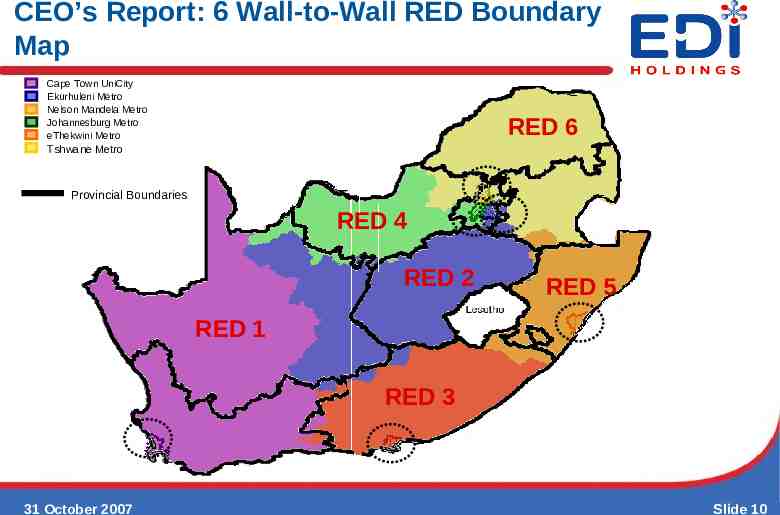

CEO’s Report: 6 Wall-to-Wall RED Boundary Map Cape Town UniCity Ekurhuleni Metro Nelson Mandela Metro Johannesburg Metro eThekwini Metro RED 6 Tshwane Metro Provincial Boundaries RED 4 RED 2 RED 5 RED 1 RED 3 31 October 2007 Slide 10

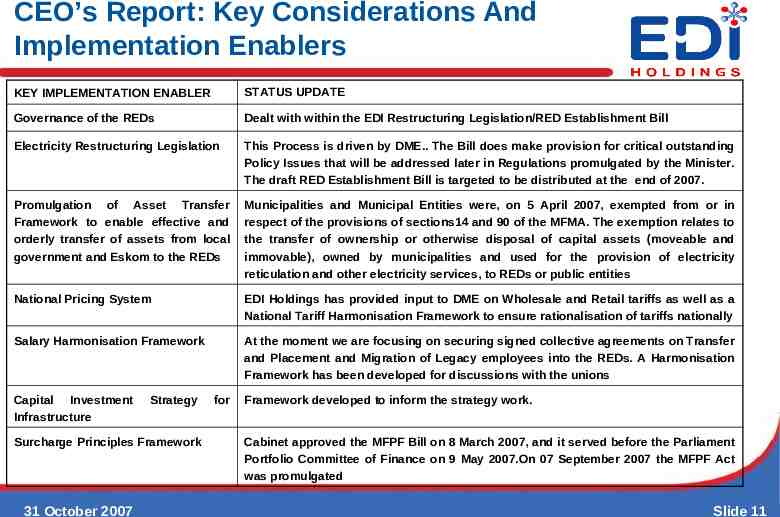

CEO’s Report: Key Considerations And Implementation Enablers KEY IMPLEMENTATION ENABLER STATUS UPDATE Governance of the REDs Dealt with within the EDI Restructuring Legislation/RED Establishment Bill Electricity Restructuring Legislation This Process is driven by DME. The Bill does make provision for critical outstanding Policy Issues that will be addressed later in Regulations promulgated by the Minister. The draft RED Establishment Bill is targeted to be distributed at the end of 2007. Promulgation of Asset Transfer Framework to enable effective and orderly transfer of assets from local government and Eskom to the REDs Municipalities and Municipal Entities were, on 5 April 2007, exempted from or in respect of the provisions of sections14 and 90 of the MFMA. The exemption relates to the transfer of ownership or otherwise disposal of capital assets (moveable and immovable), owned by municipalities and used for the provision of electricity reticulation and other electricity services, to REDs or public entities National Pricing System EDI Holdings has provided input to DME on Wholesale and Retail tariffs as well as a National Tariff Harmonisation Framework to ensure rationalisation of tariffs nationally Salary Harmonisation Framework At the moment we are focusing on securing signed collective agreements on Transfer and Placement and Migration of Legacy employees into the REDs. A Harmonisation Framework has been developed for discussions with the unions Capital Investment Infrastructure Strategy Surcharge Principles Framework 31 October 2007 for Framework developed to inform the strategy work. Cabinet approved the MFPF Bill on 8 March 2007, and it served before the Parliament Portfolio Committee of Finance on 9 May 2007.On 07 September 2007 the MFPF Act was promulgated Slide 11

PERFORMANCE AGAINST BUSINESS STRATEGY 31 October 2007 Slide 12

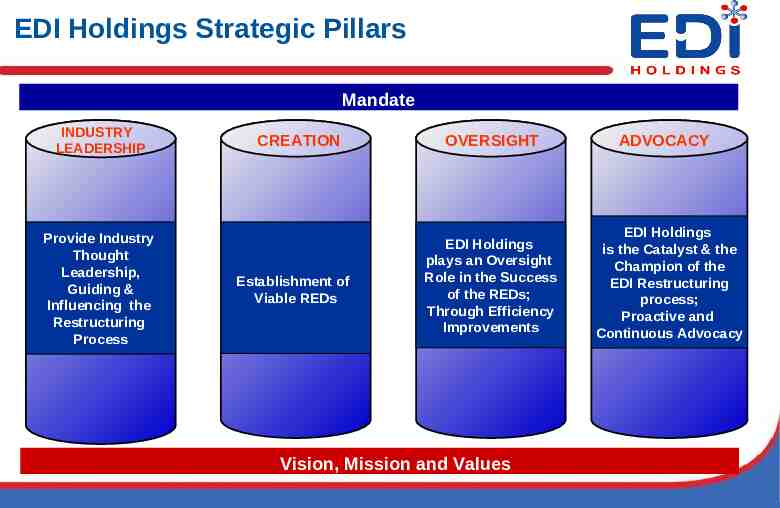

EDI Holdings Strategic Pillars Mandate INDUSTRY LEADERSHIP Provide Industry Thought Leadership, Guiding & Influencing the Restructuring Process CREATION Establishment of Viable REDs OVERSIGHT EDI Holdings plays an Oversight Role in the Success of the REDs; Through Efficiency Improvements Vision, Mission and Values ADVOCACY EDI Holdings is the Catalyst & the Champion of the EDI Restructuring process; Proactive and Continuous Advocacy

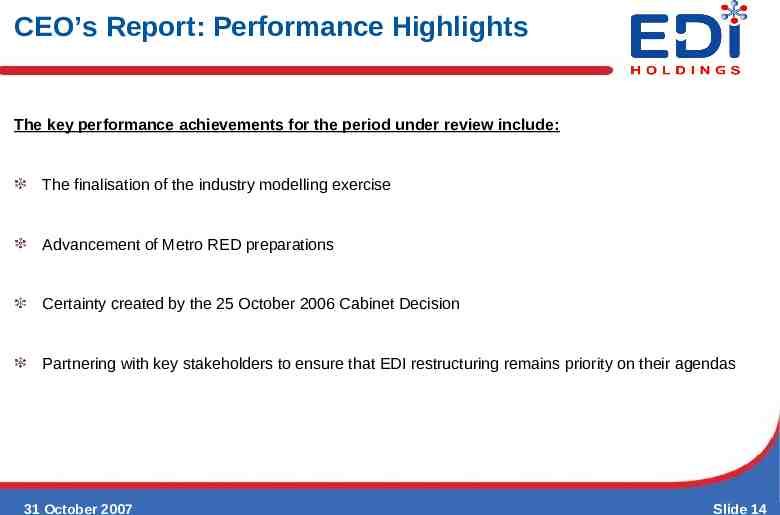

CEO’s Report: Performance Highlights The key performance achievements for the period under review include: The finalisation of the industry modelling exercise Advancement of Metro RED preparations Certainty created by the 25 October 2006 Cabinet Decision Partnering with key stakeholders to ensure that EDI restructuring remains priority on their agendas 31 October 2007 Slide 14

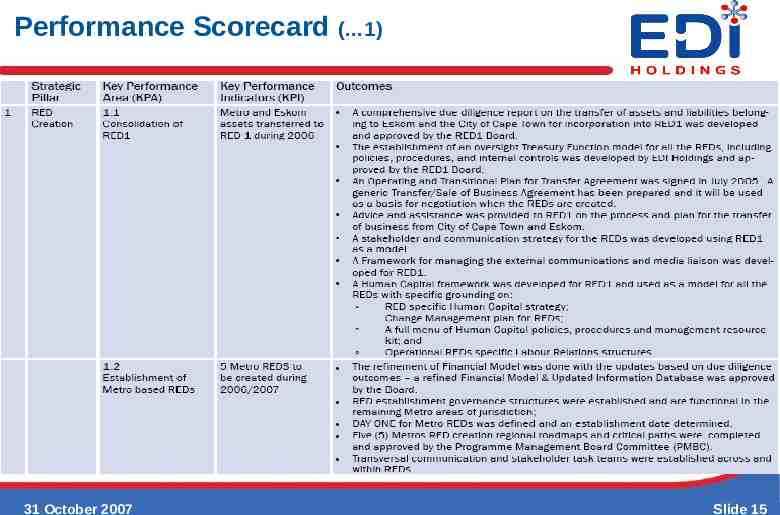

Performance Scorecard ( 1) 31 October 2007 Slide 15

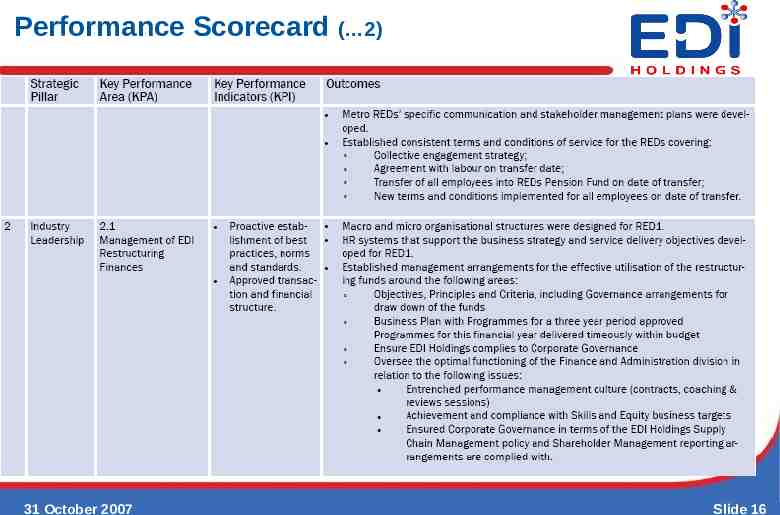

Performance Scorecard ( 2) 31 October 2007 Slide 16

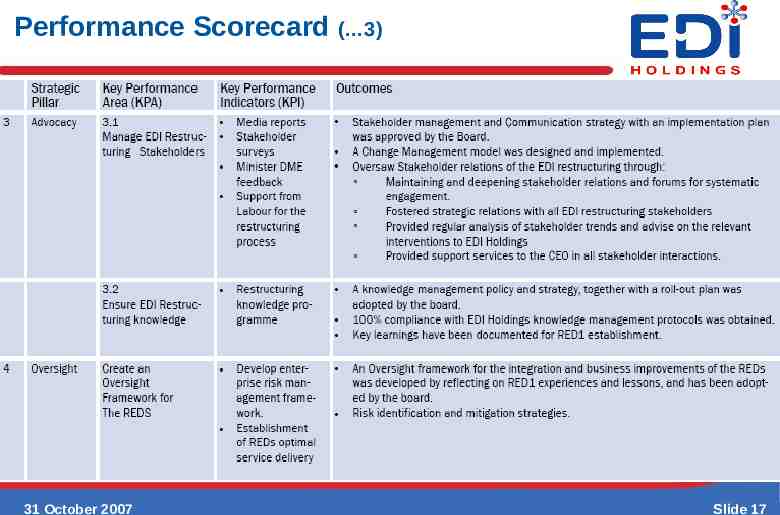

Performance Scorecard ( 3) 31 October 2007 Slide 17

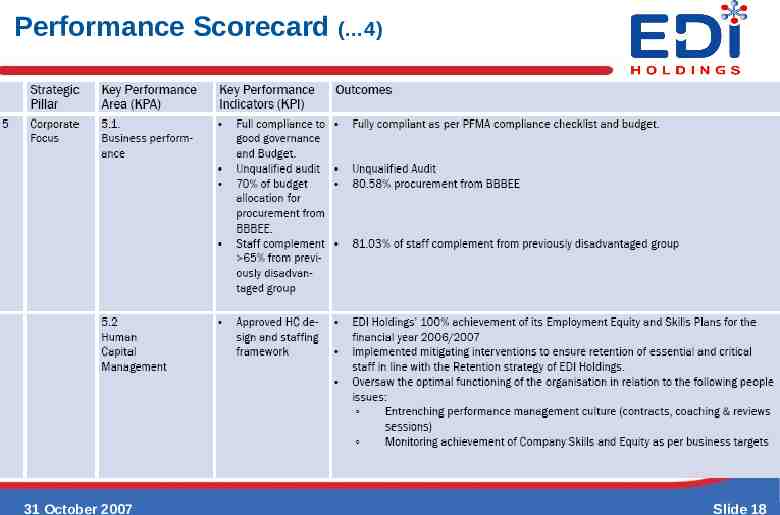

Performance Scorecard ( 4) 31 October 2007 Slide 18

CEO’s Report: Performance Against Business Strategy ( CONT’D) The 25 October 2006 Cabinet decision brought about a change in focus from creating 6 municipal entity Metro REDs to 6 wall to wall public entity REDs To implement this decision: Developed a comprehensive communication and stakeholder engagement strategy Started the process of developing an implementation strategy and roadmap Realigned the regional project governance structures to ensure broader participation by municipalities Developed a new Day One Definition premised on critical mass and representative footprint We recognize that buy-in from current asset owners and key stakeholders is critical in ensuring that the restructuring process is a success. To this effect, we believe that a deal that will underpin EDI restructuring will have to be designed and negotiated amongst stakeholders. 31 October 2007 Slide 19

LESSONS FROM RED ONE 31 October 2007 Slide 20

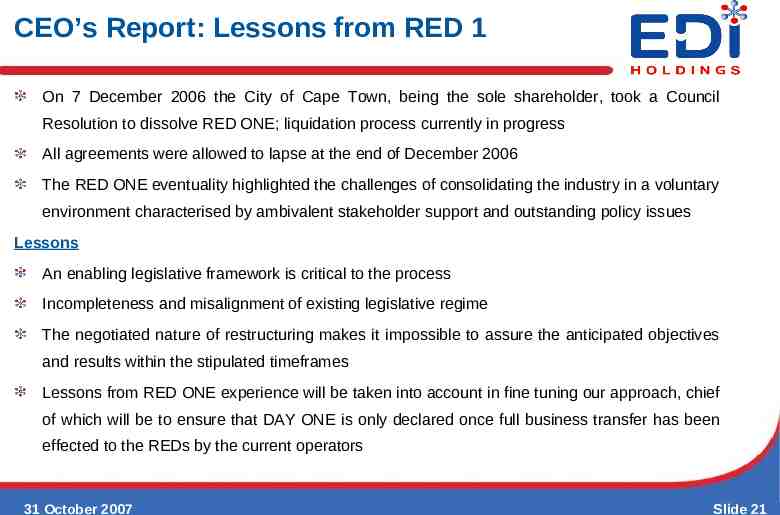

CEO’s Report: Lessons from RED 1 On 7 December 2006 the City of Cape Town, being the sole shareholder, took a Council Resolution to dissolve RED ONE; liquidation process currently in progress All agreements were allowed to lapse at the end of December 2006 The RED ONE eventuality highlighted the challenges of consolidating the industry in a voluntary environment characterised by ambivalent stakeholder support and outstanding policy issues Lessons An enabling legislative framework is critical to the process Incompleteness and misalignment of existing legislative regime The negotiated nature of restructuring makes it impossible to assure the anticipated objectives and results within the stipulated timeframes Lessons from RED ONE experience will be taken into account in fine tuning our approach, chief of which will be to ensure that DAY ONE is only declared once full business transfer has been effected to the REDs by the current operators 31 October 2007 Slide 21

TRANSFORMATION EQUITY PERFORMANCE 31 October 2007 Slide 22

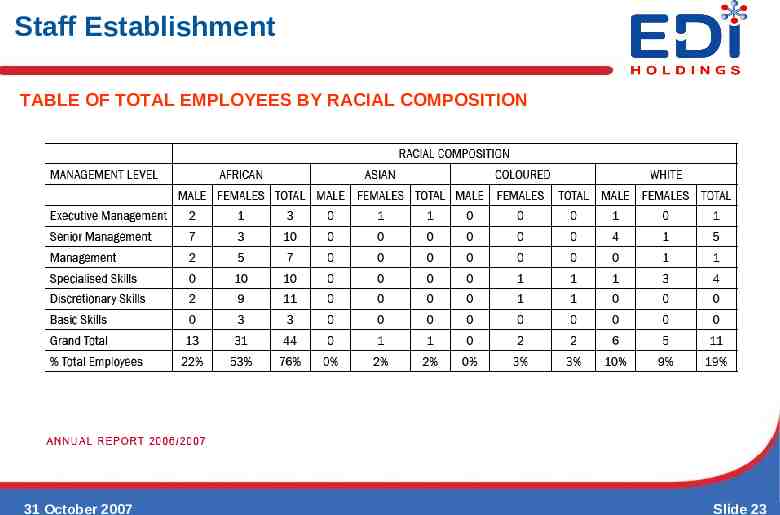

Staff Establishment TABLE OF TOTAL EMPLOYEES BY RACIAL COMPOSITION 31 October 2007 Slide 23

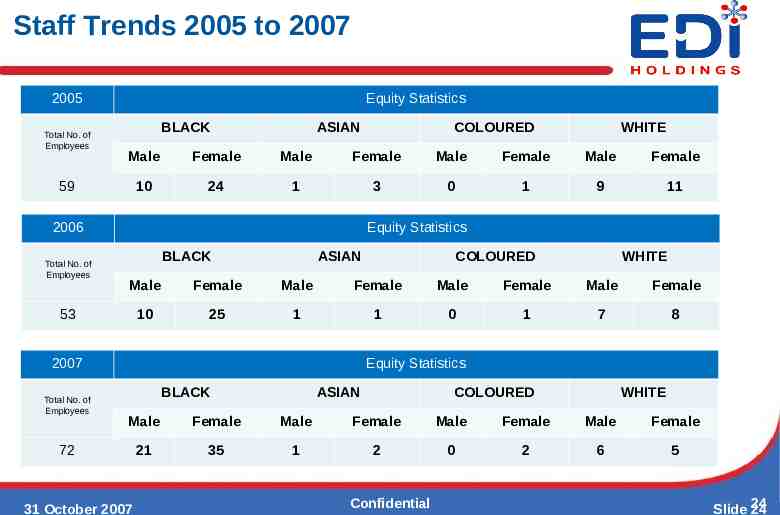

Staff Trends 2005 to 2007 2005 Total No. of Employees Equity Statistics BLACK ASIAN Female Male Female Male Female Male Female 10 24 1 3 0 1 9 11 2006 Equity Statistics BLACK ASIAN COLOURED WHITE Male Female Male Female Male Female Male Female 10 25 1 1 0 1 7 8 53 2007 Total No. of Employees WHITE Male 59 Total No. of Employees COLOURED Equity Statistics BLACK ASIAN COLOURED WHITE Male Female Male Female Male Female Male Female 21 35 1 2 0 2 6 5 72 31 October 2007 Confidential Slide 24 24

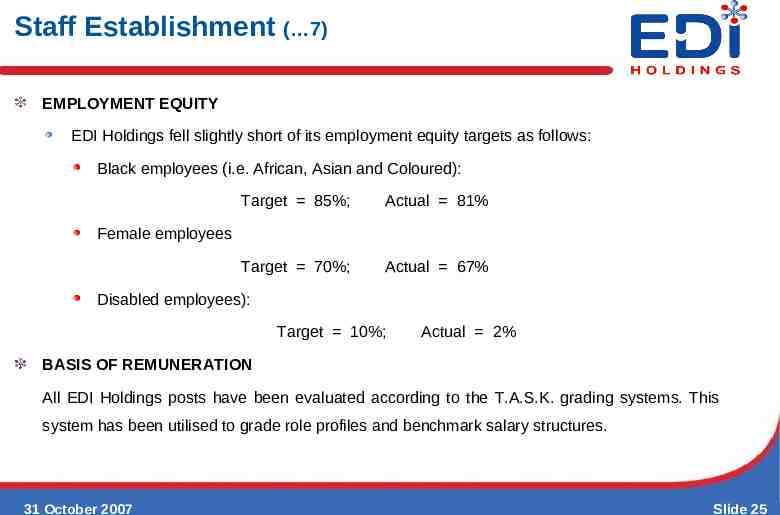

Staff Establishment ( 7) EMPLOYMENT EQUITY EDI Holdings fell slightly short of its employment equity targets as follows: Black employees (i.e. African, Asian and Coloured): Target 85%; Actual 81% Target 70%; Actual 67% Female employees Disabled employees): Target 10%; Actual 2% BASIS OF REMUNERATION All EDI Holdings posts have been evaluated according to the T.A.S.K. grading systems. This system has been utilised to grade role profiles and benchmark salary structures. 31 October 2007 Slide 25

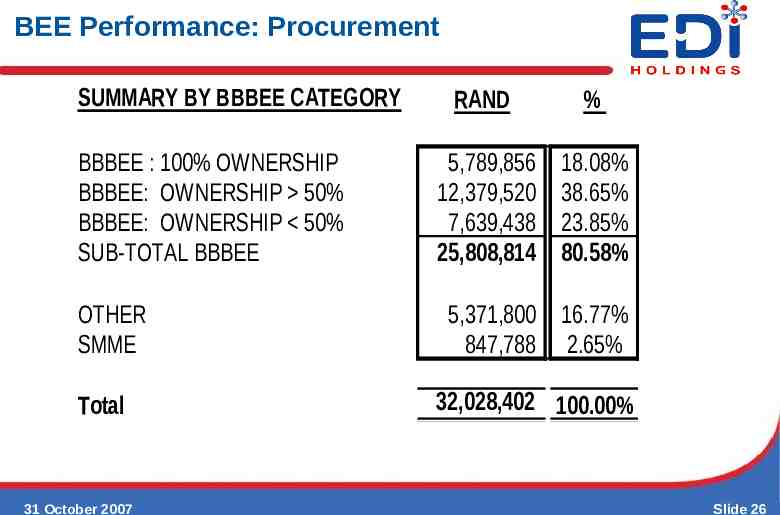

BEE Performance: Procurement SUMMARY BY BBBEE CATEGORY BBBEE : 100% OWNERSHIP BBBEE: OWNERSHIP 50% BBBEE: OWNERSHIP 50% SUB-TOTAL BBBEE OTHER SMME Total 31 October 2007 RAND % 5,789,856 12,379,520 7,639,438 25,808,814 18.08% 38.65% 23.85% 80.58% 5,371,800 16.77% 847,788 2.65% 32,028,402 100.00% Slide 26

Corporate Social Investment In celebration of the Heritage Month Celebrations, EDI Holdings spent a day with the less privileged children of the Leamogetswe Children’s Home in Tshwane Leamogetswe is home to more than 150 children in Atteridgeville. The programme for the day included: Entertainment (Drums and Rhythm, DJ and Dancers) Donation of Caps and T-Shirts Toys 2 Sets of Dinette (Tables and chairs) Mattresses (x10) Two birthday cakes and gifts, (two of the kids were celebrating their birthdays) This event, in a limited and unique way, symbolised our commitment to the struggle against poverty eradication 31 October 2007 Slide 27

ANNUAL FINANCIAL STATEMENTS (ABRIDGED) FOR THE YEAR ENDED 31 MARCH 2007 31 October 2007 Slide 28

ANNUAL FINANCIAL STATEMENTS (abridged) STATEMENT OF FINANCIAL POSITION AT 31 MARCH 2007 We present unqualified audited financial statements, which have been found by the office of the Auditor General, to present fairly, in all material respects, the financial position of the company as at 31 March 2007 and its financial performance and cash flows for the year then ended, in accordance with and in the manner required by the PFMA and the Companies Act of South Africa. EDI Holdings continues to strive for excellence in financial management. The company’s total operational budget allocation of R67.8m was fully expended for the financial year under review, underpinned by effective internal control systems and procedures. The governance processes associated with the draw down and allocation of the R1.2bn Multi Year Pricing Determination (MYPD) restructuring fund has been completed and we received R78.5m from Eskom in the year under review. 31 October 2007 Slide 29

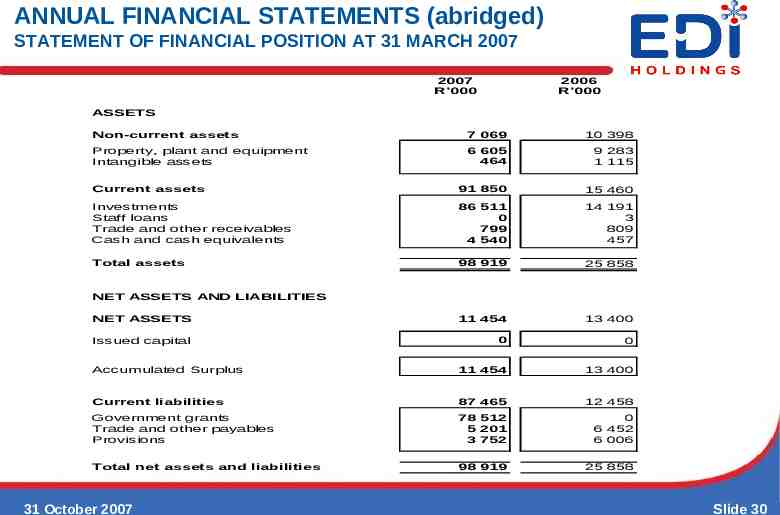

ANNUAL FINANCIAL STATEMENTS (abridged) STATEMENT OF FINANCIAL POSITION AT 31 MARCH 2007 2007 R'000 2006 R'000 ASSETS Non-current assets 7 069 10 398 Property, plant and equipment Intangible assets 6 605 464 9 283 1 115 Current assets 91 850 15 460 Investments Staff loans Trade and other receivables Cash and cash equivalents 86 511 0 799 4 540 14 191 3 809 457 Total assets 98 919 25 858 NET ASSETS 11 454 13 400 Issued capital 0 0 Accumulated Surplus 11 454 13 400 Current liabilities 87 465 12 458 Government grants Trade and other payables Provisions 78 512 5 201 3 752 0 6 452 6 006 Total net assets and liabilities 98 919 25 858 NET ASSETS AND LIABILITIES 31 October 2007 Slide 30

ANNUAL FINANCIAL STATEMENTS (abridged) STATEMENT OF FINANCIAL POSITION AT 31 MARCH 2007 Non-Current Assets No major assets acquired during financial year 32% reduction in non-current assets due to depreciation Current Assets Increase of R72m in Investments largely due MYPD funding for restructuring received from Eskom and invested with Corporation for Public Deposits (CPD) Current Liabilities Government grant in respect of Eskom MYPD EDI Restructuring Funding of R78.5m received from Eskom 31 October 2007 Slide 31

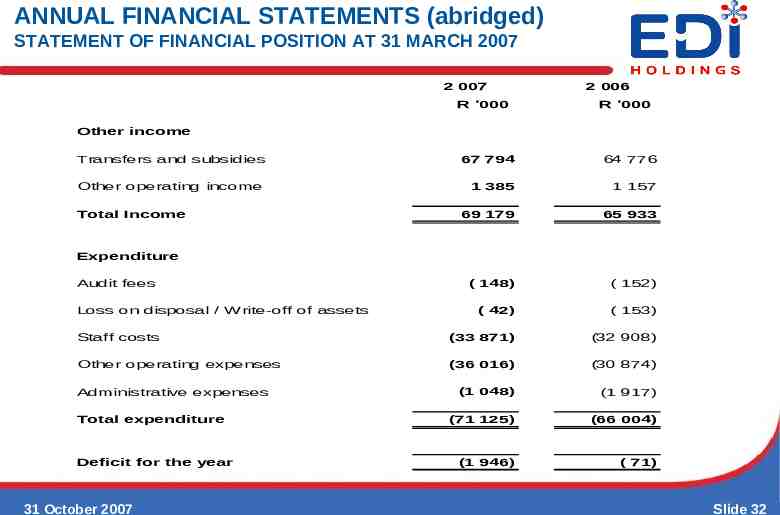

ANNUAL FINANCIAL STATEMENTS (abridged) STATEMENT OF FINANCIAL POSITION AT 31 MARCH 2007 2 007 R '000 2 006 R '000 Other income Transfers and subsidies 67 794 64 776 Other operating income 1 385 1 157 69 179 65 933 ( 148) ( 152) ( 42) ( 153) Staff costs (33 871) (32 908) Other operating expenses (36 016) (30 874) (1 048) (1 917) (71 125) (66 004) (1 946) ( 71) Total Income Expenditure Audit fees Loss on disposal / Write-off of assets Administrative expenses Total expenditure Deficit for the year 31 October 2007 Slide 32

ANNUAL FINANCIAL STATEMENTS (abridged) STATEMENT OF FINANCIAL POSITION AT 31 MARCH 2007 Change in Accounting Policy During 2006/07 financial year, the company changed its accounting policy in respect of the treatment of government grants from DME. Grants were treated as deferred income in previous financial years and matched with related costs. The company has now adopted the accrual basis in terms of IPSAS 23.44 and grants are now accounted for on an accrual basis as transfers and subsidies Transfers and Subsidies from DME 5% increase in transfers and subsidies due to annual baseline budget increase from DME Expenditure 7.8% increase in expenditure mainly due to other operating expenses i.r.o. consultants costs and travel expenses as a result of acceleration of restructuring programme activities 31 October 2007 Slide 33

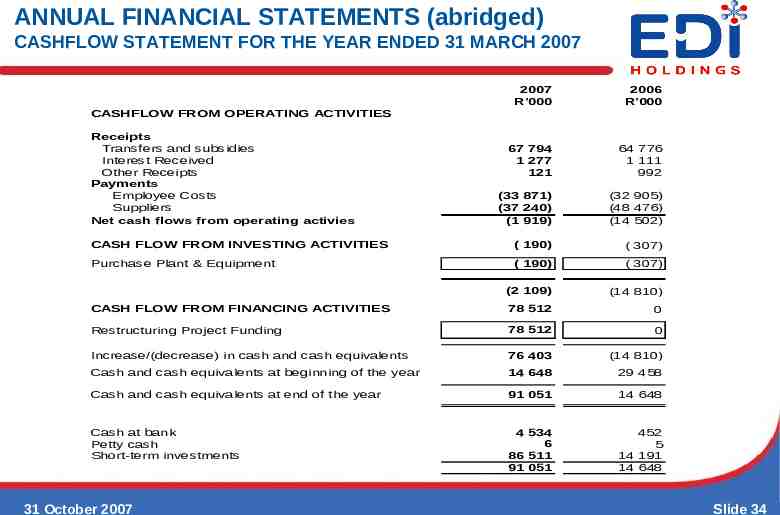

ANNUAL FINANCIAL STATEMENTS (abridged) CASHFLOW STATEMENT FOR THE YEAR ENDED 31 MARCH 2007 2007 R'000 2006 R'000 67 794 1 277 121 64 776 1 111 992 (33 871) (37 240) (1 919) (32 905) (48 476) (14 502) CASH FLOW FROM INVESTING ACTIVITIES ( 190) ( 307) Purchase Plant & Equipment ( 190) ( 307) (2 109) (14 810) CASH FLOW FROM FINANCING ACTIVITIES 78 512 0 Restructuring Project Funding 78 512 0 Increase/(decrease) in cash and cash equivalents 76 403 (14 810) Cash and cash equivalents at beginning of the year 14 648 29 458 Cash and cash equivalents at end of the year 91 051 14 648 Cash at bank Petty cash Short-term investments 4 534 6 86 511 91 051 452 5 14 191 14 648 CASHFLOW FROM OPERATING ACTIVITIES Receipts Transfers and subsidies Interest Received Other Receipts Payments Employee Costs Suppliers Other payments Net cash flows from operating activies 31 October 2007 Slide 34

PLANS FOR THE FUTURE 31 October 2007 Slide 35

CEO’s Report: Plans for the Future Never before has the environment for the establishment of the REDs looked so substantially promising The constraints that were protracting the process are well on their way to being resolved All Regional Engagement Forums, Steering Committees and Sponsors Committees have been set up across the country. These structures will be leveraged to enhance municipal and Eskom readiness As at 30 September 2007, 80 municipalities had signed accession agreements compared to 15 in May 2007. 31 October 2007 Slide 36

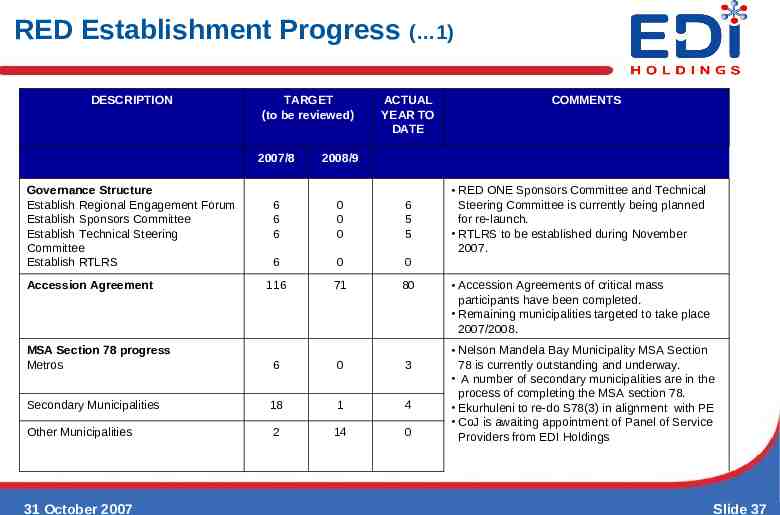

RED Establishment Progress ( 1) DESCRIPTION TARGET (to be reviewed) 2007/8 Governance Structure Establish Regional Engagement Forum Establish Sponsors Committee Establish Technical Steering Committee Establish RTLRS Accession Agreement ACTUAL YEAR TO DATE 2008/9 6 6 6 0 0 0 6 5 5 6 0 0 116 71 80 MSA Section 78 progress Metros 6 0 3 Secondary Municipalities 18 1 4 Other Municipalities 2 14 0 31 October 2007 COMMENTS RED ONE Sponsors Committee and Technical Steering Committee is currently being planned for re-launch. RTLRS to be established during November 2007. Accession Agreements of critical mass participants have been completed. Remaining municipalities targeted to take place 2007/2008. Nelson Mandela Bay Municipality MSA Section 78 is currently outstanding and underway. A number of secondary municipalities are in the process of completing the MSA section 78. Ekurhuleni to re-do S78(3) in alignment with PE CoJ is awaiting appointment of Panel of Service Providers from EDI Holdings Slide 37

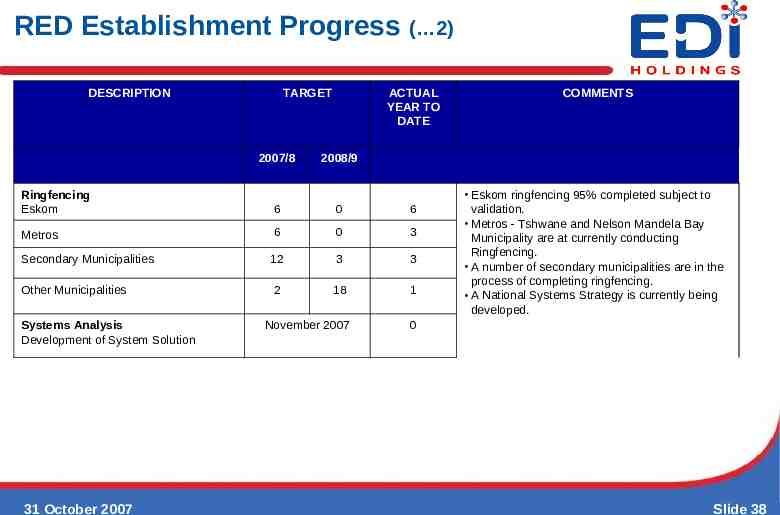

RED Establishment Progress ( 2) DESCRIPTION TARGET 2007/8 ACTUAL YEAR TO DATE 2008/9 Ringfencing Eskom 6 0 6 Metros 6 0 3 Secondary Municipalities 12 3 3 Other Municipalities 2 18 1 Systems Analysis Development of System Solution 31 October 2007 COMMENTS November 2007 Eskom ringfencing 95% completed subject to validation. Metros - Tshwane and Nelson Mandela Bay Municipality are at currently conducting Ringfencing. A number of secondary municipalities are in the process of completing ringfencing. A National Systems Strategy is currently being developed. 0 Slide 38

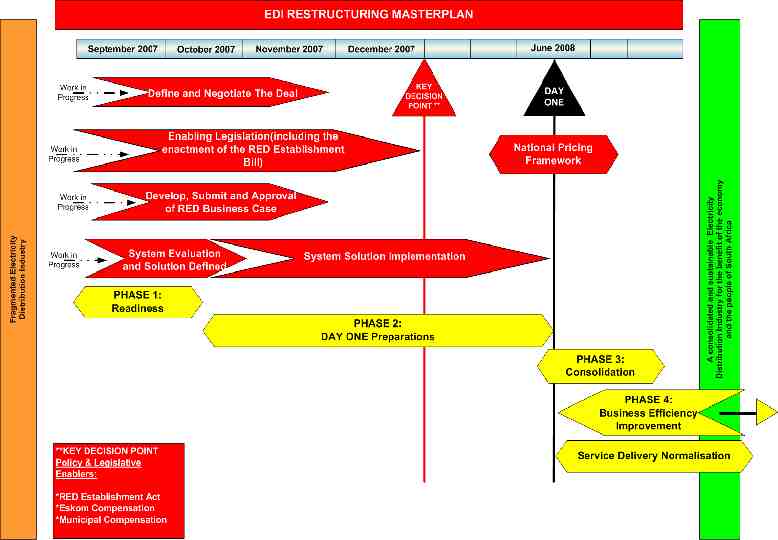

18 September 2007 31 October 2007 Slide 39 Slide 39

ACKNOWLEDGEMENTS 31 October 2007 Slide 40

Acknowledgements We sincerely appreciate: The leadership and guidance of the Minister of Minerals and Energy, Ms Buyelwa Sonjica; The Inter-Ministerial Committee which consists of the Ministers of Minerals and Energy; Finance (Mr Trevor Manuel); Public Enterprises (Mr Alec Erwin); and Provincial and Local Government (Mr Sydney Mufamadi); Parliamentary Portfolio Committee for Minerals and Energy for providing support and direction; The leadership and support of the Director General of the DME, Advocate Sandile Nogxina; Stakeholders, including all spheres of Government, Eskom, SALGA, Labour, Business, the Parliamentary Portfolio Committee and all Political formations; The Chairman and Board of Directors of EDI Holdings; The Management and staff of EDI Holdings. 31 October 2007 Slide 41

THANK YOU www.ediholdings.co.za