MISSISSIPPI HOME CORPORATION National Housing Trust Fund (HTF) Program

95 Slides1.90 MB

MISSISSIPPI HOME CORPORATION National Housing Trust Fund (HTF) Program HTF Application Training 735 Riverside Dr. / Jackson, MS / 601.718.4642 / mshomecorp.com

HISTORY The Mississippi Home Corporation (MHC), State Housing Finance Authority. MHC was created by the Mississippi Home Corporation Act of 1989 to address housing needs for low-and-moderate income Mississippians. MHC’s mission is to enhance Mississippi’s long-term economic viability by fi nancing safe, decent, aff ordable housing and helping working families build wealth. MHC is responsible for administering the HTF Program

NATIONAL HOUSING TRUST FUND HTF Program 2020 Application Training-Workshop

TRAINING AGENDA Welcome HTF Program Overview Compliance Overview Notice of Funding Availability Application Process/Timeline Application Source/Documentation Q & A Contact Information

WELCOME Welcome to the 2020 HTF Program Application Training. The purpose of this application training is to provide guidance for the 2020 HTF Application Process. The online application, HTF ALLOCATION PLAN & guidelines are available on MHC’s website @ www.mshomecorp.com/federal-programs/htf/ MHC encourages all eligible applicants to apply for funding.

HTF PROGRAM OVERVIEW

HTF PROGRAM OVERVIEW Housing and Economic Recovery Act of 2008 (HERA), July 30, 2008 Freddie Mac and Fannie to fund the NHTF Not subject to the annual appropriations process HTF statue requires money to be distributed as block grants to states by formula Each subject to receive a minimum of three (3) million allocation.

PURPOSE Increase and preserve the supply of rental housing for extremely low-income households earning less than 30% of area median income (AMI) and very low-income households earning less than 50% of area median income (AMI) or Federal Poverty guidelines published by the Department of Health and Human Services Funds used for the production, preservation, rehabilitation, or operation of rental housing HTF is primarily a rental housing program

PROGRAM REQUIREMENTS HTF Interim Regulations (24 CFR 93), January 30, 2015 Administered by HUD State’s Consolidated (Plan 24 CFR 91) HTF Annual Allocation Plan-(Demonstrate the distribution of NHTF based on priority housing needs)

HTF METHOD OF DISTRIBUTION The distribution of funds to recipients will be based on priority housing needs as determined by the grantee in accordance with the HTF regulations (24 CFR Part 93) and the State’s Consolidated (Plan 24 CFR 91).

H T F A PP LI C AT IO N T RA I N IN G G OA LS & O BJ E C T I V E S P ROVI DE GU I DA N C E I N T HE DEVELO P MENT OF AP P LI CATI ON S ENSURE REGULATORY AND PROGRAMMATIC COMPLIANCE DISTRIBUTE FUNDING ACCORDING TO THE METHOD OF DISTRIBUTION ACHIEVE THE GREATEST RETURN BY COMBINING HTF WITH OTHER SOURCES TO PRODUCE AND PRESERVE AFFORDABLE HOUSING I NC RE ASE A ND PRE SE RVE T HE SUP PLY O F RE N TAL HOU SI NG F OR E X T RE ME LY LOW IN COME (E LI) H OUSE H OLD S E N CO URAGE SU PPO RT IVE SER VICE S T O B U ILD WE A LT H AN D ASSE T S F OR BE NE F IC IARI E S ENSURE THAT SUB-RECIPIENTS AFFIRMATIVELY FURTHER FAIR HOUSING DEVELOP A N D I MP LE MEN T AFFO RDABLE HO US I NG TAI LO RED T O LO CAL N EEDS A ND PR I O RI T I E S

HTF ALLOCATION PLAN The HTF ALLOCATION PLAN is a collection of guidance and instructional materials, relevant information, forms, requirements, and other data necessary for submission of successful & competitive applications.

NATIONAL HOUSING TRUST FUND (HTF) PROGRAM 24 CFR Part 93

NATIONAL HOUSING TRUST FUND (NHTF) ELIGIBILITY Non-Profi t Organizations and For-Profi t Organizations Construction, Rehabilitation Rental Housing Income Restrictions/Targeting Extremely low-income households @ 30% AMI Must adhere to Priority Housing Needs

HTF ELIGIBLE APPLICANTS Must have demonstrated development experience and capacity with creating, rehabilitating or preserving affordable housing.

HTF RENTAL F DEVELOPMENT Provide rental housing for EXTREMELY LOW INCOME households. Eligible activities: 1) New construction/acquisition of rental housing 2) Substantial rehabilitation of rental housing

HTF RENTAL F DEVELOPMENT Eligible Property Type: Single Family Housing Developments Multi-Family Housing Developments

HTF RENTAL DEVELOPMENT MAXIMUM AWARD Maximum Award per applicant is 1.5 million Funds serve as “GAP” Financing SUBSIDY LAYERING ANALYSIS Determine costs are reasonable Verifi able sources and uses of funds Amounts requested are necessary Uses are determined feasible.

HTF RENTAL DEVELOPMENT Funds distributed through a competitive process. Structured as Cash Flow Loan.

HTF V PROCESS/CRITERIA Awards structured as a loan which will mitigate risk to eligible basis in developments also using LIHTC. Structured as payable from available cash fl ow to minimize project debt and maximize aff ordability to ELI households. Terms of loans will be set by MHC underwriting and designed to ensure that the use of HTF dollars ae maximized; the project will maintain viability; and the greatest possible return on investment.

COMPLIANCE OVERVIEW

FEDERAL REQUIREMENTS Federally funded projects must adhere to a broad base of federal regulations. Application & Implementation of HTF Program. Located 2020 HTF Allocation Plan & Federal Register.

ELIGIBLE & INELIGIBLE PROJECT COST

PROJECT COST Costs funded with HTF funds must be eligible according to 2020 HTF Allocation Plan. All project costs must be reasonable and necessary.

ELIGIBLE PROJECT COST HT F funds a wa rde d t o a n el i gi bl e pro j ec t a s a re sul t of thi s a ppl i ca ti o n may be use d fo r t he f ol l o wi ng a ssoc i a te d pro j ec t co sts: Ac qui si ti on of Propert y: Ac qui si t io n o f a n ex i st i ng st a nda rd proper ty , or a subst a nda rd prope rt y in ne ed of reha bi l i t a t i o n. Ac qui si ti on of Va ca nt L a nd: Ac qui si t i on of v a ca nt l a nd to be used f or the new c onstruc t i on of re nt a l a nd/or ho mebuy er ho usi ng. N ot e: A ppl i ca nt must demo ns tr a t e t ha t c onst ruc t i on wi l l be gi n on t he H TF proj ec t wi t hi n ( 1 2 ) mont hs of t he purc ha se . N ew Const ruc t i on: N ew c onstr uct i on o f re nt a l ho usi ng. Re ha bi l i t a t i on: The a l t e ra t i on, i mprov e me nt , or modi fi c a t i on of a n ex i sti ng st ruc t ure . N ot e: If a ddi t i ona l ho usi ng uni ts a re a dde d to a n ex i sti ng st ruc t ure , i t i s t he n c onsi dered new c onst ruct i on.

ELIGIBLE PROJECT COST On-Si te I mprov em ent s: Thi s ca n i nc l ude s i de wa l ks, ut i l i ty c onnec ti ons, sew er a nd w a t e r l i ne c onnec t i ons whe re none a re present. N ot e: Off -si t e i nf ra st ruc t ure i s not el i gi bl e a s a HTF ex pense but m ay be a pa rt of t he ov e ra l l proj e c t. Dem ol i ti on: Dem ol i t i on of a n ex i st i ng str uct ure onl y i f c onst ruct i o n wi l l be gi n o n t he H T F proj ec t wi t hi n t wel ve ( 1 2 ) mont hs. Proj e c t Rel a t ed Soft Co st s: Re a so na bl e a nd nec e ssa ry proj ec t rel a t ed c osts, i nc ludi ng but not l i m i te d t o: Fi na nc i ng co sts, a rc hit e ct ura l , engi nee ri ng a nd re l a t e d prof es si ona l se rv i ce s, a udi t c ost s, affi rm ati v e m a r ket i ng, i nsura nc e, l ega l f ee s, ma rket st udi e s, perm i ts, env i ronme nt a l st udi e s, a nd ot her re l a t e d soft c ost s a pprov ed by MH C.

INELIGIBLE PROJECT COST H TF f u n d s a w a rd e d t o a n el i g i b l e pro j ec t a s a res u l t o f t h i s a p p l i c a t i o n s h a l l n o t be u s e d t o s u p p o r t o r p a y f o r t h e f o l l o w i n g : Off -s i t e i nf ra s t r u ct ure c o s t s n o t rel a t ed t o u t i l i t y h o o ku p s . On g o i n g o p e r a t i ng a n d m a i n t e na n ce f u nd i ng . Re nt a l a s s i s t a n c e ( p ro j e c t o r t en a nt -b a s ed ) D el i nq u e nt t a xe s o r f e e s . E q ui p m en t pu rc h a s e s . Re fi na nc i n g ( p a yo ff o f b r i d ge fi n a n c i ng i s a l l o w a b l e i f c o s t s a re e l i gi b l e ) . A p ro j ec t a l re a dy a s s i s t ed w i t h H TF f u n d s . C a p i t a l i za t i o n o f o p e r a t i n g o r rep l a c em e nt re s er v es . Re l o ca t i o n p a ym e n t s . Ot he r i ne l i g i b l e c o s t s a s d efi n ed by t h e HT F g u i de l i n e s .

CITIZENS PARTICIPATION

CITIZEN PARTICIPATION For-profi t, Non-profi t organizations and developers seeking HTF funding in conjunction with Low Income Housing Tax Credits (LIHTC) will satisfy the Citizen Participation requirement with the Public Hearing held for the Qualifi ed Allocation Plan (QAP). Citizen participation requirements must be met prior to submittal of an application for HTF funding.

PERIOD OF AFFORDABILITY REQUIREMENT

AFFORDABILITY PERIODS Minimum Term of Aff ordability 30 years Monitoring/On-Site Inspections HTF Assisted Units Tenants Subject to Recapture

UNDERWRITING & SUBSIDY LAYERING REVIEW

SUBSIDY LAYERING REVIEW M H C i s req u ire d p er H U D re g u l a ti o n s to c on d u c t a s u b s id y l a y e r in g re v i e w o n a l l p roj e c t s a p p l y i n g fo r H T F f u n d i n g . Th e p u r p o s e o f t h e l a y er i n g re v i e w i s to d e te rm in e i f m o re g o v ern m e n t fu n d s ( fe d e r a l, s ta te , o r l o c a l) t h a n n e c e s s a r y a re g o i n g in to t h e p ro je c t . Pro j ec ts d ee m ed t o b e ov e r s u b s i d i ze d b y g ov e rn m e n t f u n d s wi l l e it h e r n o t re c e i v e H T F fu n d in g o r w i ll h a v e t h e H T F f u n d in g red u c e d . T h e l a y e ri n g rev ie w m u s t b e c om p le t e d p r io r t o a n y c om m i t m e n t o f H TF fu n d s t o a p ro je c t . A ll l a y e r in g rev i ew s w il l i n c l u d e a re v ie w o f t h e p e r u n i t H T F s u b s i d y re q u i re m en ts a n d a re v i e w to e n s u re t h a t a ll c os t s b e i n g fu n d ed b y t h e H TF Pro g r a m a re e l ig ib le a n d re a s o n a b l e. Re n ta l Pro j e c ts -T h e la y e r i n g re v i e w in c lu d e s a re v i ew of t h e d e v e l op m e n t b u d g e t wi th t h e s o u rc e s a n d u s e s o f a l l t h e p roj e c t fu n d i n g a n d a rev ie w o f o p e ra t in g b u d g e t ( p ro f orm a ) t h a t is p ro v i d e d in th e f u n d i n g a p p l ic a t io n .

HUD/HTF PER UNIT SUBSIDY LIMITS The amount of HTF funds requested cannot exceed the HUD/HTF per unit subsidy limits. Sources/uses of funds: As part of the application process, applicants should submit a sources/uses of funds statement for the project with supportive documentation. This should refl ect the project development budget and list all proposed sources and uses of funds. Maximum Subsidy Limits: www.mshomecorp.com/federalprograms/htf

PROPERTY STANDARDS

PROPERTY & REHABILITATION STANDARDS HTF-funded properties must meet certain property standards as specifi ed below: State and Local Codes: State and local codes and ordinances apply to any HTF funded project regardless of the project type. Projects involving construction and/or rehabilitation must address applicable local building codes. Projects involving rehabilitation must also meet local written rehabilitation standards

PROPERTY & REHABILITATION STANDARDS Model Codes: New construction projects must meet local building codes, model energy codes, Section 504 accessibility requirements and neighborhood standards requirements. For rehabilitation projects, the property must meet local building codes, handicapped accessibility requirements, and rehabilitation standards. Construction and rehabilitation: Housing that is being constructed or rehabilitated with HOME funds must meet all applicable state and local codes, rehabilitation standards and ordinances. If no state and local codes apply, the property must meet one of the national standards.

HTF FUNDED UNIT ALLOCATION The minimum number of HTF assisted units and the unit designations (fi xed vs. fl oating for rental) must be determined prior to the execution of any HTF written agreement. The number of HTF units is determined by the percentage of the HTF investment in the project. The total HTF investment is divided by the total HTF eligible project costs to determine the percentage of HTF funds in the project.

Site and Neighborhood Standards

SITE & NEIGHBORHOOD STANDARDS Requirements of 24 CFR Part 8 (which implement section 504 of the Rehabilitation Act of 1973) apply to HOME and specifi cally address the site selection with respect to accessibility for persons with disabilities. HTF assisted new construction projects must comply with standards.

INCOME & RENT RESTRICTIONS

INCOME & RENT RESTRICTIONS To qualify as affordable housing, HTF-Assisted units must be applicable to households with certain incomes at regulated rents.

INCOME LIMITS Extremely Low-Income Families: Families whose annual incomes do not exceed 30 percent of the median income for the area (adjusted for family size). Income limits are published by HUD on an annual basis. Income limits are posted on MHC’s website at www.mshomecorp.com/federal-programs/htf/

RENT LIMITS Rents should be in line with the target population served. Rents should represent 30% of the gross income of the target population, but not to exceed maximum HTF rents. Rent limits are published by HUD on an annual basis. Rent limits are posted to MHC’s website at www.mshomecorp.com/federal-programs/htf/

CONFLICT OF INTEREST

CONFLICT OF INTEREST To comply with HTF Requirements and to maintain a high standard of accountability to the public, confl icts of interest and perceived confl icts of interest must be avoided. Owners shall maintain compliance with all HUD confl ict of interest provisions as stated in HTF ALLOCATION PLAN & federal regulations.

CONFLICT OF INTEREST No person who is an employee, agent, consultant, offi cer, elected or appointed offi cial of the Recipient or Sub-Recipient who exercises any functions or responsibilities with respect to HTF activities, is in a position to participate in the decision making process, or gains inside information with regard to such activities may: obtain a fi nancial interest or benefi t from a HTF activity; have a fi nancial interest in any contract with respect to a HTF activity or its proceeds for themselves or those they have business or immediately family ties (relatives).

FAIR HOUSING ACT

FAIR HOUSING ACT The Fair Housing Act declares that it is “the policy of the United States to provide constitutional limitations for fair housing throughout the United States”. As a requirement for participating in HUD’s housing and community development programs, agencies receiving federal funding shall utilize affi rmative marketing procedures to ensure non-discrimination in housing or service directly or indirectly HUD oversees, administers, and enforces the federal Fair Housing Act

FAIR HOUSING ACT All assisted housing must meet the accessibility requirements of the Fair Housing Act and Section 504 of the Rehabilitation Act of 1973. Accessibility: All assisted housing must meet the accessibility requirements of the Fair Housing Act and Section 504 of the Rehabilitation Act of 1973

AFFIRMATIVELY FURTHERING FAIR HOUSING

AFFIRMATIVELY FURTHERING FAIR HOUSING Must be committed to an Affi rmative Action Program Develop and implement a written Affi rmative Marketing Outreach Procedures, communication tools and materials to: 1) Ensure persons without regard to race, color, ethnicity, religion, sex, age, national origin, familial status, or disability how to obtain access to facilities, & assistance. 2) Outreach programs & activities for Limited English Profi ciency (LEP) persons 3) Marketing and outreach documentation available in diff erent languages MHC-ESG Implementation Workshop 2016 52

MHC CONNECTING ACTIVITIES TO AFFH Outreach to minority publications and communities Incentives for use of Minority/Women Owned Businesses Incentives for providing supportive services to benefi ciaries Implement strategies for asset and wealth building Incentives for addressing lack of housing for homelessness and serious mental ill populations Inform public of actions/activities to Affi rmatively Further Fair Housing Conduct workshops throughout the state, especially in minority and low-income communities

MBE/WBE

MINORITY BUSINESS ENTERPRISE AND WOMEN BUSINESS ENTERPRISE (MBE/WBE) PL AN Developers must submit and maintain a MBE/WBE plan that demonstrates marketing and solicitation of MBE/WBE businesses and contractors for the construction of the project.

SECTION 3 V Section 3 requirements set forth at 24 CFR Part 135 of the federal regulation states that, to the greatest extent possible, businesses and employers working on HUD-funded projects must make a good faith effort to train and employ lowincome individuals living in the local area and also to contract with businesses owned by or that employ Section 3 residents. “Greatest Extent Feasible”

SECTION 3 V A Section 3 plan that demonstrates a marketing plan to include Section 3 contractors and all tiers of subcontractors in the construction of the project must be submitted by Developers.

AUDITS 2 CFR PART 200 Subpart F

PROCUREMENT Procurement Policy is governed by 24 CFR Part 85 (Common Rule) and/or 24 CFR Part 84 State of Mississippi Procurement Law, Section 31-7-9, Mississippi Code of 1972, Annotated

SUSPENSION & DEBARMENT Projects owned, developed, or otherwise sponsored by any individual, corporation, or other entity that is suspended, debarred, or otherwise precluded from receiving federal awards. Furthermore, the owner may not contract with any other entity (including but not limited to builders/general contractors, property management companies, or other members of the development team) that are suspended, debarred, or otherwise so precluded.

SUSPENSION & DEBARMENT General contractor will be required to determine that subcontractors are not so precluded. The System for Award Management (SAM) database should be used by applicants to confi rm that development team members are not excluded. The SAM database is available at https://www.transportation.gov/osdbu/system‐ award‐management‐sam.

ENVIRONMENTAL

ENVIRONMENTAL Federally-assisted projects are subject to a variety of environmental requirements. All HTF‐assisted projects shall be implemented in accordance with environmental review regulations as defi ned in federal regulations and HTF Allocation Plan.

ENVIRONMENTAL REVIEW A l l proj e cts w i l l ne e d to hav e an e nv i ro nm en tal re v i e w co m pl e te d i n ac cordance w i th the N ati o nal E nv i ro nm e ntal Pro te cti o n Act (N E PA). O nce the fundi ng appl i cati on i s rece i v ed , the app l i cant canno t take an y choi ce l i m i ti ng acti on s un ti l t he E R i s co mp l e te . Th e scope of the e nv i ron m en tal re v i e w w i l l de pe nd on the nature an d si ze of the p roj e ct. I f the pro j e ct re qui re s an e nv i ron m e ntal as se s sm e nt (EA ) l ev el re v i e w as d e fi ne d i n HU D re gul ati ons . Choi ce l i m i t i ng acti ons i ncl u de the acqui s i ti on of p rope r ty , be gi n ni ng con str ucti on acti v i ti e s , s i gn i ng b i ndi n g co ntr acts , e tc. If a choi ce l i m i ti ng acti o n i s take n w i th out the E A be i n g co m pl e te d, i t w i l l di squ al i fy the pro j e ct fo r fed e ral fu ndi ng .

READINESS TO PROCEED

READINESS TO PROCEED The applicant must demonstrate the ability to commit HTF dollars and undertake funded activities in a timely manner. Funds must be committed within 24 months and expended within 5 years. For new construction or rehabilitation, construction must start within 12 months of the date of the contract between the recipient and MHC. MHC will not fund any project that does not indicate in its application the ability to adhere to this requirement.

NOTICE OF FUNDING AVAILABILITY 2020

FUNDING ALLOCATIONS The State of Mississippi has available for the 2020 application cycle.

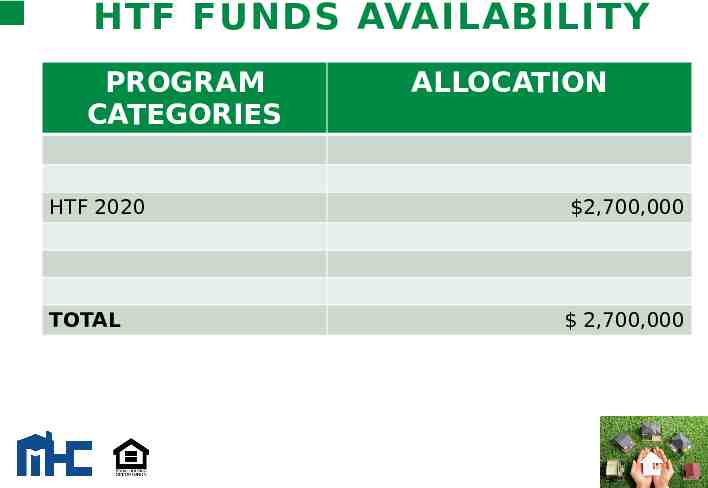

HTF FUNDS AVAILABILITY PROGRAM CATEGORIES HTF 2020 TOTAL ALLOCATION 2,700,000 2,700,000

APPLICATION PROCESS

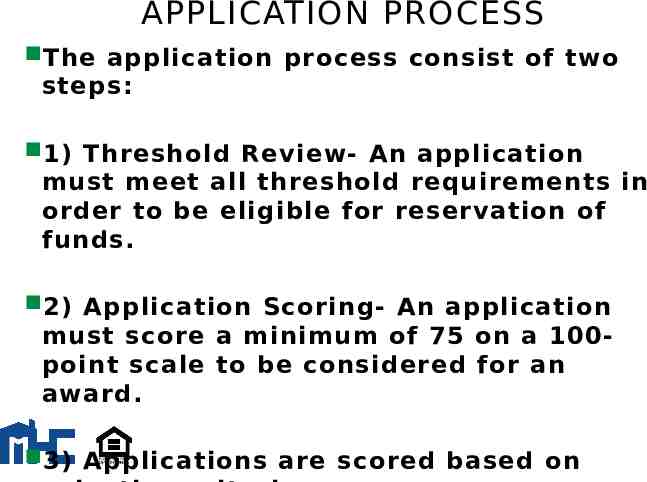

APPLICATION PROCESS The application process consist of two steps: 1) Threshold Review- An application must meet all threshold requirements in order to be eligible for reservation of funds. 2) Application Scoring- An application must score a minimum of 75 on a 100point scale to be considered for an award. 3) Applications are scored based on

APPLICATION REQUIREMENT & SELECTION CRITERIA

Applications must be submitted online by the designated application deadline. (April 24, 2020) On-line applications located at www.mshomecorp.com/federal-programs/htf/

MH C w il l us e a ra nk in g p ro ces s t o s el ec t pro je ct s f o r fu ndi ng. Appl ic a t io n s w i l l be s ub j ect t o a su bs i dy l ay eri ng rev iew o f a l l s o urce s o f fi na nci n g to d eterm i ne t ha t HT F fi l l s a fi na n ci ng ga p a n d doe s n o t re su l t i n f edera l fu nd s p ro v id i ng exce ss i n s ubsi dy. Appl ic a t io n s w i t h i nc o m pl et e s u ppo rt i n g do c um ent a t io n w i ll no t be co n si d ered f o r fu nd i ng. Appl ic a nt s w il l rec ei ve a le tt er o f rej ec t io n a nd m a y re- s ubmi t duri n g s ubs eq uent co m p eti t iv e pro ces s es .

Application Submission Period: HTF Applications Application Submission Period: (April 20, 2024-April 24, 2020)

APPLICATION TIMELINE Applications for federal programs must be received in the offi ce at 735 Riverside Drive on or before 5:00 p.m. on the closing date of the application submission period. Late applications will not be reviewed. The list of applicants awarded funds will be published on MHC’s website and all applicants will be notifi ed by letter. HTF Allocation Plan, applications and forms necessary to fi le an application may be downloaded from the MHC’s Web page at www.mshomecorp.com/federal-programs/htf/or by contacting Lillie Naylor or Kimberly Stamps.

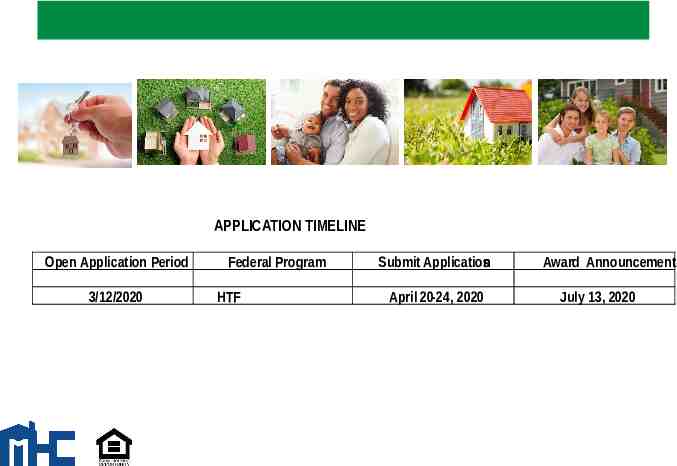

FEDERAL PROGRAMS A PPLI CATI ON TIMELINE 2020 APPLICATION TIMELINE Open Applica tion Period Federal Program Submit Applica tions Awards Announced Open Application Period Federal Program Submit Applications Award Announcement 3/12/2020 20-20-224,4,2020 202 0 July July 13,13, 20 20 3/12/2020 Hom e Renta HTF l & CHDO AprilApril 2020 Applications for federa l programs m ust be received in the offi ce at 735 Riverside Drive on or before 5 :00 p.m. on the closing date of the application submission period. M H C ’ s w e b s i t e a n d a l l a p p l i c a n t s w i l l b e n o t i fi e d b y l e t t e r . M a n u a l s , a p p l i c a t i o n s ww w.ms homec or p.c om or by c ont ac ti ng L i l li e N ay lor or K i m ber l y St am ps . Late and applications forms necessary will to not fi l e be an reviewed. application The may list be of applicants downloaded awarded from the funds MHC’s will Web be page published at on

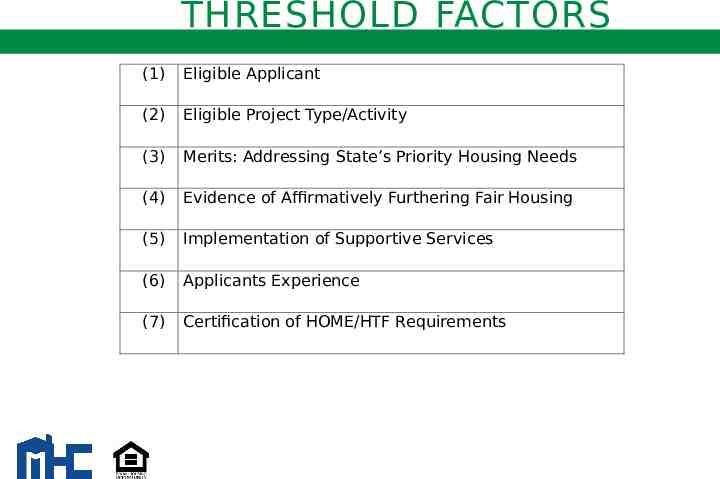

THRESHOLD FACTORS

THRESHOLD FACTORS (1) Eligible Applicant (2) Eligible Project Type/Activity (3) Merits: Addressing State’s Priority Housing Needs (4) Evidence of Affirmatively Furthering Fair Housing (5) Implementation of Supportive Services (6) Applicants Experience (7) Certification of HOME/HTF Requirements

Applications are reviewed for completeness. All required documentation must be included in online application. Applicants will be notifi ed if documentation provided is unclear and will have a cure period to clarify requested items. This does not apply to missing items.

Any competitive application that does not meet all the threshold requirements within the timeframe of the notifi cation letter will be disqualifi ed.

Complete applications will proceed to scoring.

SCORING FACTORS

SCORING FACTORS (1)Geographic Diversity Up to 15 pts (2) Rental Assistance 10 pts (3) Extended Affordability Period 5 pts (4) Supportive Service Commitment Up to 20 pts (5) High Opportunity Areas Up to 10 pts (6) Section 504 Compliant Units Up to 20 pts (7) Energy Efficiency Plan Up to 10 pts (8) Development Amenities Up to 10 p t s Total 100 pts

Applications must score a minimum of 75 on a 100point scale to be considered for funding. Regardless of strict numerical ranking, the Selection Criteria does not operate to vest in an applicant or development any right to a reservation or allocation of HTF funds in any amount.

Funding Announc em ents: Applic ants will be notifi ed of appro vals a nd denials by mail. Staff av ailable for rev iew of funding results. Funding Announc em ents- U pon the com pletion of the applic ation revie w pro cess in a c ompe titiv e cy cle, MH C Staff will m ake approv al recom m endation to its Board of Directo rs (the Board) at its nex t regularly sc he duled board mee ting. Once the Bo ard approv es the r e c o m m e n d a t i o n s , a c o m m i t m e n t l e t t e r w i l l b e m a i l e d t o a p p l i c a n t .

Documents are located on Mississippi Home Corporation’s Website at: www.mshomecorp.com/federalprograms/htf/

2020 HT F Al loc at ion Plan/Appl ic at ion Guide Exh ibi ts 1,2, 3 Federal Regi ster Applic an t Own er Au thorizat ion Cert ifi ca ti on s an d Assurances En viron men tal Chec kl ist Applic an t Self Certifi c ati on Applic at ion Prepa rer’s Certi fi c at ion Sou rc es of Fu n ds Projec t Co mpl eti on Sc hedul e Affi rm ati ve Fai r Hou sing Marketing P lan

State of Mississippi HTF Maximum Mortgage Limits Initial Site Assessment Form Construction Certifi cation Form Contractor’s Bid Authorization Certifi cate of Consistency w/Consolidated Plan Minimum Design Quality Standards (MDQS) MHC Housing Tax Credit Compliance Monitoring Plan Violence Against Women Act (VAWA) Rehabilitation Standards

Uniform Physical Condition Standards (UPCS) Physical Needs Assessment Form Development Experience Form Management Experience Form Supportive Services Certifi cation Form Development Organization Chart Proposal Form Income Limits Rent limits

SUMMARY In order to be considered for funding, the following conditions must be met: T h e a pp l ic a n t m u s t h a v e s i t e c o n t ro l a s e v id e n c e d b y a s i gn e d pu rc h a s e a g re e m e n t o r v e s ti n g t i tl e t o th e p ro p e r t y f o r Re n t al pro j e c t s. T h e pro j e c t m u s t s e r v e e l i g i b l e h o u s e h o ld s . T h e pro j e c t m u s t b e HT F e l i g ib l e . T h e pro j e c t c o s ts m u s t b e H T F e l i g i b l e . T h e pro j e c t m u s t m e e t m i n i m u m p e r i od o f a ff o rd a b i l i t y. T h e pro j e c t m u s t m e e t l a y e r i n g re v i e w c r i te r i a a n d n o t b e d e e m e d t o be o v e r- s u b s i d i z e d . T h e pro j e c t m u s t m e e t M H C ’ s a n d H T F ti m e l i n e s s re q u i re m e n t s. T h e pro j e c t m u s t m e e t a l l re l e v a n t f e d e r a l re q u ire m e n t s .

QUESTIONS & ANSWERS (Q&A) SUBMIT TO STAFF VIA EMAIL OR PHONE

CONTACT INFORMATION Kimberly Stamps601-718-4638/[email protected] Lillie Naylor -601-718-4658/[email protected] Lisa Coleman- 601-718-4657/[email protected] Ben Mokry -601-718-4611/[email protected]

CONTACT INFORMATION Mississippi Home Corporation 735 Riverside Drive Jackson, MS 39202 601-718-4642 www.mshomecorp.com