Curiosity killed the “Cat” 2019 Women In Ag Conference Kearney,

53 Slides6.94 MB

Curiosity killed the “Cat” 2019 Women In Ag Conference Kearney, NE Carmen Egging-Draper [email protected] / 308-249-4795 Insurance Officer Farm Credit Services of America

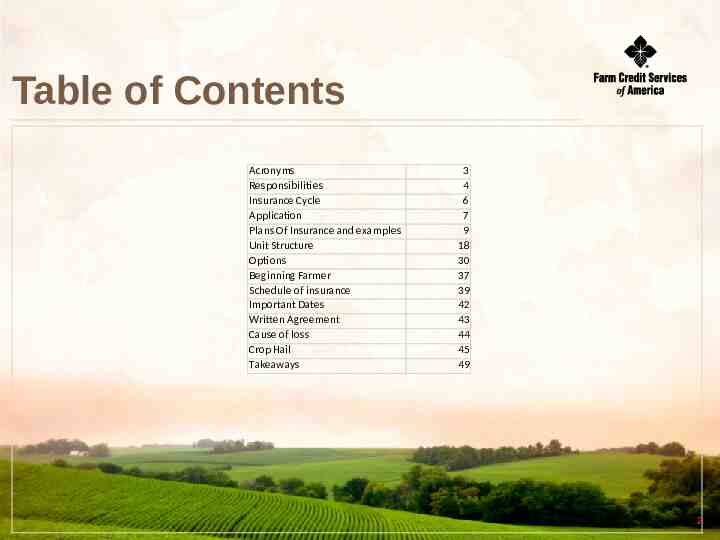

Table of Contents Acronyms Responsibilities Insurance Cycle Application Plans Of Insurance and examples Unit Structure Options Beginning Farmer Schedule of insurance Important Dates Written Agreement Cause of loss Crop Hail Takeaways 3 4 6 7 9 18 30 37 39 42 43 44 45 49 2

Packet Materials In your packet, you will find: APH Schedule of Insurance Crop Insurance Guide Crop Hail Guide Miscellaneous brochures on Crop Insurance 3

4

Responsibilities What does the Company Do? What does the Agent Do? Insures crops Identifies a need for insurance Provides for the processing of paper Explains product options Appoints agents Sells insurance contract Hires loss adjusters Collects production and acreage report Ensures all claims are fairly and promptly paid Notifies company in case of loss Accepts risk on the insurance policies Interacts with RMA/agent/farmers Trains agents and adjusters Informs farmer about changes to the program Local, professional, trusted contact for farmer 5

Insured’s Responsibilities Complete application – for crops and counties Report entity changes Keep and report production separate by unit Report ALL acres by crop and practice – Mapped Based Acreage Report – Report planting dates and share Report probable losses to the agent as soon as discovered Provide adjuster with scale tickets and other production evidence – sell crop in insured name Pay premium timely 6

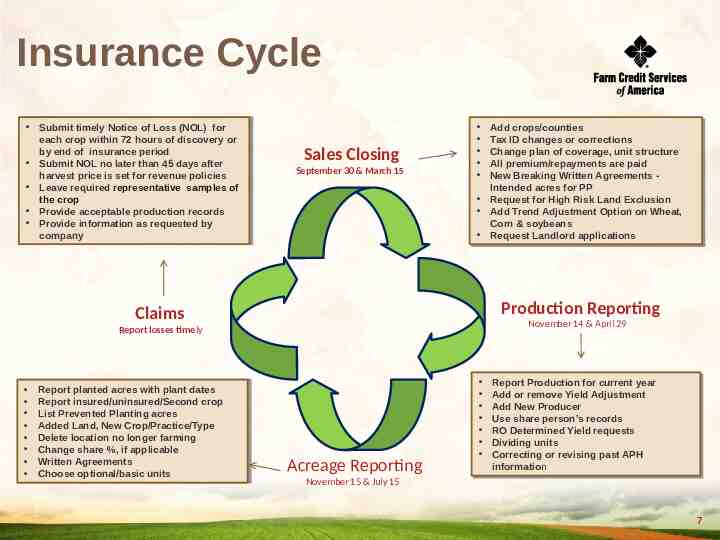

Insurance Cycle Submit Submittimely timelyNotice Noticeof ofLoss Loss(NOL) (NOL) for for each eachcrop cropwithin within72 72hours hoursof ofdiscovery discoveryor or by byend endof of insurance insuranceperiod period Submit SubmitNOL NOLno nolater laterthan than45 45days daysafter after harvest harvestprice priceis isset setfor forrevenue revenuepolicies policies Leave Leaverequired requiredrepresentative representative samples samplesof of the thecrop crop Provide Provideacceptable acceptableproduction productionrecords records Provide Provideinformation informationas asrequested requestedby by company company Sales Closing September 30 & March 15 Production Reporting Claims November 14 & April 29 Report losses timely Report Reportplanted plantedacres acreswith withplant plantdates dates Report Reportinsured/uninsured/Second insured/uninsured/Secondcrop crop List ListPrevented PreventedPlanting Plantingacres acres Added AddedLand, Land,New NewCrop/Practice/Type Crop/Practice/Type Delete Deletelocation locationno nolonger longerfarming farming Change Changeshare share%, %,ififapplicable applicable Written WrittenAgreements Agreements Choose Chooseoptional/basic optional/basicunits units Add Add crops/counties crops/counties Tax Tax ID ID changes changes or or corrections corrections Change plan of coverage, Change plan of coverage, unit unit structure structure All premium/repayments are All premium/repayments are paid paid New New Breaking Breaking Written Written Agreements Agreements -Intended acres for PP Intended acres for PP Request Request for for High High Risk Risk Land Land Exclusion Exclusion Add Trend Adjustment Add Trend Adjustment Option Option on on Wheat, Wheat, Corn & soybeans Corn & soybeans Request Request Landlord Landlord applications applications Acreage Reporting Report Report Production Production for for current current year year Add or remove Yield Adjustment Add or remove Yield Adjustment Add Add New New Producer Producer Use share Use share person’s person’s records records RO Determined RO Determined Yield Yield requests requests Dividing Dividing units units Correcting Correcting or or revising revising past pastAPH APH information information November 15 & July 15 7

Application New Insured must apply for a policy by Sales Closing Date – Policies are continuous thereafter until cancelled Applicant must be of legal age – Minors may have a policy with a parent/guardian to co-sign Duplicate policies covering same crop/county are not permitted Applicant must choose plan of insurance, coverage levels and options for each insured crop 8

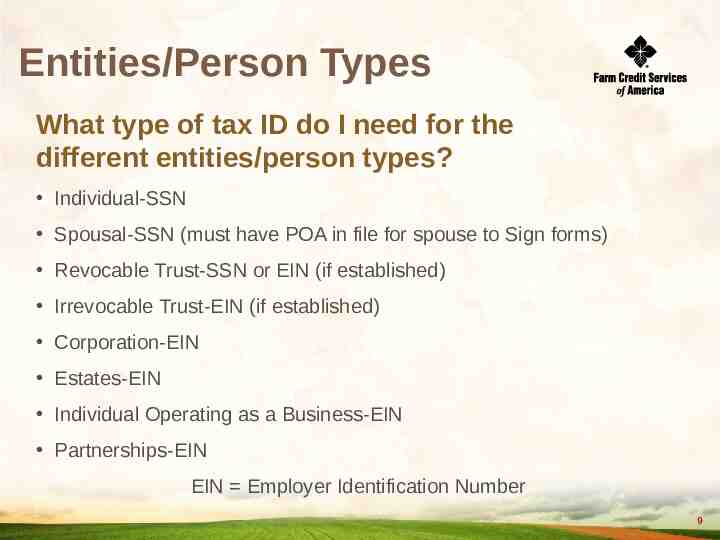

Entities/Person Types What type of tax ID do I need for the different entities/person types? Individual-SSN Spousal-SSN (must have POA in file for spouse to Sign forms) Revocable Trust-SSN or EIN (if established) Irrevocable Trust-EIN (if established) Corporation-EIN Estates-EIN Individual Operating as a Business-EIN Partnerships-EIN EIN Employer Identification Number 9

Plans of Insurance Multi Peril Crop Insurance (MPCI) – protects from natural crop yield losses includes APH (yield protection), RP(revenue protection), and YP (yield protection) Crop Hail (CH) –protects against crop damage caused by hail, fire, lightening and transit. Can add wind coverage to some policies. Whole Farm Revenue Protection (WFRP) – Insurance plan that insures up to 8.5 million in insured revenue from all agriculture commodities produced on the farm. Pasture Rangeland and Forage (PRF) – Insurance plan to provide insurance coverage on pasture, rangeland, or forage acres that are used to feed livestock. Livestock Risk Protection (LRP) –declining market prices. Dairy Revenue Production (DRP) – Insurance plan that protects milk and milk products against declining market prices. 10

Actual Production History (APH) Yield Protection (YP) APH is for any crop where Revenue protection is not available, (millet, sugar beets, and dry beans) Yield guarantee based on the growers previous Actual Production History (APH) Available coverage levels are 50% to 85% in 5% increments of APH yield Indemnifies the grower for harvested and/or appraised production less than the production guarantee Growers may choose established or additional price election (Sometimes a price is increased by March 1 from the established price on APH crops, so grower should always choose additional price election. ) CAT coverage is available 655 per crop per county (2020?) Prevented planting and replant protection (on some crops) are provided 11

APH and YP Example Corn yield of 218 bushel 70% level 218 x 70% 152.6 bushel guarantee Established price 3.96 per bushel (set March 1st) Guarantee dollars of 604.30 You must go below 152.6 bu/acre to collect crop insurance payment regardless of what happens to price at harvest 12

Revenue Protection (RP) Dollar guarantee based on the (Board of Trade) projected price The projected price is used to calculate premium, replant payments and prevented planting payments Available coverage levels are 50% to 85% in 5% increments Additional dollar protection is available if the harvest price is higher than the projected price Good product if you are marketing your crop I recommend you do NOT take RP without the harvest price if marketing your crop 13

Revenue Protection with Harvest Price Exclusion (RPHPE) Dollar guarantee based on the projected price Projected price is used to calculate the premium, replant payments and prevented planting The available coverage levels are 50% to 85% in 5% increments Additional dollar protection is not provided if the harvest price is higher than the projected price The harvest price is used to calculate production to count at claims time NOT a recommended option 14

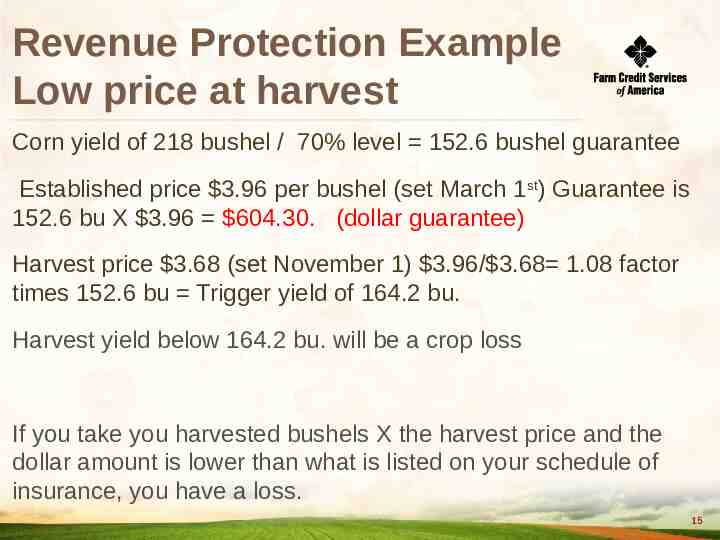

Revenue Protection Example Low price at harvest Corn yield of 218 bushel / 70% level 152.6 bushel guarantee Established price 3.96 per bushel (set March 1st) Guarantee is 152.6 bu X 3.96 604.30. (dollar guarantee) Harvest price 3.68 (set November 1) 3.96/ 3.68 1.08 factor times 152.6 bu Trigger yield of 164.2 bu. Harvest yield below 164.2 bu. will be a crop loss If you take you harvested bushels X the harvest price and the dollar amount is lower than what is listed on your schedule of insurance, you have a loss. 15

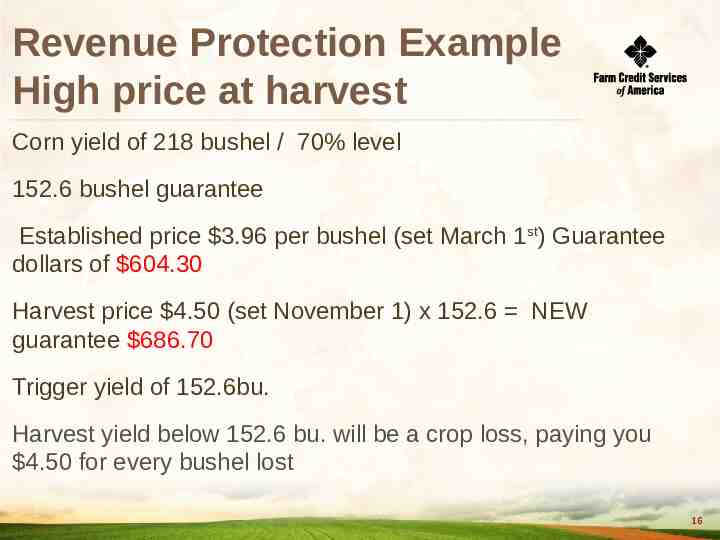

Revenue Protection Example High price at harvest Corn yield of 218 bushel / 70% level 152.6 bushel guarantee Established price 3.96 per bushel (set March 1st) Guarantee dollars of 604.30 Harvest price 4.50 (set November 1) x 152.6 NEW guarantee 686.70 Trigger yield of 152.6bu. Harvest yield below 152.6 bu. will be a crop loss, paying you 4.50 for every bushel lost 16

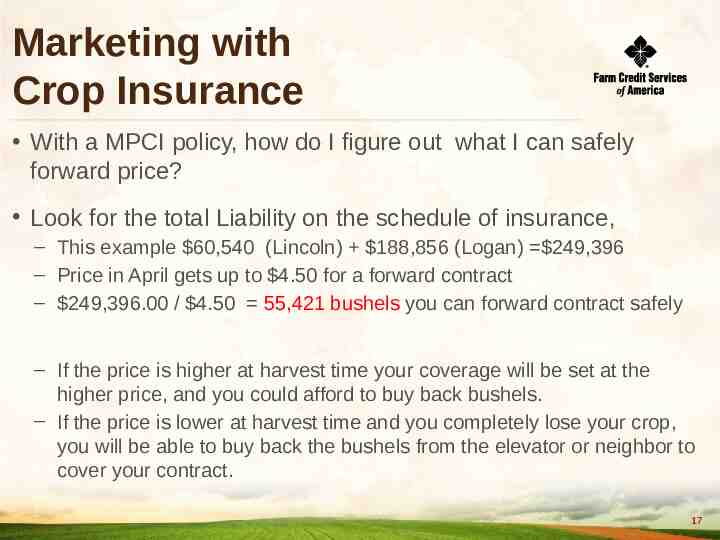

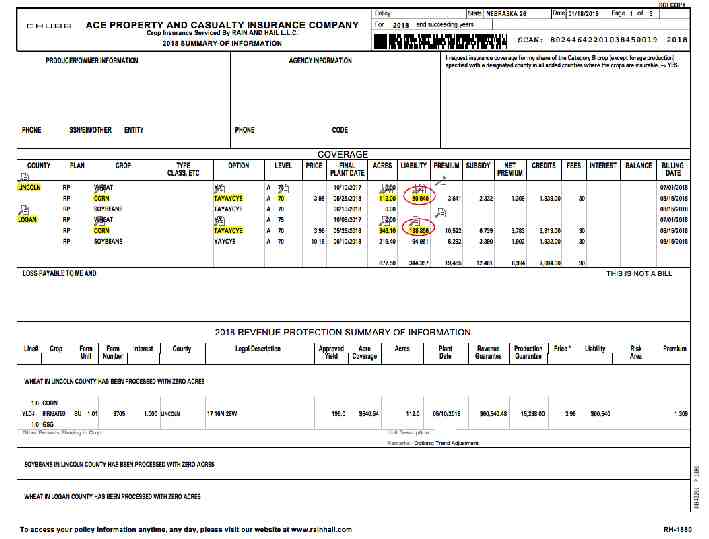

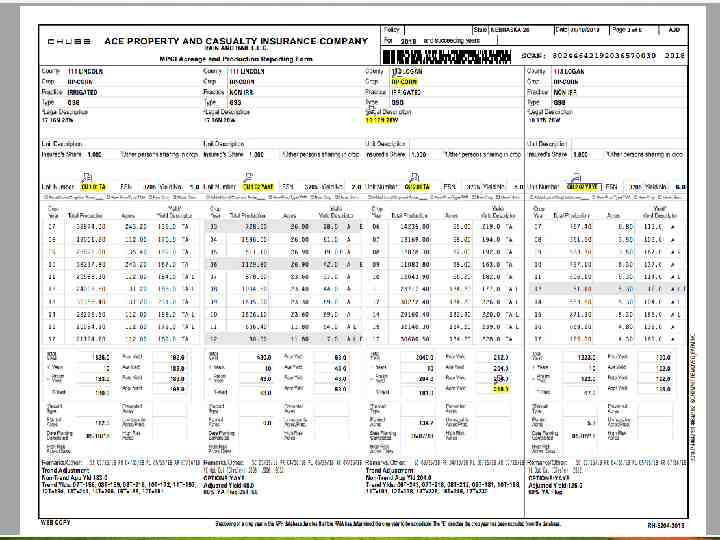

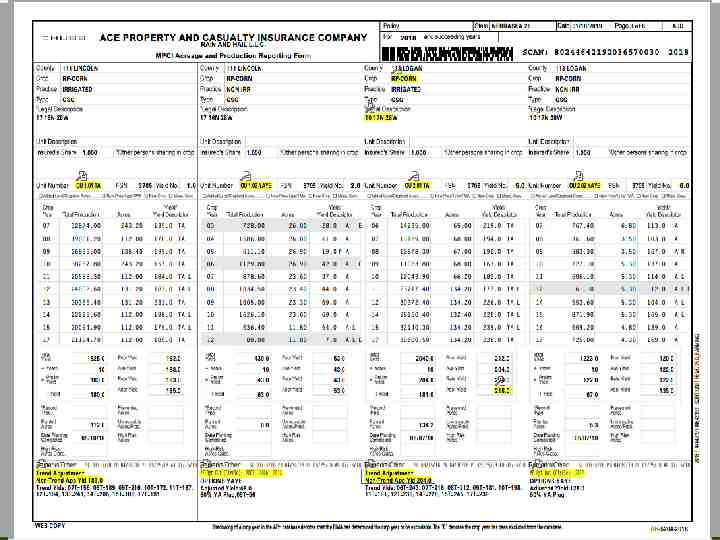

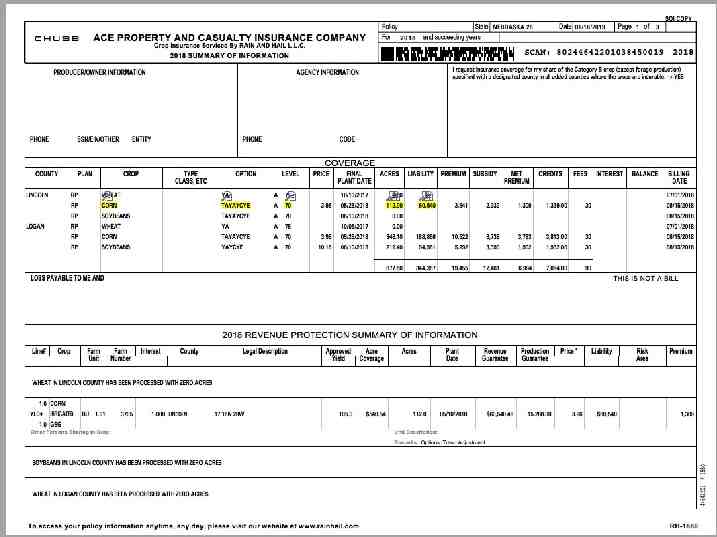

Marketing with Crop Insurance With a MPCI policy, how do I figure out what I can safely forward price? Look for the total Liability on the schedule of insurance, – This example 60,540 (Lincoln) 188,856 (Logan) 249,396 – Price in April gets up to 4.50 for a forward contract – 249,396.00 / 4.50 55,421 bushels you can forward contract safely – If the price is higher at harvest time your coverage will be set at the higher price, and you could afford to buy back bushels. – If the price is lower at harvest time and you completely lose your crop, you will be able to buy back the bushels from the elevator or neighbor to cover your contract. 17

18

19

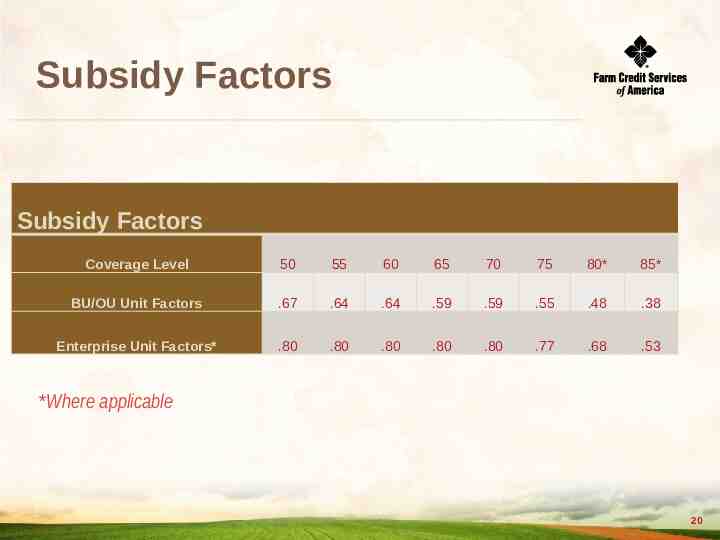

Subsidy Factors Subsidy Factors Coverage Level 50 55 60 65 70 75 80* 85* BU/OU Unit Factors .67 .64 .64 .59 .59 .55 .48 .38 Enterprise Unit Factors* .80 .80 .80 .80 .80 .77 .68 .53 *Where applicable 20

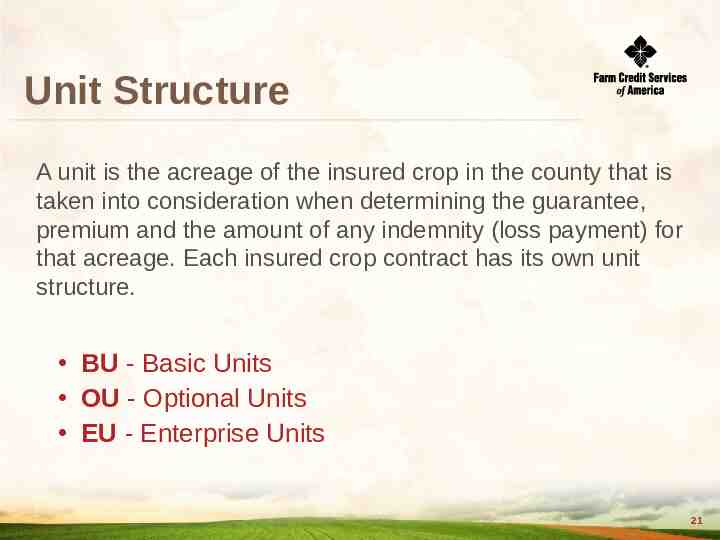

Unit Structure A unit is the acreage of the insured crop in the county that is taken into consideration when determining the guarantee, premium and the amount of any indemnity (loss payment) for that acreage. Each insured crop contract has its own unit structure. BU - Basic Units OU - Optional Units EU - Enterprise Units 21

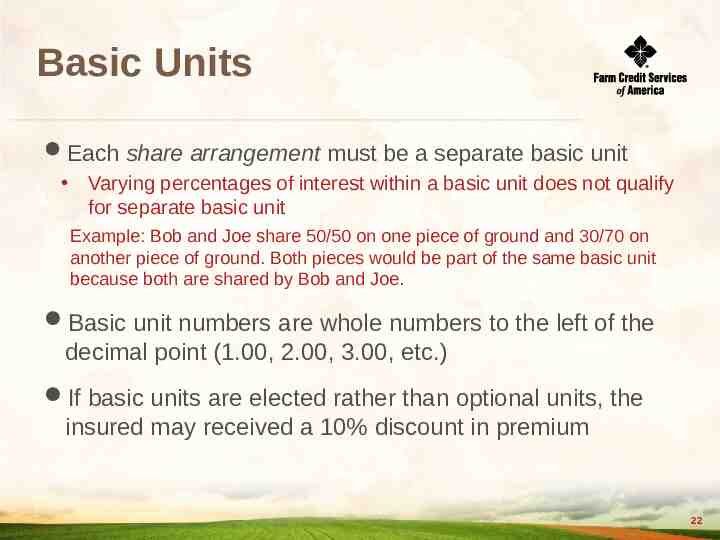

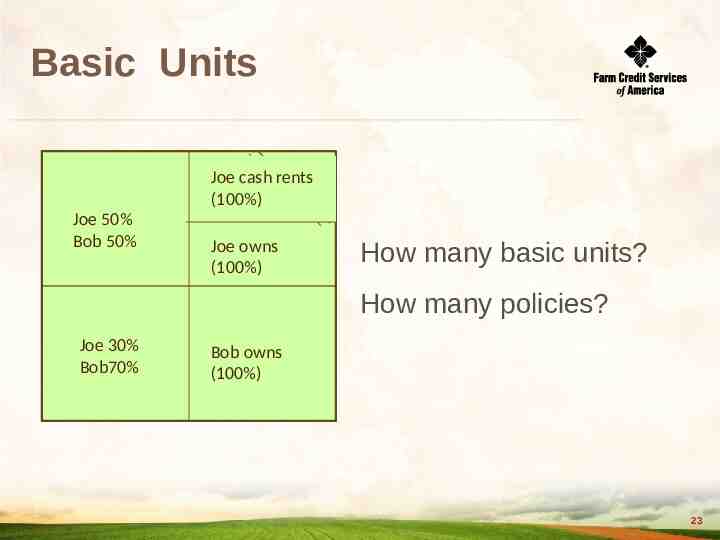

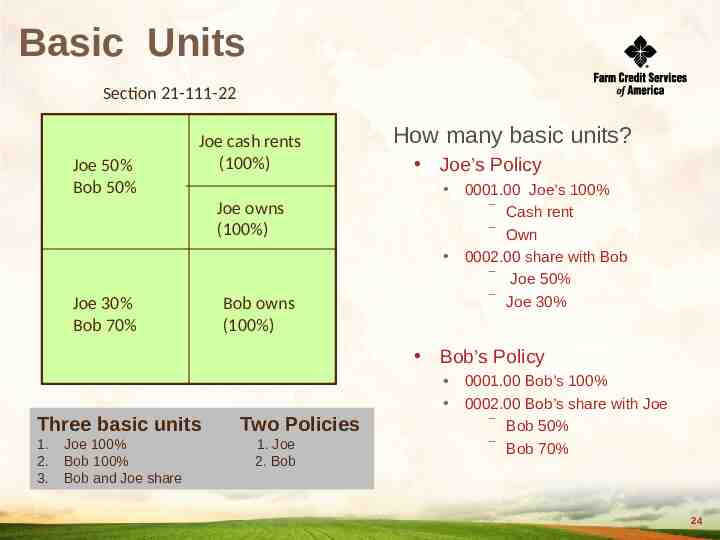

Basic Units Each share arrangement must be a separate basic unit Varying percentages of interest within a basic unit does not qualify for separate basic unit Example: Bob and Joe share 50/50 on one piece of ground and 30/70 on another piece of ground. Both pieces would be part of the same basic unit because both are shared by Bob and Joe. Basic unit numbers are whole numbers to the left of the decimal point (1.00, 2.00, 3.00, etc.) If basic units are elected rather than optional units, the insured may received a 10% discount in premium 22

Basic Units Joe cash rents (100%) Joe 50% Bob 50% Joe owns (100%) How many basic units? How many policies? Joe 30% Bob70% Bob owns (100%) 23

Basic Units Section 21-111-22 Joe 50% Bob 50% Joe cash rents (100%) How many basic units? Joe’s Policy Joe owns (100%) Joe 30% Bob 70% Bob owns (100%) Bob’s Policy Three basic units 1. 2. 3. Joe 100% Bob 100% Bob and Joe share Two Policies 1. Joe 2. Bob 0001.00 Joe’s 100% ‾ Cash rent ‾ Own 0002.00 share with Bob ‾ Joe 50% ‾ Joe 30% 0001.00 Bob’s 100% 0002.00 Bob’s share with Joe ‾ Bob 50% ‾ Bob 70% 24

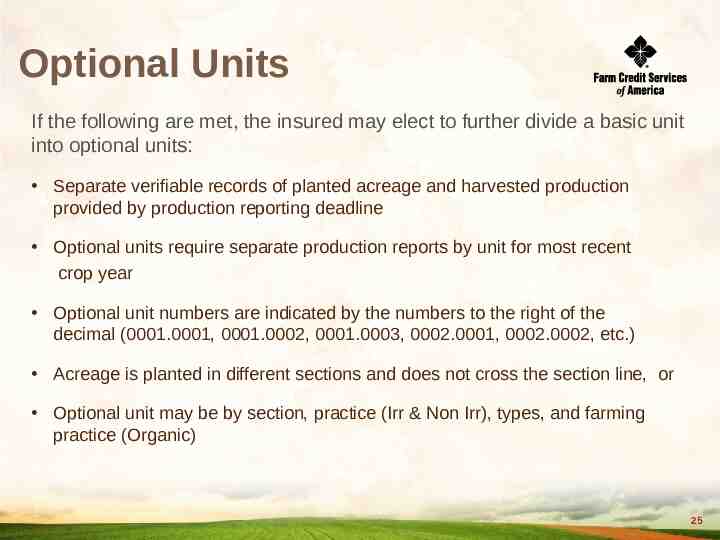

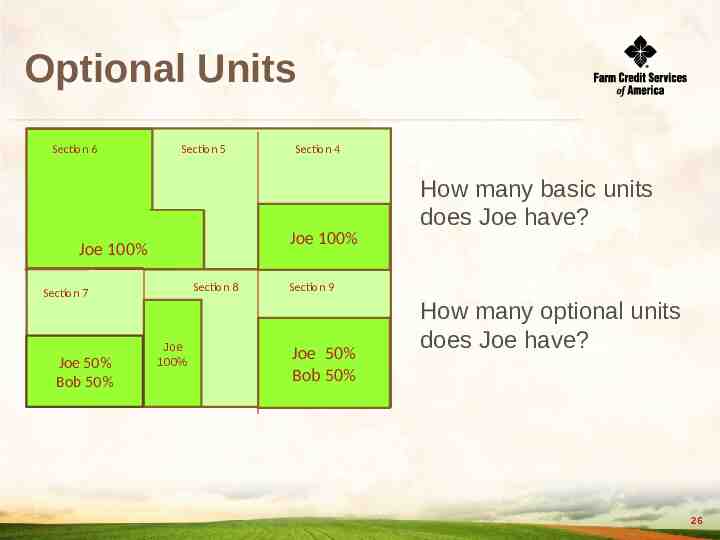

Optional Units If the following are met, the insured may elect to further divide a basic unit into optional units: Separate verifiable records of planted acreage and harvested production provided by production reporting deadline Optional units require separate production reports by unit for most recent crop year Optional unit numbers are indicated by the numbers to the right of the decimal (0001.0001, 0001.0002, 0001.0003, 0002.0001, 0002.0002, etc.) Acreage is planted in different sections and does not cross the section line, or Optional unit may be by section, practice (Irr & Non Irr), types, and farming practice (Organic) 25

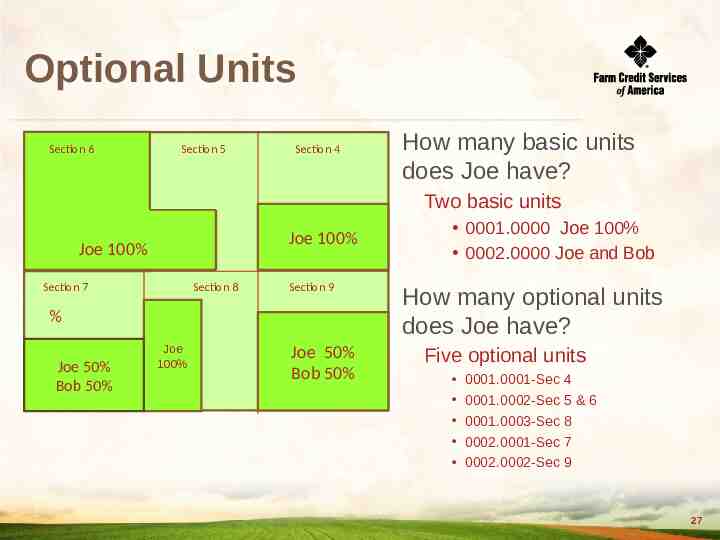

Optional Units Section 6 Section 5 Section 4 How many basic units does Joe have? Section 6SS Joe 100% Joe 100% Section 8 Section 7 Joe 50% Bob 50% Joe 100% Section 9 Joe 50% Bob 50% How many optional units does Joe have? 26

Optional Units Section 6 Section 5 Section 4 How many basic units does Joe have? Two basic units Section 6SS Joe 100% Joe 100% Section 7 Section 8 Section 9 % Joe 50% Bob 50% Joe 100% Joe 50% Bob 50% 0001.0000 Joe 100% 0002.0000 Joe and Bob How many optional units does Joe have? Five optional units 0001.0001-Sec 4 0001.0002-Sec 5 & 6 0001.0003-Sec 8 0002.0001-Sec 7 0002.0002-Sec 9 27

Enterprise Units An Enterprise Unit is defined as all insurable acreage of the insured crop in the county in which you have a share on the date coverage begins for the crop year. Available under Revenue Protection or Yield Protection Must be selected by the applicable sales closing date Must qualify: ‾ Two or more sections, if sections are the basis for optional units ‾ At least two of the sections must each have planted acres equal to 20 acres or 20% of the insured crop acres in the enterprise unit If there are planted acres in more than two sections, they can be aggregated to form at least two parcels 28

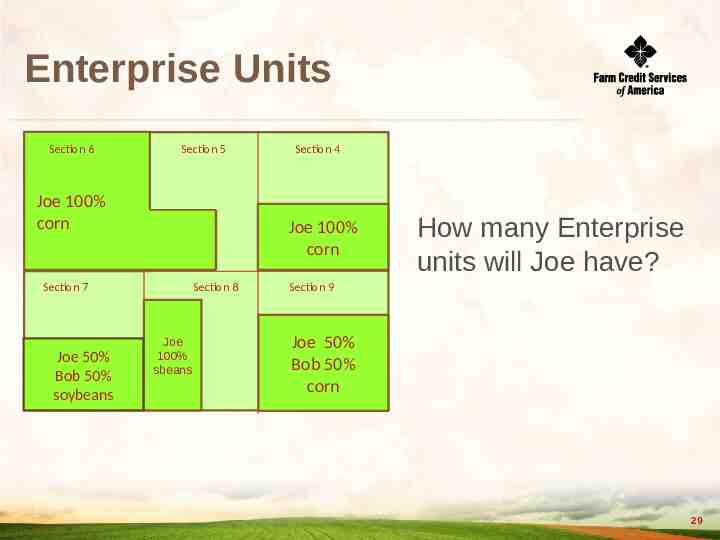

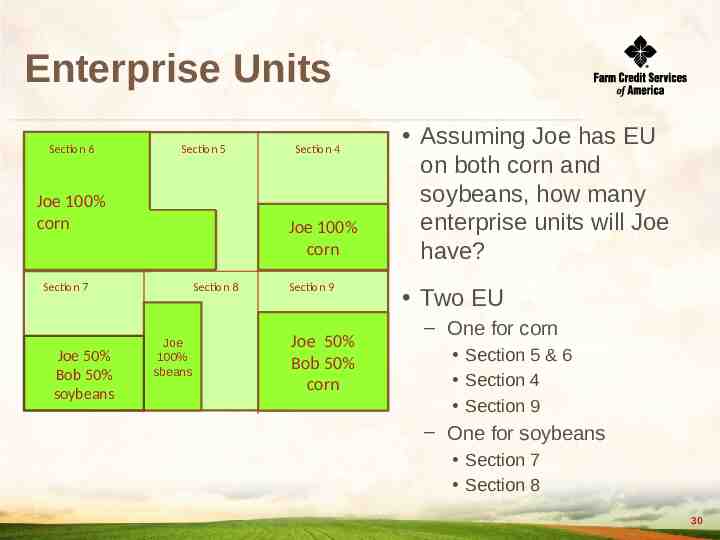

Enterprise Units Section 6 Section 5 Section Joe 100% 6SS corn Joe 100% corn Section 7 Joe 50% Bob 50% soybeans Section 4 Section 8 Joe 100% sbeans How many Enterprise units will Joe have? Section 9 Joe 50% Bob 50% corn 29

Enterprise Units Section 6 Section 5 Section Joe 100% 6SS corn Joe 100% corn Section 7 Joe 50% Bob 50% soybeans Section 4 Section 8 Joe 100% sbeans Section 9 Joe 50% Bob 50% corn Assuming Joe has EU on both corn and soybeans, how many enterprise units will Joe have? Two EU – One for corn Section 5 & 6 Section 4 Section 9 – One for soybeans Section 7 Section 8 30

31

32

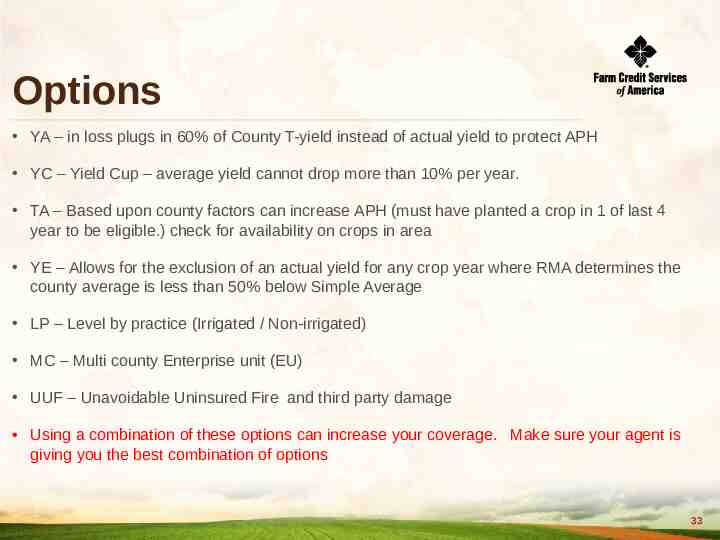

Options YA – in loss plugs in 60% of County T-yield instead of actual yield to protect APH YC – Yield Cup – average yield cannot drop more than 10% per year. TA – Based upon county factors can increase APH (must have planted a crop in 1 of last 4 year to be eligible.) check for availability on crops in area YE – Allows for the exclusion of an actual yield for any crop year where RMA determines the county average is less than 50% below Simple Average LP – Level by practice (Irrigated / Non-irrigated) MC – Multi county Enterprise unit (EU) UUF – Unavoidable Uninsured Fire and third party damage Using a combination of these options can increase your coverage. Make sure your agent is giving you the best combination of options 33

Different Coverage Levels by Practice Have the option of choosing a different converge level for each practice for all crops Cannot have a CAT as one of the levels One administrative fee per crop/county Must elect by sales closing date 34

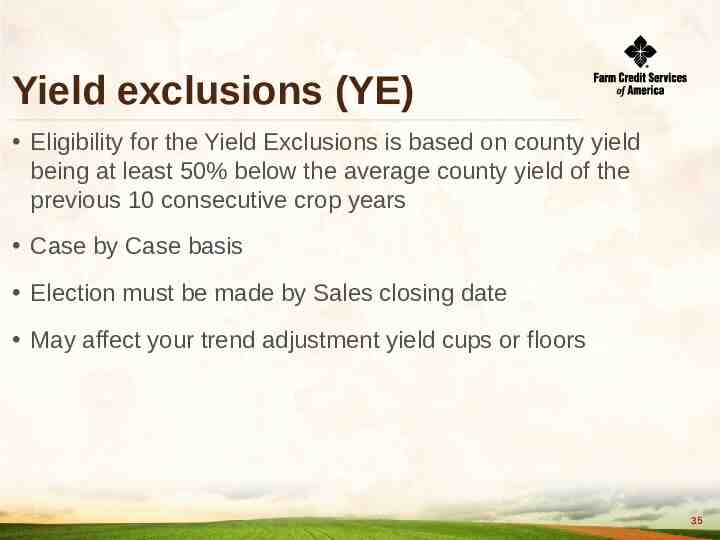

Yield exclusions (YE) Eligibility for the Yield Exclusions is based on county yield being at least 50% below the average county yield of the previous 10 consecutive crop years Case by Case basis Election must be made by Sales closing date May affect your trend adjustment yield cups or floors 35

36

Yield Descriptors 37

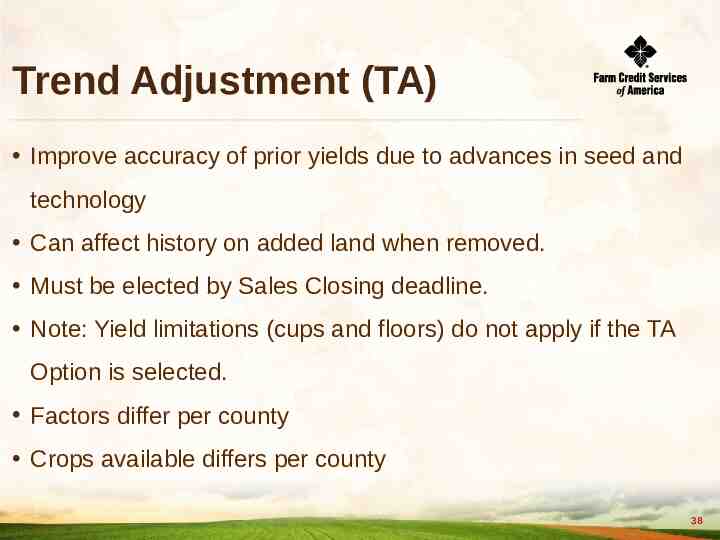

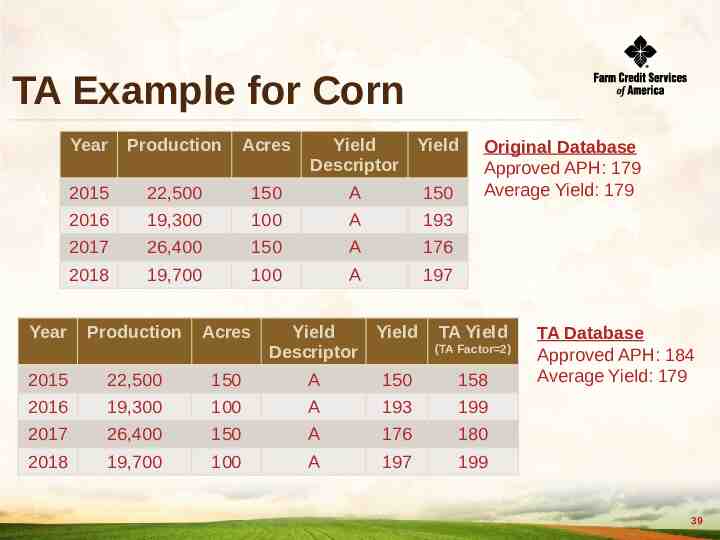

Trend Adjustment (TA) Improve accuracy of prior yields due to advances in seed and technology Can affect history on added land when removed. Must be elected by Sales Closing deadline. Note: Yield limitations (cups and floors) do not apply if the TA Option is selected. Factors differ per county Crops available differs per county 38

TA Example for Corn Year Year Production Acres 2015 22,500 150 A 150 2016 19,300 100 A 193 2017 26,400 150 A 176 2018 19,700 100 A 197 Production Acres Yield Yield Descriptor Yield Yield Descriptor Original Database Approved APH: 179 Average Yield: 179 TA Yield (TA Factor 2) 2015 22,500 150 A 150 158 2016 19,300 100 A 193 199 2017 26,400 150 A 176 180 2018 19,700 100 A 197 199 TA Database Approved APH: 184 Average Yield: 179 39

Beginning Farmers and Ranchers (BFR) Eligible for certain benefits designed to help start operations – BFR benefits may be available for up to 5 years – Available for most crops, except annual forage and nursery – Administrative fees are waived – Premium subsidy increased by 10 percentage points – Yields qualifying for Yield Adjustment (YA) will be replaced with 80% of applicable yield – May be eligible to use production history from other farming operations where insured was previously involved in decision-making or physical activities – Application deadline is Sales Closing Date 40

BFR – Rules ·Uninsurable crop count for the year they would have been harvested, even if they did not grow ·Uninsurable livestock-crop year is July – June using the ending calendar year ·Don’t count anything the year that they turn age 18 · College exclusion means they must have been enrolled for at least on semester (not to exceed 5 years) ·It is a continuous endorsement ·If a business all individuals must qualify for BFR and use the individual with fewest remaining years. 1 8

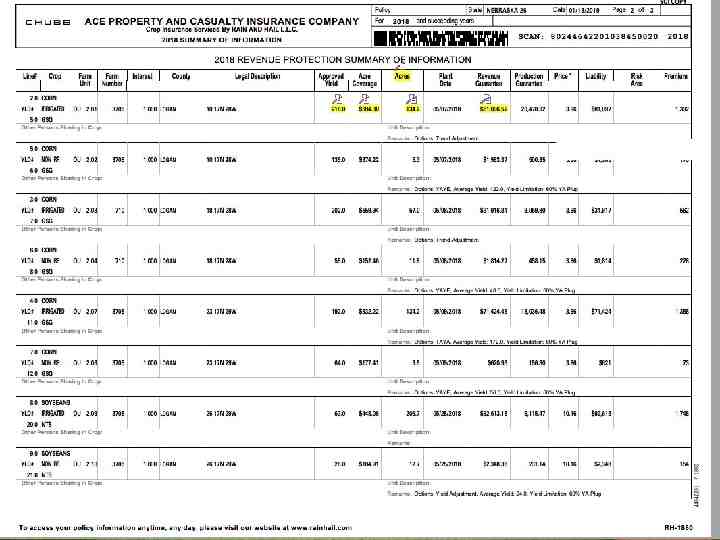

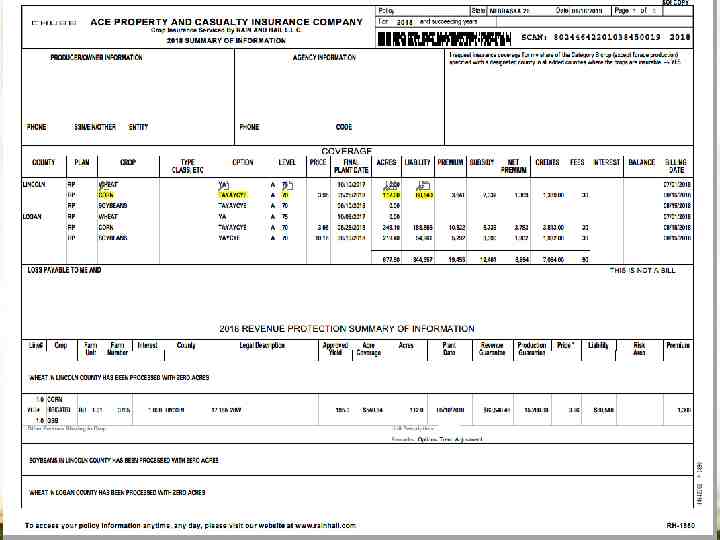

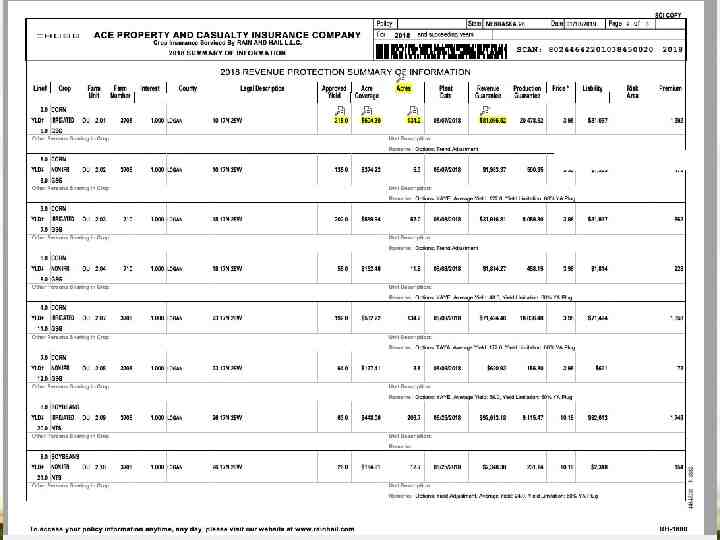

Schedule of Insurance Once acres are processed, a Schedule of insurance (SOI)* will generate and be mailed. Please review the following to make sure they are correct: Planted Acres/Plant Date Prevented Planting Acres Uninsured Acreage Legal Description Added Land Units Risk Area Share Percent * A Schedule of Insurance may also be known as Summary of Coverage (SOC ) 42

43

44

Important Dates Sales closing ‾ Fall- September 30 ‾ Spring- March 15 Production reporting ‾ Fall- November 14 ‾ Spring- April 29 Acreage reporting Premiums must be paid in full, by September 30th for fall crops and March 15th for spring crops. If premiums are not paid by these dates your policy will be cancelled, for the next crop year. Not many exceptions! ‾ Fall- November 15 ‾ Spring- July 15 Premium billing date ‾ ‾ ‾ ‾ Premium is earned and due when coverage attaches Billing Date will not be earlier than August 15 for most crops Billing Date for wheat is July 1 Check with your agent to be sure of the dates in your county Deadlines that fall on weekends or Federal holidays are extended to the next business day. 45

Written Agreements If a crop/practice is considered uninsurable we can submit a Written Agreement to the RMA to request coverage. Deadlines may vary. Examples of this are: Uninsurable crop such as popcorn, amylose corn – – – – Need to provide any past production University Data Where you will market the crop or contracts Any other information Newly Broke ground-pasture, grass Re-Rate high risk ground 46

Causes of Loss Adverse Weather Fire (due to natural causes) Insects, but not damage due to insufficient or improper application of pest control Plant disease, but not damage due to insufficient or improper application of disease control measures Wildlife Earthquake Volcanic eruption Failure of the irrigation water supply Failure of irrigation equipment or facilities, due to an insured cause of loss For Revenue Protection, a change in the harvest price from the projected price unless FCIC can prove the price change was the direct result of an uninsured cause of loss Good Farming Practice must be carried out at all times. 47

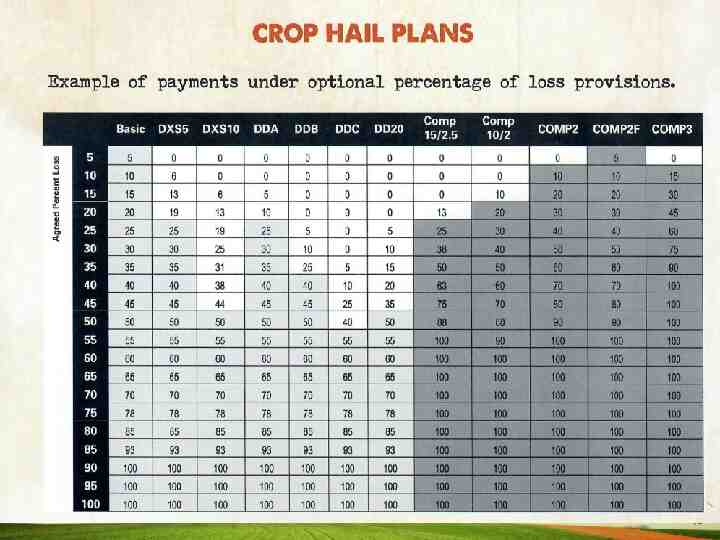

Crop Hail Crop Hail coverage protects against damage due to hail, fire and lightning. It also protects against damage occurring during transit. Crop Hail is not subsidized or regulated by RMA – state insurance departments and state insurance laws Crop Hail policies and rates differ by company and state. Many different types of coverages and deductibles are available. Wind is an endorsement with crop hail, know when the cut off date is, they vary per company. For Nebraska the 2019 rates have changed. Check with your agent on crop hail rates as well as production hail rates. Some crop hail rates have gone down and almost all production hail rates have gone up. 48

49

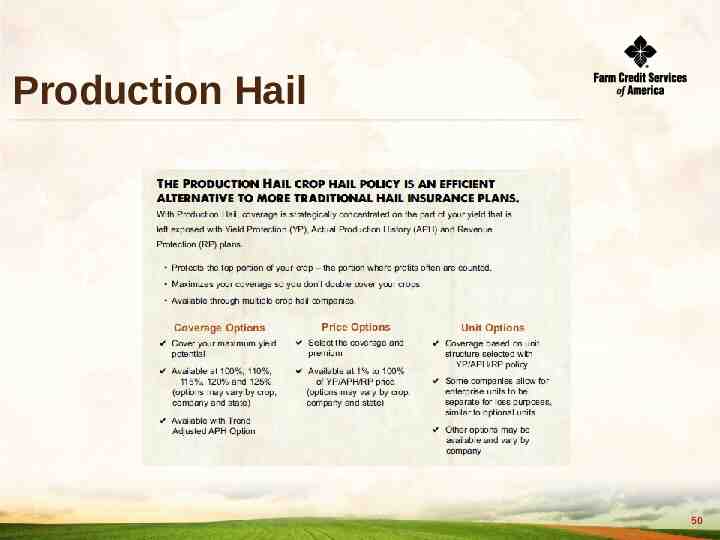

Production Hail 50

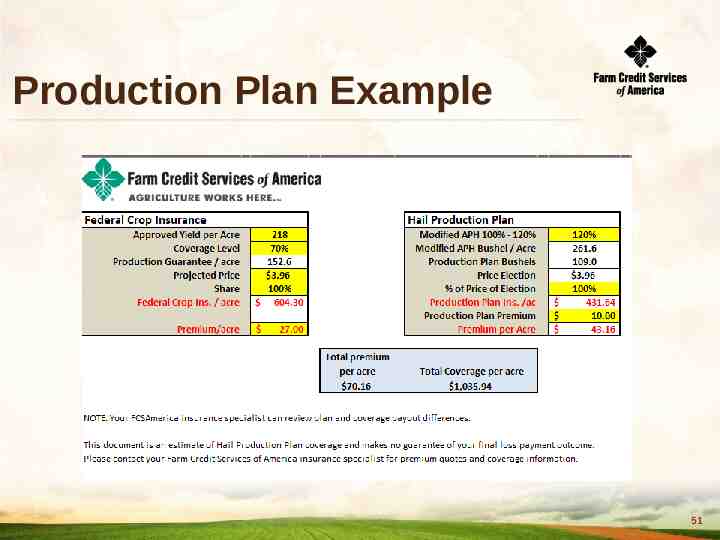

Production Plan Example 51

Takeaways Today Get POA from your spouse on your policy Always review the schedule of insurance – Acres and crop correct? – Review your premium – If a problem is found call your agent right away Use Revenue Protection whenever available Know what your revenue coverage is when marketing your crop Do a yearly review of your policy and ask your agent if there were any changes Understand what you are buying and ask questions. 52

THANK YOU! ANY QUESTIONS? 53