Cost Principles – 2 CFR Part 200 Subpart E U.S. Department

28 Slides583.74 KB

Cost Principles – 2 CFR Part 200 Subpart E U.S. Department of Education

Purpose and Use of this Presentation The Department of Education is providing this presentation to help its grantees understand the contents of the Uniform Guidance and should be viewed after or alongside of the regulations. It is not a substitute for reading the regulations. To get the most out of this presentation, view this as a notes page. The notes section of each slide provides information to supplement the points on the slide. To change to notes page: Go to View and click on Notes Page. 2

Learning Outcomes 3 Understand the basic concepts of Cost Principles; Understand changes required by 2 CFR Part 200; Know where to locate differences depending on entity type; and Be able to find and cite the relevant regulations in 2 CFR Part 200 Subpart E.

Uniform Guidance Title 2 of the Code of Federal Regulations, Part 200 (2 CFR Part 200) Accepted by the Department of Education in 2 CFR Part 3474 4

Authorities to consider when using 2 CFR Part 200 “This guidance does not change or modify any existing statute or guidance otherwise based on any existing statute.” 5

When does 2 CFR Part 200 start? Uniform Guidance (2 CFR Part 200) applies to: New and Continuation grants awarded on or after December 26, 2014 Former regulations (EDGAR Part 74 or 80 and OMB circulars) apply to: 6 Grants awarded prior to December 26, 2014

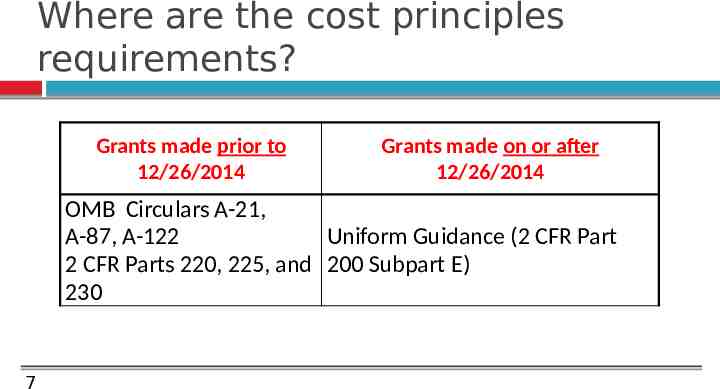

Where are the cost principles requirements? Grants made prior to 12/26/2014 Grants made on or after 12/26/2014 OMB Circulars A-21, A-87, A-122 Uniform Guidance (2 CFR Part 2 CFR Parts 220, 225, and 200 Subpart E) 230 7

Cost Principles Background, Key Concepts and Changes 8

Cost Principles: Fundamental Principles Fundamental requirements for grantees (2 CFR 200.400): 9 responsibility for the efficient and effective administration through the application of sound management practices; responsibility for administering an award in a manner consistent with underlying agreements, program objectives, and the terms and conditions; having accounting practices consistent with

Cost Principles: Fundamental Principles 10 responsibility for employing sound organization and management techniques to assure proper and efficient administration; not earn or keep profit, unless authorized by the terms and conditions of the award; and (Institutes of Higher Education) recognize dual role of students as trainees and employees, as appropriate.

Cost Principles: Overview 11 Allowable Reasonable and Necessary Allocable Direct v. Indirect Special Considerations by Entity Type Selected Items of Cost Expanded Authorities

Cost Principles: Allowability (§200.403) General Considerations in Determining Allowability: 12 Is the cost reasonable and necessary for the program? Is the expense in compliance with laws, regulations and grant terms? To what extent is the expense allocable to the grant? Is the cost adequately documented? Is it consistent with grantee rules that apply to both Federally funded and non-Federally funded activities?

Cost Principles: Reasonable (§200.404) “A cost is reasonable if, in its nature and amount, it does not exceed that which would be incurred by a prudent person under the circumstances prevailing at the time the decision was made to incur the cost.” Consideration: Do sound business practices support the expenditure? 13

Cost Principles: Allocable Costs (§200.405) Allocable means the good or service can be assigned to an award or cost objective in accordance with the relative benefit achieved. (d) If a cost benefits two or more projects, activities, or programs in proportions that can be determined without undue effort or cost, the cost should be allocated to the projects based on the proportional benefit. 14

Blended Funds (§200.430(i)(7)) Qualifications: Funds are from more than one program or agency Activities are the same or closely related Single or multiple grants Requirements: Single Cost Accounting Code to account for blended funds Prior approval from all agencies providing funding to blend funds See the Department’s FAQs and contact your program officer at the Department for more information on blending. 15

Cost Principles: Prior Approvals Prior approval requirements (§200.407) When grantees must consult with the Department and receive approval BEFORE making a change to the grant Expanded Authorities (§200.308) When the requirement for prior approval before making a change is waived 16

Expanded Authorities (§200.308) 17 Pre-award Costs Carryover Budget Transfers No-Cost Time Extension

Pre-Award Costs (§200.308(d)(1)) Incurred up to 90 days before budget period begins without prior approval Applies to both new and non-competing continuations 18 Reasonable expectation of receiving a grant Incurred at the entity’s own risk Not for cost over-runs

No-Cost Time Extension(§200.308(d)(2)) Grantees should send written notice to program officer: 19 No later than 10 days before project ends. Stating the reasons for extension. Providing a revised expiration date.

No-Cost Time Extension(§200.308(d)(2)) 20 The one-time extension may not be used merely for the purpose of using unobligated funds No change in scope or objectives are permitted No additional funds will be made available Additional extensions or an extension in

Carryover (§200.308(d)(3)) 21 Unexpended funds are carried over from one budget period to the next without prior approval Funds may be used for any allowable cost within the approved project scope ED may require a written statement explaining: How the funds will be spent ED, set out at 34 CFR 75.253, may reduce new funds in some cases

Budget Transfers (§200.308) Most budget transfers at ED do not require prior approval ED may restrict a grantee’s ability to transfer funds among direct cost categories or programs 22 Review the terms and conditions listed in the GAN

Cost Principles: By Entity Type Special Considerations identified for: States, Local Governments, and Indian Tribes Institutes of Higher Education 23 2 CFR 200.416 and 200.417 2 CFR 200.418 and 200.419

Cost Principles: Certification (§200.415) 24 Certification for financial reports and vouchers: ED Form 524B, revised Identify pass-through entities’ requirements for oversight regarding required certification Grantees should ensure appropriate oversight of subawards, as appropriate, as part of internal controls. The certification is required every time funds are drawn down from G5.

Cost Principles: Certification (§200.415) 25 “By signing this report, I certify to the best of my knowledge and belief that the report is true, complete, and accurate, and the expenditures, disbursements and cash receipts are for the purposes and objectives set forth in the terms and conditions of the Federal award. I am aware that any false, fictitious, or fraudulent information, or the omission of any material fact, may subject me to criminal, civil or administrative penalties for fraud, false statements, false claims or otherwise. (U.S. Code Title 18, Section 1001 and Title 31, Sections 3729-3730 and 3801-3812).”

Cost Principles: Select Items of Cost 26 These sections (§§200.421 through 200.475) identify the allowability of certain items: Allowability applies to direct costs, indirect costs, and matching funds. Allowability of any costs not included in the select items should based on the treatment provided for similar or related items of cost and the principles of allocability, reasonableness, and necessity (§200.420).

Cost Principles Responsibilities for Compliance 27

Compliance: Grantees Strong Internal Controls Communication with ED Staff 28 Prior Approvals and Expanded Authorities Documentation Audit Readiness Audit Follow up on Questioned Costs, Corrective Action Plan