Compliance with Maine Workers’ Compensation Board Requirements

26 Slides544.74 KB

Compliance with Maine Workers’ Compensation Board Requirements Office of Monitoring, Audit and Enforcement Rev 10-22-18

How is Compliance Measured? Monitoring The Monitoring Division measures the timely filing of: Lost Time First Report of Injury (FROI) Initial Memorandum of Payment (MOP) Initial Indemnity Notice of Controversy (NOC) Wage Statement (WCB-2) Schedule of Dependents (WCB-2A) Fringe Benefit Worksheet (WCB-2B) the timely payment of: Initial Indemnity Payment

How is Compliance Measured? Auditing The Audit Division determines compliance with statutory and regulatory requirements in the following areas: Form Filing Timeliness of Benefit Payments Accuracy of Indemnity Payments Timeliness & Accuracy of Medical Bill Payments Other Significant Issues

Maine Claim Scenarios Scenario 1 – No Day Lost and Medicals Accepted FROI not required to be filed with MWCB

Maine Claim Scenarios Scenario 2 – No Day Lost and Medicals Denied File NOC within 30 days of receipt of a medical bill (or other notice of a claim for medical benefits) File FROI with the NOC (See Rule 8.13)

Maine Claim Scenarios Scenario 3 – Employee Has Lost a Day’s Work, Returns To Work Within 7 Days, Medicals Accepted File FROI within 7 days of employer’s notice or knowledge of the injury that has caused the employee to lose a day’s work. (See Section 303, Rule 3.1) File updated FROI within 7 days of RTW (See Rule 8.16)

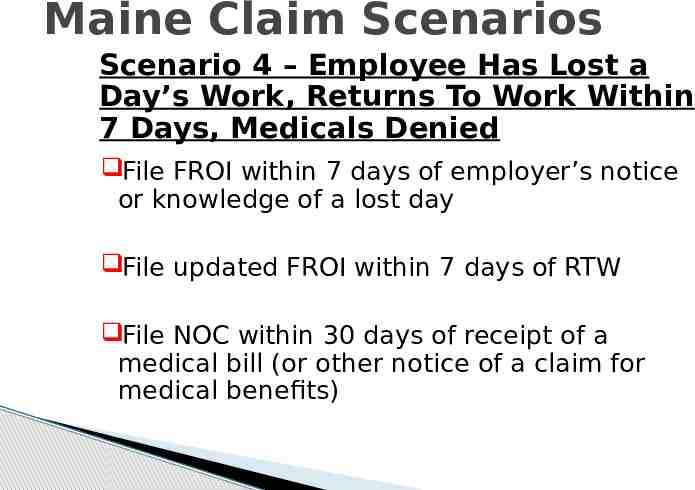

Maine Claim Scenarios Scenario 4 – Employee Has Lost a Day’s Work, Returns To Work Within 7 Days, Medicals Denied File FROI within 7 days of employer’s notice or knowledge of a lost day File updated FROI within 7 days of RTW File NOC within 30 days of receipt of a medical bill (or other notice of a claim for medical benefits)

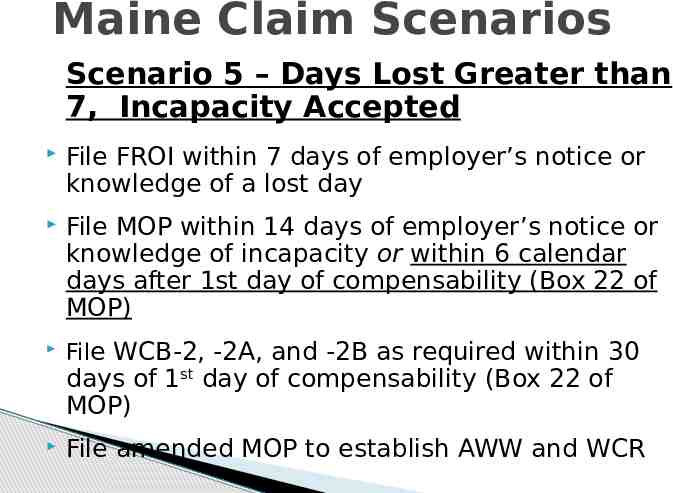

Maine Claim Scenarios Scenario 5 – Days Lost Greater than 7, Incapacity Accepted File FROI within 7 days of employer’s notice or knowledge of a lost day File MOP within 14 days of employer’s notice or knowledge of incapacity or within 6 calendar days after 1st day of compensability (Box 22 of MOP) File WCB-2, -2A, and -2B as required within 30 days of 1st day of compensability (Box 22 of MOP) File amended MOP to establish AWW and WCR

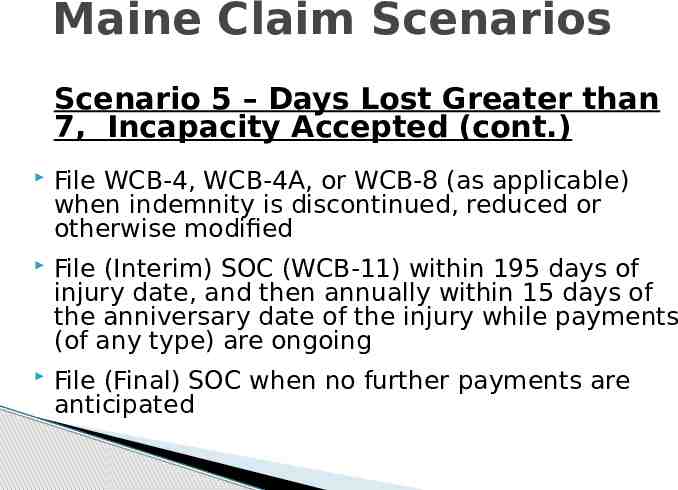

Maine Claim Scenarios Scenario 5 – Days Lost Greater than 7, Incapacity Accepted (cont.) File WCB-4, WCB-4A, or WCB-8 (as applicable) when indemnity is discontinued, reduced or otherwise modified File (Interim) SOC (WCB-11) within 195 days of injury date, and then annually within 15 days of the anniversary date of the injury while payments (of any type) are ongoing File (Final) SOC when no further payments are anticipated

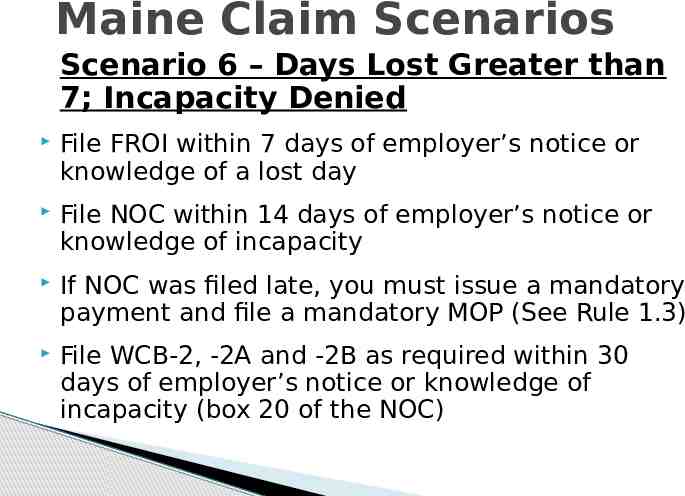

Maine Claim Scenarios Scenario 6 – Days Lost Greater than 7; Incapacity Denied File FROI within 7 days of employer’s notice or knowledge of a lost day File NOC within 14 days of employer’s notice or knowledge of incapacity If NOC was filed late, you must issue a mandatory payment and file a mandatory MOP (See Rule 1.3) File WCB-2, -2A and -2B as required within 30 days of employer’s notice or knowledge of incapacity (box 20 of the NOC)

Maine Claim Scenarios Scenario 6 – Days Lost Greater than 7 days, Incapacity Denied (cont.) File amended mandatory MOP to establish AWW and WCR, and to revise the “Amount Paid” (Box 20C), if applicable File (Interim) SOC within 195 days of injury date, and then annually within 15 days of the anniversary date of the injury while payments (of any type) are ongoing File (Final) SOC when no further payments are anticipated

How is Compliance Measured? Monitoring Insurance entity compliance information is measured in: 4 Quarterly Compliance Reports 1 Annual Compliance Report Individual entity and insurance community compliance data is analyzed for trends and patterns

How is Compliance Measured? Auditing Insurance entities (insurers, selfinsurers, and third-party administrators) are audited periodically An entity’s schedule may be accelerated by Complaint(s) for Audit, Corrective Action Plans, or other performance and claims handling issues

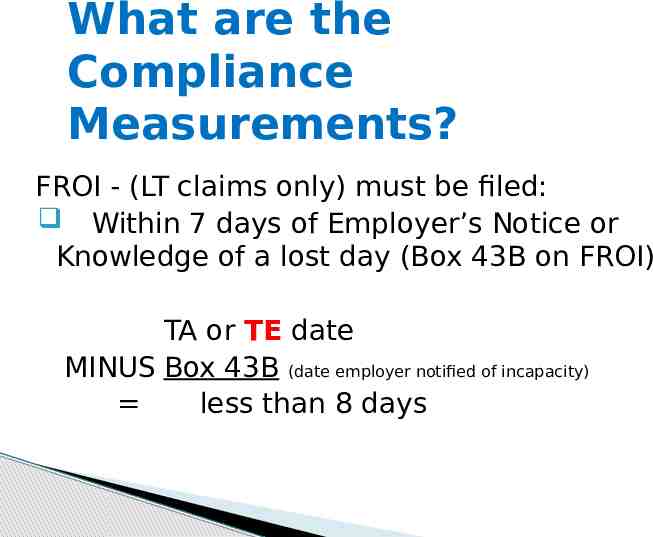

What are the Compliance Measurements? FROI - (LT claims only) must be filed: Within 7 days of Employer’s Notice or Knowledge of a lost day (Box 43B on FROI) TA or TE date MINUS Box 43B (date employer notified of incapacity) less than 8 days

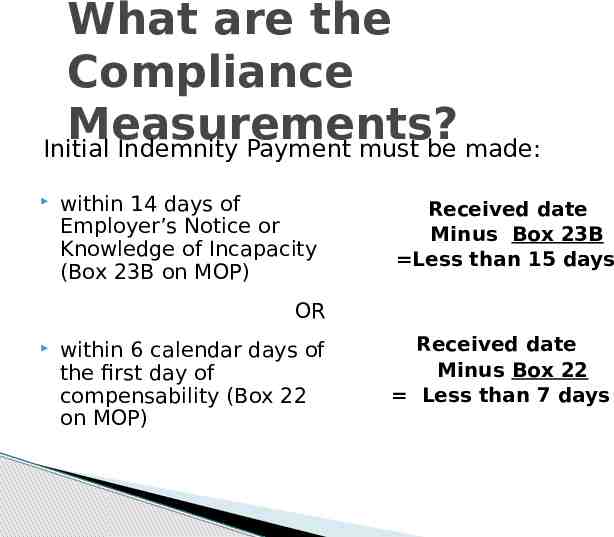

What are the Compliance Measurements? Initial Indemnity Payment must be made: within 14 days of Employer’s Notice or Knowledge of Incapacity (Box 23B on MOP) Received date Minus Box 23B Less than 15 days OR within 6 calendar days of the first day of compensability (Box 22 on MOP) Received date Minus Box 22 Less than 7 days

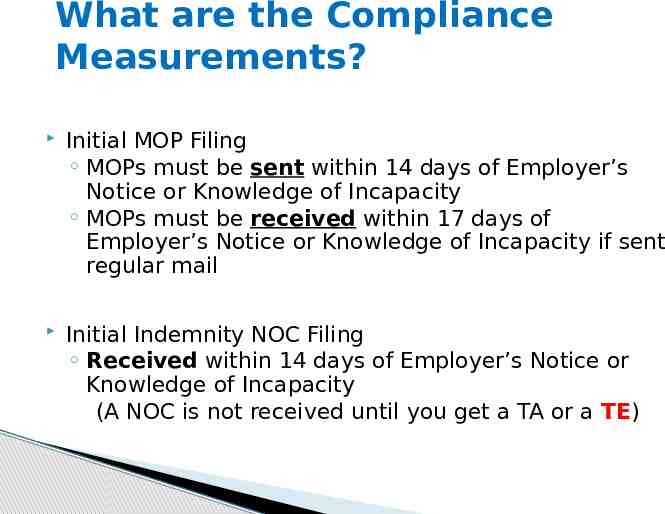

What are the Compliance Measurements? Initial MOP Filing MOPs must be sent within 14 days of Employer’s Notice or Knowledge of Incapacity MOPs must be received within 17 days of Employer’s Notice or Knowledge of Incapacity if sent regular mail Initial Indemnity NOC Filing Received within 14 days of Employer’s Notice or Knowledge of Incapacity (A NOC is not received until you get a TA or a TE)

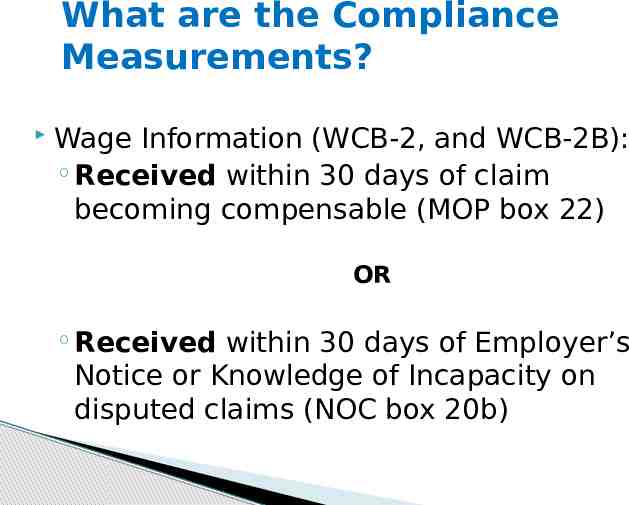

What are the Compliance Measurements? Wage Information (WCB-2, and WCB-2B): Received within 30 days of claim becoming compensable (MOP box 22) OR Received within 30 days of Employer’s Notice or Knowledge of Incapacity on disputed claims (NOC box 20b)

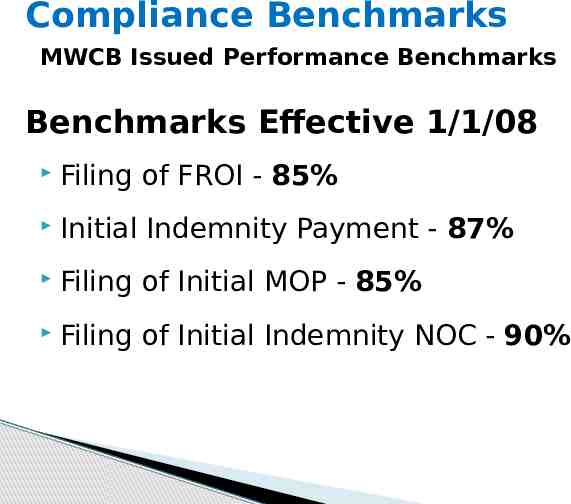

Compliance Benchmarks MWCB Issued Performance Benchmarks Benchmarks Effective 1/1/08 Filing of FROI - 85% Initial Indemnity Payment - 87% Filing of Initial MOP - 85% Filing of Initial Indemnity NOC - 90%

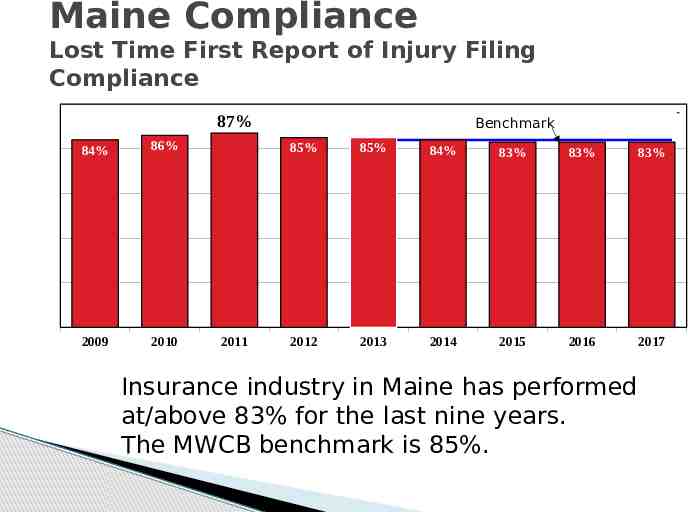

Maine Compliance Lost Time First Report of Injury Filing Compliance 87% 84% 86% 2009 2010 2011 Benchmark 85% 85% 84% 83% 83% 83% 2012 2013 2014 2015 2016 2017 Insurance industry in Maine has performed at/above 83% for the last nine years. The MWCB benchmark is 85%.

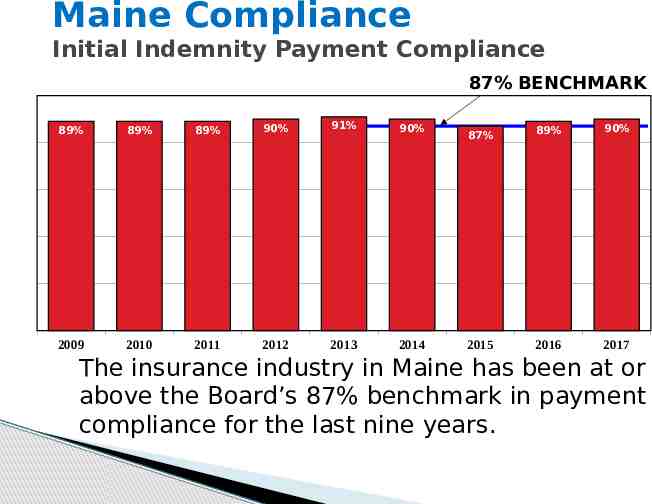

Maine Compliance Initial Indemnity Payment Compliance 87% BENCHMARK 89% 89% 89% 90% 91% 90% 2009 2010 2011 2012 2013 2014 87% 89% 90% 2015 2016 2017 The insurance industry in Maine has been at or above the Board’s 87% benchmark in payment compliance for the last nine years.

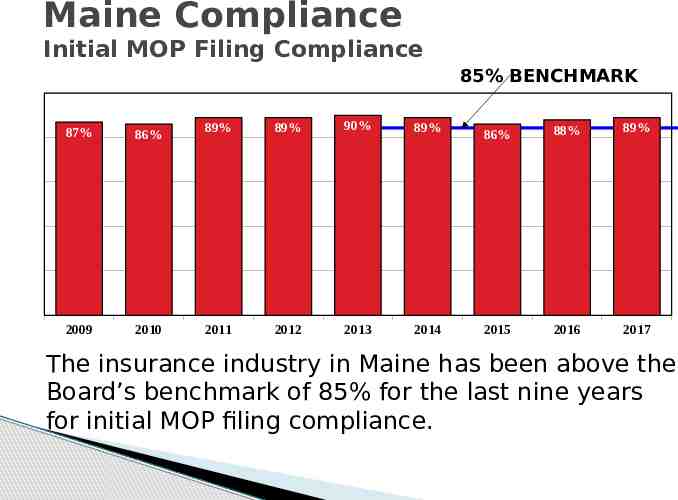

Maine Compliance Initial MOP Filing Compliance 85% BENCHMARK 87% 86% 89% 89% 90% 89% 86% 88% 89% 2009 2010 2011 2012 2013 2014 2015 2016 2017 The insurance industry in Maine has been above the Board’s benchmark of 85% for the last nine years for initial MOP filing compliance.

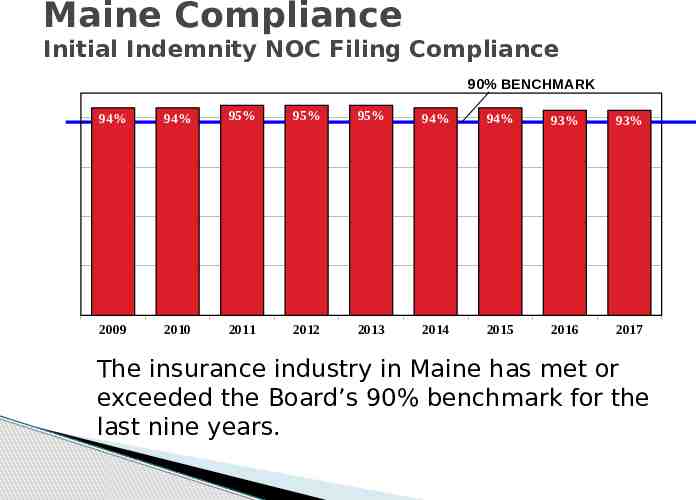

Maine Compliance Initial Indemnity NOC Filing Compliance 90% BENCHMARK 94% 94% 95% 95% 95% 94% 94% 93% 93% 2009 2010 2011 2012 2013 2014 2015 2016 2017 The insurance industry in Maine has met or exceeded the Board’s 90% benchmark for the last nine years.

Why is Compliance Important? Poor compliance can trigger Corrective Action Plans (CAP) and/or audits CAPs are agreements and action plans between MWCB and the Insurer/Adjuster to improve poor compliance and improve claims handling Failure to engage in a CAP or abide by one can result in an accelerated audit

Why is Compliance Important? Compliance data is published for: Internal Customers (Claims Management, Executive Management, etc.) External Customers (Regulators, Competitors, Claimants, etc.)

Why is Compliance Important? Penalties can result Excessive late filings/payments may be interpreted as a questionable claims-handling technique Under §359, an insurer, self-insurer, TPA or adjuster can have their license revoked by the Bureau of Insurance

Maine Compliance Review Questions?