COMPANY SECRETARIES

46 Slides697.50 KB

COMPANY SECRETARIES

APPOINTMENT OF SECRETARY SEC.221 Every company should have a secretary. Every company having a turnover of One Million Rupees or more per annum or a stated capital of Five Hundred Thousand Rupees or more should have a qualified secretary. A person cannot be appointed as the secretary without his consent. And the person must have necessary qualifications.

QUALIFICATIONS a. Be a citizen of Sri Lanka and be ordinarily resident in Sri Lanka. b. 1. Attorney -at -Law 2.Member of the Institute of Charted Accountants of Sri Lanka (ICASL) 3. Member of the Institute of Charted Secretaries and Administratiors in Sri Lanka 4. Member of the of the Charted Institute of Management Accountants (CIMA) 6.Secretary,assistant sec ,deputy sec under the previous Act (Registrar must be satisfied)

THE CHANGE OF THE ROLE OF A SECRETARY Barnett,Hoares &Co. v. South London Transways Co.(1887) Panorama Developments(Guilford) Ltd v Fidelis Furnishing Fabrics Ltd (1971) HE MAY NOT DO . Borrow money on the company’s behalf Bind the company on trading contracts Strike a name off the register of members Summon a general meeting on his own authority.

AUDITORS

WHAT IS AN AUDITOR? An auditor is a person who makes an independent report to a company's members (shareholders) as to whether its financial statements have been properly prepared in accordance with the Companies Act and relevant Accounting and Auditing Standards. The report must also say whether a company's Financial Statements give a “true and fair” view of its affairs. SBEs (as per Accounting and Auditing Standards Act,) are required to have their accounts audited.

AUDITORS Sec 159- Appointment of first auditor. The first auditor of a company may be appointed by the board of the company before the first annual general meeting. If the board does not appoint an auditor, the company should appoint the first auditor at a meeting of the company. Subsequent auditors – Sec 158 An auditor of a company, other than the first auditor appointed by the board of the co. should be deemed to be re-appointed at an annual general meeting of the company, unless(a) he is not qualified for appointment; (b) the company passes a resolution at the meeting appointing another person to replace him as auditor; or (c) the auditor has given notice to the company that he does not wish to be re-appointed.

PARTNERSHIP AS AUDITORS Sec 156 - A partnership may be appointed by the firm’s name to be the auditor of a company, provided all the partners of the firm are qualified to be appointed as auditors of the company.

AUDITORS 157. (1) A person should not be appointed or act as auditor of a company, unless that person – (a) is a member of the Institute of Chartered Accountants of Sri Lanka; or (b) is a registered auditor. DISQUALIFICATIONS If he is not a charted accountant or registered auditor If he is a director or employee of the co. If he is a partner or in the employment of a director or employee of the company; if he is a liquidator or an administrator or receiver in respect of the property of the company; If that person is a body corporate; if he is not qualified to be appointed or act as auditor of a related company because of any office or relationship referred in above

AUDITOR’S FEES AND EXPENSES Sec 55 - The fees and expenses of an auditor of a company should be fixed – (a) if the auditor is appointed at a meeting of the company at such meeting, or (b) if the auditor is appointed by the directors, by the directors; or (c) if the auditor is appointed by the Registrar by the registrar

WHAT DOES AN AUDITOR DO? The auditor will check the accounts and accounting records of the company and prepare a report for the company's members. The report will say if the company's annual accounts have been properly prepared in accordance with the Companies Acts and if they give a true and fair view of the company's financial affairs. The auditor will also consider if the information given in the directors' report is consistent with the annual accounts. If in the auditor's opinion, the accounts or directors' report does not comply with the Companies Act, the auditor will say so in the report.

DUTIES OF AN AUDITOR Should prepare Auditor’s report - Sec 163 Avoid conflict of interest Sec 162 Issue of certificate of solvency Determine fair value

AUDITOR’S REPORT Sec 163 - The auditor of a company shall make a report to the shareholders on the financial statement audited by him

AUDITOR TO AVOID CONFLICT OF INTEREST Sec 162 - An auditor of a company should in carrying out the duties of an auditor under this Act, ensure that his judgment is not impaired by reason of any relationship with or interest in the company or any of its subsidiaries.

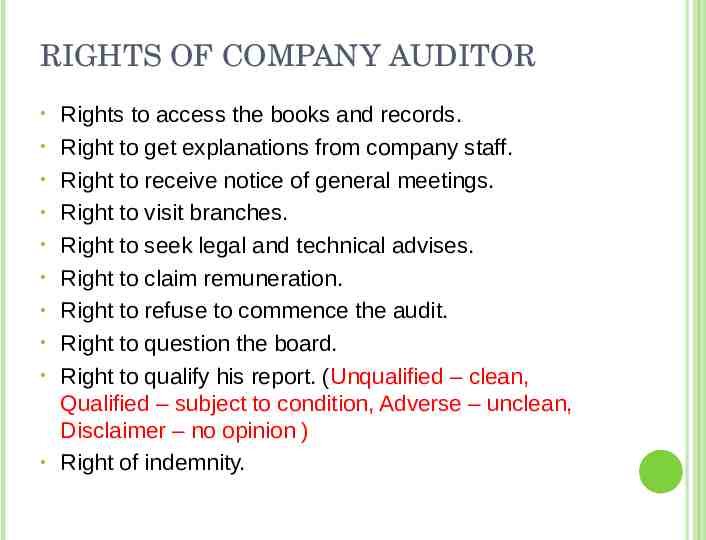

RIGHTS OF COMPANY AUDITOR Rights to access the books and records. Right to get explanations from company staff. Right to receive notice of general meetings. Right to visit branches. Right to seek legal and technical advises. Right to claim remuneration. Right to refuse to commence the audit. Right to question the board. Right to qualify his report. (Unqualified – clean, Qualified – subject to condition, Adverse – unclean, Disclaimer – no opinion ) Right of indemnity.

ROYAL MAIL STEAM PACKET COMPANY True and correct to true and fair

KINGSTON COTTON MILLS CO. "It is the duty of an auditor to bring to bear on the work he has to perform that skill, care and caution which a reasonably careful, cautious auditor would use. What is reasonable skill, care and caution must depend on the particular circumstances of each case. An auditor is not bound to be a detective, or, as was said to approach his work with suspicion, or with a forgone conclusion that there is something wrong. He is a watchdog, not a bloodhound. He is justified in believing tried servants of the company in whom confidence is placed by the company. He is entitled to assume that they are honest and rely upon their representations, provided he takes reasonable care."

LONDON AND GENERAL BANK CASE It was held that a auditor should be honest. He should not certify what he is not believe to be true and should exercise reasonable skill and care before he certify what he is believe to be true, it is not a part of auditors duty to give advice to shareholders or to directors. The auditors duty is confined to examination of financial information and expressing an opinion on the financial statements.

COMPANY MEETING S

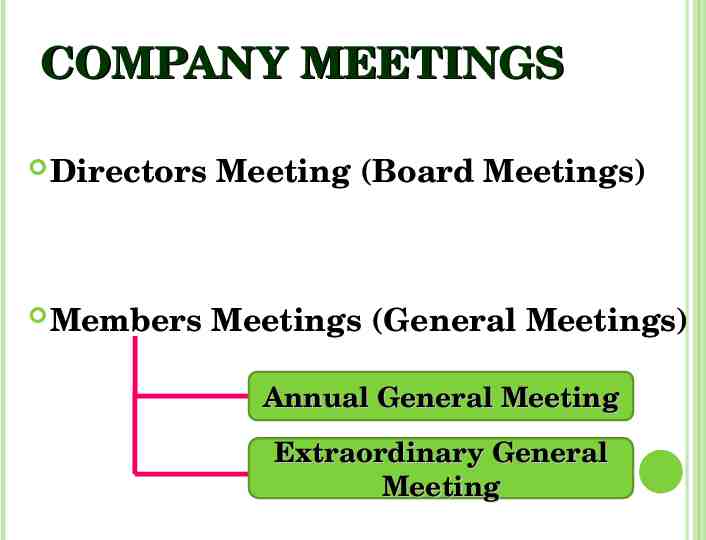

COMPANY MEETINGS Directors Meeting (Board Meetings) Members Meetings (General Meetings) Annual General Meeting Extraordinary General Meeting

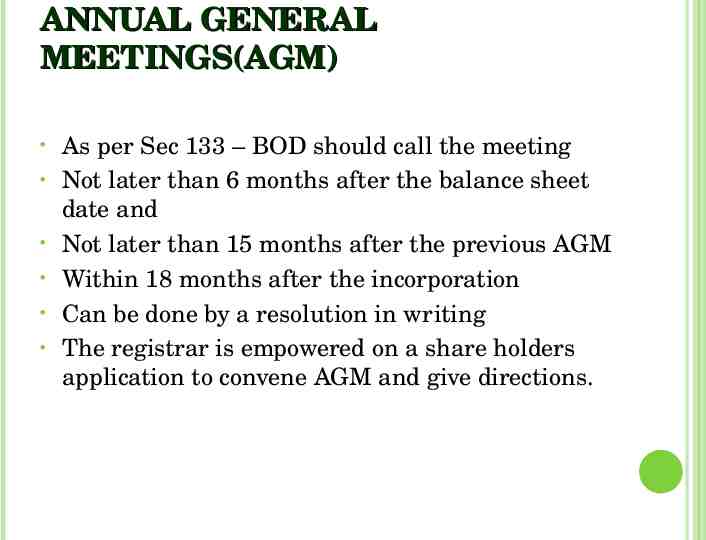

ANNUAL GENERAL MEETINGS(AGM) As per Sec 133 – BOD should call the meeting Not later than 6 months after the balance sheet date and Not later than 15 months after the previous AGM Within 18 months after the incorporation Can be done by a resolution in writing The registrar is empowered on a share holders application to convene AGM and give directions.

(1) Subject to the provisions of subsection (2) and of section 144, the board of a company shall call an annual general meeting of shareholders to be held once in each calendar year (a) not later than six months after the balance sheet date of the company ; and (b) not later than fifteen months after the previous annual general meeting. (2) A company is not required to hold its first annual general meeting in the calendar year of its incorporation, but shall hold that meeting within eighteen months of its incorporation.

EXTRA-ORDINARY GENERAL MEETINGS EGM is convened for transacting some special or urgent business that may arise in between two AGMs, for instance, change in the objects or shift of registered office or alteration of capital

CONVENING OF EXTRAORDINARY GENERAL MEETING ON REQUISITION S 134(1) - Notwithstanding anything in its articles, the directors of a company should on the requisition of shareholders holding shares which carry not less than ten per centum of the votes which may be cast on an issue, proceed duly to convene an extraordinary general meeting of the company to consider and vote on that issue. The meeting shall be convened not later than fifteen working days after the date of the deposit of the requisition and held not later than thirty working days after the date of the deposit of the requisition. Where the directors do not within fifteen working days from the date of the deposit of the requisition duly proceed to convene a meeting, the requisitionists can themselves convene a meeting, But any meeting so convened should not be held after the expiration of three months from the said date.

LENGTH OF NOTICE FOR CALLING MEETINGS AGM-not less than15 days notice in writting(sec.135) Other meetings(EGM) -not less than 05 for Pvt Co. & unlimited co. & not less than10 days for other Co.s Meetings to consider special resolutions- not less than15 days notice(sec.143) Waiver of notice for AGM –by all the share holders agreeing Waiver of notice for other meetings– share holders with 95%voting rights agreeing

PERSONS ENTITLED TO NOTICE Every member, Every person who is entitled to receive notice(legal representative or trustee) The auditor for the time being of the Co. The registrar general of Companies. Young v Ladies Imperial Club

ACCIDENTAL OMISSION CLAUSE It is usual to state in the Articles that the accidental omission to give notice to or the nonreceipt of notice by any person entitled to receive notice should not invalidate the proceedings at that meetings.

PROCEEDINGS AT GENERAL MEETINGS Quorum; Quorum is usually prescribed by the Articles If the Articles are silent Pvt co. -02, Any other Co-03 (sec,136) SH or authorised representative present CHAIRMAN If the Articles are silent any member elected by the members may be chairman of a general meeting, Generally chairman of the board will be the chairman of meetings

POWER OF COURT TO ORDER MEETING -137. Where it is impracticable to call a meeting of a company or to conduct the meeting of the company in the manner specified by the company's articles or this Act, the court can either of its own motion or on the application of -any director of the company or -of any shareholder of the company who would be entitled to vote at the meeting, order a meeting of the company to be called, held and conducted in such manner as the court thinks fit. Such meeting should be deemed to be a meeting of the company duly called. A copy of each notice calling a meeting should be sent to the Registrar and the shareholders.

RESOLUTIONS ORDINARY RESOLUTION "ordinary resolution“ is a resolution that is approved by a simple majority of the votes of those shareholders entitled to vote and voting on the question. Sec 91 provides- Unless otherwise provided by this Act or in the articles of a company, a power reserved to shareholders may be exercised by an ordinary resolution. An OR can be passed In a pvt co – 5 working days notice Pub co. – 10 working days notice But, if the OR is to be passed in an AGM, 15 working days notice must be given.

SPECIAL RESOLUTION -143 A resolution is a special resolution when it has been passed(a) by a seventy-five per centum shareholders entitled to vote and voting on the question; (b) at a general meeting not less than fifteen working days' notice, specifying the intention to propose the resolution as a special resolution has been duly given : However, where it is agreed by not less than eighty-five per centum of the shareholders having the right to attend and vote at any such meeting, a resolution may be proposed and passed as a special resolution at a meeting with less than fifteen working days' notice. o A special resolution need to be passed only if it is required by the Articles or the Act

RESOLUTION REQUIRING SPECIAL NOTICE – SEC 145 Where by any provision in the CA, special notice is required of a resolution, the resolution shall not be effective unless notice of the intention to move it has been given to the company not less than twenty-eight days before the date of the meeting, and the company should give its shareholders notice of any such resolution at the same time and in the same manner as it gives notice of the meeting, or if that is not practicable, shall give them notice thereof either by advertisement in a newspaper having an appropriate circulation or in any other manner allowed by the company's articles, not less than fifteen working days before the date of the meeting. However, where after notice of the intention to move such a resolution has been given to the company a meeting is called for a date twenty-eight days or less from the date of the notice, the notice though not given within the time required by this section, should be deemed to have been properly given for the purposes thereof.

WRITTEN RESOLUTION 144 Subject to the provisions contained in the company's articles, a resolution in writing signed by not less than eighty-five per centum of the shareholders who would be entitled to vote at a meeting of shareholders, should be as valid as if it had been passed at a meeting of those shareholders.

RESOLUTIONS PASSED AT ADJOURNED MEETINGS – SEC 146 Where after the appointed date, a resolution is passed at an adjourned meeting of(a) a company ; (b) the holders of any class of shares in a company; (c) the directors of a company, the resolution should for all purposes be treated as having been passed on the date on which it was in fact passed, and should not be deemed to have been passed on any earlier date.

VOTING There are 2 methods of voting 1. Show of Hands Poll 2. Who can demand a Poll? (i) by not less than five shareholders having the right to vote at the meeting; or (ii) by a shareholder or shareholders representing not less than one-tenth of the total voting rights of all the shareholders having the right to vote at the meeting.

PROXIES - SEC139 Any shareholder of a company entitled to attend and vote at a meeting of the company should be entitled to appoint another person (whether a shareholder or not) as his proxy to attend and vote instead of him. A proxy so appointed should have the same right as the shareholder to vote on a show of hands or on a poll and to speak at the meeting

CHARGES

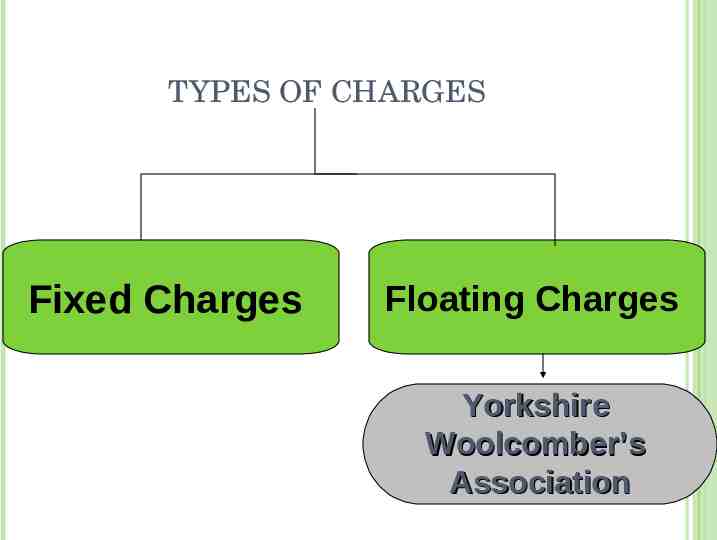

TYPES OF CHARGES Fixed Charges Floating Charges Yorkshire Woolcomber’s Association

FIXED CHARGE/SPECIFIC CHARGE A fixed charge is a mortgagee or ascertained and definite property; such property though it usually remains in the companies possession .cannot be disposed by free of the charge without the consent of the holder of the charge.

FLOTING CHARGE A floating charge is usually upon the undertaking and general assets of the company, and permits the company to deal with the assets in the ordinary course of business until the charge crystallizes or become fix. It may include movable chattels, book debts and uncalled capital It is a very wide charge and may extend to all the assets of the Co. It may include present and future assets of the Co.

CRYSTALIZATION Floating Charges Fixed Charges

CRYSTALLIZATION MEANS THE CONVERSION OF THE FLOATING CHARGE IN TO FIX CHARGE (a) the appointment of a receiver (b) the commencement of the winding up of the company ; (c) the disposal by the company of the whole or any part of its undertaking, other than in the normal course of its business ; (d) the company ceasing to carry on business ; (e) any other event the occurrence of which is expressed in the instrument creating the floating charge to have the effect of causing that charge to attach to the property comprised in it.

CRYSTALLIZATION OCCURS IF. The w-up commences The Co. ceases to carry on its business According to the events specified in the debenture Appointment of a receiver.

REGISTRATION OF CHARGES Where a co creates a charge it is a duty of the co. within the time specified to deliver to the Registrar to the registration a copy of the document by which a charge is craeted. Charges made by a company on its assets whether in connection with an issue of debentures or not, must be registered. 1. In the company’s own Register (Sec 110) and 2. with the Registrar of Companies (Sec 102)

REGISTRATION WITH THE REGISTRAR OF COMPANIES According to Sec 102 the following charges created by a co. together with the instrument creating charge must be sent to the Registrar of Companies within 21 days of creation. a charge for the purpose of securing any issue of debentures ; (b) a charge on uncalled share capital of the company ; (c) a charge created or evidenced by an instrument which, if executed by an individual, would require registration as a bill of sale ; (d) a charge on land wherever situated, or on any interest in land ; (e) a charge on book debts of the company ; (f) a floating charge on the undertaking or property of the company ; (g) a charge on calls made but not paid ; (h) a charge on a ship or aircraft or any share in a ship or aircraft ; (i) a charge on goodwill or intellectual property within the meaning of the Intellectual Property Act, No. 36 of 2003 ; and (ii) (j) a trust receipt to which section 4 of the Trust Receipts Ordinance (Cap. 86) applies or an inland trust receipt within the meaning of the Inland Trust Receipts Act, No. 14 of 1990. (a)

CONSEQUENCES OF UNREGISTERED CHARGES The co. and very officer in default of sush registration are liable to be punished for an offence, and Such unregistered charge will become invalid against the liquidator and any creditor of the co.