California State University DOMINGUEZ HILLS PAYROLL SERVICES AND

35 Slides157.91 KB

California State University DOMINGUEZ HILLS PAYROLL SERVICES AND BENEFITS Employee Benefits Summary

Staff Chris Muller, Payroll and Benefits Manager [email protected] Nicole Melara, Payroll & Benefits Support Asst. [email protected] Welch Hall 478 (310) 243-3769 or (310) 243-3005

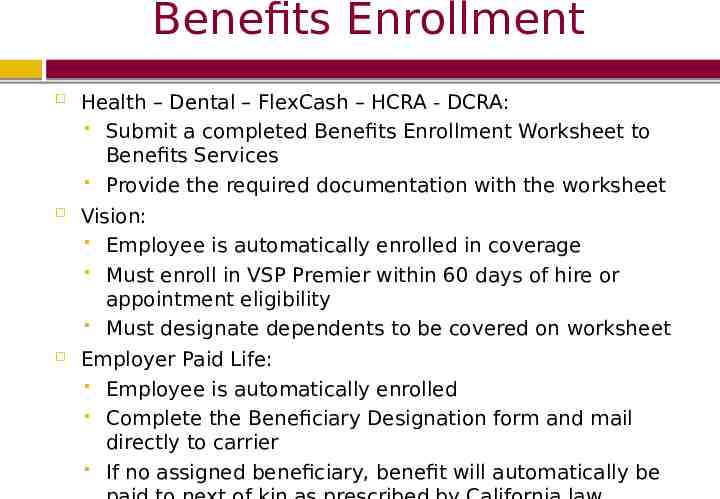

Benefits Enrollment Health – Dental – FlexCash – HCRA - DCRA: Submit a completed Benefits Enrollment Worksheet to Benefits Services Provide the required documentation with the worksheet Vision: Employee is automatically enrolled in coverage Must enroll in VSP Premier within 60 days of hire or appointment eligibility Must designate dependents to be covered on worksheet Employer Paid Life: Employee is automatically enrolled Complete the Beneficiary Designation form and mail directly to carrier If no assigned beneficiary, benefit will automatically be

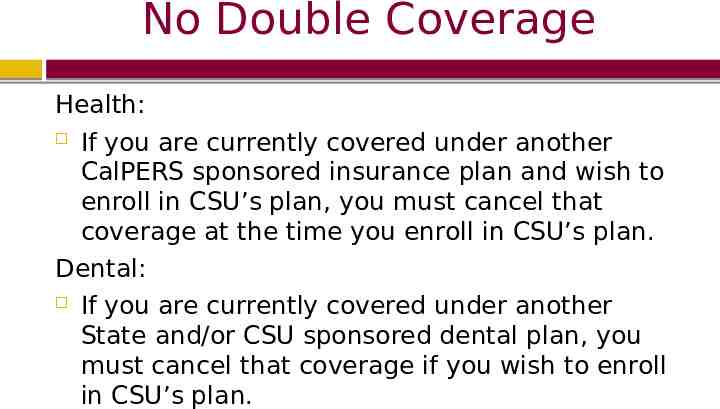

No Double Coverage Health: If you are currently covered under another CalPERS sponsored insurance plan and wish to enroll in CSU’s plan, you must cancel that coverage at the time you enroll in CSU’s plan. Dental: If you are currently covered under another State and/or CSU sponsored dental plan, you must cancel that coverage if you wish to enroll in CSU’s plan.

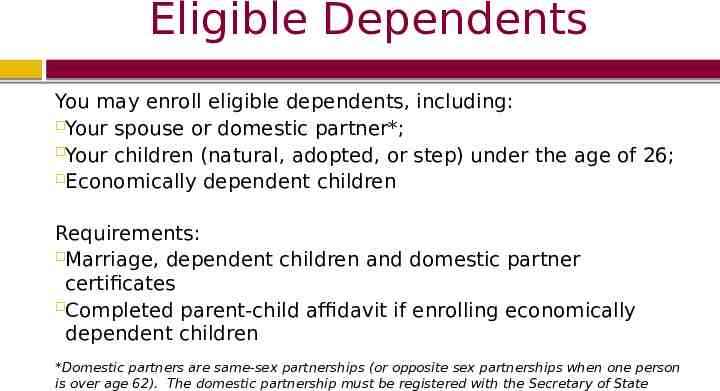

Eligible Dependents You may enroll eligible dependents, including: Your spouse or domestic partner*; Your children (natural, adopted, or step) under the age of 26; Economically dependent children Requirements: Marriage, dependent children and domestic partner certificates Completed parent-child affidavit if enrolling economically dependent children *Domestic partners are same-sex partnerships (or opposite sex partnerships when one person is over age 62). The domestic partnership must be registered with the Secretary of State

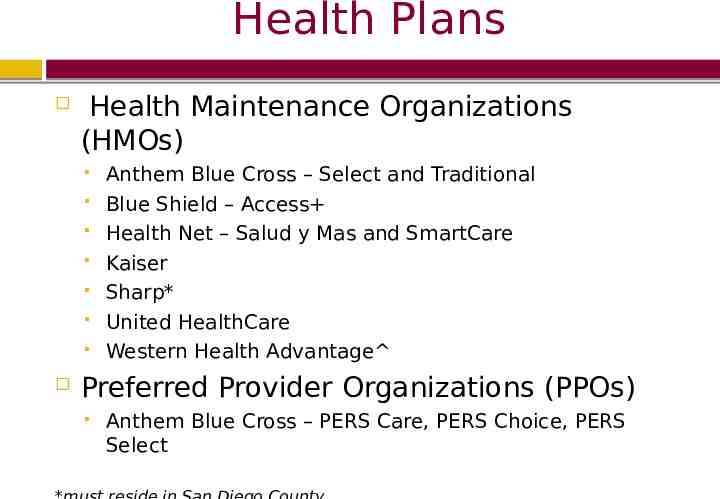

Health Plans Health Maintenance Organizations (HMOs) Anthem Blue Cross – Select and Traditional Blue Shield – Access Health Net – Salud y Mas and SmartCare Kaiser Sharp* United HealthCare Western Health Advantage Preferred Provider Organizations (PPOs) Anthem Blue Cross – PERS Care, PERS Choice, PERS Select

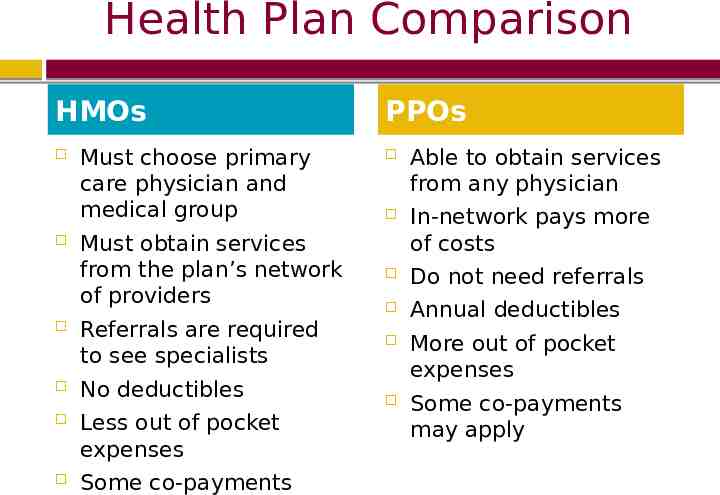

Health Plan Comparison HMOs Must choose primary care physician and medical group PPOs Able to obtain services from any physician Must obtain services from the plan’s network of providers In-network pays more of costs Do not need referrals Referrals are required to see specialists Annual deductibles More out of pocket expenses Some co-payments may apply No deductibles Less out of pocket expenses Some co-payments

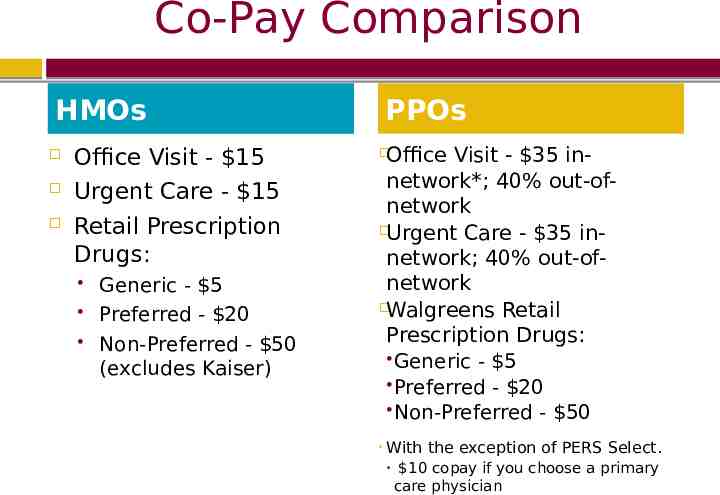

Co-Pay Comparison HMOs Office Visit - 15 Urgent Care - 15 Retail Prescription Drugs: Generic - 5 Preferred - 20 Non-Preferred - 50 (excludes Kaiser) PPOs Office Visit - 35 innetwork*; 40% out-ofnetwork Urgent Care - 35 innetwork; 40% out-ofnetwork Walgreens Retail Prescription Drugs: Generic - 5 Preferred - 20 Non-Preferred - 50 With the exception of PERS Select. 10 copay if you choose a primary care physician

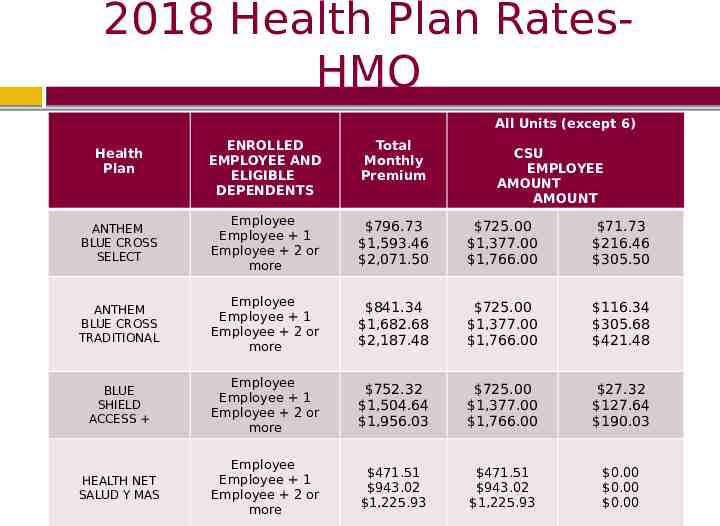

2018 Health Plan RatesHMO All Units (except 6) ENROLLED EMPLOYEE AND ELIGIBLE DEPENDENTS Total Monthly Premium ANTHEM BLUE CROSS SELECT Employee Employee 1 Employee 2 or more 796.73 1,593.46 2,071.50 725.00 1,377.00 1,766.00 71.73 216.46 305.50 ANTHEM BLUE CROSS TRADITIONAL Employee Employee 1 Employee 2 or more 841.34 1,682.68 2,187.48 725.00 1,377.00 1,766.00 116.34 305.68 421.48 BLUE SHIELD ACCESS Employee Employee 1 Employee 2 or more 752.32 1,504.64 1,956.03 725.00 1,377.00 1,766.00 27.32 127.64 190.03 HEALTH NET SALUD Y MAS Employee Employee 1 Employee 2 or more 471.51 943.02 1,225.93 471.51 943.02 1,225.93 0.00 0.00 0.00 Health Plan CSU EMPLOYEE AMOUNT AMOUNT

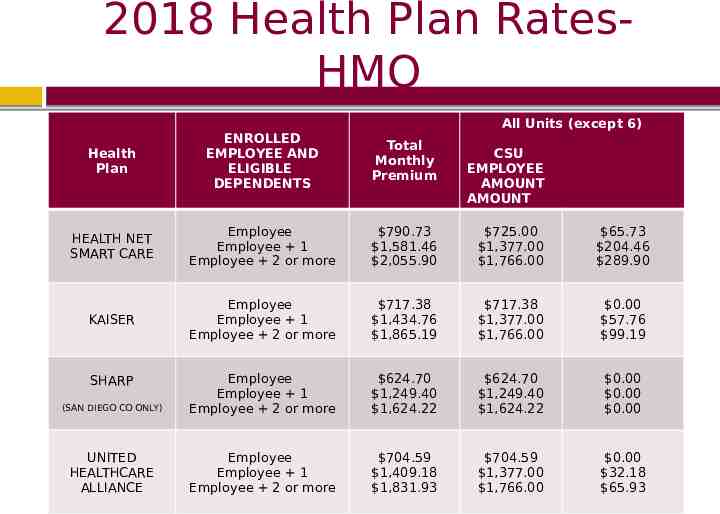

2018 Health Plan RatesHMO All Units (except 6) Health Plan ENROLLED EMPLOYEE AND ELIGIBLE DEPENDENTS Total Monthly Premium HEALTH NET SMART CARE Employee Employee 1 Employee 2 or more 790.73 1,581.46 2,055.90 725.00 1,377.00 1,766.00 65.73 204.46 289.90 KAISER Employee Employee 1 Employee 2 or more 717.38 1,434.76 1,865.19 717.38 1,377.00 1,766.00 0.00 57.76 99.19 (SAN DIEGO CO ONLY) Employee Employee 1 Employee 2 or more 624.70 1,249.40 1,624.22 624.70 1,249.40 1,624.22 0.00 0.00 0.00 UNITED HEALTHCARE ALLIANCE Employee Employee 1 Employee 2 or more 704.59 1,409.18 1,831.93 704.59 1,377.00 1,766.00 0.00 32.18 65.93 SHARP CSU EMPLOYEE AMOUNT AMOUNT

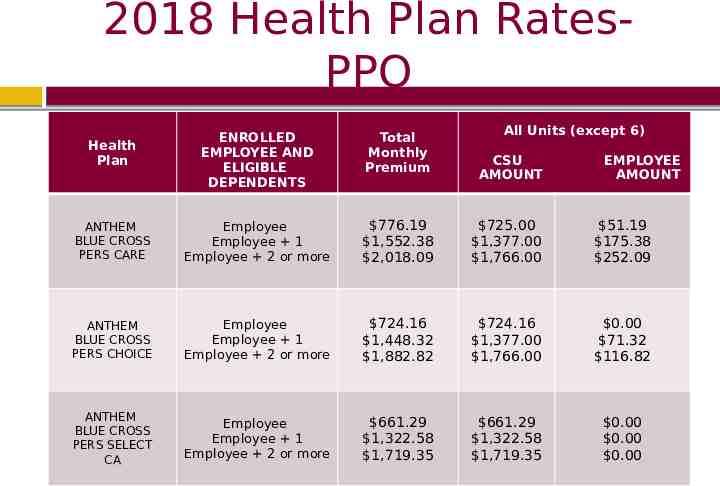

2018 Health Plan RatesPPO All Units (except 6) ENROLLED EMPLOYEE AND ELIGIBLE DEPENDENTS Total Monthly Premium ANTHEM BLUE CROSS PERS CARE Employee Employee 1 Employee 2 or more 776.19 1,552.38 2,018.09 725.00 1,377.00 1,766.00 51.19 175.38 252.09 ANTHEM BLUE CROSS PERS CHOICE Employee Employee 1 Employee 2 or more 724.16 1,448.32 1,882.82 724.16 1,377.00 1,766.00 0.00 71.32 116.82 ANTHEM BLUE CROSS PERS SELECT CA Employee Employee 1 Employee 2 or more 661.29 1,322.58 1,719.35 661.29 1,322.58 1,719.35 0.00 0.00 0.00 Health Plan CSU AMOUNT EMPLOYEE AMOUNT

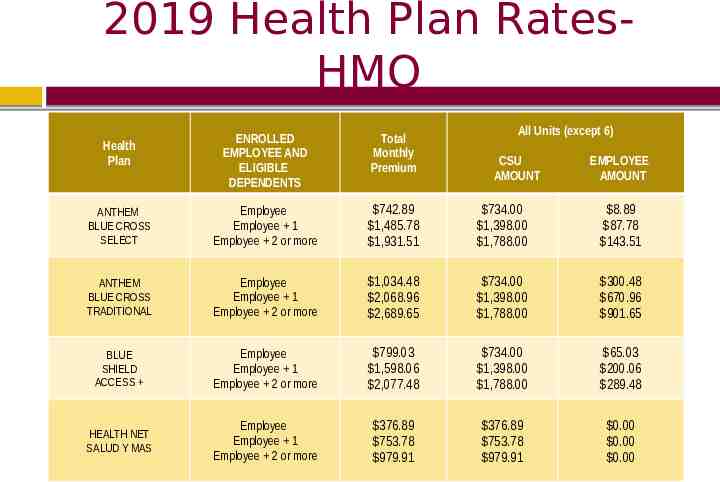

2019 Health Plan RatesHMO All Units (except 6) ENROLLED EMPLOYEE AND ELIGIBLE DEPENDENTS Total Monthly Premium ANTHEM BLUE CROSS SELECT Employee Employee 1 Employee 2 or more 742.89 1,485.78 1,931.51 734.00 1,398.00 1,788.00 8.89 87.78 143.51 ANTHEM BLUE CROSS TRADITIONAL Employee Employee 1 Employee 2 or more 1,034.48 2,068.96 2,689.65 734.00 1,398.00 1,788.00 300.48 670.96 901.65 BLUE SHIELD ACCESS Employee Employee 1 Employee 2 or more 799.03 1,598.06 2,077.48 734.00 1,398.00 1,788.00 65.03 200.06 289.48 HEALTH NET SALUD Y MAS Employee Employee 1 Employee 2 or more 376.89 753.78 979.91 376.89 753.78 979.91 0.00 0.00 0.00 Health Plan CSU AMOUNT EMPLOYEE AMOUNT

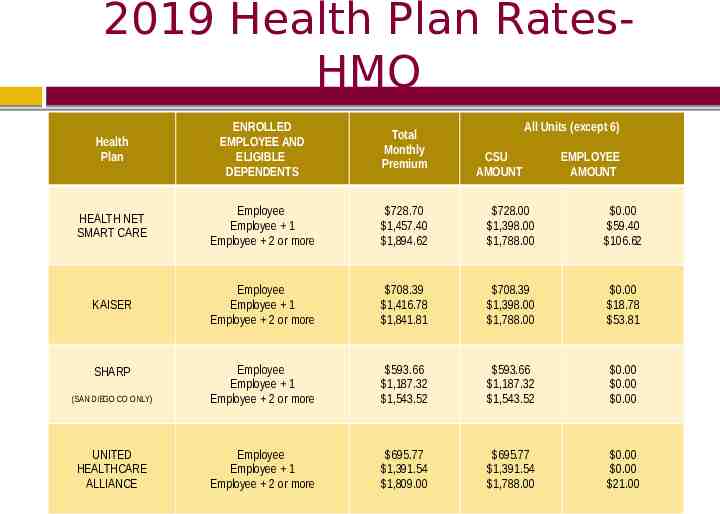

2019 Health Plan RatesHMO Health Plan ENROLLED EMPLOYEE AND ELIGIBLE DEPENDENTS Total Monthly Premium HEALTH NET SMART CARE Employee Employee 1 Employee 2 or more 728.70 1,457.40 1,894.62 728.00 1,398.00 1,788.00 0.00 59.40 106.62 KAISER Employee Employee 1 Employee 2 or more 708.39 1,416.78 1,841.81 708.39 1,398.00 1,788.00 0.00 18.78 53.81 (SAN DIEGO CO ONLY) Employee Employee 1 Employee 2 or more 593.66 1,187.32 1,543.52 593.66 1,187.32 1,543.52 0.00 0.00 0.00 UNITED HEALTHCARE ALLIANCE Employee Employee 1 Employee 2 or more 695.77 1,391.54 1,809.00 695.77 1,391.54 1,788.00 0.00 0.00 21.00 SHARP All Units (except 6) CSU AMOUNT EMPLOYEE AMOUNT

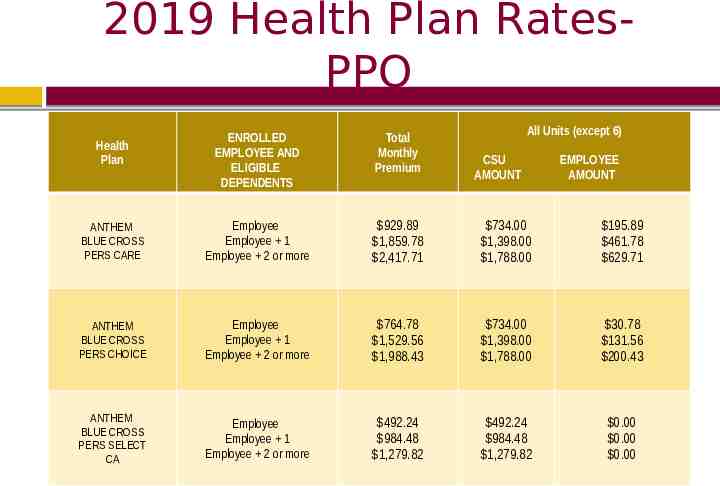

2019 Health Plan RatesPPO All Units (except 6) ENROLLED EMPLOYEE AND ELIGIBLE DEPENDENTS Total Monthly Premium ANTHEM BLUE CROSS PERS CARE Employee Employee 1 Employee 2 or more 929.89 1,859.78 2,417.71 734.00 1,398.00 1,788.00 195.89 461.78 629.71 ANTHEM BLUE CROSS PERS CHOICE Employee Employee 1 Employee 2 or more 764.78 1,529.56 1,988.43 734.00 1,398.00 1,788.00 30.78 131.56 200.43 ANTHEM BLUE CROSS PERS SELECT CA Employee Employee 1 Employee 2 or more 492.24 984.48 1,279.82 492.24 984.48 1,279.82 0.00 0.00 0.00 Health Plan CSU AMOUNT EMPLOYEE AMOUNT

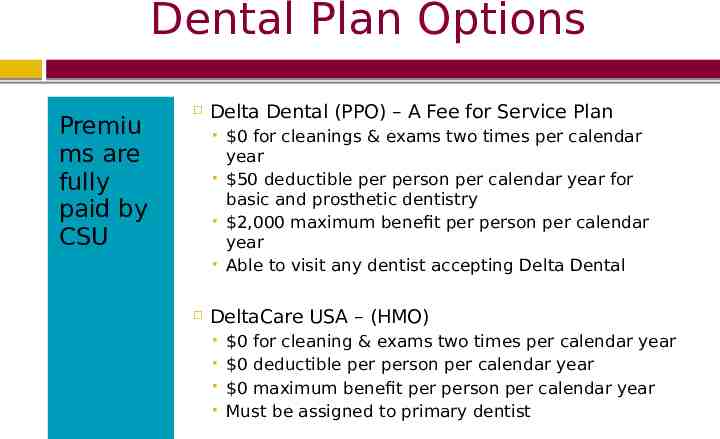

Dental Plan Options Premiu ms are fully paid by CSU Delta Dental (PPO) – A Fee for Service Plan 0 for cleanings & exams two times per calendar year 50 deductible per person per calendar year for basic and prosthetic dentistry 2,000 maximum benefit per person per calendar year Able to visit any dentist accepting Delta Dental DeltaCare USA – (HMO) 0 for cleaning & exams two times per calendar year 0 deductible per person per calendar year 0 maximum benefit per person per calendar year Must be assigned to primary dentist

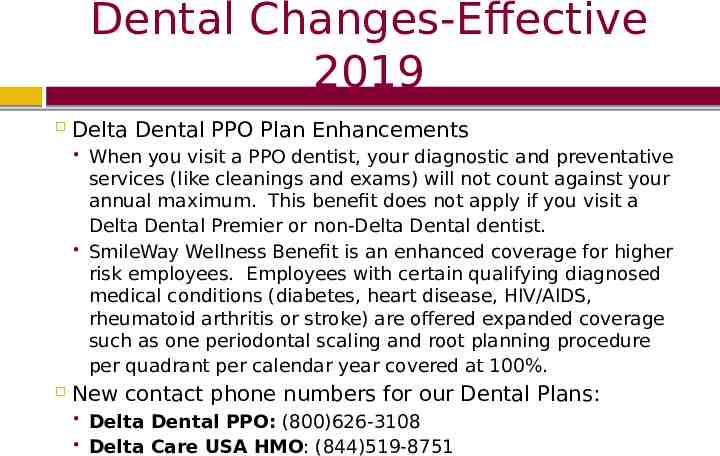

Dental Changes-Effective 2019 Delta Dental PPO Plan Enhancements When you visit a PPO dentist, your diagnostic and preventative services (like cleanings and exams) will not count against your annual maximum. This benefit does not apply if you visit a Delta Dental Premier or non-Delta Dental dentist. SmileWay Wellness Benefit is an enhanced coverage for higher risk employees. Employees with certain qualifying diagnosed medical conditions (diabetes, heart disease, HIV/AIDS, rheumatoid arthritis or stroke) are offered expanded coverage such as one periodontal scaling and root planning procedure per quadrant per calendar year covered at 100%. New contact phone numbers for our Dental Plans: Delta Dental PPO: (800)626‐3108 Delta Care USA HMO: (844)519‐8751

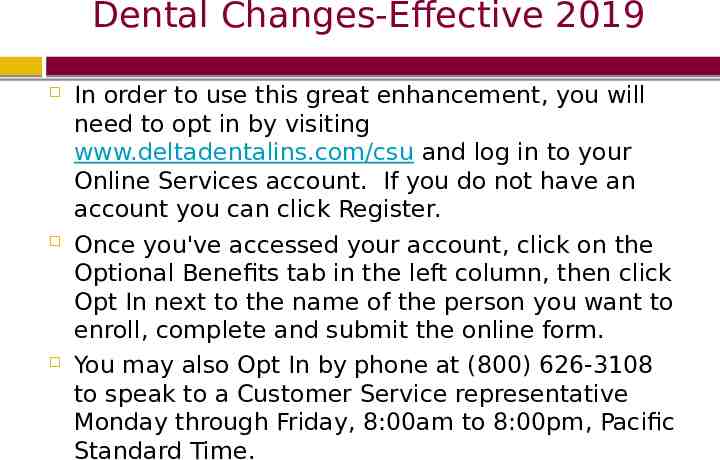

Dental Changes-Effective 2019 In order to use this great enhancement, you will need to opt in by visiting www.deltadentalins.com/csu and log in to your Online Services account. If you do not have an account you can click Register. Once you've accessed your account, click on the Optional Benefits tab in the left column, then click Opt In next to the name of the person you want to enroll, complete and submit the online form. You may also Opt In by phone at (800) 626-3108 to speak to a Customer Service representative Monday through Friday, 8:00am to 8:00pm, Pacific Standard Time.

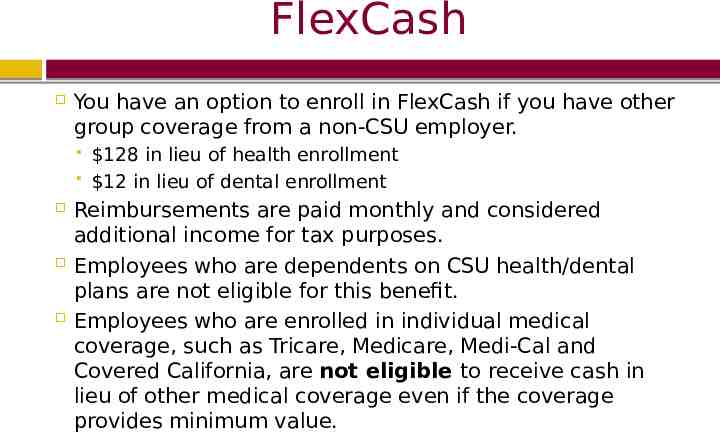

FlexCash You have an option to enroll in FlexCash if you have other group coverage from a non-CSU employer. 128 in lieu of health enrollment 12 in lieu of dental enrollment Reimbursements are paid monthly and considered additional income for tax purposes. Employees who are dependents on CSU health/dental plans are not eligible for this benefit. Employees who are enrolled in individual medical coverage, such as Tricare, Medicare, Medi-Cal and Covered California, are not eligible to receive cash in lieu of other medical coverage even if the coverage provides minimum value.

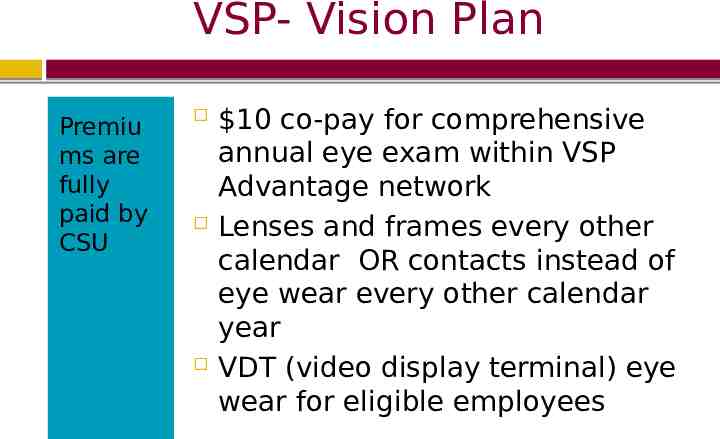

VSP- Vision Plan Premiu ms are fully paid by CSU 10 co-pay for comprehensive annual eye exam within VSP Advantage network Lenses and frames every other calendar OR contacts instead of eye wear every other calendar year VDT (video display terminal) eye wear for eligible employees

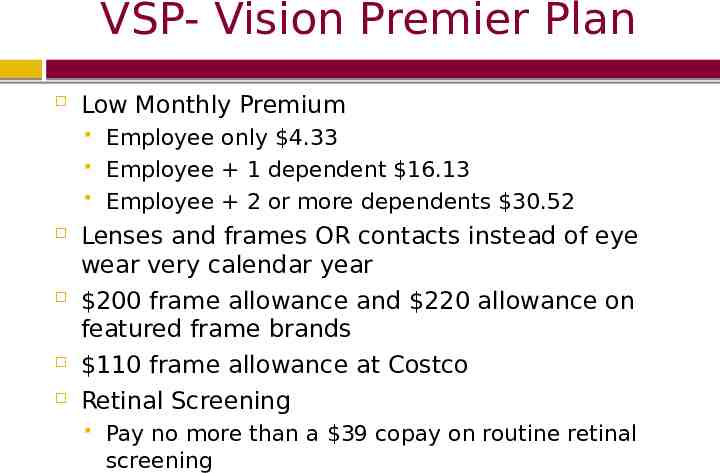

VSP- Vision Premier Plan Low Monthly Premium Employee only 4.33 Employee 1 dependent 16.13 Employee 2 or more dependents 30.52 Lenses and frames OR contacts instead of eye wear very calendar year 200 frame allowance and 220 allowance on featured frame brands 110 frame allowance at Costco Retinal Screening Pay no more than a 39 copay on routine retinal screening

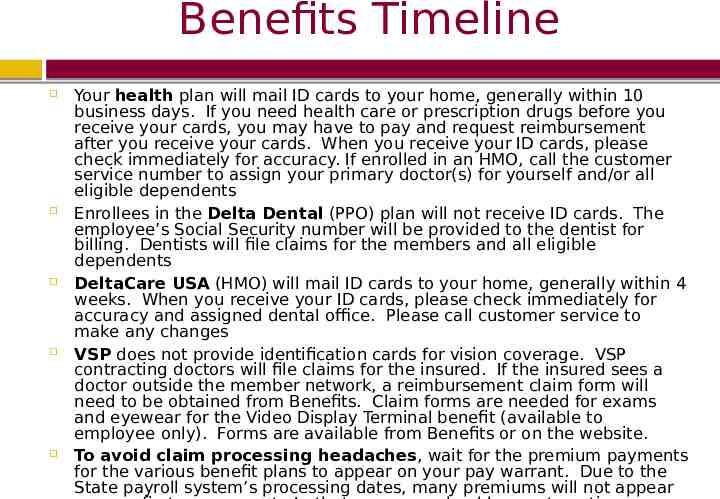

Benefits Timeline Your health plan will mail ID cards to your home, generally within 10 business days. If you need health care or prescription drugs before you receive your cards, you may have to pay and request reimbursement after you receive your cards. When you receive your ID cards, please check immediately for accuracy. If enrolled in an HMO, call the customer service number to assign your primary doctor(s) for yourself and/or all eligible dependents Enrollees in the Delta Dental (PPO) plan will not receive ID cards. The employee’s Social Security number will be provided to the dentist for billing. Dentists will file claims for the members and all eligible dependents DeltaCare USA (HMO) will mail ID cards to your home, generally within 4 weeks. When you receive your ID cards, please check immediately for accuracy and assigned dental office. Please call customer service to make any changes VSP does not provide identification cards for vision coverage. VSP contracting doctors will file claims for the insured. If the insured sees a doctor outside the member network, a reimbursement claim form will need to be obtained from Benefits. Claim forms are needed for exams and eyewear for the Video Display Terminal benefit (available to employee only). Forms are available from Benefits or on the website. To avoid claim processing headaches, wait for the premium payments for the various benefit plans to appear on your pay warrant. Due to the State payroll system’s processing dates, many premiums will not appear

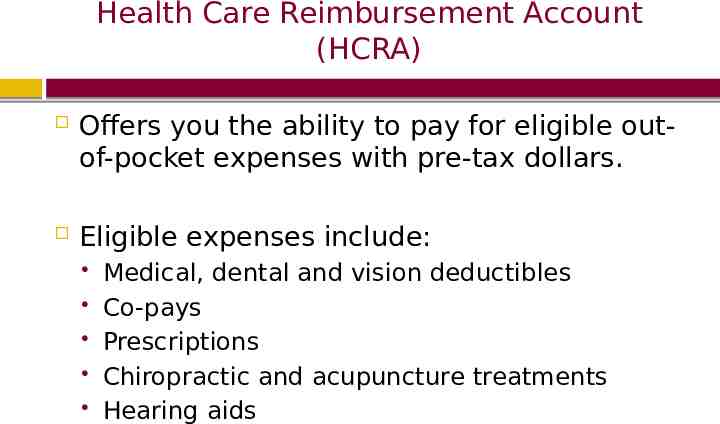

Health Care Reimbursement Account (HCRA) Offers you the ability to pay for eligible outof-pocket expenses with pre-tax dollars. Eligible expenses include: Medical, dental and vision deductibles Co-pays Prescriptions Chiropractic and acupuncture treatments Hearing aids

Dependent Care Reimbursement Account (DCRA) Offers the ability to pay for eligible outof-pocket dependent care expenses with pre-tax dollars. In general, eligible dependents include: Children under age 13 Spouse who is physically/mentally unable to care for self Financially dependent member of household

Life Insurance Benefits Premiums are paid by CSU for bargaining units 1, 2, 3, 4, 5, 7, 8, 9, Confidential Classification and Management Life Insurance Policy 10,000 for Bargaining Units 2, 5, 7, 8 and 9 25,000 for Bargaining Units 1 and 4 50,000 for Bargaining Unit 3 and Confidential Classification 100,000 for Management* *Policy in excess of 50,000 results in imputed taxes for employee

Voluntary Life and AD&D Insurance Employees can purchase up to 1.5 million of additional life insurance for themselves* Employees can purchase up to 750,000 of additional life insurance for their spouse or registered domestic partner Employees can purchase up to 20,000 for their eligible dependent children Employees can purchase Group AD&D Insurance up to 1 million for themselves Coverage is also available for a spouse, domestic partner, and/or eligible dependent children *Benefit amounts in excess of 50,000 have an imputed income tax charged to the

Accidental Death & Dismemberment Insurance (AD & D) Premiums are paid by CSU for bargaining units 1, 3, 4, Confidential Classification and Management Policy Amounts 25,000 for Bargaining Units 1 and 4 50,000 for Bargaining Unit 3 and Confidential Classification 100,000 for Management

CalPERS CalPERS is a defined benefit retirement plan Provides benefits based on members' years of service, age, and final compensation Employees who have five years full-time service vested with CalPERS and meet the age requirement may be eligible to retire and receive a pension Employees who became a CalPERS member as of January 1, 2013 or later will have 7.25% taken out of their pay for CalPERS contributions

CalPERS - continued Staff employees who are hired or eligible for CalPERS prior to July 1, 2018 are vested after five years of credited service and are eligible to retire at age 52 with lifelong health and dental benefits for themselves and their eligible dependents New faculty hired or become CalPERS eligible on or after July 1, 2017 become CalPERS eligible must be vested for equivalent of ten years of full-time service and reach age of 52 to be eligible to retire with life long health and dental benefits for themselves and their eligible dependents New staff hired or become CalPERS eligible on or after July 1, 2018 must be vested for equivalent of ten years of fulltime service and reach age of 52 to be eligible to retire with life long health and dental benefits for themselves and their eligible dependents

Retirement Savings Programs Allows an employee to save towards retirement by investing pre-tax contributions into a tax deferred plan Retirement Savings Programs include: Tax Sheltered Annuity (403b) Thrift Plan (401k) Deferred Compensation Plan (457) Income taxes are paid at the time funds are withdrawn or at annuitization Maximum amount employees can “shelter” is determined by the IRS

403b, 401k and 457 Enrollment 403b plan: 401k and 457 plans: Contact a Fidelity Representative at (800) 343-0860 Establish contributions to 403b through NetBenefits.com/calstate Must begin and make contribution changes by the 5th of the month for contributions to take effect for the first of the following month Contact Savings Plus Program at (855) 616-4776 Complete and submit the required enrollment form to Saving Plus Program Must begin and make contributions changes by the end of the month for contributions to take effect for the first of the following month Generally, contributions will begin the second month following the month of enrollment

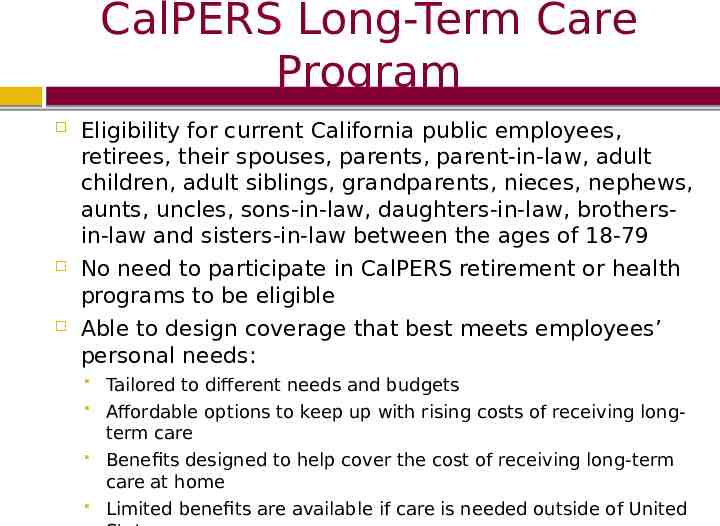

CalPERS Long-Term Care Program Eligibility for current California public employees, retirees, their spouses, parents, parent-in-law, adult children, adult siblings, grandparents, nieces, nephews, aunts, uncles, sons-in-law, daughters-in-law, brothersin-law and sisters-in-law between the ages of 18-79 No need to participate in CalPERS retirement or health programs to be eligible Able to design coverage that best meets employees’ personal needs: Tailored to different needs and budgets Affordable options to keep up with rising costs of receiving longterm care Benefits designed to help cover the cost of receiving long-term care at home Limited benefits are available if care is needed outside of United

Voluntary Benefits Programs CSU offers numerous voluntary benefits to employees: Alfac Group Critical Illness MetLaw Legal Plan Voluntary Long Term Disability CA Casualty Auto and Home Insurance Employee Assistance Program

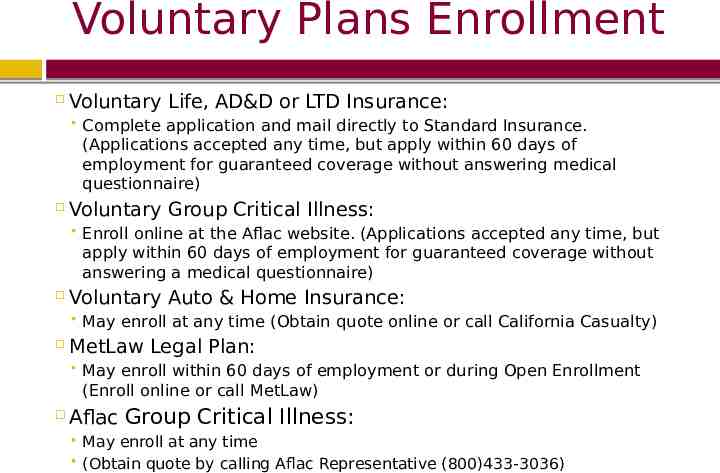

Voluntary Plans Enrollment Voluntary Life, AD&D or LTD Insurance: Voluntary Group Critical Illness: May enroll at any time (Obtain quote online or call California Casualty) MetLaw Legal Plan: Enroll online at the Aflac website. (Applications accepted any time, but apply within 60 days of employment for guaranteed coverage without answering a medical questionnaire) Voluntary Auto & Home Insurance: Complete application and mail directly to Standard Insurance. (Applications accepted any time, but apply within 60 days of employment for guaranteed coverage without answering medical questionnaire) May enroll within 60 days of employment or during Open Enrollment (Enroll online or call MetLaw) Aflac Group Critical Illness: May enroll at any time (Obtain quote by calling Aflac Representative (800)433-3036)

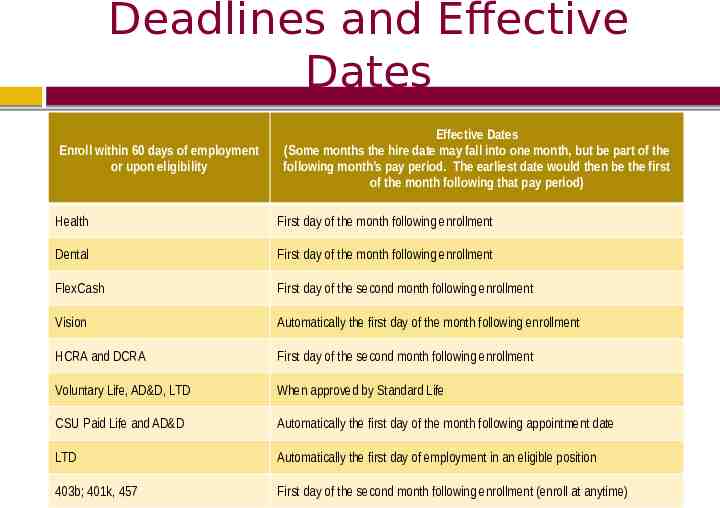

Deadlines and Effective Dates Enroll within 60 days of employment or upon eligibility Effective Dates (Some months the hire date may fall into one month, but be part of the following month’s pay period. The earliest date would then be the first of the month following that pay period) Health First day of the month following enrollment Dental First day of the month following enrollment FlexCash First day of the second month following enrollment Vision Automatically the first day of the month following enrollment HCRA and DCRA First day of the second month following enrollment Voluntary Life, AD&D, LTD When approved by Standard Life CSU Paid Life and AD&D Automatically the first day of the month following appointment date LTD Automatically the first day of employment in an eligible position 403b; 401k, 457 First day of the second month following enrollment (enroll at anytime) 34

Important Reminders Complete a Benefits Worksheet along with the Accounts Receivable Signature Authorization form and the CalPERS Declaration of Health form and submit to Benefits Services within 60 days of hire to avoid the 90day waiting period Attach copies of certificates (marriage, domestic partnership and/or birth certificates of all dependent children) and provide Social Security numbers for all dependents Complete Medical Plan and Dental Plan Selection on Benefits Enrollment Worksheet Contact VSP within 60 days of hire or eligibility to enroll in VSP Premier Provide proof of other non-CSU group coverage if enrolling in FlexCash for Medical and/or Dental Enroll within the first 60 days of hire date to avoid a