Approved Vs Denied “What it takes to make it through the home

17 Slides1.12 MB

Approved Vs Denied “What it takes to make it through the home buying process”

About Me 3 Years Mortgage Experience 2nd Generation Mortgage Professional Started as a Call Center MLO (Mortgage Loan Officer) Formerly an MLO Training Manager Currently an Affinity Retail MLO

How do Lenders determine the quality of a borrower?

Capacity: Ability To Repay Credit: Payment History Capital: Liquid Assets Collateral: Subject Property The 4 C’s

Capacity: Ability To Repay INCOME EMPLOYMENT HISTORY SAVINGS MONTHLY DEBT PAYMENTS

Credit Score (When qualifying Lenders use the Middle Score) Number of accounts open Credit: Payment History Credit Balances in proportion to credit limits Late payments 30, 60, or 90 days overdue Bankruptcies Recent Inquiries

Capital: Liquid Assets Investments that can be converted to cash Savings Money Market Funds Gift’s from Family Members Down payment Assistance Programs Grants Equity

Collateral : Subject Property Home you are buying Investment Properties Houses you own

What makes Lenders say Yes or No?

Mortgage Loan Programs Conventional FHA Loan VA Loan USDA Loan Non-Qualified Mortgage Products

Factors We Look At When Determin ing a Loan Program LTV Credit Score (Loan-to-Value Ratio) DTI Occupancy Status (Debt-to-Income Ratio) (Primary, Secondary, or Investment)

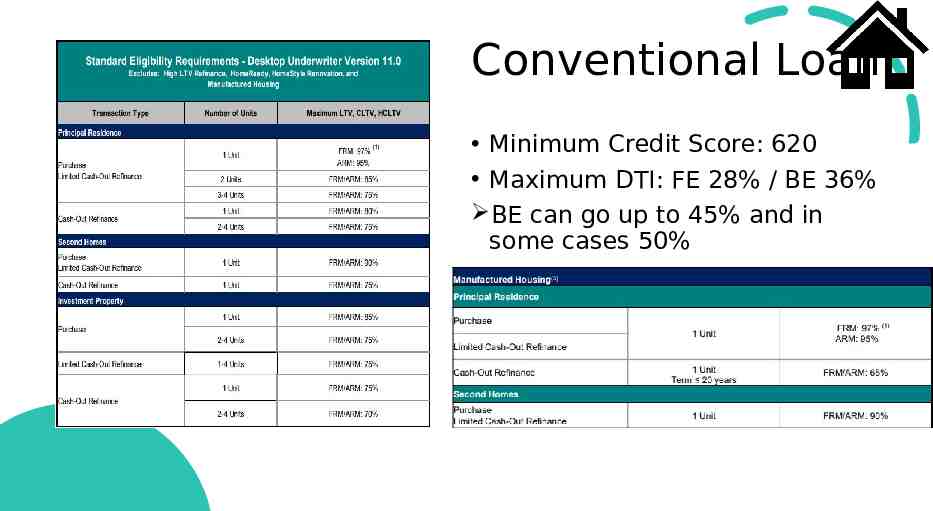

Conventional Loan Minimum Credit Score: 620 Maximum DTI: FE 28% / BE 36% BE can go up to 45% and in some cases 50%

FHA Loan Minimum Credit Score: 580 Maximum DTI: FE 31% / BE 43% BE can go up to 50% and in some cases 55% Max LTV 96.5% Borrower’s must put at least 3.5% down. Only available for a Primary Residence

VA Loan Minimum Credit Score: 580-620 Maximum DTI: BE 41% BE can go up to 50% and in some cases 55% Max LTV 100% VA loans do not require a Down Payment. Only available for a Primary Residence

USDA Loans Minimum Credit Score: 640 Maximum DTI: FE 29% / BE 41% BE can go up to 50% and in some cases 55% Max LTV 100% USDA loans do not require a Down Payment. Only available for a Primary Residence in a Rural area

Non-Qualified Mortgage Loan Programs that are offered by Private Investors Some Features include: No DTI Loans DSCR (Debt Service Cover Ratio) Loans Qualify using just reserves (12 or 24 Months worth)

Q&A