Intermediate University Accounting BTAC02

39 Slides1.53 MB

Intermediate University Accounting BTAC02

Class Objectives Accounting Basics GL Account Overview Reporting Tools

ACCOUNTING BASICS

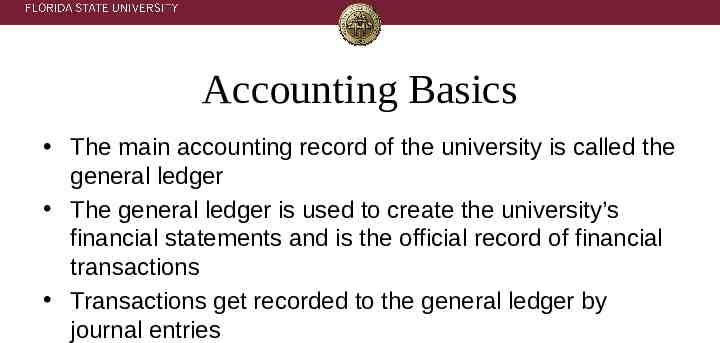

Accounting Basics The main accounting record of the university is called the general ledger The general ledger is used to create the university’s financial statements and is the official record of financial transactions Transactions get recorded to the general ledger by journal entries

Accounting Basics Journal Entries Used to record ALL transactions in the ledger Sources – OMNI Systems – “Third Party” Systems – Direct Journal Entries Journal ID Journal Source – FSU DPT CODES GL SOURCE

Accounting Basics The basis for all entries in the general ledger is the double-entry system – Every entry has both a debit and a credit – Debits must equal credits Debit – an entry in the left column of the ledger Credit – an entry in the right column of the ledger

Accounting basics

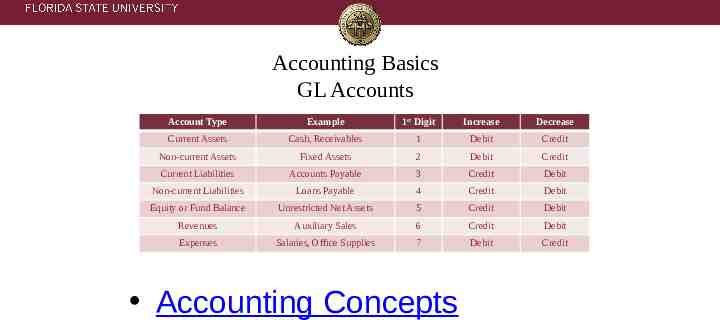

Accounting Basics GL Accounts Account Type Example 1st Digit Increase Decrease Current Assets Cash, Receivables 1 Debit Credit Non-current Assets Fixed Assets 2 Debit Credit Current Liabilities Accounts Payable 3 Credit Debit Non-current Liabilities Loans Payable 4 Credit Debit Equity or Fund Balance Unrestricted Net Assets 5 Credit Debit Revenues Auxiliary Sales 6 Credit Debit Expenses Salaries, Office Supplies 7 Debit Credit Accounting Concepts

Accounting basics T-Account Revenue T-Account Expense

Accrual Accounting Accrual accounting is a method of accounting where events are recorded when the transaction occurs rather than when the payment is made Revenue is recorded when it is earned Expenses are recorded when incurred

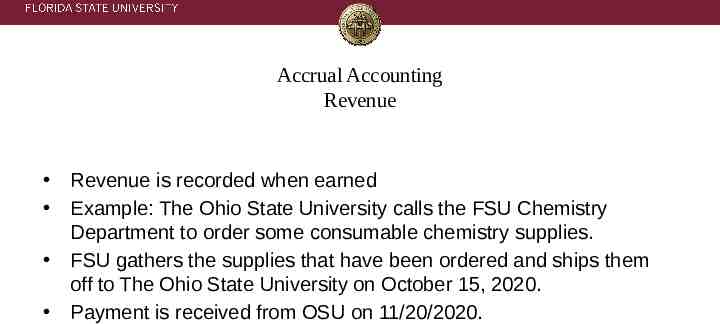

Accrual Accounting Revenue Revenue is recorded when earned Example: The Ohio State University calls the FSU Chemistry Department to order some consumable chemistry supplies. FSU gathers the supplies that have been ordered and ships them off to The Ohio State University on October 15, 2020. Payment is received from OSU on 11/20/2020.

Accrual Accounting Revenue FSU sends an invoice to The Ohio State University (10/15/2020) – Debit: 151300 Accounts receivable – Credit: 623001 Sales/Svc Other Extrn FSU receives payment from The Ohio State University (11/20/2020) – Debit: 112000 Cash – Credit: 151300 Accounts receivable

Accrual Accounting Revenue

Accrual Accounting Expenses Expenses are recorded when incurred Example: The Controller’s office places an order for 15 laptops on 9/26/2020. – An encumbrance is created in KK ledger at the time the order is placed and the purchase order is created The laptops are received by the Controller’s Office on 10/15/2020. The invoice is received from Dell on 10/20/2020.

Accrual Accounting Expenses Accounting entries: – When the department receives on the purchase order: Debit: 741153 Equip Computer/IT Expendable Credit: 311000 Accounts payable – When accounts payable sends payment to the vendor Debit: 311000 Accounts payable Credit: 112xxx Cash Other common examples – payroll liabilities

Accrual Accounting Expenses

GENERAL LEDGER ACCOUNT OVERVIEW

GL Accounts Cash Cash (112000) – Especially important for auxiliaries to monitor – Should always be positive – Budget vs. Cash For E&G departments, cash should follow budget Cash transfers are recorded weekly by the Controller’s Office to match budget transfers For auxiliaries and others, cash and budget will almost never match due to timing

GL Accounts Other Balance Sheet Accounts Receivable (15xxxx) Due From Component Units (167000) Accounts Payable (311000)

GL Accounts Revenue Accounts 6xxxxx Auxiliary Revenues – Internal vs. External – Internal – Received from any entity with an FSU six-digit DeptID – External All other auxiliary revenues received from any non-FSU dept Includes students, employees and related organizations like FSUF

GL Accounts Expense Accounts Budgetary high-level categories – 71 – Salary and benefit expenses – 72 – OPS expenses – 74 – All other operating expenses – 76 – Capital expenditures (aka OCO) – 78 – Transfers out

GL Accounts Expense Accounts Expense Short List – Account names standardized so they can be sorted and grouped together (Account Codes are all over the place) E.g. all student tuition & fee accounts begin with “Stdnt Aid” – Account Use Description provides significantly more detail Expenditure Guidelines – Lays out which types of expenditures can be made on different funds

REPORTING TOOLS

Reporting Tools Overview OMNI Financials – Queries Best for up-to-the-minute data or specific info (e.g. a listing of Journal Sources) Recommended Queries listing available on Controller’s website https://controller.vpfa.fsu.edu/recommended-queries – Static Departmental Ledgers – “Canned” PeopleSoft reports

Reporting Tools Overview Oracle Business Intelligence (BI) – – – – – Link from myFSU portal page FSU’s data warehouse reporting tool Firefox is strongly recommended Data loaded nightly from OMNI Numerous dashboard reports available

OMNI Queries What are they? Which one? – http://controller.vpfa.fsu.edu/query How do I run them? – OMNI FI Transactions and Reporting Reporting Query Viewer

BI Reports Budget and Transaction Intended to be a “one stop shop” Each tab/report structure has its own intended use Prompts on Exec Overview tab carry over to E&G Detail, Aux Detail, and C&G Detail NOT other tabs

BI Reports Budget and Transaction Executive Overview – Intended for DDDHs to see their financial situation at a glance – Info on ALL funding sources for department(s) selected – Formatted for printing to PDF – SRAD summary section may take some time to load if department has many sponsored projects

BI Reports Budget and Transaction E&G Detail – – – – Carryover of high-level Available Balance/Cash summary Encumbrance balances by GL Account, Supplier, or Source Expense month-to-month trend with totals All encumbrance/expense amounts link to detail Aux/Designated Detail – Contains same information as E&G Detail report PLUS: – Profit & Loss summary information – Revenue trend information (in addition to expense trends) that hyperlinks to relevant detail/backup

BI Reports Budget and Transaction C&G/SRAD/PI Support Detail – Provides high level available balance information on ALL open Sponsored Research projects – Broken down into 4 sections Other SRAD – Projects NOT identified as “research support” in the name SRAD Research Support – “Research support” in name Sponsored Salary Account(s) – Projects from any C&G fund ID’d with “salary” in the name Other Sponsored Research – All other open C&G Projects with a link from each Project to detailed information (also available from “Sponsored Project Lookup”) – Yellow highlights mean project deadline past but still open

BI Reports Budget and Transaction Sponsored Project Lookup – “Lookup” for any individual sponsored Project ID – Same reporting information available as hyperlink from C&G Detail report – 4 sections: Award Attributes – Lists researchers and sponsor Sponsored Project Summary (and “Burn Rate”) – Available Balance and “burn rate” Sponsored Project Expense Trend – Expense totals by Account, FY, or Period Sponsored Project Encumbrances – Same options as E&G/Aux

BI Reports Budget and Transaction Foundation Detail – A Project ID must be selected for the report to run – High level Available Balance summary at FSUF Project level – Just like E&G Detail: Encumbrance balances by GL Account, Supplier, or Source Expense month-to-month trend with totals All encumbrance/expense amounts link to detail Trial Balance – For E&G, Carryforward, Auxiliary/Designated funds only – Should mirror FSU DPT TRIAL BALANCE query – Can be used to monitor balance sheet accounts such as AP and AR

BI Reports Transaction Details Same data as is linked to from Budget & Transaction report Downloadable to Excel or CSV Prompts available for Optional Chartfields (not an option in Budget & Transaction) Hyperlinks to OMNI pages and backup attachments

BI Reports Transaction Details Separate reports by transaction type – Expense – Encumbrance – Cash (will display most period activity) – Revenue – Liabilities (shows available balance changes for FSUF funds as changes to unearned revenues) – Other Assets (primarily AR activity) Customization/saved preference options available

BI Reports Expense Data Mining To be used in researching specific expense data ALL the prompts Can break expense data down into smaller parts, e.g. – ID vouchers associated with particular PO – Then run again for those vouchers w/out PO to ID unencumbered freight

Questions?

Resources Controller’s Office Website – controller.vpfa.fsu.edu Other central office websites – – – – Budget Office Procurement Services Sponsored Research Human Resources Financial Policies & Procedures

Contacts Accounting & Reporting Services – [email protected] – 644-5010 [email protected] Slides available at http://controller.vpfa.fsu.edu/training – Located under General Ledger training materials

Presenters Betsy Miller – [email protected] – 850-644-0292 Carla Daniels – [email protected] – 850-644-1851