ACOA and the BUSINESS OF FOOD Presentation to University of Ottawa

18 Slides613.58 KB

ACOA and the BUSINESS OF FOOD Presentation to University of Ottawa Study Tour Group February 6, 2019

OUTLINE Purpose of Discussion ACOA – who we are and what we do ACOA Food Champion file Regulatory issues for food companies Business impact and Responses Questions / Comments

PURPOSE OF DISCUSSION ACOA has a long-standing (1987) and hands-on relationship with Atlantic Canadian SMEs and communities; This deck calls on that history and also more recent, targeted consultations with food businesses, in particular; The Regulatory World is complex and nuanced; Today is an opportunity to share what we know about business and what we, plus many others, are doing to address regulatory impacts on SMEs; Goal is to have a good exchange of knowledge.

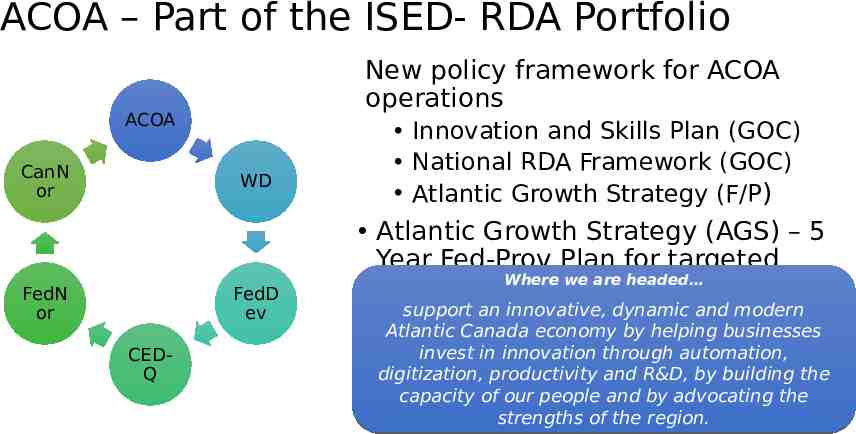

ACOA – Part of the ISED- RDA Portfolio New policy framework for ACOA operations ACOA CanN or WD FedN or FedD ev CEDQ Innovation and Skills Plan (GOC) National RDA Framework (GOC) Atlantic Growth Strategy (F/P) Atlantic Growth Strategy (AGS) – 5 Year Fed-Prov Plan for targeted Where we are headed growth / initiatives support an innovative, dynamic and modern Atlantic Canada economy by helping businesses invest in innovation through automation, digitization, productivity and R&D, by building the capacity of our people and by advocating the strengths of the region.

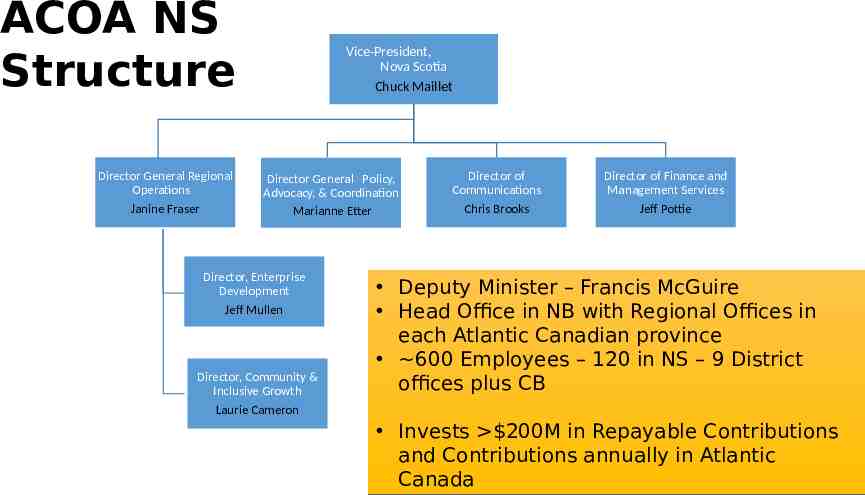

ACOA NS Structure Director General Regional Operations Janine Fraser Vice-President, Nova Scotia Chuck Maillet Director General Policy, Advocacy, & Coordination Marianne Etter Director, Enterprise Development Jeff Mullen Director, Community & Inclusive Growth Laurie Cameron Director of Communications Chris Brooks Director of Finance and Management Services Jeff Pottie Deputy Minister – Francis McGuire Head Office in NB with Regional Offices in each Atlantic Canadian province 600 Employees – 120 in NS – 9 District offices plus CB Invests 200M in Repayable Contributions and Contributions annually in Atlantic 5 Canada

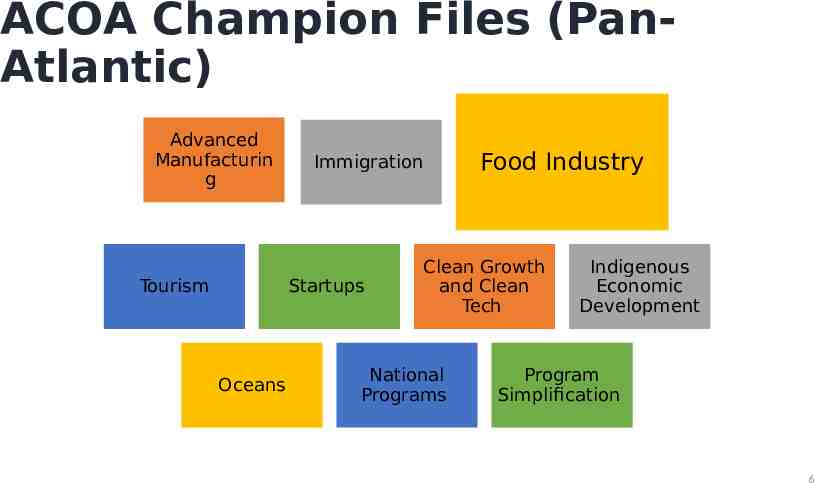

ACOA Champion Files (PanAtlantic) Advanced Manufacturin g Tourism Startups Oceans Food Industry Immigration Clean Growth and Clean Tech National Programs Indigenous Economic Development Program Simplification 6

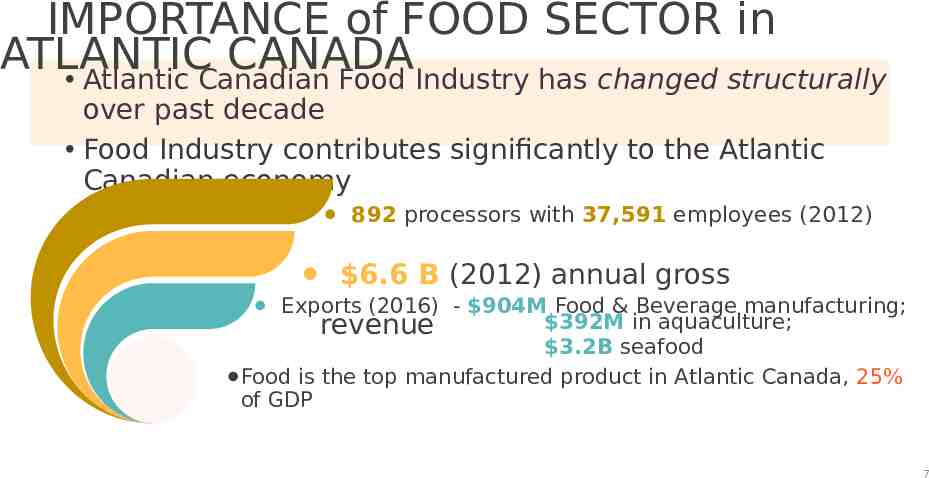

IMPORTANCE of FOOD SECTOR in ATLANTIC CANADA Atlantic Canadian Food Industry has changed structurally over past decade Food Industry contributes significantly to the Atlantic Canadian economy 892 processors with 37,591 employees (2012) 6.6 B (2012) annual gross Exports (2016) - 904M Food & Beverage manufacturing; 392M in aquaculture; revenue 3.2B seafood Food is the top manufactured product in Atlantic Canada, 25% of GDP 7

CHALLENGES to FOOD SECTOR in ATLANTIC CANADA The Region’s small size restricts potential for internal sector growth – oriented. growth has to be export- Scaling companies up to be able to export is crucial. Agri-food sector faces challenges with an aging population and productivity gaps Atlantic Canada’s productivity is 83% of the national avg, 66% for the three Maritime Provinces Exports are concentrated in seafood and frozen food sectors and in larger companies. Food is the top manufactured product in Atlantic Canada, 25% of GDP 8

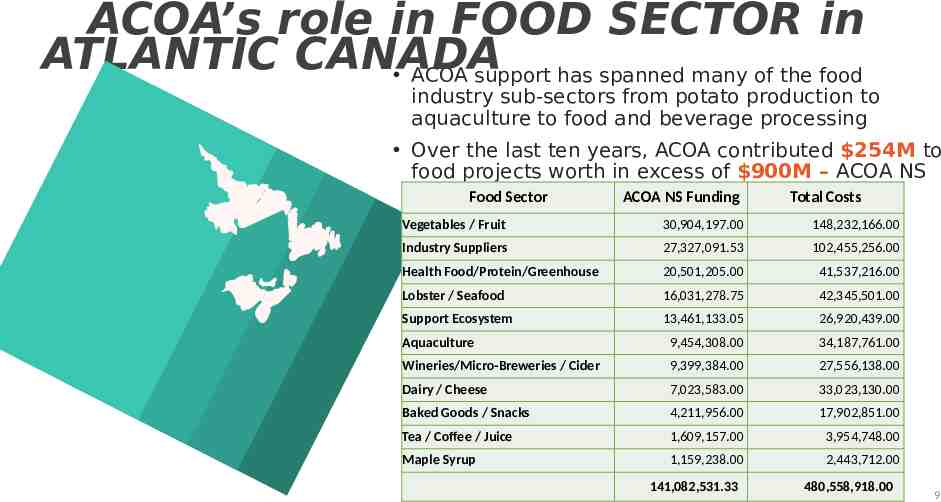

ACOA’s role in FOOD SECTOR in ATLANTIC CANADA ACOA support has spanned many of the food industry sub-sectors from potato production to aquaculture to food and beverage processing Over the last ten years, ACOA contributed 254M to food projects worth in excess of 900M – ACOA NS 141M - Sector 480.6M ACOA NS Funding Food Total Costs Vegetables / Fruit 30,904,197.00 148,232,166.00 Industry Suppliers 27,327,091.53 102,455,256.00 Health Food/Protein/Greenhouse 20,501,205.00 41,537,216.00 Lobster / Seafood 16,031,278.75 42,345,501.00 Support Ecosystem 13,461,133.05 26,920,439.00 Aquaculture 9,454,308.00 34,187,761.00 Wineries/Micro-Breweries / Cider 9,399,384.00 27,556,138.00 Dairy / Cheese 7,023,583.00 33,023,130.00 Baked Goods / Snacks 4,211,956.00 17,902,851.00 Tea / Coffee / Juice 1,609,157.00 3,954,748.00 Maple Syrup 1,159,238.00 2,443,712.00 141,082,531.33 480,558,918.00 9

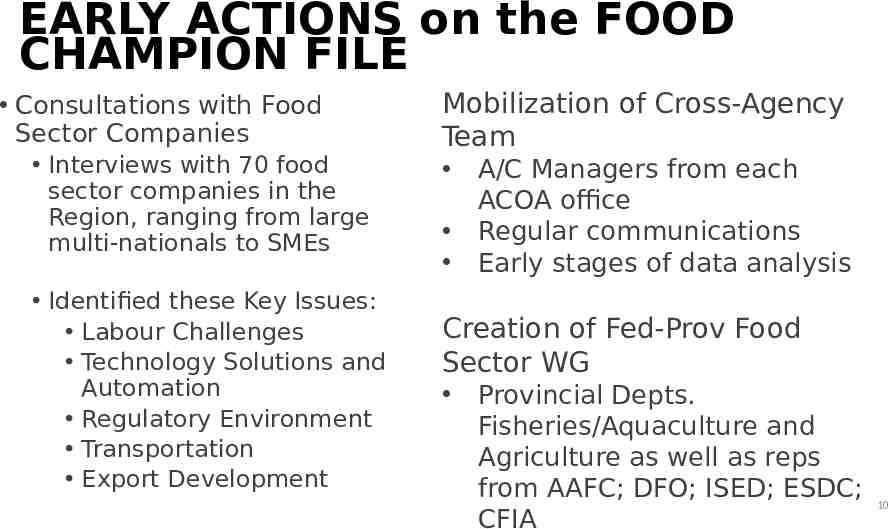

EARLY ACTIONS on the FOOD CHAMPION FILE Consultations with Food Sector Companies Interviews with 70 food sector companies in the Region, ranging from large multi-nationals to SMEs Identified these Key Issues: Labour Challenges Technology Solutions and Automation Regulatory Environment Transportation Export Development Mobilization of Cross-Agency Team A/C Managers from each ACOA office Regular communications Early stages of data analysis Creation of Fed-Prov Food Sector WG Provincial Depts. Fisheries/Aquaculture and Agriculture as well as reps from AAFC; DFO; ISED; ESDC; CFIA 10

11

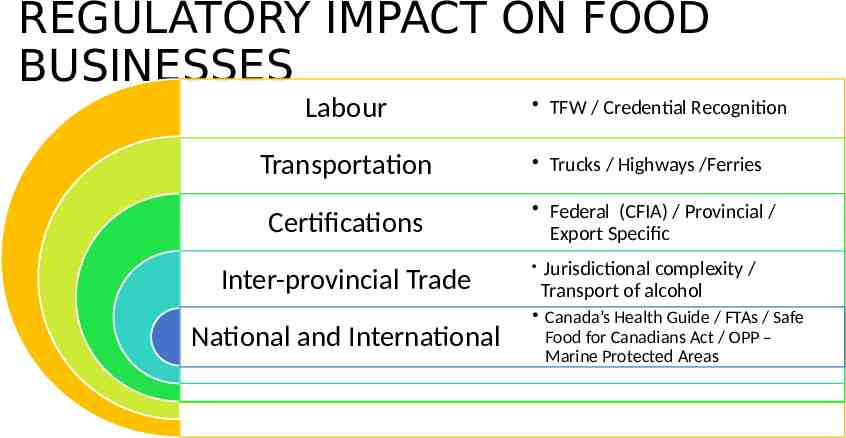

REGULATORY IMPACT ON FOOD BUSINESSES Labour Transportation Certifications Inter-provincial Trade National and International TFW / Credential Recognition Trucks / Highways /Ferries Federal (CFIA) / Provincial / Export Specific Jurisdictional complexity / Transport of alcohol Canada’s Health Guide / FTAs / Safe Food for Canadians Act / OPP – Marine Protected Areas

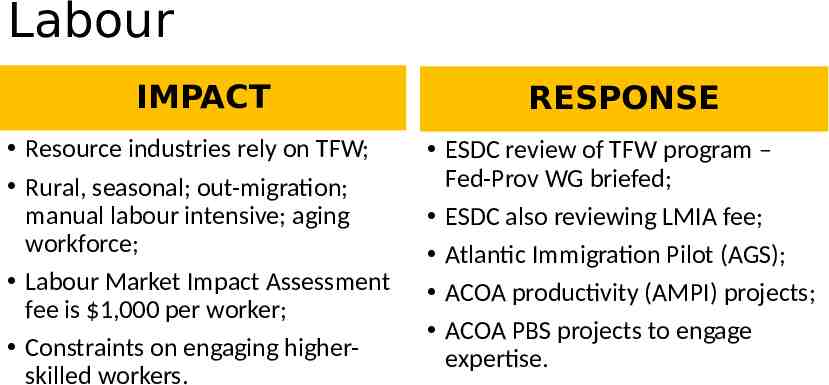

Labour IMPACT RESPONSE Resource industries rely on TFW; Rural, seasonal; out-migration; manual labour intensive; aging workforce; Labour Market Impact Assessment fee is 1,000 per worker; Constraints on engaging higherskilled workers. ESDC review of TFW program – Fed-Prov WG briefed; ESDC also reviewing LMIA fee; Atlantic Immigration Pilot (AGS); ACOA productivity (AMPI) projects; ACOA PBS projects to engage expertise.

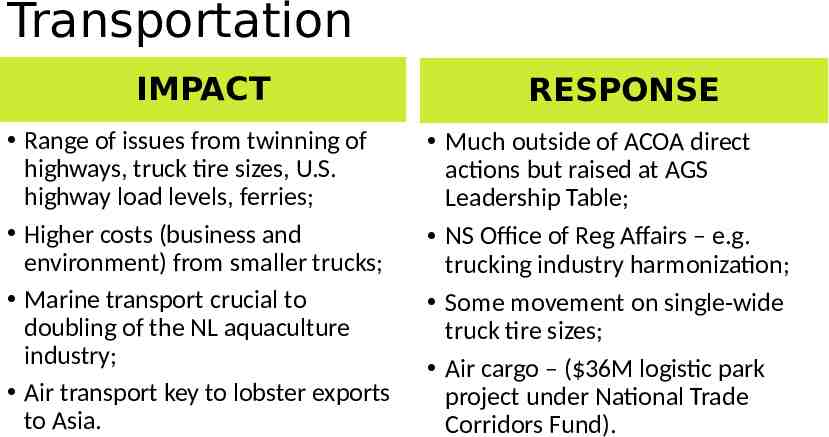

Transportation IMPACT Range of issues from twinning of highways, truck tire sizes, U.S. highway load levels, ferries; Higher costs (business and environment) from smaller trucks; Marine transport crucial to doubling of the NL aquaculture industry; Air transport key to lobster exports to Asia. RESPONSE Much outside of ACOA direct actions but raised at AGS Leadership Table; NS Office of Reg Affairs – e.g. trucking industry harmonization; Some movement on single-wide truck tire sizes; Air cargo – ( 36M logistic park project under National Trade Corridors Fund).

Certifications, licensing, labelling IMPACT SMEs do not have the same capacity / resources to comply; CFIB estimates the cost to small business is 6,683 / employee (2014); SMEs do not have dedicated staff to handle process; Constraint to business growth and scale-up. RESPONSE Much applies to provincial jurisdiction; Council of Atlantic Premiers have signed agreement in principle; NS Office of Reg Affairs making progress on many issues; Best practice with NS Business Navigator service; Possible role for an Atlantic Food Hub.

Inter-Provincial Trade - Alcohol IMPACT RESPONSE Wineries, micro-breweries, cider, and distilleries; Deterrent to domestic trade therefore a constraint to scale-up; Ironically makes international trade easier to do than just across the highway; Micro-breweries establish in neighbor provinces but this negates economies of scale. The Canadian Free Trade Agreement came into effect on July 1, 2017; A pan-provincial working group has been established to investigate and make recommendations; Priority of the AGS Leadership Table.

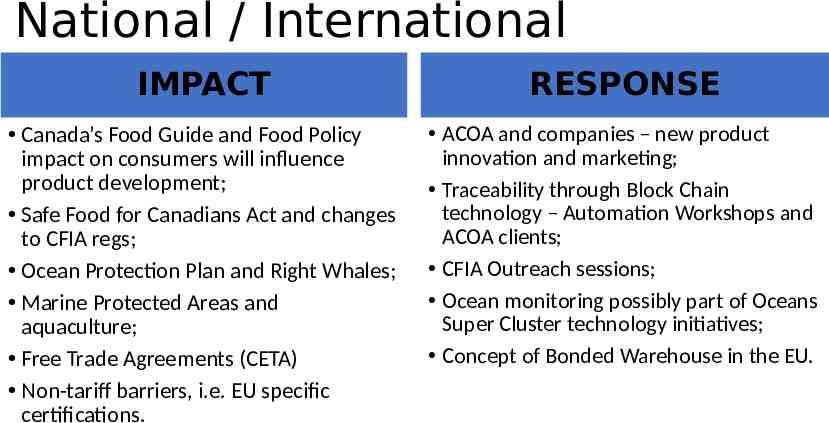

National / International IMPACT RESPONSE Canada’s Food Guide and Food Policy impact on consumers will influence product development; Safe Food for Canadians Act and changes to CFIA regs; Ocean Protection Plan and Right Whales; Marine Protected Areas and aquaculture; Free Trade Agreements (CETA) Non-tariff barriers, i.e. EU specific certifications. ACOA and companies – new product innovation and marketing; Traceability through Block Chain technology – Automation Workshops and ACOA clients; CFIA Outreach sessions; Ocean monitoring possibly part of Oceans Super Cluster technology initiatives; Concept of Bonded Warehouse in the EU.

Questions / Comments? Jeff Mullen, Director Enterprise Development, ACOA NS [email protected] 902-426-8978 Gail Edwards, Economic Development Officer, ACOA NS [email protected] 902-426-4871