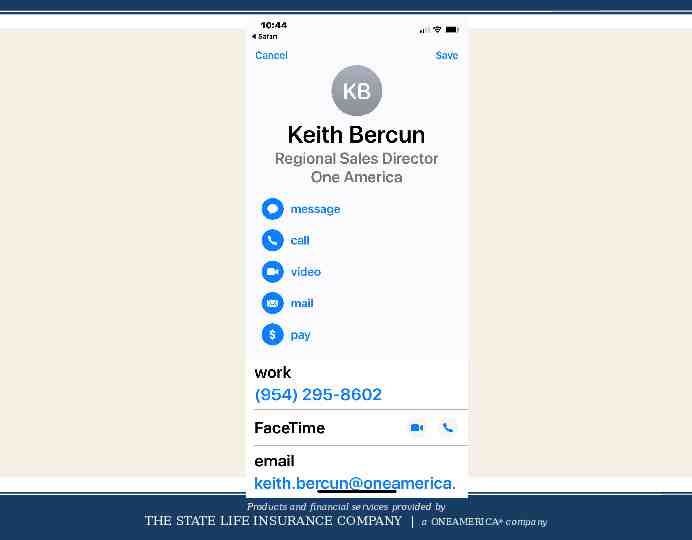

YOUR ASSET-BASED LTC OPPORTUNITY Presented by: Keith Bercun,

38 Slides2.64 MB

YOUR ASSET-BASED LTC OPPORTUNITY Presented by: Keith Bercun, Regional Sales Director CLTC For company and recruiting use only. Not for public distribution. Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

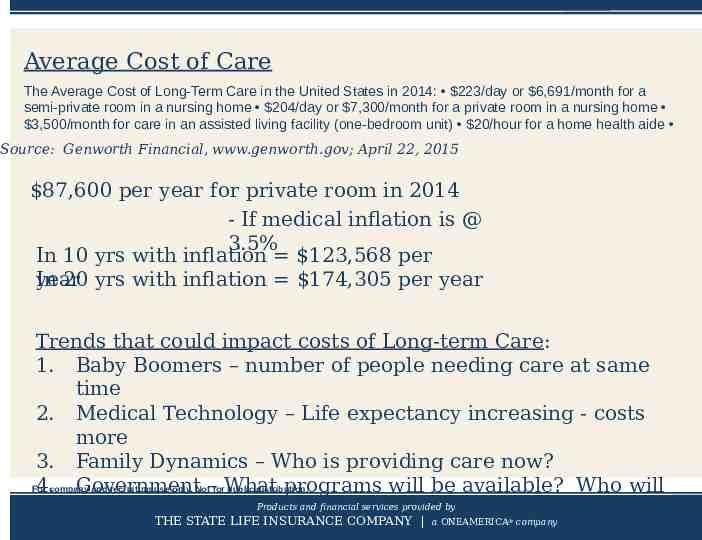

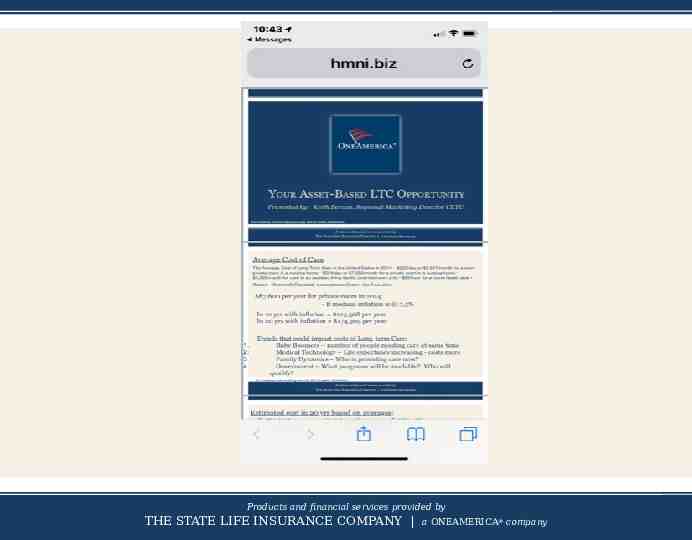

Average Cost of Care The Average Cost of Long-Term Care in the United States in 2014: 223/day or 6,691/month for a semi-private room in a nursing home 204/day or 7,300/month for a private room in a nursing home 3,500/month for care in an assisted living facility (one-bedroom unit) 20/hour for a home health aide Source: Genworth Financial, www.genworth.gov; April 22, 2015 87,600 per year for private room in 2014 - If medical inflation is @ 3.5% In 10 yrs with inflation 123,568 per In 20 yrs with inflation 174,305 per year year Trends that could impact costs of Long-term Care: 1. Baby Boomers – number of people needing care at same time 2. Medical Technology – Life expectancy increasing - costs more 3. Family Dynamics – Who is providing care now? For and recruiting use only. Not– forWhat public distribution. 4.company Government programs will be available? Who will and financial services provided by qualify?THE STATE LIFEProducts INSURANCE COMPANY a ONEAMERICA company

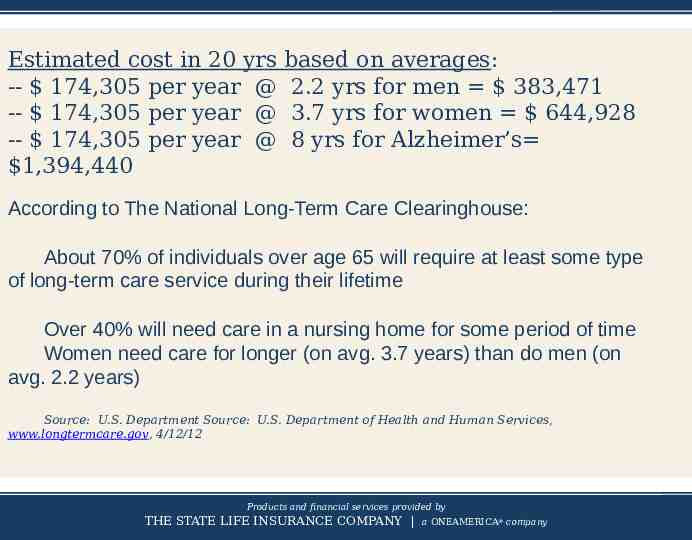

Estimated cost in 20 yrs -- 174,305 per year @ -- 174,305 per year @ -- 174,305 per year @ 1,394,440 based on averages: 2.2 yrs for men 383,471 3.7 yrs for women 644,928 8 yrs for Alzheimer’s According to The National Long-Term Care Clearinghouse: About 70% of individuals over age 65 will require at least some type of long-term care service during their lifetime Over 40% will need care in a nursing home for some period of time Women need care for longer (on avg. 3.7 years) than do men (on avg. 2.2 years) Source: U.S. Department Source: U.S. Department of Health and Human Services, www.longtermcare.gov, 4/12/12 Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

Two Questions Every Financial Professional Should ask their clients: 1. You may never need care, but if you did, how will that affect your family? Spouse? Adult children? Family Dynamics? Finances? 2. And if you did need care, how will you pay for it? Government? LTC insurance? Self fund? For company and recruiting use only. Not for public distribution. Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

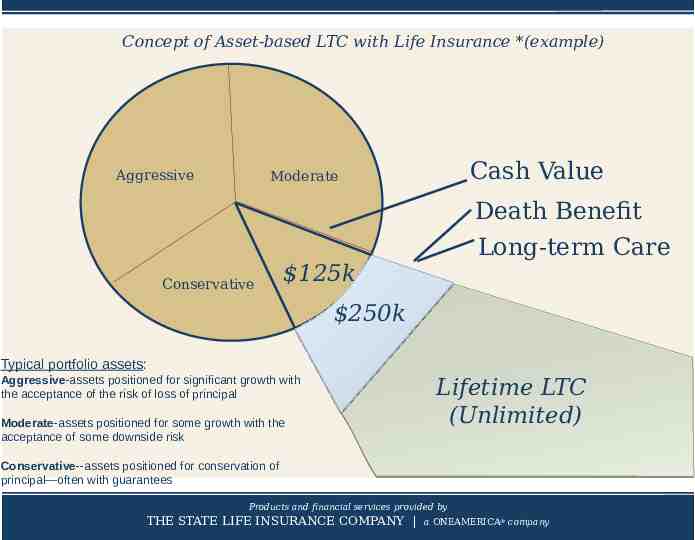

Concept of Asset-based LTC with Life Insurance *(example) Aggressive Cash Value Moderate Conservative Death Benefit Long-term Care 125k 250k Typical portfolio assets: Aggressive-assets positioned for significant growth with the acceptance of the risk of loss of principal Moderate-assets positioned for some growth with the acceptance of some downside risk Lifetime LTC (Unlimited) Conservative--assets positioned for conservation of principal—often with guarantees Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

Portfolio Protection! Not only is this portfolio protection for the client, it’s portfolio protection for a producer! If an agent has a producer clientele, and over the next 10-15 years their clients begin to withdraw hundreds of thousands of dollars out of accounts that are being managed . what happens to their business? For company and recruiting use only. Not for public distribution. Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

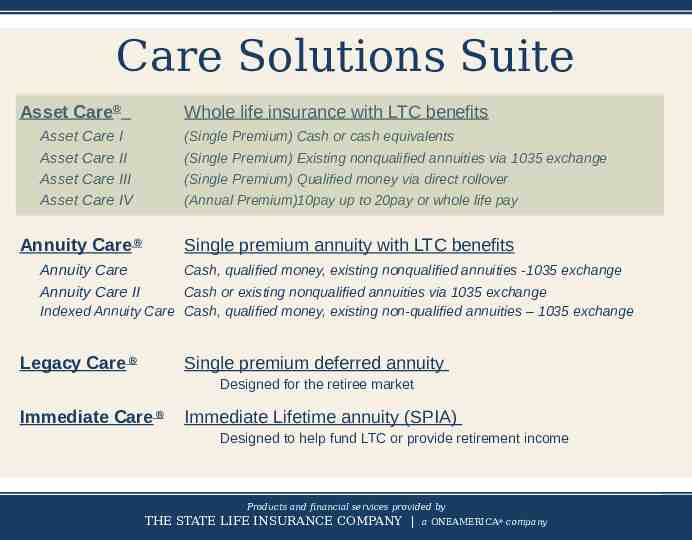

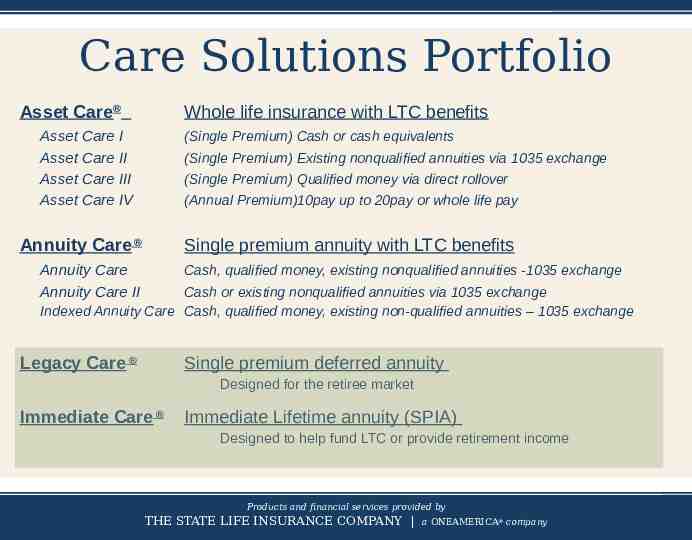

Care Solutions Suite Asset Care Whole life insurance with LTC benefits Asset Care I Asset Care II Asset Care III Asset Care IV (Single Premium) Cash or cash equivalents (Single Premium) Existing nonqualified annuities via 1035 exchange (Single Premium) Qualified money via direct rollover (Annual Premium)10pay up to 20pay or whole life pay Annuity Care Single premium annuity with LTC benefits Annuity Care Annuity Care II Cash, qualified money, existing nonqualified annuities -1035 exchange Cash or existing nonqualified annuities via 1035 exchange Indexed Annuity Care Cash, qualified money, existing non-qualified annuities – 1035 exchange Legacy Care Single premium deferred annuity Designed for the retiree market Immediate Care Immediate Lifetime annuity (SPIA) Designed to help fund LTC or provide retirement income Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

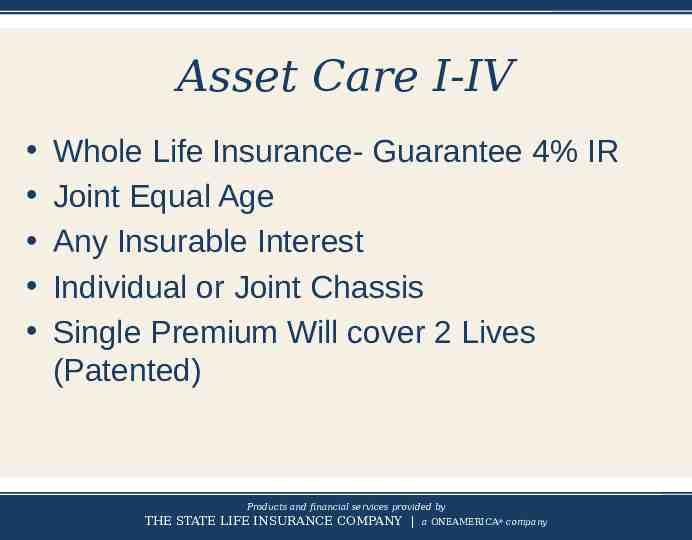

Asset Care I-IV Whole Life Insurance- Guarantee 4% IR Joint Equal Age Any Insurable Interest Individual or Joint Chassis Single Premium Will cover 2 Lives (Patented) Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

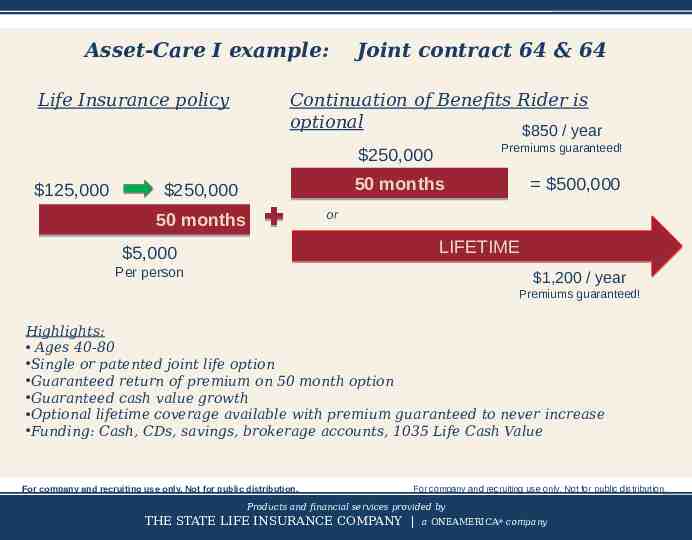

Asset-Care I example: Life Insurance policy 125,000 Joint contract 64 & 64 Continuation of Benefits Rider is optional 850 / year Premiums guaranteed! 250,000 500,000 50 months 250,000 or 50 months LIFETIME 5,000 Per person 1,200 / year Premiums guaranteed! Highlights: Ages 40-80 Single or patented joint life option Guaranteed return of premium on 50 month option Guaranteed cash value growth Optional lifetime coverage available with premium guaranteed to never increase Funding: Cash, CDs, savings, brokerage accounts, 1035 Life Cash Value For company and recruiting use only. Not for public distribution. For company and recruiting use only. Not for public distribution. Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

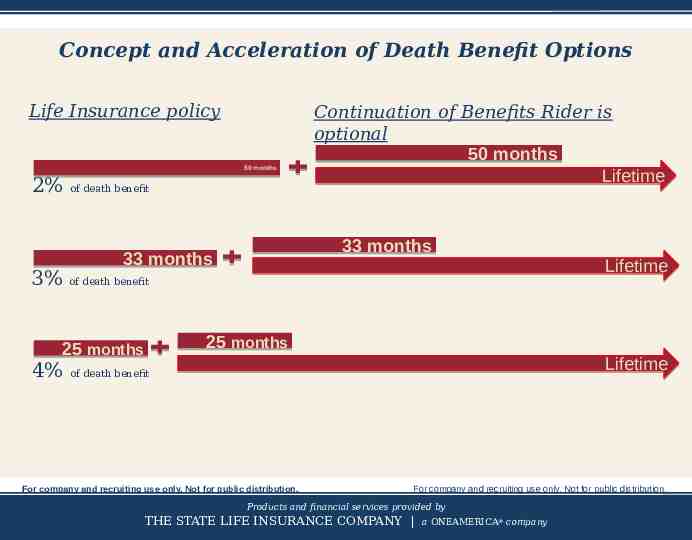

Concept and Acceleration of Death Benefit Options Life Insurance policy 2% 3% 50 50 months months of death benefit 33 months 33 months Lifetime of death benefit 25 months 25 months 4% Continuation of Benefits Rider is optional 50 months Lifetime Lifetime of death benefit For company and recruiting use only. Not for public distribution. For company and recruiting use only. Not for public distribution. Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

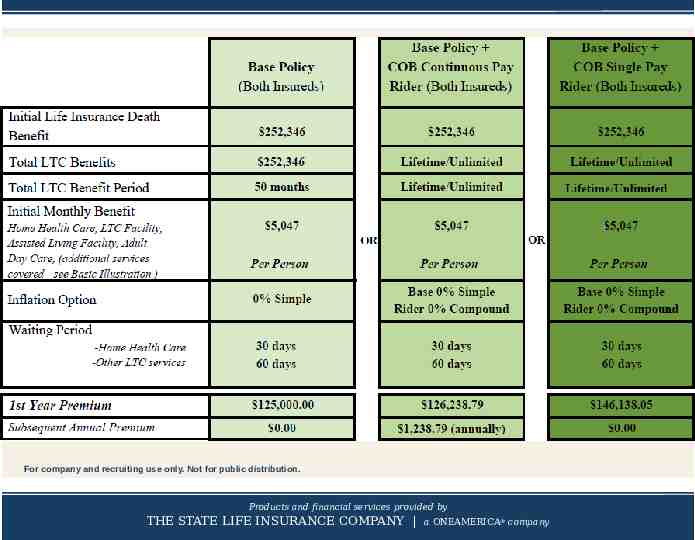

For company and recruiting use only. Not for public distribution. Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

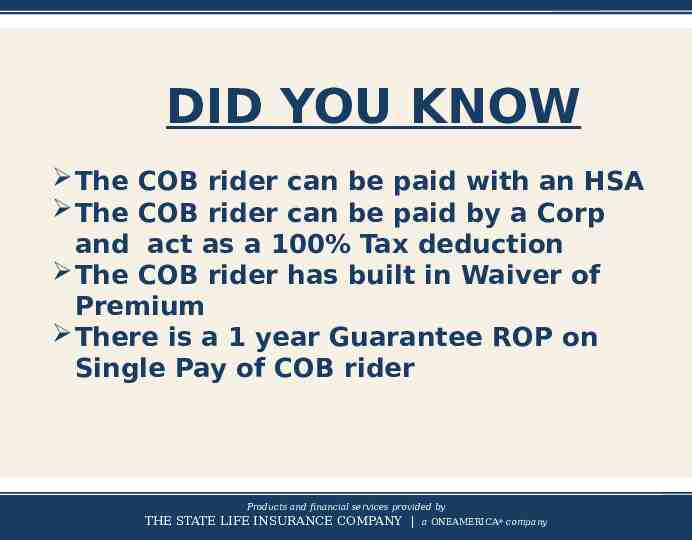

DID YOU KNOW The COB rider can be paid with an HSA The COB rider can be paid by a Corp and act as a 100% Tax deduction The COB rider has built in Waiver of Premium There is a 1 year Guarantee ROP on Single Pay of COB rider Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

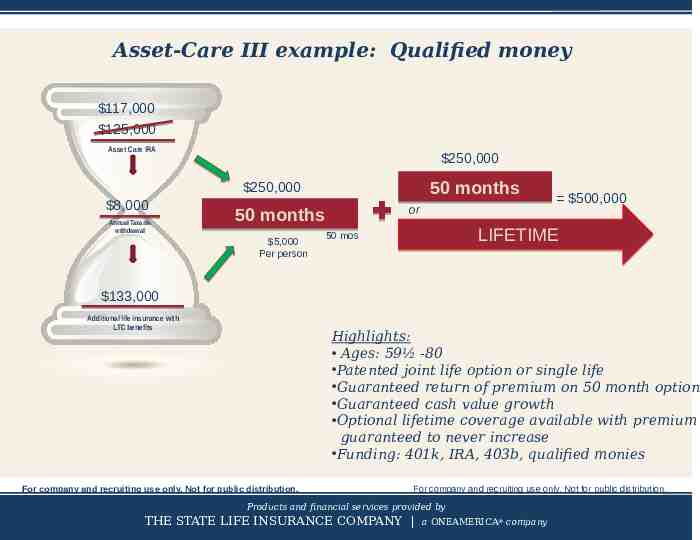

Asset-Care III example: Qualified money 117,000 125,000 Asset Care IRA 250,000 50 months 250,000 8,000 Annual Taxable withdrawal or 50 months 5,000 Per person 500,000 LIFETIME 50 mos 133,000 Additional life insurance with LTC benefits Highlights: Ages: 59½ -80 Patented joint life option or single life Guaranteed return of premium on 50 month option Guaranteed cash value growth Optional lifetime coverage available with premium guaranteed to never increase Funding: 401k, IRA, 403b, qualified monies For company and recruiting use only. Not for public distribution. For company and recruiting use only. Not for public distribution. Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

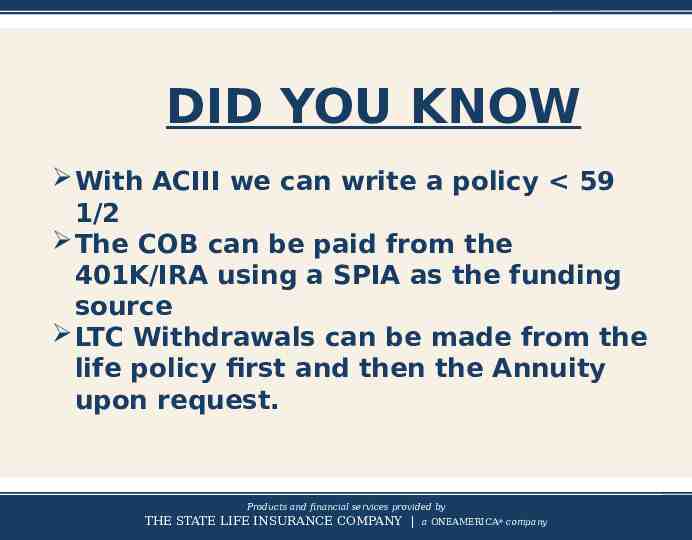

DID YOU KNOW With ACIII we can write a policy 59 1/2 The COB can be paid from the 401K/IRA using a SPIA as the funding source LTC Withdrawals can be made from the life policy first and then the Annuity upon request. Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

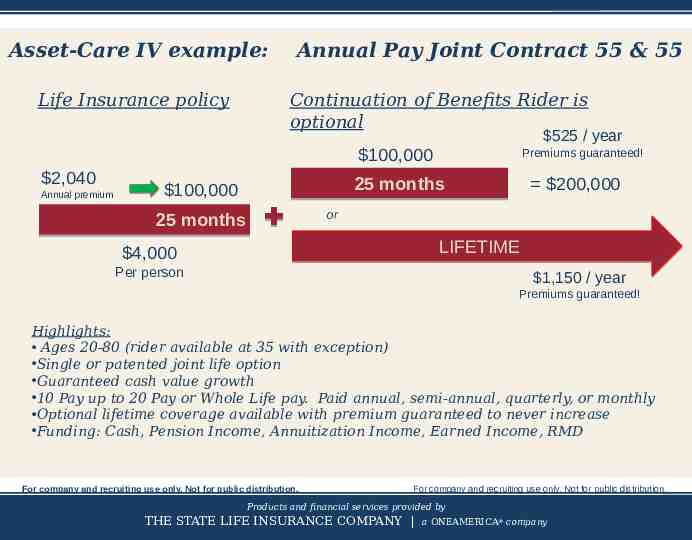

Asset-Care IV example: Life Insurance policy Annual Pay Joint Contract 55 & 55 Continuation of Benefits Rider is optional 525 / year 100,000 2,040 Annual premium Premiums guaranteed! 200,000 25 months 100,000 or 25 months LIFETIME 4,000 Per person 1,150 / year Premiums guaranteed! Highlights: Ages 20-80 (rider available at 35 with exception) Single or patented joint life option Guaranteed cash value growth 10 Pay up to 20 Pay or Whole Life pay. Paid annual, semi-annual, quarterly, or monthly Optional lifetime coverage available with premium guaranteed to never increase Funding: Cash, Pension Income, Annuitization Income, Earned Income, RMD For company and recruiting use only. Not for public distribution. For company and recruiting use only. Not for public distribution. Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

DID YOU KNOW You can fund the Base policy and COB using 1035 from an existing life policy When on claim your premiums are reduced proportionately Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

Care Solutions Portfolio Asset Care Whole life insurance with LTC benefits Asset Care I Asset Care II Asset Care III Asset Care IV (Single Premium) Cash or cash equivalents (Single Premium) Existing nonqualified annuities via 1035 exchange (Single Premium) Qualified money via direct rollover (Annual Premium)10pay up to 20pay or whole life pay Annuity Care Single premium annuity with LTC benefits Annuity Care Annuity Care II Cash, qualified money, existing nonqualified annuities -1035 exchange Cash or existing nonqualified annuities via 1035 exchange Indexed Annuity Care Cash, qualified money, existing non-qualified annuities – 1035 exchange Legacy Care Single premium deferred annuity Designed for the retiree market Immediate Care Immediate Lifetime annuity (SPIA) Designed to help fund LTC or provide retirement income Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

Annuities According to 2013 Gallop survey of Non-Qualified Annuity owners: – 79% intend to use their annuity as a financial resource to avoid being a financial burden on their children – 73% intend to use their annuity as an emergency fund in the case of a catastrophic illness or for nursing home care For company and recruiting use only. Not for public distribution. Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

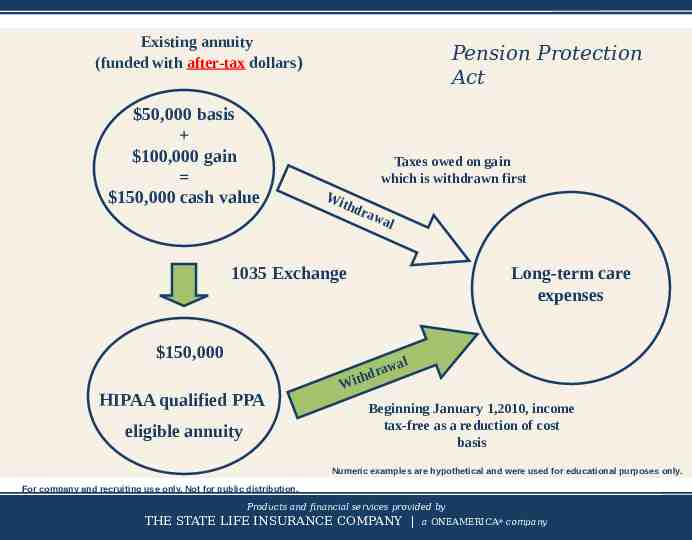

Existing annuity (funded with after-tax dollars) 50,000 basis 100,000 gain 150,000 cash value Pension Protection Act Taxes owed on gain which is withdrawn first Wit hd raw a l 1035 Exchange 150,000 HIPAA qualified PPA eligible annuity Long-term care expenses a raw d h t Wi l Beginning January 1,2010, income tax-free as a reduction of cost basis Numeric examples are hypothetical and were used for educational purposes only. For company and recruiting use only. Not for public distribution. Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company Not FDIC Insured-May Lose Value-Not Bank Guaranteed –For company and recruiting use only - Not for Public Distribution

Annuity Care I & II SPDA- Current rates 1.65%/Cash and 2.85%/LTC Joint Equal Age Individual or Joint Chassis Must be Spouses Single Premium Will cover 2 Lives PPA eligible HIPPA qualified Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

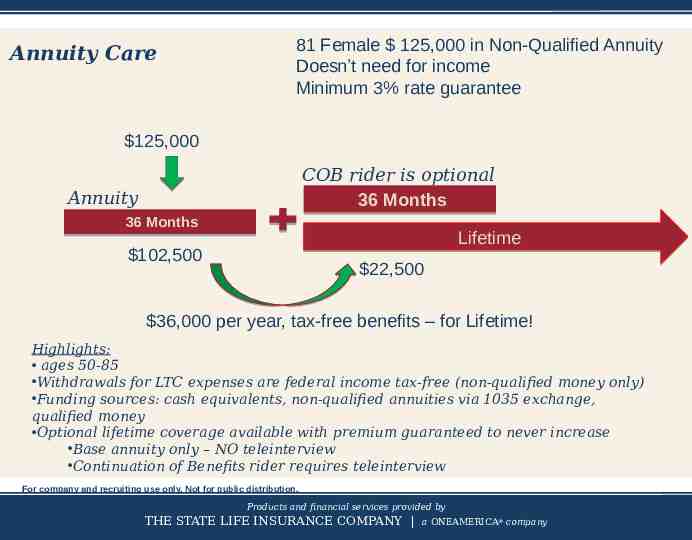

Annuity Care 81 Female 125,000 in Non-Qualified Annuity Doesn’t need for income Minimum 3% rate guarantee 125,000 COB rider is optional 36 Months Annuity 36 Months Lifetime 102,500 22,500 36,000 per year, tax-free benefits – for Lifetime! Highlights: ages 50-85 Withdrawals for LTC expenses are federal income tax-free (non-qualified money only) Funding sources: cash equivalents, non-qualified annuities via 1035 exchange, qualified money Optional lifetime coverage available with premium guaranteed to never increase Base annuity only – NO teleinterview Continuation of Benefits rider requires teleinterview For company and recruiting use only. Not for public distribution. Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

DID YOU KNOW We will insure up to age 87 if no COB rider, no exception needed! Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

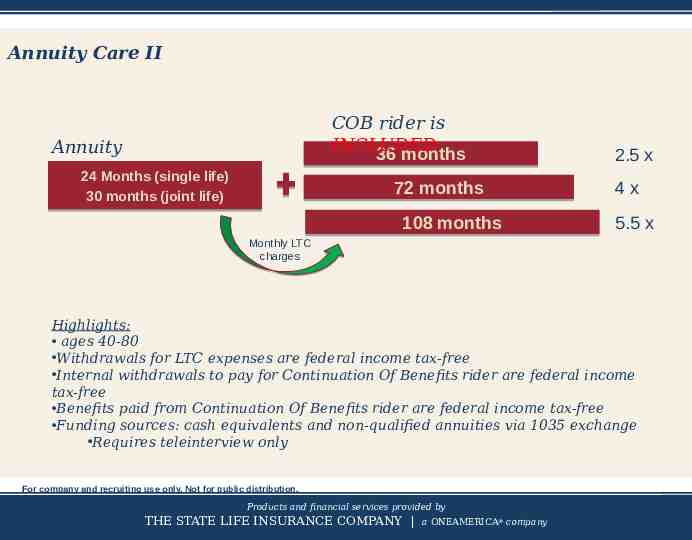

Annuity Care II COB rider is INCLUDED 36 months Annuity 24 Months (single life) 30 months (joint life) 72 months 108 months 2.5 x 4x 5.5 x Monthly LTC charges Highlights: ages 40-80 Withdrawals for LTC expenses are federal income tax-free Internal withdrawals to pay for Continuation Of Benefits rider are federal income tax-free Benefits paid from Continuation Of Benefits rider are federal income tax-free Funding sources: cash equivalents and non-qualified annuities via 1035 exchange Requires teleinterview only For company and recruiting use only. Not for public distribution. Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

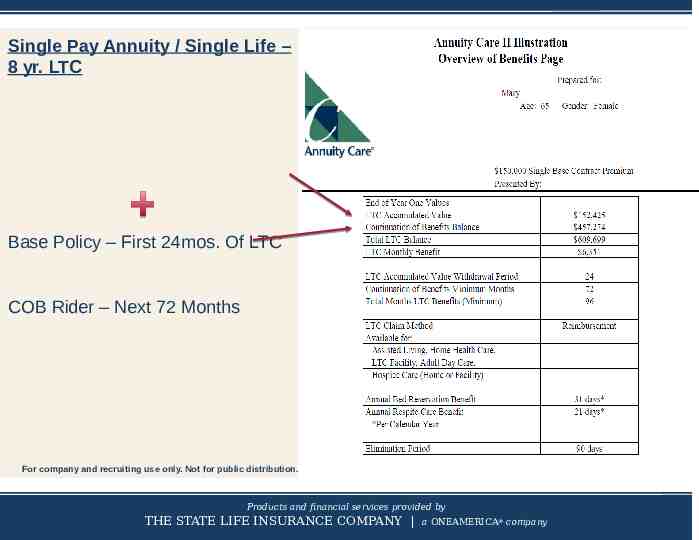

Single Pay Annuity / Single Life – 8 yr. LTC Base Policy – First 24mos. Of LTC COB Rider – Next 72 Months For company and recruiting use only. Not for public distribution. Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

For company and recruiting use only. Not for public distribution. Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

For company and recruiting use only. Not for public distribution. Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

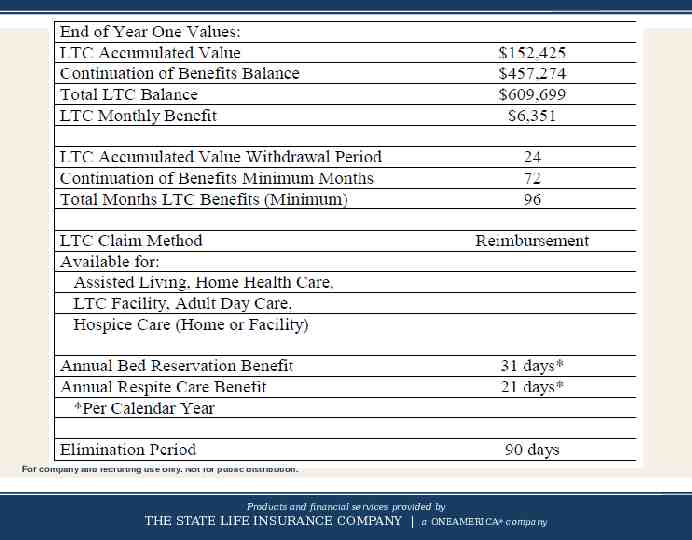

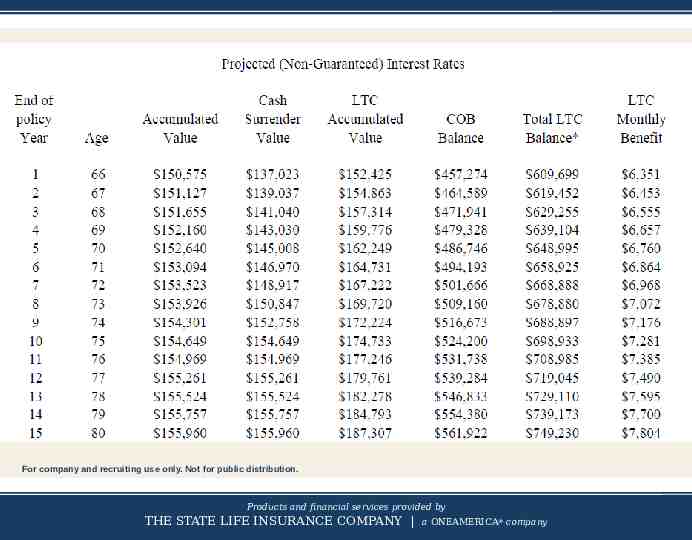

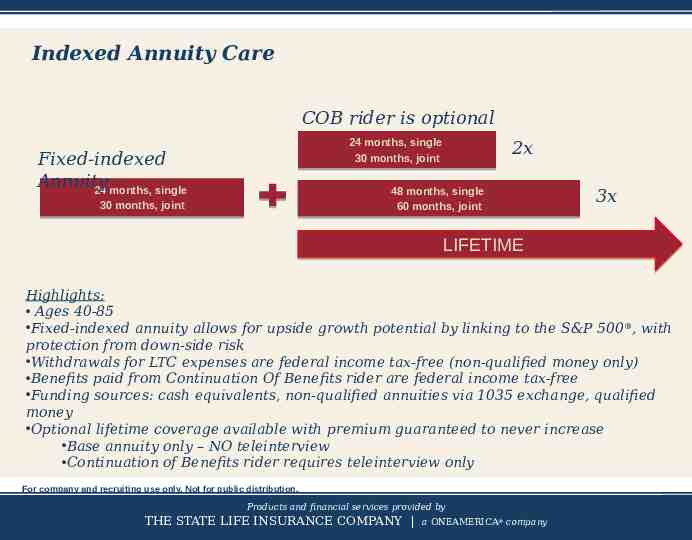

Indexed Annuity Care COB rider is optional 24 months, single 30 months, joint Fixed-indexed Annuity 24 months, single 2x 48 months, single 60 months, joint 24 months, single 30 months, joint 3x LIFETIME Highlights: Ages 40-85 Fixed-indexed annuity allows for upside growth potential by linking to the S&P 500 , with protection from down-side risk Withdrawals for LTC expenses are federal income tax-free (non-qualified money only) Benefits paid from Continuation Of Benefits rider are federal income tax-free Funding sources: cash equivalents, non-qualified annuities via 1035 exchange, qualified money Optional lifetime coverage available with premium guaranteed to never increase Base annuity only – NO teleinterview Continuation of Benefits rider requires teleinterview only For company and recruiting use only. Not for public distribution. Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

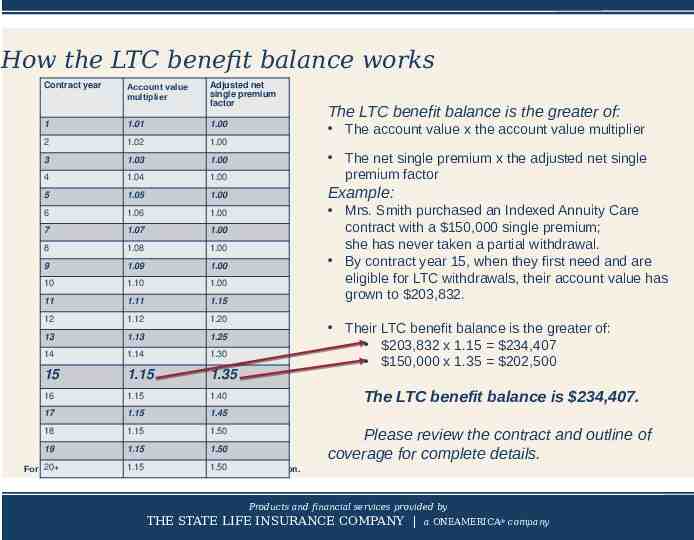

How the LTC benefit balance works Contract year Account value multiplier Adjusted net single premium factor 1 1.01 1.00 2 1.02 1.00 3 1.03 1.00 4 1.04 1.00 The net single premium x the adjusted net single premium factor 5 1.05 1.00 Example: 6 1.06 1.00 7 1.07 1.00 8 1.08 1.00 9 1.09 1.00 10 1.10 1.00 11 1.11 1.15 12 1.12 1.20 13 1.13 1.25 14 1.14 1.30 15 1.15 1.35 16 1.15 1.40 17 1.15 1.45 18 1.15 1.50 19 1.15 1.50 The LTC benefit balance is the greater of: The account value x the account value multiplier Mrs. Smith purchased an Indexed Annuity Care contract with a 150,000 single premium; she has never taken a partial withdrawal. By contract year 15, when they first need and are eligible for LTC withdrawals, their account value has grown to 203,832. Their LTC benefit balance is the greater of: 203,832 x 1.15 234,407 150,000 x 1.35 202,500 The LTC benefit balance is 234,407. Please review the contract and outline of coverage for complete details. 20 1.15 use only. Not for 1.50 For company and recruiting public distribution. Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

Care Solutions Portfolio Asset Care Whole life insurance with LTC benefits Asset Care I Asset Care II Asset Care III Asset Care IV (Single Premium) Cash or cash equivalents (Single Premium) Existing nonqualified annuities via 1035 exchange (Single Premium) Qualified money via direct rollover (Annual Premium)10pay up to 20pay or whole life pay Annuity Care Single premium annuity with LTC benefits Annuity Care Annuity Care II Cash, qualified money, existing nonqualified annuities -1035 exchange Cash or existing nonqualified annuities via 1035 exchange Indexed Annuity Care Cash, qualified money, existing non-qualified annuities – 1035 exchange Legacy Care Single premium deferred annuity Designed for the retiree market Immediate Care Immediate Lifetime annuity (SPIA) Designed to help fund LTC or provide retirement income Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

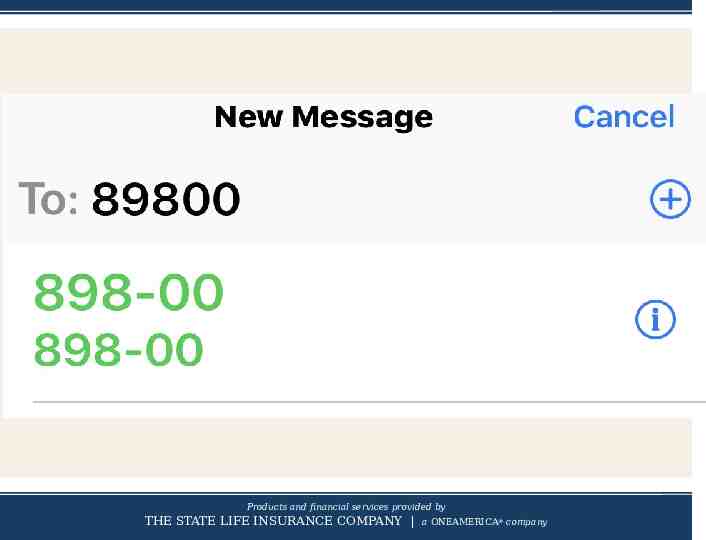

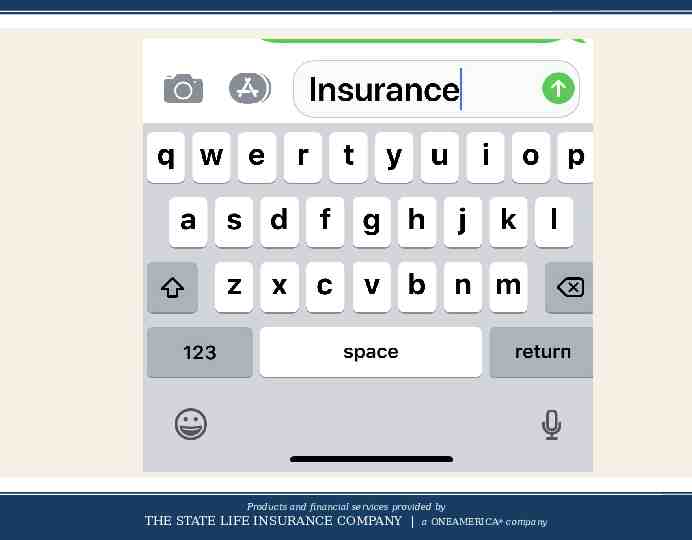

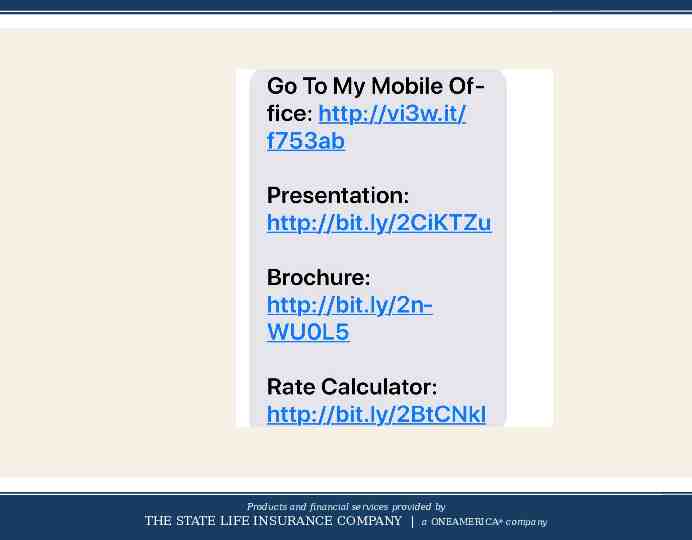

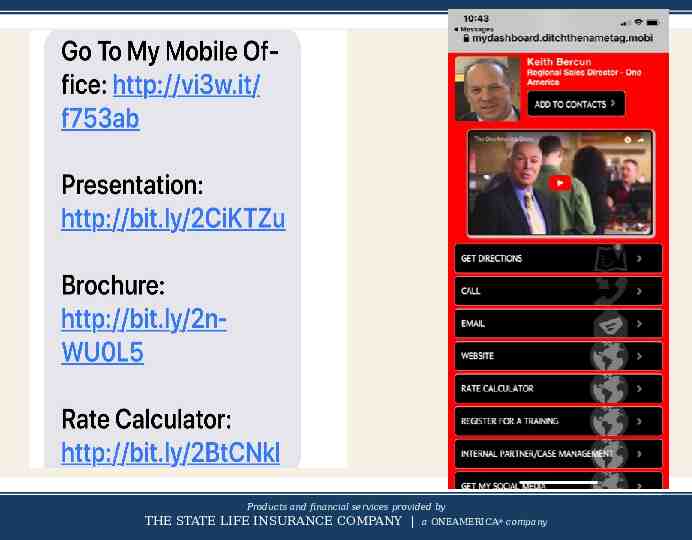

Let’s get started Immediately text to: 89800 “Insurance” [email protected] Products and financial services provided by THE STATE LIFE INSURANCE COMPANY For company and recruiting use only. Not for public distribution. a ONEAMERICA company

Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company

Products and financial services provided by THE STATE LIFE INSURANCE COMPANY a ONEAMERICA company