Usability Testing Redesign at TIAA-CREF: Unexpected Results presented

26 Slides784.00 KB

Usability Testing Redesign at TIAA-CREF: Unexpected Results presented by Deborah S. Bosley, Ph.D. www.theplainlanguagegroup.com Center for Plain Language Symposium November 7, 2008

Here’s how some people think

Consider this Simplicity Credibility Advocacy

Simplicity Many customers have to understand the financial information well enough to explain it to someone else. Readers think that the more complex written information is, the less respect they had for the writer1 33% of senior citizens miss out on benefits, services, and money because application process too difficult 1 Daniel M. Oppenheimer. “Consequences of Erudite Vernacular Utilized Irrespective of Necessity: Problems with Using Long Words Needlessly.” Applied Cognitive Psychology. March 2006.

Credibility “Trust remains the most ‘essential’ quality for a financial services firm, outranking performance.” 70% of Americans: “I don’t know whom to trust anymore.” TIAA-CREF Trust in America Survey: investor trust drops: 2005 Trust in America Index -- 10.8%; 2004 -- 13.2% 2 TIAA-CREF’s trust quotient is high: “Rollover to another company? I wouldn’t think of it.” 1 J.Lukaszewski, ed. Trust, consumer study. Golin/Harris International Chicago, February 2002 1

Advocacy “If a company advocates for its customers, they will reciprocate with their trust, loyalty, and purchases -either now or in the future.”1 “Customer Advocacy provides customers with open, honest, and complete information truly representing their customers’ best interests, essentially becoming advocates for them.”1 “Advocacy strategies have been emerging in a range of industries including the financial ”1 1 Urban, Glenn R. The Emerging Era of Customer Advocacy, MITSloan Management Review, Winter 2004

Minimum Distribution is Fed requirement that individuals who turn 70 ½ must receive at least a minimum amount of income from the most tax-favored retirement plans Traditional IRAs begin MD by April 1 of the year after the year in which the person turns 70 ½ or retires, whichever is later Individuals may be subject to a 50% tax penalty if they do not receive required distributions by the deadlines.

Why communicate? Make participants aware of potential distribution requirements Help participants receive the required amounts of income and avoid tax penalties. Deepen and strengthen participant relationships

Original MDO Letter

Original MDO Letter

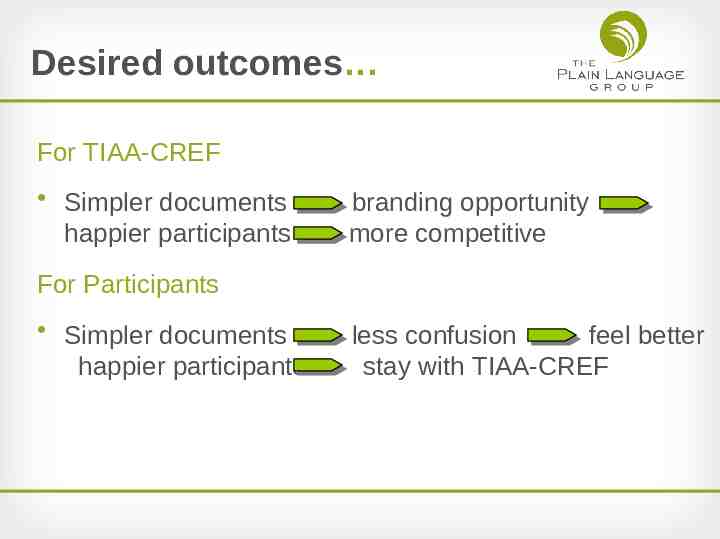

Desired outcomes For TIAA-CREF Simpler documents happier participants branding opportunity more competitive For Participants Simpler documents happier participants less confusion feel better stay with TIAA-CREF

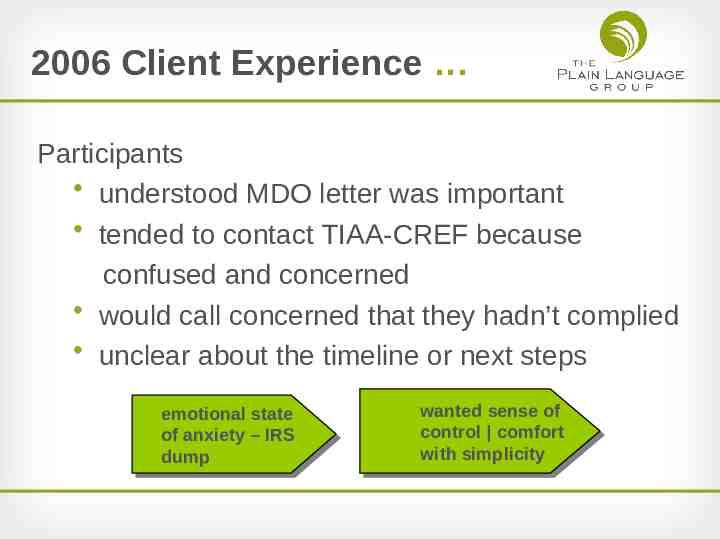

2006 Client Experience Participants understood MDO letter was important tended to contact TIAA-CREF because confused and concerned would call concerned that they hadn’t complied unclear about the timeline or next steps emotional emotional state state of of anxiety anxiety –– IRS IRS dump dump wanted wanted sense sense of of control control comfort comfort with with simplicity simplicity

2007 approach Value Proposition Personal, objective consultation for specific needs, free of charge, from longstanding retirement experts Key Proof Points Noncommissioned consultants; among first firms to offer options that automatically calculate and annually pay out required amount Call to Action Encourage contacting TIAA-CREF consultant via phone to address the participant’s specific situation

Methodology Tested 13 participants Four in 65 group Nine in 40 group

Methodology used a “talk aloud protocol” encouraged to fill out forms asked questions videotaped interviews took notes during interviews noted patterns of responses counted certain responses

Areas of Attention expectations content vocabulary forms and processes emotions privacy and security

Content “I don’t understand the underlined passage.” “Need to read it one more time. I think I understand.” “You don’t have to take it all out? You can still be working and get it?” “What if you turn 70 1/2 and hadn’t done something?” “If I don’t retire, do I have to do this?” What must you do next after reading the letter? 3: call 1: do nothing What are the consequences of not responding to the letter? 4: penalties

Vocabulary “Lifetime retirement income? Not sure what that is.” “Minimum Distribution Option don’t know what that is don’t know what the ‘option’ is.” Do you plan to receive what the letter refers to as "lifetime retirement income?” 3: didn’t know what that meant 1: yes

Forms, processes “Wish this stuff about all these dates were in a table so it’s easier to read.” “What lead time do you need? three months prior to when you’ll need the income? What, if any, follow-up communication would you expect after receiving this letter? 3: a reminder 1: nothing

Patterns Participants called (the primary purpose) but because they were confused, not because they knew they were supposed to understood the importance of the letter, but not necessarily what to do about it were not clear on timeline and dates

Different approach Transformed message by offering guidance and consultation Developed simple and direct content with minimal legal tax language Tested again pre-launch to fine-tune

What we learned Make the point of the letter the focus of the letter Eliminate all information that can be more easily conveyed on the telephone Use plain language strategies Be helpful, urgent but not threatening

What we did Transformed message by offering guidance and consultation Developed simple and direct content with minimal legal tax language Tested again pre-launch to fine-tune

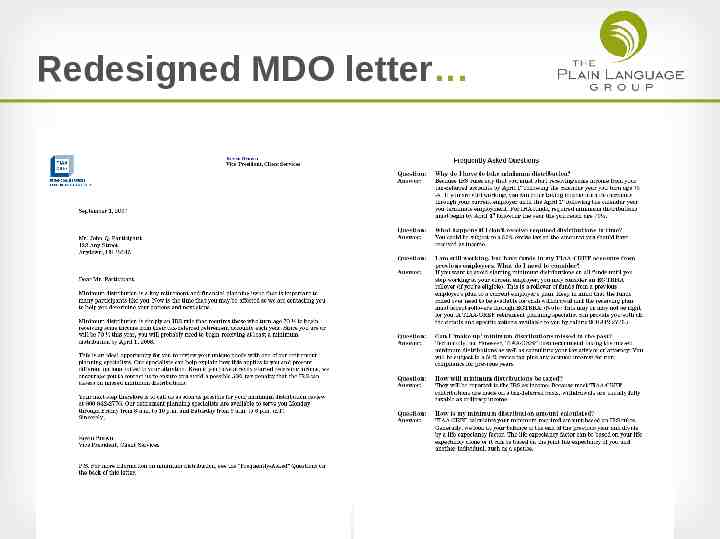

Redesigned MDO letter

Unexpected results As a result of the revised letter increase in number of positive calls positive participant experience increase in transferred assets (surprise!)

Plain language adds value raises profile in the market-place distinguishes you from your competitors gains and retains customers meets customer needs increases profit