Unemployment Compensation for Federal Employees (UCFE) United

28 Slides2.07 MB

Unemployment Compensation for Federal Employees (UCFE) United States Department of Labor Office of Unemployment Insurance

Today’s Objectives: Background Federal-State Partnership Financing Responsibilities of DOL/Federal Agencies/States UCFE Claims Process Determinations Appeals UCFE Forms Resources Available to Federal Agencies 2

Background The Social Security Act was enacted in 1935 as a response to the ill effects of the Great Depression of the 1930's. Intended to provide general welfare benefits for elderly persons, the disabled, dependent children, and the framework for the Federal/state unemployment insurance system. In 1954, Public Law 83-767 added Title XV, added the Unemployment Compensation for Federal Employees to the Social Security Act. UCFE provides benefits for eligible unemployed former civilian Federal employees. 3

Federal-State Partnership The UI program is based on federal law but administered by states under state UI law. The program has broad coverage - applicable to about 98% of all wage and salary workers in the U.S. All 50 states, the District of Columbia, Puerto Rico, and the U.S. Virgin Islands operate individual UI programs. States act as agents of the Federal government in administering the UCFE, UCX and certain other federal UI programs.

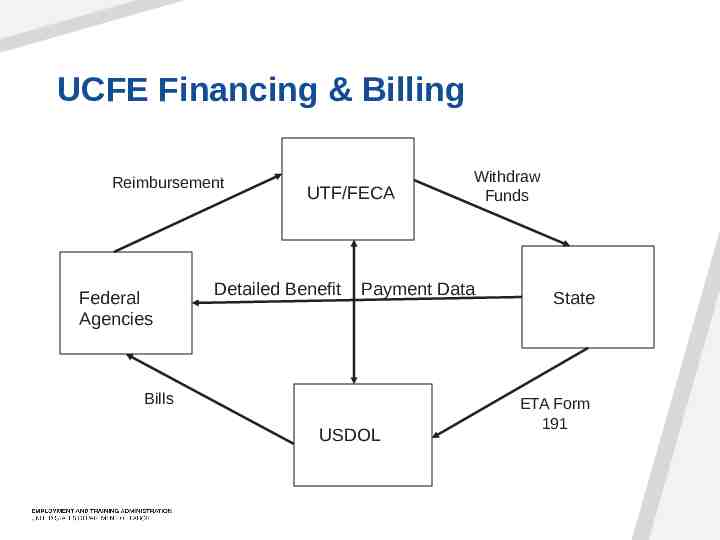

UCFE Financing & Billing Reimbursement Federal Agencies UTF/FECA Detailed Benefit Withdraw Funds Payment Data Bills USDOL State ETA Form 191

U.S. Department of Labor Responsibilities Oversight of the UI programs; Ensure state laws conform to federal law; Provide administrative funds to states; Set broad policies for administration of program, monitor state performance, and provide technical assistance; and Maintain a directory of all Federal agencies’ contact information for UCFE purposes.

Directory of Federal Agencies Federal Agencies are assigned unique Federal Identification Codes (FIC) and Destination Codes for UCFE purposes. The FIC and Destination Codes are maintained by the USDOL in a database known as the Directory of Federal Agencies (aka, UCFE Directory). States access the UCFE Directory to find the appropriate Federal agency to provide a notice of claim filed and to request wage and separation information when a UCFE is filed.

Federal Agencies Responsibilities Notify the Department of Labor of address and UCFE contact information changes; Provide a SF-8 to all separating Federal employees; Respond to requests for wage and separation information within 12 days of the mailing date; and Reimburse the Federal Employee Compensation Account.

State Responsibilities Devise operational procedures to administer its UI programs; Process applications, determine eligibility and ensure timely benefit payments; Collect state UI taxes from employers for regular UI; Submit summary detailed benefit payment data to Federal agencies; and Submit the ETA 191 form to the US Department of Labor.

Federal Claims Control Center (FCCC) Maintains system of “claims control records” for the UCFE and Unemployment Compensation for ExServicemember’s (UCX) programs. Used by states to transmit records of UCFE and/or UCX claims filed and/or established (or canceled). Serves to help maintain integrity in these federal programs

Assignment of UCFE Wages In general, individuals will file a UCFE claim in the state where they last worked. An individual's Federal civilian service and Federal wages will be assigned to the State in which the individual had his or her last official duty station prior to filing a claim unless: 1) the individual performed other covered employment in another state, 2) or the individual performed his/her Federal service outside the United States.

Provisions of State Law State UI Law determines both monetary and non-monetary entitlement: Monetary Entitlement Earnings and length of employment needed to quality for benefits; Benefit amounts; Duration of benefits; and Eligibility and disqualification provisions. Nonmonetary Entitlement Job separation is non-disqualifying according to state law; Must be able to work/available for work and actively seeking work; and Must Meet other state UI eligibility provisions. Comparison of State Unemployment Insurance Laws: http://www.unemploymentinsurance.doleta.gov/unemploy/comparison2016.asp

Nonmonetary Determinations In general, a non-monetary determination by the state(s) is A decision made by the initial authority based on facts related to an “issue.” An “issue” is an act, circumstance or condition potentially disqualifying under state/federal law. Issues fall into two categories: separations and nonseparations.

Forms Used for UCFE Employee Forms SF-8: Notice to Federal Employee about Unemployment Compensation SF-50: Standard Form 50 Federal Employer Forms ETA-931: Request for Wage & Separation Information ETA-931A: Request for Separation Information for Additional Claim ETA-934: Request for Additional Information or Reconsideration of Federal Findings-UCFE Affidavit Form ETA-935: Claimant’s Affidavit of Federal Civilian Service, Wages and Reason for Separation

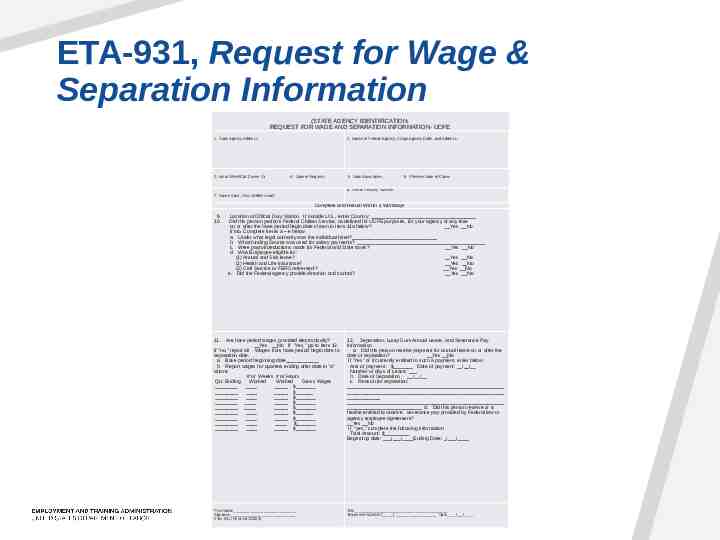

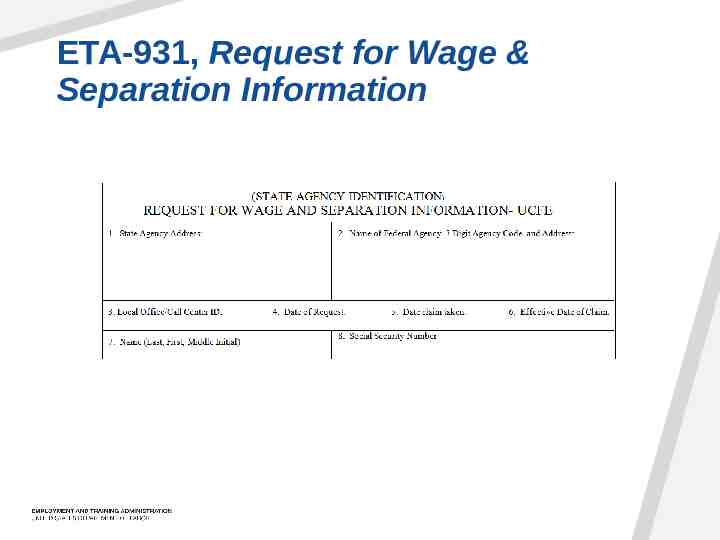

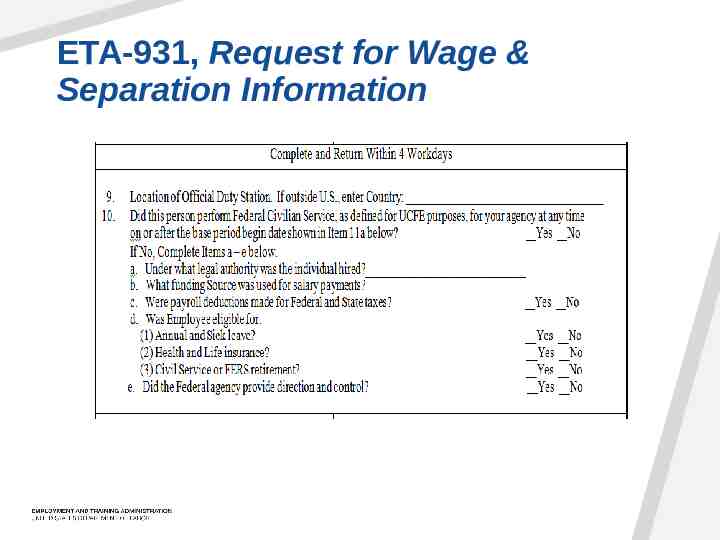

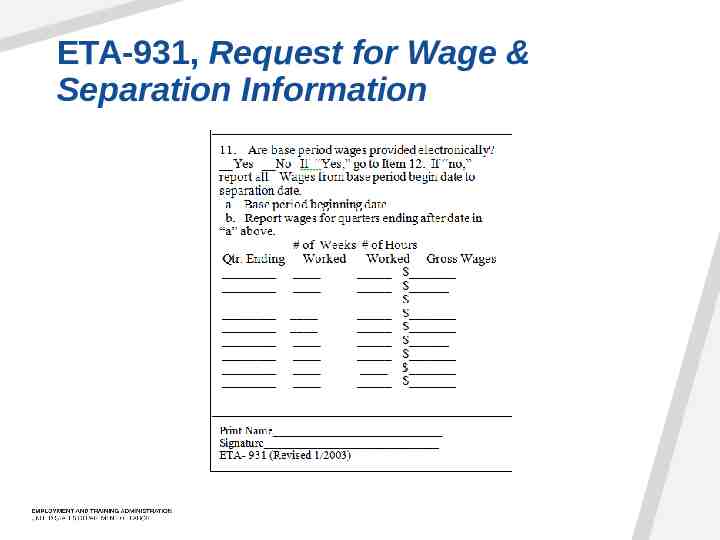

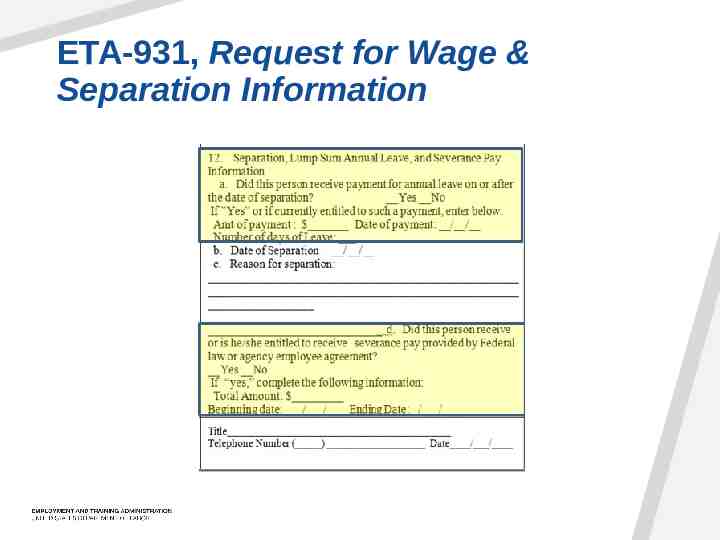

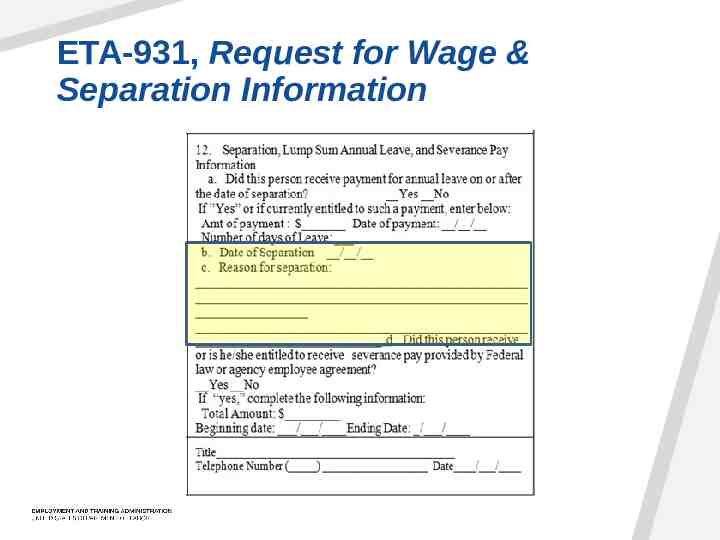

ETA-931, Request for Wage & Separation Information (STATE AGENCY IDENTIFICATION) REQUEST FOR WAGE AND SEPARATION INFORMATION- UCFE 1. State Agency Address: 3. Local Office/Call Center ID: 2. Name of Federal Agency, 3 Digit Agency Code, and Address: 4. Date of Request: 5. Date claim taken: 6. Effective Date of Claim: 8. Social Security Number 7. Name (Last, First, Middle Initial) Complete and Return Within 4 Workdays 9. 10. Location of Official Duty Station. If outside U.S., enter Country: Did this person perform Federal Civilian Service, as defined for UCFE purposes, for your agency at any time on or after the base period begin date shown in Item 11a below? Yes No If No, Complete Items a – e below. a. Under what legal authority was the individual hired? b. What funding Source was used for salary payments? c. Were payroll deductions made for Federal and State taxes? Yes No d. Was Employee eligible for: (1) Annual and Sick leave? Yes No (2) Health and Life insurance? Yes No (3) Civil Service or FERS retirement? Yes No e. Did the Federal agency provide direction and control? Yes No 11. Are base period wages provided electronically? Yes No If “Yes,” go to Item 12. If “no,” report all Wages from base period begin date to separation date. a. Base period beginning date b. Report wages for quarters ending after date in “a” above. # of Weeks # of Hours Qtr. Ending Worked Worked Gross Wages 12. Separation, Lump Sum Annual Leave, and Severance Pay Information a. Did this person receive payment for annual leave on or after the date of separation? Yes No If ”Yes” or if currently entitled to such a payment, enter below: Amt of payment : Date of payment: / / Number of days of Leave: b. Date of Separation / / c. Reason for separation: d. Did this person receive or is he/she entitled to receive severance pay provided by Federal law or agency employee agreement? Yes No If “yes,” complete the following information: Total Amount: Beginning date: / / Ending Date: / / Print Name Signature ETA- 931 (Revised 1/2003) Title Telephone Number ( ) Date / /

ETA-931, Request for Wage & Separation Information

ETA-931, Request for Wage & Separation Information

ETA-931, Request for Wage & Separation Information

ETA-931, Request for Wage & Separation Information

ETA-931, Request for Wage & Separation Information

ETA-931 Discharge Why was the employee discharged? What were the conditions of work? What did the employer do to maintain the employer/employee relationship?

ETA-931 Voluntary Quit Why did the employee quit? Was the reason for leaving personal or work related? What were the conditions of work? What steps did the employee take to remedy the situation prior to leaving?

ADDITIONAL INFORMATION For additional information on eligibility requirements and completing the ETA-931, please see the Unemployment Compensation for Federal Employees (UCFE) Federal Agency Responsibilities Related to UCFE: Guide to Responding to Wage and Separation Information Requests (ETA Form 931) at: https://ows.doleta.gov/unemploy/unemcomp.asp

Appeals Claimants and employers may appeal the states’ determination of eligibility. Appeal levels: Before a referee or hearing officer; Decision made by a review board;* and State and federal court. Notification of the state’s decision is provided to interested parties as determined by state law, which typically includes the claimant and Federal agency. * Note: Not all states have a second or higher authority appeals body

Office of the Inspector General Findings on the UCFE Program Late or no responses to request for wage and separation information; Incomplete ETA-931s; Incorrect information provided on the SF-8; and Not returning phone calls or email inquiries

26 Reminders Provide an SF-8 with the correct agency contact information to all separating Federal employee. Respond timely to all requests for wage and separation information. Provide detailed information regarding the separation. Notify the Department of Labor of any address and contact information changes.

References Title 5, United States Code, Chapter 85, (8501-8509) Code of Federal Regulations, Title 20, Part 609.3 UCFE Instructions for Federal Agencies http://ows.doleta.gov/unemploy/pdf/UCFE.pdf ET Handbook No. 391, UCFE Handbook for State Agencies http://wdr.doleta.gov/directives/corr doc.cfm?DOCN 2233 Training and Employment Notice No. 32-15, and Unemployment Insurance Program Letter Numbers: 20-10 & 31-13, http://wdr.doleta.gov/directives/ 27

Contact Information: General UCFE Inquires Candace Edens, US Department of Labor [email protected] 202.693.3195 Billing UCFE Inquiries Cindy Le US Department of Labor [email protected] 202.693.2829