® FAFSA NIGHTS Free Application for Federal Student Aid Parent

25 Slides4.50 MB

FAFSA NIGHTS Free Application for Federal Student Aid Parent TOOLKIT Fall 2018/Spring 2019

FAFSA NIGHTS Recognition First and foremost, the FAFSA (Free Application for Federal Student Aid) Nights Committee would like to acknowledge all Greater El Paso region school district representatives, our higher education partners and corporate sponsors who contributed to this Toolkit.

FAFSA NIGHTS Recognition Since 1986, FAFSA Nights has been at the forefront of college access and equity for all students through financial aid support. This Toolkit represents the hard work of those individuals who were instrumental in bringing the vision of college and career readiness to all students.

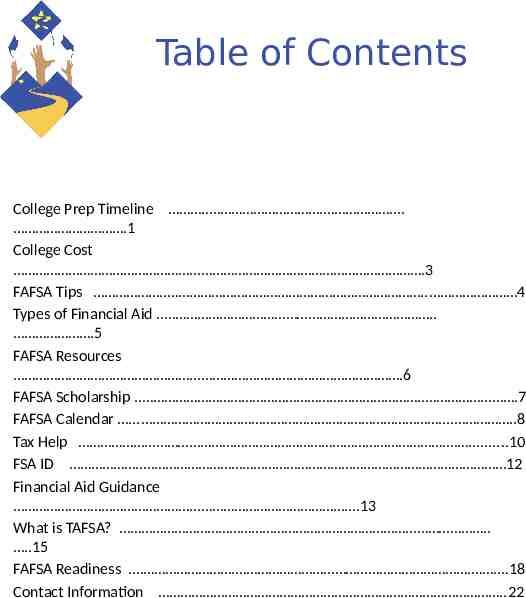

Table of Contents College Prep Timeline . . . .1 College Cost .3 FAFSA Tips . . 4 Types of Financial Aid . . .5 FAFSA Resources .6 FAFSA Scholarship . . .7 FAFSA Calendar . . .8 Tax Help . .10 FSA ID . 12 Financial Aid Guidance .13 What is TAFSA? . .15 FAFSA Readiness . . . .18 Contact Information .22

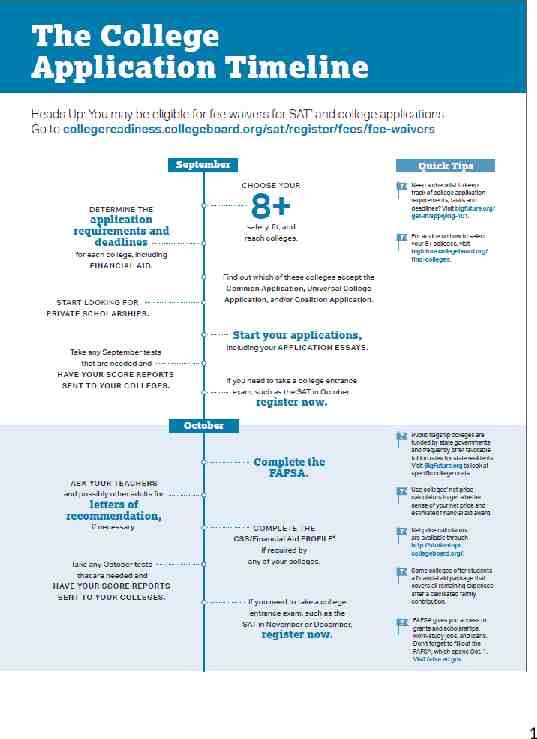

1

2

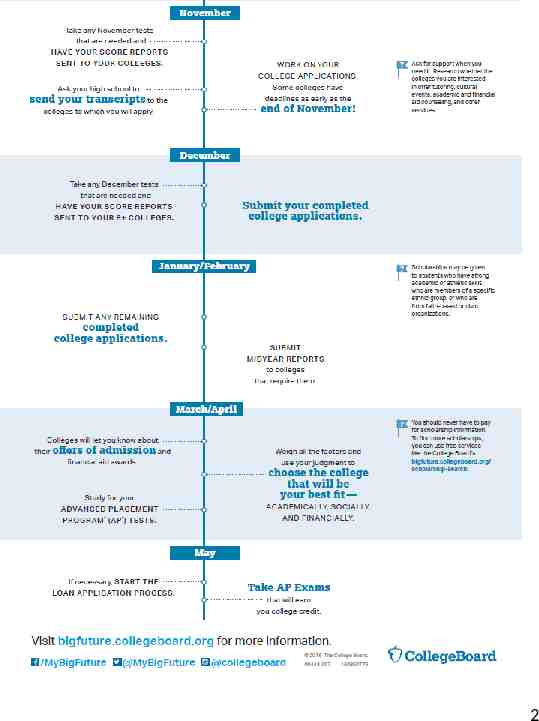

Parent Information: College Cost How can financial aid be used to pay for college? College costs include more than tuition and room and board. Here’s a description of terms: ITEM DESCRIPTION Tuition The cost of taking courses. Course cost vary by school. Room and board Lodging and food costs vary by school. Books and supplies Books can be expensive. School supplies include: Book bags; Notebooks; Pens and pencils; Paper and computer paper; and Desk accessories such as folders, trays, and pen holders. Fees Fees depend upon your school. Examples include activity fees and parking decal fees. Schools can provide a list of fees. Equipment and room materials This category might include: Computer and printer; Reading lamps; Microwave and refrigerator; Sheets, towels, etc. Travel and miscellaneous expenses If you commute to school, include transportation costs. If you live on campus, include travel during school breaks. You may also want to include clothing and mobile phone cost. 3

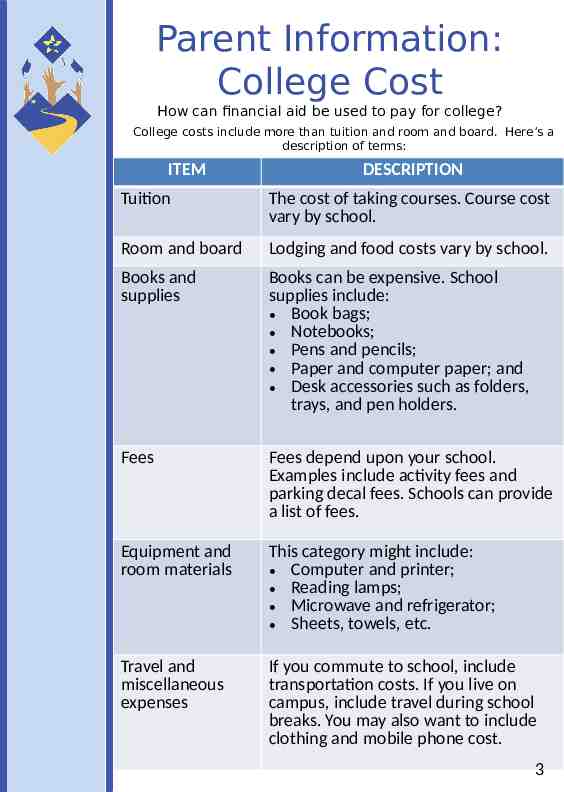

Tips for FAFSA Planning Parents To Do: Work with your child on filling out the FAFSA. To Explore: Make sure your child’s personal information is safe when he or she applies for financial aid. For tips, read “Student Aid and Identity Theft.” Visit: https:// studentaid.ed.gov/sa/sites/default/files/student-aid-a nd-identity-theft.pdf for more information. Read IRS Publication 970, Tax Benefits for Education to see how you might benefit from federal income tax credits for education expenses. Visit: https:// www.irs.gov/pub/irs-pdf/p970.pdf for more information. Understand the benefits of federal student loans. Visit: https:// studentaid.ed.gov/sa/types/loans/federal-vs-private for more information. Look at communications from schools to which your child sent FAFSA information. If a school has offered Direct PLUS Loans, the Direct Loan Basics for Parents brochure might be useful to you. 4

Parent Information: Types of Financial Aid Federal student aid includes: Grants: Financial aid that doesn’t have to be repaid (unless, for example, you withdraw from school and owe a refund) Loans: Borrowed money for college or career school; you must repay your loans, with interest Work-Study: A work program through which you earn money to help you pay for school PLUS Loan: A loan available to graduate students and parents of dependent undergraduate students for which the borrower is fully responsible for paying the interest regardless of the loan status. Avoid Scams: Before you apply for financial aid, learn how to spot potential fraud, avoid paying for free services, and prevent identity theft. Save Your Money: Don’t Pay for Help to Find Money for College and Don’t Pay for the FAFSA! 5

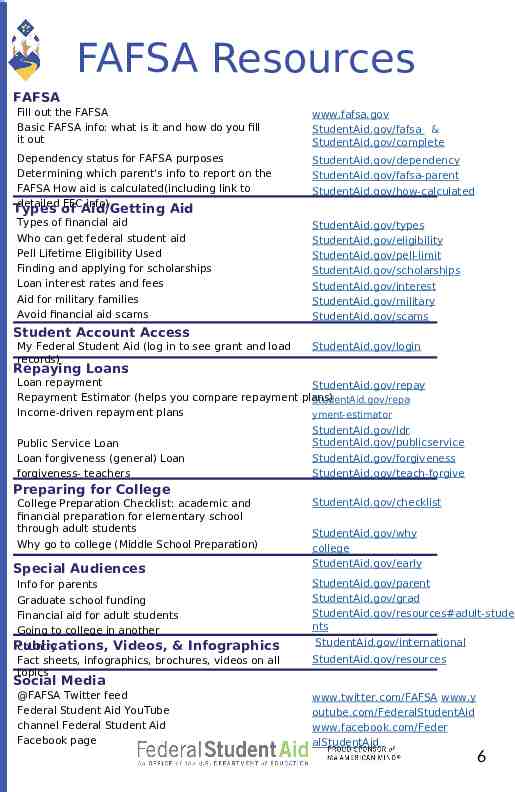

FAFSA Resources FAFSA Fill out the FAFSA Basic FAFSA info: what is it and how do you fill it out www.fafsa.gov StudentAid.gov/fafsa & StudentAid.gov/complete Dependency status for FAFSA purposes Determining which parent’s info to report on the FAFSA How aid is calculated(including link to detailed EFC info) StudentAid.gov/dependency StudentAid.gov/fafsa-parent StudentAid.gov/how-calculated Types of financial aid Who can get federal student aid Pell Lifetime Eligibility Used Finding and applying for scholarships Loan interest rates and fees Aid for military families Avoid financial aid scams StudentAid.gov/types StudentAid.gov/eligibility StudentAid.gov/pell-limit StudentAid.gov/scholarships StudentAid.gov/interest StudentAid.gov/military StudentAid.gov/scams Types of Aid/Getting Aid Student Account Access My Federal Student Aid (log in to see grant and load records) StudentAid.gov/login Repaying Loans Loan repayment StudentAid.gov/repay Repayment Estimator (helps you compare repayment plans) StudentAid.gov/repa Income-driven repayment plans yment-estimator Public Service Loan Loan forgiveness (general) Loan forgiveness- teachers Preparing for College College Preparation Checklist: academic and financial preparation for elementary school through adult students Why go to college (Middle School Preparation) Special Audiences Info for parents Graduate school funding Financial aid for adult students Going to college in another Publications, Videos, & Infographics country Fact sheets, infographics, brochures, videos on all topics StudentAid.gov/idr StudentAid.gov/publicservice StudentAid.gov/forgiveness StudentAid.gov/teach-forgive StudentAid.gov/checklist StudentAid.gov/why college StudentAid.gov/early StudentAid.gov/parent StudentAid.gov/grad StudentAid.gov/resources#adult-stude nts StudentAid.gov/international StudentAid.gov/resources Social Media @FAFSA Twitter feed Federal Student Aid YouTube channel Federal Student Aid Facebook page www.twitter.com/FAFSA www.y outube.com/FederalStudentAid www.facebook.com/Feder alStudentAid 6

FAFSA Nights Scholarship Thanks to the generosity of our FAFSA Nights Sponsors, the FAFSA Nights Committee has been able to fund the FAFSA Nights Scholarship. We will be awarding ten, 1,000.00 scholarships to students who attend a FAFSA Night. Please help us motivate students to attend this event by promoting the FAFSA Night Scholarship! Scholarship Information The scholarships will be awarded to the student and the college of choice. Verified enrollment at a post secondary institution or technical college is required to receive funds. Scholarships will be awarded following FAFSA Nights events in late spring. Required Student Information Students must: Participate in a FAFSA Nights event and fill out an evaluation form following the event. Social Media Help spread the word by liking FAFSA Nights via Facebook and following us on Instagram (fafsa nights). 7

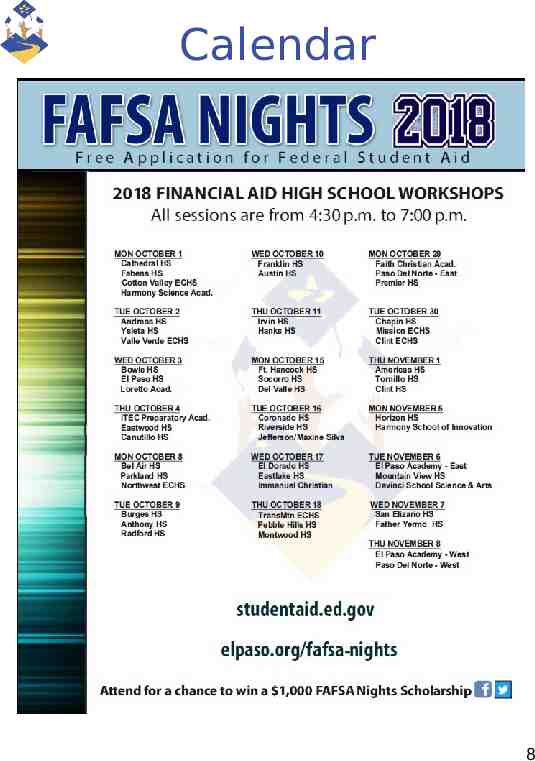

Calendar 8

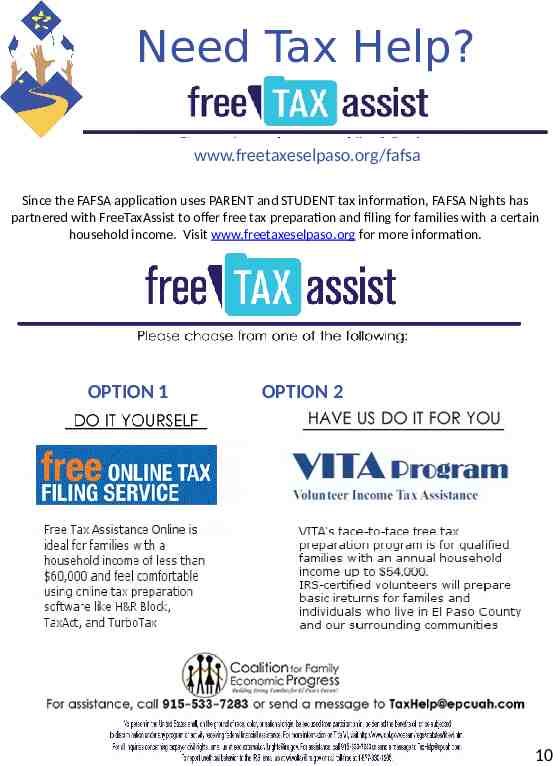

Need Tax Help? www.freetaxeselpaso.org/fafsa Since the FAFSA application uses PARENT and STUDENT tax information, FAFSA Nights has partnered with FreeTaxAssist to offer free tax preparation and filing for families with a certain household income. Visit www.freetaxeselpaso.org for more information. OPTION 1 OPTION 2 10

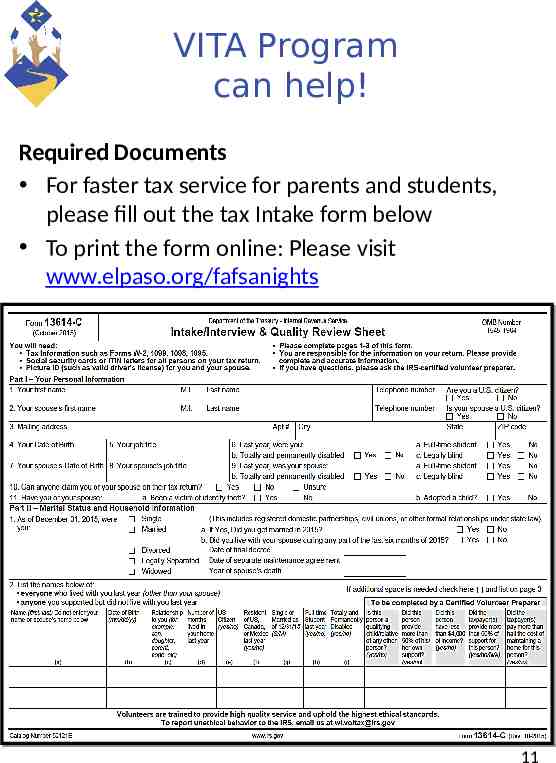

VITA Program can help! Required Documents For faster tax service for parents and students, please fill out the tax Intake form below To print the form online: Please visit www.elpaso.org/fafsanights 11

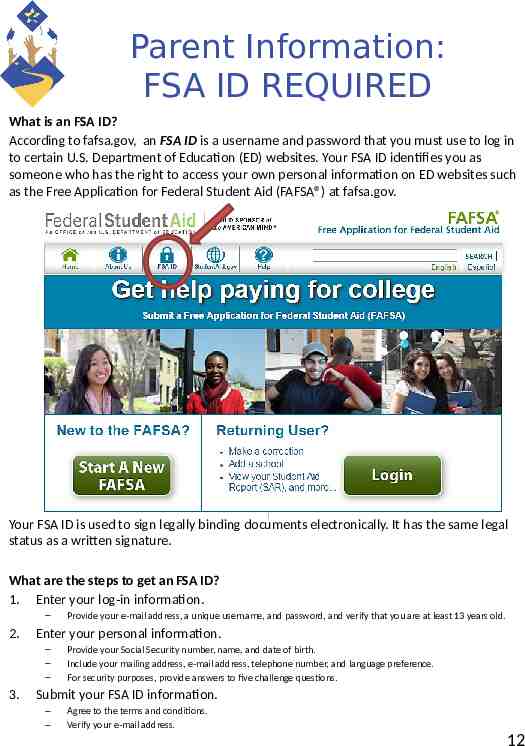

Parent Information: FSA ID REQUIRED What is an FSA ID? According to fafsa.gov, an FSA ID is a username and password that you must use to log in to certain U.S. Department of Education (ED) websites. Your FSA ID identifies you as someone who has the right to access your own personal information on ED websites such as the Free Application for Federal Student Aid (FAFSA ) at fafsa.gov. Your FSA ID is used to sign legally binding documents electronically. It has the same legal status as a written signature. What are the steps to get an FSA ID? 1. Enter your log-in information. – 2. Enter your personal information. – – – 3. Provide your e-mail address, a unique username, and password, and verify that you are at least 13 years old. Provide your Social Security number, name, and date of birth. Include your mailing address, e-mail address, telephone number, and language preference. For security purposes, provide answers to five challenge questions. Submit your FSA ID information. – – Agree to the terms and conditions. Verify your e-mail address. 12

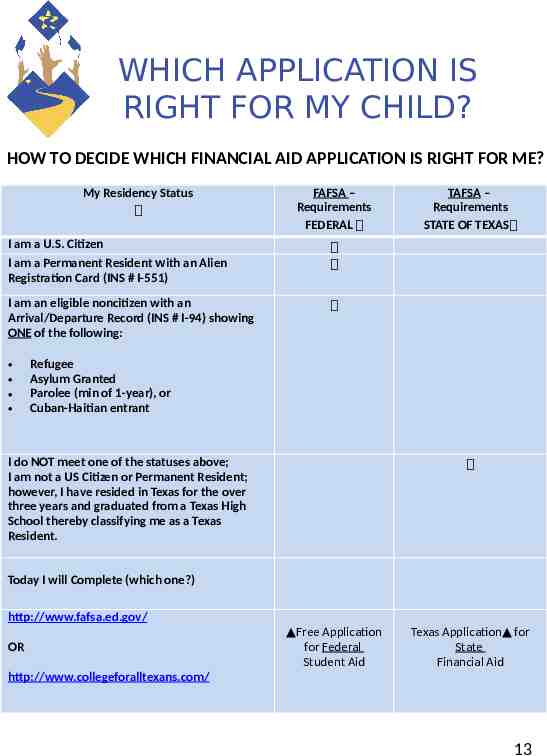

WHICH APPLICATION IS RIGHT FOR MY CHILD? HOW TO DECIDE WHICH FINANCIAL AID APPLICATION IS RIGHT FOR ME? My Residency Status FAFSA – Requirements FEDERAL I am a U.S. Citizen I am a Permanent Resident with an Alien Registration Card (INS # I-551) I am an eligible noncitizen with an Arrival/Departure Record (INS # I-94) showing ONE of the following: TAFSA – Requirements STATE OF TEXAS Refugee Asylum Granted Parolee (min of 1-year), or Cuban-Haitian entrant I do NOT meet one of the statuses above; I am not a US Citizen or Permanent Resident; however, I have resided in Texas for the over three years and graduated from a Texas High School thereby classifying me as a Texas Resident. Today I will Complete (which one?) http://www.fafsa.ed.gov/ OR Free Application for Federal Student Aid Texas Application for State Financial Aid http://www.collegeforalltexans.com/ 13

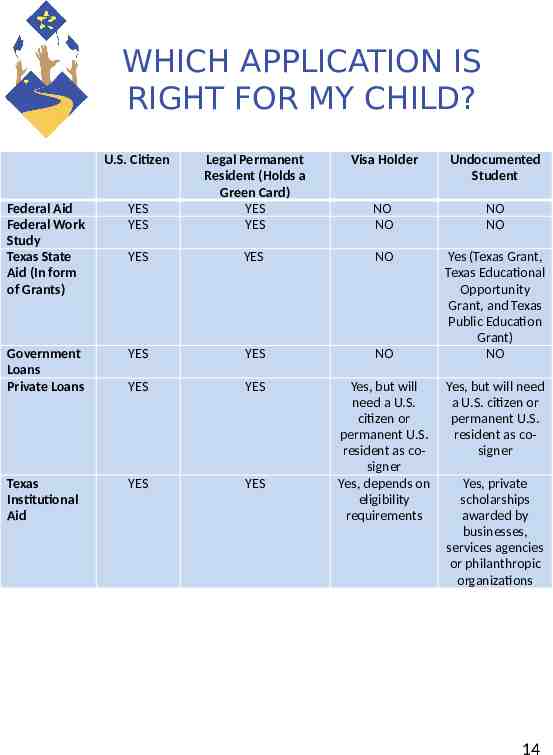

WHICH APPLICATION IS RIGHT FOR MY CHILD? U.S. Citizen Federal Aid Federal Work Study Texas State Aid (In form of Grants) YES YES Legal Permanent Resident (Holds a Green Card) YES YES Visa Holder Undocumented Student NO NO NO NO YES YES NO Yes (Texas Grant, Texas Educational Opportunity Grant, and Texas Public Education Grant) NO Government Loans Private Loans YES YES NO YES YES Texas Institutional Aid YES YES Yes, but will need a U.S. citizen or permanent U.S. resident as cosigner Yes, depends on eligibility requirements Yes, but will need a U.S. citizen or permanent U.S. resident as cosigner Yes, private scholarships awarded by businesses, services agencies or philanthropic organizations 14

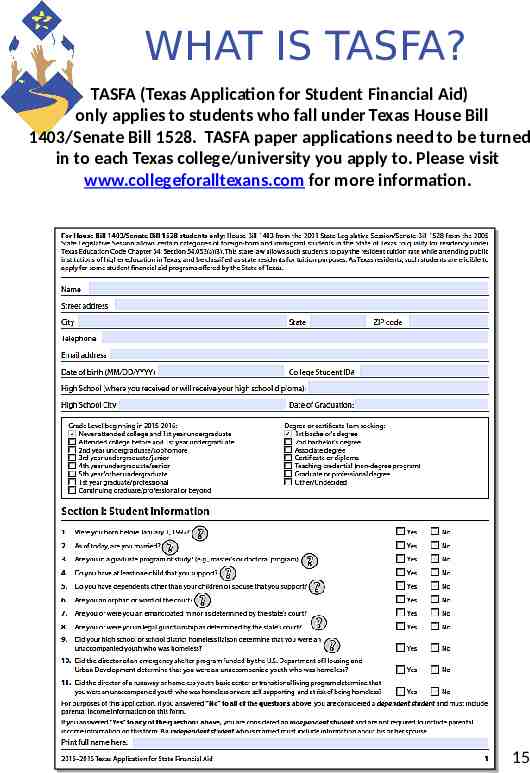

WHAT IS TASFA? TASFA (Texas Application for Student Financial Aid) only applies to students who fall under Texas House Bill 1403/Senate Bill 1528. TASFA paper applications need to be turned in to each Texas college/university you apply to. Please visit www.collegeforalltexans.com for more information. 15

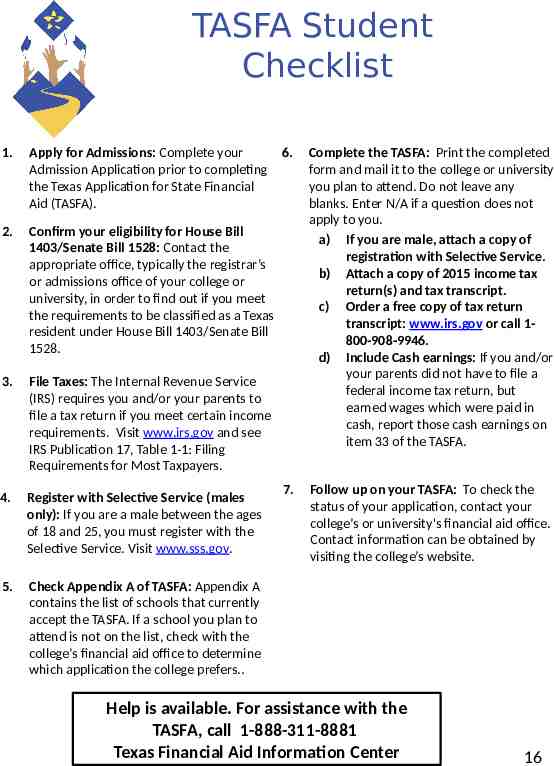

TASFA Student Checklist 1. Apply for Admissions: Complete your 6. Admission Application prior to completing the Texas Application for State Financial Aid (TASFA). 2. Confirm your eligibility for House Bill 1403/Senate Bill 1528: Contact the appropriate office, typically the registrar’s or admissions office of your college or university, in order to find out if you meet the requirements to be classified as a Texas resident under House Bill 1403/Senate Bill 1528. 3. File Taxes: The Internal Revenue Service (IRS) requires you and/or your parents to file a tax return if you meet certain income requirements. Visit www.irs.gov and see IRS Publication 17, Table 1-1: Filing Requirements for Most Taxpayers. 4. Register with Selective Service (males only): If you are a male between the ages of 18 and 25, you must register with the Selective Service. Visit www.sss.gov. 5. Check Appendix A of TASFA: Appendix A contains the list of schools that currently accept the TASFA. If a school you plan to attend is not on the list, check with the college’s financial aid office to determine which application the college prefers. 7. Complete the TASFA: Print the completed form and mail it to the college or university you plan to attend. Do not leave any blanks. Enter N/A if a question does not apply to you. a) If you are male, attach a copy of registration with Selective Service. b) Attach a copy of 2015 income tax return(s) and tax transcript. c) Order a free copy of tax return transcript: www.irs.gov or call 1800-908-9946. d) Include Cash earnings: If you and/or your parents did not have to file a federal income tax return, but earned wages which were paid in cash, report those cash earnings on item 33 of the TASFA. Follow up on your TASFA: To check the status of your application, contact your college’s or university's financial aid office. Contact information can be obtained by visiting the college’s website. Help is available. For assistance with the TASFA, call 1-888-311-8881 Texas Financial Aid Information Center 16

TASFA Additional Resources Deferred Action for Childhood Arrivals (DACA) What is deferred action for childhood arrivals? On June 15, 2012, the Secretary of Homeland Security announced that certain people who came to the United States as children and meet several key guidelines may request consideration of deferred action for a period of two years, subject to renewal, and would then be eligible for work authorization. Individuals who can demonstrate through verifiable documentation that they meet these guidelines will be considered for deferred action. Determinations will be made on a case-bycase basis under the guidelines set forth in the Secretary of Homeland Security’s memorandum. How can I request differed action? If you: Were under the age of 31 as of June 15, 2012; Came to the United States before reaching your 16th birthday; Have continuously resided in the United States since June 15, 2007, up to the present time; Were physically present in the United States on June 15, 2012, and at the time of making your request for consideration of deferred action with USCIS; Entered without inspection before June 15, 2012, or your lawful immigration status expired as of June 15, 2012; Are currently in school, have graduated or obtained a certificate of completion from high school, have obtained a general education development (GED) certificate, or are an honorably discharged veteran of the Coast Guard or Armed Forces of the United States; and Have not been convicted of a felony, significant misdemeanor, three or more other misdemeanors, and do not otherwise pose a threat to national security or public safety. Individuals can call USCIS at 1-800-375-5283 with questions or to request more information on the deferred action for childhood arrivals process or visit www.uscis.gov. DACA Resources: Texas Law Help: texaslawhelp.org United We Dream: unitedwedream.org 17

FAFSA Readiness Information Even if you do not have all the necessary documents, please bring what is available to start the FAFSA Process. For the 2017-2018 school year, you can use financial information from 2015 Tax Return: Your Social Security Number (SSN). Be sure the SSN is correct! Birthdates for: Mom \ Dad \ or Legal Guardian [mm/dd/yyyy] ALL 2015 W-2 FORMS (Dad, Mom, Student) and other records of money earned ALL 2015 FEDERAL INCOME TAX RETURN(S) IRS Form(s): 1040 \ 1040 A \ 1040 EZYOUR PARENTS 2015 FEDERAL INCOME TAX RETURN Include your 2015 untaxed income records (income that has not undergone taxation) such as but not limited to: Veteran benefits records Child support received Worker's compensation Unemployment checks Current bank statements [NOT common] Your current business and investment mortgage information, business and farm records, stocks, bonds and other investment records (if documents are available). Your alien registration or permanent resident card (if you are not a U.S. citizen) Non U.S. Citizens (Texas Residents) can complete a TASFA (Texas Application for State Financial Aid) To organize your information, print and complete a FAFSA ON THE WEB WORKSHEET before you begin entering your information at https://studentaid.ed.gov/sa/fafsa Call the TEXAS Toll-free Financial Aid Information Center at (888) 311-8881 or the Federal Financial Aid helpline at 1-800-433-3243. Visit www.collegeforalltexans.com or http://gentx.org/ for more information. 18

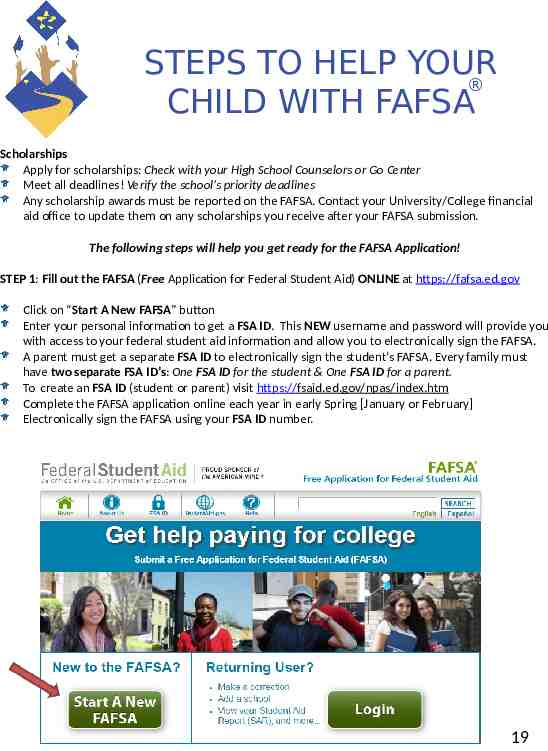

STEPS TO HELP YOUR CHILD WITH FAFSA Scholarships Apply for scholarships: Check with your High School Counselors or Go Center Meet all deadlines! Verify the school’s priority deadlines Any scholarship awards must be reported on the FAFSA. Contact your University/College financial aid office to update them on any scholarships you receive after your FAFSA submission. The following steps will help you get ready for the FAFSA Application! STEP 1: Fill out the FAFSA (Free Application for Federal Student Aid) ONLINE at https://fafsa.ed.gov Click on “Start A New FAFSA” button Enter your personal information to get a FSA ID. This NEW username and password will provide you with access to your federal student aid information and allow you to electronically sign the FAFSA. A parent must get a separate FSA ID to electronically sign the student’s FAFSA. Every family must have two separate FSA ID’s: One FSA ID for the student & One FSA ID for a parent. To create an FSA ID (student or parent) visit https://fsaid.ed.gov/npas/index.htm Complete the FAFSA application online each year in early Spring [January or February] Electronically sign the FAFSA using your FSA ID number. 19

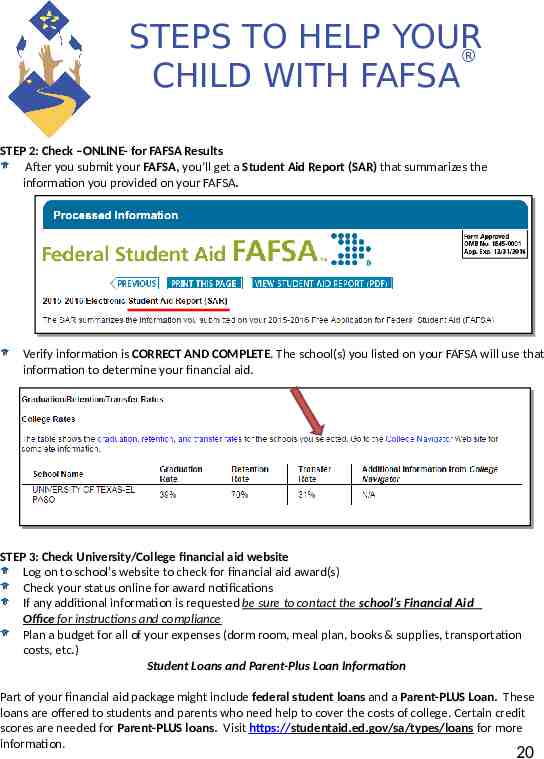

STEPS TO HELP YOUR CHILD WITH FAFSA STEP 2: Check –ONLINE- for FAFSA Results After you submit your FAFSA, you’ll get a Student Aid Report (SAR) that summarizes the information you provided on your FAFSA. Verify information is CORRECT AND COMPLETE. The school(s) you listed on your FAFSA will use that information to determine your financial aid. STEP 3: Check University/College financial aid website Log on to school’s website to check for financial aid award(s) Check your status online for award notifications If any additional information is requested be sure to contact the school’s Financial Aid Office for instructions and compliance Plan a budget for all of your expenses (dorm room, meal plan, books & supplies, transportation costs, etc.) Student Loans and Parent-Plus Loan Information Part of your financial aid package might include federal student loans and a Parent-PLUS Loan. These loans are offered to students and parents who need help to cover the costs of college. Certain credit scores are needed for Parent-PLUS loans. Visit https://studentaid.ed.gov/sa/types/loans for more information. 20

WHAT HAPPENS AFTER FAFSA SUBMISSION? TO REVIEW: YOU’VE DONE THE FOLLOWING: Applied for FAFSA and an FSA ID (student and parent) Completed, electronically signed, and submitted the FAFSA Printed your “confirmation” page showing your Estimated Family Contribution [EFC] Unsure? Check your status at www.fafsa.gov and log-in or call 1-800-433-3243 Your STUDENT AID REPORT (SAR) Access your SAR at www.fafsa.gov IMPORTANT: Read “comments about your FAFSA” on your SAR Review all of the information for accuracy. Print – if necessary If corrections are needed, visit www.fafsa.gov, click “Login,” click “Make FAFSA Corrections,” enter your FSA ID (username and password), change your information and submit. Contact the financial aid office at the school you applied to for more information VERIFICATION IF your SAR states you have been selected for verification, you will be required to submit additional documents. Follow-up to ensure verification process is complete by: (a) contacting the college financial aid office, (b) logging-in to your FAFSA account to review the status. FINANCIAL AID AWARD NOTIFICATION Review all awards (either letter – or online) ACCEPT the award before the deadline . Visit - or call - your local Go Center, your high school counselor or call the college/university for more information. 21

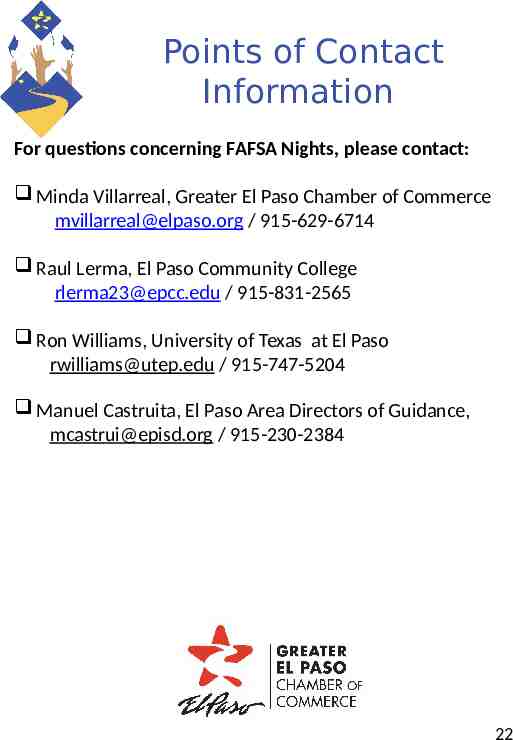

Points of Contact Information For questions concerning FAFSA Nights, please contact: Minda Villarreal, Greater El Paso Chamber of Commerce [email protected] / 915-629-6714 Raul Lerma, El Paso Community College [email protected] / 915-831-2565 Ron Williams, University of Texas at El Paso [email protected] / 915-747-5204 Manuel Castruita, El Paso Area Directors of Guidance, [email protected] / 915-230-2384 22