Talent Pipeline Management

31 Slides2.96 MB

Talent Pipeline Management

Goals 1. Introduce USCCF and our work focused on closing the skills 2. Familiarize you with the tools, resources, and supports available 3. Engage with one another on the possibility of implementing this approach within your industry sector

America’s Skill Gap Our education and workforce system is failing to keep pace with our economy Employers struggle with finding skilled workers who can contribute to economic growth and competitiveness Disconnect between what employers need and what prospective employees are prepared to do Status quo contributes to high unemployment/underemployment, growing entitlements, and lost opportunities for growing the middle class.

America’s Skill Gap – By the Numbers Executives believe there is a serious gap in workforce skills: 92% Employers struggling to fill vacant jobs: 49% Growth of skills gap by 2020: 6 million unfilled positions. Employers believe college grads are prepared for the workforce: 11% vs. 96% (CAO) Planning to hire recent graduates: 65% (up from 57%) Sources: Adecco; Accenture; Manufacturing Institute; Georgetown Center on Education and the Workforce.

America’s Skill Gap – By the Numbers Forgone revenue per unfilled position: 23,000 Mid-size manufacturers loss in annual earnings: 11% ( 4.6 million) Fail to achieve key financial targets: 43% Reduced ability to innovate: 40% Unable to start a major project or strategic initiative: 37% Sources: CareerBuilder; Accenture and Manufacturing Institute; Chartered Global Management Accountant.

Strategy for Our Time

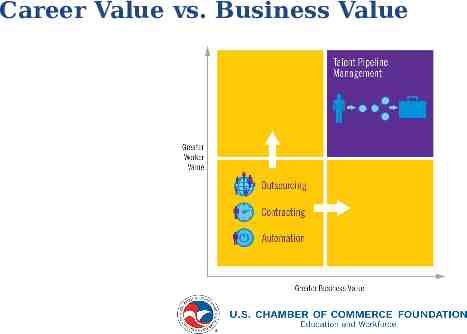

Career Value vs. Business Value

Employer Investment

Moving to a Supply Chain Approach Employers can close the skills gap by applying lessons learned from supply chain management (SCM) to their education and workforce partners. Raw Materials Supplier Manufacturer Distributor Retailer Customer

Lessons Learned from Supply Chain Management Principles Supply Chain Management Talent Pipeline Management 1. Supply chains drive competitive advantage, they are not a cost of doing business 1. Connect your talent strategy to your business strategy to improve competitiveness 2. Supply chain networks create shared value and competitiveness across all partners 2. Organize and manage flexible and responsive partnerships with preferred providers to create shared value 3. End-to-end metrics and aligned incentives improve performance across the supply chain 3. Shared measures and aligned incentives improve performance of education and workforce partners

Core Capabilities

Workforce Segmentation

Simple vs. Extended Value Chains

Silo Measures

End-to-End Performance

Balanced Measures

Promote Preferred Providers

The Talent SCM Approach – Stakeholder Implications Will employers play the role of the end-customer? What are the major implications for education and workforce partners? Can students and workers get a better ROI from talent supply chains? How does this approach change the role of government?

The National Learning Network 19

Implementation Guide Strategies Strategy 1: Organize Employer Collaboratives Strategy 4: Analyze Talent Flows Strategy 2: Engage in Demand Planning Strategy 5: Implement Shared Performance Measures Strategy 3: Communicate Competency and Credential Requirements Strategy 6: Align Incentives 20

Coordinated Approach

Mapping the Value Stream

Mapping the Value Stream (continued)

Analyzing Talent Flows

Performance Dashboard Example

Employer Quality Assurance Layers Level 3 Employers & Collaboratives Level 2 Industry Associations Level 1 National Business Associations Employer Employer Employer Employer Employer Employer Collaborative Employer

Employer Quality Assurance – Principles & Requirements Principle Level 1 Requirements Level 2 Requirements Level 3 Requirements End-Customer Focus National business associations e.g., U.S. Chamber of Commerce and Business Roundtable National or regional industry associations e.g., National Association of Manufacturers and Center for Energy Workforce Development Local chambers of commerce, economic development organizations, or employers e.g., Vermilion Advantage or Alcoa Managing Customer Requirements Common employability skills e.g., teamwork, problem solving, and communication Level 1 plus industry-specific competencies and credentials e.g., machining and NIMS Level 2 plus more specific competencies, credentials and other hiring requirements e.g., security clearances Performance Management and Continuous Improvement Basic supplier effectiveness measures e.g., completion rates, program duration, cost, and employment and earnings Level 1 plus integration with certification data held by third party organizations e.g., certification organizations Level 2 plus integration with applicant tracking systems and HRIS e.g., hires, retention, time-tofull productivity, time-to-career advancement

www.TheTalentSupplyChain. org

Discussion Questions 1. Where would you start and which employers are ready? 2. Can this approach add value to industry-led efforts underway today? 3. What are the major barriers or challenges and what supports are needed? 4. What are the remaining questions and issues that need to be addressed?

Thank You to Our Sponsor “Completion with a purpose”

Jason A. Tyszko Senior Director, Policy & Programs [email protected]