SYSTEMATIC INVESTMENT PLAN Presented By : Frontline Securities Limited

29 Slides1.30 MB

SYSTEMATIC INVESTMENT PLAN Presented By : Frontline Securities Limited Date :23.02.2009 1 Disclaimer : This document has been prepared by FRONTILNE SECURITIES LIMITED for the use of recipient only and not for circulation. The information and opinions contained in the document have been compiled from sources believed to be reliable. Frontline does not warrant its accuracy, completeness and correctness. This document is not , and should not be construed as , an offer to sell or solicitation to buy any securities. This document may not be reproduced, distributed or published, in whole or a part ,by any recipient hereof for any purpose without prior permission from us .

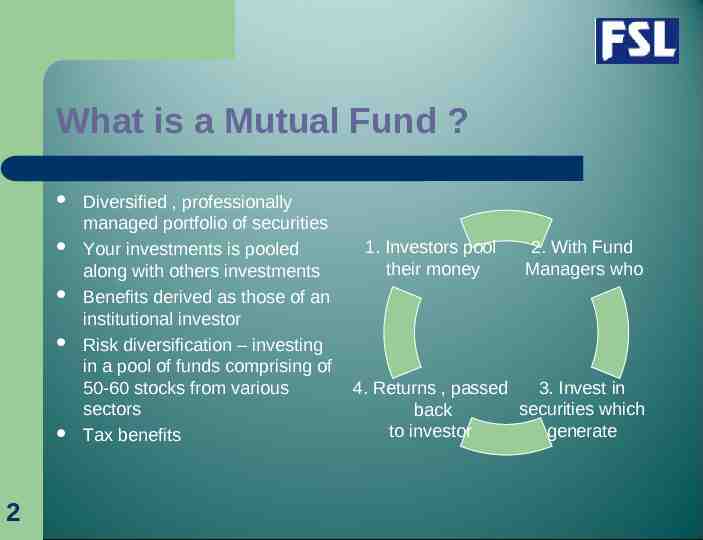

What is a Mutual Fund ? 2 Diversified , professionally managed portfolio of securities Your investments is pooled along with others investments Benefits derived as those of an institutional investor Risk diversification – investing in a pool of funds comprising of 50-60 stocks from various sectors Tax benefits 1. Investors pool their money 2. With Fund Managers who 3. Invest in 4. Returns , passed securities which back generate to investor

Why Invest ? Children’s education / marriage Medical Emergency Retirement Aspirational goals – House , Foreign Holiday Other Obligations 3

TIME VALUE OF MONEY Patience and discipline are required not to make the wrong move at the wrong time – the results can be dramatic – it is far more common to do the wrong thing than to not do the right thing. Considering inflation @ 5 % 4

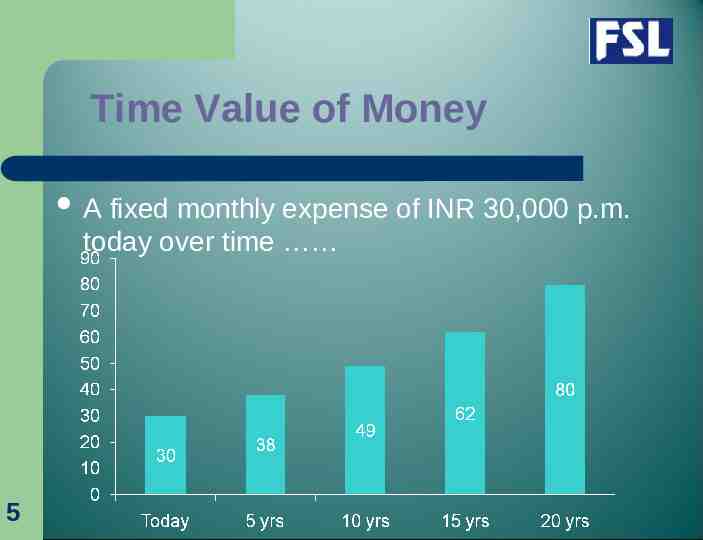

Time Value of Money A fixed monthly expense of INR 30,000 p.m. today over time 5

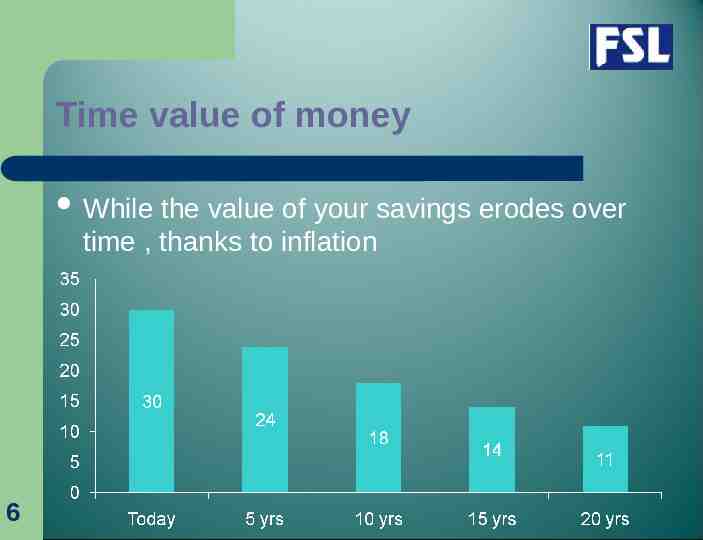

Time value of money While the value of your savings erodes over time , thanks to inflation 6

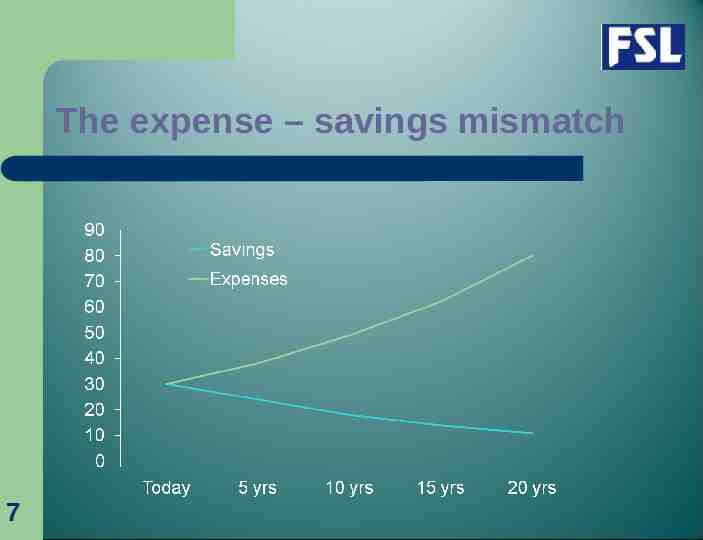

The expense – savings mismatch 7

LET’S PLAN TO GET RICH TOGETHER INVESTORS NEED TO SAVE REGULARLY INTO ASSETS THAT CAN BEAT INFLATION TO MEET THEIR FINANCIAL GOALS. 8

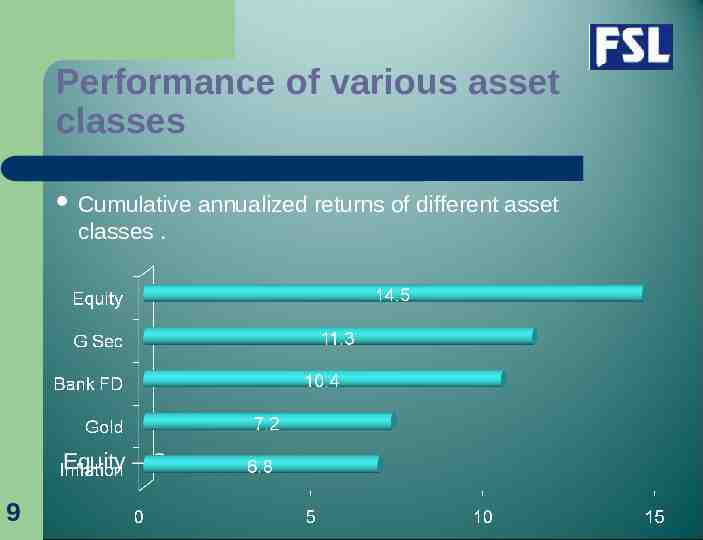

Performance of various asset classes Cumulative classes . Equity – C 9 annualized returns of different asset

MARKET TIMING – DOES IT MATTER ? 10

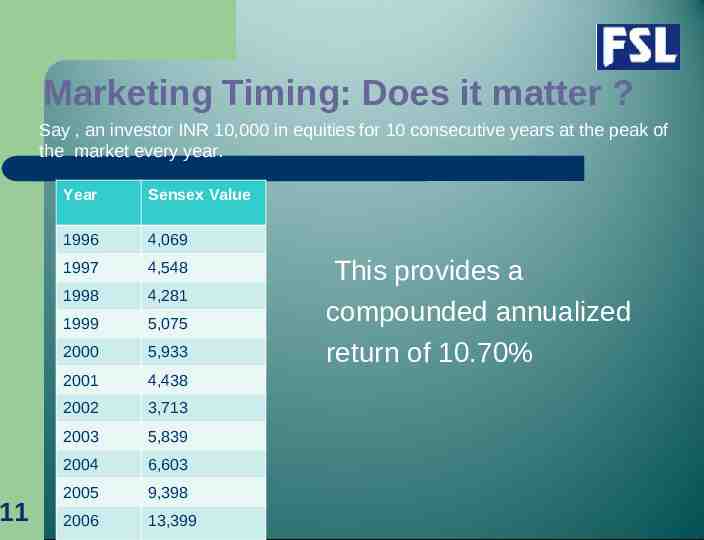

Marketing Timing: Does it matter ? Say , an investor INR 10,000 in equities for 10 consecutive years at the peak of the market every year. 11 Year Sensex Value 1996 4,069 1997 4,548 1998 4,281 1999 5,075 2000 5,933 2001 4,438 2002 3,713 2003 5,839 2004 6,603 2005 9,398 2006 13,399 This provides a compounded annualized return of 10.70%

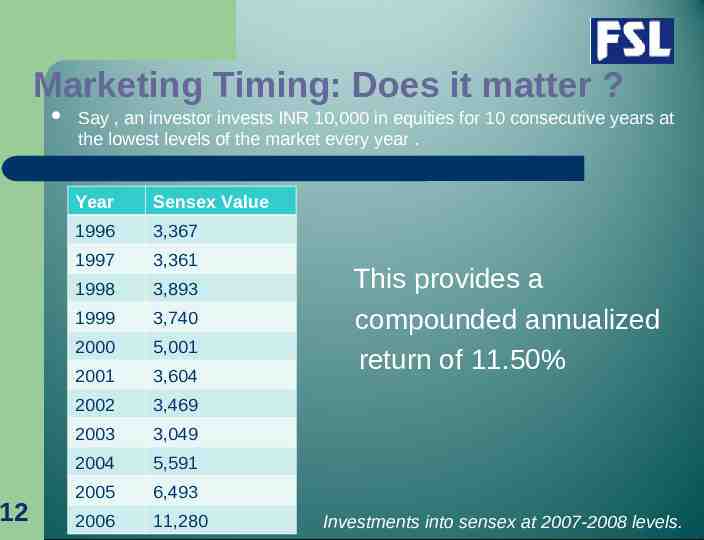

Marketing Timing: Does it matter ? 12 Say , an investor invests INR 10,000 in equities for 10 consecutive years at the lowest levels of the market every year . Year Sensex Value 1996 3,367 1997 3,361 1998 3,893 1999 3,740 2000 5,001 2001 3,604 2002 3,469 2003 3,049 2004 5,591 2005 6,493 2006 11,280 This provides a compounded annualized return of 11.50% Investments into sensex at 2007-2008 levels.

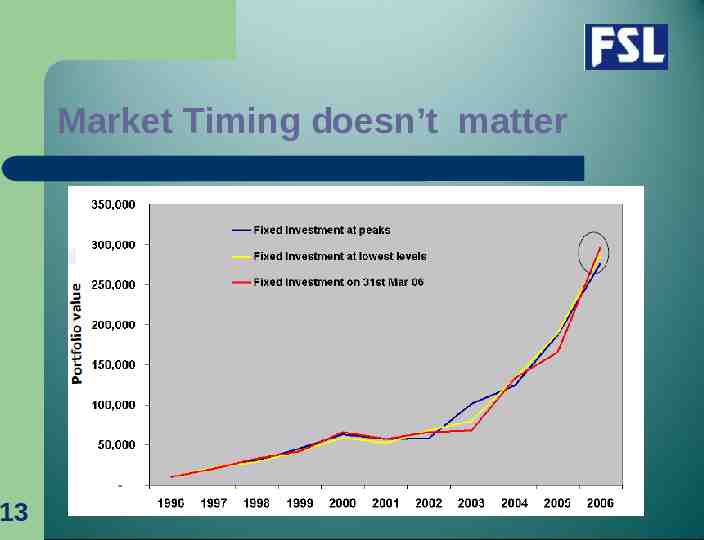

Market Timing doesn’t matter 13

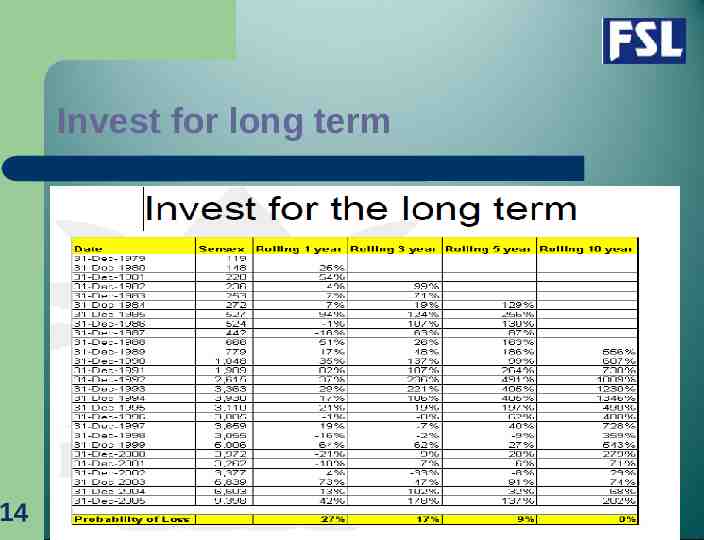

Invest for long term 14

MORAL Market timing doesn’t help !!! . It is the time in the markets that matters 15

Case Study – Systematic Investing 16 Little Drops of Water Make the Mighty Ocean

Systematic Investment Plan 17 Let’s take an example Anil is a businessman. He is married to Tina who is a housewife. He has a son and daughter , both are in school. Over next couple of years, he desires to follow a savings plan to build wealth for his children’s education/marriage and buy a bigger house. In order to hedge against uncertainties of business , he has been regularly investing in fixed income instruments.

Systematic Investment Plan The lower interest rates over the years have been worrying him. He decides to take the help of Sreeni , financial advisor. After carefully evaluating his financial goals and time required to achieve his financial goals , he advises him to invest in equity mutual funds for following reasons — Portfolio diversification — Superior returns ( refer slide on cumulative annualized returns for different asset classes for details ) 18

Systematic Investment Plan 19 However, Anil is not comfortable investing into equity mutual funds as they are volatile and therefore risky and avoidable. Sreeni advises Mahesh to register for Systematic Investment Plan (SIP) and make use of volatility in the market rather than get worried and avoid investing in equity mutual funds. Anil is not clear as to how SIP will work to his advantage and requests for more details Sreeni explains as follows :

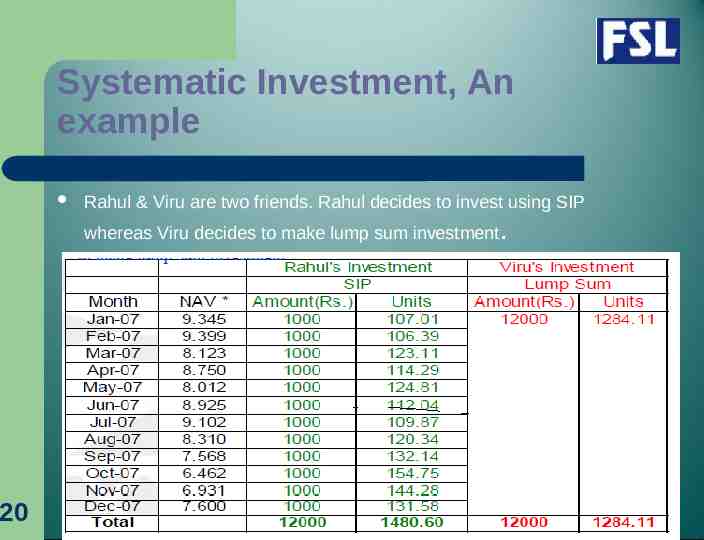

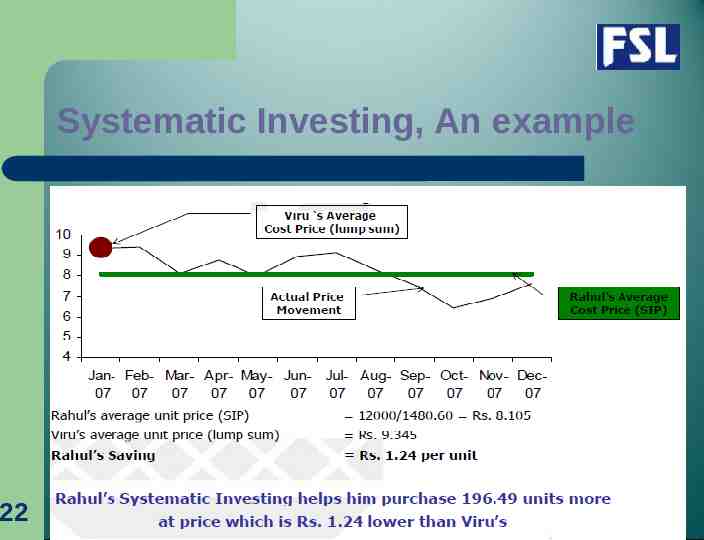

Systematic Investment, An example Rahul & Viru are two friends. Rahul decides to invest using SIP whereas Viru decides to make lump sum investment. 20

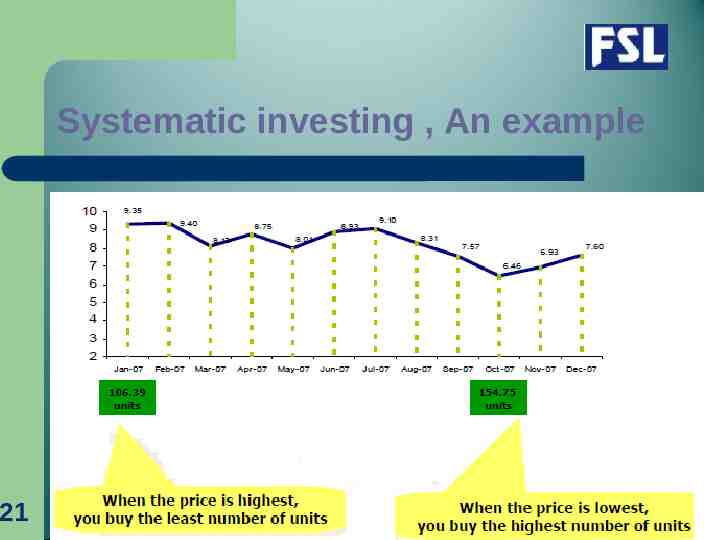

Systematic investing , An example 21

Systematic Investing, An example 22

Why Systematic Investing? 1. 2. 3. 23 The Goal of most investors is to buy when the prices are low, and sell when the prices are high. Sounds simple, but trying to time the market like this is : Time Consuming Risky And almost Impossible A more successful strategy is to adopt Rupee Cost Averaging.

What is Rupee Cost Averaging ? 1. 2. 3. 4. 24 The markets are volatile : they move up and down in an unpredictable manner. Invest a fixed amount, at regular, predetermined intervals and use the market fluctuations to your benefit. How does it help you : You buy less when the market is up. You buy more when the market is down Overtime the market fluctuations are averaged Most likely you will realize a saving on the cost per unit This may lead to HIGHER RETURNS

Three common reasons for not investing I don’t have enough money to invest I am too busy making money to worry about managing it I don’t have the time or expertise to follow the market movements and make investments at the right time. SYSTEMATIC INVESTMENT PLAN is the only answer to all reasons. 25

Investment made easy – SIP SIP is an investment program that allows you to contribute a fixed amount (as low as Rs.1000 )in mutual funds at regular intervals. 26

Systematic Investment Plan The Smart Law of Averages 27 Invest regularly and periodically instead of Lumpsum / 1 time investment. For example , if you have Rs. 60000 to invest – you can either do a one time investment or alternatively you can spread the investment amount over a period of time say Rs. 5000 every month for 12 months or Rs.10,000 every month for 6 months.

How to make Sip work for you ? Set your financial goals Identify the scheme Decide the SIP amount Look for a long term commitment Aim for the big picture Start investing. 28

Thank You 29