Small Church Network – Session 3 PRESENTED BY: SUSAN ALDANA

31 Slides2.01 MB

Small Church Network – Session 3 PRESENTED BY: SUSAN ALDANA – ASSISTANT CONTROLLER JONATHAN BLAKER – DIRECTOR OF TREASURY DAVID FISHER – DIRECTOR OF FOUNDATIONS ANDRE KIERKIEWICZ - CONTROLLER SEPTEMBER 30, 2019

Essential Topics in Parish Finance Taxes Unrestricted Vs. Restricted Funds Audit Stewardship and Grants Planned Giving SMG Grants New Matching Grant Resources 2

Taxes Unrelated business income tax – 2019 update Clergy Discretionary Fund Charitable Contributions Reporting Sales Taxes Payroll/Pension Information Reporting Income Taxes Property Taxes 3

Retirement Benefits o Pension Defined Benefit 18% of Total Assessable Compensation is contributed by church employer. o Pension RSVP Tax deferred retirement savings plan option May contribute any % or amount up to IRS max 19,000 – 2019 Ability to transfer assets and change allocation 4

Unrestricted vs Restricted Funds Distinction Responsibility to honor donor restrictions Financial statement presentation – restricted funds separate from unrestricted 2019 change in classification 5

The Audit What is an audit? Why do we need one? Internal review. Audit Committee. Audit process. Title I, Canon 4, Section 4.5, Annual Audits 6

7 The Audit Committee Have Be not less than 3 members appointed by the Vestry Not include members who have responsibility for the records to be reviewed May, but need not, include Vestry members

Audit Program Summary Review prior year audit Documentation Audit receipts Review Bank Disbursements Statements and Reconciliation Payroll and Taxes Budget Variances Report 8

9 Stewardship and Grants

10 Planned Giving

11 “The Minister of the congregation is directed to instruct the people, from time to time, about the duty of Christian parents to make prudent provision for the well-being of their families, and of all persons to make wills, while they are in health, arranging for the disposal of their temporal goods, not neglecting, if they are able, to leave bequests for religious and charitable uses.” - The Book of Common Prayer, Page 445

What is Planned Giving? Planned Giving – ways in which various future gifts can be made to the Church utilizing different vehicles The process may involve Estate Planning – advice from legal and tax counsel in strongly advised Planned Gifts are often associated with legacy giving as the gift(s) can impact future generations

Common Planned Giving Vehicles Bequest in a Will – source of 80% of planned gifts Lifetime Gifts – guidance from legal tax counsel advised Outright Gifts Charitable Annuities (more complex) - fixed income for life - remainder or lead - chartable tax deductions can be taken with lifetime gifts Gifts by Beneficiary Designation Life Insurance Policy Individual Retirement Account (IRA) 401(k) 403(b)

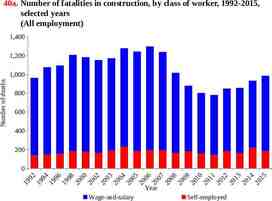

The Current Giving Climate

PLANNED GI VING TRIVIA QUESTIO

Question #1 16 What percentage of all charitable gifts made in 2018 in the Unites States were given to religious institutions? A. 29% B. 40% C. 57% D. 22%

Question #2 17 What percentage of all charitable gifts made in 1985 in the Unites States were given to religious institutions? A. 37% B. 40% C. 53% D. 61%

Examples of Giving in the Diocese Bishop Quin Foundation Episcopal Foundation of Texas Our Congregations

Strategic Mission Grants

Strategic Mission Grants

Strategic Mission Grants Purpose of Strategic Mission Grants Fund programs that will result in growing the Church by investing seed money in start-up concepts Foster new relationships with communities and encourage new ideas to build the Church Capital related projects are not eligible for funding 21

Strategic Mission Grants Purpose of Strategic Mission Grants (cont.) Encourage congregations to “look beyond their walls” Most grants are paid over 3 Years – usually in declining amounts each year (congregations will typically contribute funds for their proposed initiative) Funding provided by three EDOT foundations Bishop Quin Foundation Episcopal Foundation of Texas Great Commission Foundation 22

Strategic Mission Grants Process – Where to Begin Internal Assessment Identify need Who is underserved in your neighborhood Consult with EDOT Mission Amplification team Submit Concept via the SMG Website www.smgedot.org Can submit anytime Two Step Process Version in Spanish 23

Strategic Mission Grants Step #2 – Invitation to Submit an Application SMG Committee will review Proposals at their meetings (they meet four times per year) Committee will decide to: Invite congregation to complete an Application Refer to EDOT Mission Amplification Team with feedback 24

Strategic Welcome Grants (SWG’s)

Strategic Welcome Grants (SWGs) Purpose is to fund attractional projects like beautification of campus or evangelism projects Examples: bathrooms, landscaping, nursery, etc. They are not for deferred maintenance items Grant is up to 4,000 of matching funds Grant is to be submitted to Mission Amp, who will review and recommend to the SMG Committee of GCF Payments are made after the work has been completed and receipts are provided 26

Resources Diocesan Personnel The Rev. Canon Joann Saylors – Mission Amplification Linda Riley Mitchell - Chief Financial Officer [email protected] Andre Kierkiewicz - Controller [email protected] Susan Aldana - Assistant Controller [email protected] 27

Resources Diocesan Personnel Jonathan Blaker – Director of Treasury [email protected] David Fisher - Foundations & Property [email protected] Zee Turnbull - Human Resources Administrator [email protected] EDOT: 713-520-6444 28

Resources Clergy Manual (each priest has a copy) Vestry Resource guide Manual of Business Methods (TEC) Download from Diocesan website: http://www.epicenter.org/diocese/the-office-of-financial-services/ Available in English, y en Español Vestry Resource Guide from Forward Movement The Vestry Handbook from Church Publishing Financial Management for Episcopal Parishes 29

Calendar of Important Dates * Date will vary depending on Council dates January 15th* Churches to submit Parochial Reports January 15th* Churches to submit Journal Directory, Lay Delegate Certifications and Necrology repots January 15th* Churches to submit Christmas Attendance and other metrics as requested January 31st Form W-2: Employee‘s Wage and Tax Statement Form provided to all employees, including parochial clergy. January 31st Form 941: Employer‘s Quarterly Payroll Tax Return File return with the Internal Revenue Service for quarter ending December 31. January 31st Form 1098: Mortgage Interest Copy of form provided to recipient (for any mortgages held by churches or dioceses). January 31st Form 1099: INT & MISC. Copy of form provided to recipient. January 31st Substantiation of Contributions statements provided to donors of gifts over 250. February 28th Form W-2: Employee‘s Wage and Tax Statement Forms remitted to the Social Security Administration along with Transmittal Form W-3. February 28th Form 1099: INT & MISC Forms remitted to Internal Revenue Service along with Transmittal Form 1096 March 1st Form 1099: INT & MISC Forms remitted to Internal Revenue Service along with Transmittal Form 1096 April 30th Form 941: Employer‘s Quarterly Payroll Tax Return File return with the Internal Revenue Service for quarter ending March 31 May 1st Churches to Submit Changes to Parochial Reports May 1st Diocesan Journal Volume II Posted June 15th Diocese to send Lay License reports to churches July 31st Form 941: Employer‘s Quarterly Payroll Tax Return File return with the Internal Revenue Service for the quarter ending June 30 August 31st Churches to submit Lay License Applications September 1st (or sooner, as required by Diocesan Canons): Audited Financial Statements of all congregations and institutions to be filed with the Diocesan Office September 1st Annual Diocesan Report to be filed by all dioceses with the Executive Council/General Convention Office September 30th Diocese to send Assessment Letters to churches October 31st Form 941: Employer‘s Quarterly Payroll Tax Return File return with the Internal Revenue Service for the quarter ending September 30 November 1st Council Registration for Attendees, Volunteers and Exhibitors Open and Forms Posted November 15th Council Forms emailed to Churches December 31st Diocesan Journal Volume I Posted December 31st Assessments due 30

Q&A