Site Activity (Program Metrics) Training Chapter 7 TAXAIDE

12 Slides656.60 KB

Site Activity (Program Metrics) Training Chapter 7 TAXAIDE

Content Covered In this training you will learn What Activity Reporting is and why it is important to Tax-Aide What and when volunteers report information Site process for collecting and reporting site activity How to view and report site activity in the new Volunteer Portal About available site activity reports AARP Foundation Tax-Aide AARP Foundation Tax-Aide Confidential & Proprietary Page 2

Activity Reporting Overview WHAT: A collection of volunteer generated site-level service and tax return preparation data detailing the services volunteers deliver to AARP Tax-Aide clients WHY: The information is used: – Primarily to: Secure funding from sponsors and to meet grant reporting requirements (IRS, AARP, others) – And also to: Monitor site and program growth, effectiveness and equipment needs AARP Foundation Tax-Aide AARP Foundation Tax-Aide Confidential & Proprietary Page 3

Information Reported by Volunteers 1) 2) 3) 4) 5) Paper Filed Federal Returns (Current Year) Paper Filed Federal Returns (Prior Year) Paper Filed Federal Returns (Amended) Paper Filed State/Local Only Returns Questions & Answers Only * * Q&A counts are critical for determining the number of taxpayers served. AARP Foundation Tax-Aide AARP Foundation Tax-Aide Confidential & Proprietary Page 4

Reporting Periods & Due Dates One Reporting Period per Tax Season February 1 – September 30 Recommended: Report monthly Some states may require more frequent reporting No DC approval/submission required Review to ensure that data is being collected and reported each year All Leaders w/Edit and the LC can report activity data AARP Foundation Tax-Aide AARP Foundation Tax-Aide Confidential & Proprietary Page 5

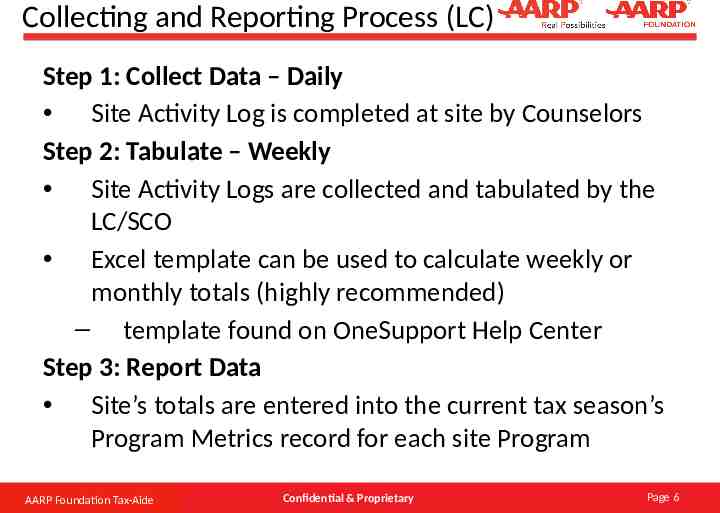

Collecting and Reporting Process (LC) Step 1: Collect Data – Daily Site Activity Log is completed at site by Counselors Step 2: Tabulate – Weekly Site Activity Logs are collected and tabulated by the LC/SCO Excel template can be used to calculate weekly or monthly totals (highly recommended) – template found on OneSupport Help Center Step 3: Report Data Site’s totals are entered into the current tax season’s Program Metrics record for each site Program AARP Foundation Tax-Aide AARP Foundation Tax-Aide Confidential & Proprietary Page 6

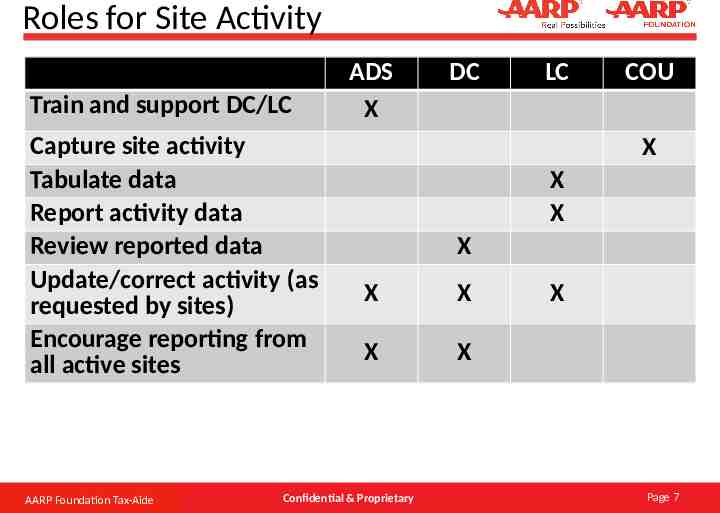

Roles for Site Activity Train and support DC/LC Capture site activity Tabulate data Report activity data Review reported data Update/correct activity (as requested by sites) Encourage reporting from all active sites AARP Foundation Tax-Aide AARP Foundation Tax-Aide ADS X DC LC COU X X X X X X X X Confidential & Proprietary X Page 7

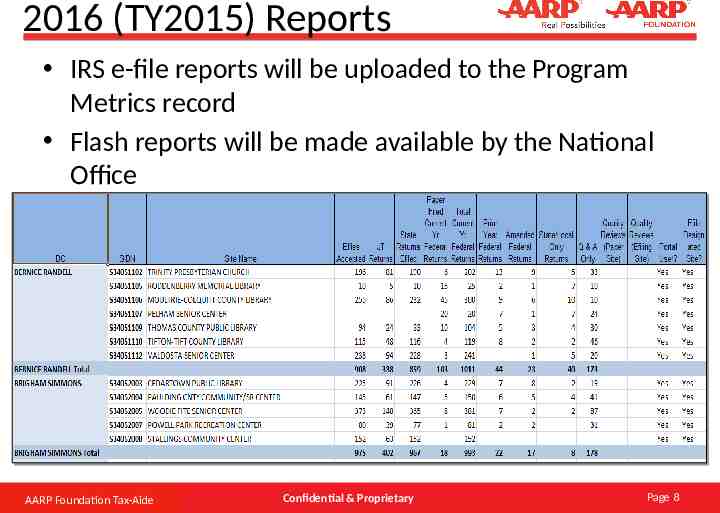

2016 (TY2015) Reports IRS e-file reports will be uploaded to the Program Metrics record Flash reports will be made available by the National Office AARP Foundation Tax-Aide AARP Foundation Tax-Aide Confidential & Proprietary Page 8

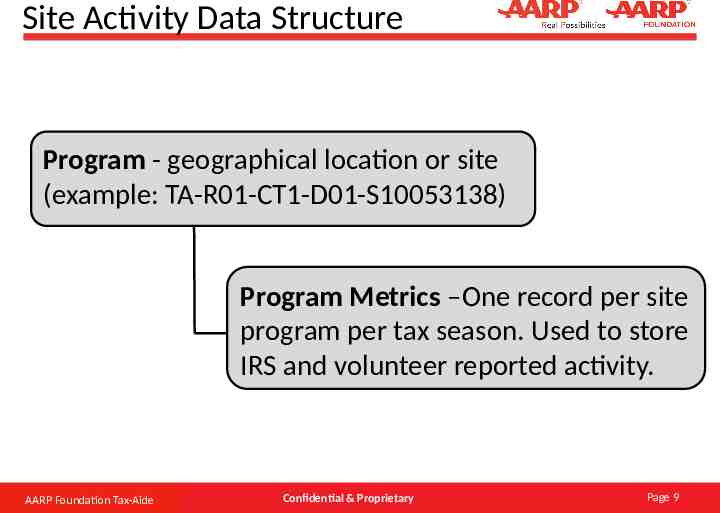

Site Activity Data Structure Program - geographical location or site (example: TA-R01-CT1-D01-S10053138) Program Metrics –One record per site program per tax season. Used to store IRS and volunteer reported activity. AARP Foundation Tax-Aide AARP Foundation Tax-Aide Confidential & Proprietary Page 9

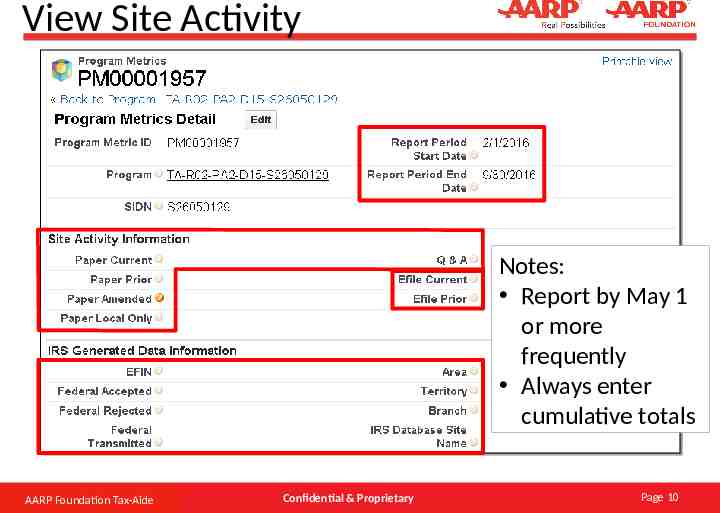

View Site Activity Notes: Report by May 1 or more frequently Always enter cumulative totals AARP Foundation Tax-Aide AARP Foundation Tax-Aide Confidential & Proprietary Page 10

DEMO: REPORTING SITE ACTIVITY AARP Foundation Tax-Aide Confidential & Proprietary Page 11

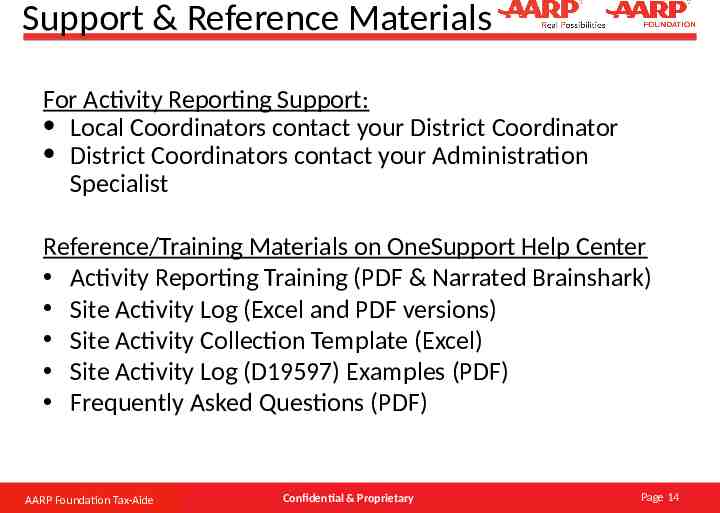

Support & Reference Materials For Activity Reporting Support: · Local Coordinators contact your District Coordinator · District Coordinators contact your Administration Specialist Reference/Training Materials on OneSupport Help Center Activity Reporting Training (PDF & Narrated Brainshark) Site Activity Log (Excel and PDF versions) Site Activity Collection Template (Excel) Site Activity Log (D19597) Examples (PDF) Frequently Asked Questions (PDF) AARP Foundation Tax-Aide AARP Foundation Tax-Aide Confidential & Proprietary Page 14