Comprehensive Deposit Insurance Seminar For Bankers Important: This is

85 Slides2.24 MB

Comprehensive Deposit Insurance Seminar For Bankers Important: This is a printable version of the seminar and does not include certain graphics, video and animation that are part of the “live” presentation of the seminar. To view the entire presentation, please see FIL-18-2017 for registration instructions. 2017

Outline Part 1 General Principles Part 3 Review of Ownership Category Requirements 2 Part 2 Introduction to Ownership Categories Part 4 Deposit Insurance Coverage Resources FEDERAL DEPOSIT INSURANCE CORPORATION

Deposit Insurance Coverage Resources – www.fdic.gov/deposit Many of the FDIC’s deposit insurance resources are available on FDIC’s Deposit Insurance Coverage webpage. FDIC’s Electronic Deposit Insurance Estimator (EDIE) – http://www.fdic.gov/edie. FDIC’s Your Insured Deposits – a written guide for use and distribution to depositors -https ://www.fdic.gov/deposit/deposits/brochures/your insured deposits-english.html FDIC’s Online Product Catalogue – https://catalog.fdic.gov/ Financial Institution Employee’s Guide to Deposit Insurance (Employee’s Guide) – https:// www.fdic.gov/deposit/DIGuideBankers/index.html FDIC’s toll free number 1-877-ASK-FDIC or 1-800-275-3342 Consumer Assistance On-Line Form – https://www2.fdic.gov/starsmail/index.asp Important: The “live” seminar provides animation on this slide which can only be viewed by participating in the WebEx conference. See FIL-18-2017 to register. 3 FEDERAL DEPOSIT INSURANCE CORPORATION

The Financial Institution Employee’s Guide to Deposit Insurance 2016 New Version of The Financial Institution Employee’s Guide to Deposit Insurance https://www.fdic.gov/deposit 4 FEDERAL DEPOSIT INSURANCE CORPORATION

The Financial Institution Employee’s Guide to Deposit Insurance The Employee’s Guide is available on the FDIC’s deposit insurance webpage. This resource was published in 2016 and is designed to assist bank employees in understanding deposit insurance coverage. This resource provides bankers in-depth explanations of the 14 deposit insurance ownership categories, as well as comprehensive examples for the nine most common ownership categories. This presentation is a summary of information that can be found in the Employee’s Guide. This link to the Employee’s Guide can be bookmarked or a PDF version available may be printed. https://www.fdic.gov/deposit/diguidebankers/index.html Important: The “live” seminar provides animation on this slide which can only be viewed by participating in the WebEx conference. See FIL-18-2017 to register. 5 FEDERAL DEPOSIT INSURANCE CORPORATION

Seminar on Deposit Insurance Coverage Part 1 – General Principles 6 FEDERAL DEPOSIT INSURANCE CORPORATION

General Principles Since 1933, the FDIC seal at financial institutions has signified trust and stability to millions of Americans. FDIC deposit insurance is backed by the full faith and credit of the United States government. Since the FDIC’s inception no depositor has ever lost a penny of insured deposits. FDIC insurance enables consumers to confidently deposit their money at FDIC insured banks across the United States and in the unlikely event of a bank failure, guarantees they can get their insured deposits promptly. Important: The “live” seminar provides animation on this slide which can only be viewed by participating in the WebEx conference. See FIL-18-2017 to register. 7 FEDERAL DEPOSIT INSURANCE CORPORATION

General Principles Depositors are insured at each bank for up to at least the standard maximum deposit insurance amount (“SMDIA”). The SMDIA is 250,000 (made permanent in 2010 under the Dodd-Frank Wall Street Reform and Consumer Protection Act). Coverage includes principal and accrued interest up through the date of a bank’s failure. 8 FEDERAL DEPOSIT INSURANCE CORPORATION

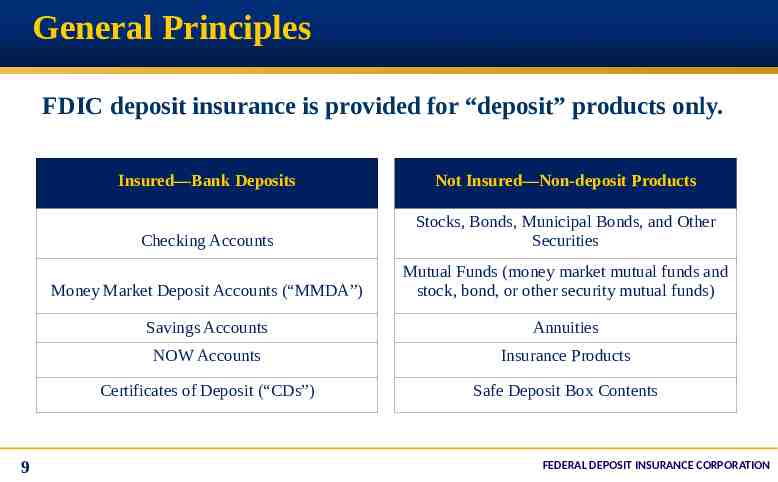

General Principles FDIC deposit insurance is provided for “deposit” products only. 9 Insured—Bank Deposits Not Insured—Non-deposit Products Checking Accounts Stocks, Bonds, Municipal Bonds, and Other Securities Money Market Deposit Accounts (“MMDA”) Mutual Funds (money market mutual funds and stock, bond, or other security mutual funds) Savings Accounts Annuities NOW Accounts Insurance Products Certificates of Deposit (“CDs”) Safe Deposit Box Contents FEDERAL DEPOSIT INSURANCE CORPORATION

Basic Insurance Coverage Example Coverage includes principal and interest earned up to the SMDIA. Jane Smith Principal Amount Accrued Interest 248,000 3,000 Total 251,000 Amount Insured 250,000 Amount Uninsured 10 Balance 1,000 FEDERAL DEPOSIT INSURANCE CORPORATION

General Principles Deposit insurance coverage is provided 11 Per Depositor Per Ownership Category Per Bank FEDERAL DEPOSIT INSURANCE CORPORATION

General Principles: Per Depositor Coverage is provided on a per depositor basis Deposit accounts owned by different depositors are separately insured. Depositors that may qualify to receive FDIC deposit insurance coverage include: Natural persons; Legal entities such as corporations, partnerships, and unincorporated associations; and Public units such as cities and counties. A depositor does not have to be a citizen or resident of the United States to be eligible for deposit insurance coverage. 12 FEDERAL DEPOSIT INSURANCE CORPORATION

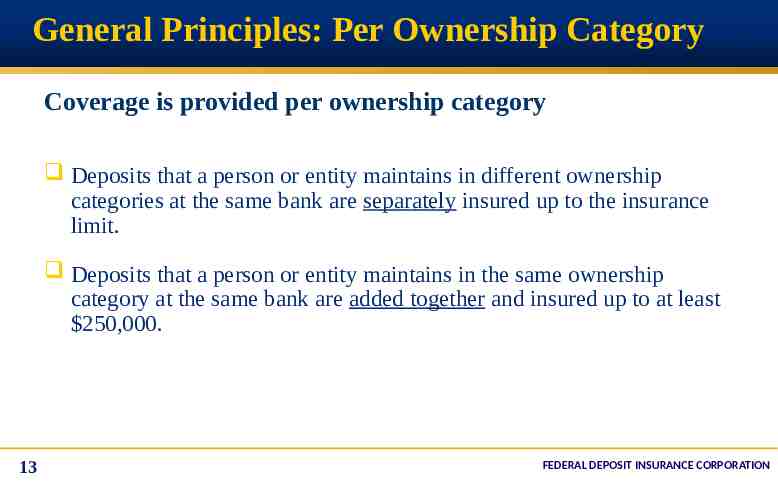

General Principles: Per Ownership Category Coverage is provided per ownership category Deposits that a person or entity maintains in different ownership categories at the same bank are separately insured up to the insurance limit. Deposits that a person or entity maintains in the same ownership category at the same bank are added together and insured up to at least 250,000. 13 FEDERAL DEPOSIT INSURANCE CORPORATION

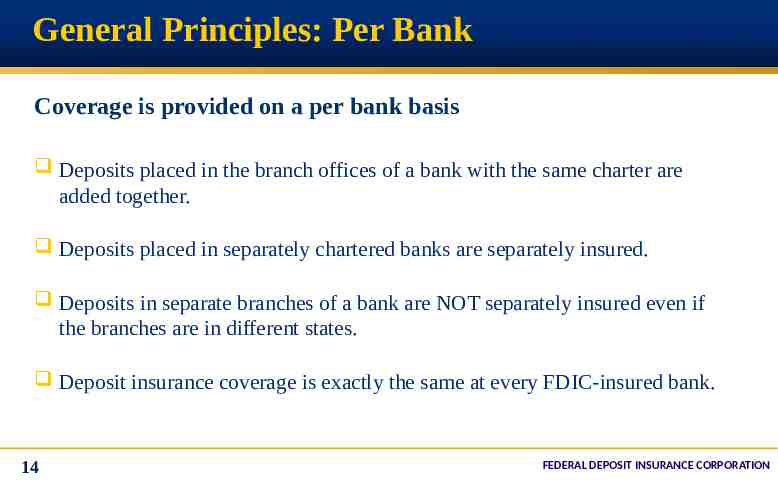

General Principles: Per Bank Coverage is provided on a per bank basis Deposits placed in the branch offices of a bank with the same charter are added together. Deposits placed in separately chartered banks are separately insured. Deposits in separate branches of a bank are NOT separately insured even if the branches are in different states. Deposit insurance coverage is exactly the same at every FDIC-insured bank. 14 FEDERAL DEPOSIT INSURANCE CORPORATION

General Principles BankFind Depositors can determine whether a particular institution is insured by the FDIC by entering information onto the FDIC's BankFind Directory (ID). BankFind provides the latest comprehensive financial and demographic data for every FDICinsured institution. You can access the database from the main FDIC webpage at www.fdic.gov or, by clicking on the BankFind link provided on this slide: http://research.fdic.gov/bankfind/. Once on the BankFind Directory, depositors can enter the name of the institution they wish to search and BankFind will return results indicating whether the institution by that name is insured. Important: The “live” seminar provides animation on this slide which can only be viewed by participating in the WebEx conference. See FIL-18-2017 to register. 15 FEDERAL DEPOSIT INSURANCE CORPORATION

General Principles Death of an Account Owner The death of an account owner will in some cases reduce the amount of deposit insurance coverage. This is especially the case for co-owned accounts. If an account owner dies, the FDIC provides a six-month grace period during which the account will be insured as if the account owner had not died. After the six-month grace period, the funds will be insured according to the ownership category in which the deposits are held. 16 FEDERAL DEPOSIT INSURANCE CORPORATION

General Principles Coverage When Banks Merge Basic rule – There is separate deposit insurance coverage (i.e., for deposits at each bank) for up to six months (after the effective date of the merger) if a depositor has funds in two banks that merged. Special exception for time deposits – For time deposits (i.e., CDs) issued by the assumed bank, separate deposit insurance coverage will continue for the greater of either six months or the first maturity date of the time deposit. For additional information on mergers, please call the FDIC at 1-877-2753342 or view the FDIC’s Seminar on Advanced Topics in Deposit Insurance Coverage at the following link: https://youtu.be/X3Vr7EfOG9w 17 FEDERAL DEPOSIT INSURANCE CORPORATION

General Principles FDIC pays depositors “as soon as possible.” FDIC’s goal is to make deposit insurance payments within two business days after a bank’s failure. Coverage When A Bank Fails Processing brokered deposits may take longer since the broker needs to supply the FDIC with information about each depositor. FDIC pays 100 cents on the dollar for all insured deposits. Depositors with uninsured deposits may recover a portion of their uninsured funds. 18 FEDERAL DEPOSIT INSURANCE CORPORATION

General Principles Examples of bank deposit account records may include: Account ledgers Deposit Account Records In the event of a bank failure, the FDIC relies on bank deposit account records to determine ownership. Signature cards Certificate of deposits (CDs) Corporate resolutions in possession of the bank authorizing the accounts Other books and records of the bank including computer records that relate to the bank’s deposit-taking function 19 FEDERAL DEPOSIT INSURANCE CORPORATION

Seminar on Deposit Insurance Coverage Part 2 - Introduction to Ownership Categories 20 FEDERAL DEPOSIT INSURANCE CORPORATION

Introduction to Ownership Categories In order to determine deposit insurance coverage, bankers must ask and answer the following three questions: 1. Who owns the funds? 2. What ownership category is the depositor eligible to use or attempting to use? 3. Does the depositor meet the requirements of that category? 21 FEDERAL DEPOSIT INSURANCE CORPORATION

Introduction to Ownership Categories 1. Who Owns The Funds: Calculating the amount of FDIC deposit insurance coverage begins with determining who owns the funds. An owner or a depositor can be: A person A business/organization A government entity 22 FEDERAL DEPOSIT INSURANCE CORPORATION

Introduction to Ownership Categories 2. What ownership category is the depositor eligible to use or attempting to use? An “ownership category,” also referred to as a “right and capacity” in the deposit insurance regulations, is defined by either a federal statute or by an FDIC regulation and provides for separate FDIC deposit insurance coverage. The FDIC regulations provide for 14 ownership categories. This seminar will discuss the nine most common ownership categories. 23 FEDERAL DEPOSIT INSURANCE CORPORATION

Introduction to Ownership Categories 3. Does the depositor meet the requirements of a specific category? If depositors can meet the rules for a specific category, then their deposits will be entitled to both of the following: Separate coverage from funds deposited under a different ownership category, and Up to the SMDIA in deposit insurance coverage that is provided for under the ownership category. 24 FEDERAL DEPOSIT INSURANCE CORPORATION

Nine Most Common Ownership Categories Owner individual Category 1 Single Accounts Category 2 Joint Accounts Owner business/organization Category 7 Corporations, Partnerships and Unincorporated Association Accounts Owner government entity 25 Category 3 Revocable Trust Accounts Category 4 Irrevocable Trust Accounts Category 5 Certain Retirement Accounts Category 6 Employee Benefit Plan Accounts Category 8 Government Accounts Owner mortgage servicer Category 9 Mortgage Servicing Accounts FEDERAL DEPOSIT INSURANCE CORPORATION

Five Least Common Ownership Categories Category 10 Category 10 Public Bonds Public Bonds Accounts Accounts Category 13 Category 13 Custodian Custodian Accounts for Accounts for Native Native Americans Americans 26 Category 11 Category 11 Irrevocable Irrevocable Trust Account Trust Account with Bank as with Bank as Trustee Trustee Category 12 Category 12 Annuity Annuity Contract Contract Accounts Accounts Category 14 Category 14 Accounts of a Bank Accounts of a Bank pursuant to the Bank pursuant to the Bank Deposit Financial Deposit Financial Assistance Program of the Assistance Program of the Department of Energy Department of Energy FEDERAL DEPOSIT INSURANCE CORPORATION

Seminar on Deposit Insurance Coverage Part 3 – Review of Ownership Category Requirements 27 FEDERAL DEPOSIT INSURANCE CORPORATION

Hypothetical Signature Card SIGNATURE CARD FOR DEPOSIT ACCOUNTS SELF DIRECTED RETIREMENT ACCOUNT ENROLLMENT Ac c ount Title Ac c ount Number TIN of First Name on Acc ount or Legal Entity Signature Title Printed Name Date Signature Title Printed Name Date p p p p AC C OUNT TYPE p Inherited IRA p Inherited Roth IRA p Rollover IRA p K eogh Traditional IRA Roth IRA SIMPLE IRA SEP IRA Name Address SSN DOB / / Home Phone Business Phone State Zip City BENE FIC IARIES Name and Address AC C OUNT DESC RIPTION p P ersonal Account p Non-Personal Account p p p p p p p p p p p Individual / Single Estate Individual Unincorporated (e.g. DBA) J oint With Survivorship J oint No Survivorship P OD / ITF / Totten Revocable Trust Irrevocable Trust Corporation / P artnership / LLC Non-Profit Government AC C OUNT BENEFIC IARIE S 28 DOB SSN Share Name of Benefic iary Name of Benefic iary 2 Name of Benefic iary 3 POWER OF ATTORNEY (POA) 4 Signature of Agent Printed Name of Agent Signature of Ac c ount Owner Date p Fiduciary Relationship 1 C USTOMER AGREEME NT Signature Date C USTODIAN / TRUSTEE AC C E PTANC E Signature Date FEDERAL DEPOSIT INSURANCE CORPORATION

Hypothetical Signature Card Ownership Categories (Cat.1) Single Accounts (Cat.2) Joint Accounts (Cat.3) Revocable Trust Accounts 29 Individual / Single Estate Individual Unincorporated (e.g. DBA) Joint With Survivorship (JTWROS) Joint No Survivorship (TIC) POD / ITF / Totten (Informal) Revocable Trust (Formal) FEDERAL DEPOSIT INSURANCE CORPORATION

Hypothetical Signature Card Ownership Categories (Cat.4) Irrevocable Trust Accounts Irrevocable Trust (Cat.7) Corporation, Partnership, Unincorporated Association Accounts Corporation/Partnership/LLC Non-Profit (Cat.8) Public Unit/Government Accounts Government (Cat.5) Certain Retirement Accounts* Traditional IRA Roth IRA Simple IRA SEP IRA Inherited IRA Inherited Roth IRA Rollover IRA Keogh NOT AN OWNERSHIP CATEGORYDeposit insurance coverage “passes Fiduciary (Broker, IOLTA, UTMA, etc.) through” the fiduciary to the actual owner, based on how the funds are held. *Note: Self-directed defined contribution plans are included under Category 5 FEDERAL DEPOSIT INSURANCE CORPORATION 30

Six Ownership Categories Available To Individuals 31 Category 1 Single Accounts Category 2 Joint Accounts Category 3 Revocable Trust Accounts Category 4 Irrevocable Trust Accounts Category 5 Certain Retirement Accounts Category 6 Employee Benefit Plan Accounts FEDERAL DEPOSIT INSURANCE CORPORATION

Category 1- Single Accounts A Single Account represents funds: Owned by one natural person and where no beneficiaries are named. Examples of Single Accounts: Funds owned by a Sole Proprietorship or DBA (not insured as Category 7 – Business/Organization accounts); Accounts established for a deceased person (not insured as Category 3 – Revocable Trust accounts). 32 FEDERAL DEPOSIT INSURANCE CORPORATION

Category 1- Single Account Coverage Coverage: Up to 250,000 for all Category 1 – Single Account deposits. All Category 1 – Single Accounts owned by the same depositor at the same bank are added together and insured up to 250,000. Remember! If a depositor designates an account as “payable on death” and names beneficiaries, the deposit will NOT be insured as a Category 1 – Single Account, (deposits that designate beneficiaries, are insured under Category 3 – Revocable Trust Accounts). Category 1 – Single Account is the default category for depositors who do not meet the requirements of another category. 33 FEDERAL DEPOSIT INSURANCE CORPORATION

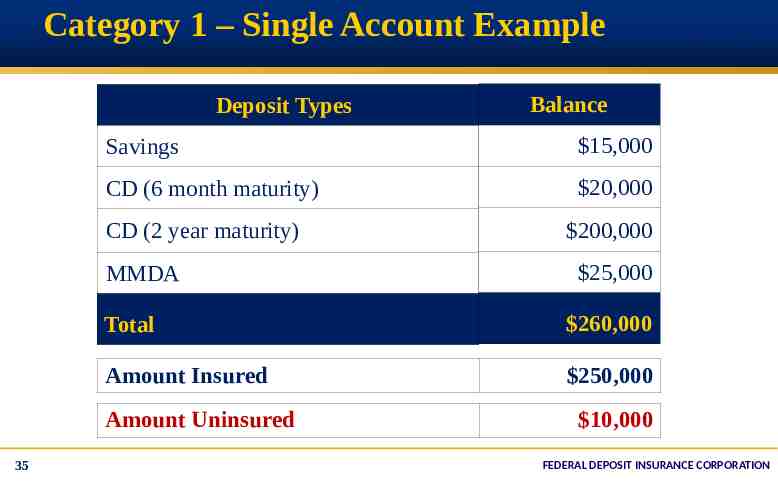

Category 1 – Single Account Example Account Title Deposit Types Balance Jane Smith Savings 15,000 Jane Smith CD (6 month maturity) 20,000 Jane Smith CD (2 year maturity) Jane Smith MMDA 200,000 25,000 Total 260,000 Amount Insured 250,000 Amount Uninsured 10,000 Important: The “live” seminar provides animation on this slide which can only be viewed by participating in the WebEx conference. See FIL-18-2017 to register. 34 FEDERAL DEPOSIT INSURANCE CORPORATION

Category 1 – Single Account Example Deposit Types Savings 15,000 CD (6 month maturity) 20,000 CD (2 year maturity) MMDA 200,000 25,000 Total 260,000 Amount Insured 250,000 Amount Uninsured 35 Balance 10,000 FEDERAL DEPOSIT INSURANCE CORPORATION

Category 2 – Joint Accounts Joint Accounts represent funds owned by two or more depositors. Requirements: Depositors must be natural persons. Corporations, partnerships, associations, trusts and estates are not eligible for Category 2 – Joint Account coverage. Each co-owner must sign the signature card. CDs, broker or agent exceptions. Electronic signatures are acceptable. Each co-owner must have the same withdrawal rights as the other co-owner(s). Be aware of restrictions when adding minors as co-owners. Note: FDIC assumes ownership of a joint account is equal unless otherwise stated in the bank’s records. 36 FEDERAL DEPOSIT INSURANCE CORPORATION

Category 2 – Joint Accounts Coverage: Up to 250,000 for each owner’s share of all Category 2 – Joint Account deposits at the same bank. If a depositor establishes multiple joint accounts, the owner’s shares in all joint accounts are added together and insured up to 250,000. Remember! Adding a name to a joint account for convenience purposes may limit equal withdrawal rights and result in the account being insured as a Category 1 – Single Account. If two or more depositors designate an account as “payable on death” and name beneficiaries, the deposit will be analyzed as a Category 3 – Revocable Trust Account. 37 FEDERAL DEPOSIT INSURANCE CORPORATION

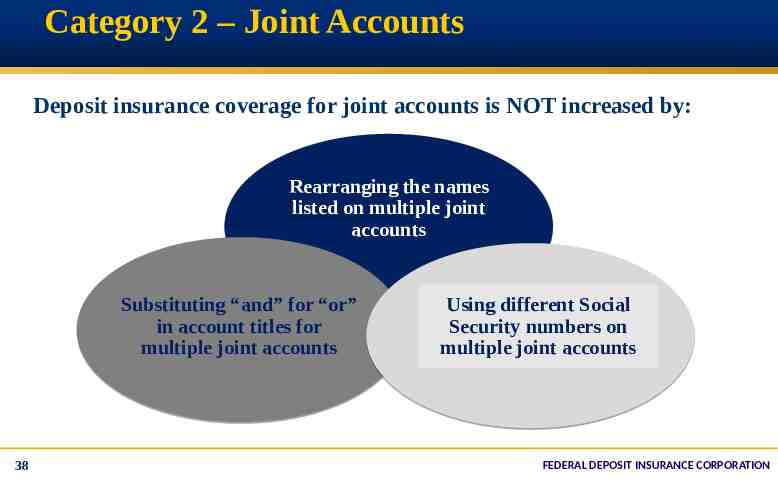

Category 2 – Joint Accounts Deposit insurance coverage for joint accounts is NOT increased by: Rearranging the names listed on multiple joint accounts Substituting “and” for “or” in account titles for multiple joint accounts 38 Using different Social Security numbers on multiple joint accounts FEDERAL DEPOSIT INSURANCE CORPORATION

Category 2 – Multiple Joint Accounts Example Account Account Title Balance Account 1 Jane Smith and Andrew Smith 400,000 Account 2 Jane Smith and Harry Jones 200,000 Total 600,000 Are all of the owners fully insured? 39 FEDERAL DEPOSIT INSURANCE CORPORATION

Multiple Joint Accounts Example - EDIE https://www5.fdic.gov/edie/index.html Important: The “live” seminar provides animation on this slide which can only be viewed by participating in the WebEx conference. See FIL-18-2017 to register. 40 FEDERAL DEPOSIT INSURANCE CORPORATION

Category 2 – Multiple Joint Accounts Example Account Andrew’s Interest Harry’s Interest Total Account 1 200,000 200,000 0 400,000 Account 2 100,000 0 100,000 200,000 Total 300,000 200,000 100,000 600,000 Amount Insured 250,000 200,000 100,000 550,000 50,000 0 0 50,000 Amount Uninsured 41 Jane’s Interest FEDERAL DEPOSIT INSURANCE CORPORATION

Category 2 – Joint Account Coverage Death of an Account Owner Example: John and Jane Smith opened a joint account for 500,000 on January 1, 2013. John dies on March 31, 2013. What is the deposit insurance coverage for the account? Six Month Rule Applies: For six months after John’s death, the account will be insured for 500,000 as though John was still living. After the six-month grace period, beginning October 1, 2013, assuming the account has not been restructured and Jane does not have any other single accounts at that bank, she would be insured for 250,000 in her Category 1 – Single Account and uninsured for 250,000. 42 FEDERAL DEPOSIT INSURANCE CORPORATION

Category 3 – Revocable Trust Accounts A Revocable Trust Account is a deposit where the owner indicates an intention that the funds will belong to one or more named beneficiaries upon the last owner’s death. In a Revocable Trust, the owner retains the right to change beneficiaries and/or allocations or to terminate the trust. The FDIC recognizes two types of revocable trusts: Informal revocable trusts Formal revocable trusts 43 FEDERAL DEPOSIT INSURANCE CORPORATION

Category 3 – Revocable Trust Beneficiaries Who or what can be a beneficiary? The beneficiary must be an eligible beneficiary as defined below: A natural person (living), A charity (must be valid under IRS rules) or A non-profit organization (must be valid under IRS rules) An eligible beneficiary is any natural person. There is no kinship requirement. 44 FEDERAL DEPOSIT INSURANCE CORPORATION

Category 3 – Revocable Trust Account Titling For revocable trust accounts, the trust relationship must exist in the account title. 45 For informal revocable trust accounts, commonly accepted terms such as “payable-on-death”, “in trust for” and “as trustee for” must appear in the account title. For purposes of this rule, “account title” includes the electronic deposit account records of the bank. The FDIC will recognize the account as a revocable trust account provided the bank’s electronic deposit account records identify the deposit as a POD account. For instance, this designation can be made using a code in the bank’s electronic deposit account records. FEDERAL DEPOSIT INSURANCE CORPORATION

Category 3 – Five or Fewer Beneficiaries Coverage depends on the number of beneficiaries named by an owner and the amount of the deposit: Owner 5 or fewer beneficiaries If the owner names five or fewer unique eligible beneficiaries, then the deposit insurance coverage is: Up to 250,000 multiplied by the number of unique eligible beneficiaries named by the owner. This applies to the combined interests for all beneficiaries the owner has named in all (both informal and formal) revocable trust deposits. The result is the same as above even if the owner has allocated different or unequal percentages or amounts to multiple beneficiaries. To calculate the deposit insurance coverage, multiply 250,000 by the number of owners multiplied by the number of unique eligible beneficiaries. 46 FEDERAL DEPOSIT INSURANCE CORPORATION

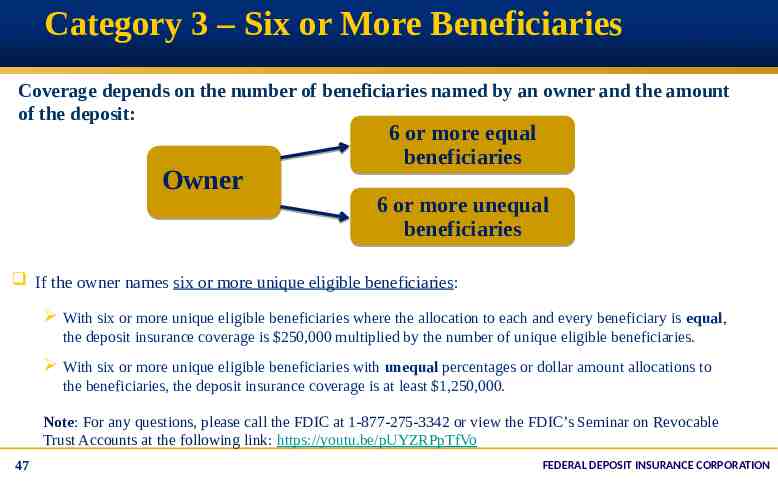

Category 3 – Six or More Beneficiaries Coverage depends on the number of beneficiaries named by an owner and the amount of the deposit: Owner 6 or more equal beneficiaries 6 or more unequal beneficiaries If the owner names six or more unique eligible beneficiaries: With six or more unique eligible beneficiaries where the allocation to each and every beneficiary is equal, the deposit insurance coverage is 250,000 multiplied by the number of unique eligible beneficiaries. With six or more unique eligible beneficiaries with unequal percentages or dollar amount allocations to the beneficiaries, the deposit insurance coverage is at least 1,250,000. Note: For any questions, please call the FDIC at 1-877-275-3342 or view the FDIC’s Seminar on Revocable Trust Accounts at the following link: https://youtu.be/pUYZRPpTfVo 47 FEDERAL DEPOSIT INSURANCE CORPORATION

Category 3 – Revocable Trust Accounts What is the deposit insurance coverage for a POD account with one owner and one beneficiary? There is a misconception that deposit insurance is determined by counting or adding the total number of owners and beneficiaries listed on a POD account. This is incorrect! Example: John POD Lisa What is the maximum amount that can be insured for this deposit? For five or fewer beneficiaries, deposit insurance coverage is determined by using the following formula: Number of owners multiplied by the number of beneficiaries multiplied by 250,000 deposit insurance coverage. There is one owner (John) and there is one beneficiary (Lisa). 1 owner x 1 beneficiary x 250,000 250,000. The maximum deposit insurance coverage is 250,000, NOT 500,000. 48 FEDERAL DEPOSIT INSURANCE CORPORATION

Category 3 – Revocable Trust Accounts Owner A Beneficiary B Beneficiary C Owner A has opened a POD account where he has identified B and C as his beneficiaries. What is the maximum amount that can be insured? 49 FEDERAL DEPOSIT INSURANCE CORPORATION

Category 3 – Revocable Trust Accounts Owner A Owner A receives 250,000 of coverage for Beneficiary B. Deposit insurance coverage is 500,000 not 750,000. Owner A receives 250,000 of coverage for Beneficiary C. This example illustrates the misconception that each person on the POD account is entitled to 250,000. We refer to this as the “counting heads” method. It is incorrect! Deposit insurance coverage is based on one owner and two unique beneficiaries. To determine coverage, we use the following formula: 1 owner x 2 beneficiaries x 250,000 500,000 50 FEDERAL DEPOSIT INSURANCE CORPORATION

Category 3 – Revocable Trust Accounts Example What is the deposit insurance coverage when an owner identifies the same beneficiaries on multiple POD accounts? Coverage is based on the number of unique beneficiaries named by an owner. While a beneficiary can be named on multiple accounts by an owner, FDIC will only recognize the beneficiary once in applying the insurance coverage. Example: John opens three POD accounts: Account Owner Title Beneficiary Account 1 John POD Alice Account 2 John POD Betty & Alice Account 3 John POD Cindy & Betty What is the maximum amount that can be insured for John’s deposits? 51 FEDERAL DEPOSIT INSURANCE CORPORATION

Category 3 – Revocable Trust Accounts Example Deposit insurance coverage formula the number of owners multiplied by the number of unique beneficiaries multiplied by 250,000. 1 owner x 3 beneficiaries x 250,000 750,000. John’s Beneficiaries Distribution of Beneficiaries Account 1 – Alice Alice Account 2 – Betty & Alice Alice Account 3 – Cindy & Betty Total Alice Unique Beneficiaries Betty Betty Cindy Betty Cindy 3 The maximum deposit insurance coverage for these POD accounts is 750,000, NOT 1,250,000 52 FEDERAL DEPOSIT INSURANCE CORPORATION

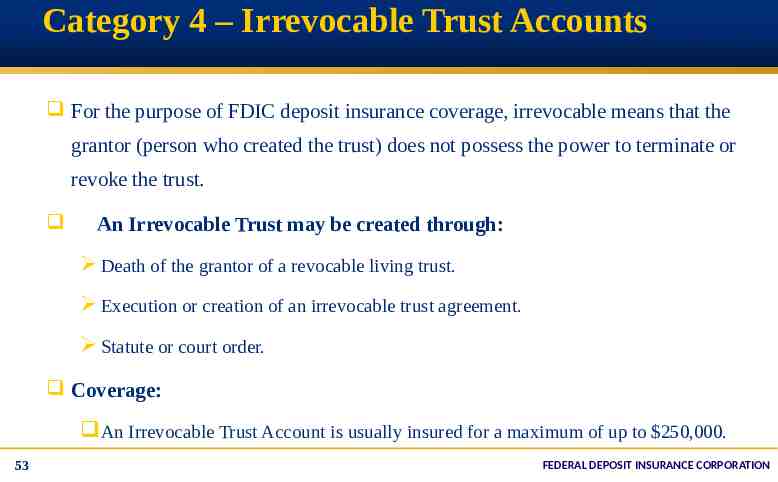

Category 4 – Irrevocable Trust Accounts For the purpose of FDIC deposit insurance coverage, irrevocable means that the grantor (person who created the trust) does not possess the power to terminate or revoke the trust. An Irrevocable Trust may be created through: Death of the grantor of a revocable living trust. Execution or creation of an irrevocable trust agreement. Statute or court order. Coverage: An Irrevocable Trust Account is usually insured for a maximum of up to 250,000. 53 FEDERAL DEPOSIT INSURANCE CORPORATION

Category 4 – Irrevocable Trust Accounts To determine the maximum deposit insurance coverage for an Irrevocable Trust Account, consider the following: 1. Grantor Retained Interest: Insured up to 250,000 as the grantor’s Category 1 – Single Account deposits along with any other single accounts owned by the grantor. 2. Contingent Beneficial Interests: All such interests are added together and insured up to 250,000. Contingency examples include: Beneficiaries do not receive funds unless certain conditions are met Trustee may invade principal of the trust on behalf of another beneficiary Trustee may exercise discretion in allocating funds 3. Non-contingent Beneficial Interests: Coverage for each beneficial interest would be up to 250,000. 54 FEDERAL DEPOSIT INSURANCE CORPORATION

Category 5 - Certain Retirement Accounts In a Certain Retirement Account, deposits are owned by only one participant. Requirements: Must be self-directed (except for Section 457 Plans). The owner of the plan, not an administrator, has the right to direct how the funds are invested, including the ability to direct that the funds be deposited at a specific bank. Account must be titled in the name of the owner’s self-directed retirement plan. Coverage: 250,000 for all deposits in Category 5 – Certain Retirement Accounts. 55 FEDERAL DEPOSIT INSURANCE CORPORATION

Category 5 - Certain Retirement Accounts Types of accounts insured under this category include: Traditional and Roth IRAs (IRAs in non-deposit products are not insured) Section 457 deferred compensation plans (whether or not self-directed) Savings Incentive Match Plan for Employees (SIMPLE) IRAs Self-directed defined contribution plans Simplified Employee Pension (SEP) IRAs Self-directed Keogh plans Remember! For deposits under this category such as IRAs, deposit insurance coverage does NOT increase by adding beneficiaries. All “defined benefit plans” are excluded from this category but included under Category 6 – Employee Benefit Plan Accounts. 56 FEDERAL DEPOSIT INSURANCE CORPORATION

Category 6 – Employee Benefit Plan Accounts Employee Benefit Plan Accounts are deposits held by any plan that satisfies the definition of an employee benefit plan in section 3(3) of the Employee Retirement Income Security Act of 1974 (“ERISA”), except for those plans that qualify under Category 5 – Certain Retirement Accounts. Requirements: Account title must indicate the existence of an employee benefit plan. Plan administrator must be prepared to produce copies of the plan documents. Coverage: 250,000 for each participant’s non-contingent interest*. *Non-contingent interest means an interest that can be determined without evaluation of a contingency other than life expectancy. 57 57 FEDERAL DEPOSIT INSURANCE CORPORATION

Category 6 – Employee Benefit Plan Accounts Types of accounts insured under this category include: Defined contribution plans, including profit-sharing plans and 401(k) plans that do NOT qualify as “self-directed” plans; All defined benefit plans. 58 FEDERAL DEPOSIT INSURANCE CORPORATION

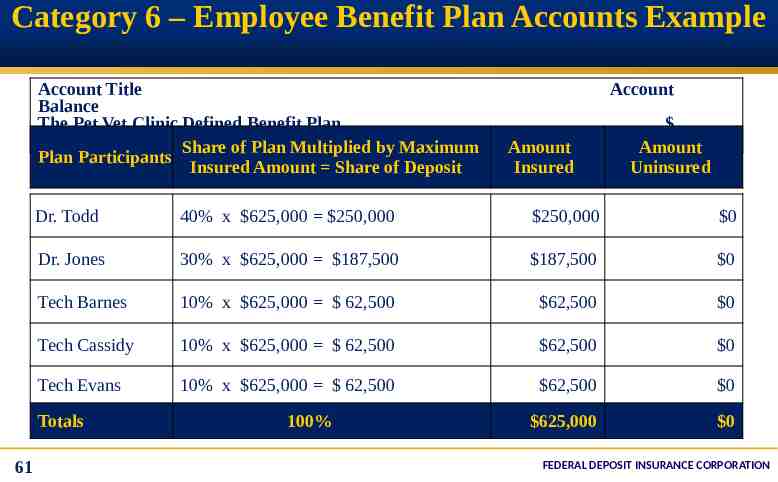

Category 6 – Employee Benefit Plan Accounts Example The Pet Vet Clinic Defined Benefit Plan Plan Participants Share of Plan Dr. Todd 40% Dr. Jones 30% Tech Barnes 10% Tech Evans 10% Tech Cassidy 10% Plan Totals 100% Note: Assume the actuary for the plan has determined these percentages represent the non-contingent share for each participant. The value of an employee's non-contingent interest in a defined benefit plan shall be deemed to be the present value of the employee's interest in the plan, evaluated in accordance with the method of calculation ordinarily used under such plan, as of the date of the bank failure. 59 FEDERAL DEPOSIT INSURANCE CORPORATION

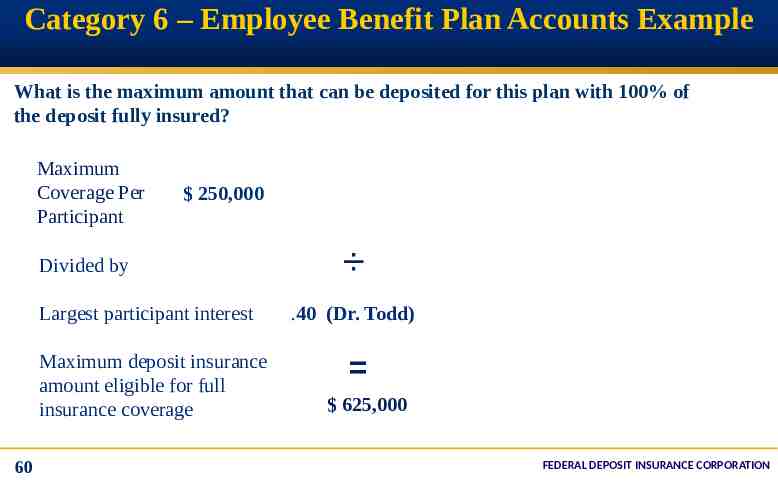

Category 6 – Employee Benefit Plan Accounts Example What is the maximum amount thatthat cancan be deposited forfor thisthis plan with 100% of of What is the maximum amount be deposited plan with 100% thethe deposit fully insured? deposit fully insured? Maximum Coverage Per Participant 250,000 Divided by Largest participant interest Maximum deposit insurance amount eligible for full insurance coverage 60 .40 (Dr. Todd) 625,000 FEDERAL DEPOSIT INSURANCE CORPORATION

Category 6 – Employee Benefit Plan Accounts Example Account Title Balance The Pet Vet Clinic Defined Benefit Plan 625,000 Share of Plan Multiplied by Maximum Plan Participants Insured Amount Share of Deposit Amount Insured Amount Uninsured Dr. Todd 40% x 625,000 250,000 250,000 0 Dr. Jones 30% x 625,000 187,500 187,500 0 Tech Barnes 10% x 625,000 62,500 62,500 0 Tech Cassidy 10% x 625,000 62,500 62,500 0 Tech Evans 10% x 625,000 62,500 62,500 0 625,000 0 Totals 61 Account 100% FEDERAL DEPOSIT INSURANCE CORPORATION

Category 7 – Business/Organization Accounts Business/Organization Accounts represent funds owned by a business or an organization. Requirements: Based on state law, the business/organization must be a legally created entity: Corporation (includes Subchapter S, LLCs, and PCs) Partnership Unincorporated Association The business/organization must be engaged in an independent activity* which is generally supported by: Separate tax identification numbers Separate charter or bylaws * Independent activity means the entity was formed for a business reason and not solely to increase deposit insurance coverage. 62 FEDERAL DEPOSIT INSURANCE CORPORATION

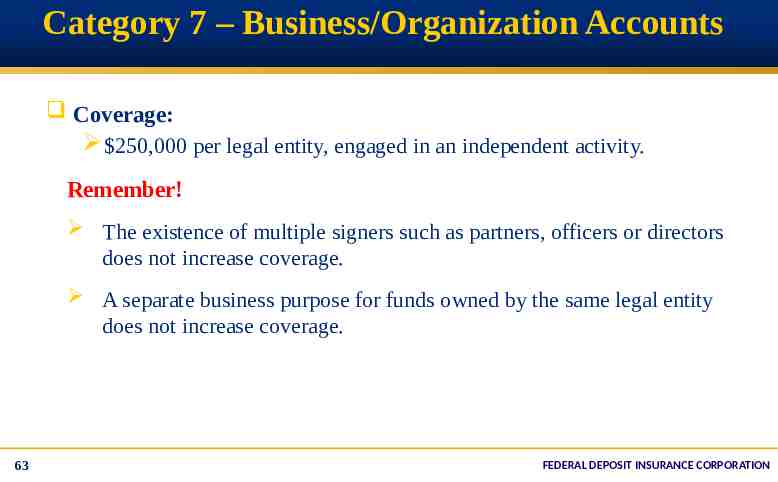

Category 7 – Business/Organization Accounts Coverage: 250,000 per legal entity, engaged in an independent activity. Remember! The existence of multiple signers such as partners, officers or directors does not increase coverage. A separate business purpose for funds owned by the same legal entity does not increase coverage. 63 FEDERAL DEPOSIT INSURANCE CORPORATION

Category 8 – Government Accounts Government Accounts are funds placed by an official custodian of a government entity, including a federal, state, county, municipal entity, or political subdivision. For Category 8 – Government Accounts, the insured party is the “official custodian”– an appointed or elected official who has “plenary authority” over funds in the account owned by the public unit. “Plenary authority” includes possession, as well as the authority to establish accounts for such funds in banks and to make deposits, withdrawals, and disbursements of such funds. Note: Please be careful not to assume that all of the “signers” on a government account qualify as official custodians. For the purpose of internal control, a government account might have three signers on an account, with the requirement that two out of three signers must authorize a transaction to withdraw funds. In this situation, the FDIC finds there is one official custodian. 64 FEDERAL DEPOSIT INSURANCE CORPORATION

Category 8 – Government Accounts By law, each of these government entities is eligible for deposit insurance coverage: 65 United States States Counties Municipalities District of Columbia Puerto Rico Other territories Indian tribes School districts Power districts Irrigation districts Bridge or port authorities Other “political subdivisions” FEDERAL DEPOSIT INSURANCE CORPORATION

Category 8 – Government Accounts Coverage: Funds held by an official custodian of a government entity are insured as follows: Accounts held in an in-state bank Up to 250,000 for the combined amount of all time and savings accounts (including NOW accounts) and Up to 250,000 for all demand deposit accounts (interest-bearing and noninterest-bearing) Accounts held in an out-of-state bank 66 Up to 250,000 for the combined total of all deposit accounts FEDERAL DEPOSIT INSURANCE CORPORATION

Government Accounts Fact Sheet https://www.fdic.gov/deposit/deposits/factsheet.html 67 FEDERAL DEPOSIT INSURANCE CORPORATION

Category 9 – Mortgage Servicing Accounts Mortgage Servicing Accounts are established by mortgage servicers and represent commingled principal and interest payments received from mortgagors (also known as “borrowers”). Coverage: Based on the borrowers’ payments of principal and interest into the mortgage servicing account. Provided to the mortgage servicer on behalf of the mortgagees. Up to 250,000 per borrower. These funds will not be aggregated with other deposit accounts that the borrowers or mortgagees may maintain at the same bank. 68 FEDERAL DEPOSIT INSURANCE CORPORATION

Category 9 – Mortgage Servicing Accounts A typical mortgage payment received by a mortgage servicer could be insured under different deposit insurance categories as described below: Payment Type Insured Owner The Principal & Interest (P&I) Mortgage Servicer Borrowers’ Tax & Insurance Escrow (T&I) Borrower (Mortgagor) Mortgage Related Fees (for example: guaranty fees, pair-off fees, extension fees and any other fees required by the Mortgagee) 69 Mortgagee Insurance Category Mortgage Servicing Pass-through to Borrower in same ownership category as they hold title to the real estate. Pass-through to Mortgagee in the Business Organization Accounts ownership category. FEDERAL DEPOSIT INSURANCE CORPORATION

Category 9 – Mortgage Servicing Accounts Example Example: A mortgage servicer collects from one thousand different borrowers their monthly mortgage payments of 2,000 (P&I) and places the funds into a mortgage servicing account. Is the 2,000,000 aggregate balance of the mortgage servicer’s mortgage servicing account fully insured? Yes, the account is fully insured to the mortgage servicer because each mortgagor’s payment of 2,000 (P&I) is insured separately for up to 250,000. 70 FEDERAL DEPOSIT INSURANCE CORPORATION

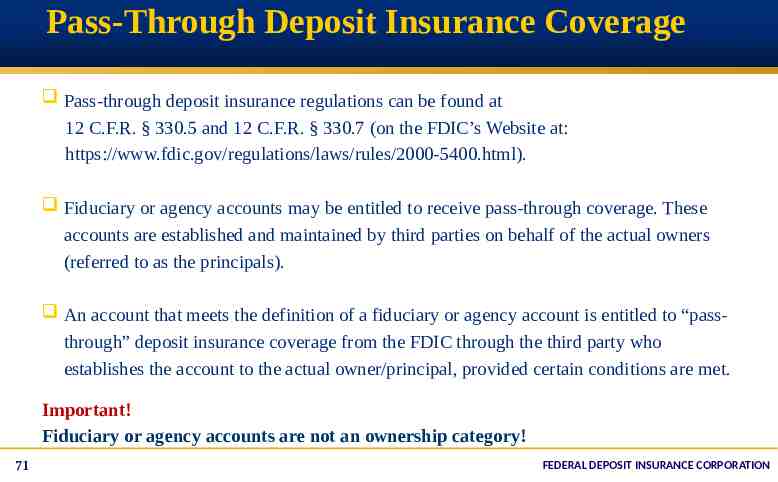

Pass-Through Deposit Insurance Coverage Pass-through deposit insurance regulations can be found at 12 C.F.R. § 330.5 and 12 C.F.R. § 330.7 (on the FDIC’s Website at: https://www.fdic.gov/regulations/laws/rules/2000-5400.html). Fiduciary or agency accounts may be entitled to receive pass-through coverage. These accounts are established and maintained by third parties on behalf of the actual owners (referred to as the principals). An account that meets the definition of a fiduciary or agency account is entitled to “passthrough” deposit insurance coverage from the FDIC through the third party who establishes the account to the actual owner/principal, provided certain conditions are met. Important! Fiduciary or agency accounts are not an ownership category! 71 FEDERAL DEPOSIT INSURANCE CORPORATION

Pass-Through Deposit Insurance Coverage 72 Examples of Third Parties Who Establish Fiduciary Accounts Examples of Fiduciary or Agency Accounts Agent Escrow Nominee Power of Attorney Guardian Uniform Transfer to Minors Act (UTMA) Conservator Attorney Trust (IOLTA) Executor Agency Broker Brokered CDs FEDERAL DEPOSIT INSURANCE CORPORATION

Pass-Through Deposit Insurance Coverage What is “pass-through” deposit insurance coverage? When funds are deposited by a fiduciary or custodian on behalf of one or more actual owners of the funds, the FDIC will insure the funds as if the actual owners had established the deposit in the bank. What is the amount of “pass-through” deposit insurance coverage? Assuming the deposit meets the requirements for pass-through insurance coverage, the amount of FDIC deposit insurance coverage will be based on the ownership capacity (i.e., under the applicable ownership category) in which each principal holds the funds. 73 FEDERAL DEPOSIT INSURANCE CORPORATION

Requirements for Pass-through Coverage Funds must be owned by the principal, not the third party who set up the account (i.e., the fiduciary or custodian who is placing the funds). To confirm the actual ownership of the deposit funds, the FDIC may review: 1. 2. The agreement between the third party and the principal and Applicable state law The bank’s account records must indicate the agency nature of the account (e.g., XYZ Company as Custodian, XYZ FBO, Jane Doe UTMA John Smith, Jr.). The bank’s records or accountholder’s records must indicate both the principals’ identities as well as their ownership interests in the deposit. Deposit terms (i.e., the interest rate and maturity date) for accounts opened at the bank must match the terms the third party agent promised the customer. If the terms don’t match, the third party agent might be deemed to be the legal owner of the funds by the FDIC. An agent may retain a portion of the interest (as the agent’s fee) without precluding pass-through coverage. *For more information, please see FIL-29-2010: https://www.fdic.gov/news/news/financial/2010/fil10029.pdf 74 FEDERAL DEPOSIT INSURANCE CORPORATION

Prepaid Cards and Deposit Insurance Coverage There has been an increase in the use of prepaid cards. These cards may be offered directly through the bank or through a third party program manager. In order for deposit insurance to apply to prepaid funds, the pass-through requirements must be met. Once the pass-through requirements are met (may require card registration), the actual owner of the funds, and not the custodian, is the insured party. The deposit insurance coverage will be based on the ownership category in which the funds are held. Deposit insurance only applies when a bank fails. The funds underlying the prepaid cards must be deposited in a bank. 75 FEDERAL DEPOSIT INSURANCE CORPORATION

Health Savings Accounts - Employee’s Guide The Financial Institution Employee’s Guide to Deposit Insurance - the “Employee’s Guide” is intended to assist IDI employees in providing accurate information about FDIC insurance coverage. The Employee’s guide is available at: www.fdic.gov/deposit/diguidebankers/index.html Example: Using the “Employee’s Guide” to answer Health Savings Accounts (“HSAs”) questions: What is a Health Savings Account (“HSA”) How are Health Savings Accounts (“HSAs”) insured? 76 FEDERAL DEPOSIT INSURANCE CORPORATION

Health Savings Accounts - Employee’s Guide https://www.fdic.gov/deposit/diguidebankers/index.html Important: The “live” seminar provides animation on this slide which can only be viewed by participating in the WebEx conference. See FIL-18-2017 to register. 77 FEDERAL DEPOSIT INSURANCE CORPORATION

Section 529 Plans Qualified Tuition Savings Programs under Section 529 of the Internal Revenue Code (“529 Plans”) are state-sponsored plans which are taxadvantaged accounts that help families and individuals save for higher education expenses. While most states limit participants’ choices to investments such as stocks and bonds, some states allow participants to place their 529 plan money in bank deposits. Deposits placed in a 529 plan at a bank are insured up to 250,000 for the owner of the funds, as determined by the state law in which the plan is created. This varies as to each state. 78 FEDERAL DEPOSIT INSURANCE CORPORATION

Section 529A ABLE Accounts What are Section 529A - ABLE Accounts? 529A - Achieving A Better Life Experience (ABLE) accounts are a type of taxadvantaged account that an eligible individual can use to save funds for the disability-related expenses of the account’s designated beneficiary. How are 529A accounts insured? The designated beneficiaries of the 529A will be insured as single accounts up to the insurance limit of 250,000. Are 529A accounts aggregated with any other deposits? Each 529A beneficiary’s deposits would be insured together with any other single ownership category deposits the beneficiary may have at that same insured depository institution up to a combined total of 250,000. 79 FEDERAL DEPOSIT INSURANCE CORPORATION

Seminar on Deposit Insurance Part 4 – Deposit Insurance Coverage Resources 80 FEDERAL DEPOSIT INSURANCE CORPORATION

Deposit Insurance Coverage Resources - Appendix 9 Most Common Deposit Insurance Categories Category 1: Single accounts (12 C.F.R. § 330.6) – Slides 32-35 Category 2: Joint accounts (12 C.F.R. § 330.9) – Slides 36-42 Category 3: Revocable trust accounts (12 C.F.R. § 330.10) – Slides 43-52 Category 4: Irrevocable trust accounts (12 C.F.R. § 330.13) – Slides 53-54 Category 5: Certain retirement accounts (12 C.F.R. § 330.14(b)(2)) – Slides 55-56 Category 6: Employee benefit plan accounts (12 C.F.R. § 330.14) – Slides 57-61 Category 7: Business/Organization accounts (12 C.F.R. § 330.11) – Slides 62-63 Category 8: Government accounts (12 CFR § 330.15) – Slides 64-67 Category 9: Mortgage servicing accounts (12 CFR § 330.7(d)) – Slides 68-70 81 FEDERAL DEPOSIT INSURANCE CORPORATION

Deposit Insurance Coverage Resources –Appendix 5 Least Common DI Categories Category 10: Public bonds accounts. (12 CFR § 330.15(c)) - This category consists of funds which by law or under a bond indenture are required to be set aside to discharge a debt owed to the holders of notes or bonds issued by a public unit. Deposit insurance coverage under this category is up to 250,000 for the beneficial interest of each noteholder or bondholder provided certain requirements are met. Category 11: Irrevocable trust accounts with an insured depository institution as trustee. (12 CFR § 330.12) - This category consists of trust funds held by an insured depository institution in its capacity as trustee of an irrevocable trust. Deposit insurance coverage under this category is up to 250,000 for each owner or beneficiary provided certain requirements are met. Category 12: Annuity contract accounts. (12 CFR § 330.8) – This category consists of funds held by an insurance company or other corporation in a deposit account for the sole purpose of funding life insurance or annuity contracts and any benefits linked to the contracts. FDIC deposit insurance under this category is up to 250,000 per annuitant provided certain requirements are met. Category 13: Custodian accounts for American Indians. (12 CFR § 330.7(e)) –This category consists of funds held on behalf of an individual American Indian deposited by the Bureau of Indian Affairs of the United States Department of the Interior in a bank. Deposit insurance coverage under this category is up to 250,000 for the interest of each American Indian provided certain requirements are met. Category 14: Accounts of an insured depository institution pursuant to the Bank Deposit Financial Assistance Program of the Department of Energy. (12 U.S.C . 1817 (i)(3)) - This category consists of funds deposited by a bank pursuant to the Bank Deposit Financial Assistance Program of the Department of Energy. Separate deposit insurance is provided up to 250,000 for each participant in the DOE program provided certain requirements are met. If you have any questions regarding these categories, please call the FDIC at 1-877-ASK-FDIC. 82 FEDERAL DEPOSIT INSURANCE CORPORATION

Additional FDIC Seminars on YouTube Fundamentals of Deposit Insurance Coverage Discussion of the nine most common deposit insurance categories Available at: https://youtu.be/OqM4uGkFCXU Deposit Insurance Coverage for Revocable Trust Accounts Detailed discussion for depositors with accounts in excess of 1,250,000 and six or more beneficiaries Available at: https://youtu.be/pUYZRPpTfVo Advanced Topics in Deposit Insurance Coverage Health Savings Accounts When Banks Merge Right of Offset Available at: https://youtu.be/X3Vr7EfOG9w Also available at: www.fdic.gov/deposit/seminars.html 83 FEDERAL DEPOSIT INSURANCE CORPORATION

Additional FDIC Resources - Correspondence www2.fdic.gov/starsmail/index.asp Important: The “live” seminar provides animation on this slide which can only be viewed by participating in the WebEx conference. See FIL-18-2017 to register. 84 FEDERAL DEPOSIT INSURANCE CORPORATION

Seminar on Deposit Insurance Thank you for participating in the seminar! 85 85 FEDERAL DEPOSIT INSURANCE CORPORATION