Short courses for Permanent Missions in Geneva Thursday 3 December

42 Slides2.36 MB

Short courses for Permanent Missions in Geneva Thursday 3 December 2009 Recent trends and developments in international investment rulemaking Anna Joubin-Bret, Senior legal Advisor Hamed El-Kady, Expert, international investment policies Work Programme on International Investment Agreements United Nations Conference on Trade and Development Geneva, 3 December 2009

PRESENTATION I. The international frameworks on investment II. Trends in international investment agreements III. Key characteristics and trends in investor-State disputes 2

I. The international framework on investment 3

Evolving trends of FDI policies Some 20 years ago, many countries had reservations as regards FDI and excluded or restricted its inflow; Today, every single country seeks to attract FDI, in many cases not only at the national level but also, and independently so, at various sub-national levels; Typically, these efforts to attract FDI take three forms: liberalization, protection and promotion. 4

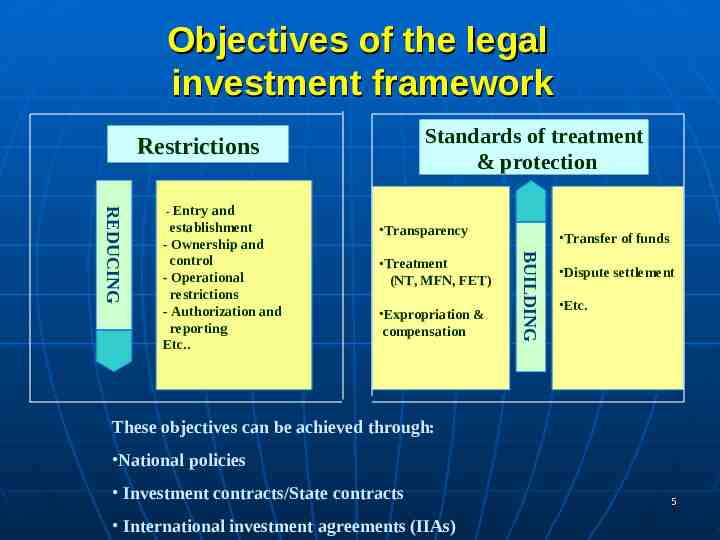

Objectives of the legal investment framework Standards of treatment & protection Restrictions establishment - Ownership and control - Operational restrictions - Authorization and reporting Etc. Transparency Treatment (NT, MFN, FET) Expropriation & compensation Transfer of funds BUILDING REDUCING - Entry and Dispute settlement Etc. These objectives can be achieved through: National policies Investment contracts/State contracts International investment agreements (IIAs) 5

Legal framework for investment: Hierarchy of norms National laws and regulations, investment codes State contracts, investment agreements, stabilization agreements Bilateral investment treaties (BITs) for the promotion and protection of investment Double taxation treaties (DTTs) Preferential trade and investment agreements Regional (OECD, APEC) and sectoral agreements (Energy Charter) Multilateral disciplines and specific agreements (WTO GATS, TRIMs, TRIPs; ICSID, 6 NY Convention, MIGA)

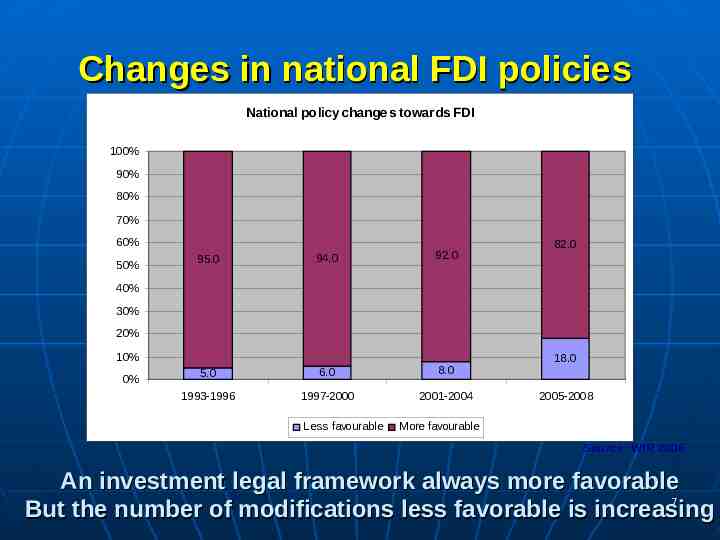

Changes in national FDI policies National policy changes towards FDI 100% 90% 80% 70% 60% 50% 95.0 94.0 92.0 5.0 6.0 8.0 1993-1996 1997-2000 2001-2004 82.0 40% 30% 20% 10% 0% Less favourable 18.0 2005-2008 More favourable Source: WIR 2006 An investment legal framework always more favorable 7 But the number of modifications less favorable is increasing

Investment contracts State contracts and investment agreements between individual investors and the host State set rules, rights and obligations for both parties Focus on a specific investment project Possible conflict between the provisions of a contract and the provisions of a treaty (umbrella effect of the treaty) 8

The international investment legal framework: role and objectives International investment agreements (IIAs): Contribute to the creation of a stable, predictable and transparent regulatory framework for international investment - strengthen the enabling framework for FDI (promotion, protection, liberalization) Facilitate the coordination of investment relations (relations between host States, home States, internationa investors and other development stakeholders) through internationally agreed common denominators Complement national laws on investment (interface between national and international investment policies) Impact of IIAs on FDI flows? Diverging views 9

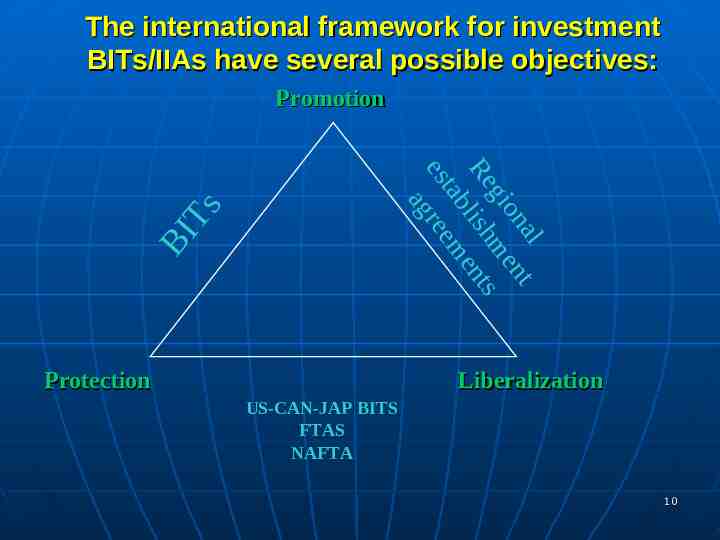

The international framework for investment BITs/IIAs have several possible objectives: Promotion BI Ts l na nt gio me Re lish ents tab m es ree ag Protection Liberalization US-CAN-JAP BITS FTAS NAFTA 10

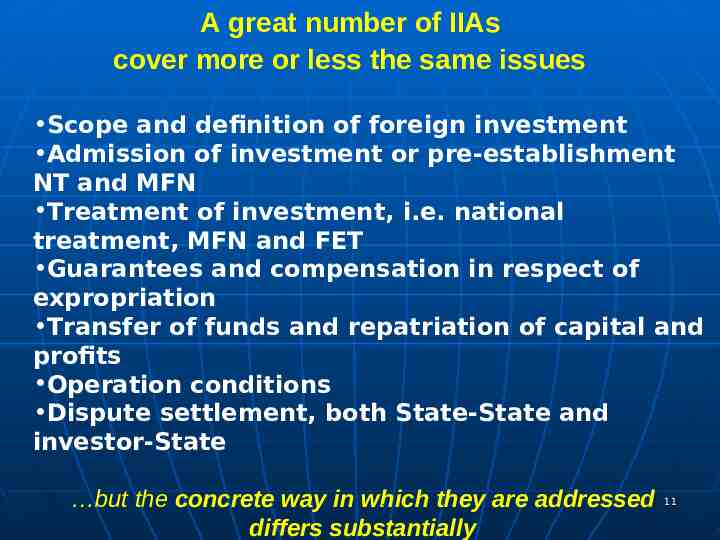

A great number of IIAs cover more or less the same issues Scope and definition of foreign investment Admission of investment or pre-establishment NT and MFN Treatment of investment, i.e. national treatment, MFN and FET Guarantees and compensation in respect of expropriation Transfer of funds and repatriation of capital and profits Operation conditions Dispute settlement, both State-State and investor-State but the concrete way in which they are addressed 12 differs substantially 11

II. Trends in international investment agreements 12

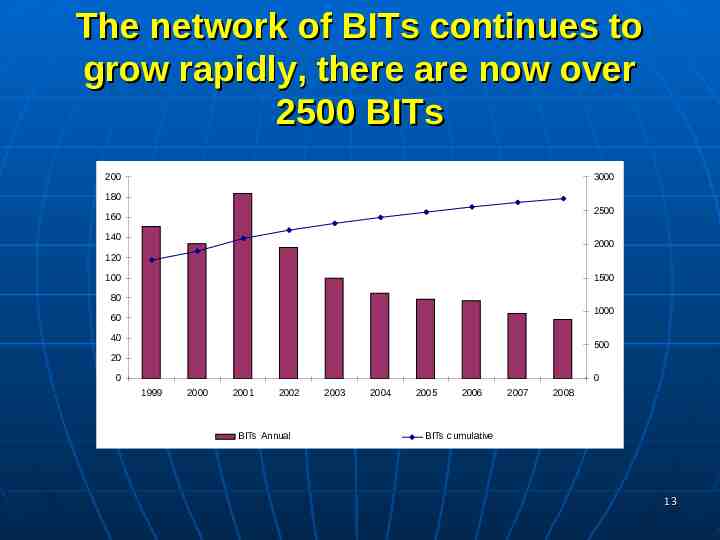

The network of BITs continues to grow rapidly, there are now over 2500 BITs 200 3000 180 2500 160 140 2000 120 100 1500 80 1000 60 40 500 20 0 0 1999 2000 2001 2002 BITs Annual 2003 2004 2005 2006 2007 2008 BITs cumulative 13

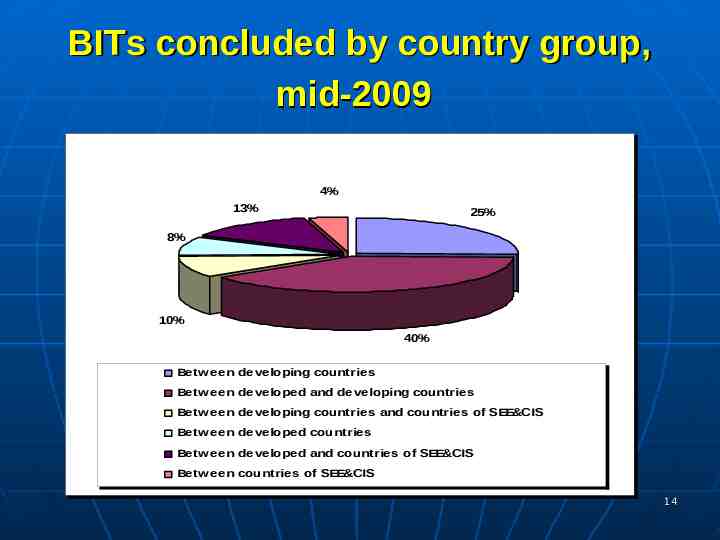

BITs concluded by country group, mid-2009 4% 13% 25% 8% 10% 40% Betw een developing countries Betw een developed and developing countries Betw een developing countries and countries of SEE&CIS Betw een developed countries Betw een developed and countries of SEE&CIS Betw een countries of SEE&CIS 14

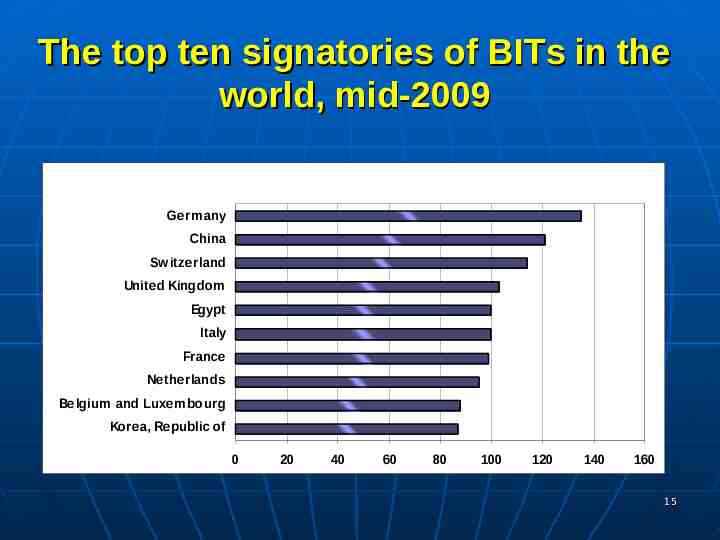

The top ten signatories of BITs in the world, mid-2009 Germ any China Sw itzerland United Kingdom Egypt Italy France Netherlands Belgium and Luxem bourg Korea, Republic of 0 20 40 60 80 100 120 140 160 15

New generation of BITs: Increasingly sophisticated and complex United States and Canadian model BITs (2004) Tend to be increasingly sophisticated in content Clarifying in greater detail the meaning of a number of standard clauses Putting more emphasis on the protection of national security, health, safety, the environment, and labour rights 16

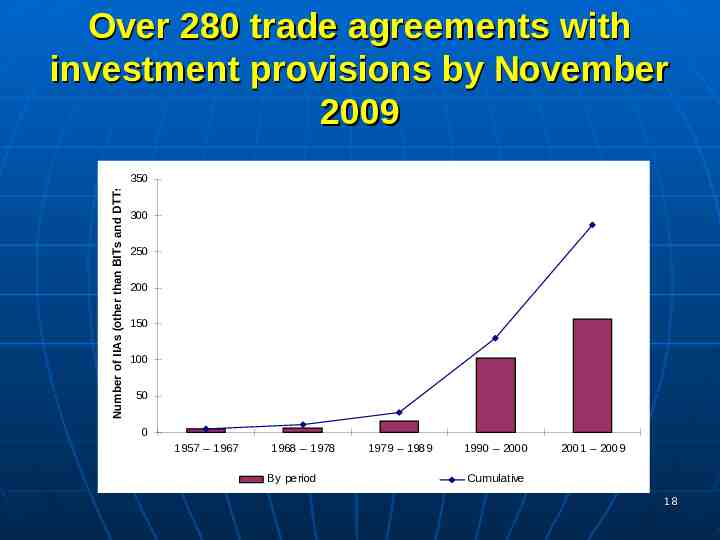

Free Trade Agreements with Investment Chapters International investment rules are increasingly being formulated as part of agreements that encompass a broader range of issues (including trade, services, competition, intellectual property) Regional integration with investment disciplines: ASEAN investment liberalization and protection The total number of such economic agreements with investment provisions exceeded 287, as of end 2009 17

Number of IIAs (other than BITs and DTTs) Over 280 trade agreements with investment provisions by November 2009 350 300 250 200 150 100 50 0 1957 – 1967 1968 – 1978 By period 1979 – 1989 1990 – 2000 2001 – 2009 Cumulative 18

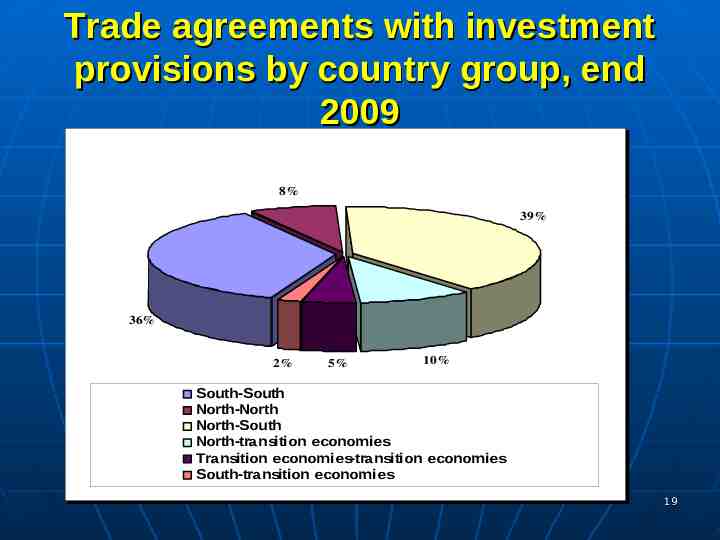

Trade agreements with investment provisions by country group, end 2009 8% 39% 36% 2% 5% 10% South-South North-North North-South North-transition economies Transition economies-transition economies South-transition economies 19

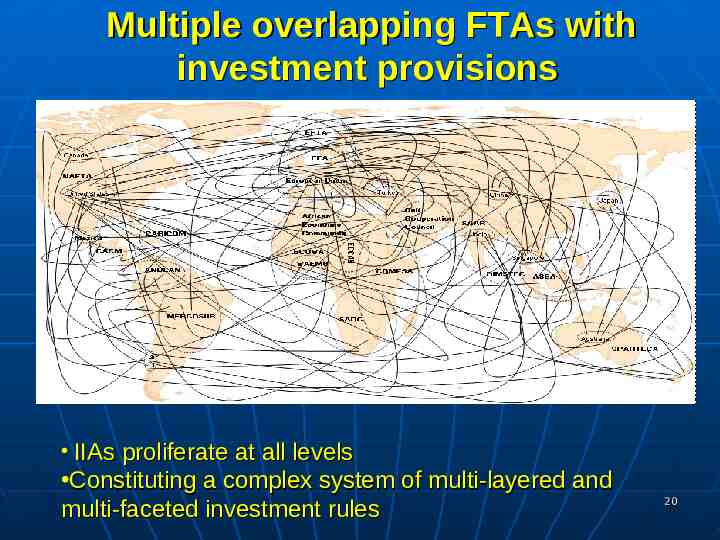

Multiple overlapping FTAs with investment provisions IIAs proliferate at all levels Constituting a complex system of multi-layered and multi-faceted investment rules 20

Recent trends: re-negotiation Re-negotiation of « old » treaties BITs vs. investment chapters in FTAs 21

South-South cooperation: Active participation of developing countries in IIAs Many developing countries are active participants in the process of concluding IIAs The total number of BITs between developing countries leaped from 47 in 1990 to over 700 by the end of 2009. By end 2009, over 100 of economic cooperation agreements with investment provisions among developing countries had been signed Some developing countries are today both capital importing and exporting (both home and host) - twin objectives: investment attraction and investment protection 22

III. Key characteristics and trends in investor-State dispute settlement 23

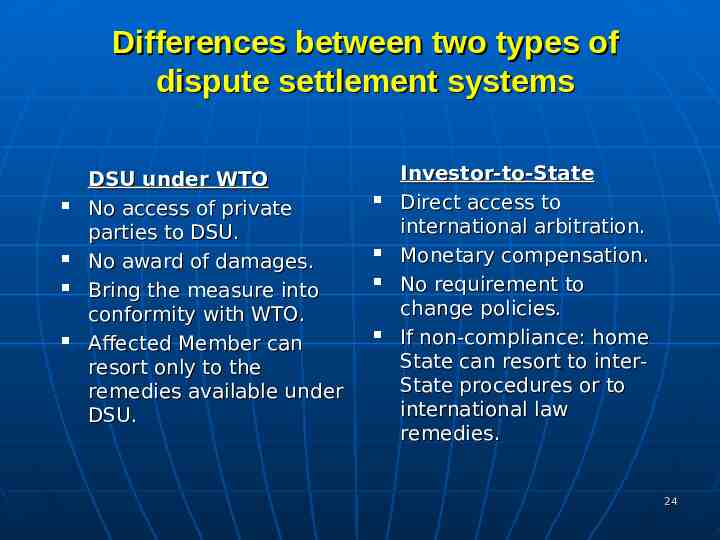

Differences between two types of dispute settlement systems DSU under WTO No access of private parties to DSU. No award of damages. Bring the measure into conformity with WTO. Affected Member can resort only to the remedies available under DSU. Investor-to-State Direct access to international arbitration. Monetary compensation. No requirement to change policies. If non-compliance: home State can resort to interState procedures or to international law remedies. 24

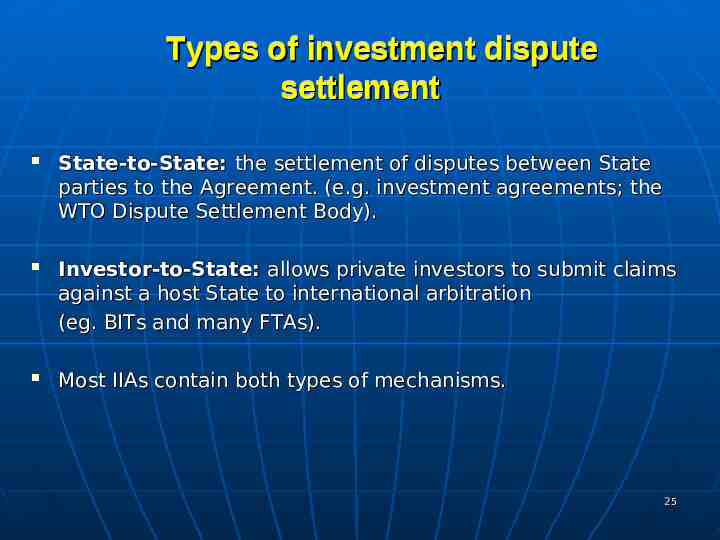

Types of investment dispute settlement State-to-State: the settlement of disputes between State parties to the Agreement. (e.g. investment agreements; the WTO Dispute Settlement Body). Investor-to-State: allows private investors to submit claims against a host State to international arbitration (eg. BITs and many FTAs). Most IIAs contain both types of mechanisms. 25

Two reasons to use State-State 1. 2. Exercise of diplomatic protection Dispute over the interpretation or application of an investment treaty. 26

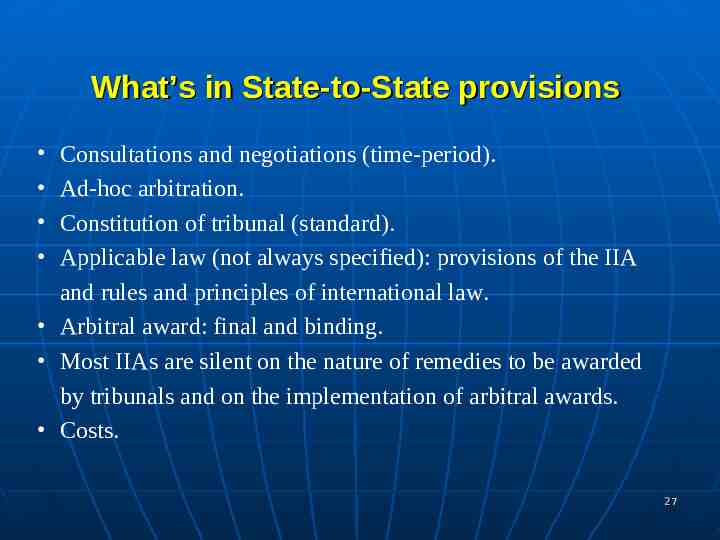

What’s in State-to-State provisions Consultations and negotiations (time-period). Ad-hoc arbitration. Constitution of tribunal (standard). Applicable law (not always specified): provisions of the IIA and rules and principles of international law. Arbitral award: final and binding. Most IIAs are silent on the nature of remedies to be awarded by tribunals and on the implementation of arbitral awards. Costs. 27

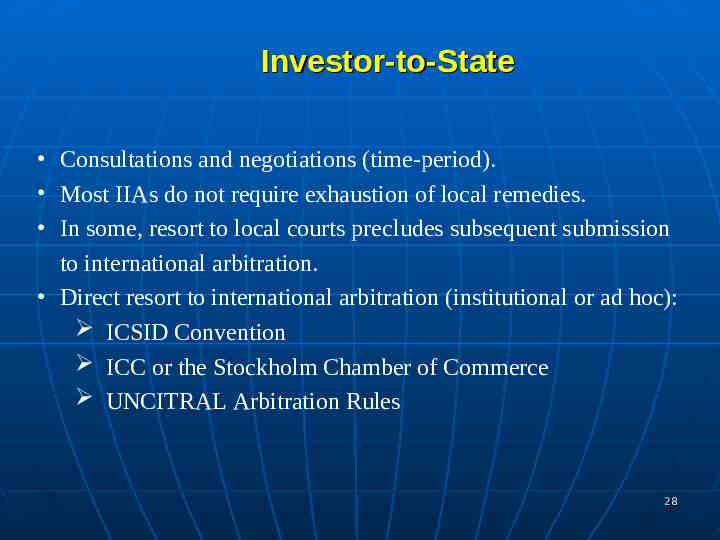

Investor-to-State Consultations and negotiations (time-period). Most IIAs do not require exhaustion of local remedies. In some, resort to local courts precludes subsequent submission to international arbitration. Direct resort to international arbitration (institutional or ad hoc): ICSID Convention ICC or the Stockholm Chamber of Commerce UNCITRAL Arbitration Rules 28

Investor-to-State Constitution of tribunal (as per arbitral rules). Applicable law: IIA’s provisions; law of the host-State; investment contract, rules of international law. ICSID Convention (Article 42): absent agreement between parties, the tribunal shall apply the law of the host State and the applicable rules of international law. Arbitral awards: final and binding, but require exequatur (except in the case of ICSID awards). ICSID Members shall recognize and enforce the awards in their territory as if they were final judgements of a State court. 29

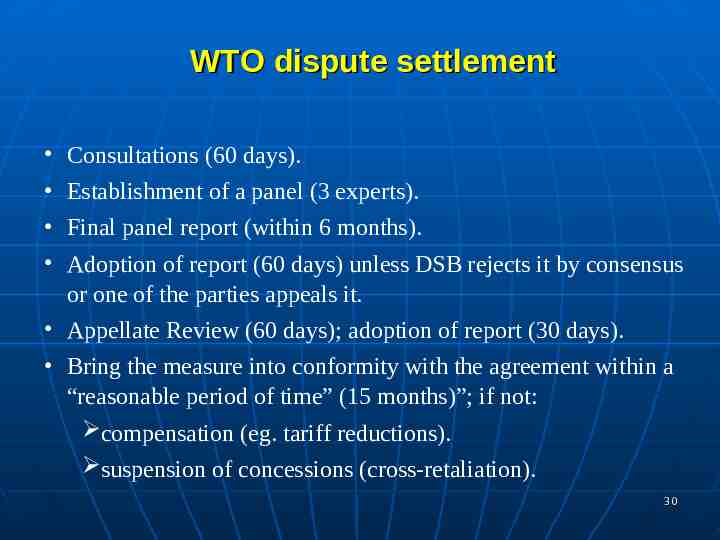

WTO dispute settlement Consultations (60 days). Establishment of a panel (3 experts). Final panel report (within 6 months). Adoption of report (60 days) unless DSB rejects it by consensus or one of the parties appeals it. Appellate Review (60 days); adoption of report (30 days). Bring the measure into conformity with the agreement within a “reasonable period of time” (15 months)”; if not: compensation (eg. tariff reductions). suspension of concessions (cross-retaliation). 30

Access to dispute settlement WTO DSU: only Member States can initiate proceedings under the DSU. Nongovernmental bodies do not have direct access to the system. Investor-to-State: investors may submit a dispute with a host State to an international tribunal, without having to resort to the diplomatic protection of their home State. 31

Access to dispute settlement Investors in services act as the pivotal link between “investment law” and “trade law”. Services companies can either pursue a remedy under: - the WTO General Agreement on Trade in Services (GATS). - ISDS. 32

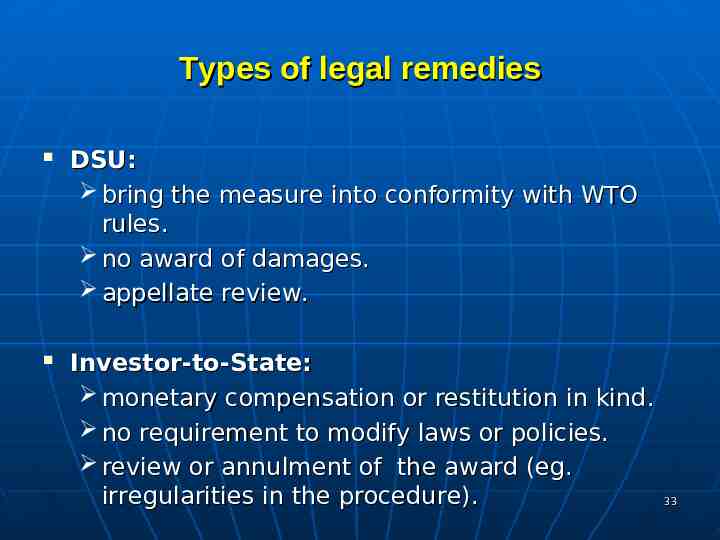

Types of legal remedies DSU: bring the measure into conformity with WTO rules. no award of damages. appellate review. Investor-to-State: monetary compensation or restitution in kind. no requirement to modify laws or policies. review or annulment of the award (eg. irregularities in the procedure). 33

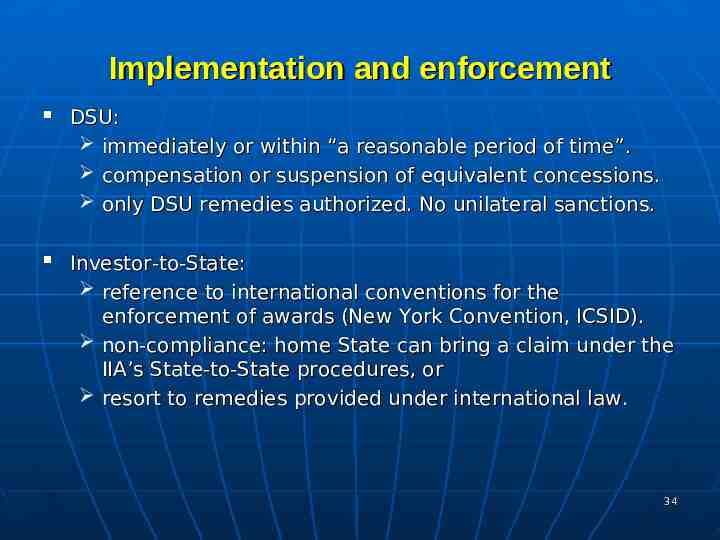

Implementation and enforcement DSU: immediately or within “a reasonable period of time”. compensation or suspension of equivalent concessions. only DSU remedies authorized. No unilateral sanctions. Investor-to-State: reference to international conventions for the enforcement of awards (New York Convention, ICSID). non-compliance: home State can bring a claim under the IIA’s State-to-State procedures, or resort to remedies provided under international law. 34

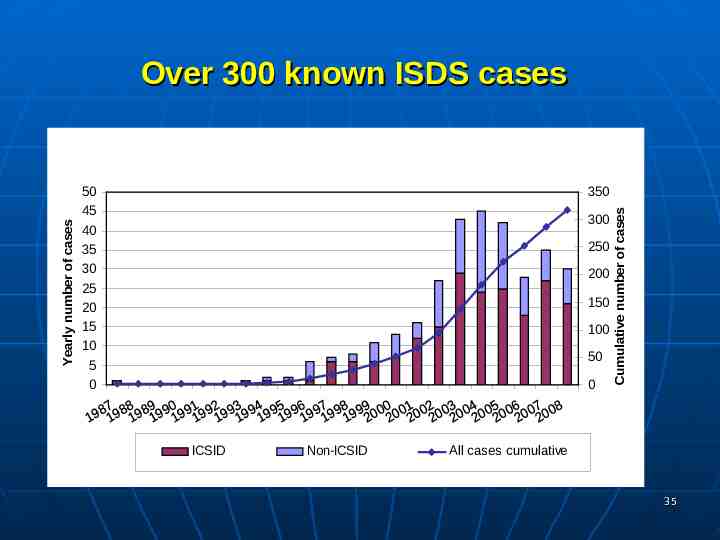

50 45 40 35 30 25 20 15 10 5 0 350 300 250 200 150 100 50 0 ICSID Non-ICSID Cumulative number of cases Yearly number of cases Over 300 known ISDS cases All cases cumulative 35

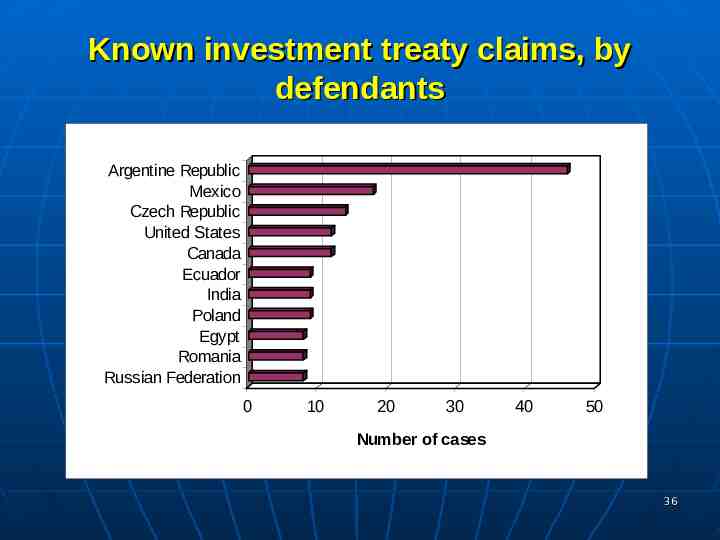

Known investment treaty claims, by defendants Argentine Republic Mexico Czech Republic United States Canada Ecuador India Poland Egypt Romania Russian Federation 0 10 20 30 40 50 Number of cases 36

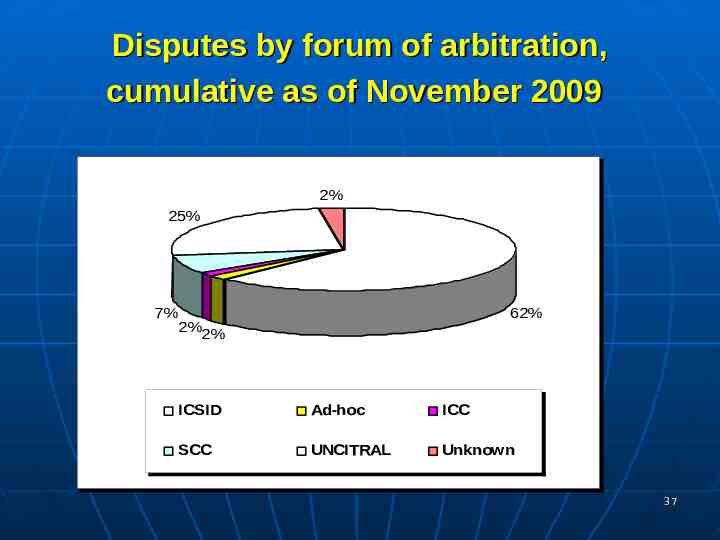

Disputes by forum of arbitration, cumulative as of November 2009 2% 25% 7% 2%2% 62% ICSID Ad-hoc ICC SCC UNCITRAL Unknown 37

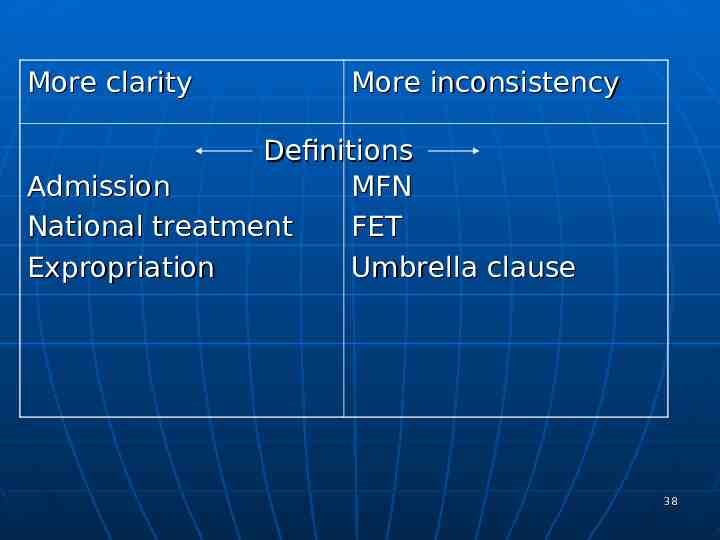

More clarity More inconsistency Definitions Admission MFN National treatment FET Expropriation Umbrella clause 38

ISDS mechanism gives rise to concerns Increasing use of ISDS mechanism High costs involved in conducting procedures Arbitration awards can involve huge sums Potential impact on coutry’s reputation as investment location Challenge to protect investment on the one hand and to respect the legitimate right of governments to regulate for the public interest ISDS, being available exclusively to foreign investors, puts domestic firms at disadvantage Sheer technical complexity of ISDS. Concerns on the technical capability of developing countries to handle investment disputes that they face 39

To respond to these challenges: UNCTAD conducts research and policy analysis in the form of publications monitoring the latest trends and the emerging issues in international investment rulemaking provides analysis from a development perspective conducts technical assistance activities aimed at deepening the understanding of the international legal framework for investment building capacity in the negotiation of IIAs through regional intensive training courses on the negotiations of IIAs training courses on managing investment disputes 40

UNCTAD’s Work programme on international investment agreements Research and policy analysis: 1st Series on issues in IIAs (28 booklets): completed ongoing update 2nd Series on international investment policies for development: on-going E-tools: BIT database (2,000 texts available) Country list of BITs Compendium of international investment instruments (selection of relevant instruments and model agreements) Database of investment dispute cases Network of IIA Experts to exchange information and experiences (700 members) 41

IIA work programme Technical assistance: The distance-learning course on key issues in IIAs (5 modules) in 5 languages The regional training sessions for IIA negotiators (including a negotiation skills workshop) The advanced training courses on managing investment disputes National and regional seminars on IIAs (tailormade at the request of countries or regional organizations) Ad hoc advisory services Facilitation of BIT negotiations and BIT signing ceremonies 42