Strategic Management Mr. Mulusa Victor PhD Candidate, MBA, BBA (CBU),

88 Slides290.91 KB

Strategic Management Mr. Mulusa Victor PhD Candidate, MBA, BBA (CBU), PDTM,MZIM [email protected]

Summary of lecture Introduction Whose Why responsibility is it it matters Definitions Business mission Strategic Objectives What is Strategy? Formulating Primary Strategy Determinants of Strategy

Introduction Investors stake there money into a firm in order to earn a return on their investments. Returns are often measured in terms of accounting figures i.e. return on assets, return on equity, or return on sales. In smaller, new venture firms, returns are sometimes measured in terms of the amount and speed of growth. Firms without a competitive advantage earn, at best, average returns.

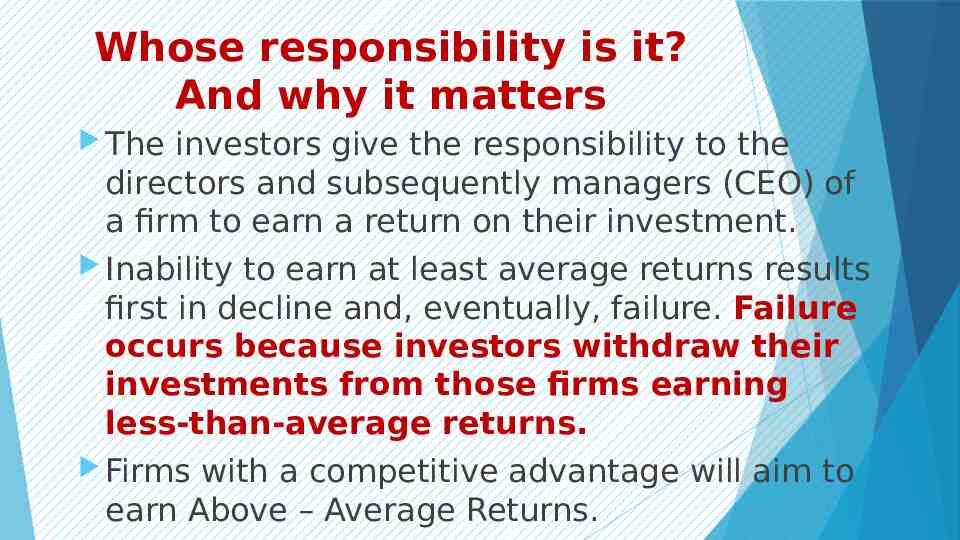

Whose responsibility is it? And why it matters The investors give the responsibility to the directors and subsequently managers (CEO) of a firm to earn a return on their investment. Inability to earn at least average returns results first in decline and, eventually, failure. Failure occurs because investors withdraw their investments from those firms earning less-than-average returns. Firms with a competitive advantage will aim to earn Above – Average Returns.

What is strategic management? Most firms use the strategic management process as the foundation for the commitments, decisions, and actions they will take when pursuing Strategic Competitiveness and Above-Average Returns. Strategic competitiveness is achieved when a firm successfully formulates and implements a value-creating Strategy. A Strategy is an integrated and coordinated set of commitments and actions designed to gain a Competitive Advantage. When choosing a strategy, firms make choices among competing alternatives as the pathway for deciding how they will pursue Strategic Competitiveness. The chosen strategy indicates what the firm will do as

STRATEGIC MANAGEMENT DEFINED Strategic management is that set of managerial decisions and actions that determines the long-run performance of a corporation. The study of strategic management, therefore, emphasizes the monitoring and evaluating of external opportunities and threats in light of a corporation’s strengths and weaknesses. Strategic management, as a field of study, incorporates the integrative concerns of business policy with a heavier

STRATEGIC MANAGEMENT DEFINED Cont’d The term strategic management underlines the importance of managers with regard to strategy to formulate them as strategies do not happen just by themselves. Strategy involves people especially managers who decide and implement strategy. Therefore, Strategic Management includes understanding the Strategic Position of an organization, Strategic Choices for the future and managing Strategy in Action. Strategy is the direction and scope of an organization over the long-term, which achieves advantage in a changing environment through its configuration of resources and competences with the aim of fulfilling stakeholder expectations. (Scholes- Exploring Corporate Strategy)

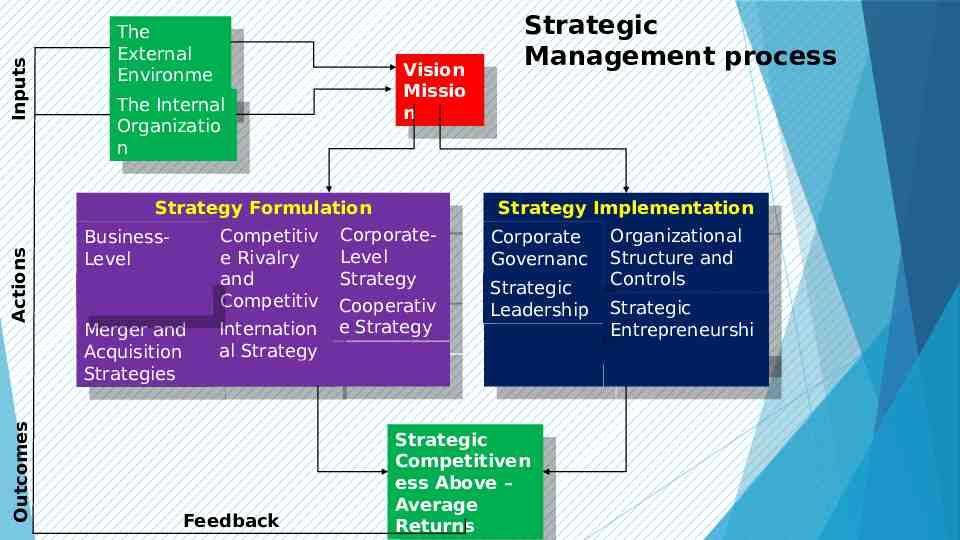

Strategic management process The Strategic Management Process is the full set of commitments, decisions, and actions required for a firm to achieve strategic competitiveness and earn aboveaverage returns. The firm’s first step in the process is to analyze its External Environment and Internal Organization to determine its resources, capabilities, and core competencies - the sources of its “strategic inputs.” With this information, the firm develops its Vision and Mission and formulates one or more strategies.

Inputs Actions Outcomes The The External External Environme Environme nt The Internal nt The Internal Organizatio n Organizatio n Vision Vision Missio nMissio n Strategy Formulation Strategy Formulation Competitiv CorporateBusinessCorporateBusinessLevel e Competitiv Rivalry Level Level e Rivalry Level Strategy and Strategy Strategy and Strategy Competitiv Cooperativ Competitiv e Dynamics e Cooperativ Strategy Internation Merger and e Dynamics e Strategy Merger and alInternation Strategy Acquisition al Strategy Acquisition Strategies Strategies Feedback Strategic Management process Strategy Implementation Strategy Implementation Organizational Corporate Organizational Corporate Structure and Governanc Structure and Governanc Controls e Strategic Controls e Strategic Leadership Strategic Strategic Leadership Entrepreneurshi p Entrepreneurshi p Strategic Strategic Competitiven Competitiven ess Above – ess Above – Average Average Returns

vision A vision or strategic intent is the desired future state of the organization. It is an aspiration around which a strategist, perhaps CEO, might seek to focus the attention and energies of members of the organization. A vision is a picture of what the firm wants to be and, in broad terms, what it wants to ultimately achieve. A vision statement tends to be relatively short and concise, making it easily remembered. Examples of vision statements include the following: To be the leading supplier of mining equipment in Zambia.

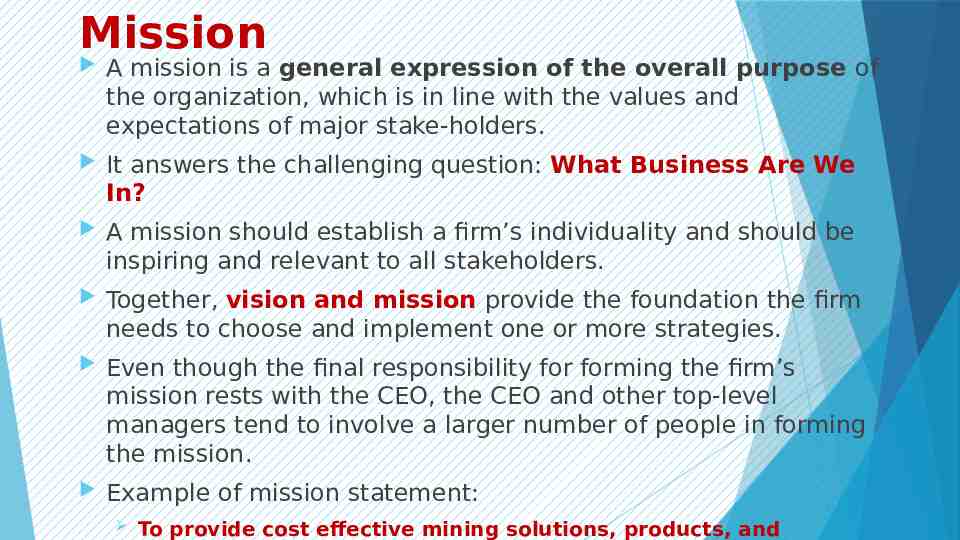

Mission A mission is a general expression of the overall purpose of the organization, which is in line with the values and expectations of major stake-holders. It answers the challenging question: What Business Are We In? A mission should establish a firm’s individuality and should be inspiring and relevant to all stakeholders. Together, vision and mission provide the foundation the firm needs to choose and implement one or more strategies. Even though the final responsibility for forming the firm’s mission rests with the CEO, the CEO and other top-level managers tend to involve a larger number of people in forming the mission. Example of mission statement: To provide cost effective mining solutions, products, and

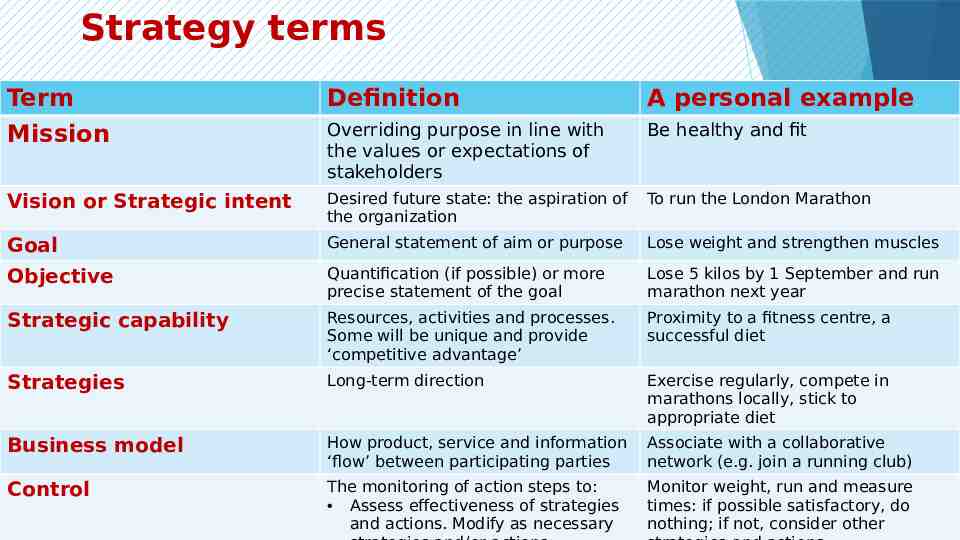

Strategy terms Term Mission Definition A personal example Overriding purpose in line with the values or expectations of stakeholders Be healthy and fit Vision or Strategic intent Desired future state: the aspiration of the organization To run the London Marathon Goal General statement of aim or purpose Lose weight and strengthen muscles Objective Quantification (if possible) or more precise statement of the goal Lose 5 kilos by 1 September and run marathon next year Strategic capability Resources, activities and processes. Some will be unique and provide ‘competitive advantage’ Proximity to a fitness centre, a successful diet Strategies Long-term direction Exercise regularly, compete in marathons locally, stick to appropriate diet Business model How product, service and information ‘flow’ between participating parties Associate with a collaborative network (e.g. join a running club) Control The monitoring of action steps to: Assess effectiveness of strategies and actions. Modify as necessary Monitor weight, run and measure times: if possible satisfactory, do nothing; if not, consider other

The Benefits of Strategic Management Research has revealed that organizations that engage in strategic management generally outperform those that do not. A survey of nearly 50 corporations in a variety of countries and industries found the 3 most highly rated benefits of strategic management to be: Clearer sense of strategic vision for the firm Sharper focus on what is strategically important Improved understanding of a rapidly changing environment

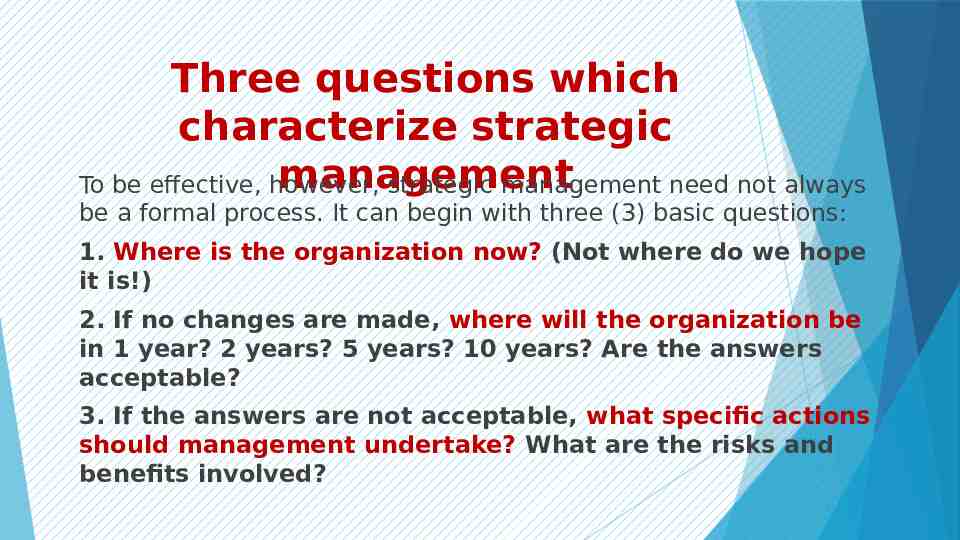

Three questions which characterize strategic management To be effective, however, strategic management need not always be a formal process. It can begin with three (3) basic questions: 1. Where is the organization now? (Not where do we hope it is!) 2. If no changes are made, where will the organization be in 1 year? 2 years? 5 years? 10 years? Are the answers acceptable? 3. If the answers are not acceptable, what specific actions should management undertake? What are the risks and benefits involved?

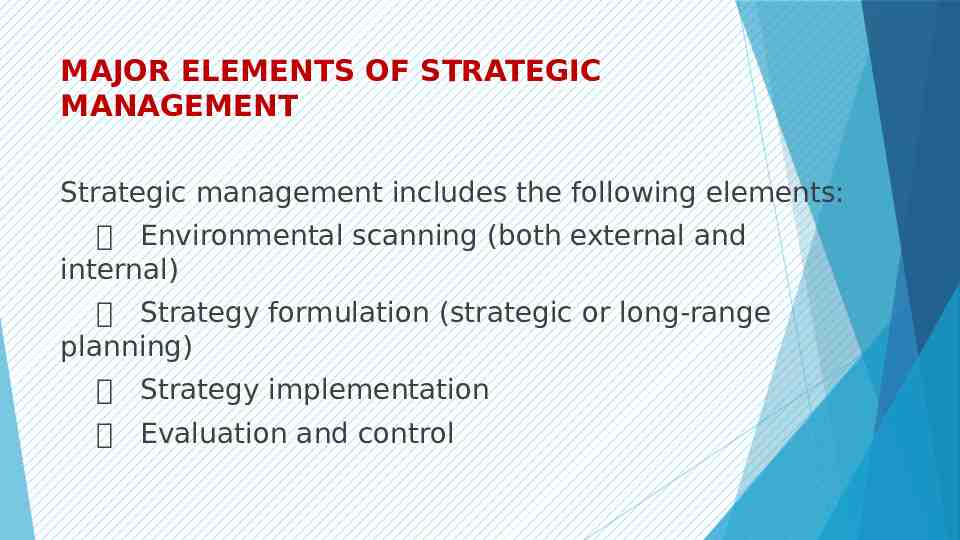

MAJOR ELEMENTS OF STRATEGIC MANAGEMENT Strategic management includes the following elements: Environmental scanning (both external and internal) Strategy formulation (strategic or long-range planning) Strategy implementation Evaluation and control

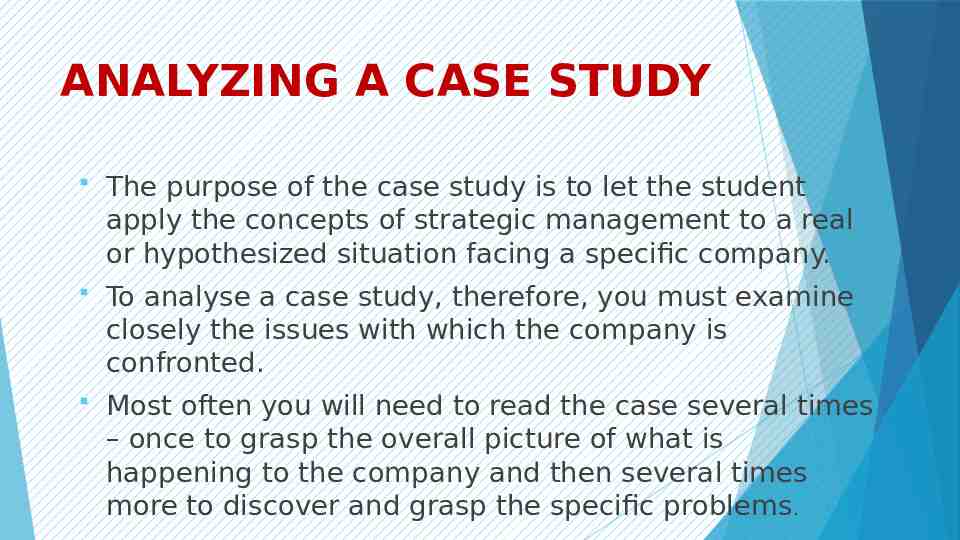

ANALYZING A CASE STUDY The purpose of the case study is to let the student apply the concepts of strategic management to a real or hypothesized situation facing a specific company. To analyse a case study, therefore, you must examine closely the issues with which the company is confronted. Most often you will need to read the case several times – once to grasp the overall picture of what is happening to the company and then several times more to discover and grasp the specific problems .

Eight (8) steps in Conducting a detailed case study analysis 1. The history, development, and growth of the company over time. 2. The identification of the company’s internal strengths and weaknesses. 3. The nature of the external environment surrounding the company. 4. A SWOT analysis.

case study analysis Cont’d 5. The kind of corporate-level strategy pursued by the company. 6. The nature of the company’s business-level strategy. 7. The company’s structure and control systems and how they match its strategy. 8. Recommendations.

ENVIRONMENTAL SCANNING This is the monitoring, evaluating and disseminating of information from the external and internal environments to key people within the corporation. Its purpose is to identify strategic factors – those external and internal elements that will determine the future of the corporation. The simplest way to conduct environmental scanning is through SWOT analysis. SWOT is an acronym used to describe those particular Strengths, Weaknesses, Opportunities and Threats that are strategic factors for a specific company.

The external environment This environment consists of variables (Opportunities and Threats) that are outside the organization. These variables form the context within which the organization exists. The key environmental variables may be: general forces and trends within the overall societal environment (economic, technological, political-legal, sociocultural forces) or specific factors that operate within an organization’s task environment – often called its industry (shareholders, suppliers, employees/labour unions, competitors, trade associations, communities, creditors, customers, special interest groups, governments).

The internal environment The internal environment of a corporation consists of variables (Strengths and Weaknesses) that are within the organization itself and are usually within the short-run control of top management. These variables form the context in which work is done. They include the corporation’s structure, culture and resources. Key strengths form a set of core competencies that the corporation can use to gain competitive advantage.

STRATEGY FORMULATION This is the development of long-range plans for the effective management of environmental opportunities and threats, in light of corporate strengths and weaknesses. It includes defining the corporate mission, specifying achievable objectives, developing strategies, and setting policy guidelines

Mission An organization’s mission is the purpose or reason for the organization’s existence. It tells what the company is providing to society, either a service or a product. A well-conceived mission statement: defines the fundamental, unique purpose that sets a company apart from other firms of its type and identifies the scope of the company’s operations in terms of products and services offered and markets served.

Objectives These are the end results of planned activity. They state what is to be accomplished by when and should be quantified if possible. The achievement of corporate objectives should result in the fulfilment of a corporation’s mission. In effect, this is what society gives back to the corporation when the corporation does a good job of fulfilling its mission.

Objectives Cont’d Some of the areas in which a corporation might establish its goals and objectives are: Profitability (e.g. net profits) Efficiency (e.g. low costs, etc.) Growth (e.g. increase in total assets, sales, etc.) Shareholder wealth (dividends plus stock price appreciation) Utilization of resources ( e.g. return on investment or equity) Reputation (being considered a “top” firm) Contributions to employees (employment security, wages, diversity) Contributions to society (taxes paid, participation in charities etc)

Strategies A strategy of a corporation forms a comprehensive master plan stating how the corporation will achieve its objectives and fulfil its mission. It maximizes competitive advantage and minimizes competitive disadvantage. The typical business firm usually considers 3 types of strategy: Corporate, Business and Functional.

1. Corporate Strategy This describes a company’s overall direction in terms of its general attitude toward growth and the management of its various businesses and product lines. Corporate strategies typically fit within the 3 main categories of stability, growth and retrenchment.

Corporate-Level Strategy. Corporate-level strategy is senior management's game plan for directing and running the organization as a whole. It cuts across all of an' organization's activities-its different businesses, divisions, product lines, and technologies. The task of developing a corporate strategy has three elements:

ELEMENT 1: Managing The Scope & Mix of The Firm’s Activities Developing plans for managing the scope and mix of the firms' various activities in order to improve corporate performance. Managing the business portfolio requires decisions' and actions regarding when and how the enterprise should get into new businesses. which existing businesses the company should get out of (and whether it should do so quickly or gradually), The portfolio management plan may, in addition, involve designating a common strategic theme to be pursued by all of the company's lines of business.

Providing for coordination among different businesses in the portfolio. Coordination of interrelated activities allows a diversified firm to; enhance the competitive strength of its business units and makes overall corporate strategy more than just a collection of the action plans of independent subunits.

Establishing Investment Priorities & Allocating Corporate Resources Across The Company's Different SBUs. Decisions about how much of the corporate investment budget each organizational unit will get and actions to control the pattern of corporate resource allocation. These decisions and actions serve to channel resources out of areas where earnings potentials are lower into areas where they are higher. The portfolio management actions of corporate officers in entering or exiting certain markets.

2. Business Strategy This usually occurs at the business unit or product level, and it emphasizes improvement of the competitive position of a corporation’s products or services in the specific industry or market segment served by that business unit. Business strategies may fit within the 2 overall categories of competitive or cooperative strategies. Competitive strategies include differentiation, cost leadership and focus.

3. Functional Strategy This is the approach taken by a functional area to achieve corporate and business unit objectives and strategies by maximizing resource productivity. It is concerned with developing and nurturing a distinctive competence to provide a company or business unit with a competitive advantage. Examples of R&D functional strategies are Technological followership (imitate the products of other companies) and Technological leadership (pioneer an innovation). Business firms use all 3 types of strategy simultaneously.

HIERARCHY OF STRATEGY A hierarchy of strategy is the grouping of strategy types by level in the organization. This hierarchy of strategy is a nesting of one strategy within another so that they complement and support one another. Functional strategies support business strategies, which in turn, support corporate strategy(ies). Just as many firms often have no formally stated objectives, many firms have unstated, incremental or intuitive strategies that have never been articulated or analyzed.

Policies These are broad guidelines for decision making that links the formulation of strategy with its implementation. Companies use policies to make sure that employees throughout the firm make decisions and take actions that support the firm’s mission, objectives and strategies. A company may develop policies in areas like Recruitment, disbursement of funds, a policy on procurement of materials, a policies on Health and safety, a policy on CSR etc.

INTERNAL ENVIRONMENT ANALYSIS

Introduction Strategic analysis of any Business enterprise involves two stages: Internal and External analysis. Internal analysis is the systematic evaluation of the key internal features of an organization.

Four broad areas need to be considered for internal analysis The organization’s resources, capabilities. The way in which the organization configures and co-ordinates its key value-adding activities. The structure of the organization and the characteristics of its culture. The performance of the organization as measured by the strength of its products.

Resources Resources are assets employed in the activities and processes of the organization. They can be tangible or intangible. They can be obtained externally (organizationaddressable) or internally generated (organizationspecific). They can be specific and non-specific: Specific resources can only be used for highly specialized purposes and are very important to the organization in adding value to goods and services. Assets that are less specific are less important in adding value, but are more flexible.

Resources fall within several categories: Human Financial Physical Technological Informational A resource audit would include an evaluation of resources in terms of availability, quantity and quality, extent of employment, sources, control systems and performance.

General Competences/capabilities They are assets like industry-specific skills, relationships and organizational knowledge which are largely intangible and invisible assets. Competences and capabilities will often be internally generated, but may be obtained by collaboration with other organizations. Certain competences are likely to be common to competing businesses within a global industry or strategic group.

Core Competences/Distinctive Capabilities Core competences or distinctive capabilities are combinations of resources and capabilities which are unique to a specific organization and which are responsible for generating its competitive advantage. Kay (1993) identified four potential sources of Core competences: Reputation Architecture relationship) (i.e., internal and external

Criteria to evaluate Core Competences Complexity: How elaborate is the bundle of resources and capabilities which comprise the core competence? Identifiability: How difficult is it to identify? Imitability: How difficult is it to imitate? Durability: How long does it to be replaced by an alternative competence? Superiority: Is it clearly superior to the competences of other organizations? Adaptability: How easily can the competence be leveraged or adapted? Customer orientation: How is the competence perceived by customers and how far is it linked to their needs?

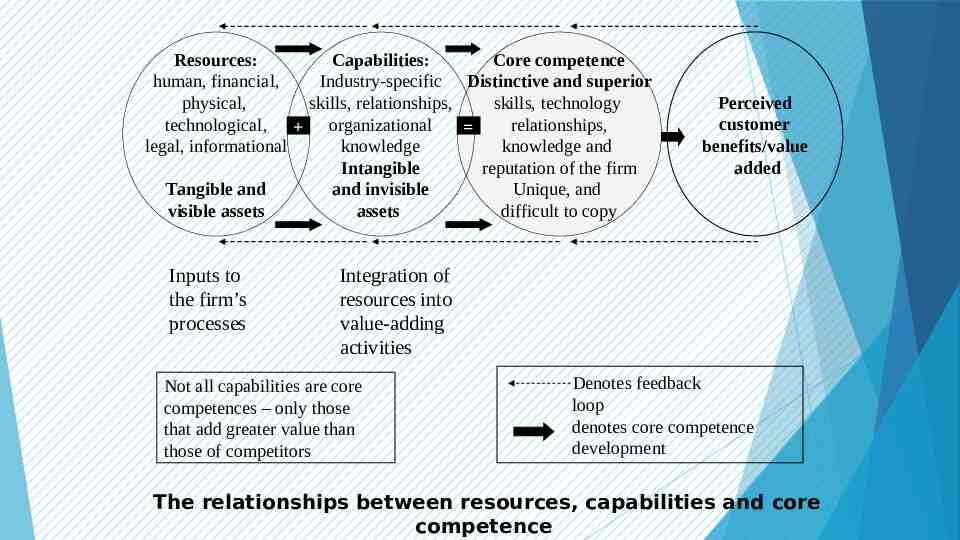

Resources: Capabilities: Core competence human, financial, Industry-specific Distinctive and superior physical, skills, relationships, skills, technology technological, organizational relationships, legal, informational knowledge knowledge and Intangible reputation of the firm Tangible and and invisible Unique, and visible assets assets difficult to copy Inputs to the firm’s processes Perceived customer benefits/value added Integration of resources into value-adding activities Not all capabilities are core competences – only those that add greater value than those of competitors Denotes feedback loop denotes core competence development The relationships between resources, capabilities and core competence

Global Value Chain Analysis Competitive advantage depends on the ability of the organization to organize its resources and valueadding activities in a way that is superior to its competitors. Value chain analysis is a technique developed by Porter (1985) for understanding an organization’s value-adding activities and relationship between them.

Value can be added in two ways: By producing products at a lower cost than competitors By producing products of greater perceived value than those of competitors. Porter extended value chain analysis to the value system, analysis of the relationship between the organization, its suppliers, distribution channels and customers.

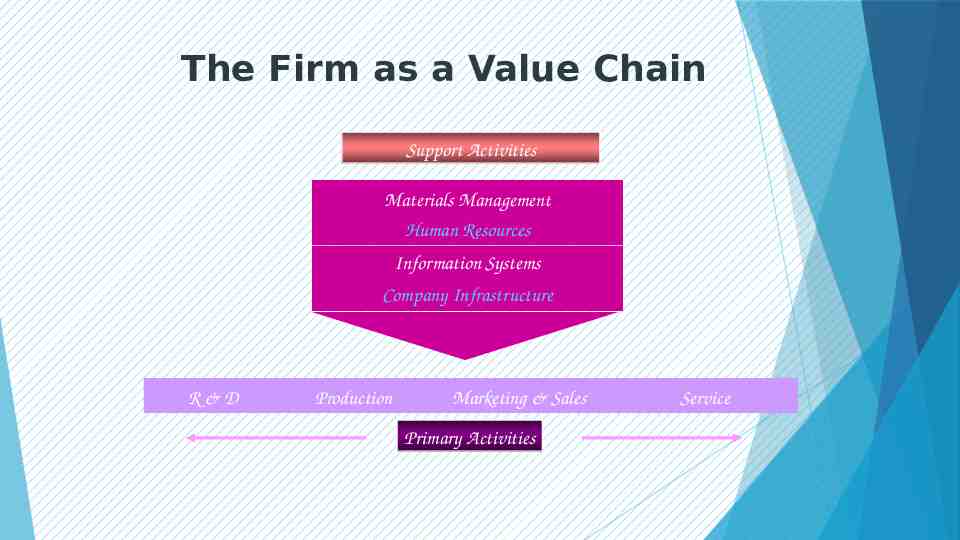

The Value Chain The value chain is the chain of activities which results in the final value of a business’s products. Value added, or margin is indicated by sales revenue minus costs. Porter divided internal parts of organization into primary and support activities

Primary activities are those that directly contribute to production of good or services and organization’s provision to customer. Support activities are those that aid primary activities, but do not themselves add value.

The Firm as a Value Chain Support Activities Materials Management Human Resources Information Systems Company Infrastructure R&D Production Marketing & Sales Primary Activities Service

Certain activities or combinations of activities are likely to relate closely to the organization’s core competences, termed core activities. They: Add the greatest value. Add more value than the same activities in competitors’ value chains. Relate to and reinforce core competences. Other value chain activities relate to capabilities, but do not add greater value than competitors and therefore do not relate to core competence.

The Value System The value chain of an individual organization provide an incomplete picture of its ability to add value. Many value-adding activities are shared between organizations often in the form of a collaborative network. As organizations identify and concentrate on their core competences and core activities, they increasingly outsource activities to other business for whom such activities are core.

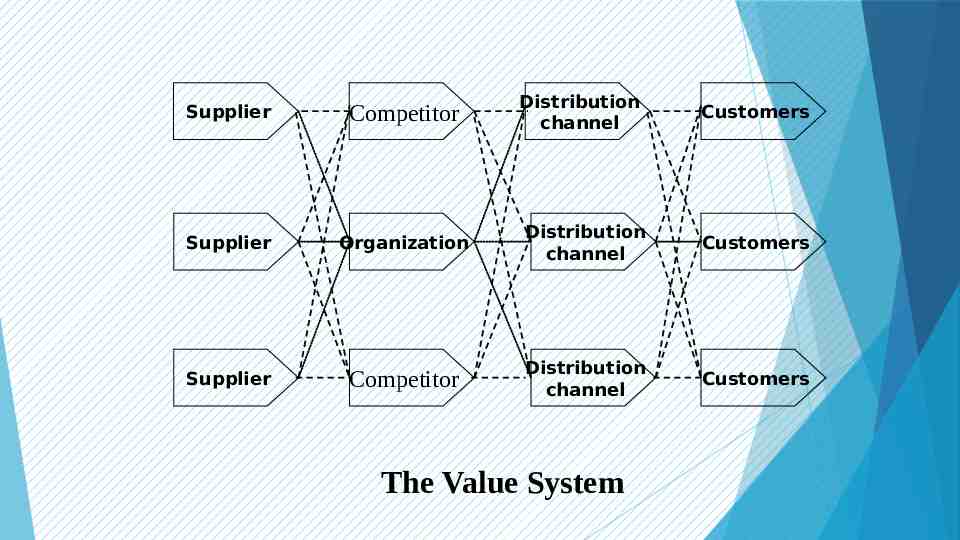

The value system is the chain of activities from supply of resources through to final consumption of a product. The total value system, in addition to the organization’s own value chain, can consists of upstream linkages with suppliers and downstream linkages with distributions and customers. The value system is a similar concept to that of the supply chain and illustrates the interactions between an organization, its suppliers, distribution channels and customers.

Distribution channel Supplier Competitor Supplier Organization Distribution channel Customers Supplier Competitor Distribution channel Customers The Value System Customers

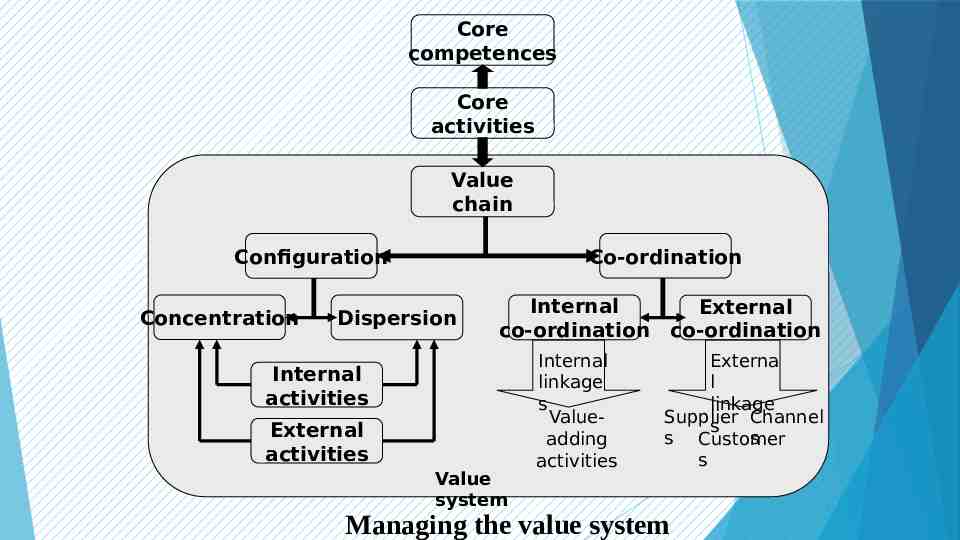

The “Global” Value Chain The configuration of an organization’s activities relates to where and in how many nations each activities in the value chain is performed. Co-ordination is concerned with the management of dispersed international activities and the linkages between them. Managers must examine the current configuration of value-adding activities and the extent and methods of co-ordination as part of their strategic analysis, which may determine possibilities for reconfiguration or improving co-ordination.

A global business has two broad choices of 1. configuration: Concentration of the activity in a limited number of locations to take advantage of benefits offered by those locations. Dispersion Change of the activity to a large number of locations. in the business environment (e.g., technological change) may well lead to changes over time in the configuration that gives greatest competitive advantage.

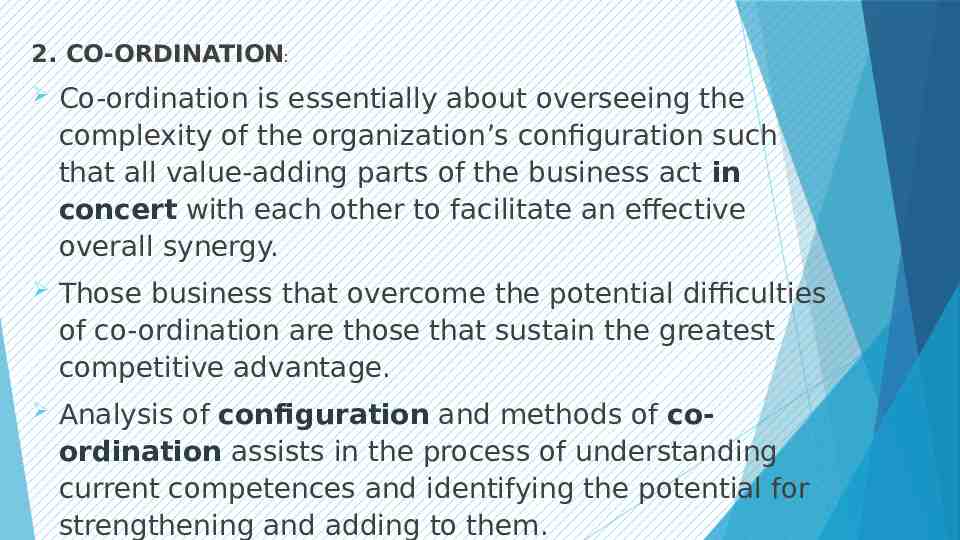

2. CO-ORDINATION: Co-ordination is essentially about overseeing the complexity of the organization’s configuration such that all value-adding parts of the business act in concert with each other to facilitate an effective overall synergy. Those business that overcome the potential difficulties of co-ordination are those that sustain the greatest competitive advantage. Analysis of configuration and methods of coordination assists in the process of understanding current competences and identifying the potential for strengthening and adding to them.

Core competences Core activities Value chain Co-ordination Configuration Concentration Dispersion Internal co-ordination External co-ordination Internal linkage s Valueadding activities Externa l linkage Supplier Channel s s Customer s s Internal activities External activities Value system Managing the value system

THE COMPETITIVE ENVIRONMENT Introduction Competition is yet another factor in a company’s environment that can present an opportunity or a threat to a firm. Competition is an opportunity when a company has a competitive advantage over its rivals. A company is said to have a competitive edge over its rivals when its profitability is greater than the average profitability of all companies in its industry. Competition is a threat to a firm when its rivals have the ability to erode a firm’s profitability base.

Competitive Advantage Competitive advantage leads to superior profitability. Profitability in turn depends on three factors: The value customers place on a product or service. The price that a company charges for its product, and The costs of creating the product.

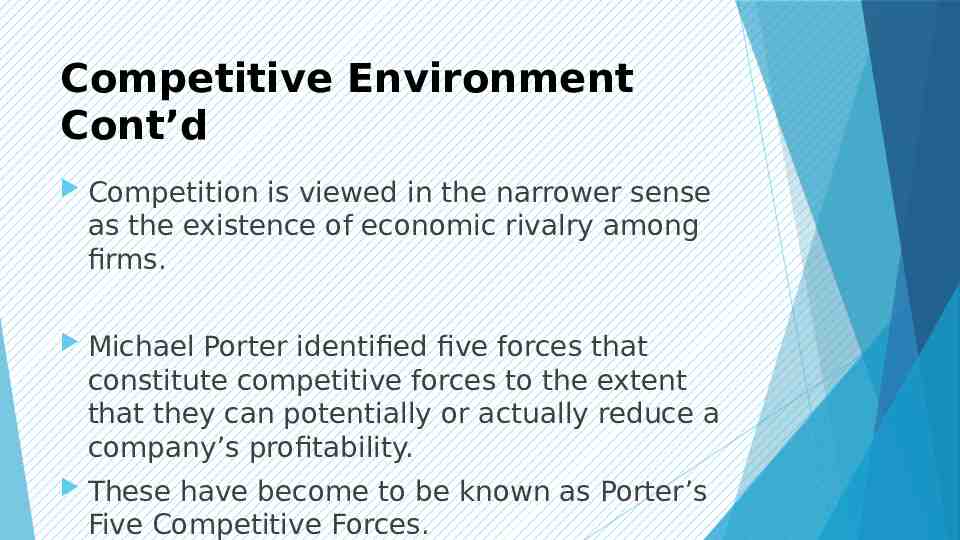

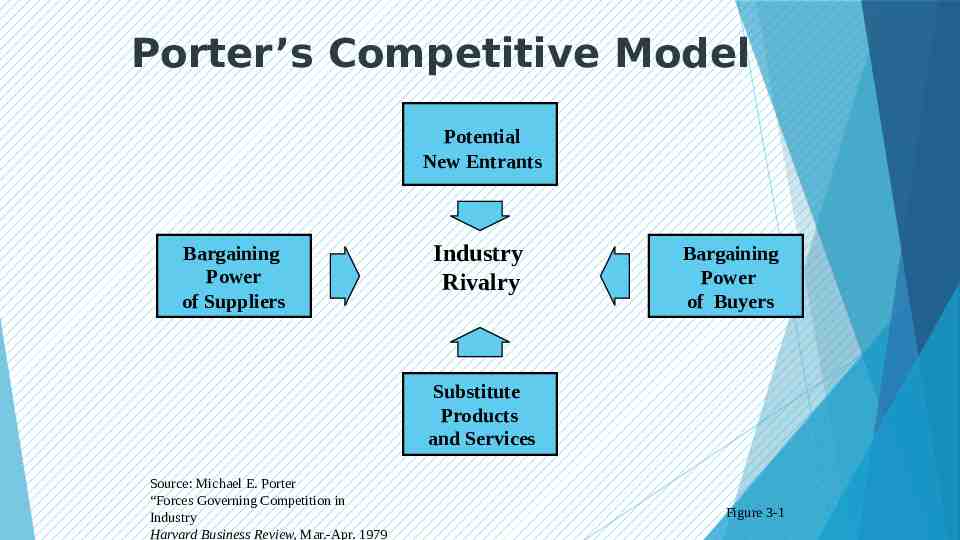

Competitive Environment Cont’d Competition is viewed in the narrower sense as the existence of economic rivalry among firms. Michael Porter identified five forces that constitute competitive forces to the extent that they can potentially or actually reduce a company’s profitability. These have become to be known as Porter’s Five Competitive Forces.

Porter’s Competitive Model Potential New Entrants Bargaining Power of Suppliers Industry Rivalry Bargaining Power of Buyers Substitute Products and Services Source: Michael E. Porter “Forces Governing Competition in Industry Harvard Business Review, Mar.-Apr. 1979 Figure 3-1

1. The Threat of New Entrants The threat of new entrants refers to the risk of entry posed by companies that are not currently in the industry but have the capability to enter the industry if they should choose to do so. Potential entrants to an industry pose a threat by seeking to gain market share, or by bringing into the industry better valued or lower priced products. This has the effect of shifting customers and profitability away from firms in the industry

Possible Barriers to Entry Some of these barriers include: Economies of scale: They refer to unit costs of a firm falling as volume increases. The capital requirements of entry: These refer to investment needed to set up the requisite plants, machinery or distribution outlets. Access to distribution channels: This refers to the ease or difficulty of establishing customer contacts, either directly or through intermediaries. Expected retaliation from existing firms through e.g. price cuts Government policy: Policies enacted by govt that may inhibit entry into the industry e.g. licensing requirements,

2. The Bargaining Power of Suppliers Suppliers refer to providers of inputs to an industry. Inputs include raw materials, components, services or labour. Suppliers may become powerful under the following circumstances: 1. When the product is unique and switching costs to the buyer are high. 2. When profitability of suppliers is not significantly affected by the purchases of buyers in the industry e.g. the buyers are not important customers to the supplier. 3. When buyers are likely to incur significant switching costs because they depend on the supplier’s product. 4. When suppliers can threaten to enter the buyers’ industry and use their inputs to produce products that would compete with products of their buyers. 5. When buyers cannot threaten to enter their supplier’s industry and make their own inputs. 6. When the supplier’s customers are highly fragmented

3. Bargaining Power of Buyers Buyers consist of consumers, users or distributors of a product. Bargaining power of buyers refers to the ability of buyers to bargain down prices or to raise the costs of suppliers by demanding better quality and service. This has the effect of squeezing the profits of the supplier. The power of buyers manifests itself when: The buyers are few, concentrated and buy in large volumes. The The products bought are standard or undifferentiated. industry’s product is unimportant to the quality of the buyer’s products or services

4. The Threat of Substitutes Substitutes are products of different industries or businesses that can potentially satisfy similar customer needs. Product substitution can take the following forms: Product-for-product substitution e.g. postal service, fax and email, Substitution of a need by a new product e.g. maize meal, cassava, rice and potatoes. Doing without as might be the case with drinking, smoking or dieting.

5. Industry Rivalry Rivalry among existing firms in the same industry refers to the competitive struggle for market share through price competition after sales service product design product differentiation, innovation advertising and sales promotion

Strategic Implications of Competition In coping with competition, a firm must search out a market position and a competitive approach that will: Insulate it as much as possible from forces of competition; Influence the industry’s competition rules in its favour; and Give it a strong position from which to “play the game” of competition.

Alternative Strategic Responses 1. Strategic Cost Analysis An assessment of the relative cost position of a firm. It involves showing the make-up of costs all the way from purchase of raw materials to the end product paid for by the customer (activity cost analysis).

Strategic Cost Analysis Supply related activities Manufacturing-related activities Production Marketing Forward channel Wholesale/ Distribution Raw materials Processing Sales force Dealer/ Component parts Labour Advertising distributor Maintenance Marketing Management Process design research and relations Energy In-bound transportation In-bound materials Quality and handling inspection Inspection/ Inventory warehousing management

2. Competitor Analysis This involves a careful assessment of a company’s relative competitive standing and an understanding of the firm’s relative strengths and weaknesses in say, the following areas: product design – convenience, comfort product innovation pricing strategies distribution network advertising/sales customer service promotion

Objective of the Competitor Analysis The objective of this analysis is to explore ways in which the firm might retain or improve its standing on the competitive ladder. The rungs on the ladder can be broadly categorized by : Dominant leader-who usually has the largest market share and is therefore the acknowledged leader in innovation and sales. One of the industry’s top leaders-this is characterized by a few firms dominating the industry. Middle-of-the-pack- this category comprises a large group of firms who are basically followers. Firms on the fringe-these are firms whose individual market share is small and insignificant.

3. Product differentiation This involves creating a difference from rivals and the difference being valued by customers. The difference could be in: Procurement of materials; for instance, firms place a value on whether or not an input is original or from a secondary source. Production process and product design. Marketing process, e.g. product branding, product appearance and packaging. Improved quality.

Perceived Value Perceived value will entail any of the following: Greater convenience and ease in use of product More economy The design and availability of extras to meet occasional needs, e.g. packaging for picnics and outdoor recreation Non-economic wants status prestige image comfort

Pitfalls of differentiation Pitfalls (caveats) of differentiation include the following: Buyers must quickly see the intended value implicit in the difference. The danger of competitors copying new features/innovation, including pricing. The risk of over-differentiation, that is, the resultant quality being needlessly superfluous or the investment being too high for the perceived value.

4. Market Focus This entails concentrating on catering to a narrower and limited segment (or niche) of the market rather than going after the whole market with a “somethingfor-everyone” approach. Segmentation of the market may be based on: Demographic/socioeconomic characteristics (age, gender, education etc.) Purchase (Size, application i.e. industrial, consumer, government etc.) Geographic (territories, cities, regions etc.)

Risks of using a focus approach Buyers may shift their preferences away from the focuser’s special product attributes. The possibility that broad-range competitors will find effective ways of serving the narrow target markets. The risk that competitors will find smaller segments within the target segment and thus “outfocus” the focuser. This often happens in the electronics industry.

THE COMPANY AND ITS EXTERNAL ENVIRONMENT The Nature of the Company’s Environment The major purpose of an environmental analysis is to identify opportunities and threats which obtain in the environment. Whatever factors or events exist in the environment are regarded as external influences on the firm.

Globalization A market typically evolves from submarket within a national market, to a national market, to a regional market, to a continental market and to a global market, viz. Lusaka Provinc e Zambia Comesa Global National Regional World

Globalization Cont’d The concept of globalization lies in looking at the whole world (globe) as constituting a firm’s sphere of operations rather than any part of it. The key influences toward globalisation include: Convergence of needs and preferences across nations. The functional utility of most goods tend to be universal. Such goods and services include: Electric/electronic gadgets, e.g.

Globalization Cont’d It is generally accepted that the most obvious and direct route to growth is to operate beyond one’s immediate border. Among the many reasons why firms seek external growth are: To find a new market for a product in the maturity or decline stage. To spread the risk of operating in one country. To seek tax relief abroad.

Strategic Impact Of Globalization The strategic impact of globalization is twofold; One is that it creates opportunities of doing business in new markets. Secondly, in as much as opportunities for new markets overseas are created through economic liberalization, national economies also become exposed to foreign competition by way of imports and entry of foreign investment.

PEST ANALYSIS (EXTERNAL AUDIT) Technological developments are not only the fastest unfolding but the most far-reaching in extending or contracting opportunity for an established company. They include: the discoveries of science the impact of related product development, and the progress of automation We see a continually accelerating rate of change with new developments piling up before the implications of yesterday’s changes can be assimilated. Besides, science gives the impetus to change not only in

The Technological Environment Cont’d Areas where we have noticed emerging technological advancements include; New Processes New ways of doing things are constantly emerging i.e. satellite broadcasting involves consumers purchasing satellite dishes; EFTPOS- Electronic Funds Transfer at The Point of sale- has been developed for retailers. New Materials New materials have become available; optic fibres and carbon fibres are examples. The laser compact disc (CD) has replaced vinyl records. The Internet There are a lot of E-Commerce activities like, selling online, Online Banking and using the internet to research and gather information, are a normal part of life in the developed world. The

The Political Environment Politics is a dominant and pervasive feature of our lives: The most powerful and influential office in a nation, that of a Head of State, is controlled/occupied by a politician Politicians control the most important organs of governance, namely, the legislature, the executive and the judiciary Politicians usually have some influence on institutions and organs that affect every day lives, such as, educational, health, religion or even recreational activities. Major national and international events are initiated, presided over or controlled by politicians, such as a nation’s stability national disasters war/peace sports major events contracts: airports, roads, telecommunications, bridges, infrastructure of towns, cities, buildings

The Political Environment Cont’d The political environment can be influenced by three factors; Ideology, the Law and Ethics The Governments Ideology towards Business Activity Governments may have an ideology of participating in the business environment through participation by establishing state owned enterprises. The other way is through playing a role as regulator of sensitive sectors of the economy. Government ideology is also manifested through the economic systems that the government of the day may adopt i.e. command economy, free-market economy and mixed economy.

THE ECONOMIC ENVIRONMENT The following are some the economic factors of direct influence on business; Income Levels Income levels have a strong bearing, for the amount of disposable income individuals receive determines the amount of goods and services that consumers get. A better description of a country’s wealth can be found in its “per capita” income, which is the total national income divided by its population. Inflation Inflation erodes the purchasing power of money and causes other problems for organizations in areas such as pricing and the accurate estimation of demand. Governments all over the world try to reduce inflation rates in order to stabilize the economy and make easier for international trade to take place. The rate of inflation is often an indicator of how stable the economy of a country is. Distribution of Income The way income is distributed is important to most organizations and this is reflected in the segmentation (dividing the market into specific groups of consumers) as part of the marketing strategy.

THE SOCIAL ENVIRONMENT The social environment can be divided into two categories; demographic and behavioural. Demographic aspects include; population size ( which determines the size of the market), Age distribution(which affects changing tastes and needs and therefore marketing activities need to adapt overtime. Behavioural aspects include; cultural values, people grow up in societies which shape their beliefs i.e. alcohol is forbidden in most Moslem countries, which may consequently affect the marketing of alcoholic beverages. Aesthetic Values: What one society rates as