Savings

64 Slides3.55 MB

Savings

Differences Between Saving and Investing Now that you know how important it is to pay yourself first you must decide what to do with that money.

Savings what people usually do to meet shortterm goals. money is safe in a savings account. usually earn a small amount of interest. It’s also easy to get to (high liquidity).

How INVESTING is Different Setting money aside for longer-term goals. In the long run, investments can earn a lot more than you can usually make in a savings account. There is some risk that you may lose money on an investment

Why It’s Important Savings/Investments are money put aside for future use. Savings plans will allow you to put money aside and help you make your money grow. The amount of money you save depends on how much of your income you’re willing not to spend. Opportunity cost of savings—when you save money, you are putting off spending money on something now to get something else later.

Reasons to Save Major purchases Emergencies Retirement

Major Purchases If you purchase items on credit or borrow money to make purchases, you have to pay finance charges. If you use cash for the purchase, you don’t have to pay those charges.

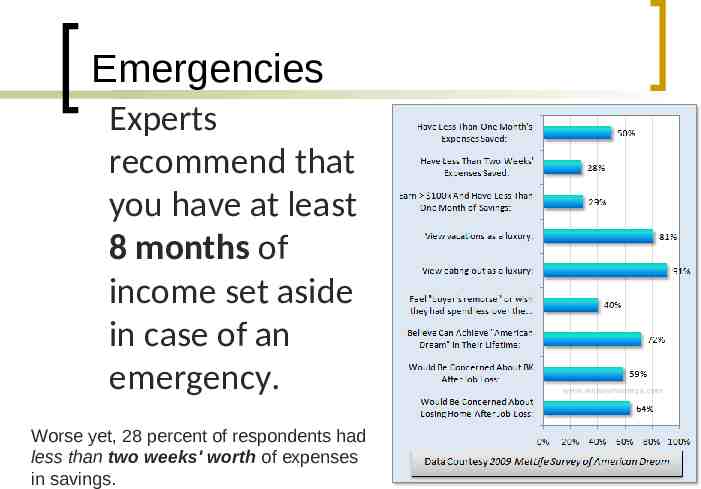

Emergencies Experts recommend that you have at least 8 months of income set aside in case of an emergency. Worse yet, 28 percent of respondents had less than two weeks' worth of expenses in savings.

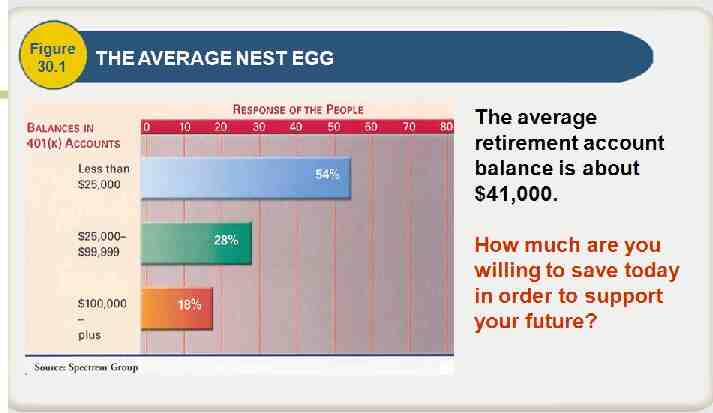

Retirement The three main sources of retirement income are: Social Security Retirement Plans Savings

Retirement For most people, social security and retirement plans still don’t provide enough money to retire comfortably. If you put away just 20 per week starting now, by the time you retire you would have 50,000. With interest earned on a savings account, it could come to several times more than that.

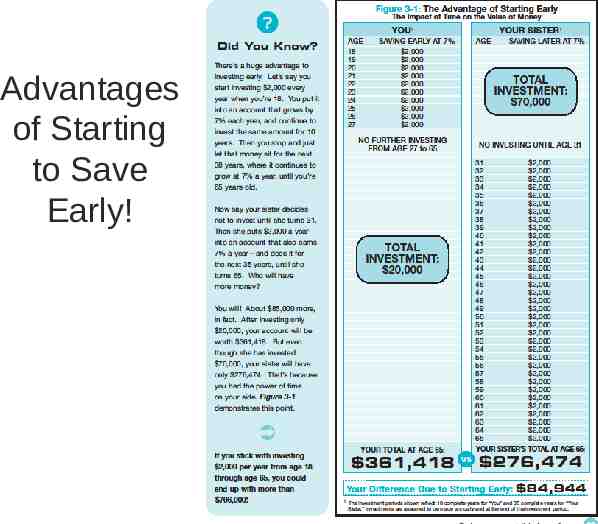

Advantages of Starting to Save Early!

Budget for Saving Strategies for growing your savings: – Pay yourself first – Use direct deposit – Let your savings grow – Reduce spending; increase saving.

Maximizing Savings Maximize your savings by considering – total amount deposited – interest rate – time span of deposit – interest type: simple interest or compound interest – frequency of compounding. continued

Insurance Against Loss Banks, savings and loans, and credit unions all have insurance. The Federal Deposit Insurance Corporation (FDIC), a government agency, insures bank accounts for up to 250,000.

Evaluating Savings Plans When evaluating savings plans, consider these factors: Risk Liquidity Rate of Return Inflation Restrictions and Fees

Risk Pyramid Savings Accounts Money Market Accounts Least risky, easy to get to Little Risk, but required to maintain high balances Bonds/Cds Little Risk from changing interest rates Money is tied up for period of time

Liquidity Liquidity means the ability to quickly turn an investment into cash. Savings accounts are highly liquid because you can easily withdraw cash from them. Houses are NOT liquid because someone has to want to buy it to get a value from it

Rate of Return Rate of Return is the percentage increase in the value of your savings from earned interest.

Rate of Return How much interest can you make on your investment? Are you Locked into a rate? Is it adjustable

The Time Value of Money A dollar is not always worth a dollar. The value of a dollar changes dramatically depending on when you get it and what you do with it. So time is a critical variable in the exact value of a dollar. Time value of money refers to the relationship among time, money, and rate of interest.

Inflation Risk Inflation risk is the risk that the rate of inflation will increase more than the rate of interest on savings. (Inflation is the rise in prices)

Inflation Risk If you put all your money in the savings at 1% interest and the rate of inflation (rise in the cost of prices) is 3% you LOSE Money due to being able to buy less! Your rate of savings MUST be higher than the inflation rate to make savings worthwhile. If it is not, you may need to invest some of your savings

Inflation Risk The interest rates on most savings accounts increase with inflation. The main risk is with CDs, where you are locked into an interest rate over a long period of time. If you need your money early you will have to pay a penalty fee.

Consider Inflation and Taxes By reducing or deferring taxes on savings, you accumulate more money over time Minimize taxes by putting money into tax-exempt or tax-deferred savings.

Cost of Savings Plans-fees Some accounts charge a penalty fee for early withdrawal or is the account balance falls below a certain minimum. Some accounts charge a fee for each deposit and withdrawal. You have to pay income tax on the interest you earn on savings accounts.

Three Elements of Time Value of Money 1. 2. 3. The more money you have to save or invest, the more money you are likely to earn. The higher the rate of interest you earn, the more money you are likely to have. The sooner you invest your money, the more time it has to make new money.

Earning Interest on Savings Interest Income- Payments you receive for letting the bank use your money. Banks use the money in your savings account to lend to other people, so they pay you a rental fee, or interest.

Simple Interest Simple interest is interest earned only on the money you deposited into your savings account, or the principal.

Simple Interest The three main factors determining the amount of interest are: The amount of savings. The interest rate. Length of time of the account.

Simple Interest If you have a savings account that pays you 5 percent annual interest and 1,000 is the account the entire year, you will receive 50 in interest. 1,000 x .05 (5%) x 1 50 interest

Compound Interest Compound interest is interest earned on both the principal—the money you deposited in your savings account—and any interest you earned on it. You are earning interest on interest.

Compound Interest Compound interest is usually earned daily, monthly, quarterly, or annually. The more often interest is compounded, the more you make in extra interest.

Compound Interest 100 in savings that earns 10 percent a year 100 x 10% 10 At the end of year 1, you will have 110. 100 10 110 At the end of year two you will have 121. 110 x 10% 11 110 11 121

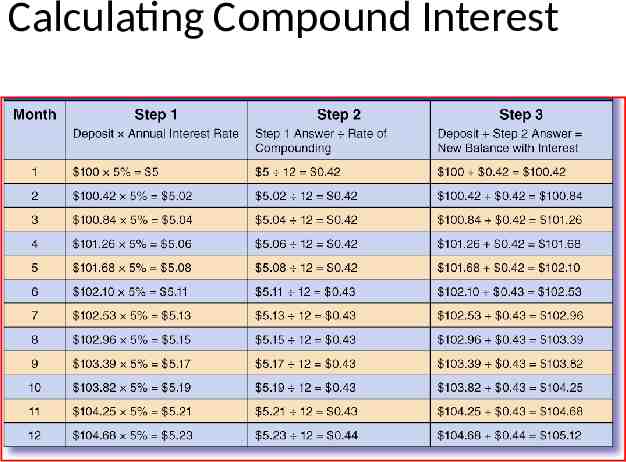

Calculating Compound Interest

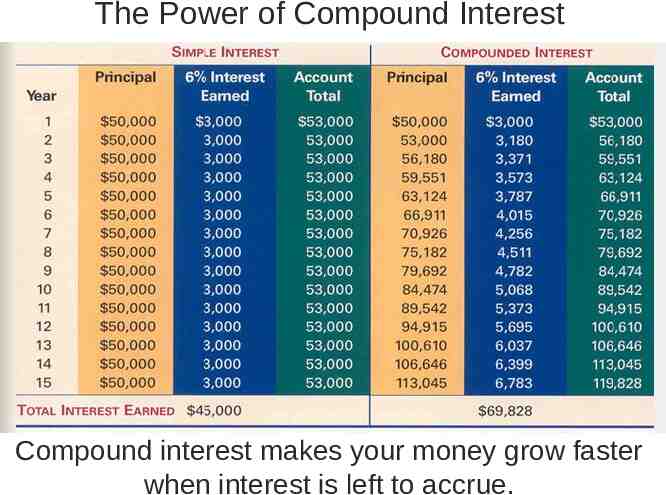

The Power of Compound Interest Compound interest makes your money grow faster when interest is left to accrue.

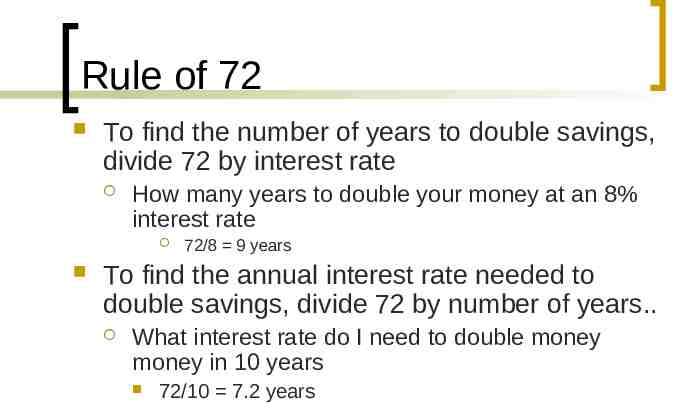

Rule of 72 Use Rule of 72 to estimate the amount of time or interest needed to double savings The Rule of 72 can also tell you the interest rate you need to earn to double your money in a certain amount of time by dividing 72 by the number of years. continued

Rule of 72 To find the number of years to double savings, divide 72 by interest rate How many years to double your money at an 8% interest rate 72/8 9 years To find the annual interest rate needed to double savings, divide 72 by number of years. What interest rate do I need to double money money in 10 years 72/10 7.2 years continued

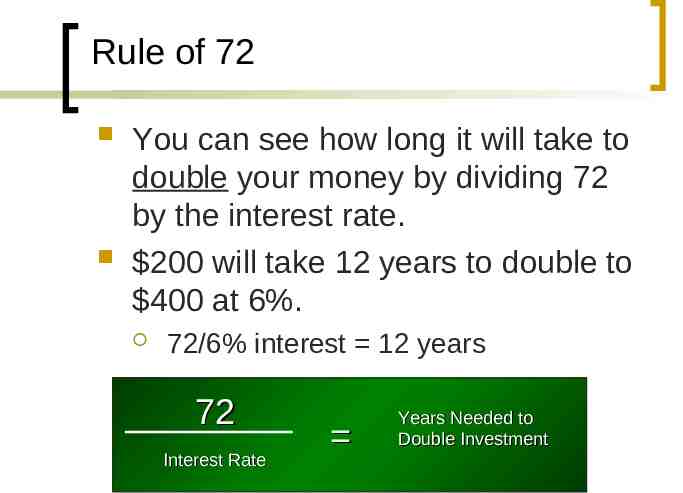

Rule of 72 You can see how long it will take to double your money by dividing 72 by the interest rate. 200 will take 12 years to double to 400 at 6%. 72/6% interest 12 years 72 Interest Rate Years Needed to Double Investment

Rule of 72 To double your 200 to 400 in 4 years, you would need an 18% interest rate. 72/4 years 18% interest. 72 Years Needed to Double Investment Interest Rate Required

Rule of 72 Practice You have 5,000 from savings bonds that just matured. You want to double that money in time to use it to purchase a house in 8 years. What rate of return would you need to do this? You are getting 3% on a 1,000 CD. How long will it take to double your principle at this rate? As part of your long term planning, you set aside 25,000 for your child’s college savings plan. Your child will be going to college in approximately 15 years. What rate of return would you need to double that investment in 15 years? You have 725 in your savings account and you are getting 0.5% interest. How long will it take to double your savings?

Savings Choices The Truth in Savings Act requires financial institutions to provide information about costs and interestearning accounts in uniform terms helps consumers compare savings products and make informed decisions. continued

Savings Choices Info financial institutions must provide: minimum required to open an account interest rate annual percentage yield (APY) and effective period minimum deposit, time requirements, other terms of APY description of fees, conditions, and penalties. continued

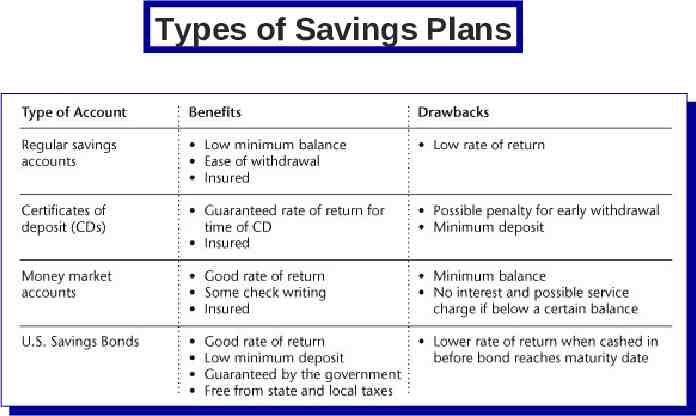

Types of Savings Plans The basic types of savings accounts are: Traditional Certificates of Deposit Money Market Deposit Accounts U.S. Savings Bonds

Savings Accounts Traditional savings accounts – pay interest – allow you to make deposits and withdrawals – usually offer lowest interest earnings, but most liquidity. continued

Traditional Savings Account Advantages: Low risk—safety guaranteed by the federal government. High level of liquidity.

Traditional Savings Account Disadvantages: Interest rates are usually quite low. Many banks charge a service fee if the savings account falls below a certain minimum balance.

Savings Accounts Special purpose accounts encourage consumers to set aside money in separate accounts for specific purposes: holiday gifts, college tuition Interest may be tax free or tax-deferred, allowing savings to accumulate faster.

Online-Only Savings Accounts Offered by Internet banks Customers access bank’s Web site to check balances and make electronic deposits, withdrawals, fund transfers Pay higher interest rates due to lower overhead costs. continued

Online-Only Savings Accounts Disadvantages: Can have a time lag for deposits and withdrawals to clear Can have technical difficulties, making funds and account info temporarily inaccessible May have a different person available each time you call.

Certificate of Deposit Advantages: The interest rate on a CD is higher than a regular savings account. The rate is guaranteed for the time of the CD. Low risk—safety guaranteed by the federal government.

Certificate of Deposit (CD) Disadvantages: Requires a minimum deposit for a specified period of time. The maturity date for a CD is when the money becomes available to you. Penalty fee if you cash in the CD before the maturity date.

Money Market Deposit Account Banks, savings and loans, and credit unions have their own form of money market fund called a money market deposit account.

Money Market Deposit Accounts Advantages: Works like a checking account. You can withdraw your money at any time. Pays a higher rate of interest than a regular savings account, but usually lower than a CD. Low risk—safety guaranteed by the federal government.

Money Market Deposit Accounts Disadvantages: A higher initial deposit required. Must maintain a higher minimum balance or no interest will be earned and charged a service fee. You can only write a limited number of checks.

U.S. Savings Bonds Buyers of U.S. savings bonds loan money to the government On a specified date, the government repays the loan with interest. continued

U.S. Savings Bonds Advantages: Low minimum deposit. Good rate of return. Guaranteed by the federal government. Do not have to pay local or state taxes on the interest earned.

U.S. Savings Bonds Disadvantages: Money is tied up for a long period of time—usually 20 to 30 years. Lower rate of return if cashed in before maturity date.

Two Main Types Series EE savings bond—purchased for half of its face value—the minimum is 25 for a 50 bond—guaranteed to reach face value in 20 years. Series I savings bonds—you can purchase at their face value and earn a fixed rate of interest.

Types of Savings Plans

Glossary of Key Terms Back annual percentage yield (APY). The rate of yearly earnings from an account, including compound interest. certificate of deposit (CD). Money deposited for a set period of time that earns a set annual rate of interest. compound interest. Interest figured on money deposited plus interest.

Glossary of Key Terms Back Rule of 72. A method used to estimate the amount of time or interest it will take for savings to double in value. simple interest. Interest computed only on the principal. tax deferred. Savings or earnings that are not taxed until the funds are withdrawn.

Glossary of Key Terms Back tax exempt. Earnings that are free of certain taxes. U.S. savings bond. A savings tool that loans money to the U.S. government for a specified period of time. The bondholder is repaid with interest at the time of maturity.