QBO and Accounting Curriculum Integration February 3, 2021 Richard

26 Slides1.99 MB

QBO and Accounting Curriculum Integration February 3, 2021 Richard L. Brown, MacArthur Senior High School, Aldine ISD

Mr. Brown is the accounting and digital media teacher at MacArthur Senior High School in the Aldine Independent School District in Houston Texas. Following a thirty plus year career working in public accounting and industry, Mr. Brown returned to where his accounting career began – the high school classroom. Currently he is focused on preparing students for careers in business and transforming the way that high school accounting is taught. Intuit Confidential and Proprietary 2

Agenda Overview of the MacArthur High School Accounting Program Why add accounting software to the high school curriculum Challenges Integrating QuickBooks into the Curriculum Integration Stages Current Progress & Next Steps Questions Intuit Confidential and Proprietary 3

MacArthur High School Accounting Program

Program Objective Provide students interested in a career in business with an understanding Finance and Accounting career opportunities and the knowledge, skills and abilities to: Successfully perform the job duties of a finance and accounting paraprofessional such as a bookkeeper or accounting clerk, Successfully gain admittance to a 4year college business program and to successfully perform as a business or accounting major at any university or college, Successfully address the business issues for students focused on becoming an entrepreneur or independent business person Intuit Confidential and Proprietary 5

Program Overview Accounting I – Financial Accounting Generally Accepted Accounting Principles (GAAP) Analyze business events according to accounting principles and concepts Create financial statements QuickBooks Certification Accounting II – Managerial Accounting Methodologies for Cost Accounting Preparation of operating and capital budgets and forecasts Data Analytics Performance Management Extra Curricular BPA Finance and Accounting competitions UIL Accounting Academic competitions Intuit Confidential and Proprietary 6

Why Add Accounting Software

Why add accounting software Because accounting is done with software Intuit Confidential and Proprietary 8

9 Why add Accounting Software Engineering students work with computer aided design tools such as AutoCad Healthcare are scheduled for regular rotations at local hospitals and pharmacies Culinary Arts learn and work in a commercial grade kitchen Robotics students are building operational robots Accounting students are working with electronic facsimiles of paper documents Intuit Confidential and Proprietary 9

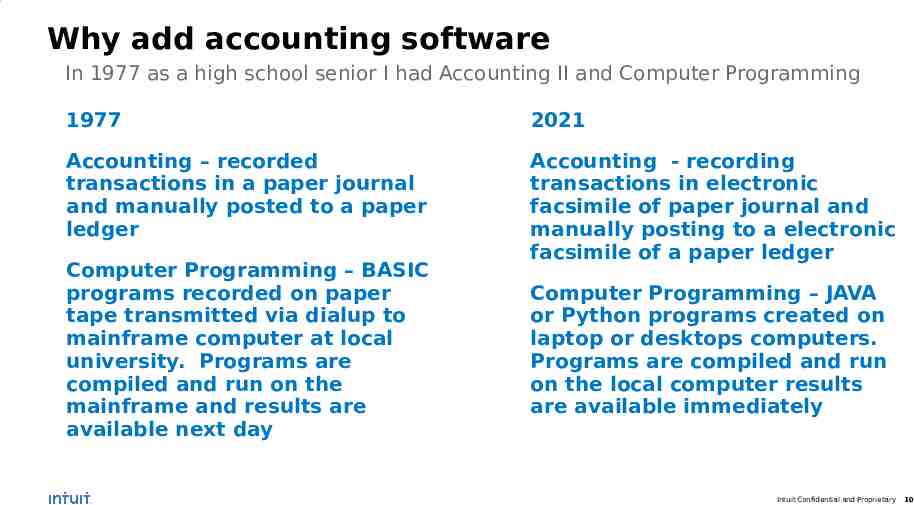

1 0 Why add accounting software In 1977 as a high school senior I had Accounting II and Computer Programming 1977 2021 Accounting – recorded transactions in a paper journal and manually posted to a paper ledger Accounting - recording transactions in electronic facsimile of paper journal and manually posting to a electronic facsimile of a paper ledger Computer Programming – BASIC programs recorded on paper tape transmitted via dialup to mainframe computer at local university. Programs are compiled and run on the mainframe and results are available next day Computer Programming – JAVA or Python programs created on laptop or desktops computers. Programs are compiled and run on the local computer results are available immediately Intuit Confidential and Proprietary 10

Why add accounting software If we want students to have the knowledge and skills needed to be successful and productive business and accounting professionals we have to prepare them using the best technology and tools available. Intuit Confidential and Proprietary 11

Integration Challenges

Curriculum integration challenges Accounting textbooks provide limited integration with accounting software programs Many accounting teachers have limited exposure to and experience with accounting software programs How do you find/make room in the curriculum – what is eliminated to make room for QuickBooks Intuit Confidential and Proprietary 13

Integration Challenges Textbooks Accounting textbooks provide limited integration with accounting software programs Textbooks make mention of software programs Lack any real integration to main body of the text Textbooks overwhelmingly teaches how to perform accounting based on a paperbased ledger and journals Standalone QuickBooks training materials from Intuit and textbook vendors fil the gap Intuit Confidential and Proprietary 14

Integration Challenges Teacher Preparation Many accounting teachers have limited exposure to and experience with accounting software programs Most of our accounting teachers have come through a general business program Most have had no hands on experience with QuickBooks or other accounting software YouTube videos and QuickBooks curriculum Intuit Confidential and Proprietary 15

Integration Challenges Culling the Curriculum How do you find/make room in the curriculum – what is eliminated to make room for QuickBooks activities Eliminate/reduce focus on obsolete materials, i.e. posting Scaleback redundant topics, i.e. adjusting entries Integrate duplicative topics with QuickBooks student activity Intuit Confidential and Proprietary 16

Integration Approaches

Integration Approaches Integration is a continuum Alternative Approaches Bolt-On Capstone Case Study Case Study Bolt-on Capstone Intuit Confidential and Proprietary 18

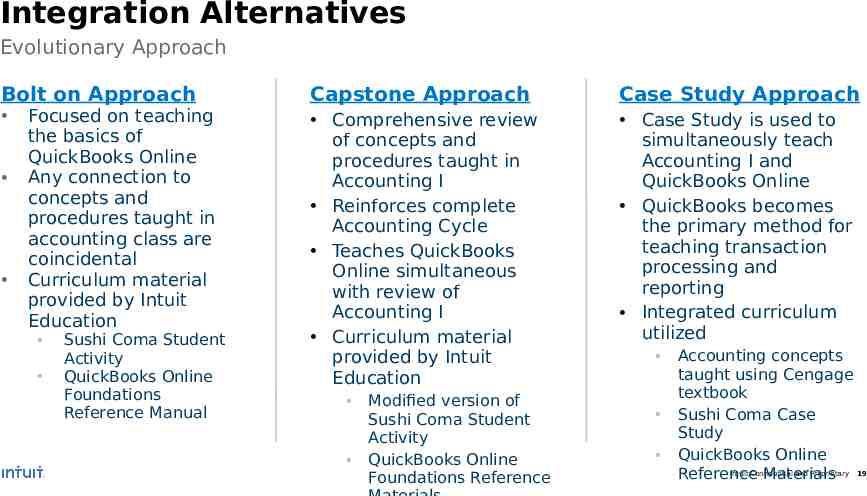

Integration Alternatives Evolutionary Approach Bolt on Approach Focused on teaching the basics of QuickBooks Online Any connection to concepts and procedures taught in accounting class are coincidental Curriculum material provided by Intuit Education Sushi Coma Student Activity QuickBooks Online Foundations Reference Manual Capstone Approach Case Study Approach Comprehensive review of concepts and procedures taught in Accounting I Reinforces complete Accounting Cycle Teaches QuickBooks Online simultaneous with review of Accounting I Curriculum material provided by Intuit Education Case Study is used to simultaneously teach Accounting I and QuickBooks Online QuickBooks becomes the primary method for teaching transaction processing and reporting Integrated curriculum utilized Modified version of Sushi Coma Student Activity QuickBooks Online Foundations Reference Accounting concepts taught using Cengage textbook Sushi Coma Case Study QuickBooks Online Intuit Confidential and Proprietary 19 Reference Materials

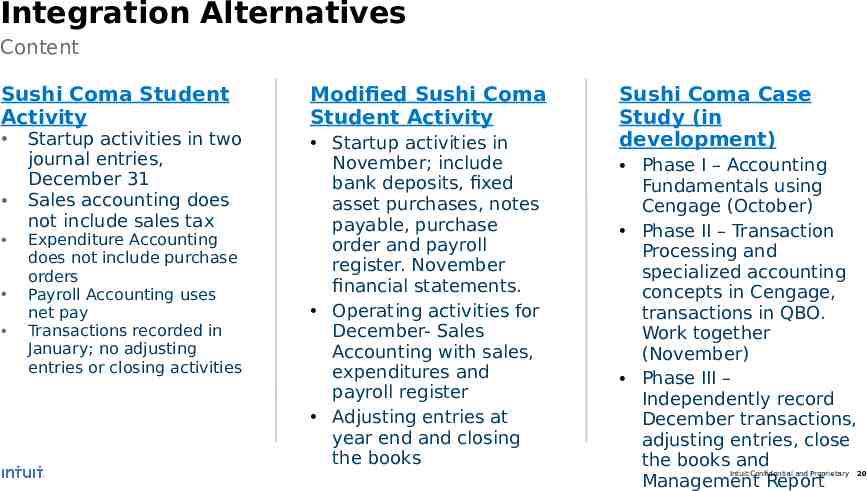

Integration Alternatives Content Sushi Coma Student Activity Startup activities in two journal entries, December 31 Sales accounting does not include sales tax Expenditure Accounting does not include purchase orders Payroll Accounting uses net pay Transactions recorded in January; no adjusting entries or closing activities Modified Sushi Coma Student Activity Startup activities in November; include bank deposits, fixed asset purchases, notes payable, purchase order and payroll register. November financial statements. Operating activities for December- Sales Accounting with sales, expenditures and payroll register Adjusting entries at year end and closing the books Sushi Coma Case Study (in development) Phase I – Accounting Fundamentals using Cengage (October) Phase II – Transaction Processing and specialized accounting concepts in Cengage, transactions in QBO. Work together (November) Phase III – Independently record December transactions, adjusting entries, close the books and Management Report Intuit Confidential and Proprietary 20

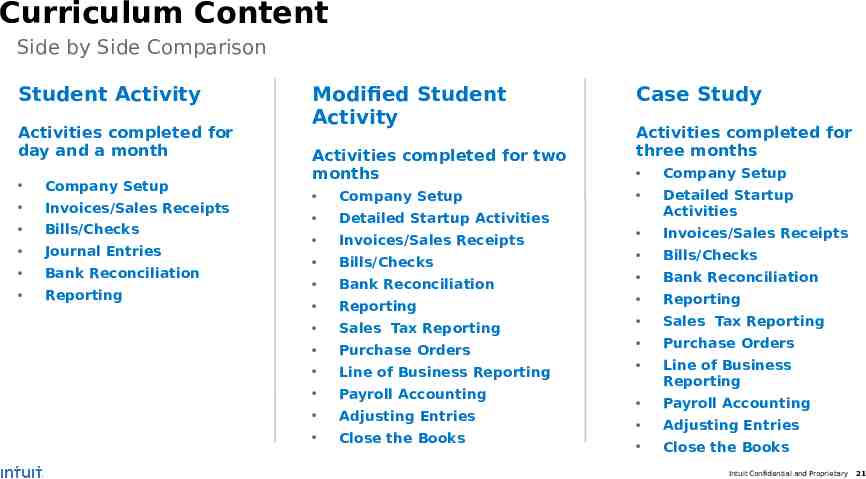

Curriculum Content Side by Side Comparison Student Activity Activities completed for day and a month Company Setup Invoices/Sales Receipts Bills/Checks Journal Entries Bank Reconciliation Reporting Modified Student Activity Activities completed for two months Company Setup Detailed Startup Activities Invoices/Sales Receipts Bills/Checks Bank Reconciliation Reporting Sales Tax Reporting Purchase Orders Line of Business Reporting Payroll Accounting Adjusting Entries Close the Books Case Study Activities completed for three months Company Setup Detailed Startup Activities Invoices/Sales Receipts Bills/Checks Bank Reconciliation Reporting Sales Tax Reporting Purchase Orders Line of Business Reporting Payroll Accounting Adjusting Entries Close the Books Intuit Confidential and Proprietary 21

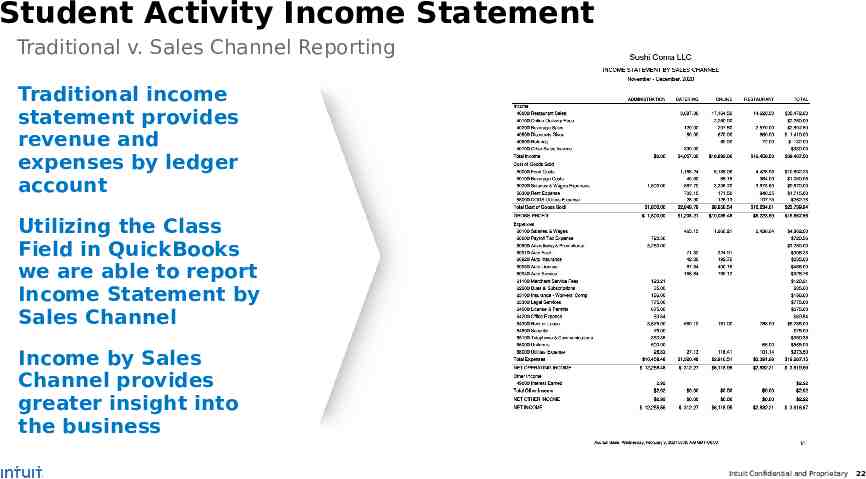

Student Activity Income Statement Traditional v. Sales Channel Reporting Traditional income statement provides revenue and expenses by ledger account Utilizing the Class Field in QuickBooks we are able to report Income Statement by Sales Channel Income by Sales Channel provides greater insight into the business Intuit Confidential and Proprietary 22

Progress and Next Steps

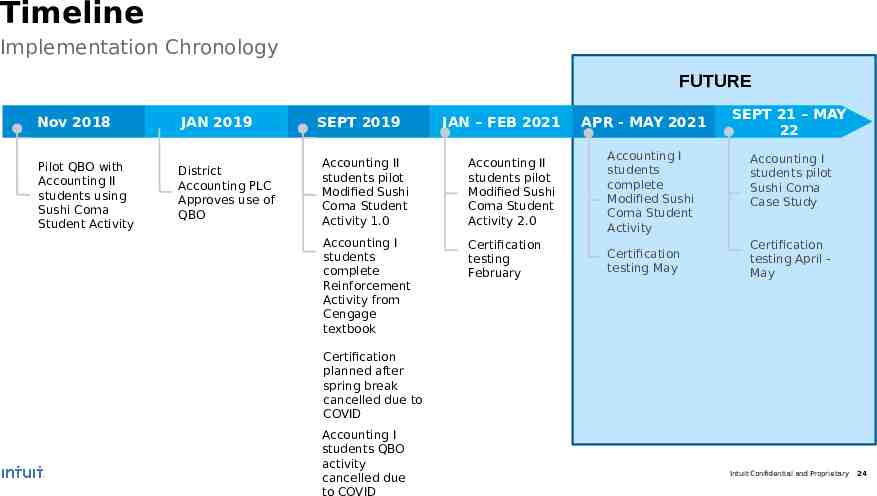

Timeline Implementation Chronology FUTURE Nov 2018 Pilot QBO with Accounting II students using Sushi Coma Student Activity JAN 2019 District Accounting PLC Approves use of QBO SEPT 2019 JAN – FEB 2021 APR - MAY 2021 Accounting II students pilot Modified Sushi Coma Student Activity 1.0 Accounting II students pilot Modified Sushi Coma Student Activity 2.0 Accounting I students complete Modified Sushi Coma Student Activity Accounting I students complete Reinforcement Activity from Cengage textbook Certification testing February Certification testing May SEPT 21 – MAY 22 Accounting I students pilot Sushi Coma Case Study Certification testing April May Certification planned after spring break cancelled due to COVID Accounting I students QBO activity cancelled due Intuit Confidential and Proprietary 24

Lessons Learned and Future Plans Implementation of a QuickBooks will be a multi year effort Modifications to student activities and case studies must take the business knowledge and maturity level of high school students Most QuickBook learners are adults with life experience; most of my students are 15 – 17 years old Some students may be resistant as QuickBooks moves them out of their comfort zones Using QuickBooks creates an opportunity for more in-depth discussions than would be otherwise possible Case study approach creates potential to utilize industry specific case content; Pilot of Cosmetology and Fashion in discussion for fall 2022 Intuit Confidential and Proprietary 25

Q&A