Production and Operations Management Systems Chapter 9: Supply

57 Slides2.02 MB

Production and Operations Management Systems Chapter 9: Supply Chain Management Sushil K. Gupta Martin K. Starr 2014 1

After reading this chapter, you should be able to: Define supply chain capacity and explain how it is measured. Identify upstream and downstream partners for a chosen product Identify activities of acquisition chain management Discuss the importance of the purchasing function Explain the role of purchasing agents Highlight the importance of ethics in purchasing Describe the process of receiving, inspection and storage Describe the use of bids in purchasing Identify steps for supplier certification 2

After reading this chapter, you should be able to (continued): Discuss systems issues in global sourcing Explain how distribution chains involve many partners Discuss the role of e-business Identify Competition, Conflict, Collaboration and Coordination (C4) issues Discuss the importance of Radio Frequency Identification (RFID) Explain how logistics and distribution planning can minimize costs Make coordinated forecasting and inventory decisions. Describe the bullwhip effect and its implications for supply chains. 3

Introduction The primary focus in supply chain management is managing the movement of material. Raw material and component parts flow from suppliers to manufacturer and are converted into finished products. Finished goods are then transported to the final consumer through several intermediate organizations. A service supply chain may not involve the movement of materials but involves the design of interlinked operations. Example, the linkages between travel agents, airlines, hotels and cruise lines to provide an overall pleasurable experience to the clients going on a cruise forms the supply chain. 4

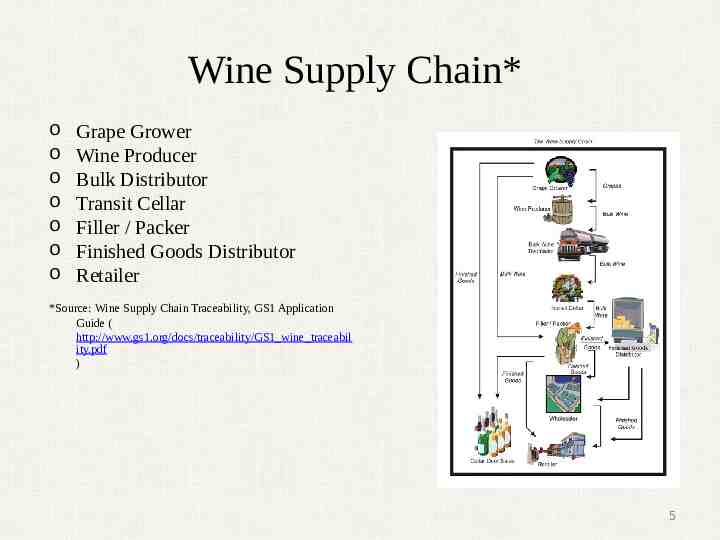

Wine Supply Chain* o o o o o o o Grape Grower Wine Producer Bulk Distributor Transit Cellar Filler / Packer Finished Goods Distributor Retailer *Source: Wine Supply Chain Traceability, GS1 Application Guide ( http://www.gs1.org/docs/traceability/GS1 wine traceabil ity.pdf ) 5

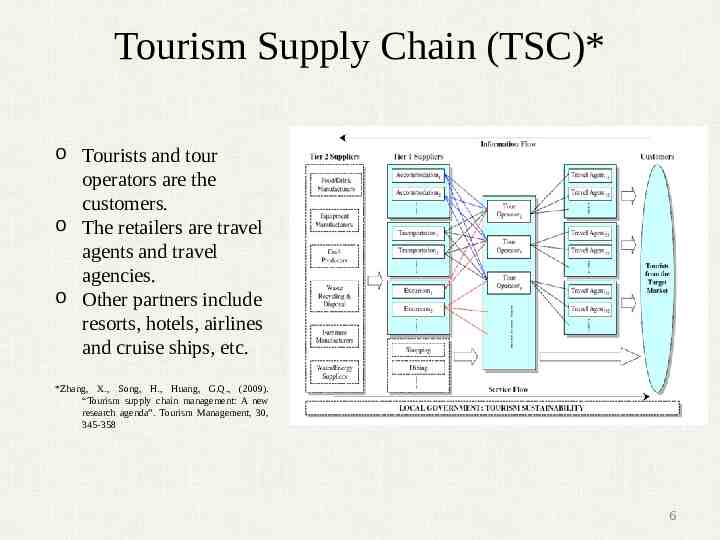

Tourism Supply Chain (TSC)* o Tourists and tour operators are the customers. o The retailers are travel agents and travel agencies. o Other partners include resorts, hotels, airlines and cruise ships, etc. *Zhang, X., Song, H., Huang, G.Q., (2009). “Tourism supply chain management: A new research agenda”. Tourism Management, 30, 345-358 6

Top Performing Supply Chains o The top-performing supply chains possess three very different qualities*. Great supply chains are agile. They react speedily to sudden changes in demand or supply. They adapt over time as market structures and strategies evolve. They align the interests of all the firms in the supply network. Only supply chains that are agile, adaptable, and aligned provide companies with sustainable competitive advantage. *Lee, Hau, L., The Triple-A Supply Chain, Harvard Business Review, October, 2004, Page: 102-112. 7

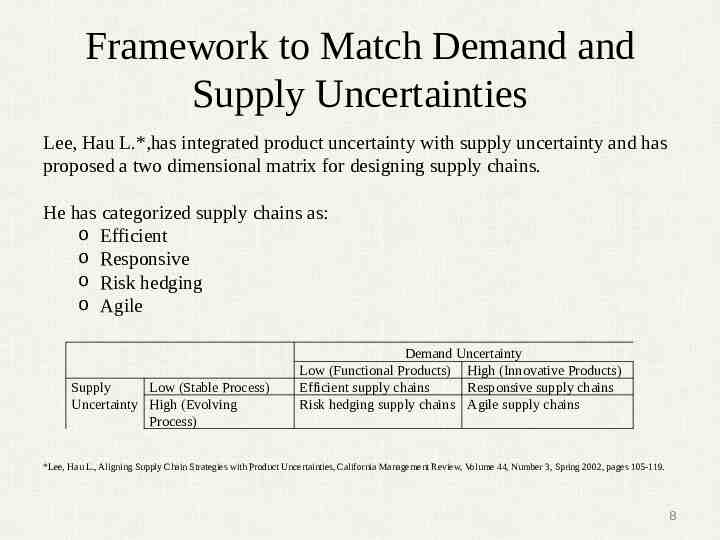

Framework to Match Demand and Supply Uncertainties Lee, Hau L.*,has integrated product uncertainty with supply uncertainty and has proposed a two dimensional matrix for designing supply chains. He has categorized supply chains as: o Efficient o Responsive o Risk hedging o Agile Supply Low (Stable Process) Uncertainty High (Evolving Process) Demand Uncertainty Low (Functional Products) High (Innovative Products) Efficient supply chains Responsive supply chains Risk hedging supply chains Agile supply chains *Lee, Hau L., Aligning Supply Chain Strategies with Product Uncertainties, California Management Review, Volume 44, Number 3, Spring 2002, pages 105-119. 8

Product Characteristics Influence Supply Chains Product characteristics are important in designing a supply chain. According to Fisher*these characteristics include: Product life cycle Demand predictability Product variety Market standards for lead times and service Based on demand patterns products fall into one of two categories: Functional (e.g. food and gas – predictable and stable demand, long product life cycles) Innovative (e.g. fashion apparel and personal computers) Ideal supply-chain strategy: More efficient for functional products More responsive for innovative products *Fisher, Marshall, L., What Is the Right Supply Chain for Your Product?, Harvard Business Review, March-April, 1997, Page: 105-116. 9

Phases of a Supply Chain Competition, conflict, collaboration and coordination (C4 ) issues span across all stages of a supply chain*. Design of supply chains, therefore, involves not only minimizing the cost of moving material but also managing the intricate behavioral relationships among supply chain partners. Supply chain management consists of three distinct phases: Acquisition Chain – purchasing of materials Transformation Process - production of goods Distribution Chain – distribution of finished products *See, Gupta, Sushil, Christos Koulamas and George J. Kyparisis, E-Business: A Review of Research Published in Production and Operations Management (1992-2008), Production and Operations Management, Volume 18, Issue 6, November – December 2009, page 604-620. 10

Phases of a Supply Chain (continued) In this presentation we will focus on: Acquisition chain The functions and activities in the acquisition chain end at the OEM. Suppliers to the OEM are called first tier suppliers; second tier supplies to first tier; third tier to second, and so forth. Distribution chain The functions and activities in the distribution chain start from the OEM manufacturer and end with the final consumer. There are some functions that are common to both phases. On the other hand there are functions that are unique to each phase. OEM original equipment manufacturer. 11

Acquisition Chain Management (ACM) o Acquisition chain represents all partners that are linked to provide raw materials, component parts, and special services to a manufacturing company. o Materials management (MM) is the bulk of acquisition chain activities. o The main classes of materials that have to be purchased and managed include raw materials, component parts and subassemblies. o Finished product can be also be procured as part of the overall make or buy strategy of a company. o Two systems measures—‘‘turnover’’ (T) and ‘‘days of inventory’’(DOI)—are very helpful for monitoring how well purchasing and inventory managers do their job. o Acquisition Chain Management (ACM) connects the external sourcing of supplies to the internal scheduling. Traditionally this topic is known as purchasing and materials management. 12

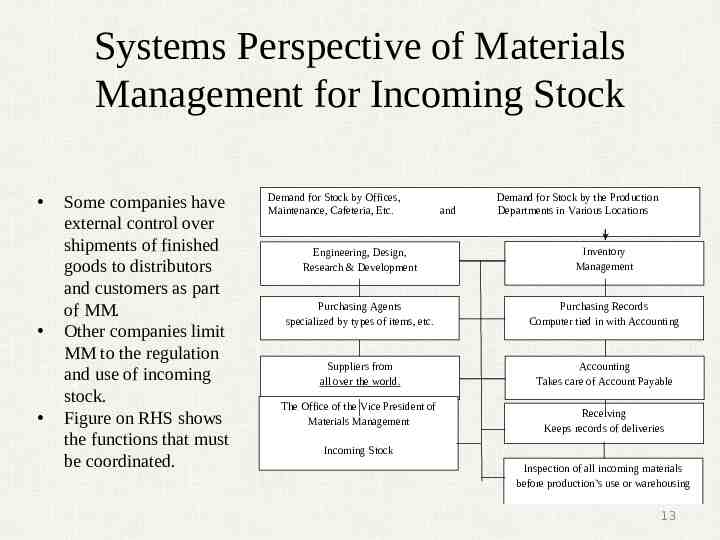

Systems Perspective of Materials Management for Incoming Stock Some companies have external control over shipments of finished goods to distributors and customers as part of MM. Other companies limit MM to the regulation and use of incoming stock. Figure on RHS shows the functions that must be coordinated. Demand for Stock by Offices, Maintenance, Cafeteria, Etc. and Demand for Stock by the Production Departments in Various Locations Engineering, Design, Research & Development Inventory Management Purchasing Agents specialized by types of items, etc. Purchasing Records Computer tied in with Accounting Suppliers from all over the world. Accounting Takes care of Account Payable The Office of the Vice President of Materials Management Receiving Keeps records of deliveries Incoming Stock Inspection of all incoming materials before production’s use or warehousing 13

Functions of Purchasing Ordering the right quantity of materials meeting all quality standards at the best possible prices. Receiving materials. Inspecting the incoming goods. Selection of suppliers and vendors. Develop stable relationships with suppliers/vendors. Keep track of engineering design changes (EDCs) that may affect material requirements. Purchasing must be adept at coordinating the materials that are needed for start-ups. The purchasing function is primarily concerned with managing vendors and suppliers. The distinction between vendors and suppliers is a matter of local usage. 14

Changing Role of Purchasing o The traditional role of purchasing agents (PAs) has been to bring the organization the needed supplies. o The role is changing and becoming more integrated within the organization. o The purchasing department in the twenty-first century also functions as an information-gathering agency. o Purchasing is expected to be on top of new materials, new suppliers, new distribution channels, new prices, new technology and new processes that produce quality levels previously not attainable. o The role now requires and is based on having a wide and informed net of important information. o Up-to-date purchasing departments have a global reach via satellites and telecommunications capabilities that constantly expand horizons. 15

Changing Role of Purchasing (continued) o Sourcing (generic name for purchasing) has become a global systems term. o Purchasing departments must be responsive to the marketing strategies of the various suppliers from whom they obtain required materials. o The price-tag approach (push suppliers on price) has been thrown out in favor of a long-term relationship with special trusted suppliers. Make or buy decisions by P/OM are influenced by the information that purchasing can provide. The decisions often depend on the terms to buy, including price, quality, delivery, and innovations, among other considerations, which purchasing learns about and communicates to the P/OM team. 16

Purchasing Agents o Purchasing Agents (PAs) are responsible for carrying out functions of purchasing. o When the purchasing process is technical, the purchasing agent may be an engineer or a person who has worked with the production department. o It is important that PAs document the history of purchasing including what the costs were, who the major suppliers were, what discounts were obtained, what quality levels were achieved, and delivery periods for specific items. o The skills and experience of purchasing agents are not readily transferable between different industries. o They may vary between companies even in the same industry. 17

Purchasing Agents (continued) o Differentiation exists by types of materials, buying and shipping terms, and supplier purchasing traditions. o Purchasing agents (PA’s) make buying decisions that involve enormous amounts of money. Ethics of PAs are very important for any company. o The fact that suppliers influence purchasing decisions through gifts is not considered illegal or unethical in some places in the world. o Cultural and legal factors can play major roles in determining PAs’ success in global sourcing. 18

Receiving, Inspection and Storage o Receiving and Shipping docks (often at the same location) have to be properly designed for these processes. o After unloading supplies, there is usually an assigned area to store them. o Cross-docking may be used to transfer goods from incoming trucks at the receiving dock to outgoing trucks at the shipping dock. o Designs of such facilities differ depending upon Types of supplies unloaded. What the supplies are unloaded from (trucks, freight cars, hopper cars, ships, planes, etc.). Where they are unloaded and to where they go. Smart warehouses that use bar codes and RFID permit optimal use of storage space and minimal time for retrieval. 19

Requiring Bids Before Purchase o Bidding is a process by which the buyer requests competing companies (suppliers) to specify: Prices Delivery dates Quality specifications Other checks and assurances o Bids can be requested where the price is fixed and the creativity and quality of the solution is at stake. Advertising agencies bid for accounts that have a set budget. Consulting organizations work under specific budget allocations. Bid requests (requests for proposal – RFP) state specifically all of the conditions that must be met. 20

Requiring Bids Before Purchase (continued) o The main focus in bidding cases is to satisfy a constituency that purchases made under its watch have been made at the lowest reasonable cost. o Many companies use bids to provide assurance that purchasing decisions are not influenced by gifts (graft) of any kind. o Bidding is a useful protection when suspicion exists that special purchasing deals are being made between suppliers and company personnel. o Many industries, particularly governmental agencies, are legally required to use bidding procedures for buying items that cost more than a given (relatively expensive) amount. With trust and transparency, the need for bidding (in the first place) is diminished. 21

Requiring Bids Before Purchase (continued) o Costs of purchasing are likely to decrease by inviting more companies to participate in the bidding process. o However, a low bidder may not produce quality work. o With a large number of bidders, qualified suppliers may leave the bidding process – leaving the field open to less qualified companies. o Oligopolies (where the market is dominated by only a few vendors) can present serious restrictive trade practices. Cartels exist (such as OPEC) which have formal agreements between producers for collusion concerning volume of production and prices. o Managing bidding can be a costly process because it requires: Evaluation of vendors on multiple criteria (lowest costs, consistent quality, engineering design capability, fastest delivery, vendor reliability, etc.). Cost of reviewing each company’s bid which can be time-consuming and expensive. 22

E-auctions and Bidding Models o Use of the Internet for auctions (e-auctions) is increasing*. o E-auctions have become popular for both forward and reverse auctions. Forward Auctions: Several buyers and one seller. Reverse Auctions: Several sellers and one buyer (the purchasing scenario). o E-auctions can be used for consumer-to-consumer (C2C) and business-to consumer (B2C) auctions through commercial vendors like eBay and Yahoo! o e-commerce vendors (such as FreeMarkets) focus on business-to-business (B2B) and e-procurement auctions. o Bidding models rely on probabilistic analyses. *See, Gupta, Sushil, Christos Koulamas and George J. Kyparisis, E-Business: A Review of Research Published in Production and Operations Management (1992-2008), Production and Operations Management, Volume 18, Issue 6, November – December 2009, page 604-620. 23

Certification of Suppliers o Suppliers’ organizations need to be certified to assure conformance with standards. o Certification may be required before a supplier is allowed to participate in a bidding contest. o Certification is expensive. It is time-consuming– so focus on A-type items. o Certification helps in developing long-term relationships with suppliers. o Potential suppliers are advised how to upgrade those capabilities on which they are rated as deficient. o A comprehensive dynamic systems plan alters conditions for certification overtime in line with the company’s strategies. The buyer’s materials management information system (MMIS) has to be able to handle many suppliers and potential suppliers for hundreds and even thousands of A-type items. 24

Certification of Suppliers (continued) o Rating procedures include formal evaluations of price, quality, delivery time, and the ability to improve all three, and more. o Scoring Models are very useful to evaluate and certify a group of vendors. o Accepted suppliers are regularly reviewed to make certain that they maintain their ‘‘winning’’ status. 25

Global Sourcing Trent and Monczka* distinguish between international purchasing and global sourcing and identify seven features that characterize organizations which are effective in global sourcing. oInternational purchasing involves a commercial transaction between a buyer and a supplier located in different countries. oGlobal sourcing, on the other hand, involves integrating and coordinating common items, materials, processes, technologies, designs and suppliers across worldwide buying, design and operating locations. Trent, Robert J. and Robert M. Monzcka, Achieving Excellence in Global Sourcing, Sloan Management Review, Fall 2005. 26

Global Sourcing (continued) Seven features of organizations which are effective in global sourcing: Executive commitment to global sourcing Rigorous and well-defined processes Availability of needed resources Integration through information technology Supportive organizational design Structured approaches to communication Methodologies for measuring savings 27

Global Sourcing (continued) o Procurement decisions in the era of globalization are no longer based entirely on an understanding of direct purchase costs or on easily observable transaction costs, such as transport expenses and import duties, but on many other types of transaction costs as well, including those related to cultural, institutional and political differences.* o An over dependency on first-tier suppliers is dangerous for OEMs (original equipment manufacturers). It weakens their control over costs, reduces their ability to stay on top of technology developments and shifts in demand, and makes it difficult to ensure that their suppliers are operating in a socially and environmentally sustainable fashion.** *Butter, Frank A.G. den and Kess A. Linse, Rethinking Procurement in the Era of Globalization, Sloan Management Review, Fall 2008. **Choi, Thomas, and Tom Linton, Don’t Let Your Supply Chain Control Your Business, Harvard Business Review, December 2011, pages 112-117. 28

Global Sourcing (continued) A manufacturer may be in a difficult situation if its contract manufacturer (CM) becomes its competitor.* To avoid such a situation, the OEM should do the following: Modesty about revealing one’s secrets. Caution about whom one consorts with. A judicious degree of intimacy, loyalty, and generosity toward one’s partners and customers. Use surplus intellectual property to enter markets beyond those for their core products. Ironically, CMs’ barrier-breaking abilities can offer OEMs access to new markets—and sometimes a way out of the dilemma. * Arruñada, Benito and Xosé H. Vázquez, When Your Contract Manufacturer Becomes Your Competitor, Harvard Business Review, Sept 2006 29

Distribution Chain o The distribution chain starts once an item has been manufactured. o The objective is to deliver the product to the consumer at the right time and at minimum cost. Note: The terms distribution chain and supply chain are used interchangeably from this point onwards. 30

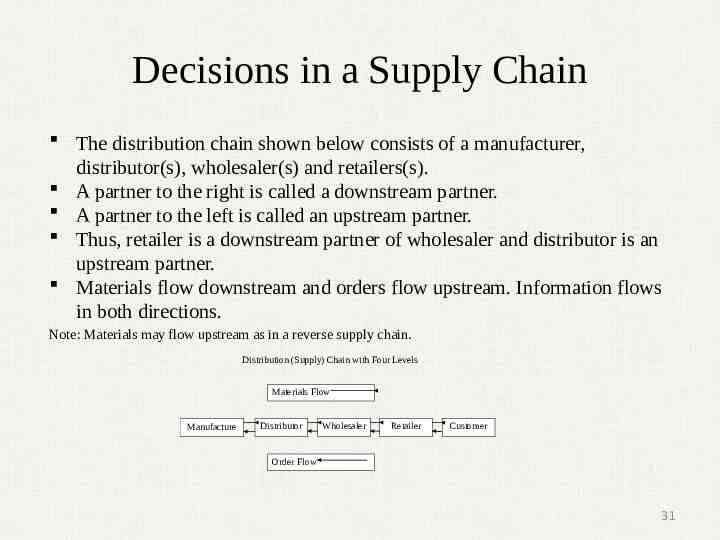

Decisions in a Supply Chain The distribution chain shown below consists of a manufacturer, distributor(s), wholesaler(s) and retailers(s). A partner to the right is called a downstream partner. A partner to the left is called an upstream partner. Thus, retailer is a downstream partner of wholesaler and distributor is an upstream partner. Materials flow downstream and orders flow upstream. Information flows in both directions. Note: Materials may flow upstream as in a reverse supply chain. Distribution (Supply) Chain with Four Levels Materials Flow Manufacture Distributor Wholesaler Retailer Customer Order Flow 31

Decisions in a Supply Chain (continued) Distribution Channel oShip the product directly to the retailer or have intermediate partners like wholesalers and distributors. oUse of e-channels. oMixed channels oNumber of wholesalers, distributors and retailers. Location Decisions oLocation of the manufacturing plant or multiple plants. oLocations of the supply chain partners. In a supply chain the relative location of partners is important because that establishes the distribution network and affects the cost of goods transported. 32

Decisions in a Supply Chain (continued) Mode of Transportation oTrucks, trains, airplanes, or ships etc. The choice depends on the product and the cost of transportation. For example, perishable products like fresh food items may have to be transported by air. Refrigerated trucking is another popular option. Extent of Vertical Integration oA manufacturing company is considered more vertically integrated if it owns the intermediaries. A company that owns trucks is more vertically integrated as compared to the one that uses a trucking company. oThe network for the flow of goods has to be designed. 33

Decisions in a Supply Chain (continued) We shall study the distribution chain under the following topics: E-Business Logistics Forecasting and Inventory 34

E-Business* E-business is a multi-dimensional discipline that involves: Application of technology. Study of customers’ attitudes, expectations, and satisfaction. Identification of internal organizational environment. Study of the relationships among partners in the supply chain, Development of collaborative strategies and coordination mechanisms. Development of analytical models. Web-based functions span across: Product design E-auction and procurement Vendor development Customer relations management Logistics and distribution, and pricing. *For a detailed discussion of e-business developments that are presented in this section, see Gupta, Sushil, Christos Koulamas and George J. Kyparisis, E-Business: A Review of Research Published in Production and Operations Management (1992-2008), Production and Operations Management, Volume 18, Issue 6, November – December 2009, page 604-620 35

E-Business System Design P/OM can make significant contributions to the profitability of the Internetbased businesses (Starr*). A user-friendly web interface that improves customer satisfaction includes: System flexibility Quality of service Product attributes Perceived ease of using the e-business systems Customer characteristics, especially with heterogeneous customers, need to be considered in the design of e-business systems. E-process adoption is easier if the internal organizational environment supports the e-process and the e-process leads to improved organizational performance. *Starr, M. 2003. Application of POM to e-business: B2C e-shopping. International Journal of Operations and Production Management 23(1) 105-124. 36

Competition, Conflict, Collaboration and Coordination (C4) Suppliers compete to win the manufacturer’s supply orders. Retailers compete among themselves for increasing their market share. Manufacturers compete with their own retailers by opening parallel Internet channels – a case of mixed channels supply chain. Some of the strategies to reduce conflict include: Revisions in the wholesale prices. Diversion of customers to the direct channel by the reseller for a commission. Fulfilling the demand only through the reseller. The retailer adds other features and value to differentiate his/her product. The manufacturer makes a side payment to the retailer to reduce conflict. Competition results in conflict which in turn leads competing entities to collaborate and coordinate to arrive at a win-win situation for everyone. 37

Radio Frequency Identification (RFID) Radio frequency identification (RFID) is an enabling technology for real time data collection. RFID uses wireless non-contact radio-frequency electromagnetic fields for data transfer, to automatically identify and track tags attached to objects ( http://en.wikipedia.org/wiki/Radio-frequency identification). RFID tracks the movement and flow of items in a supply chain and provides visibility to managers about the location and condition of the tracked items. The real time information is valuable because it helps to increase asset utilization and to minimize inventory and logistics related costs. RFID also minimizes delays in information transmission leading to improved information sharing among the partners in a supply chain. The design of RFID systems is critical because installing RFID technology infrastructure entails a large initial investment and significant potential risks in technology adoption. 38

Business Value of RFID The business value of RFID comes from the visibility it provides to managers about the items tracked. It emanates from labor cost savings, shrinkage reduction and inventory visibility. RFID has an impact on reducing information asymmetries. The stages in the evolution of RFID business value include (see Dutta et al.*): Technology deployment and integration, Integration with business processes, Development of new business architectures for employees, policies and organizational structures. Three dimensions for an RFID value proposition include: RFID technology Quantification of the RFID business value Incentives for RFID adoption and implementation. *Dutta, A., H. L. Lee, S. Whang. 2007. RFID and operations management: technology, value, and incentives. Production and Operations Management 16(5) 646-655. 39

Business Value of RFID (continued) Examples: Amini et al.* used RFID to track trauma patients in a hospital. RFID improved the tracking of patients’ time from about 25% to 80% in the trauma center where patients spent about ten to twelve hours for their treatment. RFID technology’s ability to collect data in a passive manner avoids interference with medical procedures. RFID-based simulation models help in analyzing healthcare processes more thoroughly based on the data collected for process cycle time, patient throughput rate, and equipment and personnel utilization. *Amini, M., R. F. Otondo, B. D. Janz, M. G. Pitts. 2007. Simulation modeling and analysis: A collateral application and exposition of RFID technology. Production and Operations Management 16(5) 586-598. 40

Business Value of RFID (continued) Example: Delen et al.* establish the business value of RFID for a retailer by analyzing the movement of RFID-tagged cases between distribution centers and retail stores. The analysis provides insights about the distribution of lead times among different products and different combinations of distribution centers and retail stores. The RFID-generated information also helps in tracking recalls, delivering products to the stores as per schedule, and in studying the backroom process that involves moving the products to the sales floor. In addition to providing immediate visibility, RFID data utilization leads to gains due to limited process changes first and then to the major modifications in the logistics system. *Delen, D., B. C. Hardgrave, R. Sharda. 2007. RFID for better supply-chain management through enhanced information visibility. Production and Operations Management 16(5) 613-624. 41

Adoption and Implementation of RFID Ngai et al. * present a case study of the design, development and implementation of an RFID-based traceability system. The critical success factors for RFID implementation include: – High organizational motivation, – Implementation process efficiency, – Effective cost control, – RFID skills and knowledge transfer. Several deployment issues that impede RFID implementation include: 1. Lack of in-house RFID expertise 2. Inadequate technology support from local RFID vendors 3. Existence of different sets of industry standards 4. Unreliable hardware performance 5. Underdeveloped RFID middleware. *Ngai, E.W.T., T.C.E. Cheng, K.-H. Lai, P.Y.F. Chai, Y.S. Choi, R.K.Y. Sin. 2007. Development of an RFID-based traceability system: Experiences and lessons learned from an aircraft engineering company. Production and Operations Management 16(5) 554-568. 42

Adoption and Implementation of RFID (continued) Overall, the study reports that the RFID-based traceability system has resulted in: improved lead times competitive differentiation savings from reusing RFID tags breakthrough productivity by automation reduction of human errors in handling the repairable parts improved inventory management reduced manpower and manual data recording real time monitoring and access to detailed information reduction of repairable parts loss improved customer relationships The return on investment, the business value, and the selection of partners are important considerations at the strategic level in RFID investment projects 43

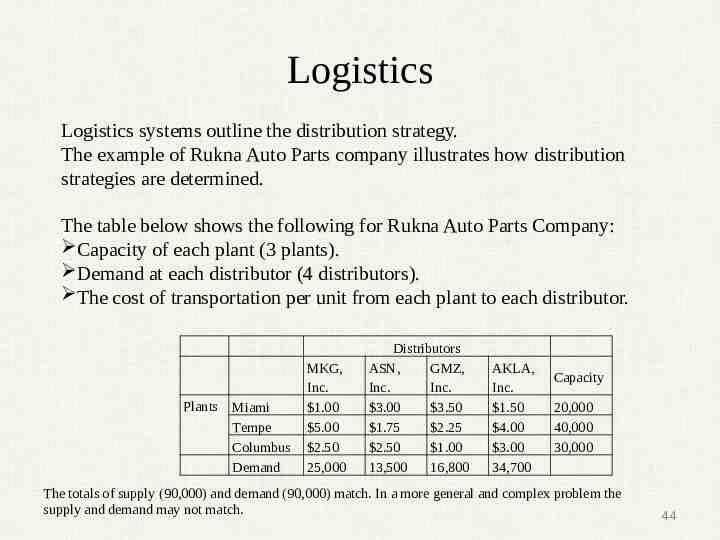

Logistics Logistics systems outline the distribution strategy. The example of Rukna Auto Parts company illustrates how distribution strategies are determined. The table below shows the following for Rukna Auto Parts Company: Capacity of each plant (3 plants). Demand at each distributor (4 distributors). The cost of transportation per unit from each plant to each distributor. Plants Miami Tempe Columbus Demand MKG, Inc. 1.00 5.00 2.50 25,000 Distributors ASN, GMZ, Inc. Inc. 3.00 3.50 1.75 2.25 2.50 1.00 13,500 16,800 AKLA, Inc. 1.50 4.00 3.00 34,700 Capacity 20,000 40,000 30,000 The totals of supply (90,000) and demand (90,000) match. In a more general and complex problem the supply and demand may not match. 44

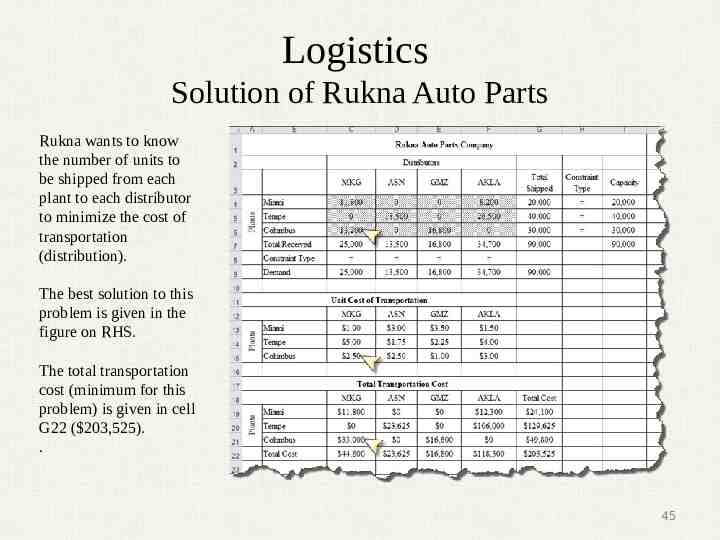

Logistics Solution of Rukna Auto Parts Rukna wants to know the number of units to be shipped from each plant to each distributor to minimize the cost of transportation (distribution). The best solution to this problem is given in the figure on RHS. The total transportation cost (minimum for this problem) is given in cell G22 ( 203,525). . 45

Logistics Solution of Rukna Auto Parts (continued) Cells C4 through F6 (highlighted cells) give the number of units shipped from a plant to a distributor. For example, cell C6 gives the number of units shipped from Columbus to MKG (13,200 units). All costs are given in cells C13 to F15. For example, cell C15 ( 2.50) gives the shipping cost per unit from Columbus to MKG. The total transportation costs for each combination of the plant and distributor are given in cells C19 to F21. The values in these cells (C19 to F21) are obtained by multiplying the number of units shipped by the shipping cost per unit in the respective cells for each combination of the plant and distributor. For example value in cell C21 ( 33,000) is obtained by multiplying the value in cell C6 (13,200) and C15 ( 2.50). The transportation method of linear programming has been used to solve this problem. 46

Forecasting and Inventory Decisions Integrated decisions in forecasting and inventory are important for effective management of supply chain systems. Bottlenecks may be created if information is not shared and the decisions are not coordinated. Any one of the components in the supply chain (see figure below)can be a bottleneck. Bottlenecks affect the entire supply chain. Contingency planning for supply chain capacity crises must be done to avoid crippling damage. 47

Forecasting and Inventory Decisions Integrated decisions in forecasting and inventory are important for effective management of supply chain systems. Excessive inventories and shortages may result in supply chains if information is not shared and the decisions are not coordinated. This may lead to amplified demand variability in a supply chain. This phenomenon is called bullwhip effect. It means that the orders by a retailer to its wholesaler to replenish the stock are likely to fluctuate more than the demand at the retailer. This phenomenon continues up the supply chain. 48

Bullwhip Effect The bullwhip phenomenon was first identified by Proctor and Gamble (P&G) for demand of diapers. The major cause of the bull-whip effect is the lack of information about the actual demand by supply chain partners. Each partner in the supply chain does its own demand forecasting and places replenishment orders. This leads to inconsistency if the entire supply chain system is not well coordinated. An integrated forecasting system needs to be developed. Such a system requires a transparent information system, trust among supply chain partners, and ability to make and adjust forecasts at each level of the supply chain. Collaborative forecasting has to be done on a periodic basis – monthly, weekly etc. 49

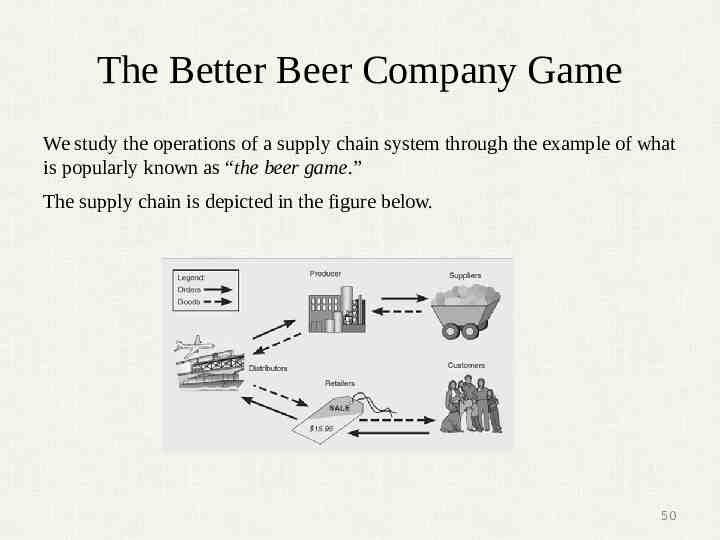

The Better Beer Company Game We study the operations of a supply chain system through the example of what is popularly known as “the beer game.” The supply chain is depicted in the figure below. 50

The Better Beer Company Game (continued) Forecasting and inventory decisions are made by the partners in the supply chain in this game. Retailers, distributors, and producer (manufacturer) can order too much (beer) or too little (beer) when information about actual demand for the brand is delayed along the linkages of a supply chain. The effects of ordering too much or too little as a result of information delays can be costly. The resulting imbalance of demand with existing capacity is important to understand. The game shows how the performance of a linked system is tied to the adequacy and timeliness of forecasts about future demand. 51

The Better Beer Company Game (continued) The tables and graphs in the next three slides show the data for simulations that reflect the effects of delays on supply chain decisions made by producers, wholesalers, retailers, suppliers, and customers. These simulations are identified with the Better Beer Company whose product, called Woodstock, is at the heart of the simulation. 52

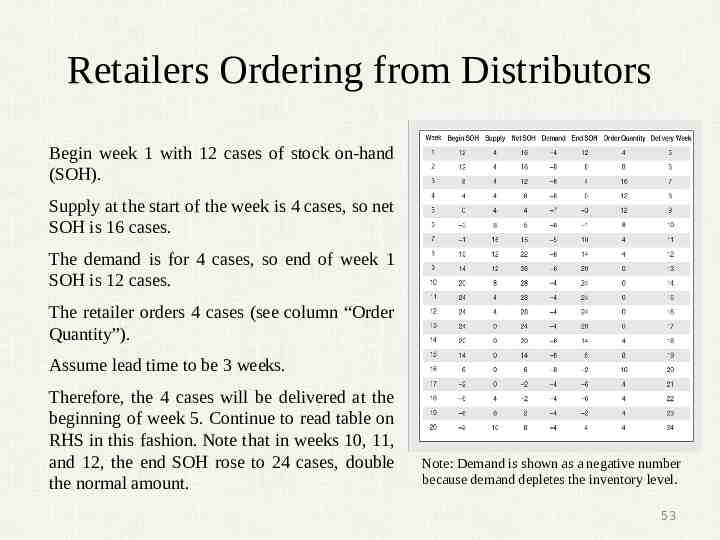

Retailers Ordering from Distributors Begin week 1 with 12 cases of stock on-hand (SOH). Supply at the start of the week is 4 cases, so net SOH is 16 cases. The demand is for 4 cases, so end of week 1 SOH is 12 cases. The retailer orders 4 cases (see column “Order Quantity”). Assume lead time to be 3 weeks. Therefore, the 4 cases will be delivered at the beginning of week 5. Continue to read table on RHS in this fashion. Note that in weeks 10, 11, and 12, the end SOH rose to 24 cases, double the normal amount. Note: Demand is shown as a negative number because demand depletes the inventory level. 53

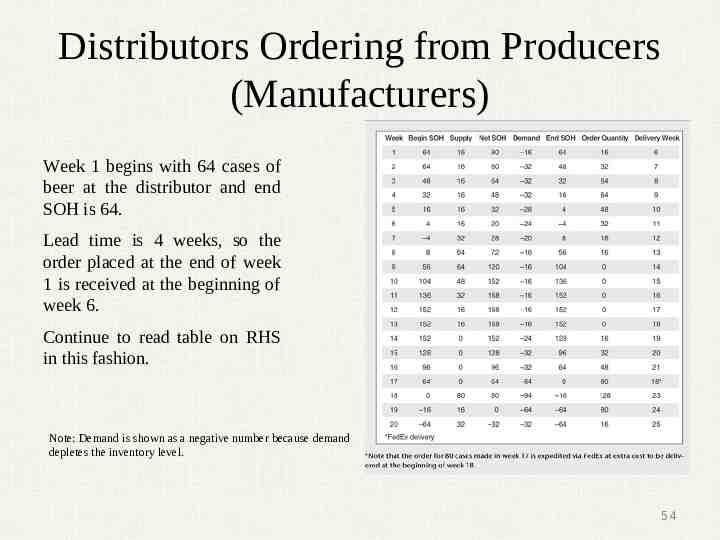

Distributors Ordering from Producers (Manufacturers) Week 1 begins with 64 cases of beer at the distributor and end SOH is 64. Lead time is 4 weeks, so the order placed at the end of week 1 is received at the beginning of week 6. Continue to read table on RHS in this fashion. Note: Demand is shown as a negative number because demand depletes the inventory level. 54

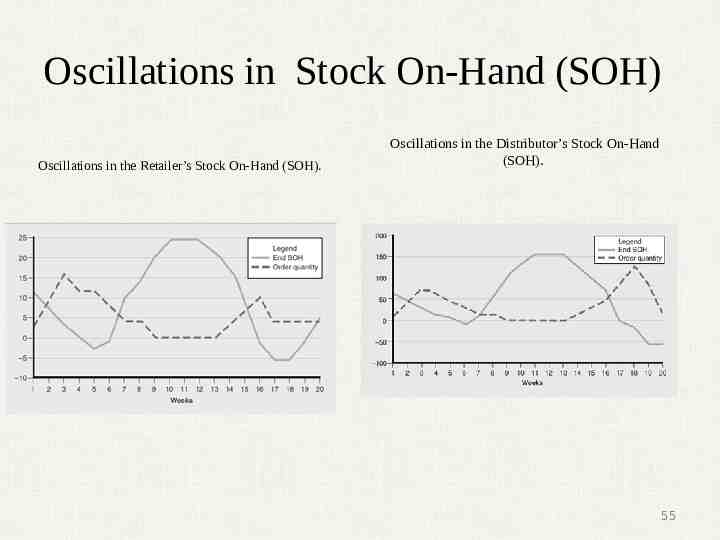

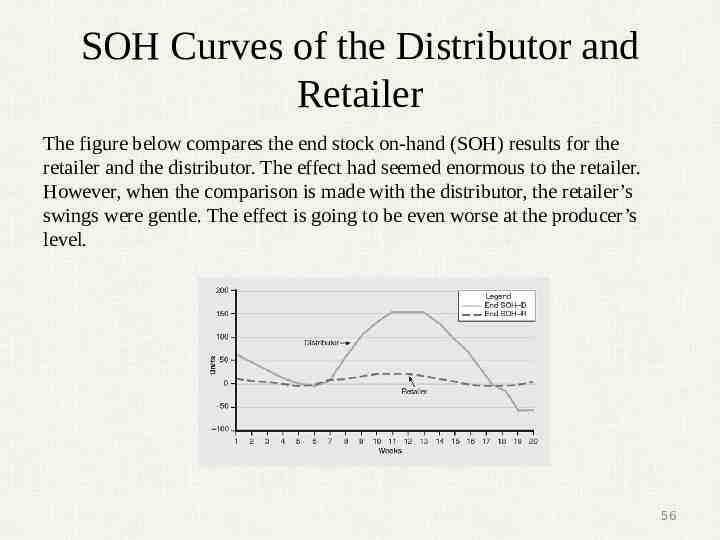

Oscillations in Stock On-Hand (SOH) Oscillations in the Retailer’s Stock On-Hand (SOH). Oscillations in the Distributor’s Stock On-Hand (SOH). 55

SOH Curves of the Distributor and Retailer The figure below compares the end stock on-hand (SOH) results for the retailer and the distributor. The effect had seemed enormous to the retailer. However, when the comparison is made with the distributor, the retailer’s swings were gentle. The effect is going to be even worse at the producer’s level. 56

Thank you 57