in Head Start Credit and Debt: Make it work for you! Name, county,

29 Slides1.78 MB

in Head Start Credit and Debt: Make it work for you! Name, county, and date here Money mart in Head Start

All Credit is Not Equal Money mart in Head Start

Affordable Credit vs. Too Much Credit Money mart in Head Start

When you use credit, you’re spending money before you earn it. Money mart in Head Start

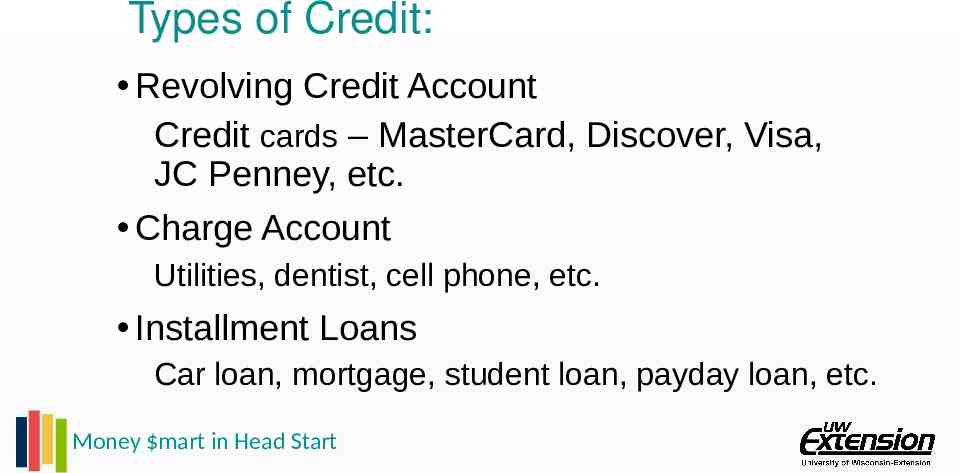

Types of Credit: Revolving Credit Account Credit cards – MasterCard, Discover, Visa, JC Penney, etc. Charge Account Utilities, dentist, cell phone, etc. Installment Loans Car loan, mortgage, student loan, payday loan, etc. Money mart in Head Start

Types of Credit Secured vs. Unsecured Dischargeable vs. Non-dischargeable Money mart in Head Start

What’s the Difference? Credit Cards Debit Cards Prepaid Cards Secured Credit Cards Money mart in Head Start

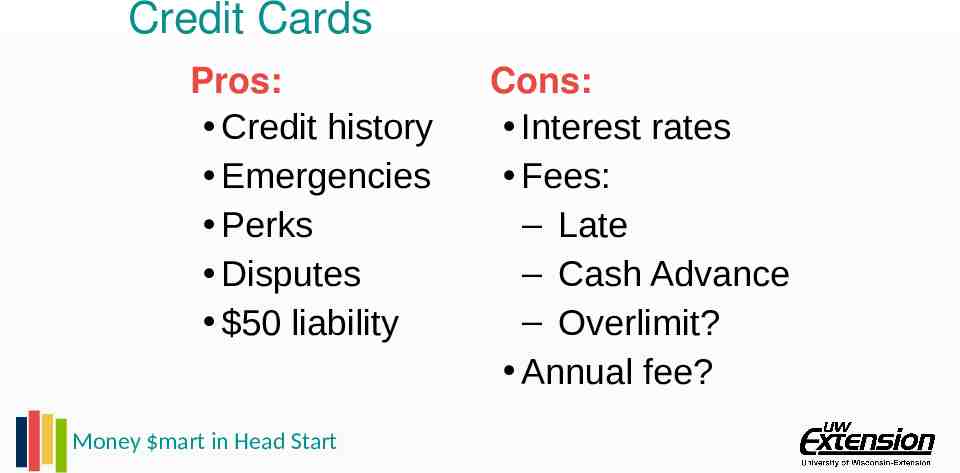

Credit Cards Pros: Credit history Emergencies Perks Disputes 50 liability Money mart in Head Start Cons: Interest rates Fees: ‒ Late ‒ Cash Advance ‒ Overlimit? Annual fee?

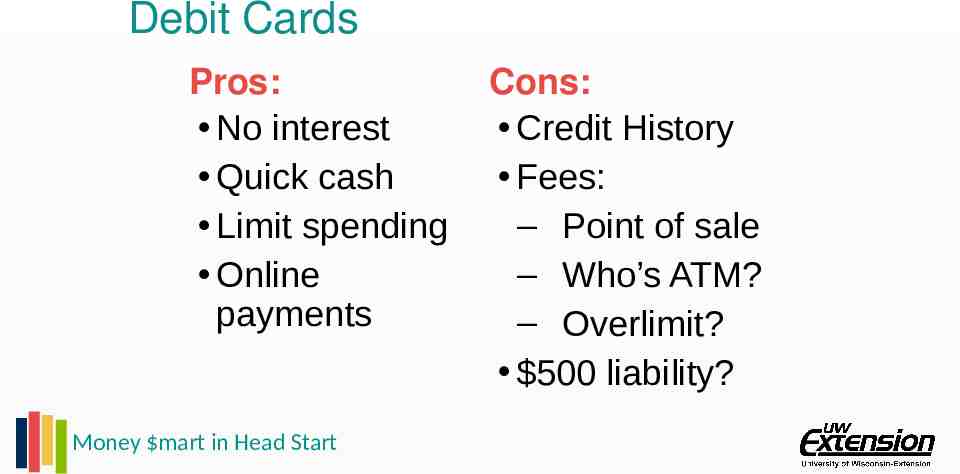

Debit Cards Pros: No interest Quick cash Limit spending Online payments Money mart in Head Start Cons: Credit History Fees: ‒ Point of sale ‒ Who’s ATM? ‒ Overlimit? 500 liability?

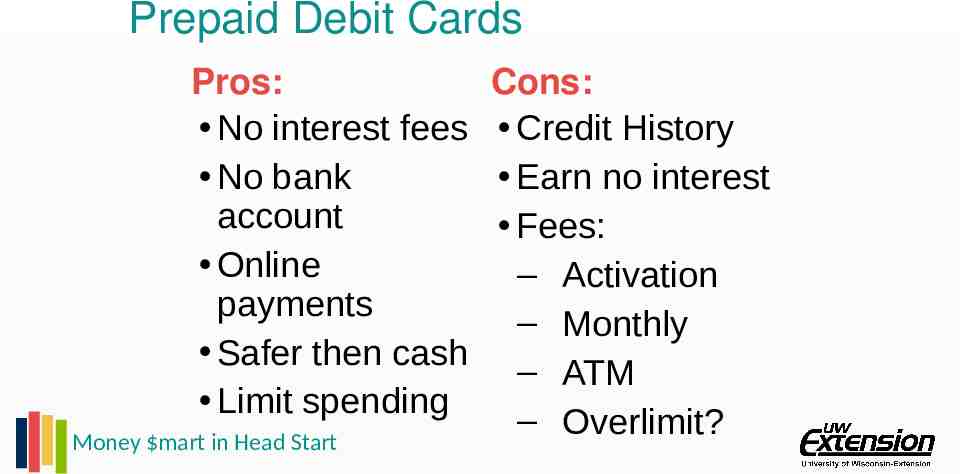

Prepaid Debit Cards Pros: No interest fees No bank account Online payments Safer then cash Limit spending Money mart in Head Start Cons: Credit History Earn no interest Fees: ‒ Activation ‒ Monthly ‒ ATM ‒ Overlimit?

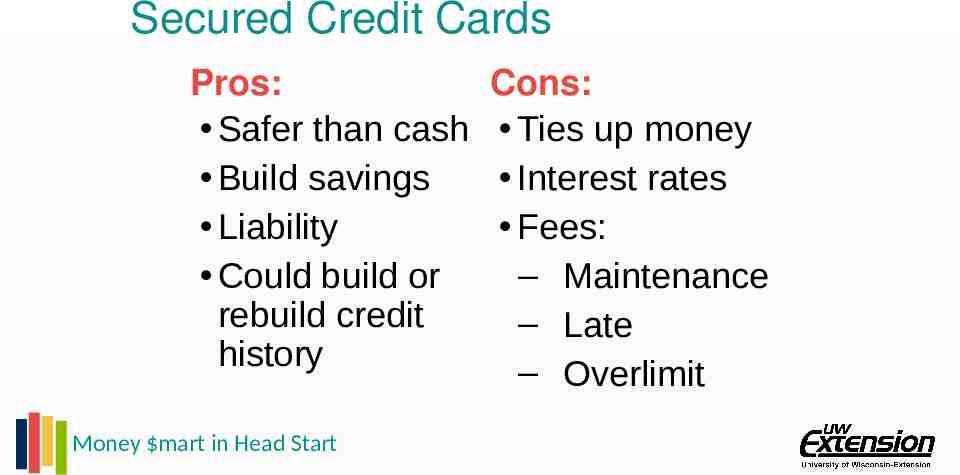

Secured Credit Cards Pros: Safer than cash Build savings Liability Could build or rebuild credit history Money mart in Head Start Cons: Ties up money Interest rates Fees: ‒ Maintenance ‒ Late ‒ Overlimit

When you do use credit know how much today’s credit will cost you tomorrow. Money mart in Head Start

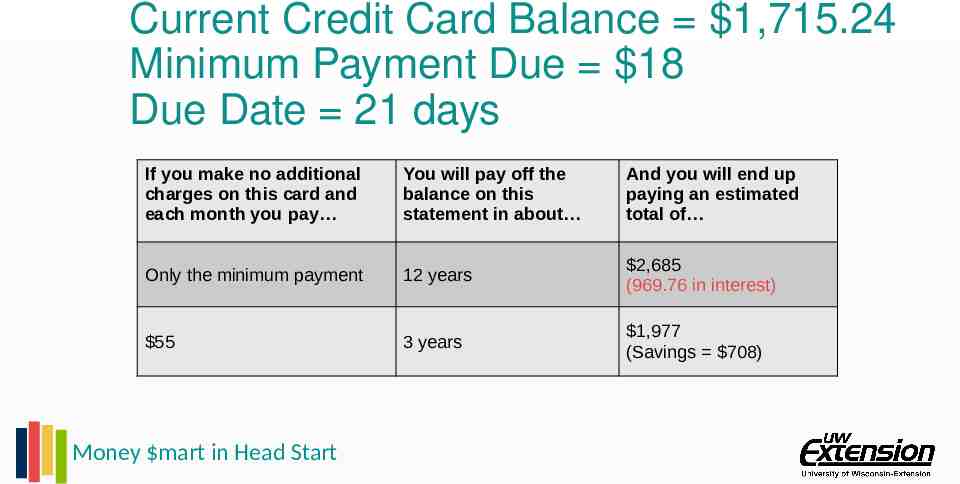

Current Credit Card Balance 1,715.24 Minimum Payment Due 18 Due Date 21 days If you make no additional charges on this card and each month you pay You will pay off the balance on this statement in about And you will end up paying an estimated total of Only the minimum payment 12 years 2,685 (969.76 in interest) 55 3 years 1,977 (Savings 708) Money mart in Head Start

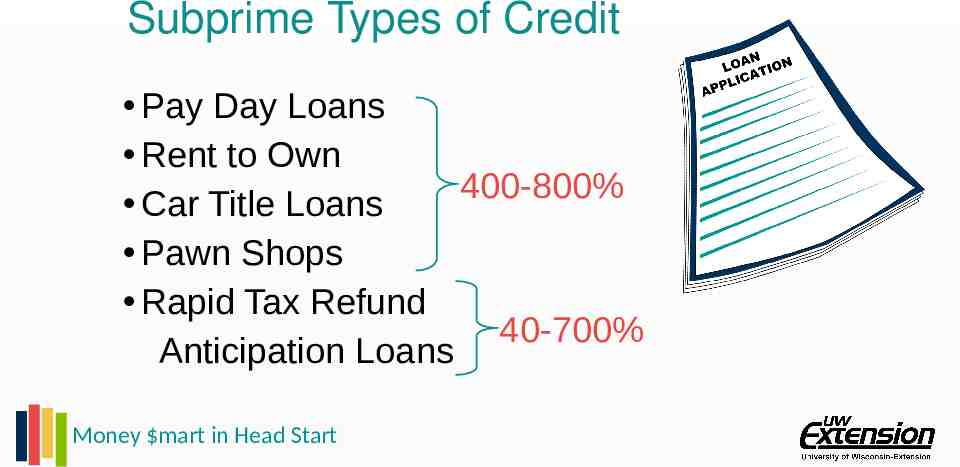

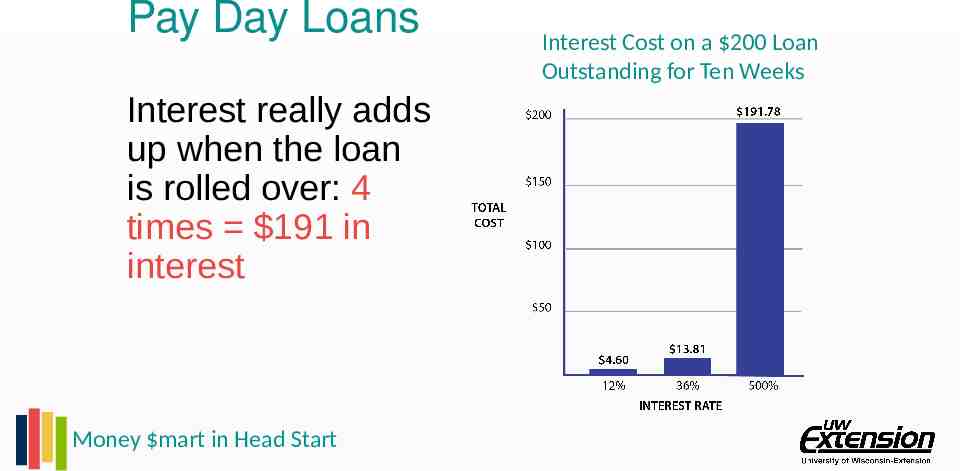

Subprime Types of Credit Pay Day Loans Rent to Own 400-800% Car Title Loans Pawn Shops Rapid Tax Refund 40-700% Anticipation Loans Money mart in Head Start

Pay Day Loans Interest really adds up when the loan is rolled over: 4 times 191 in interest Money mart in Head Start Interest Cost on a 200 Loan Outstanding for Ten Weeks

Who cares about your credit? Creditors/Lenders Insurance Companies Landlords Employers Utility Companies Government Agencies YOU! Money mart in Head Start

Credit Reporting Agencies Equifax Experian TransUnion Money mart in Head Start

FREE Credit Report www.annualcreditreport.com 1-877-322-8228 Annual Credit Report Request Service PO Box 105281 Atlanta GA 30348-5281 Check for mistakes! Money mart in Head Start

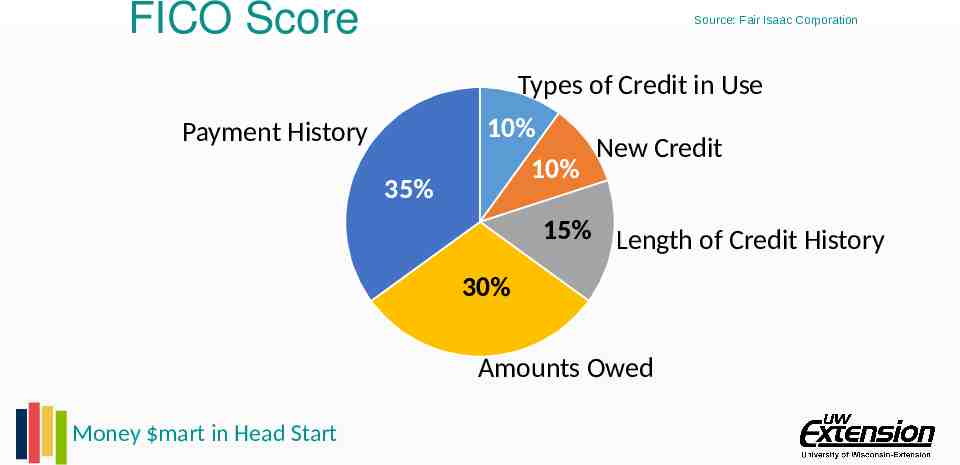

Credit Scores FICO Score most widely used Vantage Score – 3 Bureaus Many other “score” brands Money mart in Head Start

Free Educational “Credit Score” Services: Creditkarma.com Credit.com Quizzle.com Freecreditscore.com Discover card Money mart in Head Start Likely not the same score your lender uses.

FICO Score Source: Fair Isaac Corporation Types of Credit in Use Payment History 35% 10% New Credit 10% 15% Length of Credit History 30% Amounts Owed Money mart in Head Start

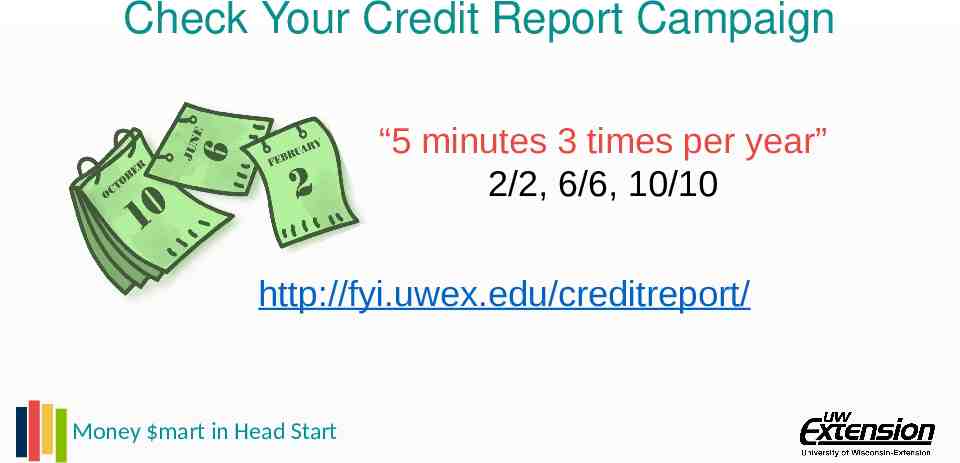

Check Your Credit Report Campaign “5 minutes 3 times per year” 2/2, 6/6, 10/10 http://fyi.uwex.edu/creditreport/ Money mart in Head Start

Signs that you have more expenses than income: e m o c n I Lost sleep. g n i d n Spe Behind on bills. Carry a credit card balance. Spending money for interest and late fees. Not able to save for future purchases. Increase in money arguments. Money mart in Head Start

Catching up on credit payments: Try not to take on any new debts. Make a list of all your debts. Figure out how much money you can pay towards debt. If you have money for payments - Use “PowerPay” Money mart in Head Start

“Power Pay” Concept Pay your credit payments as usual. When first loan is paid off . . . . . . apply that payment to the next loan. When loan two is paid off . . . . . . add that payment to the next loan. Continue this process until all loans are paid off. Utah State University Extension www.powerpay.org or app store Money mart in Head Start

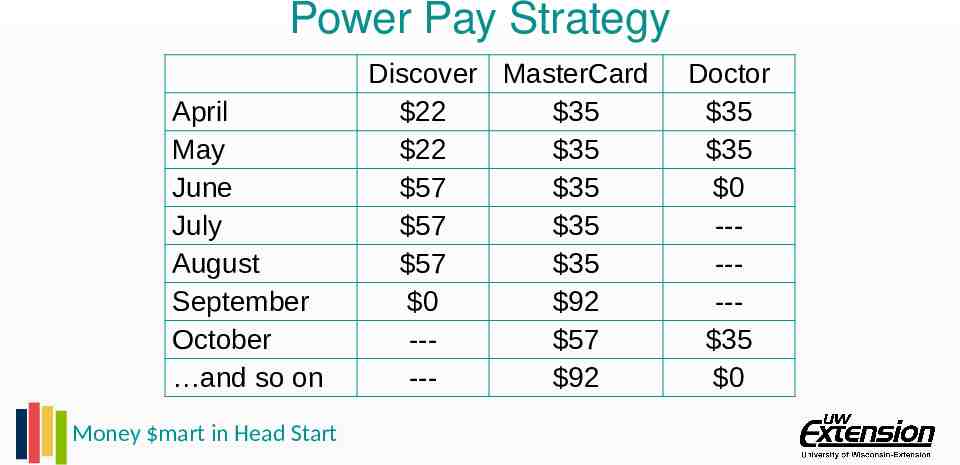

Power Pay Strategy April May June July August September October and so on Money mart in Head Start Discover MasterCard 22 35 22 35 57 35 57 35 57 35 0 92 -- 57 -- 92 Doctor 35 35 0 ------ 35 0

But what if there’s not enough money? e m o Inc g n i d n e Sp Money mart in Head Start

If you have don’t have money for minimum payments: Talk with your creditors Financial counseling Debt management plans Debt consolidation Bankruptcy Money mart in Head Start

When you can’t pay bills . . . Act now! Money mart in Head Start