South African Revenue Service Tax Directives Webinar

32 Slides1.17 MB

South African Revenue Service Tax Directives Webinar

Welcome to the SARS Webinar Purpose: This presentation is merely to provide information in an easily understandable format and is intended to make the provisions of the legislation more accessible. Disclaimer: The information therefore has no binding legal effect and the relevant legislation must be consulted in the event of any doubt as to the meaning or application of any provision. 2

SARS Vision 2024 To To build build aa smart smart modern modern SARS SARS with with unquestionable unquestionable integrity, integrity, trusted trusted and and admired admired by by Government, Government, the the public, public, as as well well as as our our international international peers. peers. For For the the purpose purpose of of this this presentation, presentation, we we focus focus on on the the following following strategic strategic objectives: objectives: MODERNIZE SYSTEMS TO PROVIDE SEAMLESS ONLINE DIGITAL SERVICES MAKE IT EASY & SIMPLE TO COMPLY MAKE IT HARD TO NOT COMPLY CREATE AWARENESS, CLARITY & CERTAINTY 3 USE DATA FOR INSIGHTS, RISKS & IMPROVED OUTCOMES

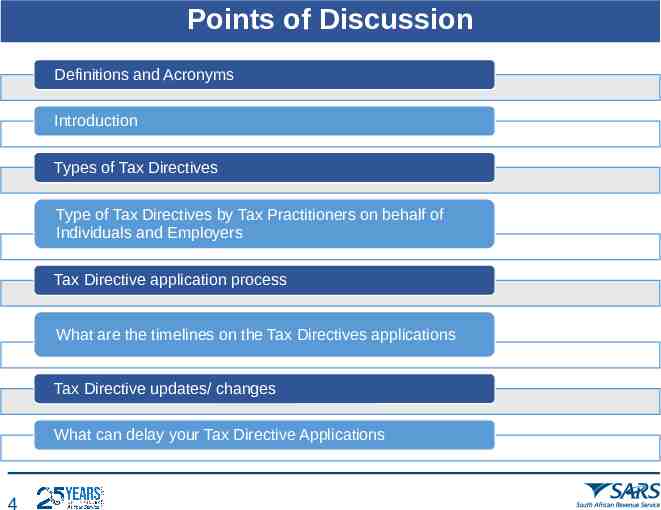

Points of Discussion Definitions and Acronyms Introduction Types of Tax Directives Type of Tax Directives by Tax Practitioners on behalf of Individuals and Employers Tax Directive application process What are the timelines on the Tax Directives applications Tax Directive updates/ changes What can delay your Tax Directive Applications 4

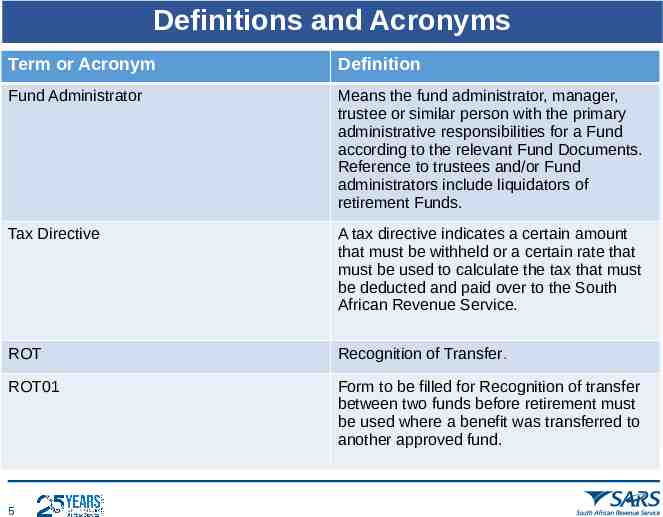

Definitions and Acronyms Term or Acronym Definition Fund Administrator Means the fund administrator, manager, trustee or similar person with the primary administrative responsibilities for a Fund according to the relevant Fund Documents. Reference to trustees and/or Fund administrators include liquidators of retirement Funds. Tax Directive A tax directive indicates a certain amount that must be withheld or a certain rate that must be used to calculate the tax that must be deducted and paid over to the South African Revenue Service. ROT Recognition of Transfer. ROT01 Form to be filled for Recognition of transfer between two funds before retirement must be used where a benefit was transferred to another approved fund. 5

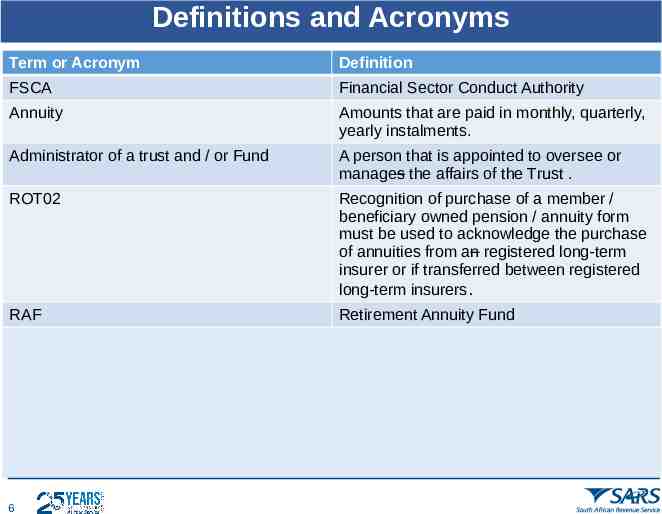

Definitions and Acronyms Term or Acronym Definition FSCA Financial Sector Conduct Authority Annuity Amounts that are paid in monthly, quarterly, yearly instalments. Administrator of a trust and / or Fund A person that is appointed to oversee or manages the affairs of the Trust . ROT02 Recognition of purchase of a member / beneficiary owned pension / annuity form must be used to acknowledge the purchase of annuities from an registered long-term insurer or if transferred between registered long-term insurers. RAF Retirement Annuity Fund 6

Introduction Why must a tax directive application be submitted? Fund Administrators and Employers are required in terms of paragraph 9(3) of the Fourth Schedule of the Act to apply for a tax directive for any lump sum payable. SARS will calculate the prescribed amount of employees’ tax that has to be withheld from the specific lump sum payment, which must be paid over to SARS. The information the Employer or Fund Administrator provided on the application form is used to determine the tax payable. Fund Administrators / Trustees / Long-term Insurers / Employers must submit a tax directive application, even if the lump sum amount payable is less than the allowable deductions in terms of the Second Schedule to the Act. Employers must also submit other tax directive application for lump sum payments such as: Gratuities, Fixed amounts, leave payment on retirement, etc. 7

Introduction Reasons for employers, Fund Administrators to apply for a tax directive irrespective of lump sum amount Applicants (Employers, Fund Administrators) are normally not aware of: the lump sum benefits submitted by other Fund Administrators, Employers or Long-term Insurers; the deductions that were previously allowed; or if the taxpayer will qualify for any deduction. Where a lump sum benefit is payable, a tax directive application must be submitted to allow SARS to: 8 consider lump sums, if any, received prior to the current lump sum; calculate the allowable deduction in terms of the Second Schedule to the Act; determine the tax to be withheld from the lump sum benefit payment; and issue a stop-order where the recipient has any outstanding taxes.

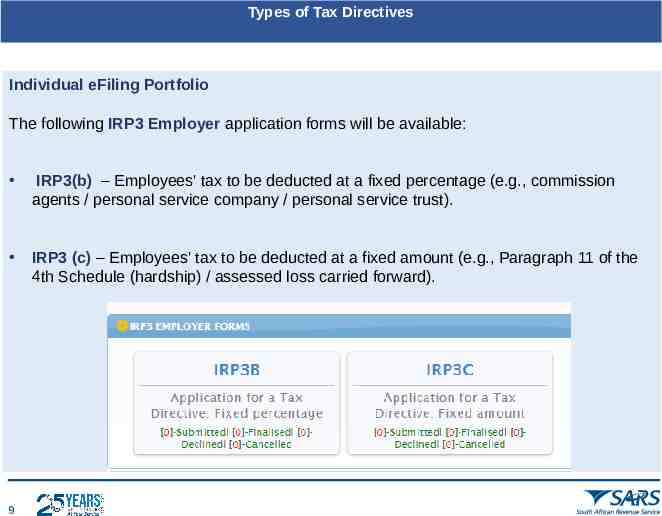

Types of Tax Directives Individual eFiling Portfolio The following IRP3 Employer application forms will be available: IRP3(b) – Employees' tax to be deducted at a fixed percentage (e.g., commission agents / personal service company / personal service trust). IRP3 (c) – Employees' tax to be deducted at a fixed amount (e.g., Paragraph 11 of the 4th Schedule (hardship) / assessed loss carried forward). 9

Types of Tax Directives Tax Practitioner eFiling Portfolio The following IRP3 Employer application forms will be available: IRP 3(b) – Employees' tax to be deducted at a fixed percentage (e.g., commission agents / personal service company / personal service trust). IRP 3(c) – Employees' tax to be deducted at a fixed amount (e.g., Paragraph 11 of the 4th Schedule (hardship) / assessed loss carried forward). IRP 3(f) - Doubtful Debts 11(j)(1)(2) IRP 3(q) – Foreign Tax Credit under paragraph of 10 of the 4th Schedule of Income Tax Act 10

Types of Tax Directives Organisation eFiling Portfolio The following applications will be available: Form A&D – Lump sums paid by pension, pension preservation fund, provident or provident preservation fund. (e.g., death before retirement / retirement due to ill health / retirement / provident fund – deemed retirement). The reason “Retirement” must be used where the member has reached the retirement age according to the rules of the Fund and has either elected to take a portion in cash or purchase an annuity or annuities with the full benefit. A member can transfer their member’s interest to a Retirement Annuity, pension preservation or provident preservation fund before electing to retire. However, if the reason on the tax directive is 'Retirement' the member cannot transfer the remaining twothirds to a Retirement Annuity Fund. The member can purchase an annuity from a registered long-term Insurer or can purchase an annuity from a registered long-term Insurer and have the annuity provided by the fund. 11

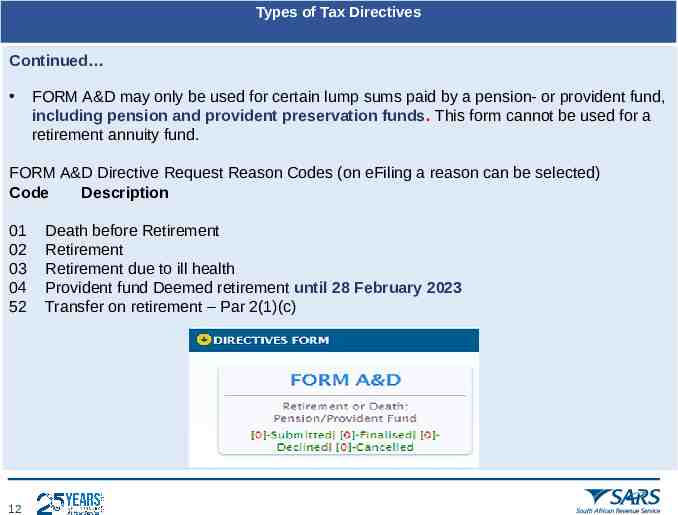

Types of Tax Directives Continued FORM A&D may only be used for certain lump sums paid by a pension- or provident fund, including pension and provident preservation funds. This form cannot be used for a retirement annuity fund. FORM A&D Directive Request Reason Codes (on eFiling a reason can be selected) Code Description 01 02 03 04 52 12 Death before Retirement Retirement Retirement due to ill health Provident fund Deemed retirement until 28 February 2023 Transfer on retirement – Par 2(1)(c)

Types of Tax Directives Form B – Lump sums paid by a pension or provident fund prior to retirement of the member (e.g. resignation / withdrawal / winding up / transfer / Section 1, Paragraph (eA) of the definition of gross income transfer or payment / future surplus / unclaimed benefit / divorce – transfer, divorce – non-member spouse / divorce – member spouse / housing loan / involuntary termination of employment (retrenchment) including withdrawals from a pension preservation or provident preservation fund). Form B directive requests must also be submitted where a pension fund or a provident fund is wound up. Note that Form B may not be used for withdrawals from retirement annuity funds, but must be used if there is a transfer from an Approved fund to a RAF. 13

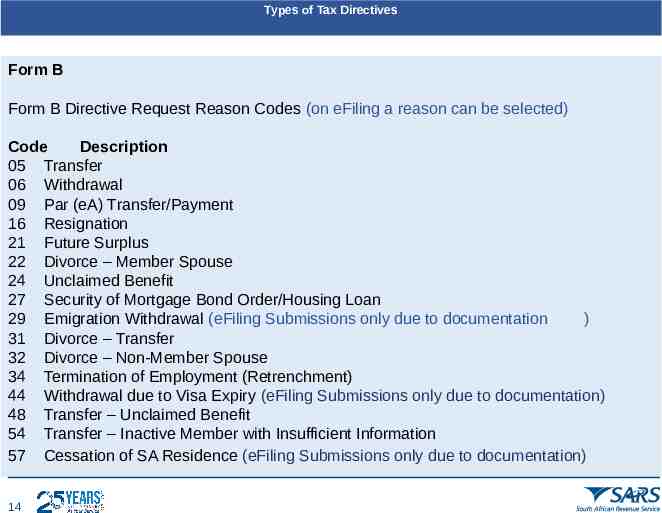

Types of Tax Directives Form B Form B Directive Request Reason Codes (on eFiling a reason can be selected) Code Description 05 Transfer 06 Withdrawal 09 Par (eA) Transfer/Payment 16 Resignation 21 Future Surplus 22 Divorce – Member Spouse 24 Unclaimed Benefit 27 Security of Mortgage Bond Order/Housing Loan 29 Emigration Withdrawal (eFiling Submissions only due to documentation ) 31 Divorce – Transfer 32 Divorce – Non-Member Spouse 34 Termination of Employment (Retrenchment) 44 Withdrawal due to Visa Expiry (eFiling Submissions only due to documentation) 48 Transfer – Unclaimed Benefit 54 Transfer – Inactive Member with Insufficient Information 57 Cessation of SA Residence (eFiling Submissions only due to documentation) 14

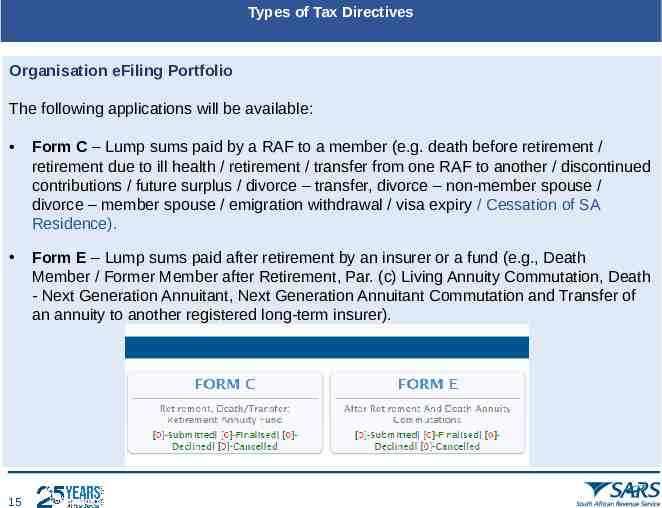

Types of Tax Directives Organisation eFiling Portfolio The following applications will be available: Form C – Lump sums paid by a RAF to a member (e.g. death before retirement / retirement due to ill health / retirement / transfer from one RAF to another / discontinued contributions / future surplus / divorce – transfer, divorce – non-member spouse / divorce – member spouse / emigration withdrawal / visa expiry / Cessation of SA Residence). Form E – Lump sums paid after retirement by an insurer or a fund (e.g., Death Member / Former Member after Retirement, Par. (c) Living Annuity Commutation, Death - Next Generation Annuitant, Next Generation Annuitant Commutation and Transfer of an annuity to another registered long-term insurer). 15

Types of Tax Directives IRP3 Employer Form IRP3(s)- share option – Employees' tax to be deducted on any amount to be included under section 8A or 8C of the Income Tax Act. IRP3(a) – Gratuities paid by employer (e.g., death / retirement / retirement due to ill health / retrenchment / other – to supply a reason for payment). IRP 3(b) – Employees' tax to be deducted at a fixed percentage (e.g. commission agents / personal service company / personal service trust). Note: The IRP3(b) directive application process has been changed. Applicants are no longer permitted to select a percentage of their own choice as was allowed in previous years. This process is now completely automated, and the system calculates the percentage based on the income and expenses declared by the applicant. 16

Types of Tax Directives IRP3 Employer Form IRP 3(c) – Employees' tax to be deducted at a fixed amount (e.g., Paragraph 11 of the 4th Schedule (hardship) / assessed loss carried forward). IRP 3(f) - Doubtful Debts 11(j)(1)(2). IRP 3(q) – Foreign Tax Credit under paragraph of 10 of the 4th Schedule of Income Tax Act. 17

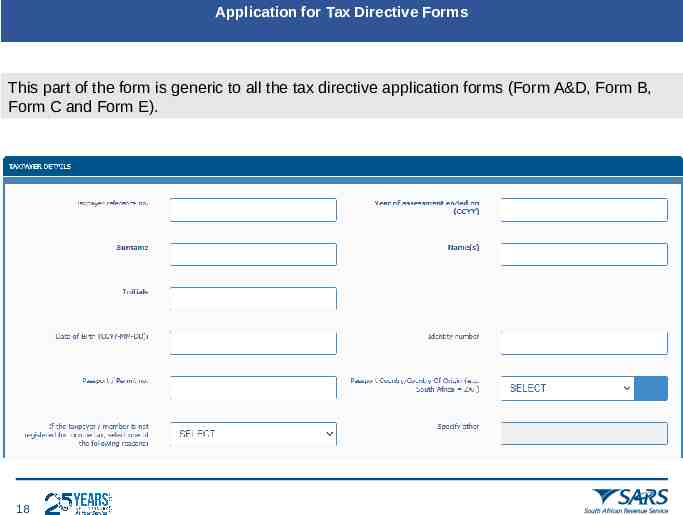

Application for Tax Directive Forms This part of the form is generic to all the tax directive application forms (Form A&D, Form B, Form C and Form E). 18

Application for Tax Directive Forms Recipient Details Under the ‘Taxpayer Details’ container provide the personal details of the member / person who will receive the lump sum benefit payment. If the tax directive application form is submitted and the directive reason ‘Divorce – transfer’ or ‘Divorce non-member spouse’ is selected on the tax directive application form, with a date of divorce after 13 September 2007 and the date of accrual is after 1 March 2009, the personal details of the spouse who will receive the lump sum benefit must be completed under this container. The information in this container must be used to issue an IRP5/IT3(a) tax certificate for the lump sum benefit amount paid. 19

Application for Tax Directive Forms Income Tax Number This number is also referred to as the income tax reference number and is allocated by SARS to the taxpayer when registering for income tax purposes. This number must be on the IRP5/IT3(a) tax certificate. In the case of a divorce order granted after 13 September 2007 and a date of accrual after 1 March 2009 the income tax reference number of the spouse who will receive the benefit must be provided on the tax directive application form. SARS has implemented a new function on eFiling that allows the Fund Administrator or Insurer to request the income tax reference number where only the ID number is known. If the taxpayer / member is not registered for income tax, select one of the following reasons: 1. Unemployed or 2. Other (Supply Reason) 20

Application for Tax Directive Forms Annual Income The annual income must reflect all income received by or which accrued to the taxpayer during the year of assessment, e.g., salary, remuneration, earnings, emolument, wages, bonuses, fees, gratuities, commission, pension, overtime payments, royalties, stipend, allowances and benefits, interest, annuities, share of profits, rental income, compensation, honorarium, etc. This field is only mandatory if: The reason on the tax directive application is ‘Par (eA) Transfer / Payment’. This is only applicable to public sector funds. The application is for unapproved funds; Form B and Form E where the date of accrual is prior to 1 March 2009; or Form A&D and Form C, where the date of accrual is prior to 1 October 2007. 21

Tax Directive Application Process How to obtain a tax directive application form? The tax directive application forms can be obtained through any of the following channels: eFiling: If not registered as an eFiler, please log on to sarsefiling.co.za to register and refer to the guide: ‘How to Register for eFiling and manage your user profile’ Electronically (via an Interface Agent or eFiling). Fund Administrators or Long-term Insurers can be registered as an Interface Agent or use established Interface Agents to capture the tax directive application forms online. The interface specification IBIR-006 and the INF001 form, to register to obtain access to the SARS Interface, are available on the SARS website. For the following applications, no supporting documents are required: 22 Form A&D, Form B, Form C, Form E; IRP3(a) and IRP3(s); and Part B of the ROT01 and ROT02.

Tax Directives Application Process For certain tax directive reasons, supporting documents are required e.g. Emigration withdrawal, Cessation of SA residence, Withdrawal due to Visa Expiry, Par.(eA) Living Annuity Commutation - Termination of a Trust, as well as for cases where any of the tax directive reasons are used for a non-resident taxpayer where the DTA (Double Taxation Agreement) must be taken into account. A certificate of residence must be provided to confirm the residence status of the person. How to submit a Tax Directive Application Form? NOTE: It is recommended that the Fund Administrator or Long-term Insurer makes use of either eFiling or the electronic submission of tax directive application form/s through the Interface agencies to obtain a tax directive. The Fund Administrators / Long-term Insurers can only submit tax directive applications, that requires supporting documents through eFiling, for example tax directives for non-residents that require the certificate of residence, ‘Visa expiry’, etc. 23

Timelines on the Tax Directives applications For applications with no supporting document the response is the same day if submitted during working hours. Only applications with supporting documents where a case is created for a user to review the supporting documents can take up to 21 working days. 24

Tax Directive updates/ changes 25 April 2022 – Legislative changes to the Tax Directives process have been implemented. Taxpayers who are members of a pension preservation or provident preservation fund, who have reached retirement age and are 55 years and older are now allowed to transfer the retirement interest in that fund before electing to retire from that preservation fund to another preservation fund or a retirement annuity fund on a tax neutral basis using Form A&D – reason ‘Transfer before Retirement [par 2(1)(c)]’. Taxpayers can now, on retirement, elect to use two thirds (⅔) or more of the total value of the retirement interest in the fund to receive a pension and / or annuity from the fund or purchase a living annuity and / or a guaranteed annuity from a registered long-term Insurer. Alternatively, they can elect to keep a portion of the retirement interest in the fund which will provide a pension and / or annuity and use a portion to purchase a living annuity and / or a guaranteed annuity from a registered Long-term Insurer. However, it is important to note that the condition placed on the purchase of an annuity is that the value of each annuity (living and / or guaranteed and / or remaining in the fund) must be R165 000 and above, respectively. 25

Tax Directive updates/ changes 25 July 2022 – Emigration withdrawal changes The tax directive system included a validation that results in tax directive applications, with the ‘Emigration withdrawal’ reason where the date of accrual is on or after 1 March 2022, being rejected. The tax directive validation has been subsequently removed. This means that the accrual date for tax directive applications with the reason ‘Emigration withdrawal’ can be a date after 1 March 2022 but the following supporting documents must be attached to the tax directive application submitted through eFiling to prevent the tax directive being rejected: The emigration application (MP336(b)) with a date stamp before 1 March 2021; and The letter issued by the Authorised dealer must indicate that the emigration is recognised for purposes of exchange control before 1 March 2022 (SARB Approval date). 19 September 2022 The guide was updated to indicate that the information on the FSCA website must be used to complete the tax directive application forms to avoid the rejection of the application forms. This means the exact fund names must be used (including spelling, special characters, etc.) 26

Tax Directive updates/ changes 10 October 2022 – Update on Tax Directives enhancements in line with Financial Sector Conduct Authority (FSCA) were implemented SARS implemented enhancements to the Tax Directives process on 16 September 2022 by validating the name of the fund at the Financial Sector Conduct Authority (FSCA) as well as the number with the FSCA database. Where Funds and Fund Administrators experience spelling errors between information on the FSCA website that is not aligned with the FSCA registration letter, a request to correct the spelling error must be sent to the following contact person: Jodine Scholts at [email protected] at the FSCA. Please note that this email address is only for the correction of spelling errors of names. All other issues relating to the FSCA, must be directly addressed with the FSCA via the existing channels available to the Funds and Fund Administrators. Fund Administrators and registered long term Insurers are advised to continue using the name exactly as it is listed on the FSCA website until the changes on the name have been effected to avoid a rejection of the directive application. 27

Tax Directive updates / changes The tax rates related to Par 2(2B) of the Fourth Schedule, are calculated using normal tax rates and information pertaining to the taxpayer at the time of processing. Given that such information may change and require a revised tax rate, an enhancement is required to cater for specific individual fixes as and when necessary. In addition to providing an indication to the retirement fund or a long-term insurer whether the tax rate results from: An initial full run; A re-run; A partial run; or A full year. 28

Tax Directive updates/ changes As per the current process, once the tax rates for Par 2(2B) have been calculated, the cover letter and tax rate file are generated, and made available to the employer on e@syfile Employer and eFiling (for employers with 50 or less employees). Enhancements to the user roles on eFiling have been implemented to specify and provide clarity for the various user profiles with respect to the following functionalities: View – the user will be able to only view the letter containing the fixed tax rates related to Par 2(2B) of the Fourth Schedule. Completion – the user will be able to view and download the file and complete application forms. Submission – the user will be able to view and download the file, complete and submit application forms. The IRP3(s) form has been improved to allow for employer share schemes that are longer than 5 years. The fields to indicate the qualifying periods during which the exemption under section 10(1)(o)(ii) may apply and other relevant fields were increased from 5 to 15 fields. 29

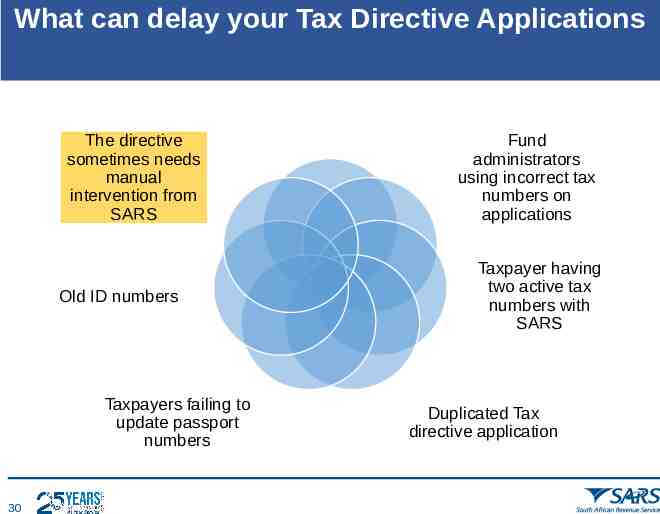

What can delay your Tax Directive Applications The directive sometimes needs manual intervention from SARS Old ID numbers Taxpayers failing to update passport numbers 30 Fund administrators using incorrect tax numbers on applications Taxpayer having two active tax numbers with SARS Duplicated Tax directive application

Go Digital Remember our Digital Channels We’ve made it easier for you Go Digital! Download the SARS MobiApp via your app store Register for eFiling SARS Online Query System Visit us on our Social Media platforms LinkedIn Facebook Twitter For more information, visit the SARS website: www.sars.gov.za 31