Medicare 101 AADVPP010M(19)-CT 1

36 Slides5.28 MB

Medicare 101 AADVPP010M(19)-CT 1

What is Medicare? Medicare is a federal insurance program administered by the Centers for Medicare and Medicaid Services (CMS) CMS is an agency within the Department of Health and Human Services (HHS) Social Security Offices process applications for Medicare and can also provide general information on the program 22

Who is eligible? Age 65 or older OR under age 65 with permanent disabilities* If age 65 or older, you are eligible if: You or your spouse worked and paid Social Security taxes for at least 40 quarters (10 years) You are a permanent resident of the US or a legal citizen who has lived in the US for five (5) years in a row *For all ages with end-stage renal disease (ESRD) or permanently disabled 33

Terms You May Need to Know Benefits: the products and services that are covered by a health plan Provider: a term for pharmacies, hospitals, doctors, other health care professionals and health care facilities Premium: a dollar amount a member gets billed monthly by a health plan to have coverage Benefit Period: starts the day you are admitted to a hospital as an inpatient, or to a SNF*. It ends the day you have been out of the hospital or SNF* for 60 days in a row. Coinsurance: the amount (usually a percentage) you may be required to pay for services after you pay any plan deductibles Deductible: a dollar amount a health care plan member must pay for covered services before the plan begins paying for covered services Co-Payment: cost sharing where the member pays a pre-set, flat amount for medical service *SNF Skilled Nursing Facility 44

The 4 parts to Medicare Original Medicare: Part A Hospital and Part B Medical Part C – Medicare Advantage Plan Part D – Prescription Drug Coverage 55

What Original Medicare Doesn’t Cover Private Insurance Plans may cover what Original Medicare does not such as: Part D Prescription Coverage Deductibles and Coinsurance Dental care Routine eye care, foot care and hearing tests Chiropractic services Emergency coverage while traveling outside of the US Services typically outside of those deemed medically necessary, i.e., meal delivery and transportation benefit, respite, daycare services and over-the-counter medication coverage 66

What Medicare Covers: Part A: Hospital Insurance Hospital stays Skilled nursing facility care Hospice care Some home health care Part B: Medical Coverage Doctors’ services Outpatient medical and surgical services, supplies Clinical lab tests Durable medical equipment Preventive services 77

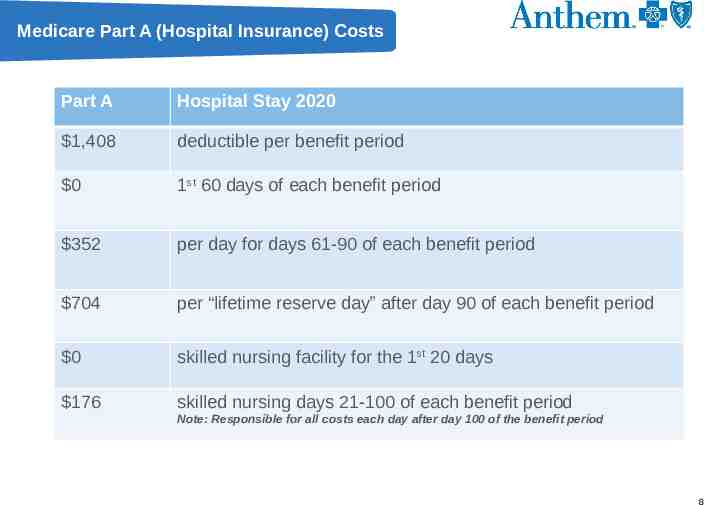

Medicare Part A (Hospital Insurance) Costs Part A Hospital Stay 2020 1,408 deductible per benefit period 0 1st 60 days of each benefit period 352 per day for days 61-90 of each benefit period 704 per “lifetime reserve day” after day 90 of each benefit period 0 skilled nursing facility for the 1st 20 days 176 skilled nursing days 21-100 of each benefit period Note: Responsible for all costs each day after day 100 of the benefit period 88

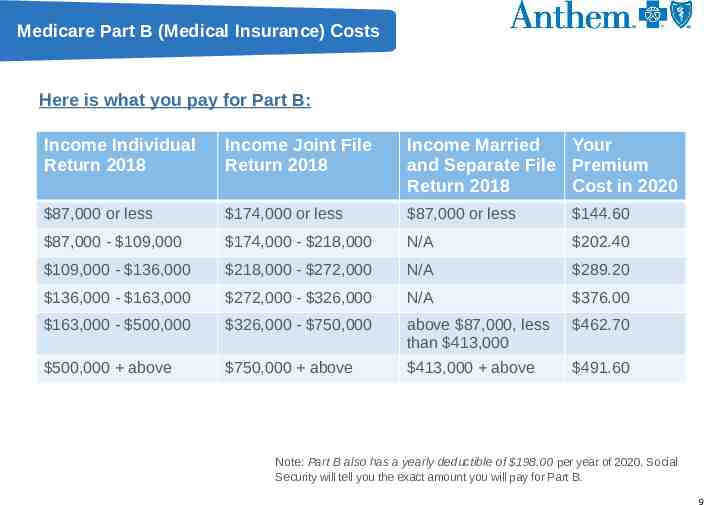

Medicare Part B (Medical Insurance) Costs Here is what you pay for Part B: Income Individual Return 2018 Income Joint File Return 2018 Income Married Your and Separate File Premium Return 2018 Cost in 2020 87,000 or less 174,000 or less 87,000 or less 144.60 87,000 - 109,000 174,000 - 218,000 N/A 202.40 109,000 - 136,000 218,000 - 272,000 N/A 289.20 136,000 - 163,000 272,000 - 326,000 N/A 376.00 163,000 - 500,000 326,000 - 750,000 above 87,000, less than 413,000 462.70 500,000 above 750,000 above 413,000 above 491.60 Note: Part B also has a yearly deductible of 198.00 per year of 2020. Social Security will tell you the exact amount you will pay for Part B. 99

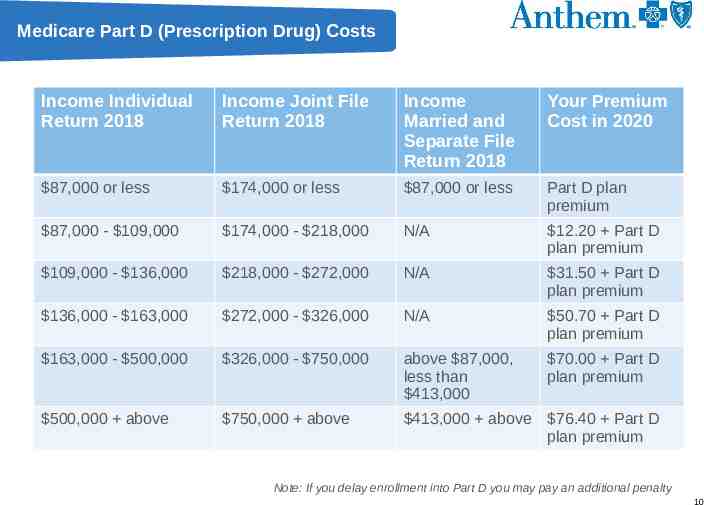

Medicare Part D (Prescription Drug) Costs Income Individual Return 2018 Income Joint File Return 2018 Income Married and Separate File Return 2018 Your Premium Cost in 2020 87,000 or less 174,000 or less 87,000 or less Part D plan premium 87,000 - 109,000 174,000 - 218,000 N/A 12.20 Part D plan premium 109,000 - 136,000 218,000 - 272,000 N/A 31.50 Part D plan premium 136,000 - 163,000 272,000 - 326,000 N/A 50.70 Part D plan premium 163,000 - 500,000 326,000 - 750,000 above 87,000, less than 413,000 70.00 Part D plan premium 500,000 above 750,000 above 413,000 above 76.40 Part D plan premium Note: If you delay enrollment into Part D you may pay an additional penalty 10 10

What We Will Cover Today 1 3 2 4 11 11

The Enrollment Periods 12

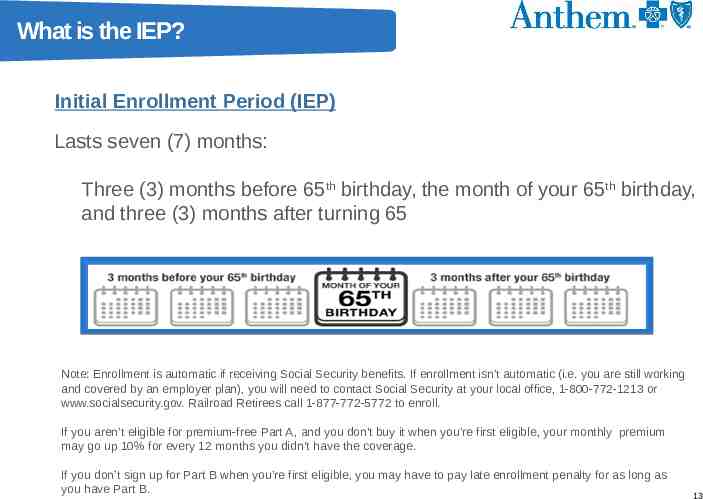

What is the IEP? Initial Enrollment Period (IEP) Lasts seven (7) months: Three (3) months before 65th birthday, the month of your 65th birthday, and three (3) months after turning 65 Note: Enrollment is automatic if receiving Social Security benefits. If enrollment isn’t automatic (i.e. you are still working and covered by an employer plan), you will need to contact Social Security at your local office, 1-800-772-1213 or www.socialsecurity.gov. Railroad Retirees call 1-877-772-5772 to enroll. If you aren’t eligible for premium-free Part A, and you don't buy it when you’re first eligible, your monthly premium may go up 10% for every 12 months you didn't have the coverage. If you don’t sign up for Part B when you’re first eligible, you may have to pay late enrollment penalty for as long as you have Part B. 13 13

Still working and not ready for Medicare? SEP Things to Consider Special Enrollment Period (SEP) If you enroll in Part A later than 65, If you are still working and have group coverage or have coverage you may do so only during the General Enrollment Period (GEP) through a spouse, you can enroll: or Special Enrollment Period Anytime still covered by (SEP) group plan Within eight (8) months of You may have to pay a late penalty the loss of coverage or for Part A if you have Part B employment, whichever happens first Having a conversation with your Benefits Administrator to identify any potential coverage gaps Note: Retiree and COBRA coverage are not considered active employment for the purposes of Part B enrollment 14 14

What is the GEP? General Enrollment (GEP) For those who do not sign up for Part B (or Premium Part A) during their Initial Enrollment Period: January 1st through March 31st annually Coverage begins July 1st Penalty applied (lifetime) 10% for each 12 months eligible but not enrolled Note: A Special Election Period (SEP) exists for those who have a qualifying life event like moving in or out of service 15 15

What is AEP? Annual Election Period (AEP) October 15 to December 7 each year You may switch to Original Medicare Change your Medicare Advantage (MA) plan too or enroll New coverage begins January 1 Note: Applies to Private Insurance and Part D ONLY 16 16

What to Remember and What’s Next Remember What Medicare covers and what it doesn’t Know how and when to sign up What’s next? Deciding on the number of choices that private insurance offer to enhance your Medicare coverage Medicare Advantage Plan Medicare Supplement Plan Prescription Drug Plan – Part D 17 17

Decision: What coverage is best for me? 18

Part B Things to Consider Part B: Medical Insurance You MUST have Part B if: You want to join a Medicare Advantage plan You want to buy Medigap (Medicare Supplement Insurance) You’re eligible for TRICARE Your employer coverage requires it You will still be required to pay 20% coinsurance unless you purchase additional coverage. Note: You could be subject to a late enrollment penalty for delaying enrollment in Part B 19 19

What is Medicare Advantage (Part C)? Combines Medicare Part A and B and in many times, Part D Prescription Drug coverage Offered by private health insurance companies like Anthem Am I eligible? Must be enrolled in Medicare Parts A and B, must live in plan service area, must not have end-stage renal disease (ESRD)* Often includes additional benefits like routine dental, vision and hearing. May also include wellness services including gym membership and telephonic nurse support * People with ESRD may be able to join a Medicare Special Needs Plan (SNP) if available in their service area. 20 20

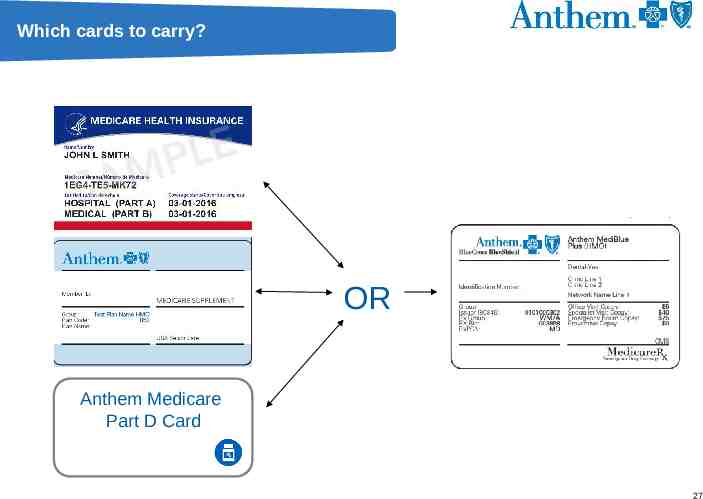

What is Medicare Supplement Insurance? Helps cover what Medicare Parts A and B do not Part D Prescription Drug coverage can be purchased separately Anthem Medicare Part D Card Offered by private insurance companies like Anthem Plans range in coverage and named A, B, C, D, F, G, K, L, M, N and a high-deductible plan, F* Am I eligible? and G benefits can vary by plan You must be enrolled in Medicare type Parts A and B, be a resident of the state you want coverage in, and of 65 years of age or qualify due to certain disabilities *As of 1/1/2020 due to changes in Federal law under MACRA, only individuals eligible for Medicare prior to 1/1/2020 can purchase Plan F. 21 21

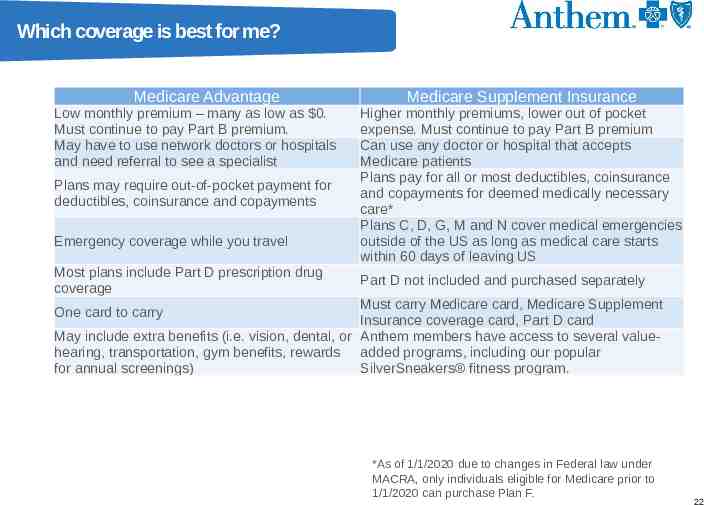

Which coverage is best for me? Medicare Advantage Low monthly premium – many as low as 0. Must continue to pay Part B premium. May have to use network doctors or hospitals and need referral to see a specialist Plans may require out-of-pocket payment for deductibles, coinsurance and copayments Emergency coverage while you travel Most plans include Part D prescription drug coverage Medicare Supplement Insurance Higher monthly premiums, lower out of pocket expense. Must continue to pay Part B premium Can use any doctor or hospital that accepts Medicare patients Plans pay for all or most deductibles, coinsurance and copayments for deemed medically necessary care* Plans C, D, G, M and N cover medical emergencies outside of the US as long as medical care starts within 60 days of leaving US Part D not included and purchased separately Must carry Medicare card, Medicare Supplement Insurance coverage card, Part D card May include extra benefits (i.e. vision, dental, or Anthem members have access to several valuehearing, transportation, gym benefits, rewards added programs, including our popular for annual screenings) SilverSneakers fitness program. One card to carry *As of 1/1/2020 due to changes in Federal law under MACRA, only individuals eligible for Medicare prior to 1/1/2020 can purchase Plan F. 22 22

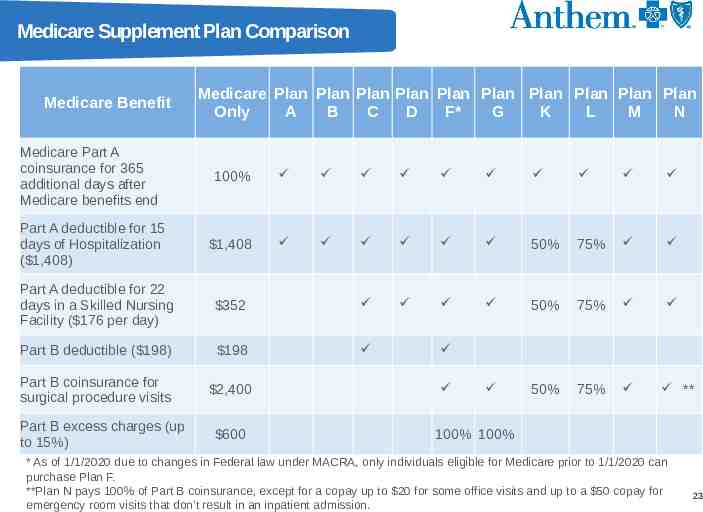

Medicare Supplement Plan Comparison Medicare Benefit Medicare Plan Plan Plan Plan Plan Plan Plan Plan Plan Plan Only A B C D F* G K L M N Medicare Part A coinsurance for 365 additional days after Medicare benefits end 100% Part A deductible for 15 days of Hospitalization ( 1,408) 1,408 50% 75% 50% 75% 50% 75% Part A deductible for 22 days in a Skilled Nursing Facility ( 176 per day) 352 Part B deductible ( 198) 198 Part B coinsurance for surgical procedure visits 2,400 Part B excess charges (up to 15%) 600 ** 100% 100% * As of 1/1/2020 due to changes in Federal law under MACRA, only individuals eligible for Medicare prior to 1/1/2020 can purchase Plan F. **Plan N pays 100% of Part B coinsurance, except for a copay up to 20 for some office visits and up to a 50 copay for emergency room visits that don’t result in an inpatient admission. 23 23

What is Part D? Available for all with Medicare Parts A and/or B and purchased through private insurance company Covers your prescription drugs Stand-alone prescription drug plan (PDP) Medicare Advantage plans (MAPD) can cover both medical and drugs Some employers, Veterans Affairs, and Unions offer Part D benefits do not impact Medicare Part A or Part B drug coverage It’s important to enroll when eligible. Going 63 days without coverage can trigger a late enrollment penalty. Can be used with Original Medicare 24 24

Medicare Savings Program and Extra Help What are Medicare Savings Programs? Help from Medicaid paying Medicare costs Pays Medicare premiums May pay Medicare deductibles and coinsurance Income amounts change each year Some states offer their own programs What extra help is out there? Help paying Part D prescription drug costs Social Security or state makes determination You automatically qualify if you get: Both Medicare and full Medicaid Supplemental Security Income (SSI) only Help from Medicare Savings Programs You or someone on your behalf can apply 25 25

Time to Decide 26

Which cards to carry? OR Anthem Medicare Part D Card 27 27

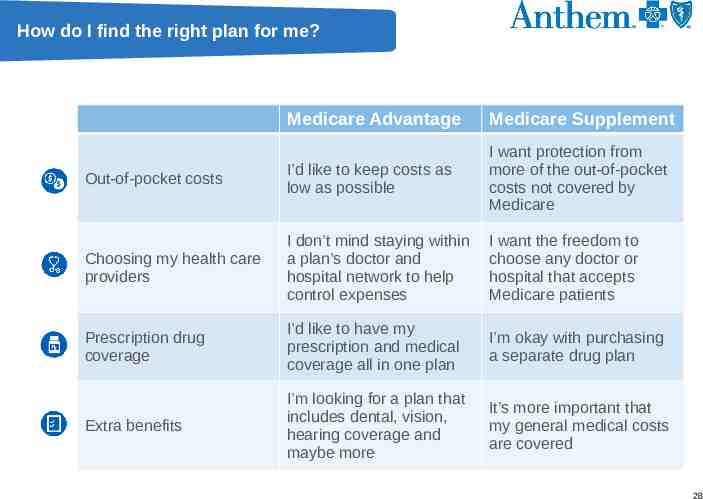

How do I find the right plan for me? Medicare Advantage Medicare Supplement Out-of-pocket costs I’d like to keep costs as low as possible I want protection from more of the out-of-pocket costs not covered by Medicare Choosing my health care providers I don’t mind staying within a plan’s doctor and hospital network to help control expenses I want the freedom to choose any doctor or hospital that accepts Medicare patients Prescription drug coverage I’d like to have my prescription and medical coverage all in one plan I’m okay with purchasing a separate drug plan Extra benefits I’m looking for a plan that includes dental, vision, hearing coverage and maybe more It’s more important that my general medical costs are covered 28 28

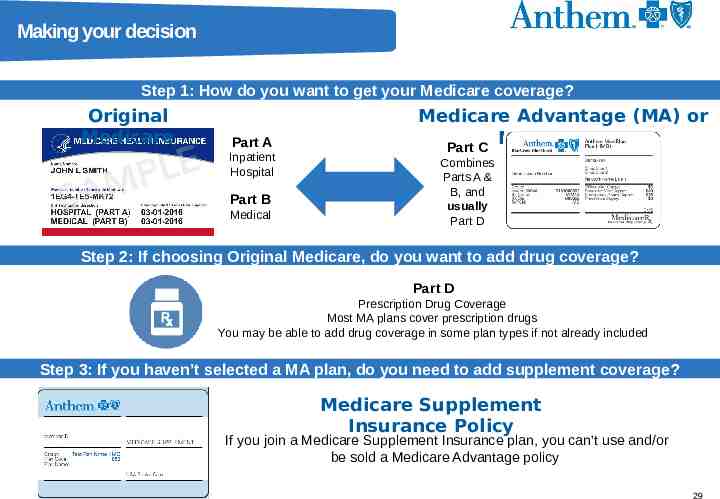

Making your decision Step 1: How do you want to get your Medicare coverage? Original Medicare Part A Inpatient Hospital Part B Medical Medicare Advantage (MA) or MAPD Plans* Part C Combines Parts A & B, and usually Part D Step 2: If choosing Original Medicare, do you want to add drug coverage? Part D Prescription Drug Coverage Most MA plans cover prescription drugs You may be able to add drug coverage in some plan types if not already included Step 3: If you haven’t selected a MA plan, do you need to add supplement coverage? Medicare Supplement Insurance Policy If you join a Medicare Supplement Insurance plan, you can’t use and/or be sold a Medicare Advantage policy 29 29

Enrolling in a plan made for you How to start your enrollment Whether you are signing up for Medicare Advantage, MAPD or Medicare Supplement Insurance and Part D, you will find assistance by: Contacting your local agent to be guided through the enrollment process Visiting shop.anthem.com/medicare Using the Medicare Plan Finder at www.medicare.gov Calling your State Health Insurance Assistance Program (SHIP) 30 30

Takeaways Medicare is a health insurance program It doesn’t cover all of your health care costs You have choices in how you get coverage Your decisions can affect the type of coverage you get Certain decisions are timesensitive Get help if you need it 31 31

Want to know more? 32 32

Helpful Resources Medicare & You Handbook www.medicare.gov/medicare-and-you Medicare Website www.medicare.gov Social Security Website www.socialsecurity.gov Medicare Plan Finder www.medicare.gov/find-a-plan/ questions/home.aspx Centers for Medicare & Medicaid Services www.cms.gov 33 33

Let Us Help Our licensed agents are here to answer any additional questions and guide you through to enrollment. Patricia Pulisciano - TrueCare Insurance, LLC Authorized licensed insurance agent for Anthem Medicare Advantage Plans CT License number: 962172 Ph: 203-915-1508 TTY: 711 Hours: 9 a.m. to 5 p.m. 5 days a week 34 34

Thank You! 35

Anthem Blue Cross and Blue Shield is a Medicare Advantage Organization with a Medicare contract. Enrollment in Anthem Blue Cross and Blue Shield depends on contract renewal. If you are an existing Anthem health plan member, this communication is intended to offer information regarding replacement of or enhancement to your current Anthem insured/administered plan. Not connected with or endorsed by the U.S. Government or the federal Medicare program. The purpose of this communication is the solicitation of insurance. Contact will be made by an insurance agent or insurance company. You must continue to pay your Medicare Part B Premium. This policy has exclusions, limitations, and terms under which the policy may be continued in force or discontinued. For costs and complete details of coverage, please contact your agent or the health plan. We do not discriminate, exclude people, or treat them differently on the basis of race, color, national origin, sex, age or disability in our health programs and activities. ATENÇÃO: Se fala português, encontram-se disponíveis serviços linguísticos, grátis. Ligue para 1-888-211-9817 (TTY: 711). ATENCIÓN: Si habla español, tiene a su disposición servicios gratuitos de asistencia lingüística. Llame al 1-888-211-9817 (TTY: 711). Non-Discrimination Notice: This document may be available in other languages. Or if you have special needs, this document may be available in other formats. Please review the Notice of Language Assistance and Notice of Non-Discrimination in Health Programs and Activities and call Customer Service for details. The SilverSneakers fitness program is provided by Tivity Health, an independent company. Tivity Health and SilverSneakers are registered trademarks or trademarks of Tivity Health, Inc., and/or its subsidiaries and/or affiliates in the USA and/or other countries. 2019 Tivity Health, Inc. All rights reserved. Anthem Blue Cross and Blue Shield is the trade name of Anthem Health Plans, Inc. Independent licensee of the Blue Cross Blue Shield Association. Anthem is a registered trademark of Anthem Insurance Companies, Inc. Y0114 20 109197 I C 0058 10/29/2019 AADVPP010M(19)-CT 501490MUSENMUB 0058 36 36