Managing Your Farm Financials Willy Wildcat- Extension Agent Robin

75 Slides3.21 MB

Managing Your Farm Financials Willy Wildcat- Extension Agent Robin Reid-K-State Ag. Economics Extension Associate Kevin Herbel-Kansas Farm Management Association Executive Director

4 Subject Areas and Associated Activities Keeping Quality Farm Records Balance Sheet Income Statement Cash Flow **Will be posted to www.AgManager.info/pft (password is KSREAgent)

Keeping Quality Farm Records

Why talk about this? To meet your goals and objectives for the future You must KNOW YOUR NUMBERS and USE YOUR NUMBERS Keeping quality records and using those records in decision making is important for successful farm management

Record keeping can be: Tedious Complex Time consuming . . . . and many of us “just don’t like paperwork!”

But your record keeping system can be— A VALUABLE BUSINESS MANAGEMENT TOOL!

Why keep records? Income tax filing Working with lender Management of operation The road to good record keeping is paved with good intentions . But good intentions aren’t much help in creating the financial information needed for decision making

Why keep records? Income tax filing Working with lender Management of operation You need your records much more than either your lender or the IRS Good records are one of the keys to your farm operation’s success . . . . One you can’t do without

What do you need in a record keeping system? Regular record keeping – develop a habit of keeping up to date Reconcile your records to your bank statements Appropriate accounts (or columns) for your farm business and personal activities Sufficient detail for you to understand and analyze your business, and make improved decisions

What do you need in a record keeping system? Accrual accounting—accurately measure your operation’s profitability (discuss cash vs. accrual) Ability to track your operation’s financial position and profitability over time Ability to compare with others and with standards Important to separate into profit centers to identify where you are making or losing money Information to help you answer the question “is this really the best use of my resources?”

So Why keep records? Record keeping is the first step to good management History of performance Track progress Understand resource base and how it is being used Compare with benchmarks Identify strengths and weaknesses Control of operation Know cost of production Detect problems and concerns Make adjustments and changes

So Why keep records? Record keeping is the first step to good management Plan for the future Goals and objectives Long- and Short-run decision making Filing of reports IRS Lender Crop Insurance FSA Other

How should I use my records? Balance Sheet Financial Position at a point in time Change in Net Worth Earned vs. FMV Net Worth Accrual Income Statement Accrual Accounting gives more accurate picture Statement of Cash Flows Source and uses of funds Amount and timing Comparative Analysis Trend Analysis

Keeping Records Accurate record keeping takes time and effort Once per year won’t get it done effectively Don’t use the shoebox method Know your operation know your financial position better than anyone else

Methods of Keeping Financial Records Manual record book Low cost Easy to get started Time consuming Opportunity for errors Can be difficult to reconcile to bank statements Can reduce errors by reconciling Difficult to get reports and analyze records

Methods of Keeping Financial Records Computer Spreadsheet Low cost More difficult to get started Need for skills with use of spreadsheet Time consuming Opportunity for errors Can be difficult to reconcile to bank statements Can reduce errors by reconciling Difficult to get reports and analyze records

Methods of Keeping Financial Records Computer Accounting Software Increase in cost – depends on software product Can be time saving Import of bank statements Memorized vendors Check printing Reduced opportunity for errors Account reconciliation Track account and loan balances Important to have appropriate accounts set up

Methods of Keeping Financial Records Computer Accounting Software Built in reports for review and analysis of records Some products allow for payroll and invoicing Choose software that you can use efficiently and that provides useful data and reports The more detailed the results desired, the more time it will take to keep the records The software you learn to use first and are most familiar with, will almost always be the “best”

Software for Farm Record Keeping Quicken QuickBooks/QB Pro/QB for Mac FarmBooks Farm Works – Farm Trac, Acctg, Stock Red Wing – Center Point Acctg for Ag Numerous others

Software for Farm Record Keeping Quicken Low cost, import bank stmts, memorized vendors, reconcile accts, built in reports, cash basis only QuickBooks/QB Pro/QB for Mac More expensive, added flexibility for business records, double entry acctg, options for payroll, A/R, A/P and invoicing, accrual reports FarmBooks More expensive, farm specific accounts and reports, built in payroll and invoicing, accrual reports

Software for Farm Record Keeping Farm Works – Farm Trac, Acctg, Stock Includes mapping, field records, inventory, payroll, built in reports, cash & accrual w/ single entry acctg Red Wing – Center Point Acctg for Ag Higher cost, double entry acctg, more difficult to use

Links for Information on Software Quicken http://quicken.intuit.com/ QuickBooks (QB, QB Pro and QB for Mac) http://quickbooks.intuit.com/ FarmBooks http://www.sanderssoftware.com/programs-farmbooks.htm

Links for Information on Software Farm Works http://farmworks.com/products/accounting Red Wing http://www.redwingsoftware.com/rwssn/?page 308

Balance Sheet -A Financial Management Tool

Balance Sheet Definition and Purpose Systematic organization of everything “owned” and “owed” by a business or individual at a given point in time Features: Provides a SNAPSHOT of the business Fundamental to sound management decision making Measurement of financial success Communicates financial position to creditors

Balance Sheet Key Measures Total Assets: The value of all financial and capital resources owned by the business Total Liabilities: The value of total debt obligations Owner’s Equity or Net Worth: The value of the owner’s investment as determined by subtracting total liabilities from total assets Assets Liabilities Net Worth (Equity)

Completing a Balance Sheet Current Assets Cash Accounts Receivable Fertilizer and Supplies Investment in Growing Crops Crops Held for Sale Market Livestock

Completing a Balance Sheet Noncurrent Assets: Breeding Livestock Machinery and Equipment Buildings Investments in Cooperatives Land

Completing a Balance Sheet Current Liabilities: Accounts Payable/Accrued Expenses Taxes Payable (Income and Social Security) Current Portion: Deferred Taxes Current Loans Due within One Year Current Portion of Term Debt Accrued Interest

Completing a Balance Sheet Noncurrent Liabilities: Noncurrent Portion: Deferred Taxes Noncurrent Portion: Notes Payable Noncurrent Portion: Real Estate Debt

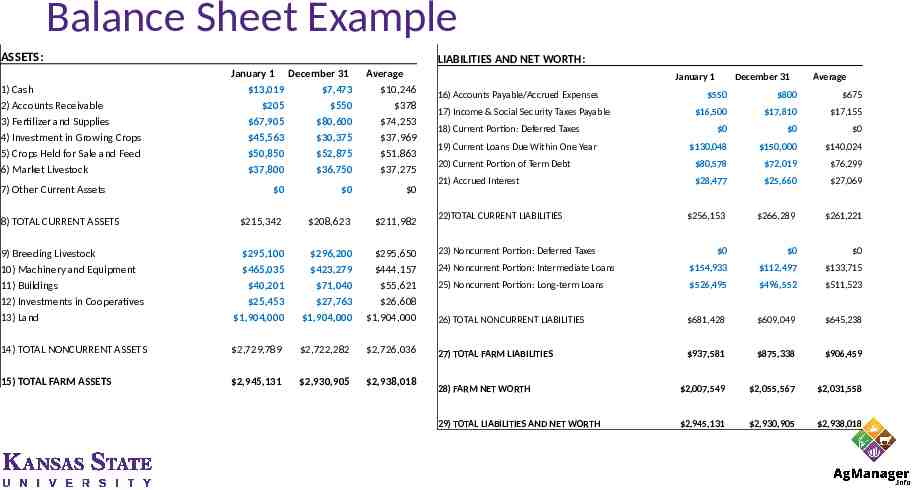

Balance Sheet Example ASSETS: 1) Cash 2) Accounts Receivable 3) Fertilizer and Supplies 4) Investment in Growing Crops 5) Crops Held for Sale and Feed 6) Market Livestock 7) Other Current Assets LIABILITIES AND NET WORTH: January 1 December 31 13,019 7,473 205 550 67,905 80,600 45,563 30,375 50,850 52,875 37,800 36,750 Average 10,246 378 74,253 37,969 51,863 37,275 0 0 0 215,342 208,623 211,982 9) Breeding Livestock 10) Machinery and Equipment 11) Buildings 12) Investments in Cooperatives 13) Land 295,100 465,035 40,201 25,453 1,904,000 296,200 423,279 71,040 27,763 1,904,000 295,650 444,157 55,621 26,608 1,904,000 14) TOTAL NONCURRENT ASSETS 2,729,789 2,722,282 2,726,036 15) TOTAL FARM ASSETS 2,945,131 2,930,905 2,938,018 8) TOTAL CURRENT ASSETS January 1 16) Accounts Payable/Accrued Expenses December 31 Average 550 800 675 16,500 17,810 17,155 0 0 0 130,048 150,000 140,024 20) Current Portion of Term Debt 80,578 72,019 76,299 21) Accrued Interest 28,477 25,660 27,069 256,153 266,289 261,221 0 0 0 24) Noncurrent Portion: Intermediate Loans 154,933 112,497 133,715 25) Noncurrent Portion: Long-term Loans 526,495 496,552 511,523 26) TOTAL NONCURRENT LIABILITIES 681,428 609,049 645,238 27) TOTAL FARM LIABILITIES 937,581 875,338 906,459 28) FARM NET WORTH 2,007,549 2,055,567 2,031,558 29) TOTAL LIABILITIES AND NET WORTH 2,945,131 2,930,905 2,938,018 17) Income & Social Security Taxes Payable 18) Current Portion: Deferred Taxes 19) Current Loans Due Within One Year 22)TOTAL CURRENT LIABILITIES 23) Noncurrent Portion: Deferred Taxes

Completing a Balance Sheet Valuation Issues Sources of Equity Contributions of equity from owners Retained earnings—Net income less owner withdrawals Valuation equity—Market value over cost of noncurrent assets Unearned and may never be realized

Completing a Balance Sheet Valuation Issues Cost Approach —Initial cost plus improvements less depreciation More accurate measure of actual performance of invested capital Critical to the examination of changes in equity Market Value Approach —Estimate asset values using current prices for similar assets Easy to derive More comparable across farms Includes opportunity cost Often required by lenders

Completing a Balance Sheet Do you include Personal Assets and Liabilities? Sometimes hard to distinguish between If included, clearly separate them and define them if possible

Completing a Balance Sheet Tips for Preparing Prepare at the same time each year Focus on completeness Inventories Accounts receivable and payable Accrued income and expense Focus on accuracy Inaccurate financial statements lead to a false sense of financial security (or insecurity)

Balance Sheet Interpretation and Use Trends Net worth increases Realized—profits generated Unrealized—asset appreciation Consistent vs. volatile changes Structure Types of assets—liquid or not Types of liabilities Collateral available

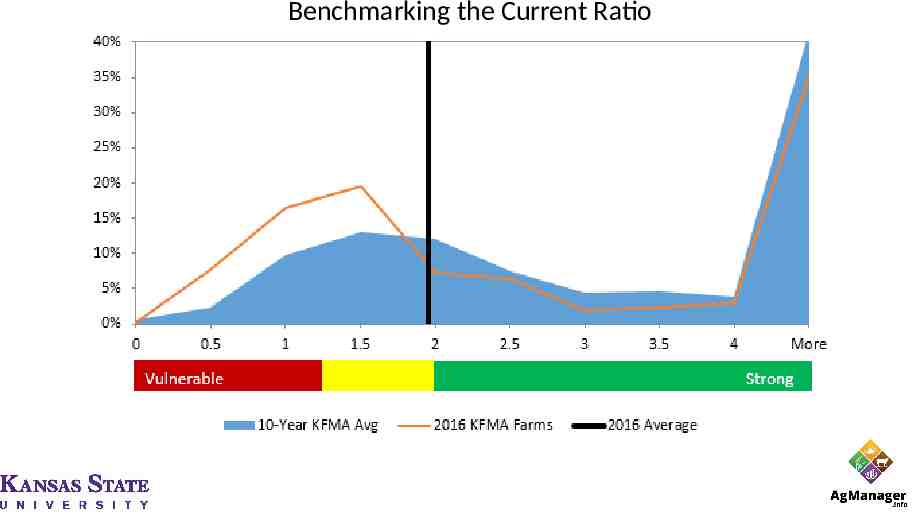

Balance Sheet Interpretation and Use Measuring Liquidity Current ratio Current Assets/Current Liabilities Working Capital Current Assets – Current Liabilities Compares sources of cash with needs for cash in the next twelve months Affects owner’s ability to make decisions Critical in the management of a farm business Working Capital/Gross Farm Income Or Working Capital/(Total Operating Expenses Interest)

Benchmarking the Current Ratio

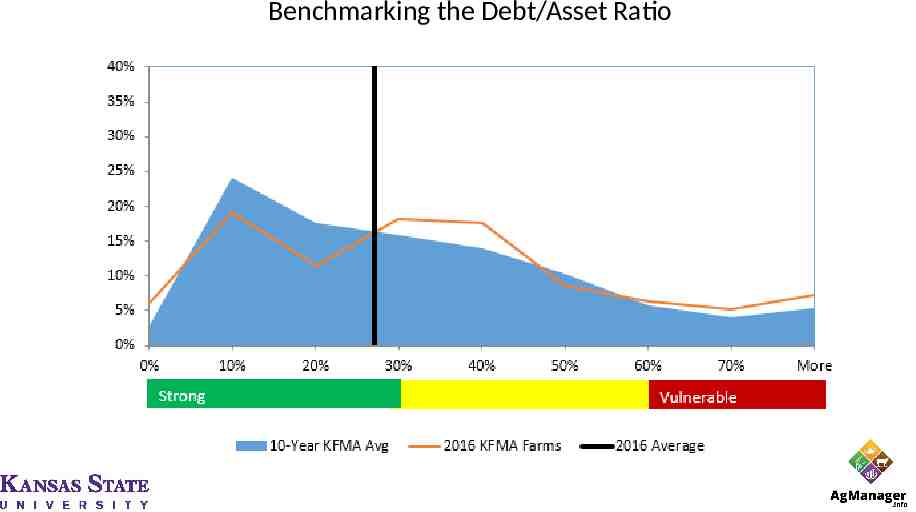

Balance Sheet Interpretation and Use Measuring Solvency Debt to Asset Ratio Total Liabilities/Total Assets Indicator of ability to take on risk Dictates intensity of management required Affects capacity to expand

Benchmarking the Debt/Asset Ratio

Balance Sheet An Important Tool in Agricultural Financial Management Complete a balance sheet annually Use it to set parameters for major financial decisions Be honest in asset valuation Be thorough in listing liabilities Be fundamentally sound in these Exciting Times Volatile yet

Income Statement -A Financial Management Tool

Income Statement Definition and Purpose Measures the success (profitability) of a business over a period of time in terms of net income or loss Features: Lists income earned and expenses incurred to derive that income A progress report of the business Can be compared across years to show growth or decline in profitability

Income Statement Definition and Purpose It is best to have an Accrual Adjusted Income Statement Matches income produced with the expenses used to generate that income Example: Holding a crop over to the next calendar year before sale, but expenses to generate that crop are incurred in the current year If you have a beginning and ending Balance Sheet for the time period, making accrual adjustments is not too difficult

Income Statement Definition and Purpose An Accrual Adjusted Income Statement will not equal the net income on the Schedule F from tax return for a farm Cash basis accounting is frequently used for tax preparation purposes for farms Depreciation for tax purposes may be accelerated If accrual accounting is used for tax preparation purposes it will usually be a “hybrid” accrual system that does not completely account for all inventory items

Income Statement Key Measures Farm Business Receipts Cash Income Inventory changes Farm Business Expenses Cash Operating Expenses Expense Inventory changes Interest Depreciation Difference Net Farm Income

Income Statement Key Measures Farm Business Receipts Cash Income from Crop and Livestock Sales Adjustment for inventory changes Difference in beginning/ending stored and growing crops Difference in beginning/ending livestock values, adjusted for purchases Difference in beginning/ending accounts receivable Crop Insurance Indemnities, Agricultural Program Payments, Other Farm Income

Income Statement Key Measures Farm Business Expenses Cash Expenses- Feed, Fuel, Seed, Fertilizer, etc. Inventory Expense Adjustment Difference in beginning/ending supplies on hand Difference in Accounts Payable/Accrued Expenses Interest Expense Cash interest paid plus change in accrued interest Depreciation

Income Statement Key Measures Depreciation Loss in asset value due to gradual wear and obsolescence Example of straight-line depreciation: Purchase a truck for 40,000 that you expect to last 5 years and have a remaining value of 10,000 40,000- 10,000 30,000 loss in value 30,000/ 5 years 6,000 per year deprecation expense

Income Statement Key Measures Depreciation Loss in asset value due to gradual wear and obsolescence Methods of determining economic depreciation: Adjust actual market values for each asset every year–the difference is the economic depreciation value Assume a percentage reduction in the beginning balance sheet values – 10% for machinery/ equipment, 5% for buildings Estimate by adjusting the depreciation taken for income tax purposes by adding accelerated depreciation back in

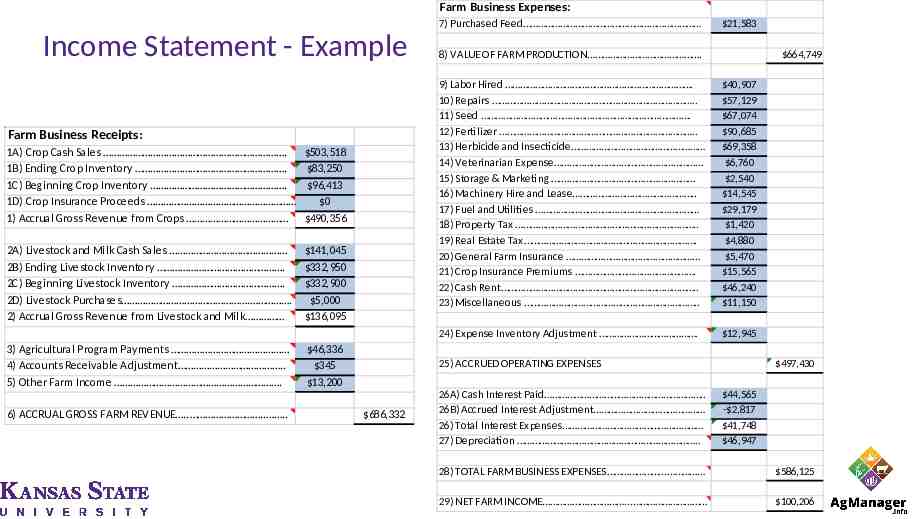

Farm Business Expenses: 7) Purchased Feed Income Statement - Example Farm Business Receipts: 1A) Crop Cash Sales . 1B) Ending Crop Inventory . 1C) Beginning Crop Inventory . 1D) Crop Insurance Proceeds 1) Accrual Gross Revenue from Crops 503,518 83,250 96,413 0 490,356 2A) Livestock and Milk Cash Sales 2B) Ending Livestock Inventory . 2C) Beginning Livestock Inventory . 2D) Livestock Purchases . . 2) Accrual Gross Revenue from Livestock and Milk 141,045 332,950 332,900 5,000 136,095 3) Agricultural Program Payments 4) Accounts Receivable Adjustment . 5) Other Farm Income . 6) ACCRUAL GROSS FARM REVENUE . . . 46,336 345 13,200 21,583 8) VALUE OF FARM PRODUCTION . 664,749 9) Labor Hired . 10) Repairs . 11) Seed . 12) Fertilizer . 13) Herbicide and Insecticide 14) Veterinarian Expense 15) Storage & Marketing . 16) Machinery Hire and Lease . 17) Fuel and Utilities 18) Property Tax . 19) Real Estate Tax . 20) General Farm Insurance 21) Crop Insurance Premiums . 22) Cash Rent . 23) Miscellaneous . 40,907 57,129 67,074 90,685 69,358 6,760 2,540 14,545 29,179 1,420 4,880 5,470 15,565 46,240 11,150 24) Expense Inventory Adjustment . 12,945 25) ACCRUED OPERATING EXPENSES 686,332 26A) Cash Interest Paid . 26B) Accrued Interest Adjustment 26) Total Interest Expenses 27) Depreciation . 497,430 44,565 - 2,817 41,748 46,947 28) TOTAL FARM BUSINESS EXPENSES . 586,125 29) NET FARM INCOME . 100,206

Completing an Income Statement Should personal income and expenses be included on a business income statement? Generally, the answer to this question is no, since the purpose is to assess the profitability and efficiency of the business operations For many family farm operations, non-farm income and expenses do have an impact of the activity of the farm operation When non-business items are included on an income statement, clearly define and separate business and non-business items, with a separate section for the non-business activity A separate non-farm income statement can be prepared to see the full picture of farm and non-farm income and expenses

Completing an Income Statement Tips for Preparing Prepare at the same time each year, preferably with a beginning and ending balance sheet Focus on completeness If you have done well on the balance sheet(s), this should be much easier Accurate recordkeeping for the year is vital Focus on accuracy Inaccurate financial statements lead to a false sense of financial security (or insecurity)

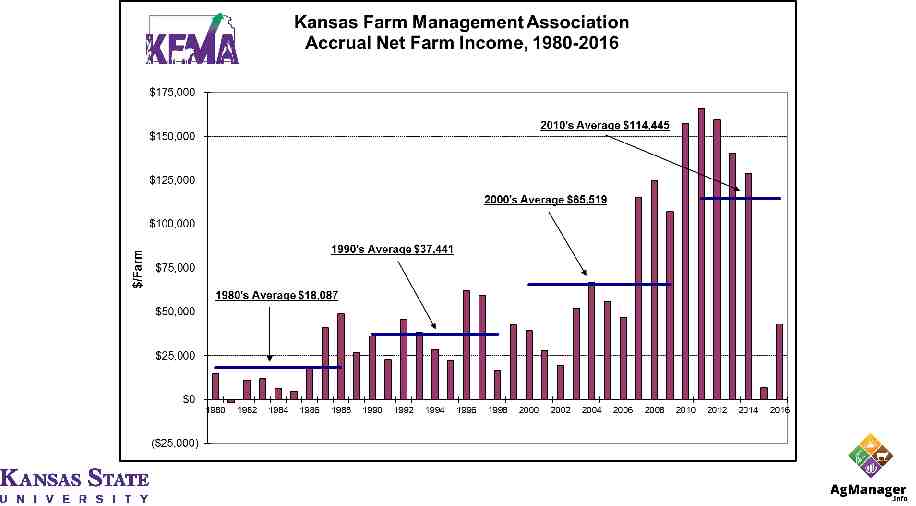

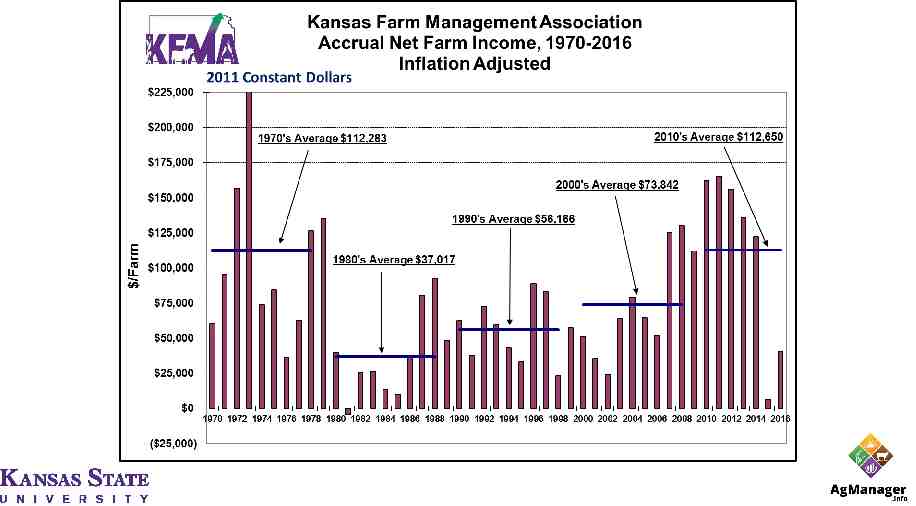

Income Statement Interpretation and Use Trends (with multiple income statements) Is profitability increasing, decreasing, level? Does the income statement show changes reflective of the ag industry in the region? What differences are seen? For good? For bad? Ratio Analysis

Income Statement Interpretation and Use Profitability Rate of Return on Farm Assets (ROA) Rate of Return on Farm Equity (ROE) Operating Profit Margin Ratio Net Farm Income

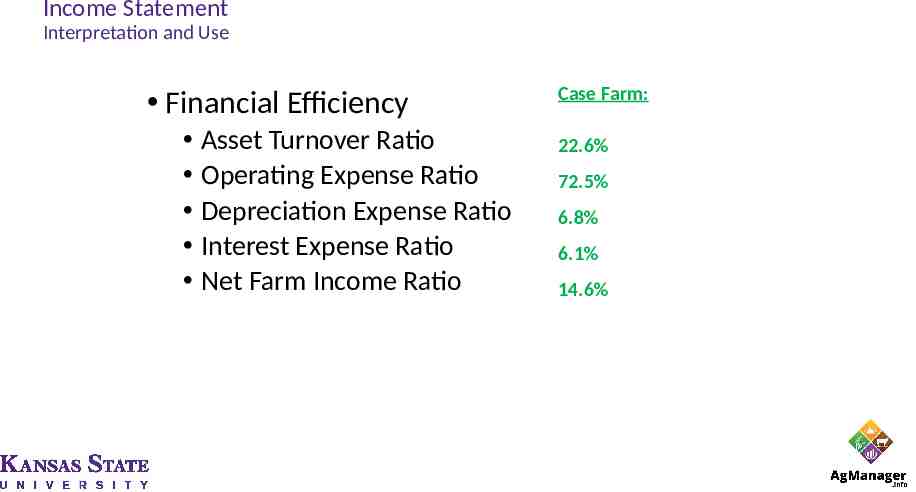

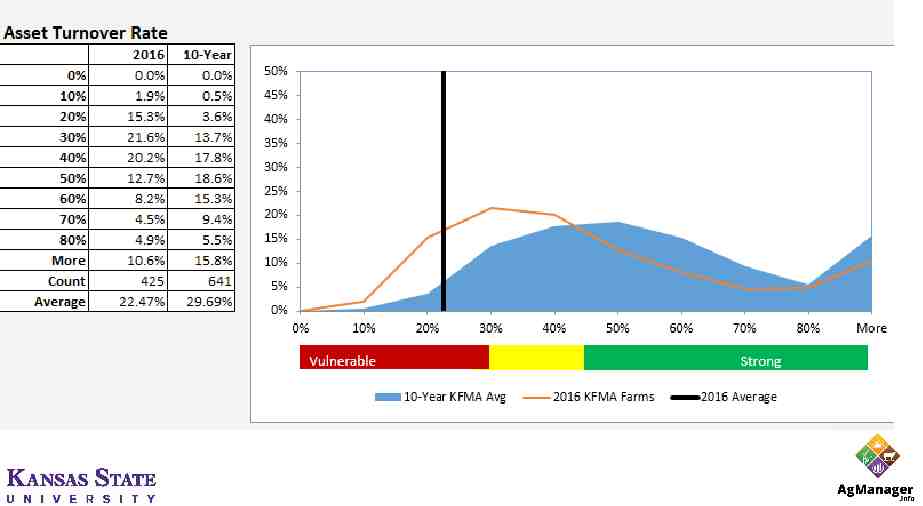

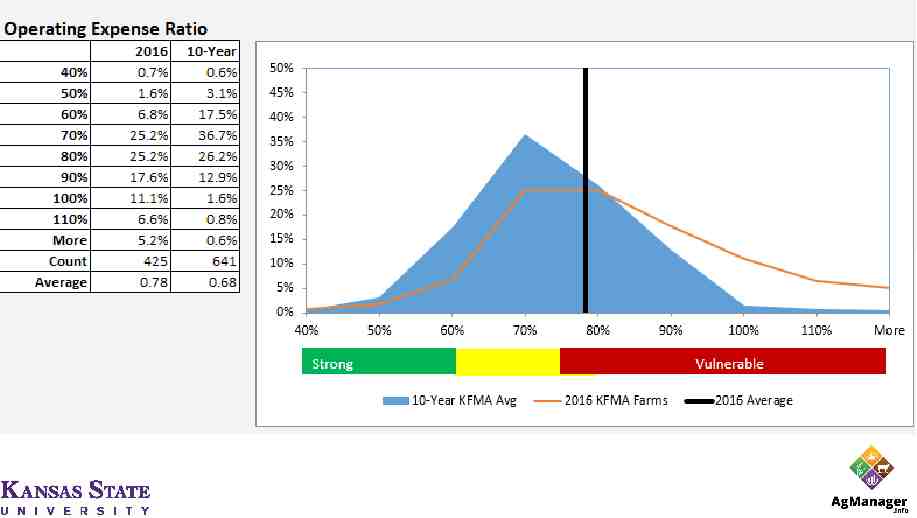

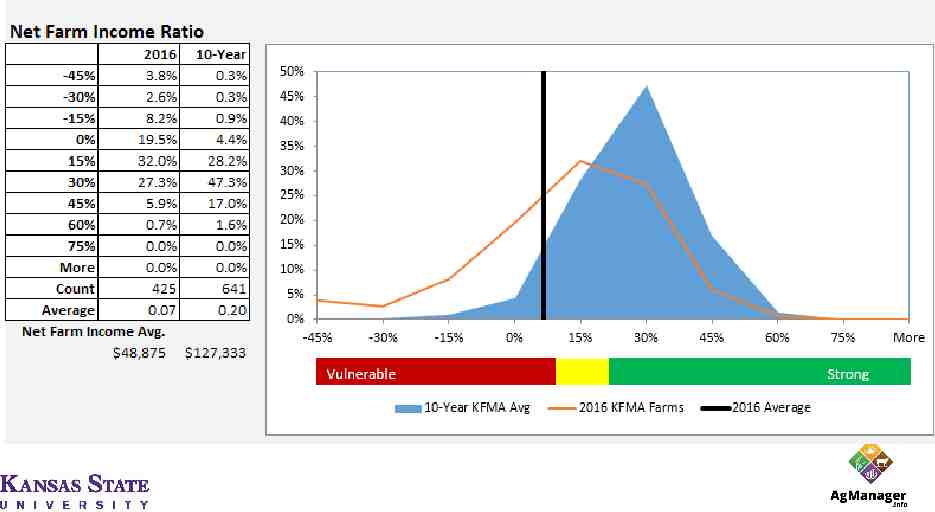

Income Statement Interpretation and Use Financial Efficiency Asset Turnover Ratio Operating Expense Ratio Depreciation Expense Ratio Interest Expense Ratio Net Farm Income Ratio Case Farm: 22.6% 72.5% 6.8% 6.1% 14.6%

Income Statement An Important Tool in Agricultural Financial Management Complete an income statement annually Be consistent with accrual adjustments Use it to set parameters for major financial decisions Know and understand your farm’s financial position better than others Use this information to guide your decision making

Cash Flow Statement -A Financial Management Tool

Cash Flow Definition and Purpose Recording of the dollars coming and going out of the business Features: Shows where the money comes from (inflows) and where it goes (outflows) Indicates how much will need to be borrowed to pay operating expenses and when it is needed

Cash Flow Key Measures Cash Inflow Items Sales of crops/livestock Agricultural Program Payments/Crop Insurance Capital Assets Sales Off-Farm Income? Cash Outflow Items Seed, Fertilizer, Chemicals, Feed, Veterinary, etc. Livestock & Capital Assets Purchases Family Living Taxes Difference Net Cash Flow

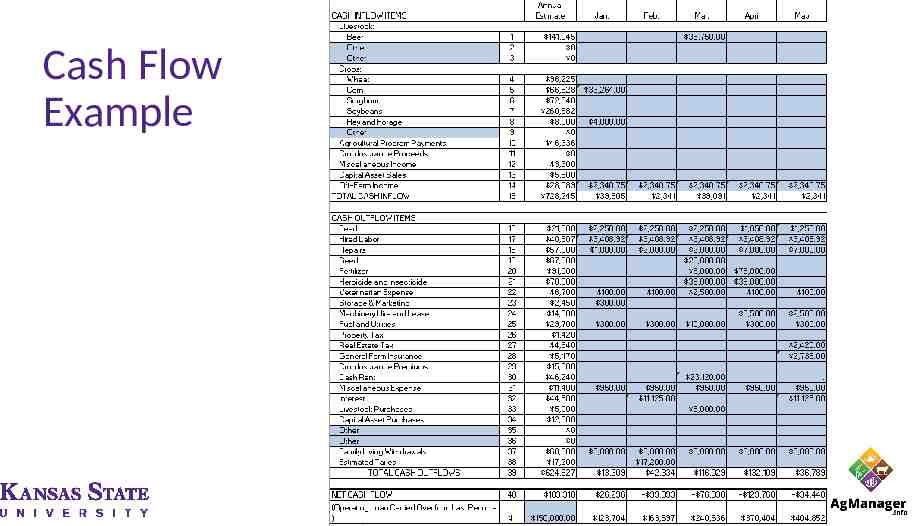

Cash Flow Example

Completing a Cash Flow Historical vs. Projected Cash Flow Historical What actually happened in that time period? Projected When will cash come in and flow out? What will my operating loan requirements be? Obviously you need to start somewhere, but the best way to make a projected cash flow is with an historical cash flow!

Completing a Cash Flow Total Business or Partial Business Cash Flow? Do you include family living and off-farm income? If it will effect your farm’s cash flow YES You can just do a cash flow for one enterprise or part of the farm You do a partial cash flow for an expansion or change in the business Monthly intervals? Full year?

Cash Flow Interpretation and Use Evaluating Feasibility Two management questions that need to be studied regarding proposed business changes are: 1. Will the changes be profitable in the long run? 2. Will the changes be feasible in the short run?

Cash Flow Interpretation and Use Indicates how much will need to be borrowed and when Can compare to actual cash flow to projections and discrepancies can alert the management about a potential problem Provides basis for planning additional investments in the farm business

Cash Flow An Important Tool in Agricultural Financial Management Complete a historical and projected cash flow annually Monitor the projected cash flow against actual cash flow throughout the time period The process of completing a projected cash flow statement will prepare a farm manager to respond and adapt as changes occur during the year Use the cash flow as an evaluation tool Feasibility!

Questions or More Information Kansas Farm Management Association (KFMA) www.AgManager.info/KFMA Extension Agricultural Economics www.AgManager.info