How Do You Submit a Successful Offer In Compromise? (2017

51 Slides2.95 MB

How Do You Submit a Successful Offer In Compromise? (2017 Update) Frank J. Rooney, Esquire Rooney Law Firm Offices in CO, MD, and VA 1-866-377-4774 www.irsequalizer.com

OFFERS IN COMPROMISE UPDATE-WHAT ARE THE CHANGES? Section 7122(c)-Lump Sum Must Pay 20% or Start Periodic Payments with Application Section 7122(f)-Deemed Accepted After 24 Months Can Pay State Taxes If Can’t Be Paid Off Student Loans Allowable Revising Calculation of Future Income Expand Allowable Living Expenses Category and Amount

OVERVIEW OF OFFERS IN COMPROMISE (OIC) Doubt as LiabilityLegitimate Basis for Objection to Tax Debt Doubt as to CollectabilityInability to Pay or Hardship Processable Offer in Compromise-No Longer Requires Compliance Pay 150 Fee-Waived If Low Income or Doubt as to Liability Pay 20 Percent with Lump Sum

HANDLING THE CASE Basic Calculation – “Reasonable Collection Potential”- Net Equity in Assets Plus Excess Inflow Over IRS Deemed Necessary Expenses Gotchas Dissipated Assets Statute of Limitations Issues Designated Payments

WHAT IS A NON-PROCESSABLE OIC? Taxpayer in Open Bankruptcy Case Did Not Pay 150 Did Not Pay 20 Percent with Lump Sum Offer Application Did Not Pay Installment Payment with Installment Offer Application and Continue with Monthly Payments While Pending Did Not Sign Form 656

WHAT ARE THE OPTIONS WHEN DEALING WITH A TAX LIABILITY? Submit an Offer Doubt as to LiabilityAmount Owed is Incorrect, Innocent Spouse Pay It OffLump or Installment Agreement Can’t PayCurrently Not Collectible Submit an Offer Doubt as to Collectability or Effective Tax Administratio n Discharge Certain Taxes and Penalties in Bankruptc y

DOUBT AS TO LIABILITY Procedural Issues: S/L-Bars IRS Claim Prior Bankruptcy Discharged Taxes Taxes Paid Innocent Spouse Substantive Issues

DOUBT AS TO COLLECTABILITY Taxpayer’s Reasonable Collection Potential- Less Than Amount Owed Calculate Excess Cash Inflow Compared to Cash Outflow for Allowable Exps. Calculate Net Equity in Assets

DISSIPATED ASSET ISSUES Asset Sold, Transferred, Gifted or Spent On Non-Priority Items IRS Will Bring Asset back into RCP Calculation Motivated by Keeping Assets from IRS

“EFFECTIVE TAX ADMINISTRATION” Calculated Amount Shows Taxpayer Can Pay More than Offer Submitted Hardship Promotes Compliance Based on Taxpayer’s History

WHAT ARE IRS NECESSARY LIVING EXPENSES? Necessary Living Expenses-Good Conditional Living Expenses-Bad

CALCULATING THE OFFER AMOUNT-DOUBT AS TO COLLECTABILITY National Standards Local Standards Transportatio n Standards Medical Expenses

NATIONAL STANDARDS Based On IRS Table Size of Family Must Show Special Circumstances to Justify Higher than Table Amounts

IRS HOUSING STANDARDS Housing Expenses Based On Geographical Table

IRS TRANSPORTATION STANDARDS Table Based Ceiling for Personal Use Use Actual for Business Use

IRS MEDICAL EXPENSES Legitimate Medical Expenses Must be Making Payments and Show Proof

OTHER NECESSARY EXPENSES Expenses in Excess of IRS Standards for Housing and Living Expenses IRS Representation Fees Additional 200 Exp. For Older Vehicle i.e. 6 years Old or Over 75,000 Miles Other Exp. for the Production of Income

PAYMENT OPTIONS FOR THE DOUBT AS TO COLLECTABILITY OFFER 5 or fewer months 6 months to 2 years (max)

5 OR FEWER MONTHS LUMP SUM OFFERS 150 fee 20 Percent Paid with Application NOTE: IRS Prefers Separate Checks

6 TO 24 MONTHS PERIODIC OFFERS Periodic Payment Must Accompany Application Payments Must Continue While Pending 150 Application Fee NOTE: Cannot Exceed 24 Months

WHAT HAPPENS IF OFFER ACCEPTED? Refunds Due Will be Kept Federal Tax Liens Not Released Until Offer Completio n Collection Activities Suspende d Legal Assessme nt and Collection Period Extended

WHAT HAPPENS IF OFFER NOT ACCEPTED? Various Options Appeal If CDP Contest in Tax Court Bankruptcy-Litigate Collectability and Liability Issues Pay Tax and Sue for Refund if Doubt as to Liability

OFFER EXAMPLE Taxpayers owns a principal residence in Boulder, CO worth 800,000 with a mortgage of 600,000. * Only Asset Taxpayers Joint Income Tax Return for 2012 (timely filed on 4/15/13) shows an Unpaid Tax Debt of 350,000 In March of 2012, Taxpayers Paid Back a 400,000 Loan to Their Parents to Buy their House Taxpayers Monthly Income is 6,000 with 1000 in mo. Fed and CO Withholdings.

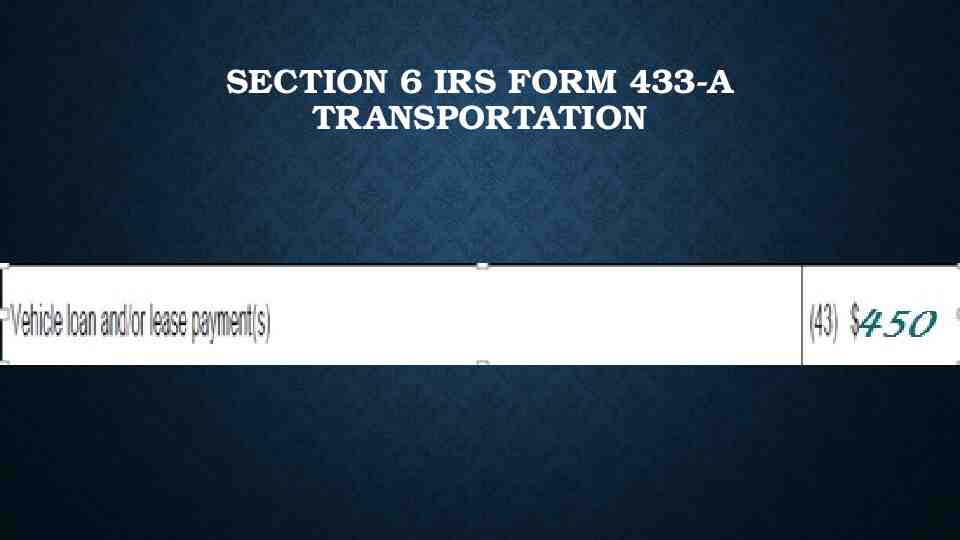

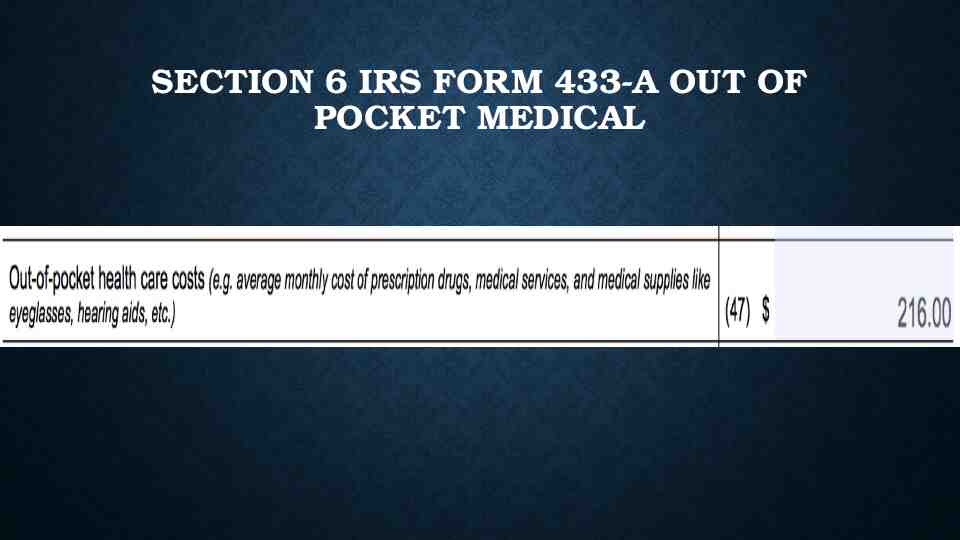

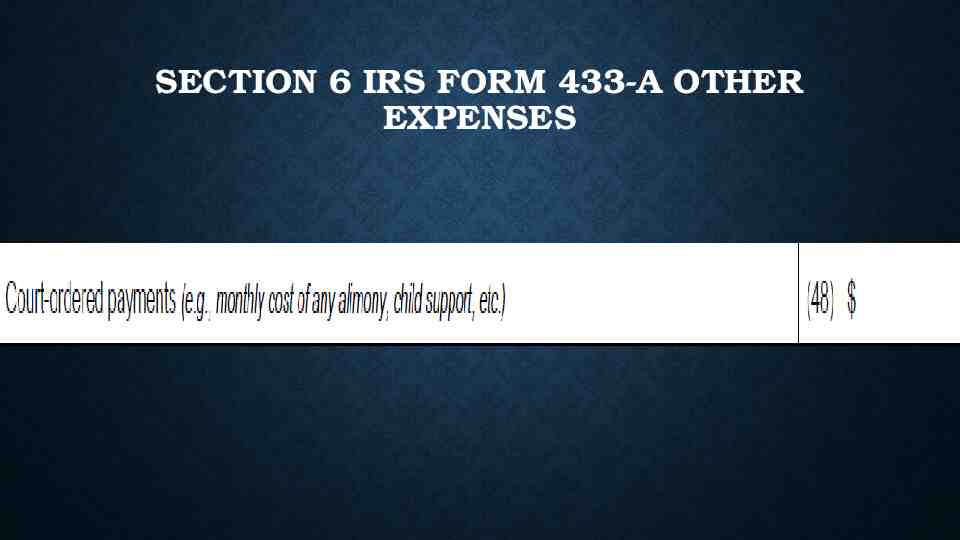

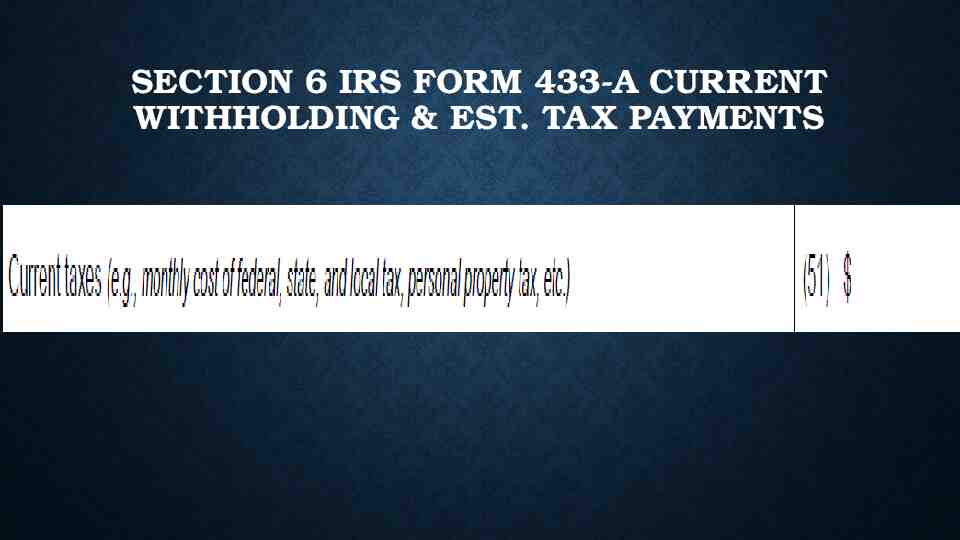

OFFER EXAMPLE CONT’D. Taxpayers with 2 children, ages 3 and 5, have the following monthly expenses: Mortgage and utils. 2900 Car payment of 450 on one of their 2 cars Car expenses on both autos of 700, one of which is 9 years old Health ins. Premiums 400 Installment agreement with state of CO 250 for back state taxes IRS Rep fees to CPA of 500 on outstanding debt of 3000 Credit card monthly payment used to pay Federal taxes of 100 Credit card payment used to pay food, clothing etc. of 200 Federal guaranteed student loan payment of 300

SECTION 3 REAL ESTATE 433-A(OIC)

SECTION 6 IRS FORM 433-A NATIONAL STANDARDS

SECTION 6 IRS FORM 433-A HOUSING STANDARDS

SECTION 6 IRS FORM 433-A TRANSPORTATION

SECTION 6 IRS FORM 433-A TRANSPORTATION

SECTION 6 IRS FORM 433-A TRANSPORTATION

SECTION 6 IRS FORM 433-A HEALTH EXPENSES

OUT OF POCKET MEDICAL

SECTION 6 IRS FORM 433-A OUT OF POCKET MEDICAL

SECTION 6 IRS FORM 433-A OTHER EXPENSES

SECTION 6 IRS FORM 433-A CHILD CARE

SECTION 6 IRS FORM 433-A LIFE INSURANCE

SECTION 6 IRS FORM 433-A CURRENT WITHHOLDING & EST. TAX PAYMENTS

SECTION 6 IRS FORM 433-A STUDENT LOANS

SECTION 6 IRS FORM 433-A PAST STATE TAXES

MONTHLY HOUSEHOLD INCOME

SECTION 6 IRS FORM 433-A OIC CALCULATION

SECTION 6 IRS FORM 433-A OIC CALCULATION CONT’D

SECTION 6 IRS FORM 433-A OIC CALCULATION CONT’D

SECTION 6 IRS FORM 433-A OIC CALCULATION CONT’D

STEP ONE OF LUMP SUM OFFER

STEP 2 OF LUMP SUM OFFER

STEP 3 OF LUMP SUM OFFER

PERIODIC PAYMENT OFFER

DESIGNATE OFFER PAYMENTS

EFFECTIVE TAX ADMINISTRATION OFFER

Q&A