HORIZON HORIZON 2020 2020 PERSONNEL COSTS

13 Slides2.35 MB

HORIZON HORIZON 2020 2020 PERSONNEL COSTS

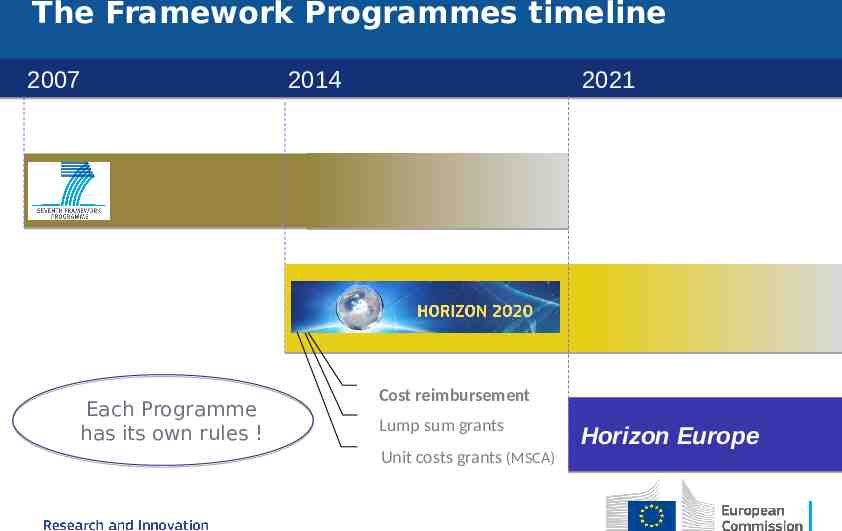

The Framework Programmes timeline 2007 Each Programme has its own rules ! 2014 2021 Cost reimbursement Lump sum grants Unit costs grants (MSCA) Horizon Europe

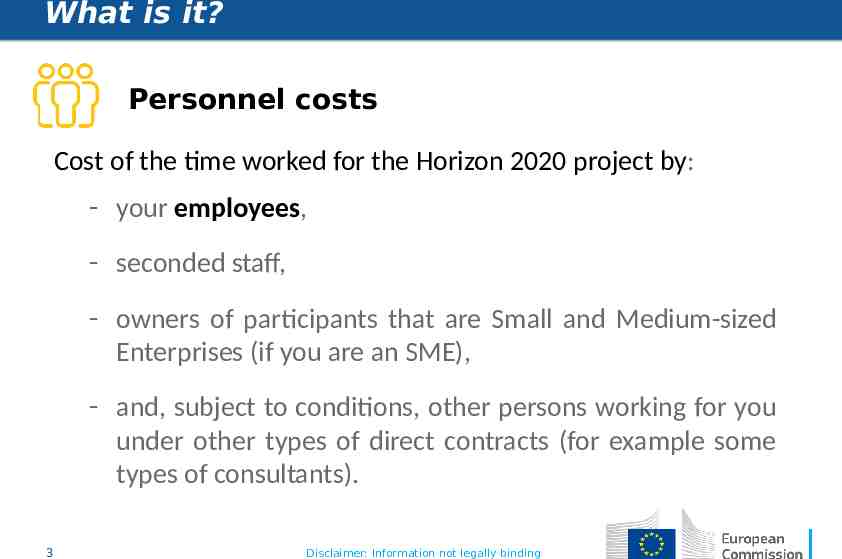

What is it? Personnel costs Cost of the time worked for the Horizon 2020 project by: - your employees, - seconded staff, - owners of participants that are Small and Medium-sized Enterprises (if you are an SME), - and, subject to conditions, other persons working for you under other types of direct contracts (for example some types of consultants). 3 Disclaimer: Information not legally binding

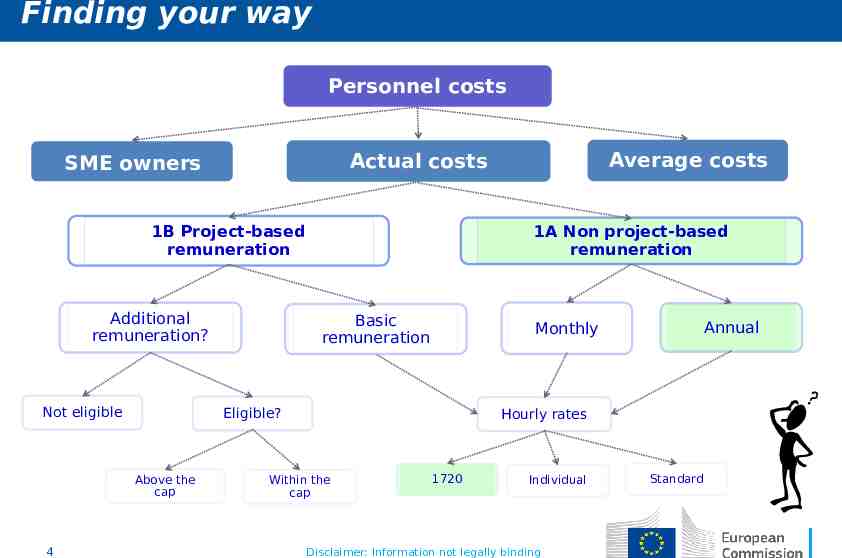

Finding your way Personnel costs 1B Project-based remuneration Additional remuneration? Not eligible 4 1A Non project-based remuneration Basic remuneration Monthly Eligible? Above the cap Average costs Actual costs SME owners Annual Hourly rates Within the cap 1720 Individual Disclaimer: Information not legally binding Standard

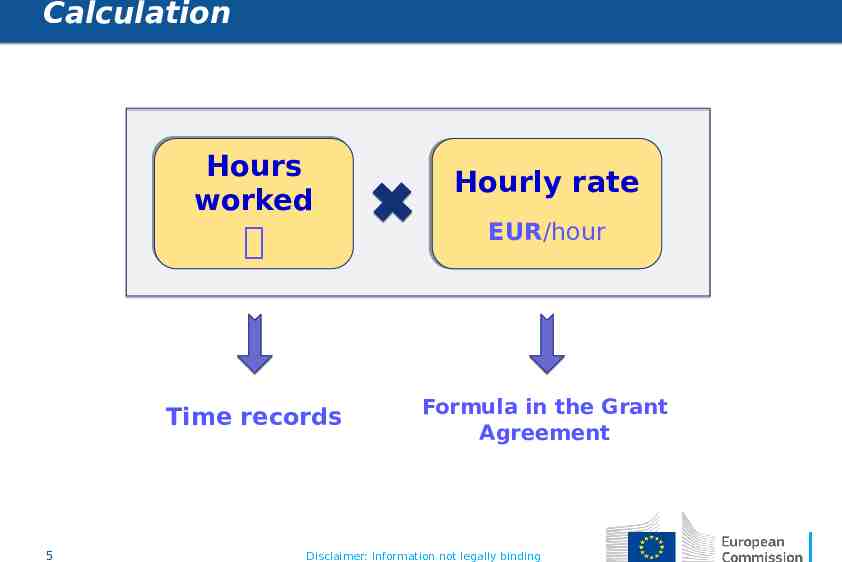

Calculation Hours worked 5 Hourly Hourly rate rate EUR/hour EUR/hour Time records Formula in the Grant Agreement Disclaimer: Information not legally binding

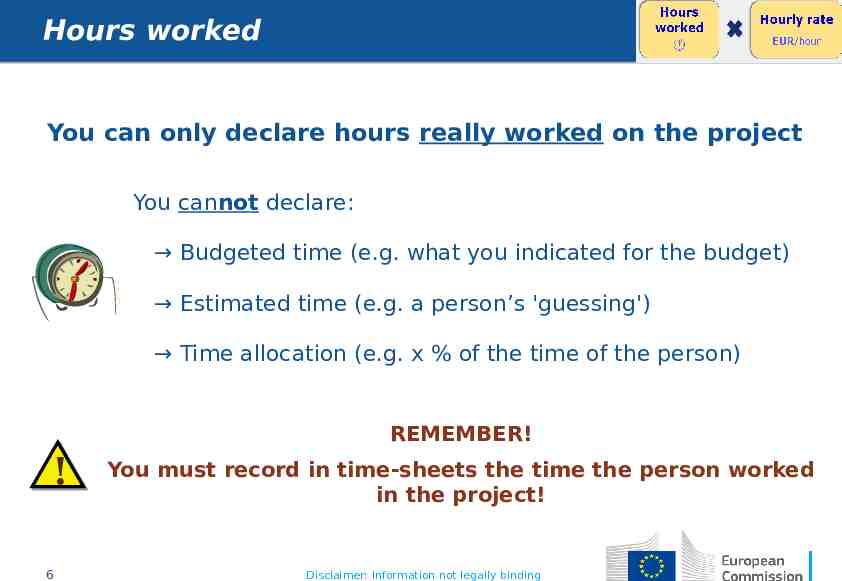

Hours worked You can only declare hours really worked on the project You cannot declare: Budgeted time (e.g. what you indicated for the budget) Estimated time (e.g. a person’s 'guessing') Time allocation (e.g. x % of the time of the person) REMEMBER! ! 6 You must record in time-sheets the time the person worked in the project! Disclaimer: Information not legally binding

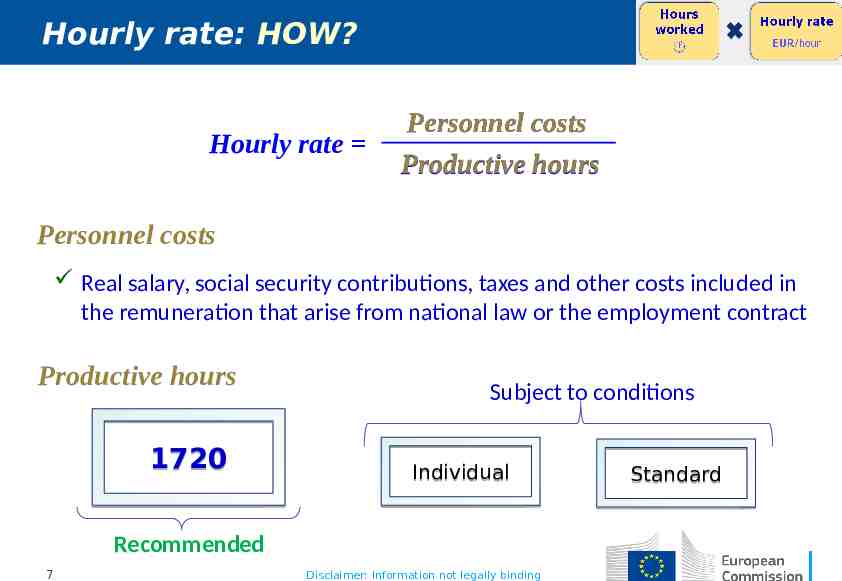

Hourly rate: HOW? Hourly rate Personnel costs Productive hours Personnel costs Real salary, social security contributions, taxes and other costs included in the remuneration that arise from national law or the employment contract Productive hours 1720 Subject to conditions Individual Recommended 7 Disclaimer: Information not legally binding Standard

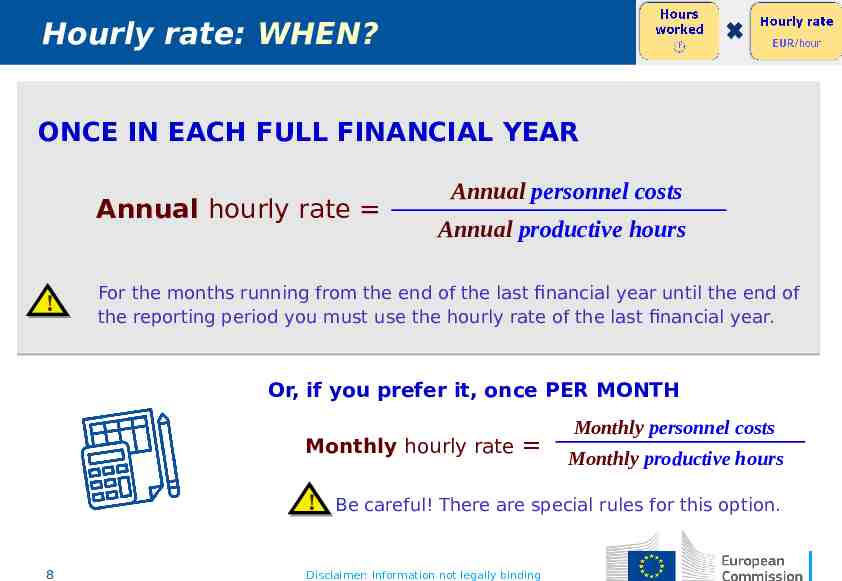

Hourly rate: WHEN? ONCE IN EACH FULL FINANCIAL YEAR Annual hourly rate ! Annual personnel costs Annual productive hours For the months running from the end of the last financial year until the end of the reporting period you must use the hourly rate of the last financial year. Or, if you prefer it, once PER MONTH Monthly hourly rate Monthly personnel costs Monthly productive hours ! Be careful! There are special rules for this option. 8 Disclaimer: Information not legally binding

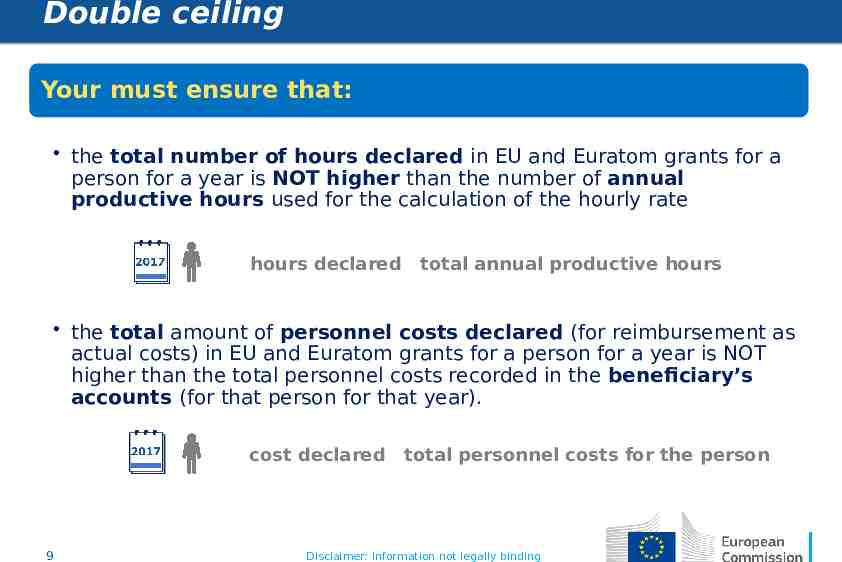

Double ceiling Your must ensure that: the total number of hours declared in EU and Euratom grants for a person for a year is NOT higher than the number of annual productive hours used for the calculation of the hourly rate hours declared total annual productive hours the total amount of personnel costs declared (for reimbursement as actual costs) in EU and Euratom grants for a person for a year is NOT higher than the total personnel costs recorded in the beneficiary’s accounts (for that person for that year). cost declared total personnel costs for the person 9 Disclaimer: Information not legally binding

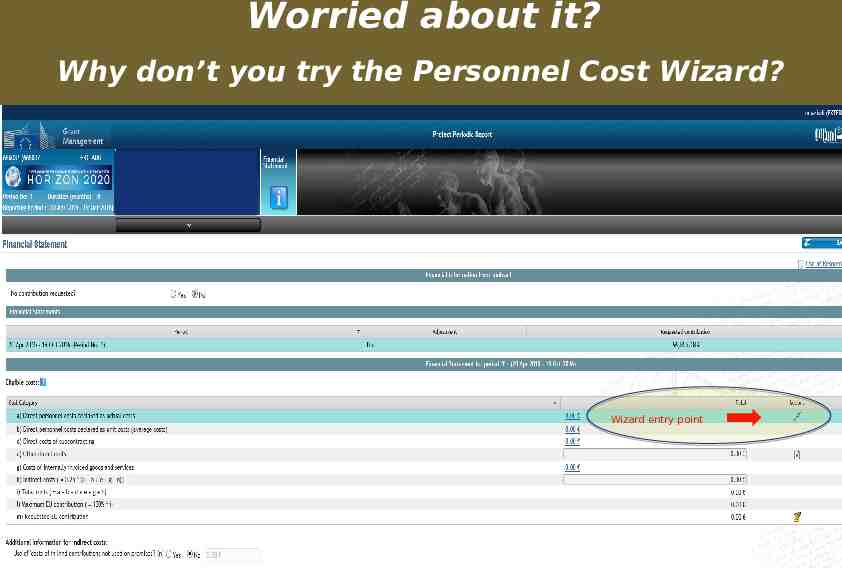

Worried about it? Why don’t you try the Personnel Cost Wizard? Wizard entry point 10 Disclaimer: Information not legally binding

Special case you should know about I want to pay to my employees more than their normal salary for their work in this prestigious grant Well, if you do it only for European Union grants, we cannot accept it That’s different, then you are under Project-based remuneration But I always do so with all prestigious grants! There are specific rules you need to apply ! 11 Disclaimer: Information not legally binding

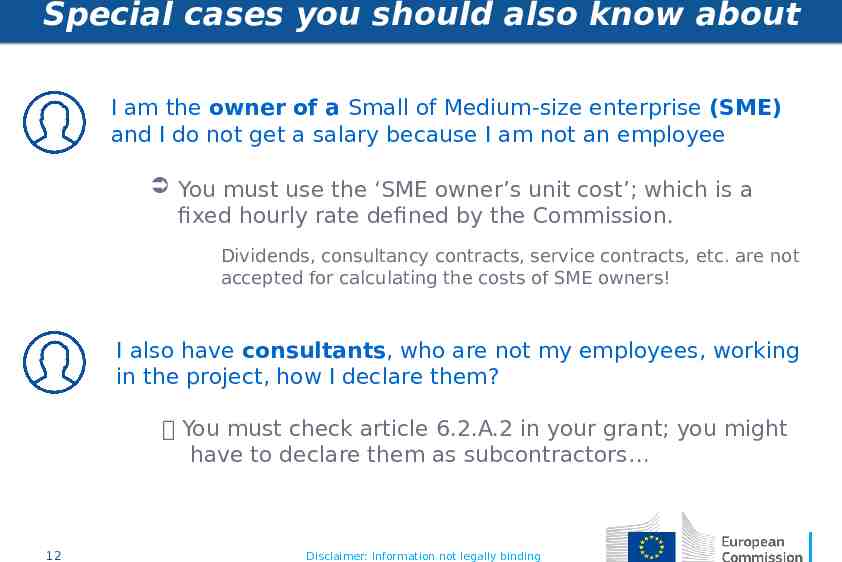

Special cases you should also know about I am the owner of a Small of Medium-size enterprise (SME) and I do not get a salary because I am not an employee You must use the ‘SME owner’s unit cost’; which is a fixed hourly rate defined by the Commission. Dividends, consultancy contracts, service contracts, etc. are not accepted for calculating the costs of SME owners! I also have consultants, who are not my employees, working in the project, how I declare them? You must check article 6.2.A.2 in your grant; you might have to declare them as subcontractors 12 Disclaimer: Information not legally binding

ADDITIONAL INFO: I want to read Horizon 2020 Annotated Grant Agreement http://ec.europa.eu/research/participants/data/ref/h2020/grants manual/amga/h2020-amga en.pdf Horizon 2020 On-line Manual https://ec.europa.eu/research/participants/docs/h2020-funding-guide/index en.htm I read, but it is still not clear National Contact Points Research Enquiry Service https://ec.europa.eu/info/funding-tenders/ http://ec.europa.eu/research/enquiries opportunities/portal/screen/support/ncp