1 Chapter 17 Income Income Recognition Recognition and and Measurement

66 Slides448.00 KB

1 Chapter 17 Income Income Recognition Recognition and and Measurement Measurement of of Net Net Assets Assets An Anelectronic electronicpresentation presentation by byDouglas DouglasCloud Cloud Pepperdine PepperdineUniversity University

2 Objectives Objectives 1. Understand the revenue recognition alternatives. 2. Explain revenue recognition at the time of sale, during production, and at time of cash receipt. 3. Explain the conceptual issues regarding revenue recognition alternatives. Continued Continued

3 Objectives Objectives 4. Describe the alternative revenue recognition methods. 5. Account for revenue recognition prior to the period of sale, including the percentage-of-completion and completed contract methods. Continued Continued

4 Objectives Objectives 6. Account for revenue recognition after the period of sale, including the installment and cost recovery methods. 7. Account for revenue recognition delayed until a future event occurs. 8. Understand software revenue recognition, franchises, real estate sales, retail land sales, and consignment sales.

5 Revenue Revenue Recognition Recognition Recognition Recognition isis the the process process of of formally formally recording recording and and reporting reporting items items in in the the financial financial statements. statements.

6 Revenue Revenue Recognition Recognition Realization Realization isis the the process process of of converting converting noncash noncash recourses recourses into into cash cash or or rights rights to to cash. cash.

7 Revenue Revenue Recognition Recognition Example Example 1: 1: Revenue Revenue Recognition Recognition at at Time Time of of Sale Sale 1. Ringwood Company manufactures the inventory. Inventory 100 Cash 100 2. Ringwood sells the inventory for 150. Accounts Receivable Revenue Cost of Goods Sold Inventory Continued Continued 150 150 100 100

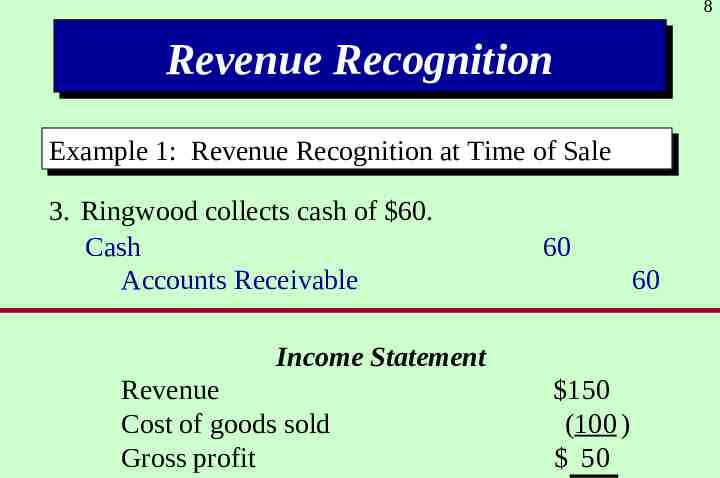

8 Revenue Revenue Recognition Recognition Example Example 1: 1: Revenue Revenue Recognition Recognition at at Time Time of of Sale Sale 3. Ringwood collects cash of 60. Cash Accounts Receivable 60 60 Income Statement Revenue Cost of goods sold Gross profit 150 (100 ) 50

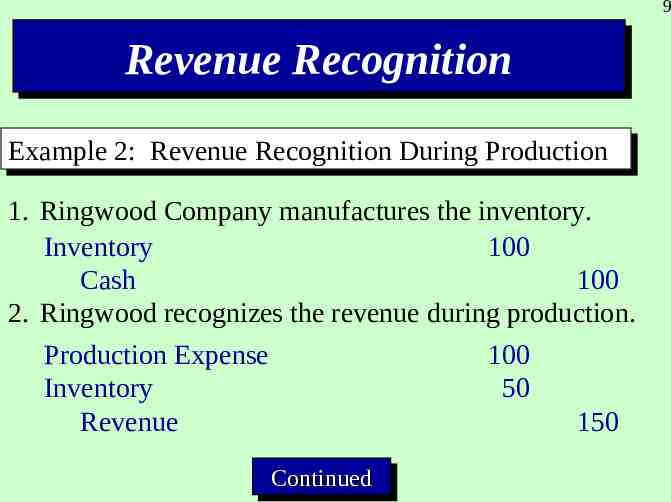

9 Revenue Revenue Recognition Recognition Example Example 2: 2: Revenue Revenue Recognition Recognition During During Production Production 1. Ringwood Company manufactures the inventory. Inventory 100 Cash 100 2. Ringwood recognizes the revenue during production. Production Expense 100 Inventory 50 Revenue 150 Continued Continued

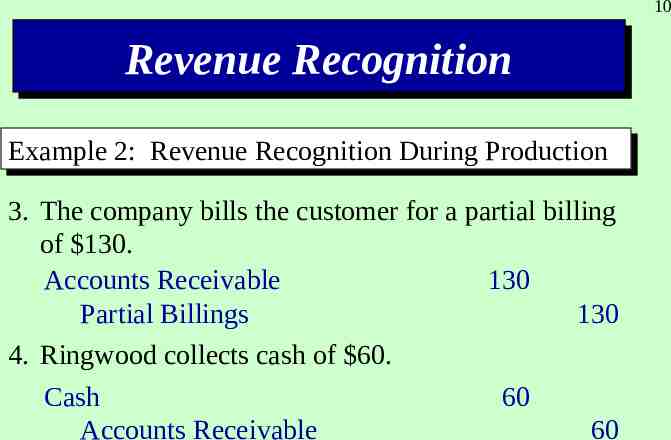

10 Revenue Revenue Recognition Recognition Example Example 2: 2: Revenue Revenue Recognition Recognition During During Production Production 3. The company bills the customer for a partial billing of 130. Accounts Receivable 130 Partial Billings 130 4. Ringwood collects cash of 60. Cash Accounts Receivable 60 60

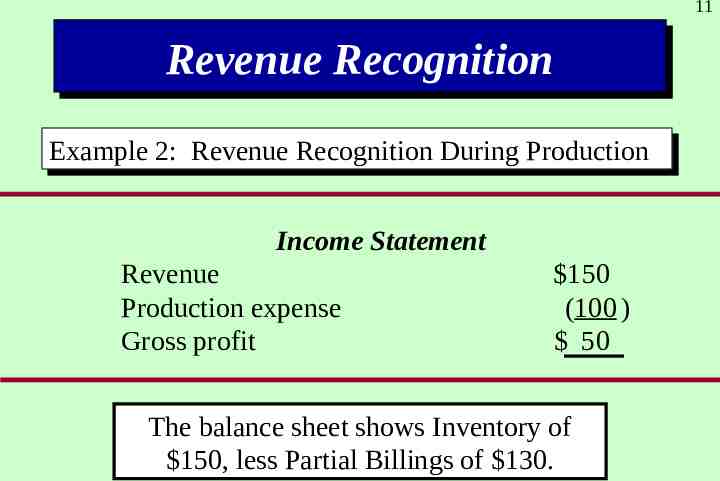

11 Revenue Revenue Recognition Recognition Example Example 2: 2: Revenue Revenue Recognition Recognition During During Production Production Income Statement Revenue Production expense Gross profit 150 (100 ) 50 The balance sheet shows Inventory of 150, less Partial Billings of 130.

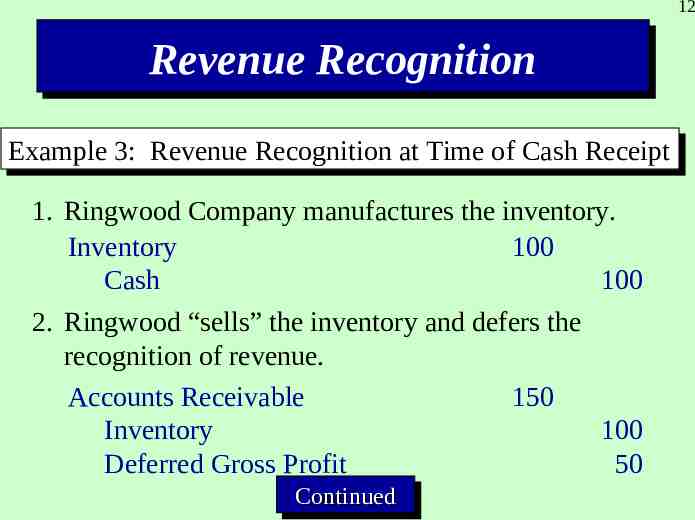

12 Revenue Revenue Recognition Recognition Example Example 3: 3: Revenue Revenue Recognition Recognition at at Time Time of of Cash Cash Receipt Receipt 1. Ringwood Company manufactures the inventory. Inventory 100 Cash 100 2. Ringwood “sells” the inventory and defers the recognition of revenue. Accounts Receivable 150 Inventory 100 Deferred Gross Profit 50 Continued Continued

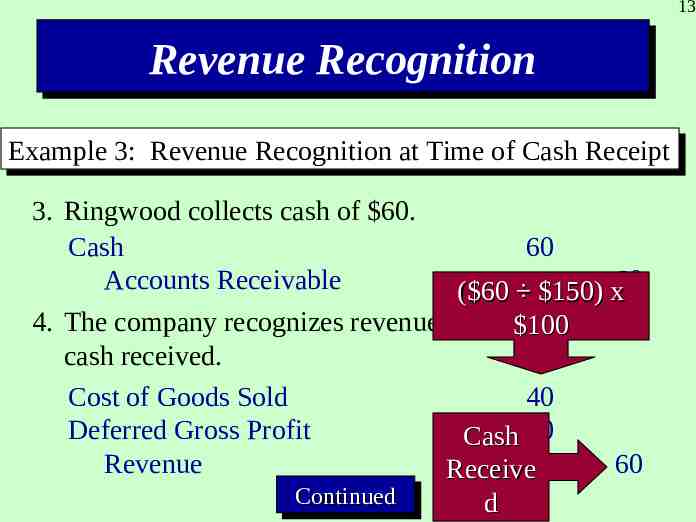

13 Revenue Revenue Recognition Recognition Example Example 3: 3: Revenue Revenue Recognition Recognition at at Time Time of of Cash Cash Receipt Receipt 3. Ringwood collects cash of 60. Cash 60 Accounts Receivable ( 60 150) x60 4. The company recognizes revenue on the 100 basis of the cash received. Cost of Goods Sold 40 Deferred Gross Profit Cash 20 Revenue 60 Receive Continued Continued d

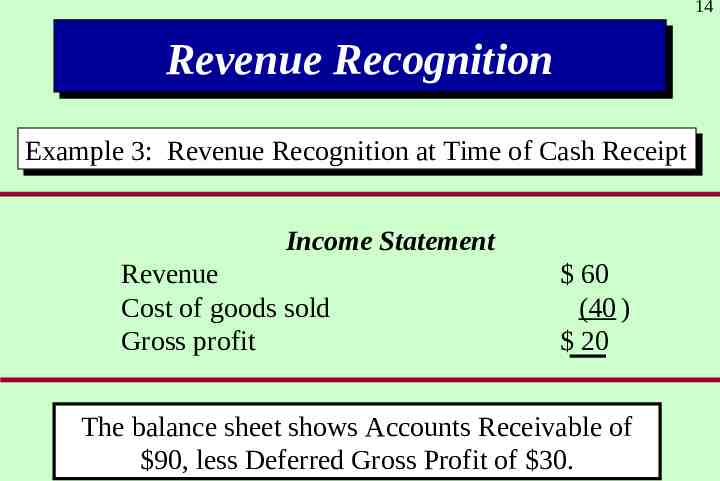

14 Revenue Revenue Recognition Recognition Example Example 3: 3: Revenue Revenue Recognition Recognition at at Time Time of of Cash Cash Receipt Receipt Income Statement Revenue Cost of goods sold Gross profit 60 (40 ) 20 The balance sheet shows Accounts Receivable of 90, less Deferred Gross Profit of 30.

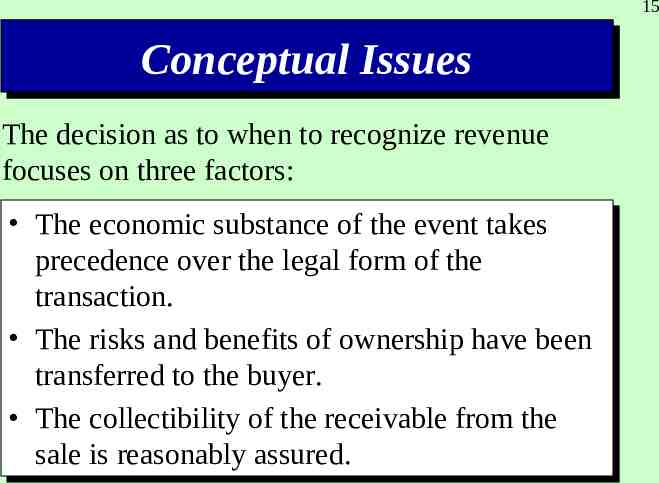

15 Conceptual Conceptual Issues Issues The decision as to when to recognize revenue focuses on three factors: The The economic economic substance substance of of the the event event takes takes precedence precedence over over the the legal legal form form of of the the transaction. transaction. The The risks risks and and benefits benefits of of ownership ownership have have been been transferred transferred to to the the buyer. buyer. The The collectibility collectibility of of the the receivable receivable from from the the sale sale isis reasonably reasonably assured. assured.

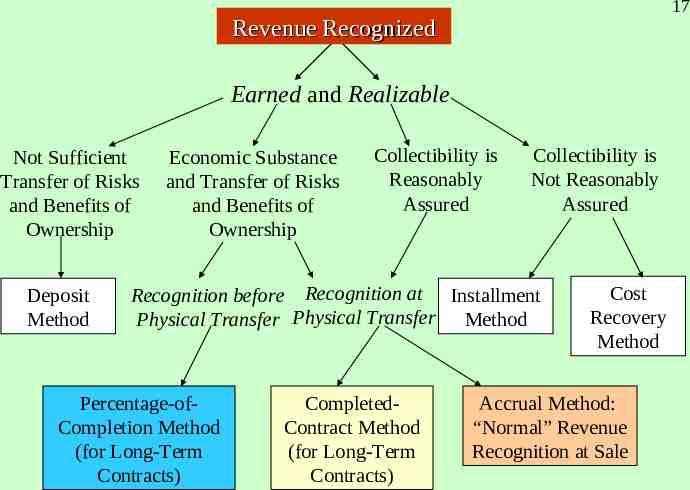

16 Alternative Alternative Revenue Revenue Recognition Recognition Methods Methods 1. Revenue recognition in the period of sale. 2. Revenue recognition prior to the period of sale. 3. Revenue recognition at the completion of production. 4.Revenue recognition after the period of sale. 5. Revenue recognition delayed until a future event.

17 Revenue Recognized Earned and Realizable Not Sufficient Transfer of Risks and Benefits of Ownership Deposit Method Economic Substance and Transfer of Risks and Benefits of Ownership Collectibility is Reasonably Assured Collectibility is Not Reasonably Assured Recognition before Recognition at Installment Physical Transfer Physical Transfer Method Percentage-ofCompletion Method (for Long-Term Contracts) CompletedContract Method (for Long-Term Contracts) Cost Recovery Method Accrual Method: “Normal” Revenue Recognition at Sale

18 Revenue Revenue Recognition Recognition Prior Prior to to the the Period Period of of Sale Sale Percentage-of-Completion Percentage-of-Completion Method Method It achieves the goals of accrual accounting. It is consistent with the argument that revenue is earned continuously over the entire earning process. It results in a more relevant measure of periodic income.

19 Percentage-of-Completion Percentage-of-Completion Method Method AICPA Statement of Position No. 81-1 requires that a construction company use the percentage-ofcompletion method for long-term contracts when all the following conditions are met:

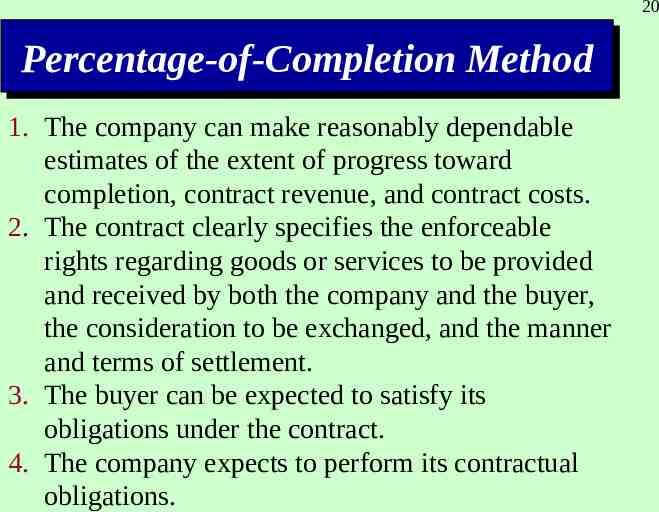

20 Percentage-of-Completion Percentage-of-Completion Method Method 1. The company can make reasonably dependable estimates of the extent of progress toward completion, contract revenue, and contract costs. 2. The contract clearly specifies the enforceable rights regarding goods or services to be provided and received by both the company and the buyer, the consideration to be exchanged, and the manner and terms of settlement. 3. The buyer can be expected to satisfy its obligations under the contract. 4. The company expects to perform its contractual obligations.

21 Percentage-of-Completion Percentage-of-Completion Method Method for short-term contract, for short-term contract, and and The Statement also requires The Statement also requires when there are inherent hazards in when there are inherent hazards in that a company use the that a company usethe thenormal the contract beyond the contract beyond the normal completed-contract method completed-contract method business risks for which business risks for which only when at least one of only when at least one of reasonably dependable estimates reasonably dependable estimates these isis not these conditions conditions not cannot be cannot be made. made. met. met.

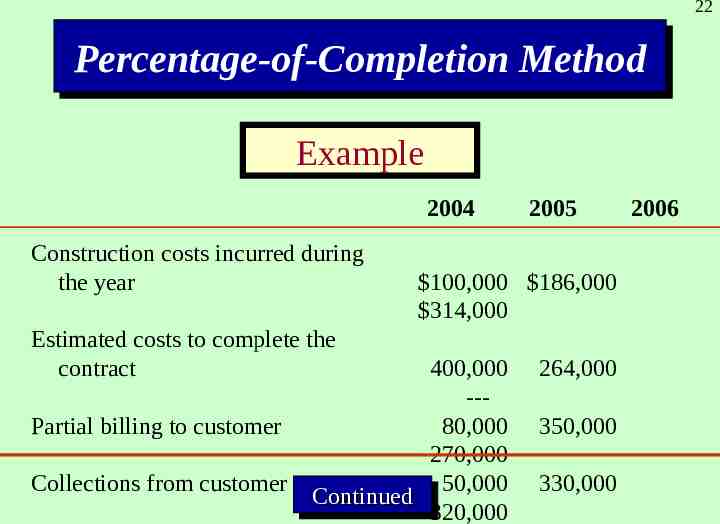

22 Percentage-of-Completion Percentage-of-Completion Method Method Example 2004 Construction costs incurred during the year 2005 100,000 186,000 314,000 Estimated costs to complete the contract 264,000 Partial billing to customer 350,000 Collections from customer 400,000 --80,000 270,000 50,000 Continued Continued 320,000 330,000 2006

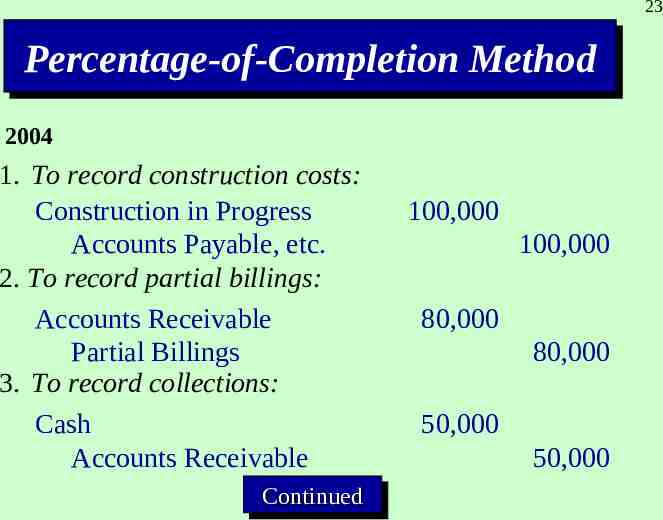

23 Percentage-of-Completion Percentage-of-Completion Method Method 2004 1. To record construction costs: Construction in Progress Accounts Payable, etc. 2. To record partial billings: Accounts Receivable Partial Billings 3. To record collections: Cash Accounts Receivable Continued Continued 100,000 100,000 80,000 80,000 50,000 50,000

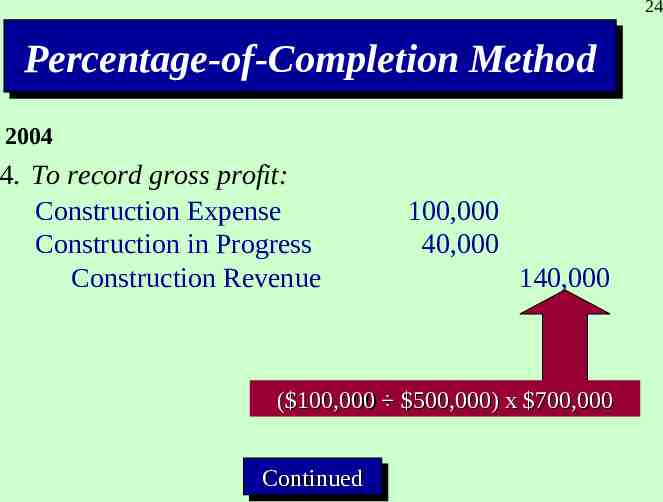

24 Percentage-of-Completion Percentage-of-Completion Method Method 2004 4. To record gross profit: Construction Expense Construction in Progress Construction Revenue 100,000 40,000 140,000 ( 100,000 500,000) x 700,000 Continued Continued

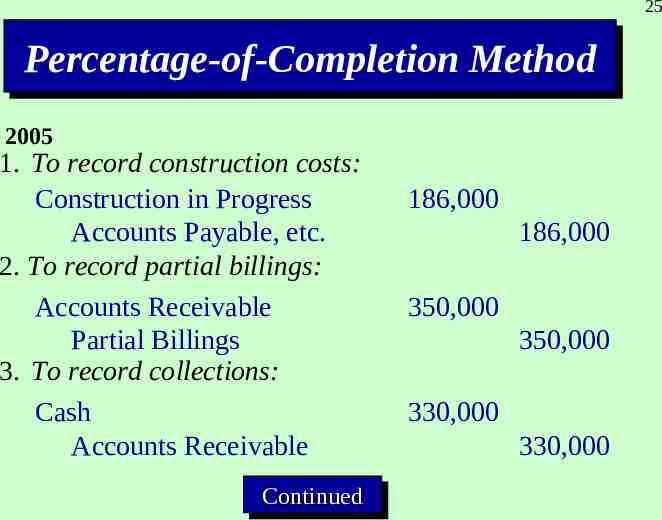

25 Percentage-of-Completion Percentage-of-Completion Method Method 2005 1. To record construction costs: Construction in Progress Accounts Payable, etc. 2. To record partial billings: Accounts Receivable Partial Billings 3. To record collections: Cash Accounts Receivable Continued Continued 186,000 186,000 350,000 350,000 330,000 330,000

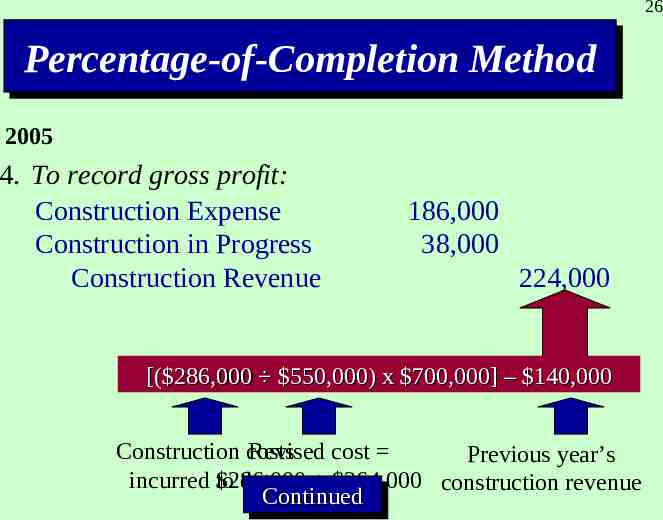

26 Percentage-of-Completion Percentage-of-Completion Method Method 2005 4. To record gross profit: Construction Expense Construction in Progress Construction Revenue 186,000 38,000 224,000 [( 286,000 550,000) x 700,000] – 140,000 Construction costs Revised cost Previous year’s incurred to 286,000 date 264,000 construction revenue Continued Continued

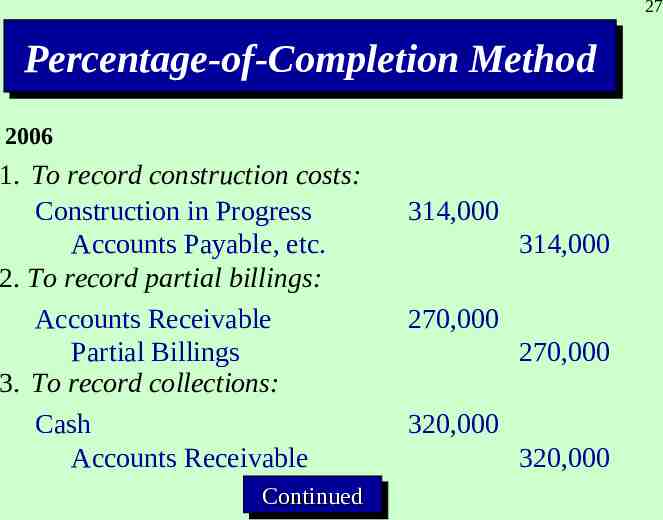

27 Percentage-of-Completion Percentage-of-Completion Method Method 2006 1. To record construction costs: Construction in Progress Accounts Payable, etc. 2. To record partial billings: Accounts Receivable Partial Billings 3. To record collections: Cash Accounts Receivable Continued Continued 314,000 314,000 270,000 270,000 320,000 320,000

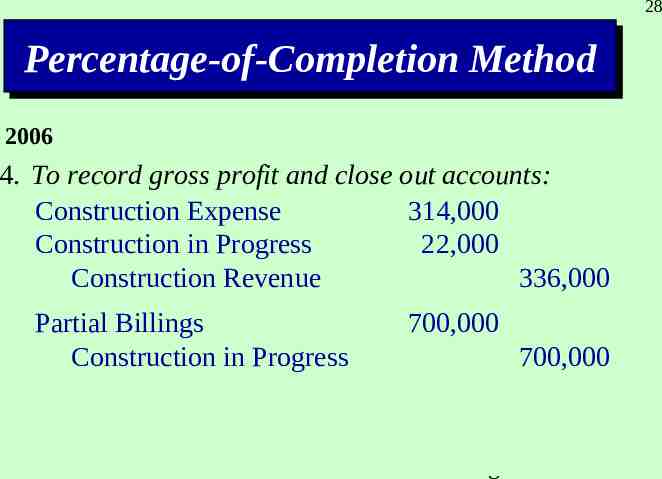

28 Percentage-of-Completion Percentage-of-Completion Method Method 2006 4. To record gross profit and close out accounts: Construction Expense 314,000 Construction in Progress 22,000 Construction Revenue 336,000 Partial Billings Construction in Progress 700,000 700,000 700,000 – 140,000 – 224,000 Recognized in 2004 in 2005 Recognized

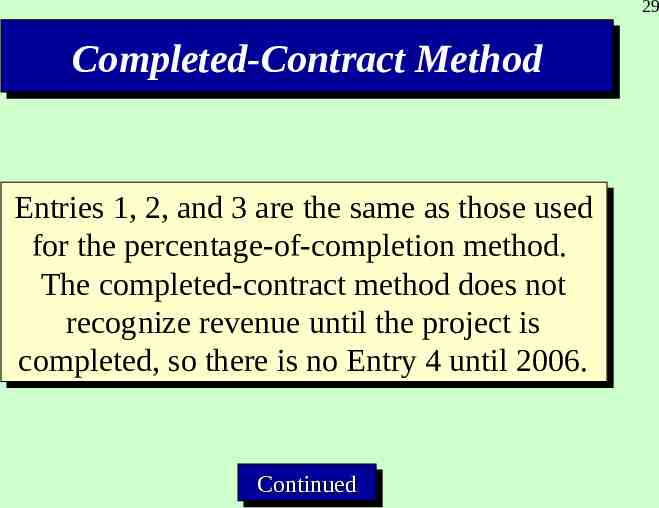

29 Completed-Contract Completed-Contract Method Method Entries Entries 1, 1, 2, 2, and and 33 are are the the same same as as those those used used for for the the percentage-of-completion percentage-of-completion method. method. The The completed-contract completed-contract method method does does not not recognize recognize revenue revenue until until the the project project isis completed, completed, so so there there isis no no Entry Entry 44 until until 2006. 2006. Continued Continued

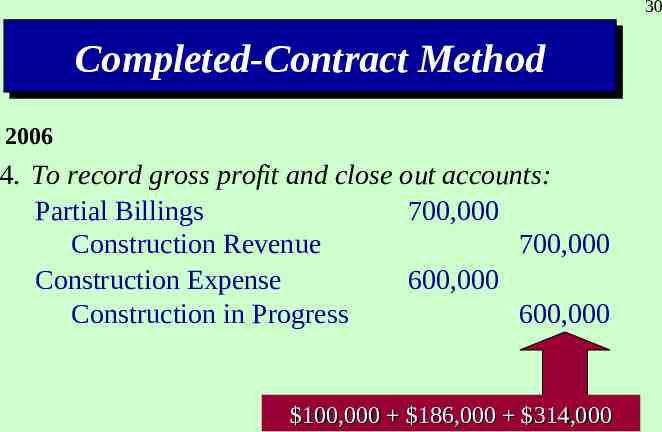

30 Completed-Contract Completed-Contract Method Method 2006 4. To record gross profit and close out accounts: Partial Billings 700,000 Construction Revenue 700,000 Construction Expense 600,000 Construction in Progress 600,000 100,000 186,000 314,000

31 Capitalized Capitalized Interest Interest IfIf interest interest cost cost isis associated associated with with the the funds funds used used in in the the construction, construction, the the firm firm should should include include this this cost cost in in the the Construction Construction in in Process Process account. account.

32 Installment Installment Method Method Installment sales involve Installment sales and agrees to make and agrees toinvolve make aperiodic financing agreement aperiodic financing agreement payments over payments over whereby the customer whereby theperiod, customer an extended often an extended period, often signs aa contract,. signs contract,. several years. several years. .makes .makes aa small small down down payment,. payment,.

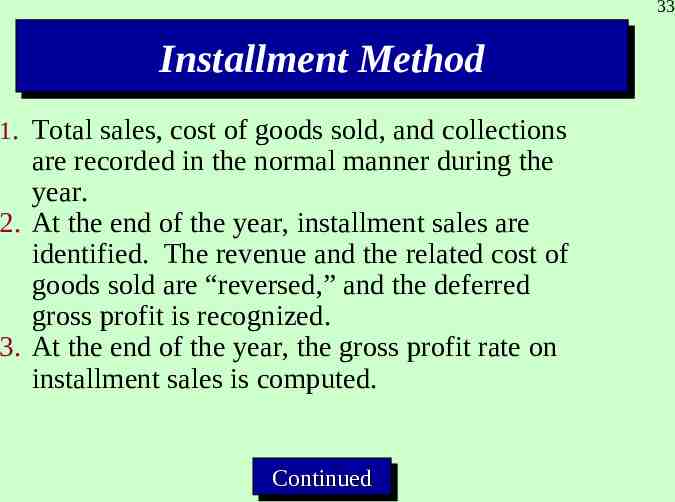

33 Installment Installment Method Method 1. Total sales, cost of goods sold, and collections are recorded in the normal manner during the year. 2. At the end of the year, installment sales are identified. The revenue and the related cost of goods sold are “reversed,” and the deferred gross profit is recognized. 3. At the end of the year, the gross profit rate on installment sales is computed. Continued Continued

34 Installment Installment Method Method 4. A portion of the deferred gross profit is recognized as gross profit. 5. In future years the remaining deferred gross profit is reduced and the gross profit is recognized based on the cash collected on the installment sales.

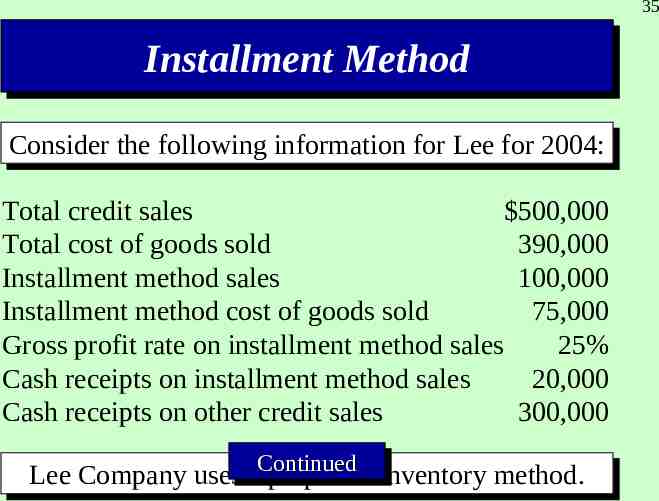

35 Installment Installment Method Method Consider Consider the the following following information information for for Lee Lee for for 2004: 2004: Total credit sales 500,000 Total cost of goods sold 390,000 Installment method sales 100,000 Installment method cost of goods sold 75,000 Gross profit rate on installment method sales 25% Cash receipts on installment method sales 20,000 Cash receipts on other credit sales 300,000 Continued Continued Lee Company uses a Lee Company uses a perpetual perpetual inventory inventory method. method.

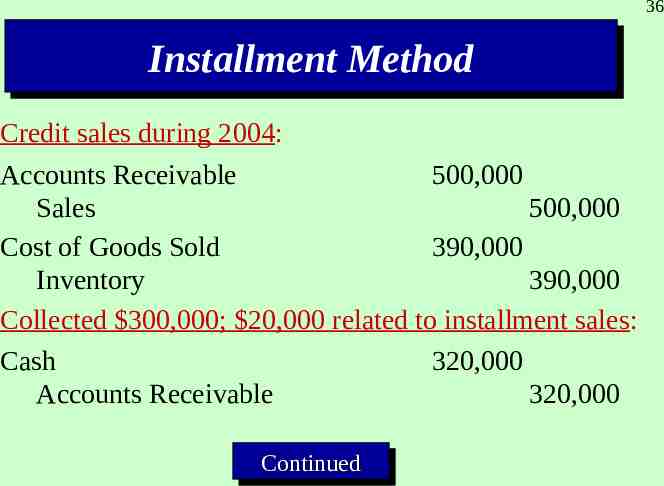

36 Installment Installment Method Method Credit sales during 2004: Accounts Receivable 500,000 Sales 500,000 Cost of Goods Sold 390,000 Inventory 390,000 Collected 300,000; 20,000 related to installment sales: Cash 320,000 Accounts Receivable 320,000 Continued Continued

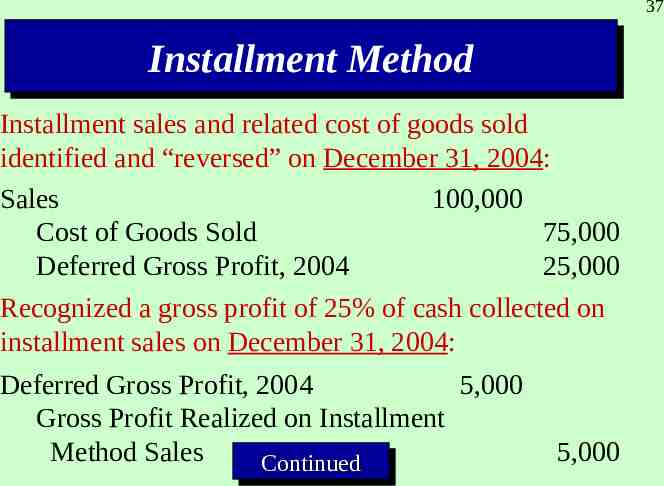

37 Installment Installment Method Method Installment sales and related cost of goods sold identified and “reversed” on December 31, 2004: Sales 100,000 Cost of Goods Sold 75,000 Deferred Gross Profit, 2004 25,000 Recognized a gross profit of 25% of cash collected on installment sales on December 31, 2004: Deferred Gross Profit, 2004 5,000 Gross Profit Realized on Installment Method Sales Continued Continued 5,000

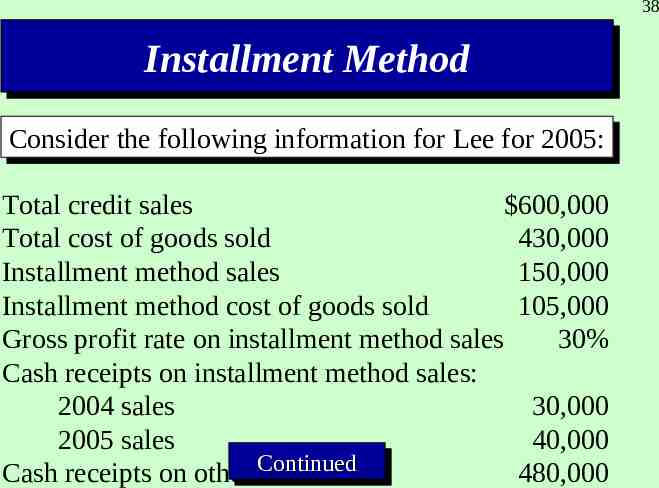

38 Installment Installment Method Method Consider Consider the the following following information information for for Lee Lee for for 2005: 2005: Total credit sales 600,000 Total cost of goods sold 430,000 Installment method sales 150,000 Installment method cost of goods sold 105,000 Gross profit rate on installment method sales 30% Cash receipts on installment method sales: 2004 sales 30,000 2005 sales 40,000 Continued Cash receipts on other Continued credit sales 480,000

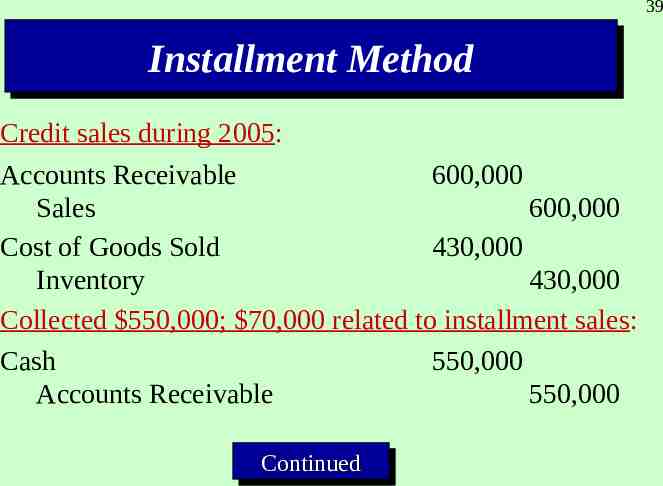

39 Installment Installment Method Method Credit sales during 2005: Accounts Receivable 600,000 Sales 600,000 Cost of Goods Sold 430,000 Inventory 430,000 Collected 550,000; 70,000 related to installment sales: Cash 550,000 Accounts Receivable 550,000 Continued Continued

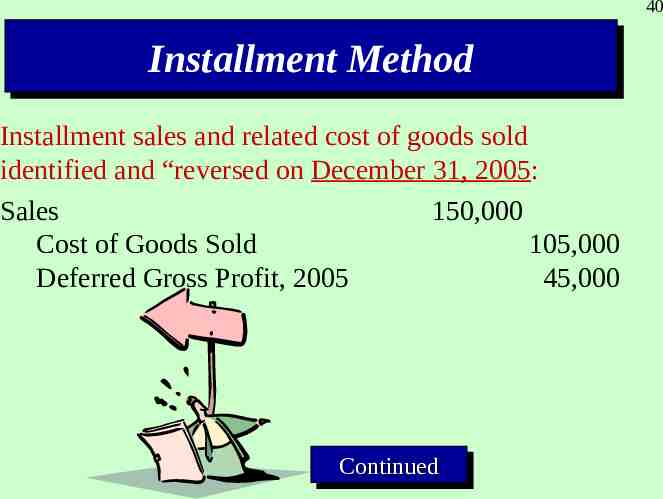

40 Installment Installment Method Method Installment sales and related cost of goods sold identified and “reversed on December 31, 2005: Sales 150,000 Cost of Goods Sold 105,000 Deferred Gross Profit, 2005 45,000 Continued Continued

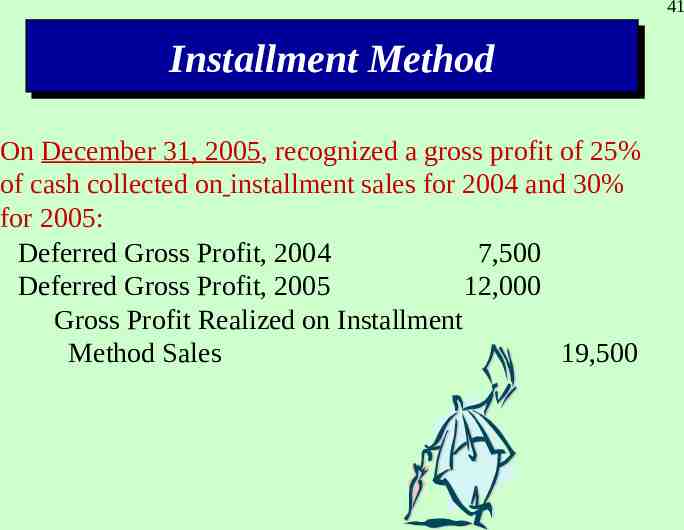

41 Installment Installment Method Method On December 31, 2005, recognized a gross profit of 25% of cash collected on installment sales for 2004 and 30% for 2005: Deferred Gross Profit, 2004 7,500 Deferred Gross Profit, 2005 12,000 Gross Profit Realized on Installment Method Sales 19,500

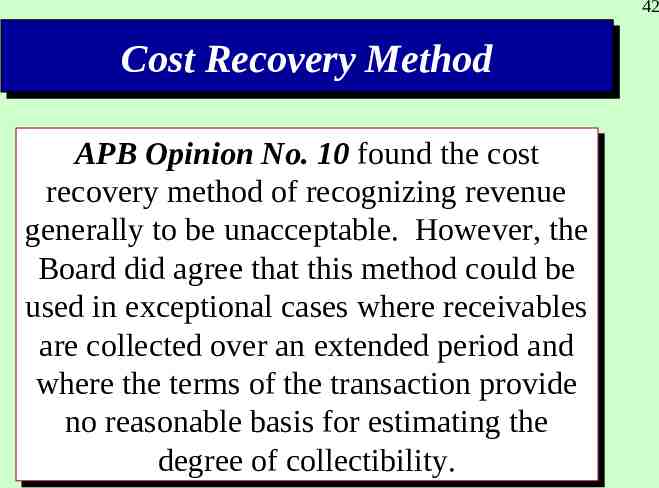

42 Cost Cost Recovery Recovery Method Method APB APB Opinion Opinion No. No. 10 10 found found the the cost cost recovery recovery method method of of recognizing recognizing revenue revenue generally generally to to be be unacceptable. unacceptable. However, However, the the Board Board did did agree agree that that this this method method could could be be used used in in exceptional exceptional cases cases where where receivables receivables are are collected collected over over an an extended extended period period and and where where the the terms terms of of the the transaction transaction provide provide no no reasonable reasonable basis basis for for estimating estimating the the degree degree of of collectibility. collectibility.

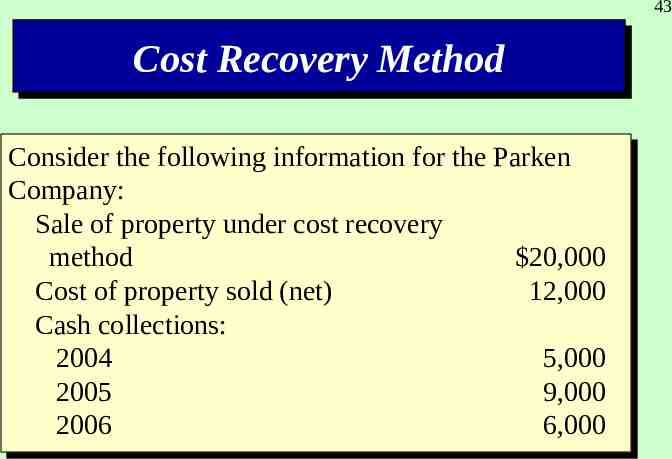

43 Cost Cost Recovery Recovery Method Method Consider Consider the the following following information information for for the the Parken Parken Company: Company: Sale Sale of of property property under under cost cost recovery recovery method 20,000 method 20,000 Cost 12,000 Cost of of property property sold sold (net) (net) 12,000 Cash Cash collections: collections: 2004 5,000 2004 5,000 2005 9,000 2005 9,000 2006 6,000 2006 6,000

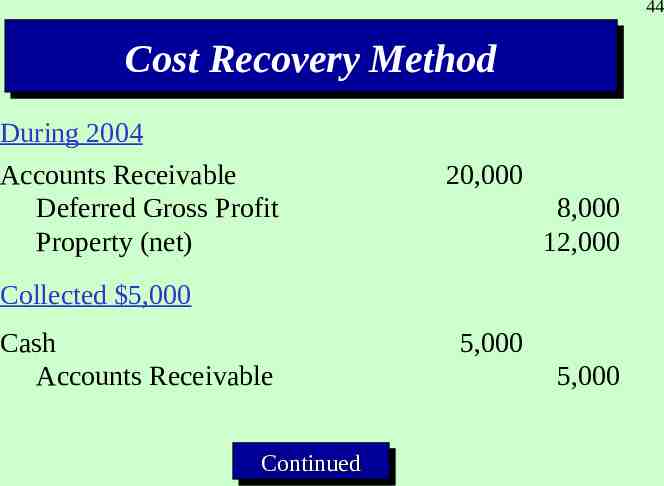

44 Cost Cost Recovery Recovery Method Method During 2004 Accounts Receivable Deferred Gross Profit Property (net) 20,000 8,000 12,000 Collected 5,000 Cash Accounts Receivable Continued Continued 5,000 5,000

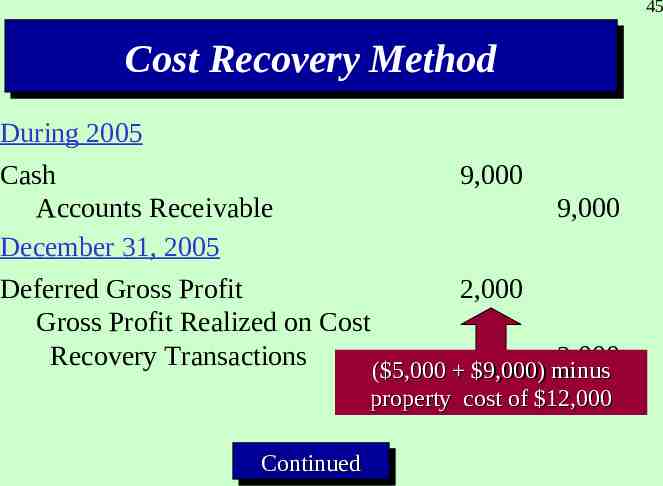

45 Cost Cost Recovery Recovery Method Method During 2005 Cash Accounts Receivable December 31, 2005 9,000 9,000 Deferred Gross Profit 2,000 Gross Profit Realized on Cost Recovery Transactions 2,000 ( 5,000 9,000) minus property cost of 12,000 Continued Continued

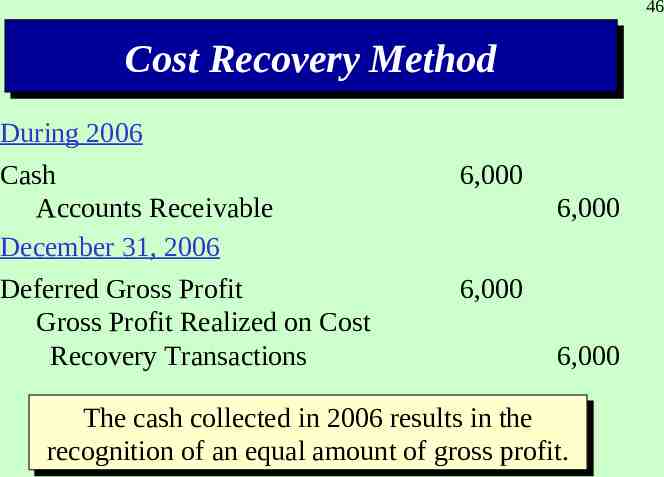

46 Cost Cost Recovery Recovery Method Method During 2006 Cash Accounts Receivable December 31, 2006 Deferred Gross Profit Gross Profit Realized on Cost Recovery Transactions 6,000 6,000 6,000 6,000 The The cash cash collected collected in in 2006 2006 results results in in the the recognition recognition of of an an equal equal amount amount of of gross gross profit. profit.

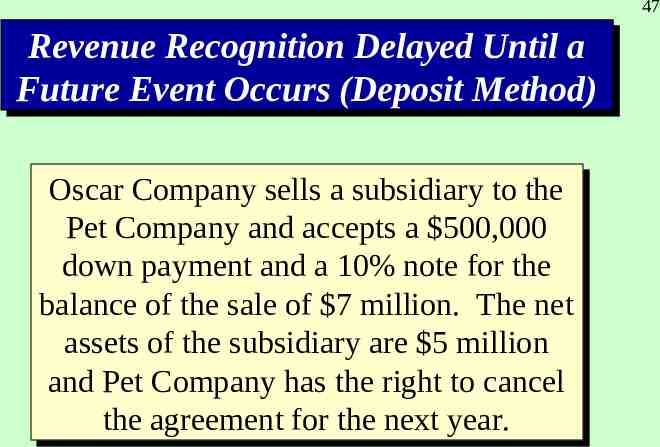

47 Revenue Revenue Recognition Recognition Delayed Delayed Until Until aa Future Future Event Event Occurs Occurs (Deposit (Deposit Method) Method) Oscar Oscar Company Company sells sells aa subsidiary subsidiary to to the the Pet Pet Company Company and and accepts accepts aa 500,000 500,000 down down payment payment and and aa 10% 10% note note for for the the balance balance of of the the sale sale of of 7 7 million. million. The The net net assets assets of of the the subsidiary subsidiary are are 5 5 million million and and Pet Pet Company Company has has the the right right to to cancel cancel the the agreement agreement for for the the next next year. year.

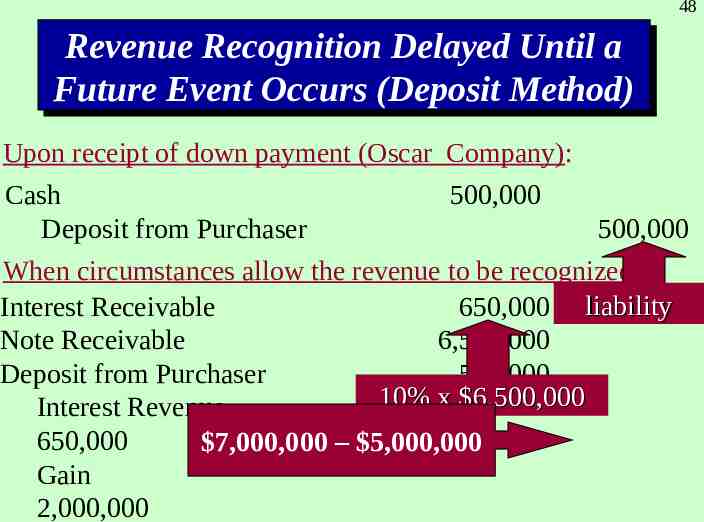

48 Revenue Revenue Recognition Recognition Delayed Delayed Until Until aa Future Future Event Event Occurs Occurs (Deposit (Deposit Method) Method) Upon receipt of down payment (Oscar Company): Cash 500,000 Deposit from Purchaser 500,000 When circumstances allow the revenue to be recognized: Interest Receivable 650,000 liability Note Receivable 6,500,000 Deposit from Purchaser 500,000 10% x 6,500,000 Interest Revenue 650,000 7,000,000 – 5,000,000 Gain 2,000,000

49 Software Software Revenue Revenue Recognition Recognition Guidelines Guidelines of of AICPA AICPAStatement Statement of of Position Position No. No. 97-2 97-2 If a company has an agreement to deliver software that requires significant production, modification, or customization of software, it uses contract accounting for the agreement .

50 Software Software Revenue Revenue Recognition Recognition Guidelines Guidelines of of AICPA AICPAStatement Statement of of Position Position No. No. 97-2 97-2 If a company has an agreement to deliver software that does not require significant production, modification, or customization of software, it recognizes revenue when (a) persuasive evidence of an agreement exists, (b) delivery has occurred, (c) the seller’s fee is fixed or determinable, and (d) collectibility is probable.

51 Software Software Revenue Revenue Recognition Recognition Guidelines Guidelines of of AICPA AICPAStatement Statement of of Position Position No. No. 97-2 97-2 A company separately accounts for a service element if (a) the services are not essential to the functionality of any other element of the transaction, and (b) the services are stated separately in the contract such that the total price of the agreement would be expected to vary as the result of inclusion or exclusion of the service.

52 Software Software Revenue Revenue Recognition Recognition Guidelines Guidelines of of AICPA AICPAStatement Statement of of Position Position No. No. 97-2 97-2 Software arrangements may consist of multiple elements such as additional software products, upgrades and/or enhancements, rights to exchange or return software, and customer support. If contract accounting does not apply, a company must allocate its fee to the various elements based on fair values.

53 Software Software Revenue Revenue Recognition Recognition Guidelines Guidelines of of AICPA AICPAStatement Statement of of Position Position No. No. 97-2 97-2 A company must allocate any discounts proportionately to all the elements, except that none can be allocated to upgrade rights.

54 Franchise Franchise A A franchise franchise agreement agreement involves involves the the granting granting of of business business rights rights by by the the franchisor franchisor to to aa franchisee franchisee who who will will operate operate the the franchised franchised business. business.

55 Franchise Franchise Castle Castle Company Company sells sells aa franchise franchise that that requires requires an an initial initial franchise franchise fee fee of of 70,000. 70,000. A A down down payment payment of of 20,000 20,000 cash cash isis required, required, with with the the balance balance covered covered by by the the issuance issuance of of aa 50,000, 50,000, 10% 10% note, note, payable payable by by the the franchisee franchisee in in five five equal equal annual annual installments. installments.

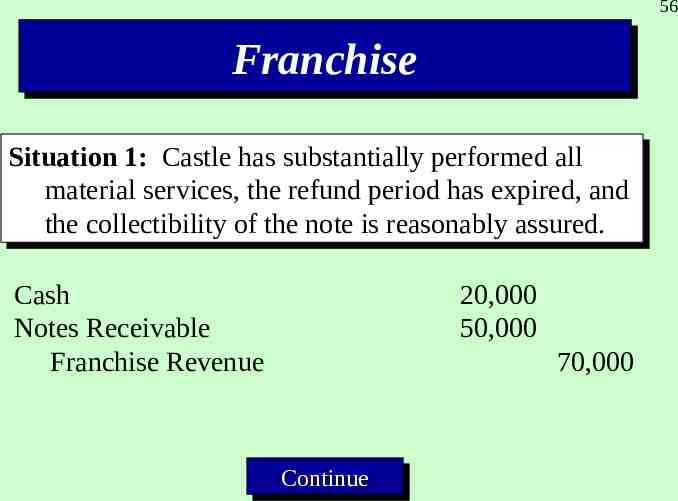

56 Franchise Franchise Situation Situation 1: 1: Castle Castle has has substantially substantially performed performed all all material material services, services, the the refund refund period period has has expired, expired, and and the the collectibility collectibility of of the the note note isis reasonably reasonably assured. assured. Cash Notes Receivable Franchise Revenue 20,000 50,000 70,000 Continue Continue

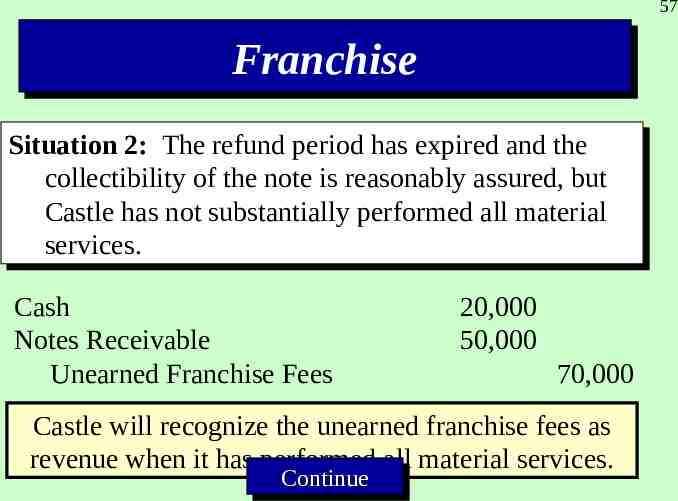

57 Franchise Franchise Situation Situation 2: 2: The The refund refund period period has has expired expired and and the the collectibility collectibility of of the the note note isis reasonably reasonably assured, assured, but but Castle Castlehas has not not substantially substantially performed performed all all material material services. services. Cash Notes Receivable Unearned Franchise Fees 20,000 50,000 70,000 Castle will recognize the unearned franchise fees as revenue when it has performed all material services. Continue Continue

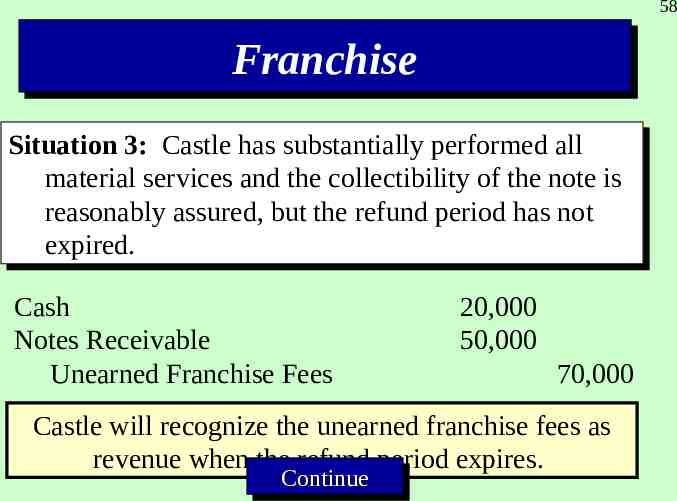

58 Franchise Franchise Situation Situation 3: 3: Castle Castle has has substantially substantially performed performed all all material material services services and and the the collectibility collectibility of of the the note note isis reasonably reasonably assured, assured, but but the the refund refund period period has has not not expired. expired. Cash Notes Receivable Unearned Franchise Fees 20,000 50,000 70,000 Castle will recognize the unearned franchise fees as revenue when the refund period expires. Continue Continue

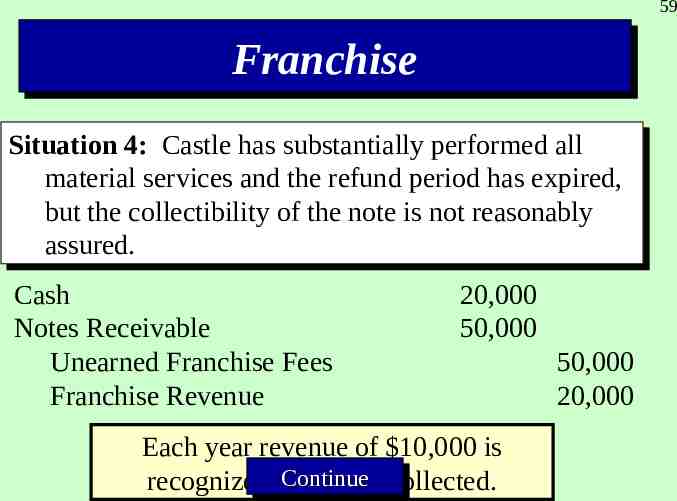

59 Franchise Franchise Situation Situation 4: 4: Castle Castle has has substantially substantially performed performed all all material material services services and and the the refund refund period period has has expired, expired, but but the the collectibility collectibility of of the the note note isis not not reasonably reasonably assured. assured. Cash Notes Receivable Unearned Franchise Fees Franchise Revenue 20,000 50,000 Each year revenue of 10,000 is Continue recognized as cash is collected. Continue 50,000 20,000

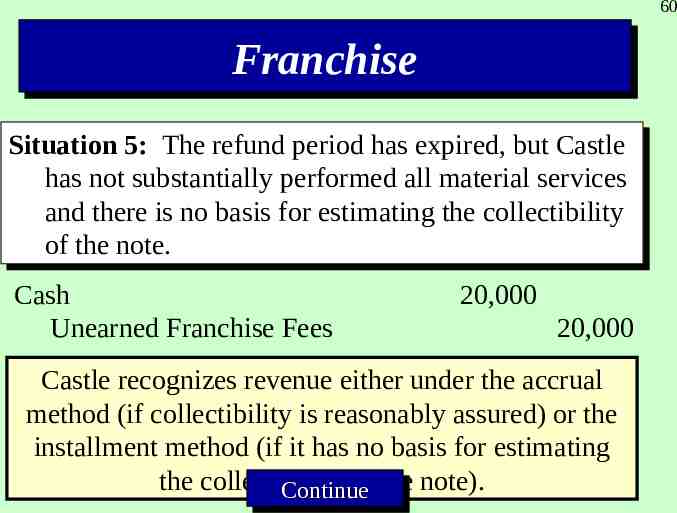

60 Franchise Franchise Situation Situation 5: 5: The The refund refund period period has has expired, expired, but but Castle Castle has has not not substantially substantially performed performed all all material material services services and and there there isis no no basis basis for for estimating estimating the the collectibility collectibility of of the the note. note. Cash Unearned Franchise Fees 20,000 20,000 Castle recognizes revenue either under the accrual method (if collectibility is reasonably assured) or the installment method (if it has no basis for estimating the collectibility of the note). Continue Continue Continue

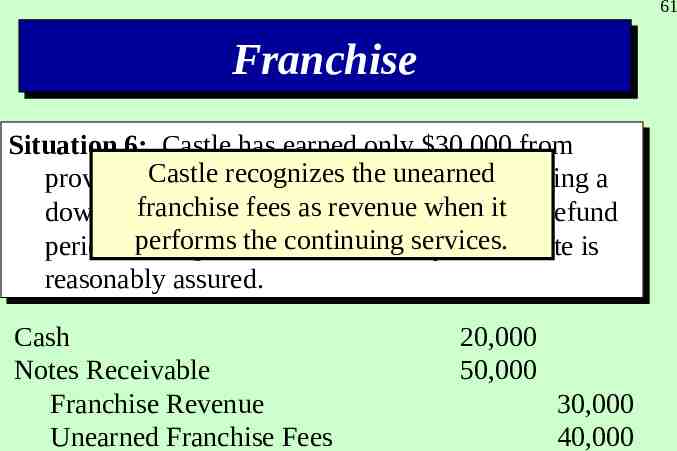

61 Franchise Franchise Situation Situation 6: 6: Castle Castle has has earned earned only only 30,000 30,000 from from the unearned providing initial services, the providingCastle initialrecognizes services, with with the balance balance being being aa franchise as revenue when itThe down for continuing services. down payment payment forfees continuing services. The refund refund performs continuing services. period expired and collectibility of period has has expiredthe and collectibility of the the note note isis reasonably reasonably assured. assured. Cash Notes Receivable Franchise Revenue Unearned Franchise Fees 20,000 50,000 30,000 40,000

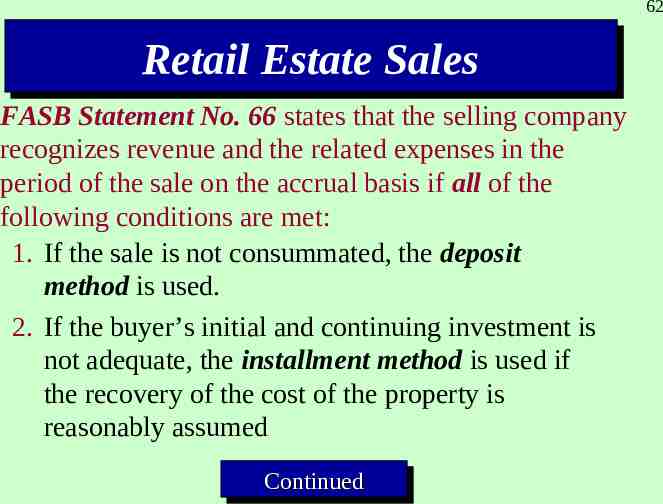

62 Retail Retail Estate Estate Sales Sales FASB Statement No. 66 states that the selling company recognizes revenue and the related expenses in the period of the sale on the accrual basis if all of the following conditions are met: 1. If the sale is not consummated, the deposit method is used. 2. If the buyer’s initial and continuing investment is not adequate, the installment method is used if the recovery of the cost of the property is reasonably assumed Continued Continued

63 Retail Retail Estate Estate Sales Sales 3. If the seller’s receivable is subject to future subordination, the cost recovery method is used. 4. If the seller has continuing involvement with the property and does not transfer substantially all the risks and benefits of ownership, generally revenue and related expenses are recognized at the time of sale with a deduction for the maximum exposure to loss.

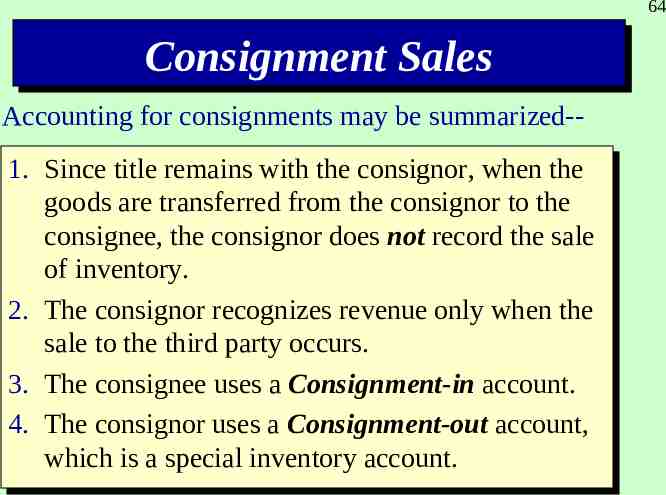

64 Consignment Consignment Sales Sales Accounting for consignments may be summarized-1. 1. Since Sincetitle titleremains remains with with the theconsignor, consignor,when whenthe the goods goods are aretransferred transferred from from the theconsignor consignor to to the the consignee, consignee, the the consignor consignor does does not not record record the the sale sale of of inventory. inventory. 2. 2. The The consignor consignor recognizes recognizes revenue revenue only only when when the the sale sale to tothe thethird third party party occurs. occurs. 3. 3. The The consignee consignee uses uses aa Consignment-in Consignment-in account. account. 4. 4. The The consignor consignor uses uses aa Consignment-out Consignment-out account, account, which which isis aa special special inventory inventory account. account.

65 Chapter 17 The The End End

66