From A to Z: Using American Rescue Plan Act Fiscal Recovery Funds to

40 Slides3.89 MB

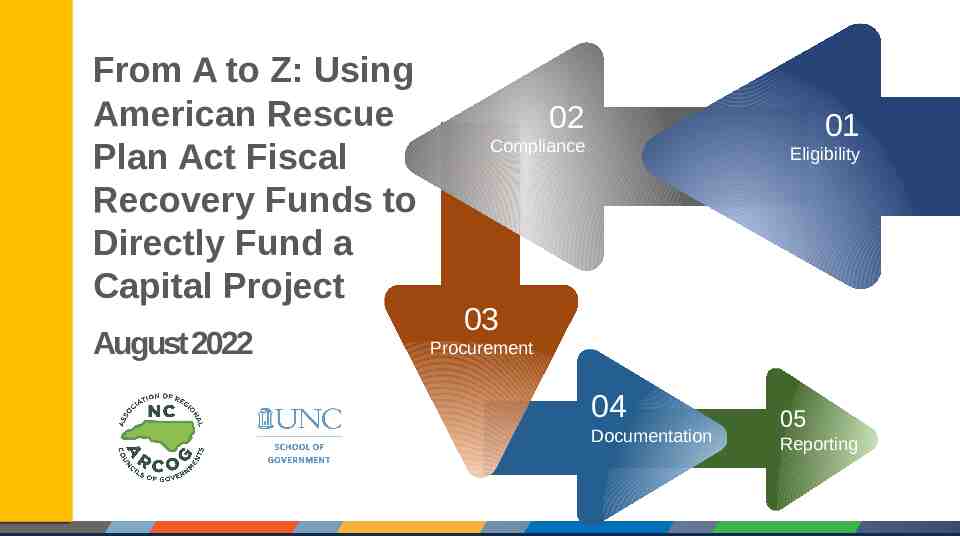

From A to Z: Using American Rescue Plan Act Fiscal Recovery Funds to Directly Fund a Capital Project August 2022 02 01 Compliance Eligibility 03 Procurement 04 Documentation 05 Reporting

The North Carolina Association of Regional Councils of Governments (NCARCOG) is proud to present this latest training series for the American Rescue Plan Act (ARPA) in partnership with the UNC School of Government. Councils of Governments (COGs) serve as lead planning organizations for their regions, and they work with their member governments to convene, coordinate, plan, and implement programs and services that make a difference in each region. ARPA represents a once-in-ageneration opportunity to bring funds into each region to make significant investments in public infrastructure that will provide benefits for several decades into the future. Our job now is to assist our local governments so they have the knowledge and expertise to implement their priorities in an impactful and compliant manner. Please reach out to your local COG if you need assistance or support! Robert Hiett Chairman North Carolina Association of Regional Councils of Governments

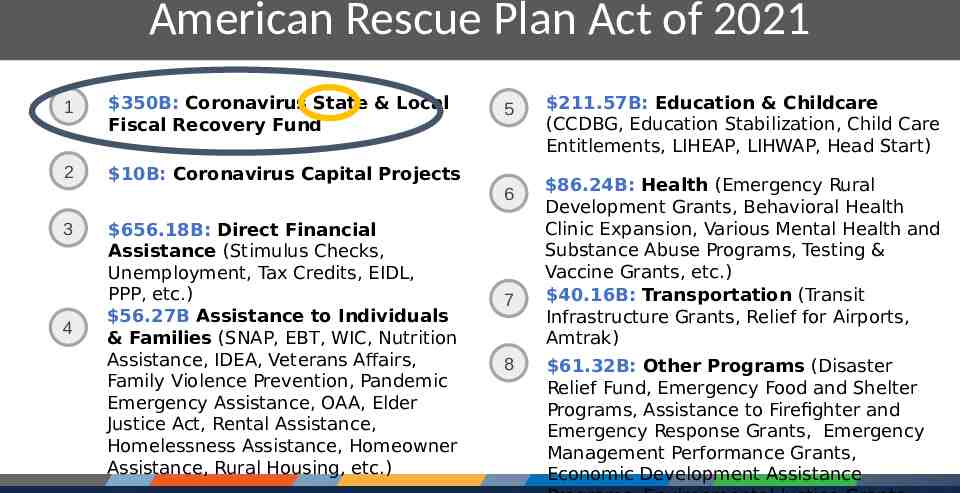

American Rescue Plan Act of 2021 1 350B: Coronavirus State & Local Fiscal Recovery Fund 2 10B: Coronavirus Capital Projects 5 6 3 4 656.18B: Direct Financial Assistance (Stimulus Checks, Unemployment, Tax Credits, EIDL, PPP, etc.) 56.27B Assistance to Individuals & Families (SNAP, EBT, WIC, Nutrition Assistance, IDEA, Veterans Affairs, Family Violence Prevention, Pandemic Emergency Assistance, OAA, Elder Justice Act, Rental Assistance, Homelessness Assistance, Homeowner Assistance, Rural Housing, etc.) 7 8 211.57B: Education & Childcare (CCDBG, Education Stabilization, Child Care Entitlements, LIHEAP, LIHWAP, Head Start) 86.24B: Health (Emergency Rural Development Grants, Behavioral Health Clinic Expansion, Various Mental Health and Substance Abuse Programs, Testing & Vaccine Grants, etc.) 40.16B: Transportation (Transit Infrastructure Grants, Relief for Airports, Amtrak) 61.32B: Other Programs (Disaster Relief Fund, Emergency Food and Shelter Programs, Assistance to Firefighter and Emergency Response Grants, Emergency Management Performance Grants, Economic Development Assistance

US Treasury Compliance Guidanc e US Treasury Treasury US Final Rule Rule FF Final AQs AQs US Treasury Resource Page Assistance Listing (21.027) Final R ule US Treasury Treasury is is routinely routinely US updating Final Final Rule Rule FAQs, FAQs, updating and compliance compliance and and and reporting guidelines. guidelines. reporting Make sure sure you you are are Make relying on on the the most most relying current guidance. guidance. current UG Compliance Supplement US Treasu Treasu US ry Final Final Ru Ru ry le Summa Summa le ry ry ARP/CSLFRF Where to go for the latest guidance on ARP/CLFRF

ARP/CSLFRF Eligible? State Law Authority and Requirements? Can We Fund it with ARP / CSLFRF? Award Term Requirements and Limitations? Uniform Guidance Requirements and Limitations? Special Justification, Documentation, & Reporting Requirements?

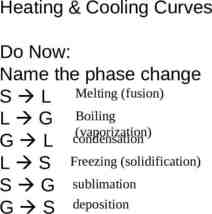

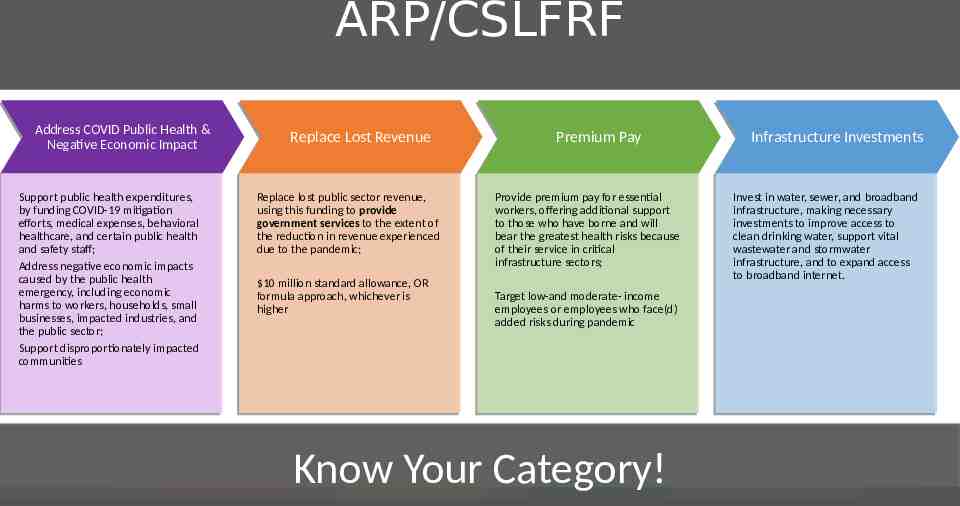

ARP/CSLFRF Address COVID COVID Public Public Health Health & & Address Negative Economic Economic Impact Impact Negative Support public public health health expenditures, expenditures, Support by funding funding COVID-19 COVID-19 mitigation mitigation by efforts, medical medical expenses, expenses, behavioral behavioral efforts, healthcare, and certain public health healthcare, and certain public health and safety staff; and safety staff; Address negative negative economic economic impacts impacts Address caused by by the the public public health health caused emergency, including including economic economic emergency, harms to workers, households, small harms to workers, households, small businesses, impacted industries, and businesses, impacted industries, and the public public sector; sector; the Support disproportionately disproportionately impacted impacted Support communities communities Replace Lost Lost Revenue Revenue Replace Replace lost lost public public sector sector revenue, revenue, Replace using this this funding funding to to provide provide using government services services to to the the extent extent of of government the reduction in revenue experienced the reduction in revenue experienced due to to the the pandemic; pandemic; due 10 million million standard standard allowance, allowance, OR OR 10 formula approach, whichever is formula approach, whichever is higher higher Premium Pay Pay Premium Provide premium premium pay pay for for essential essential Provide workers, offering offering additional additional support support workers, to those those who who have have borne borne and and will will to bear the greatest health risks because bear the greatest health risks because of their their service service in in critical critical of infrastructure sectors; infrastructure sectors; Target low-and low-and moderatemoderate- income income Target employees or employees who face(d) employees or employees who face(d) added risks during pandemic added risks during pandemic Know Your Category! Infrastructure Investments Investments Infrastructure Invest in in water, water, sewer, sewer, and and broadband broadband Invest infrastructure, making making necessary necessary infrastructure, investments to to improve improve access access to to investments clean drinking water, support vital clean drinking water, support vital wastewater and and stormwater stormwater wastewater infrastructure, and to expand expand access access infrastructure, and to to broadband broadband internet. internet. to

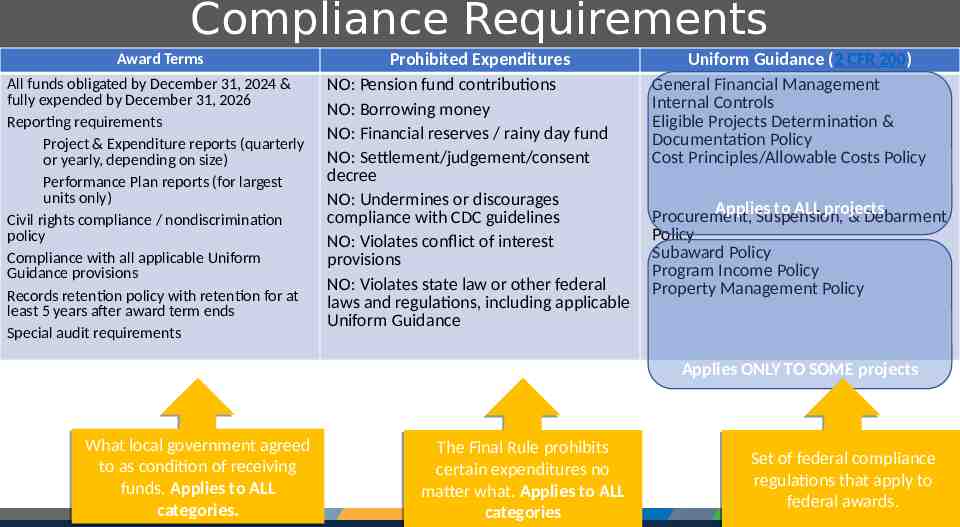

Compliance Requirements Award Terms All funds obligated by December 31, 2024 & fully expended by December 31, 2026 Reporting requirements Project & Expenditure reports (quarterly or yearly, depending on size) Performance Plan reports (for largest units only) Civil rights compliance / nondiscrimination policy Compliance with all applicable Uniform Guidance provisions Records retention policy with retention for at least 5 years after award term ends Special audit requirements Prohibited Expenditures NO: Pension fund contributions NO: Borrowing money NO: Financial reserves / rainy day fund NO: Settlement/judgement/consent decree NO: Undermines or discourages compliance with CDC guidelines NO: Violates conflict of interest provisions NO: Violates state law or other federal laws and regulations, including applicable Uniform Guidance Uniform Guidance (2 CFR 200) General Financial Management Internal Controls Eligible Projects Determination & Documentation Policy Cost Principles/Allowable Costs Policy Applies to ALL projects Procurement, Suspension, & Debarment Policy Subaward Policy Program Income Policy Property Management Policy Applies ONLY TO SOME projects What local local government government agreed agreed What to as as condition condition of of receiving receiving to funds. Applies Applies to to ALL ALL funds. categories. categories. The Final Final Rule Rule prohibits prohibits The certain expenditures expenditures no no certain matter what. what. Applies Applies to to ALL ALL matter categories categories Set of of federal federal compliance compliance Set regulations that that apply apply to to regulations federal awards. awards. federal

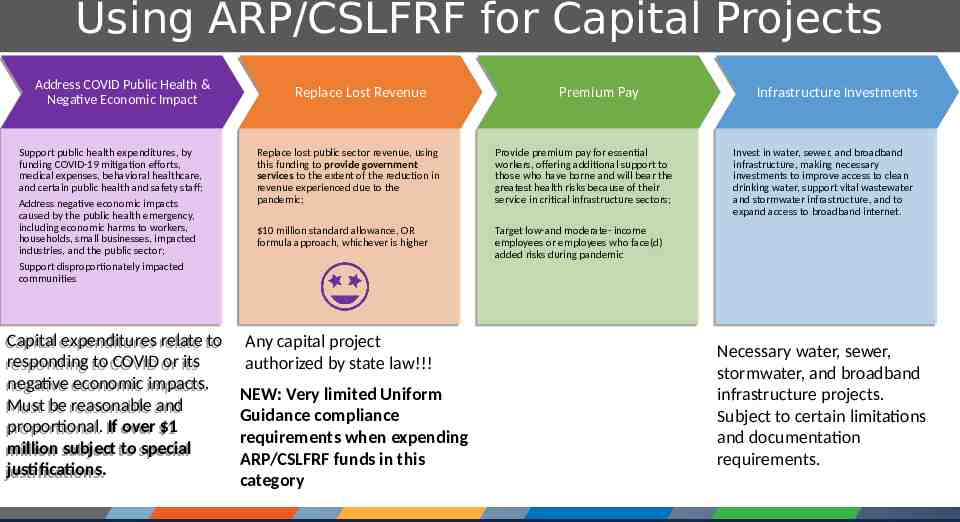

Using ARP/CSLFRF for Capital Projects Address COVID COVID Public Public Health Health & & Address Negative Economic Economic Impact Impact Negative Support public public health healthexpenditures, expenditures, by by Support funding COVID-19 COVID-19 mitigation mitigation efforts, efforts, funding medical expenses, expenses, behavioral behavioral healthcare, healthcare, medical and certain certain public public health health and and safety safety staff; staff; and Address negative negative economic economic impacts impacts Address caused by by the the public public health health emergency, emergency, caused includingeconomic economic harms harms to to workers, workers, including households, small small businesses, businesses, impacted impacted households, industries, and and the the public public sector; sector; industries, Support disproportionately disproportionately impacted impacted Support communities communities Capital expenditures expenditures relate relate to to Capital responding to to COVID COVID or or its its responding negative economic economic impacts. impacts. negative Must be be reasonable reasonable and and Must proportional. IfIf over over 1 1 proportional. million subject subject to to special special million justifications. justifications. Replace Lost Lost Revenue Revenue Replace Premium Pay Pay Premium Replace lost lost public public sector sector revenue, revenue, using using Replace this funding funding to to provide provide government government this services to to the the extent extent of of the the reduction reductionin in services revenue experienced experienced due due to to the the revenue pandemic; pandemic; Provide premium premium pay pay for for essential essential Provide workers, offering offering additional additional support support to to workers, those who who have have borne borne and and will will bear bear the the those greatest health health risks risks because because of of their their greatest service in incritical critical infrastructure infrastructure sectors; sectors; service 10 million million standard standardallowance, allowance, OR OR 10 formula approach, approach, whichever whichever isis higher higher formula Target low-and low-and moderatemoderate- income income Target employees or or employees employees who who face(d) face(d) employees added risks risks during during pandemic pandemic added Any capital project authorized by state law!!! NEW: Very limited Uniform Guidance compliance requirements when expending ARP/CSLFRF funds in this category Infrastructure Investments Investments Infrastructure Invest in in water, water, sewer, sewer, and and broadband broadband Invest infrastructure, making making necessary necessary infrastructure, investments to to improve improve access access to to clean clean investments drinking water, water, support support vital vital wastewater wastewater drinking and stormwater stormwater infrastructure, infrastructure, and and to to and expand access access to to broadband broadband internet. internet. expand Necessary water, sewer, stormwater, and broadband infrastructure projects. Subject to certain limitations and documentation requirements.

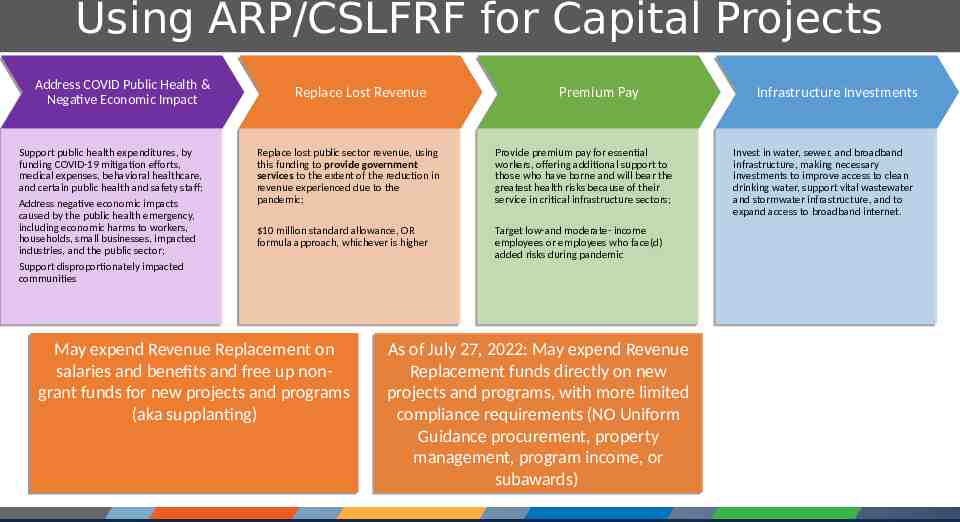

Using ARP/CSLFRF for Capital Projects Address COVID COVID Public Public Health Health & & Address Negative Economic Economic Impact Impact Negative Support public public health healthexpenditures, expenditures, by by Support funding COVID-19 COVID-19 mitigation mitigation efforts, efforts, funding medical expenses, expenses, behavioral behavioral healthcare, healthcare, medical and certain certain public public health health and and safety safety staff; staff; and Address negative negative economic economic impacts impacts Address caused by by the the public public health health emergency, emergency, caused includingeconomic economic harms harms to to workers, workers, including households, small small businesses, businesses, impacted impacted households, industries, and and the the public public sector; sector; industries, Support disproportionately disproportionately impacted impacted Support communities communities Replace Lost Lost Revenue Revenue Replace Premium Pay Pay Premium Replace lost lost public public sector sector revenue, revenue, using using Replace this funding funding to to provide provide government government this services to to the the extent extent of of the the reduction reductionin in services revenue experienced experienced due due to to the the revenue pandemic; pandemic; Provide premium premium pay pay for for essential essential Provide workers, offering offering additional additional support support to to workers, those who who have have borne borne and and will will bear bear the the those greatest health health risks risks because because of of their their greatest service in incritical critical infrastructure infrastructure sectors; sectors; service 10 million million standard standardallowance, allowance, OR OR 10 formula approach, approach, whichever whichever isis higher higher formula Target low-and low-and moderatemoderate- income income Target employees or or employees employees who who face(d) face(d) employees added risks risks during during pandemic pandemic added May expend expend Revenue Revenue Replacement Replacement on on May salaries and and benefits benefits and and free free up up nonnonsalaries grant funds funds for for new new projects projects and and programs programs grant (aka supplanting) supplanting) (aka As of of July July 27, 27, 2022: 2022: May May expend expend Revenue Revenue As Replacement funds funds directly directly on on new new Replacement projects and and programs, programs, with with more more limited limited projects compliance requirements requirements (NO (NO Uniform Uniform compliance Guidance procurement, procurement, property property Guidance management, program program income, income, or or management, subawards) subawards) Infrastructure Investments Investments Infrastructure Invest in in water, water, sewer, sewer, and and broadband broadband Invest infrastructure, making making necessary necessary infrastructure, investments to to improve improve access access to to clean clean investments drinking water, water, support support vital vital wastewater wastewater drinking and stormwater stormwater infrastructure, infrastructure, and and to to and expand access access to to broadband broadband internet. internet. expand

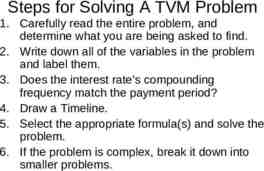

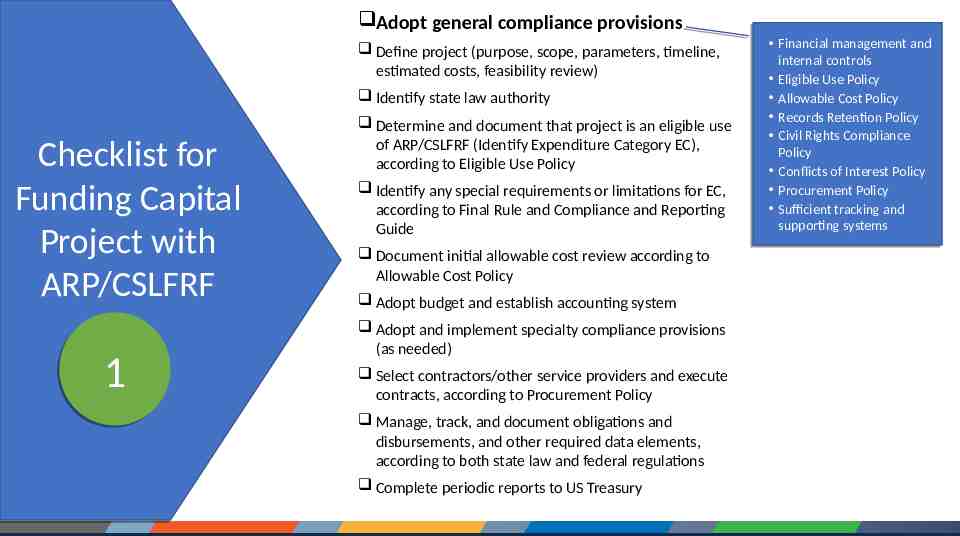

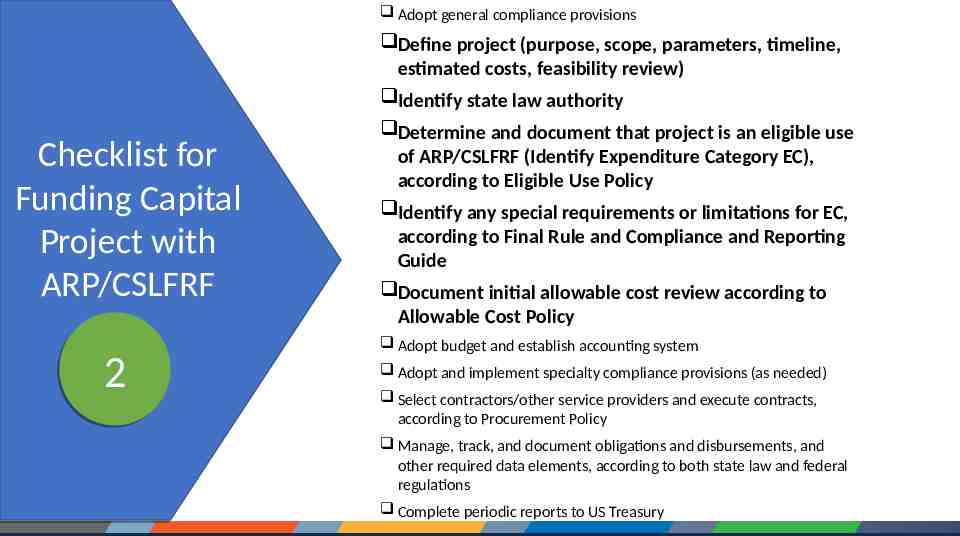

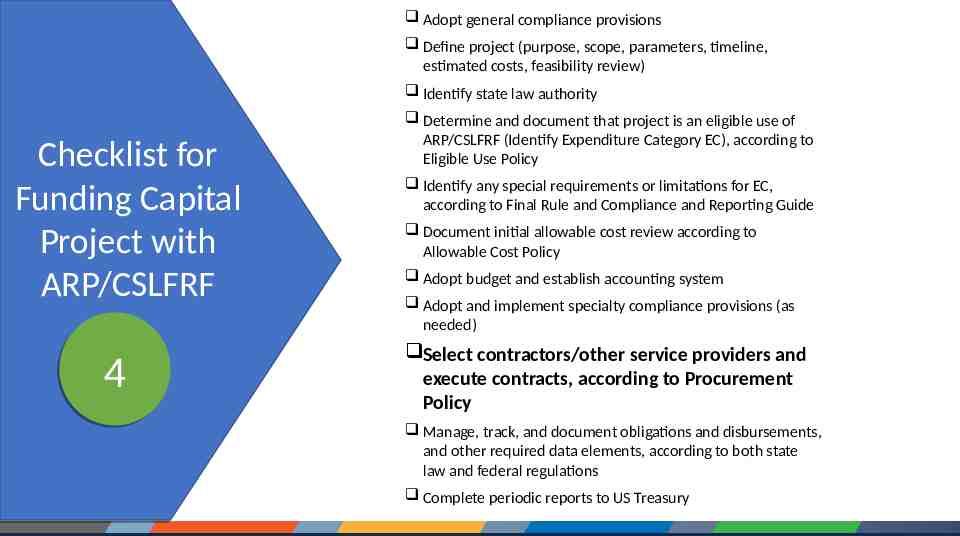

Adopt general compliance provisions Define project (purpose, scope, parameters, timeline, estimated costs, feasibility review) Identify state law authority Checklist for Funding Capital Project with ARP/CSLFRF Determine and document that project is an eligible use of ARP/CSLFRF (Identify Expenditure Category EC), according to Eligible Use Policy Identify any special requirements or limitations for EC, according to Final Rule and Compliance and Reporting Guide Document initial allowable cost review according to Allowable Cost Policy Adopt budget and establish accounting system Adopt and implement specialty compliance provisions (as needed) Select contractors/other service providers and execute contracts, according to Procurement Policy Manage, track, and document obligations and disbursements, and other required data elements, according to both state law and federal regulations Complete periodic reports to US Treasury

Adopt general compliance provisions Define project (purpose, scope, parameters, timeline, estimated costs, feasibility review) Identify state law authority Checklist for Funding Capital Project with ARP/CSLFRF 1 Determine and document that project is an eligible use of ARP/CSLFRF (Identify Expenditure Category EC), according to Eligible Use Policy Identify any special requirements or limitations for EC, according to Final Rule and Compliance and Reporting Guide Document initial allowable cost review according to Allowable Cost Policy Adopt budget and establish accounting system Adopt and implement specialty compliance provisions (as needed) Select contractors/other service providers and execute contracts, according to Procurement Policy Manage, track, and document obligations and disbursements, and other required data elements, according to both state law and federal regulations Complete periodic reports to US Treasury Financial management management and and Financial internal controls controls internal Eligible Use Use Policy Policy Eligible Allowable Cost Cost Policy Policy Allowable Records Retention Retention Policy Policy Records Civil Rights Rights Compliance Compliance Civil Policy Policy Conflicts of of Interest Interest Policy Policy Conflicts Procurement Policy Policy Procurement Sufficient tracking tracking and and Sufficient supporting systems systems supporting

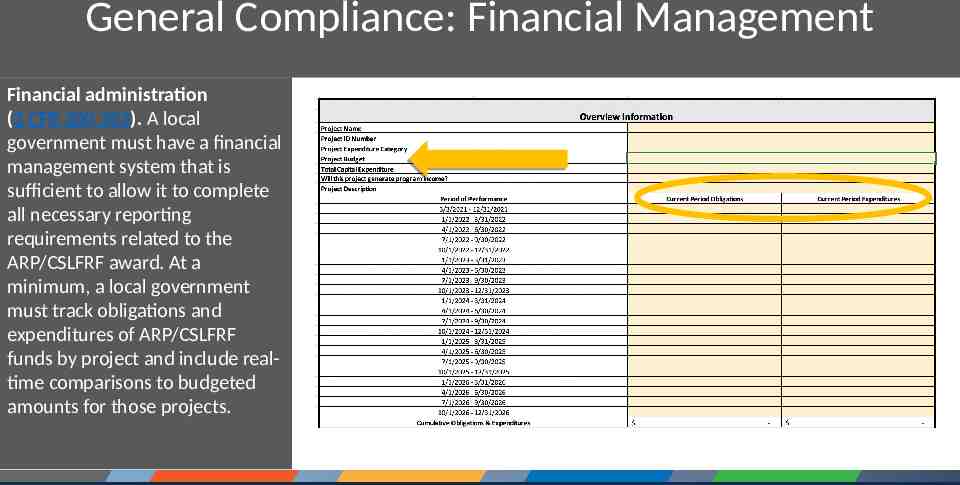

General Compliance: Financial Management Financial administration (2 CFR 200.302). A local government must have a financial management system that is sufficient to allow it to complete all necessary reporting requirements related to the ARP/CSLFRF award. At a minimum, a local government must track obligations and expenditures of ARP/CSLFRF funds by project and include realtime comparisons to budgeted amounts for those projects.

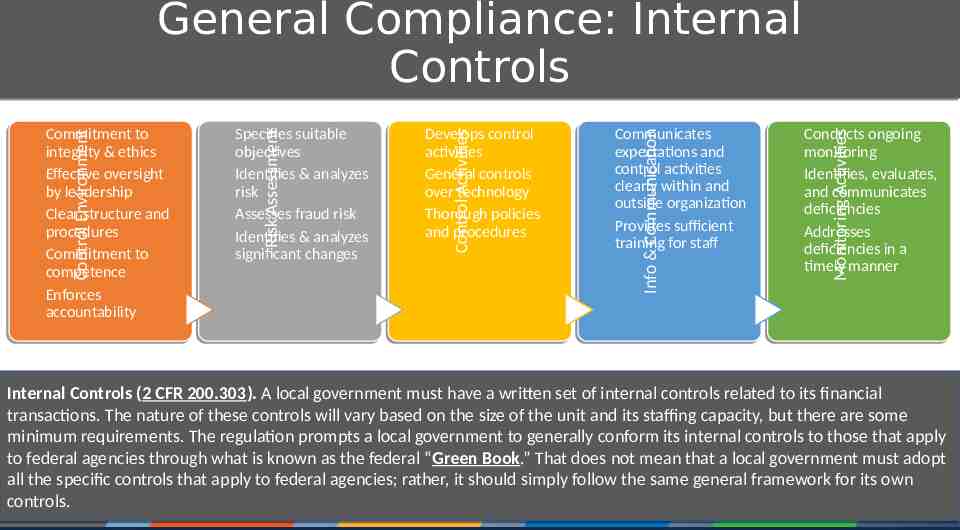

General Compliance: Internal Controls Conducts ongoing monitoring Identifies, evaluates, and communicates deficiencies Addresses deficiencies in a timely manner Monitoring Monitoring Activities Activities Communicates expectations and control activities clearly within and outside organization Provides sufficient training for staff Info Info & & Communication Communication Develops control activities General controls over technology Thorough policies and procedures Control Control Activities Activities Specifies suitable objectives Identifies & analyzes risk Assesses fraud risk Identifies & analyzes significant changes Risk Risk Assessment Assessment Control Control Environment Environment Commitment to integrity & ethics Effective oversight by leadership Clear structure and procedures Commitment to competence Enforces accountability Internal Controls Controls (2 (2 CFR CFR 200.303). 200.303). AA local local government government must must have have aa written written set set of of internal internal controls controls related related to to its its financial financial Internal transactions. The The nature nature of of these these controls controls will will vary vary based based on on the the size size of of the the unit unit and and its its staffing staffing capacity, capacity, but but there there are are some some transactions. minimum requirements. requirements. The The regulation regulation prompts prompts aa local local government government to to generally generally conform conform its its internal internal controls controls to to those those that that apply apply minimum to federal federal agencies agencies through through what what isis known known as as the the federal federal “Green “Green Book.” Book.” That That does does not not mean mean that that aa local local government government must must adopt adopt to all the the specific specific controls controls that that apply apply to to federal federal agencies; agencies; rather, rather, itit should should simply simply follow follow the the same same general general framework framework for for its its own own all controls. controls.

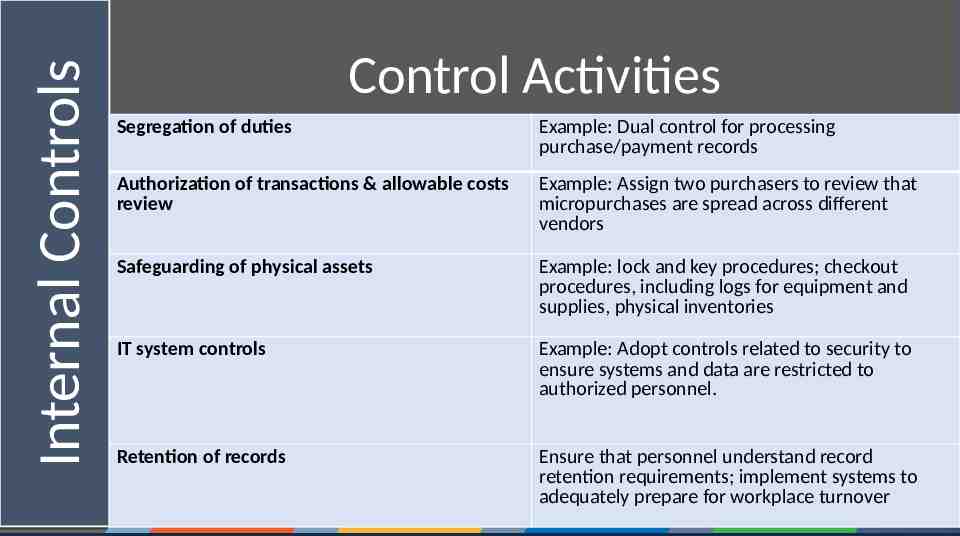

Internal Controls Control Activities Segregation of duties Example: Dual control for processing purchase/payment records Authorization of transactions & allowable costs review Example: Assign two purchasers to review that micropurchases are spread across different vendors Safeguarding of physical assets Example: lock and key procedures; checkout procedures, including logs for equipment and supplies, physical inventories IT system controls Example: Adopt controls related to security to ensure systems and data are restricted to authorized personnel. Retention of records Ensure that personnel understand record retention requirements; implement systems to adequately prepare for workplace turnover

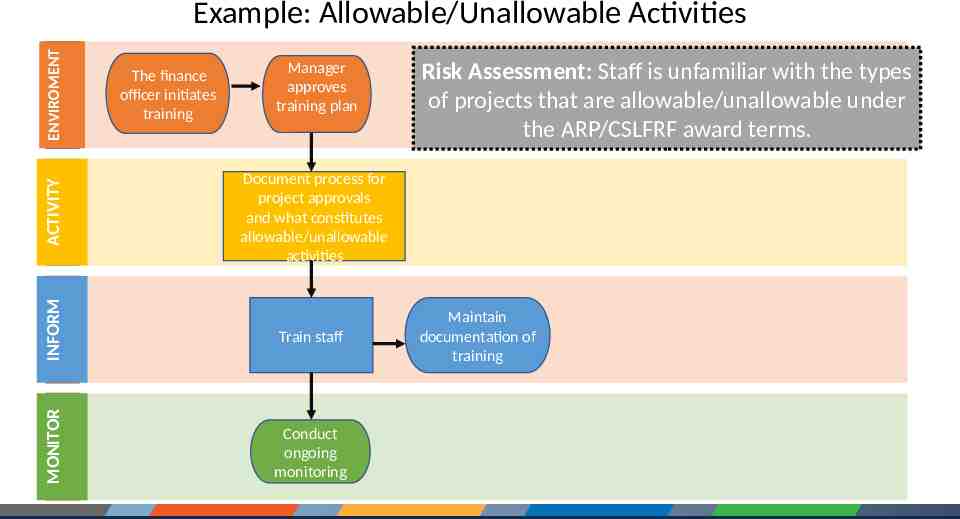

MONITOR INFORM ACTIVITY ENVIROMENT Example: Allowable/Unallowable Activities The finance officer initiates training Manager approves training plan Risk Assessment: Staff is unfamiliar with the types of projects that are allowable/unallowable under the ARP/CSLFRF award terms. Document process for project approvals and what constitutes allowable/unallowable activities Train staff Conduct ongoing monitoring Maintain documentation of training

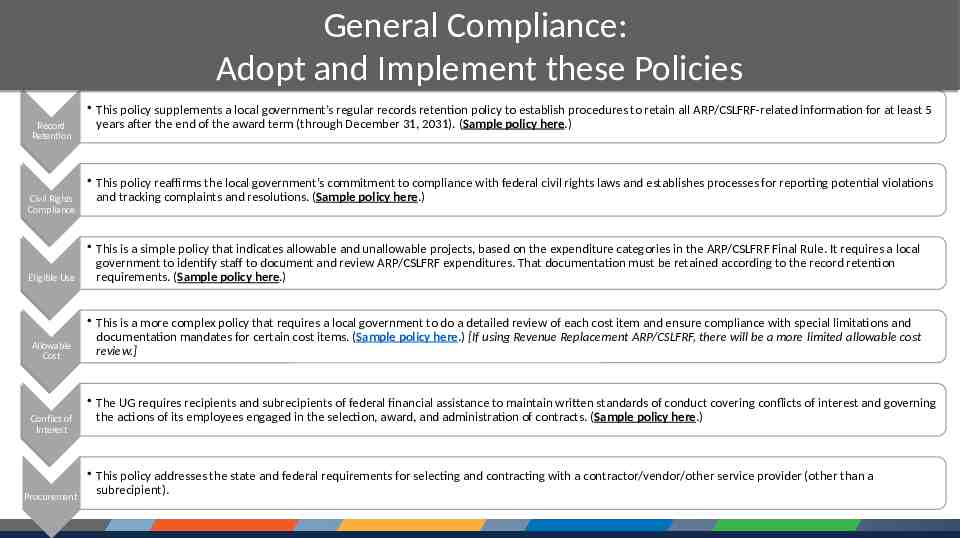

General Compliance: Adopt and Implement these Policies Record Record Retention Retention CivilRights Rights Civil Compliance Compliance EligibleUse Use Eligible Allowable Allowable Cost Cost Conflictof of Conflict Interest Interest Procurement This policy supplements a local government’s regular records retention policy to establish procedures to retain all ARP/CSLFRF-related information for at least 5 years after the end of the award term (through December 31, 2031). (Sample policy here.) This policy reaffirms the local government’s commitment to compliance with federal civil rights laws and establishes processes for reporting potential violations and tracking complaints and resolutions. (Sample policy here.) This is a simple policy that indicates allowable and unallowable projects, based on the expenditure categories in the ARP/CSLFRF Final Rule. It requires a local government to identify staff to document and review ARP/CSLFRF expenditures. That documentation must be retained according to the record retention requirements. (Sample policy here.) This is a more complex policy that requires a local government to do a detailed review of each cost item and ensure compliance with special limitations and documentation mandates for certain cost items. (Sample policy here.) [If using Revenue Replacement ARP/CSLFRF, there will be a more limited allowable cost review.] The UG requires recipients and subrecipients of federal financial assistance to maintain written standards of conduct covering conflicts of interest and governing the actions of its employees engaged in the selection, award, and administration of contracts. (Sample policy here.) This policy addresses the state and federal requirements for selecting and contracting with a contractor/vendor/other service provider (other than a subrecipient).

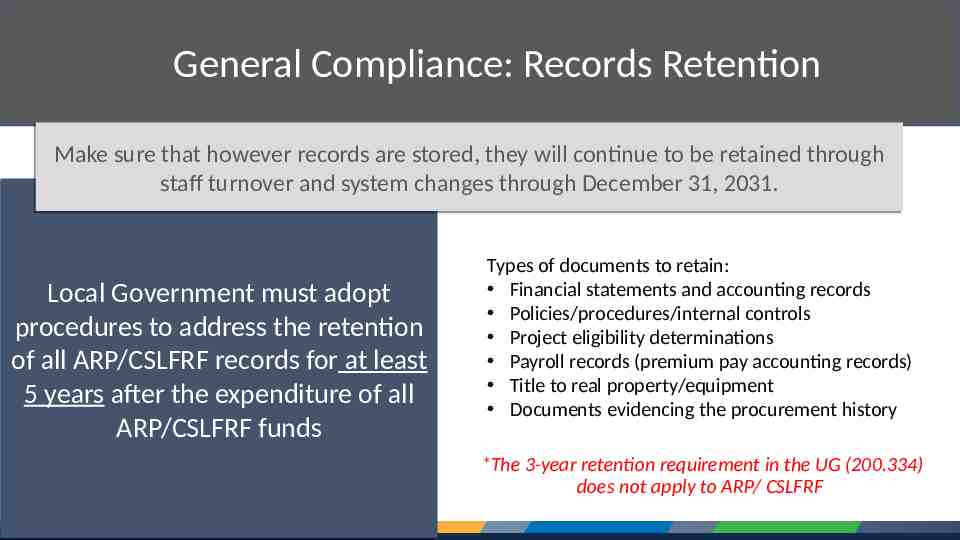

General Compliance: Records Retention Make sure that however records are stored, they will continue to be retained through staff turnover and system changes through December 31, 2031. Local Government must adopt procedures to address the retention of all ARP/CSLFRF records for at least 5 years after the expenditure of all ARP/CSLFRF funds Types of documents to retain: Financial statements and accounting records Policies/procedures/internal controls Project eligibility determinations Payroll records (premium pay accounting records) Title to real property/equipment Documents evidencing the procurement history *The 3-year retention requirement in the UG (200.334) does not apply to ARP/ CSLFRF

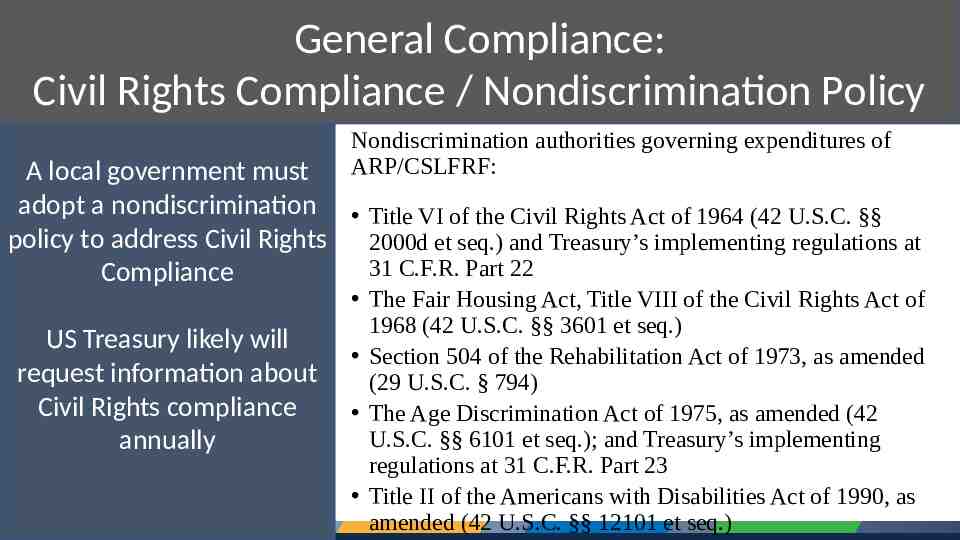

General Compliance: Civil Rights Compliance / Nondiscrimination Policy Nondiscrimination authorities governing expenditures of ARP/CSLFRF: A local government must adopt a nondiscrimination Title VI of the Civil Rights Act of 1964 (42 U.S.C. §§ policy to address Civil Rights 2000d et seq.) and Treasury’s implementing regulations at 31 C.F.R. Part 22 Compliance US Treasury likely will request information about Civil Rights compliance annually The Fair Housing Act, Title VIII of the Civil Rights Act of 1968 (42 U.S.C. §§ 3601 et seq.) Section 504 of the Rehabilitation Act of 1973, as amended (29 U.S.C. § 794) The Age Discrimination Act of 1975, as amended (42 U.S.C. §§ 6101 et seq.); and Treasury’s implementing regulations at 31 C.F.R. Part 23 Title II of the Americans with Disabilities Act of 1990, as amended (42 U.S.C. §§ 12101 et seq.)

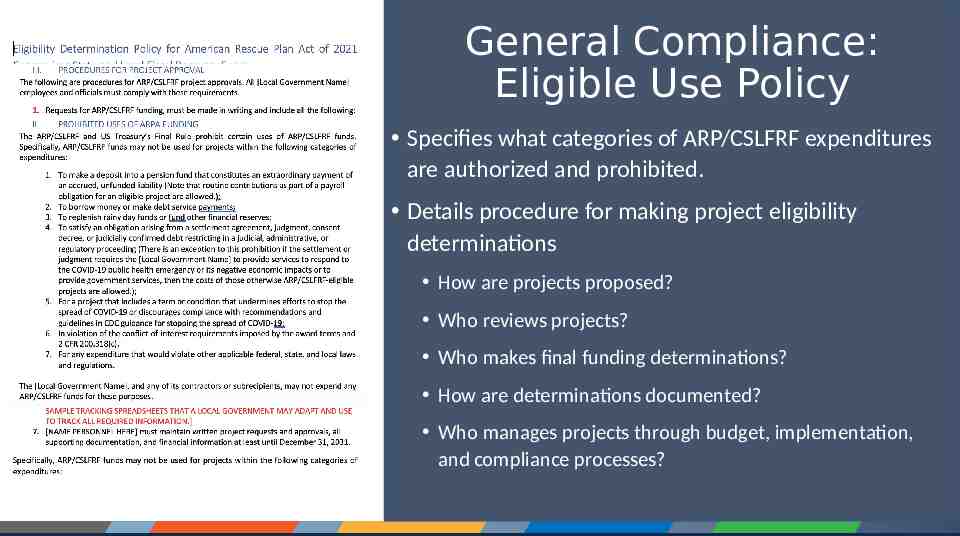

General Compliance: Eligible Use Policy Specifies what categories of ARP/CSLFRF expenditures are authorized and prohibited. Details procedure for making project eligibility determinations How are projects proposed? Who reviews projects? Who makes final funding determinations? How are determinations documented? Who manages projects through budget, implementation, and compliance processes?

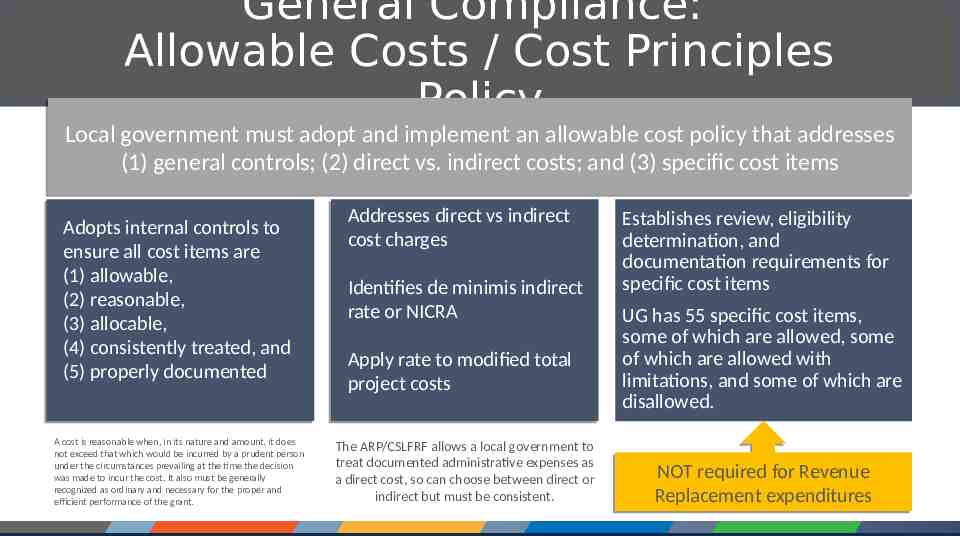

General Compliance: Allowable Costs / Cost Principles Policy Local government must adopt and implement an allowable cost policy that addresses (1) general controls; (2) direct vs. indirect costs; and (3) specific cost items Adopts internal internal controls controls to to Adopts ensure all all cost cost items items are are ensure (1) allowable, allowable, (1) (2) reasonable, reasonable, (2) (3) allocable, allocable, (3) (4) consistently consistently treated, treated, and and (4) (5) properly properly documented documented (5) A cost is reasonable when, in its nature and amount, it does not exceed that which would be incurred by a prudent person under the circumstances prevailing at the time the decision was made to incur the cost. It also must be generally recognized as ordinary and necessary for the proper and efficient performance of the grant. Addresses direct direct vs vs indirect indirect Addresses cost charges charges cost Identifies de de minimis minimis indirect indirect Identifies rate or or NICRA NICRA rate Apply rate rate to to modified modified total total Apply project costs costs project The ARP/CSLFRF allows a local government to treat documented administrative expenses as a direct cost, so can choose between direct or indirect but must be consistent. Establishes review, eligibility determination, and documentation requirements for specific cost items UG has 55 specific cost items, some of which are allowed, some of which are allowed with limitations, and some of which are disallowed. NOT required required for for Revenue Revenue NOT Replacement expenditures expenditures Replacement

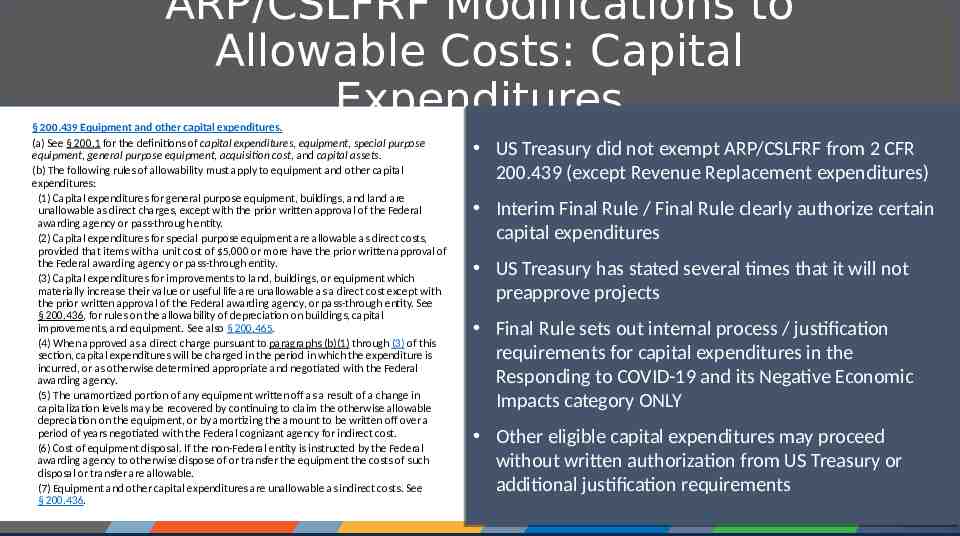

ARP/CSLFRF Modifications to Allowable Costs: Capital Expenditures § 200.439 Equipment and other capital expenditures. (a) See § 200.1 for the definitions of capital expenditures, equipment, special purpose equipment, general purpose equipment, acquisition cost, and capital assets. (b) The following rules of allowability must apply to equipment and other capital expenditures: (1) Capital expenditures for general purpose equipment, buildings, and land are unallowable as direct charges, except with the prior written approval of the Federal awarding agency or pass-through entity. (2) Capital expenditures for special purpose equipment are allowable as direct costs, provided that items with a unit cost of 5,000 or more have the prior written approval of the Federal awarding agency or pass-through entity. (3) Capital expenditures for improvements to land, buildings, or equipment which materially increase their value or useful life are unallowable as a direct cost except with the prior written approval of the Federal awarding agency, or pass-through entity. See § 200.436, for rules on the allowability of depreciation on buildings, capital improvements, and equipment. See also § 200.465. (4) When approved as a direct charge pursuant to paragraphs (b)(1) through (3) of this section, capital expenditures will be charged in the period in which the expenditure is incurred, or as otherwise determined appropriate and negotiated with the Federal awarding agency. (5) The unamortized portion of any equipment written off as a result of a change in capitalization levels may be recovered by continuing to claim the otherwise allowable depreciation on the equipment, or by amortizing the amount to be written off over a period of years negotiated with the Federal cognizant agency for indirect cost. (6) Cost of equipment disposal. If the non-Federal entity is instructed by the Federal awarding agency to otherwise dispose of or transfer the equipment the costs of such disposal or transfer are allowable. (7) Equipment and other capital expenditures are unallowable as indirect costs. See § 200.436. US Treasury Treasury did did not not exempt exempt ARP/CSLFRF ARP/CSLFRF from from 22 CFR CFR US 200.439 (except (except Revenue Revenue Replacement Replacement expenditures) expenditures) 200.439 Interim Final Final Rule Rule // Final Final Rule Rule clearly clearly authorize authorize certain certain Interim capital expenditures expenditures capital US Treasury Treasury has has stated stated several several times times that that itit will will not not US preapprove projects projects preapprove Final Rule Rule sets sets out out internal internal process process // justification justification Final requirements for for capital capital expenditures expenditures in in the the requirements Responding to to COVID-19 COVID-19 and and its its Negative Negative Economic Economic Responding Impacts category category ONLY ONLY Impacts Other eligible eligible capital capital expenditures expenditures may may proceed proceed Other without written written authorization authorization from from US US Treasury Treasury or or without additional justification justification requirements requirements additional

Adopt general compliance provisions Define project (purpose, scope, parameters, timeline, estimated costs, feasibility review) Identify state law authority Checklist for Funding Capital Project with ARP/CSLFRF 2 Determine and document that project is an eligible use of ARP/CSLFRF (Identify Expenditure Category EC), according to Eligible Use Policy Identify any special requirements or limitations for EC, according to Final Rule and Compliance and Reporting Guide Document initial allowable cost review according to Allowable Cost Policy Adopt budget and establish accounting system Adopt and implement specialty compliance provisions (as needed) Select contractors/other service providers and execute contracts, according to Procurement Policy Manage, track, and document obligations and disbursements, and other required data elements, according to both state law and federal regulations Complete periodic reports to US Treasury

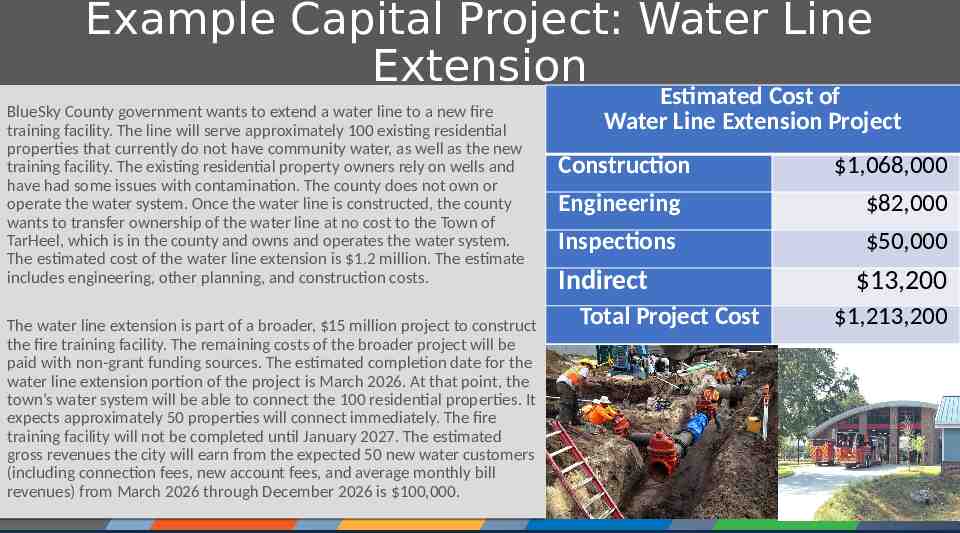

Example Capital Project: Water Line Extension BlueSky County County government government wants wants to to extend extend aa water water line line to to aa new new fire fire BlueSky training facility. facility. The The line line will will serve serve approximately approximately 100 100 existing existing residential residential training properties that that currently currently do do not not have have community community water, water, as as well well as as the the new new properties training facility. facility. The The existing existing residential residential property property owners owners rely rely on on wells wells and and training have had had some some issues issues with with contamination. contamination. The The county county does does not not own own or or have operate the the water water system. system. Once Once the the water water line line is is constructed, constructed, the the county county operate wants to to transfer transfer ownership ownership of of the the water water line line at at no no cost cost to to the the Town Town of of wants TarHeel, which which is is in in the the county county and and owns owns and and operates operates the the water water system. system. TarHeel, The estimated estimated cost cost of of the the water water line line extension extension isis 1.2 1.2 million. million. The The estimate estimate The includes engineering, engineering, other other planning, planning, and and construction construction costs. costs. includes The water water line line extension extension is is part part of of aa broader, broader, 15 15 million million project project to to construct construct The the fire fire training training facility. facility. The The remaining remaining costs costs of of the the broader broader project project will will be be the paid with with non-grant non-grant funding funding sources. sources. The The estimated estimated completion completion date date for for the the paid water line line extension extension portion portion of of the the project project is is March March 2026. 2026. At At that that point, point, the the water town’s water water system system will will be be able able to to connect connect the the 100 100 residential residential properties. properties. ItIt town’s expects approximately approximately 50 50 properties properties will will connect connect immediately. immediately. The The fire fire expects training facility facility will will not not be be completed completed until until January January 2027. 2027. The The estimated estimated training gross revenues revenues the the city city will will earn earn from from the the expected expected 50 50 new new water water customers customers gross (including connection connection fees, fees, new new account account fees, fees, and and average average monthly monthly bill bill (including revenues) from from March March 2026 2026 through through December December 2026 2026 is is 100,000. 100,000. revenues) Estimated Cost of Water Line Extension Project Construction 1,068,000 Engineering 82,000 Inspections 50,000 Indirect Total Project Cost 13,200 1,213,200

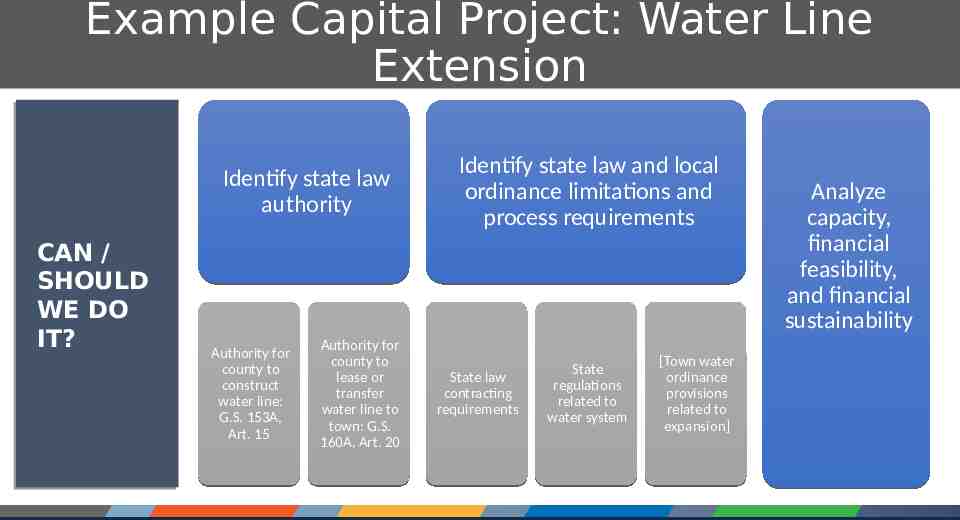

Example Capital Project: Water Line Extension Identify state law authority CAN / SHOULD WE DO IT? Authority for county to construct water line: G.S. 153A, Art. 15 Authority for county to lease or transfer water line to town: G.S. 160A, Art. 20 Identify state law and local ordinance limitations and process requirements State law contracting requirements State regulations related to water system [Town water ordinance provisions related to expansion] Analyze capacity, financial feasibility, and financial sustainability

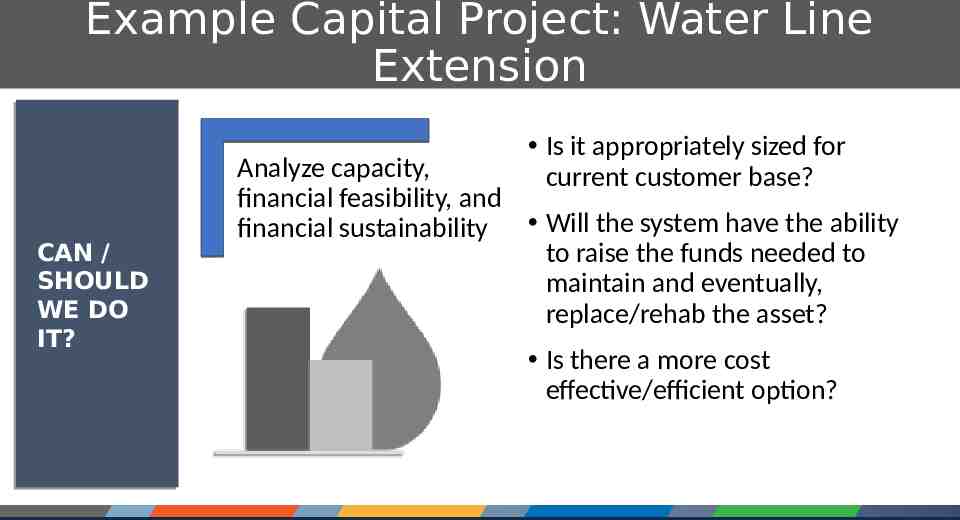

Example Capital Project: Water Line Extension Is it appropriately sized for current customer base? CAN / SHOULD WE DO IT? Analyze capacity, financial feasibility, and financial sustainability Will the system have the ability to raise the funds needed to maintain and eventually, replace/rehab the asset? Is there a more cost effective/efficient option?

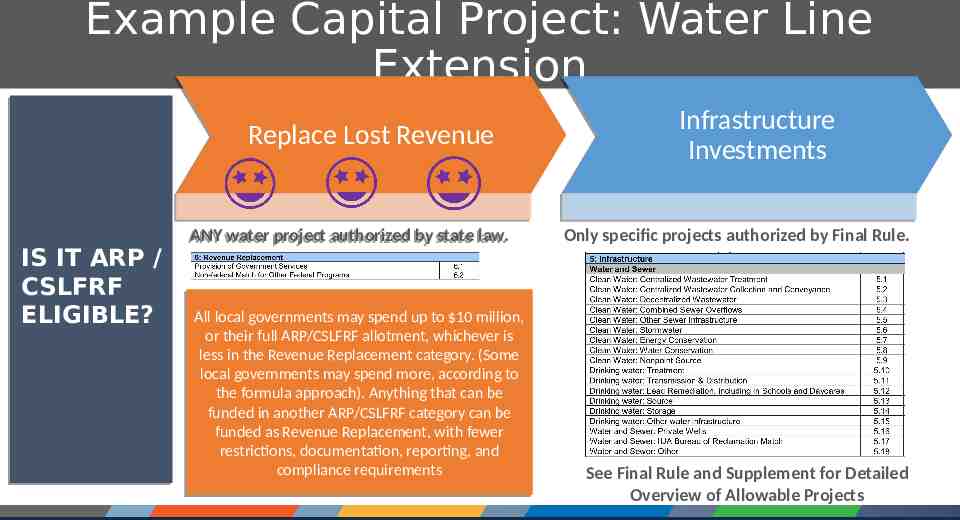

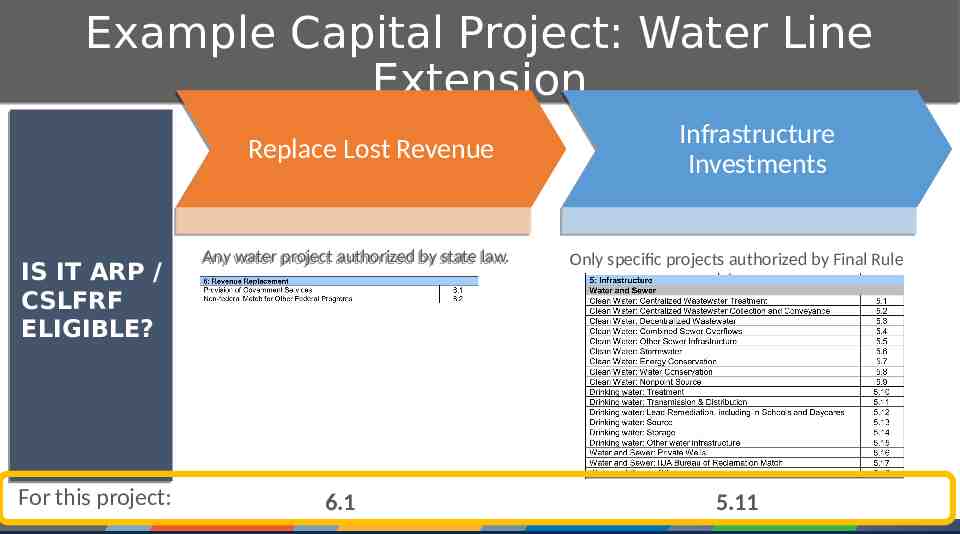

Example Capital Project: Water Line Extension Replace Lost Revenue IS IT ARP / CSLFRF ELIGIBLE? ANY water water project project authorized authorized by by state state law. law. ANY All local local governments governments may may spend spend up up to to 10 10 million, million, All or their their full full ARP/CSLFRF ARP/CSLFRF allotment, allotment, whichever whichever isis or less in in the the Revenue Revenue Replacement Replacement category. category. (Some (Some less local governments governments may may spend spend more, more, according according to to local the formula formula approach). approach). Anything Anything that that can can be be the funded in in another another ARP/CSLFRF ARP/CSLFRF category category can can be be funded funded as as Revenue Revenue Replacement, Replacement, with with fewer fewer funded restrictions, documentation, documentation, reporting, reporting, and and restrictions, compliance requirements requirements compliance Infrastructure Investments Only specific projects authorized by Final Rule. See Final Rule and Supplement for Detailed Overview of Allowable Projects

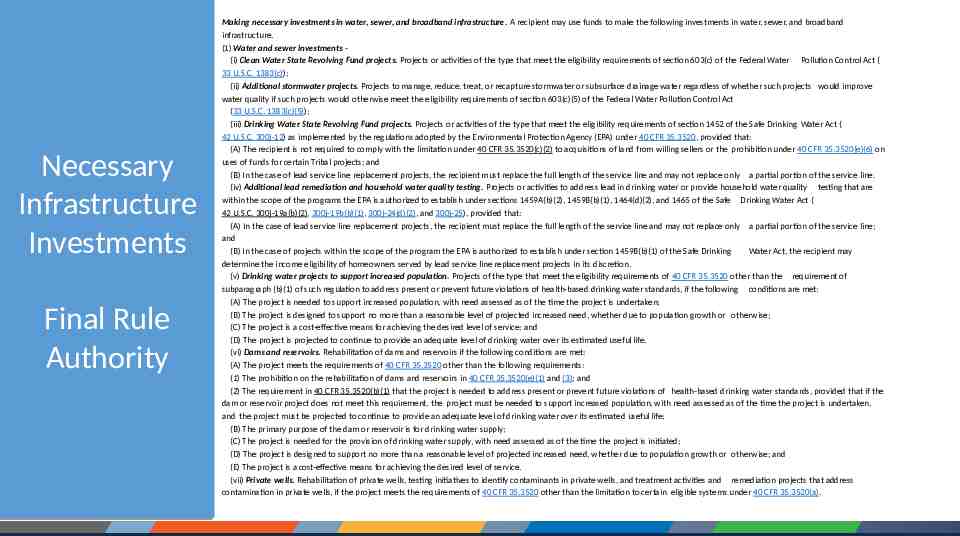

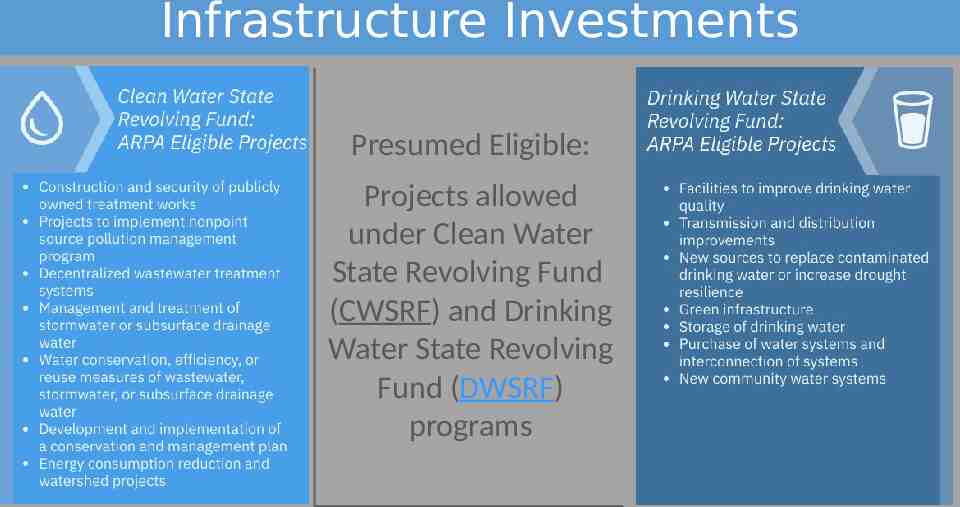

Necessary Infrastructure Investments Final Rule Authority Making necessary investments in water, sewer, and broadband infrastructure. A recipient may use funds to make the following investments in water, sewer, and broadband infrastructure. (1) Water and sewer investments (i) Clean Water State Revolving Fund projects. Projects or activities of the type that meet the eligibility requirements of section 603(c) of the Federal Water Pollution Control Act ( 33 U.S.C. 1383(c)); (ii) Additional stormwater projects. Projects to manage, reduce, treat, or recapture stormwater or subsurface drainage water regardless of whether such projects would improve water quality if such projects would otherwise meet the eligibility requirements of section 603(c)(5) of the Federal Water Pollution Control Act (33 U.S.C. 1383(c)(5)); (iii) Drinking Water State Revolving Fund projects. Projects or activities of the type that meet the eligibility requirements of section 1452 of the Safe Drinking Water Act ( 42 U.S.C. 300j-12) as implemented by the regulations adopted by the Environmental Protection Agency (EPA) under 40 CFR 35.3520, provided that: (A) The recipient is not required to comply with the limitation under 40 CFR 35.3520(c)(2) to acquisitions of land from willing sellers or the prohibition under 40 CFR 35.3520(e)(6) on uses of funds for certain Tribal projects; and (B) In the case of lead service line replacement projects, the recipient must replace the full length of the service line and may not replace only a partial portion of the service line. (iv) Additional lead remediation and household water quality testing. Projects or activities to address lead in drinking water or provide household water quality testing that are within the scope of the programs the EPA is authorized to establish under sections 1459A(b)(2), 1459B(b)(1), 1464(d)(2), and 1465 of the Safe Drinking Water Act ( 42 U.S.C. 300j-19a(b)(2), 300j-19b(b)(1), 300j-24(d)(2), and 300j-25), provided that: (A) In the case of lead service line replacement projects, the recipient must replace the full length of the service line and may not replace only a partial portion of the service line; and (B) In the case of projects within the scope of the program the EPA is authorized to establish under section 1459B(b)(1) of the Safe Drinking Water Act, the recipient may determine the income eligibility of homeowners served by lead service line replacement projects in its discretion. (v) Drinking water projects to support increased population. Projects of the type that meet the eligibility requirements of 40 CFR 35.3520 other than the requirement of subparagraph (b)(1) of such regulation to address present or prevent future violations of health-based drinking water standards, if the following conditions are met: (A) The project is needed to support increased population, with need assessed as of the time the project is undertaken; (B) The project is designed to support no more than a reasonable level of projected increased need, whether due to population growth or otherwise; (C) The project is a cost-effective means for achieving the desired level of service; and (D) The project is projected to continue to provide an adequate level of drinking water over its estimated useful life. (vi) Dams and reservoirs. Rehabilitation of dams and reservoirs if the following conditions are met: (A) The project meets the requirements of 40 CFR 35.3520 other than the following requirements: (1) The prohibition on the rehabilitation of dams and reservoirs in 40 CFR 35.3520(e)(1) and (3); and (2) The requirement in 40 CFR 35.3520(b)(1) that the project is needed to address present or prevent future violations of health-based drinking water standards, provided that if the dam or reservoir project does not meet this requirement, the project must be needed to support increased population, with need assessed as of the time the project is undertaken, and the project must be projected to continue to provide an adequate level of drinking water over its estimated useful life; (B) The primary purpose of the dam or reservoir is for drinking water supply; (C) The project is needed for the provision of drinking water supply, with need assessed as of the time the project is initiated; (D) The project is designed to support no more than a reasonable level of projected increased need, whether due to population growth or otherwise; and (E) The project is a cost-effective means for achieving the desired level of service. (vii) Private wells. Rehabilitation of private wells, testing initiatives to identify contaminants in private wells, and treatment activities and remediation projects that address contamination in private wells, if the project meets the requirements of 40 CFR 35.3520 other than the limitation to certain eligible systems under 40 CFR 35.3520(a).

Infrastructure Investments Presumed Eligible: Presumed Eligible: Projects allowed under Clean Water State Revolving Fund (CWSRF) and Drinking Projects) programs Water State Revolving Fund (DWSRF) programs

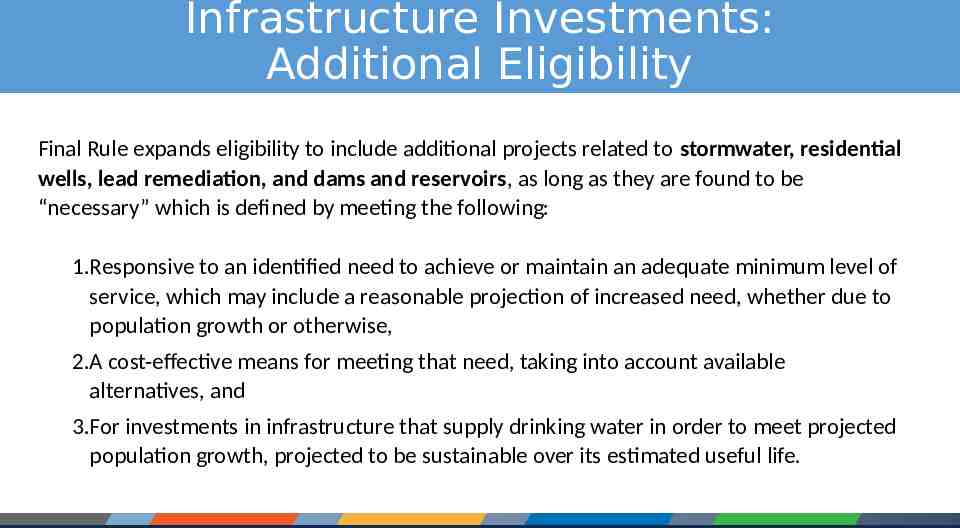

Infrastructure Investments: Additional Eligibility Final Rule expands eligibility to include additional projects related to stormwater, residential wells, lead remediation, and dams and reservoirs, as long as they are found to be “necessary” which is defined by meeting the following: 1.Responsive to an identified need to achieve or maintain an adequate minimum level of service, which may include a reasonable projection of increased need, whether due to population growth or otherwise, 2.A cost-effective means for meeting that need, taking into account available alternatives, and 3.For investments in infrastructure that supply drinking water in order to meet projected population growth, projected to be sustainable over its estimated useful life.

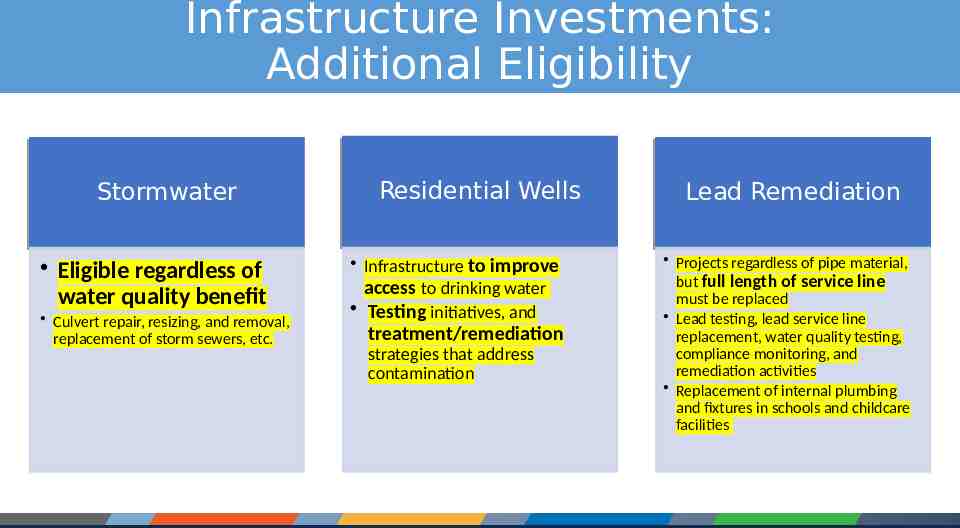

Infrastructure Investments: Additional Eligibility Stormwater Eligible regardless of water quality benefit Culvert repair, resizing, and removal, replacement of storm sewers, etc. Residential Wells Infrastructure to improve access to drinking water Testing initiatives, and treatment/remediation strategies that address contamination Lead Remediation Projects regardless of pipe material, but full length of service line must be replaced Lead testing, lead service line replacement, water quality testing, compliance monitoring, and remediation activities Replacement of internal plumbing and fixtures in schools and childcare facilities

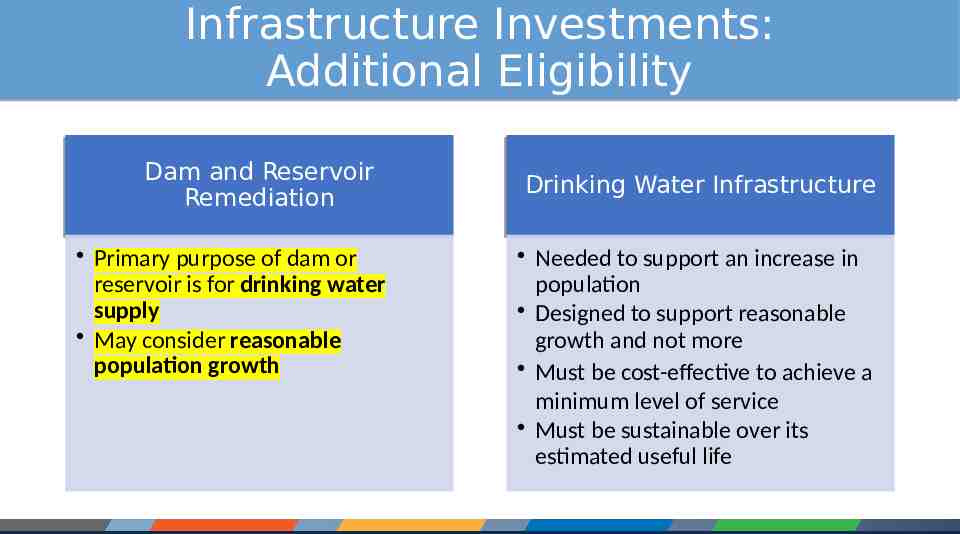

Infrastructure Investments: Additional Eligibility Dam and Reservoir Remediation Primary purpose of dam or reservoir is for drinking water supply May consider reasonable population growth Drinking Water Infrastructure Needed to support an increase in population Designed to support reasonable growth and not more Must be cost-effective to achieve a minimum level of service Must be sustainable over its estimated useful life

Example Capital Project: Water Line Extension Replace Lost Revenue 2. IS ITARP ARP / Is it CSLFRF /CSLFRF ELIGIBLE? eligible? For this project: Any water water project project authorized authorized by by state state law. law. Any 6.1 Infrastructure Investments Only specific projects authorized by Final Rule 5.11

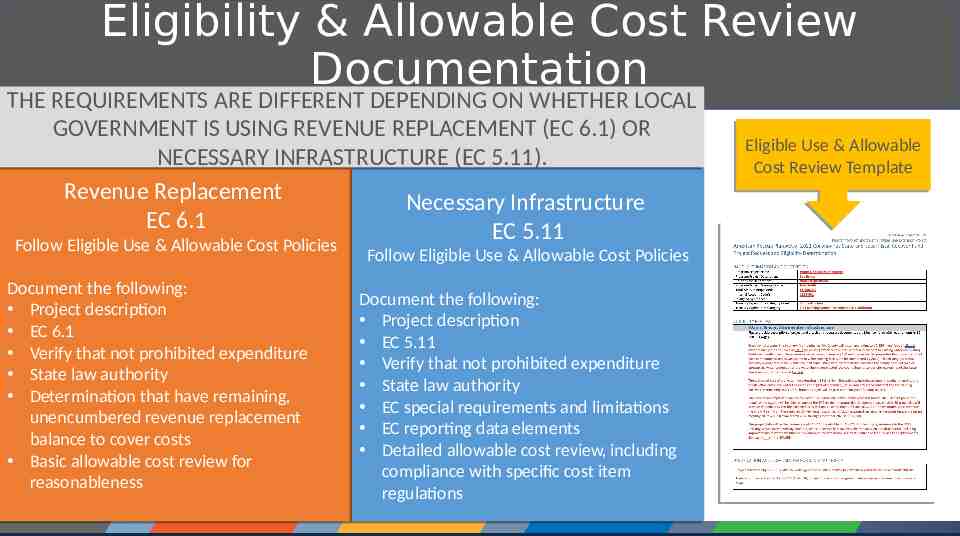

Eligibility & Allowable Cost Review Documentation THE REQUIREMENTS ARE DIFFERENT DEPENDING ON WHETHER LOCAL GOVERNMENT IS USING REVENUE REPLACEMENT (EC 6.1) OR NECESSARY INFRASTRUCTURE (EC 5.11). Revenue Replacement Necessary Infrastructure EC 6.1 EC 5.11 Follow Eligible Eligible Use Use & & Allowable Allowable Cost Cost Policies Policies Follow Document the the following: following: Document Project description description Project EC 6.1 6.1 EC Verify that that not not prohibited prohibited expenditure expenditure Verify State law law authority authority State Determination that that have have remaining, remaining, Determination unencumbered revenue revenue replacement replacement unencumbered balance to to cover cover costs costs balance Basic allowable allowable cost cost review review for for Basic reasonableness reasonableness Follow Eligible Eligible Use Use & & Allowable Allowable Cost Cost Policies Policies Follow Document the the following: following: Document Project description description Project EC 5.11 5.11 EC Verify that that not not prohibited prohibited expenditure expenditure Verify State law law authority authority State EC special special requirements requirements and and limitations limitations EC EC reporting reporting data data elements elements EC Detailed allowable allowable cost cost review, review, including including Detailed compliance with with specific specific cost cost item item compliance regulations regulations Eligible Use Use & & Allowable Allowable Eligible Cost Review Review Template Template Cost

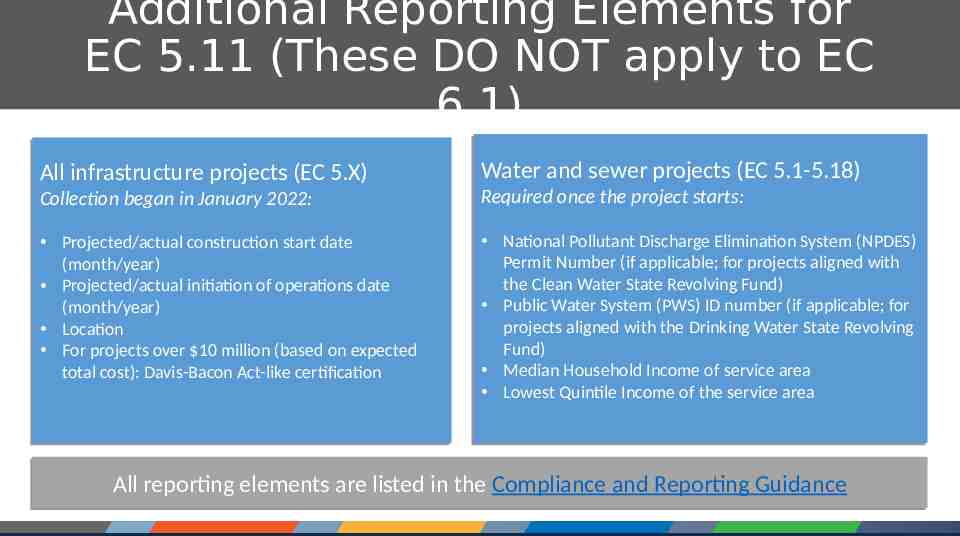

Additional Reporting Elements for EC 5.11 (These DO NOT apply to EC 6.1) All infrastructure projects (EC 5.X) Water and sewer projects (EC 5.1-5.18) Collection began began in in January January 2022: 2022: Collection Required once once the the project project starts: starts: Required Projected/actual construction construction start start date date Projected/actual (month/year) (month/year) Projected/actual initiation initiation of of operations operations date date Projected/actual (month/year) (month/year) Location Location For projects projects over over 10 10 million million (based (based on on expected expected For total cost): cost): Davis-Bacon Davis-Bacon Act-like Act-like certification certification total National Pollutant Pollutant Discharge Discharge Elimination Elimination System System (NPDES) (NPDES) National Permit Number Number (if (if applicable; applicable; for for projects projects aligned aligned with with Permit the Clean Clean Water Water State State Revolving Revolving Fund) Fund) the Public Water Water System System (PWS) (PWS) ID ID number number (if (if applicable; applicable; for for Public projects aligned aligned with with the the Drinking Drinking Water Water State State Revolving Revolving projects Fund) Fund) Median Household Household Income Income of of service service area area Median Lowest Quintile Quintile Income Income of of the the service service area area Lowest All reporting elements are listed in the Compliance and Reporting Guidance

Adopt general compliance provisions Define project (purpose, scope, parameters, timeline, estimated costs, feasibility review) Identify state law authority Checklist for Funding Capital Project with ARP/CSLFRF Determine and document that project is an eligible use of ARP/CSLFRF (Identify Expenditure Category EC), according to Eligible Use Policy Identify any special requirements or limitations for EC, according to Final Rule and Compliance and Reporting Guide Document initial allowable cost review according to Allowable Cost Policy Adopt budget and establish accounting system Adopt and implement specialty compliance provisions (as needed) 3 Select contractors/other service providers and execute contracts, according to Procurement Policy Manage, track, and document obligations and disbursements, and other required data elements, according to both state law and federal regulations Complete periodic reports to US Treasury

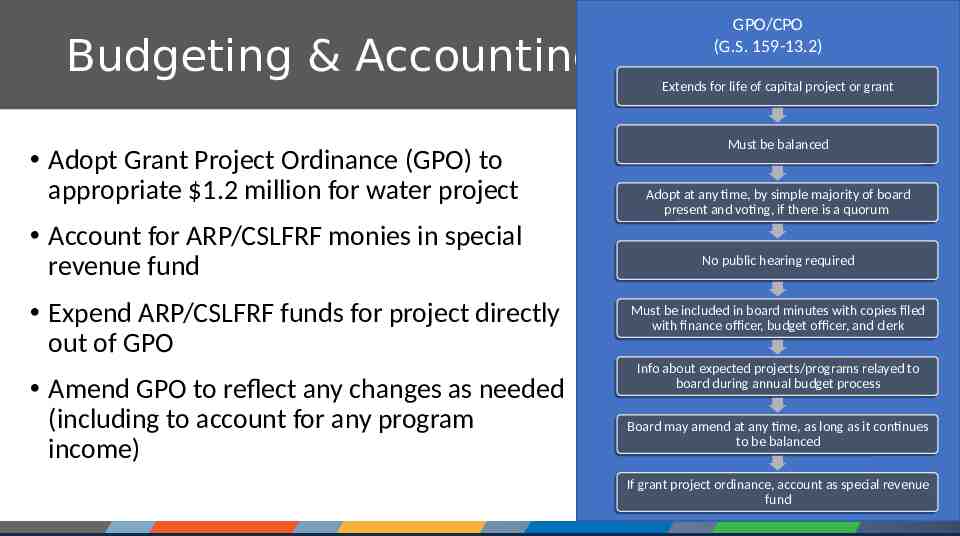

Budgeting & Accounting Adopt Grant Project Ordinance (GPO) to appropriate 1.2 million for water project Account for ARP/CSLFRF monies in special revenue fund Expend ARP/CSLFRF funds for project directly out of GPO Amend GPO to reflect any changes as needed (including to account for any program income) GPO/CPO (G.S. 159-13.2) Extends for for life life of of capital capital project project or or grant grant Extends Must be be balanced balanced Must Adopt at at any any time, time, by by simple simple majority majority of of board board Adopt present and and voting, voting, ifif there there isis aa quorum quorum present No public public hearing hearing required required No Must be be included included in in board board minutes minutes with with copies copies filed filed Must with finance finance officer, officer, budget budget officer, officer, and and clerk clerk with Info about about expected expected projects/programs projects/programs relayed relayed to to Info board during during annual annual budget budget process process board Board may may amend amend at at any any time, time, as as long long as as itit continues continues Board to be be balanced balanced to grant project project ordinance, ordinance, account account as as special special revenue revenue IfIf grant fund fund

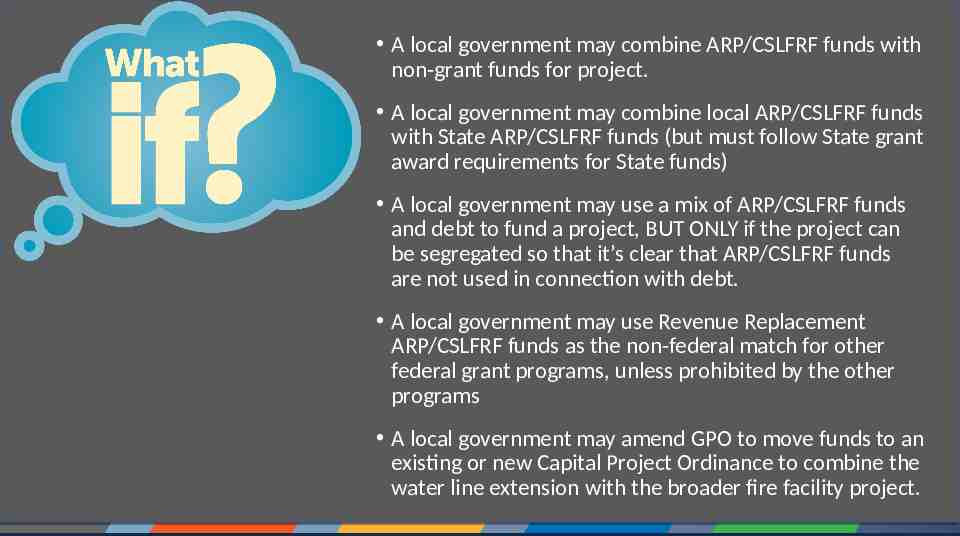

A local government may combine ARP/CSLFRF funds with non-grant funds for project. A local government may combine local ARP/CSLFRF funds with State ARP/CSLFRF funds (but must follow State grant award requirements for State funds) A local government may use a mix of ARP/CSLFRF funds and debt to fund a project, BUT ONLY if the project can be segregated so that it’s clear that ARP/CSLFRF funds are not used in connection with debt. A local government may use Revenue Replacement ARP/CSLFRF funds as the non-federal match for other federal grant programs, unless prohibited by the other programs A local government may amend GPO to move funds to an existing or new Capital Project Ordinance to combine the water line extension with the broader fire facility project.

Adopt general compliance provisions Define project (purpose, scope, parameters, timeline, estimated costs, feasibility review) Identify state law authority Checklist for Funding Capital Project with ARP/CSLFRF 4 Determine and document that project is an eligible use of ARP/CSLFRF (Identify Expenditure Category EC), according to Eligible Use Policy Identify any special requirements or limitations for EC, according to Final Rule and Compliance and Reporting Guide Document initial allowable cost review according to Allowable Cost Policy Adopt budget and establish accounting system Adopt and implement specialty compliance provisions (as needed) Select contractors/other service providers and execute contracts, according to Procurement Policy Manage, track, and document obligations and disbursements, and other required data elements, according to both state law and federal regulations Complete periodic reports to US Treasury

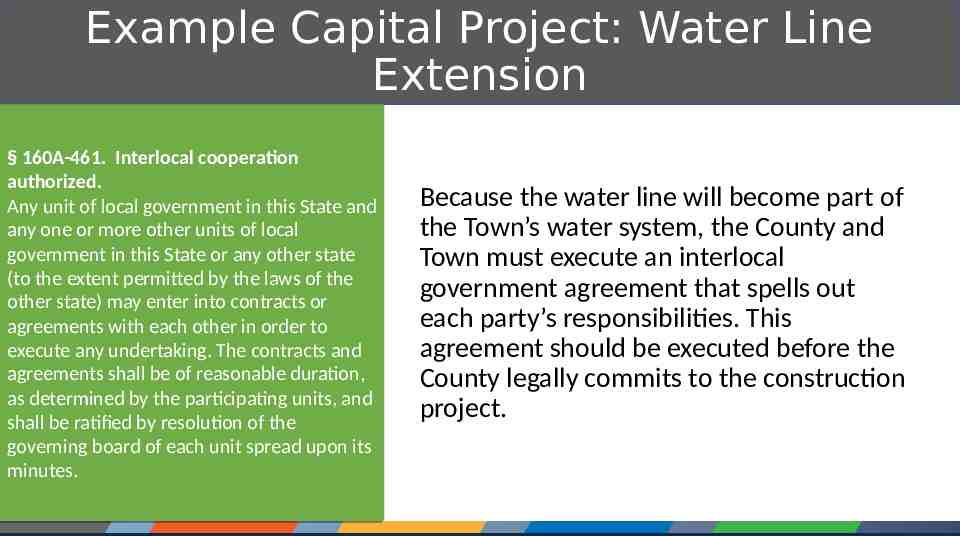

Example Capital Project: Water Line Extension 160A-461. Interlocal Interlocal cooperation cooperation §§ 160A-461. authorized. authorized. Any unit unit of of local local government government in in this this State State and and Any any one one or or more more other other units units of of local local any government in in this this State State or or any any other other state state government (to the the extent extent permitted permitted by by the the laws laws of of the the (to other state) state) may may enter enter into into contracts contracts or or other agreements with with each each other other in in order order to to agreements execute any any undertaking. undertaking. The The contracts contracts and and execute agreements shall shall be be of of reasonable reasonable duration, duration, agreements as determined determined by by the the participating participating units, units, and and as shall be be ratified ratified by by resolution resolution of of the the shall governing board board of of each each unit unit spread spread upon upon its its governing minutes. minutes. Because the water line will become part of the Town’s water system, the County and Town must execute an interlocal government agreement that spells out each party’s responsibilities. This agreement should be executed before the County legally commits to the construction project.

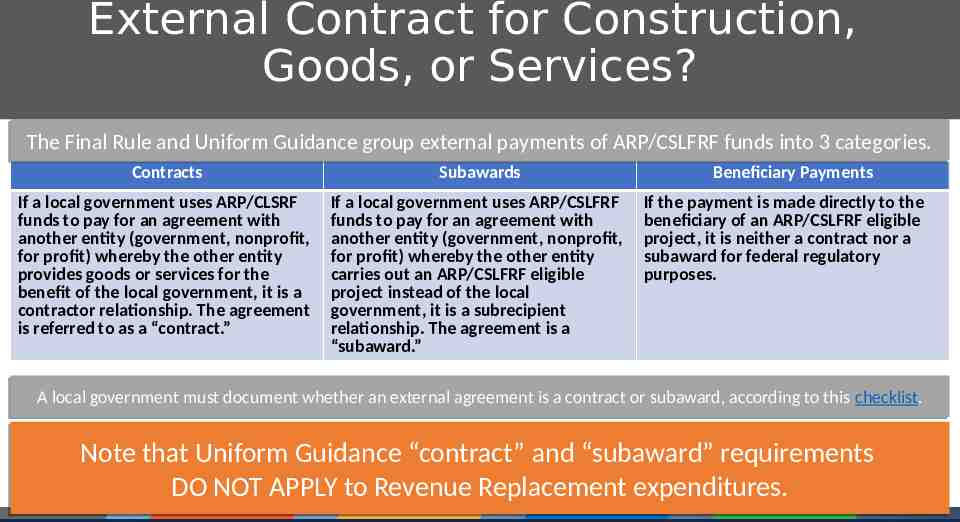

External Contract for Construction, Goods, or Services? The Final Rule and Uniform Guidance group external payments of ARP/CSLFRF funds into 3 categories. Contracts Subawards If a local government uses ARP/CLSRF funds to pay for an agreement with another entity (government, nonprofit, for profit) whereby the other entity provides goods or services for the benefit of the local government, it is a contractor relationship. The agreement is referred to as a “contract.” If a local government uses ARP/CSLFRF funds to pay for an agreement with another entity (government, nonprofit, for profit) whereby the other entity carries out an ARP/CSLFRF eligible project instead of the local government, it is a subrecipient relationship. The agreement is a “subaward.” Beneficiary Payments If the payment is made directly to the beneficiary of an ARP/CSLFRF eligible project, it is neither a contract nor a subaward for federal regulatory purposes. local government government must must document document whether whether an an external external agreement agreement is is aa contract contract or or subaward, subaward, according according to to this this checklist. checklist. AA local Note that Uniform Guidance “contract” and “subaward” requirements DO NOT APPLY to Revenue Replacement expenditures.