Financial Derivatives Daniel Thaler December 1, 2009

54 Slides2.52 MB

Financial Derivatives Daniel Thaler December 1, 2009

What are financial derivatives? They are financial instruments whose value is derived from some other asset, index, event, value, or condition. – Those from which it is derived is known as an underlying asset.

Conceptual Example It’s Super Bowl XLII between the Giants and the Patriots and the Patriots are a 4-1 favorite. Your friend places a 1,000 bet on the Giants to win the game. How much would you pay your friend to have the option to purchase his bet? (Question 1)

Scenarios Would you pay him more than 1,000 for this option at the start of the game? – No, you could make the bet yourself The Giants are winning 3-0 at the end of the first quarter how would the price of the option change? – The price of the option would increase The Patriots are winning 14-10 with 2:42 left in the game how would the price of the option change? – The price of the option would decrease The Giants score a late touchdown to make it 17-14 with 0:35 left in the game would you pay him more than 1,000 for this option? – Yes, considering if the Giants win the payout is 4,000.

Background information Rather than trade or exchange the underlying asset itself, derivative traders enter into an agreement to exchange cash or assets over time based on the underlying asset. Derivates are often highly levered, so a small change in the underlying asset can cause a large change in the value of the derivative.

More background Derivatives can be used by investors to speculate and to make a profit if the value of the underlying moves the way they expect Traders can use derivatives to hedge or mitigate risk in the underlying, by entering into a derivative contract whose value moves in the opposite direction to their underlying position and cancels part or all of it out.

Back to the Super Bowl You are a Patriots fan and bet 4,000 on them to win the game (remember the odds are 1-4 so the payout is 1,000). It’s the end of the 3rd Quarter and the Patriots are only up 4pts. You want to hedge your risk so you find someone to sell you a 500 option on a 1,000 bet that the Giants win. Answer Question 2.

Hedging Solutions How much will you win/lose if the Patriots win/lose? – Pats win, you win 1,000 - 500 500 – Pats lose, you lose 4,000 – 4,000 - 500 - 500 How much would have had to wager without options if you wanted to win 500 – 2,000

Categories The type of the underlying – Stocks, Bonds, Commodity The market which they trade – Over-the-counter (OTC), Exchange-traded derivates (ETD) The relationship between the underlying and the derivative – Options, Futures/Forwards, Swaps

Options Contracts that give the owner the right, but not the obligation to buy or sell an asset The strike price is the price at which the transaction would take place The option must also have a maturity date 1 Options contract usually represents the right to buy 100 shares of the underlying security

Types of Options Trades Long Call Long Put Short Call (“Write a Call”) Short Put (“Write a Put”)

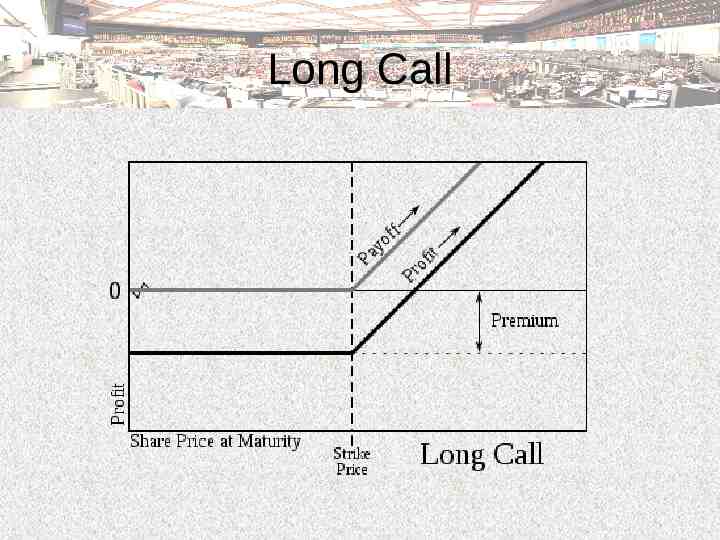

Long Call Buy the right to purchase the stock at the strike price. Will only exercise if the stocks price is higher than the strike price plus the price paid for the option Believe the price will INCREASE For the same amount of money you can obtain a larger amount of options than shares

Long Call

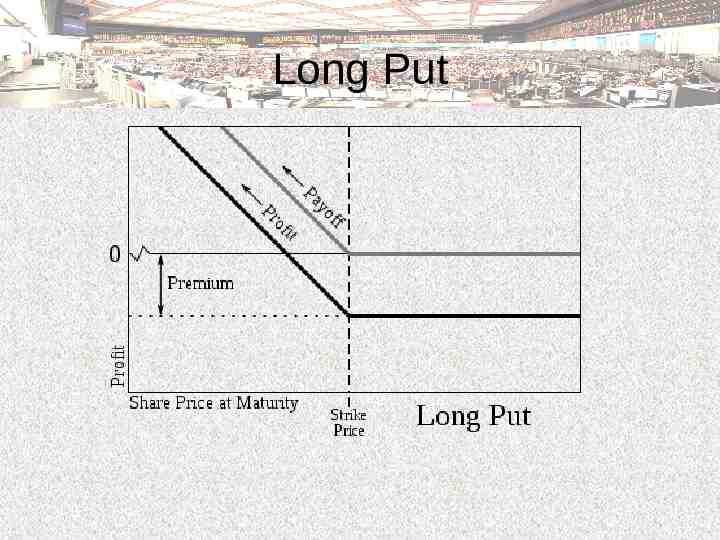

Long Put Buy the right to sell the stock at the strike price Will exercise only if the stock price plus the premium is below the strike Believe the stock price will DECREASE

Long Put

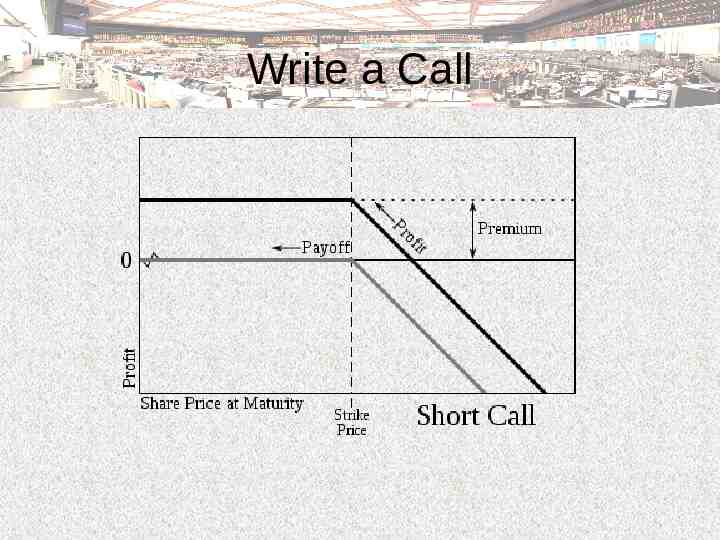

Write a Call Selling a call option to a buyer and had the obligation to fulfill the contract at a strike price Will profit only if the stock price remains below that of the strike price plus the premium Potential loss is unlimited Believe the stock price will DECREASE

Write a Call

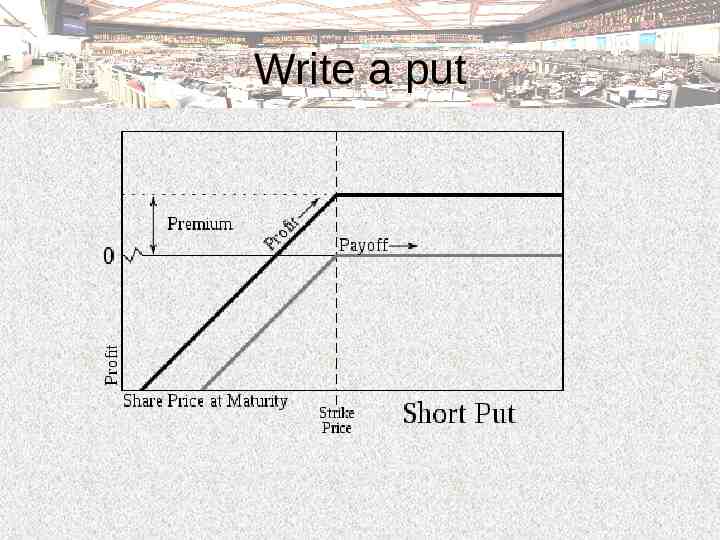

Write a put An obligation to buy the stock from the put buyer at the strike price Will profit if stock price plus the premium is above the strike price. Loss is capped at the full value of the stock Believe the stock price will INCREASE

Write a put

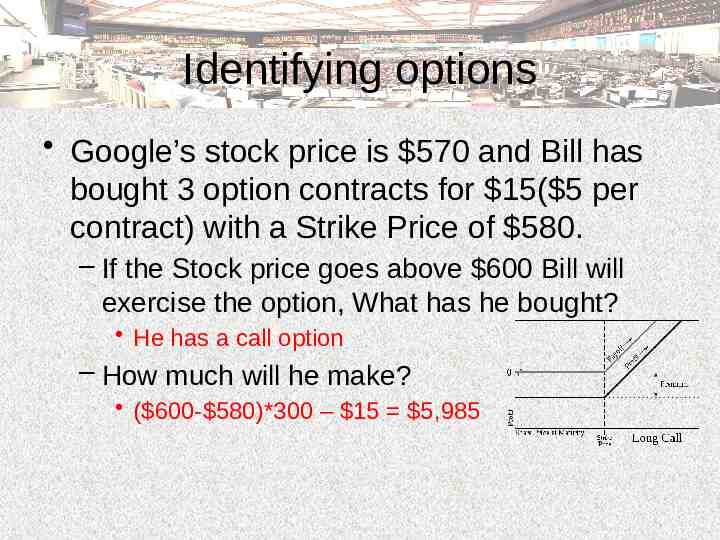

Identifying options Google’s stock price is 570 and Bill has bought 3 option contracts for 15( 5 per contract) with a Strike Price of 580. – If the Stock price goes above 600 Bill will exercise the option, What has he bought? He has a call option – How much will he make? ( 600- 580)*300 – 15 5,985

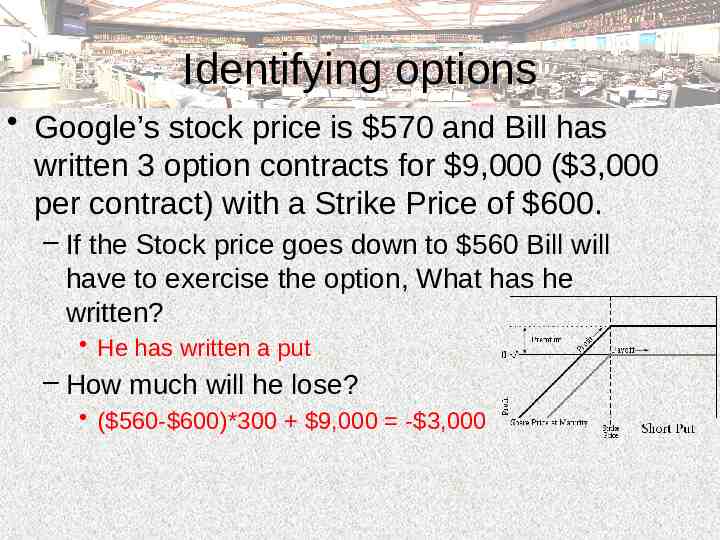

Identifying options Google’s stock price is 570 and Bill has written 3 option contracts for 9,000 ( 3,000 per contract) with a Strike Price of 600. – If the Stock price goes down to 560 Bill will have to exercise the option, What has he written? He has written a put – How much will he lose? ( 560- 600)*300 9,000 - 3,000

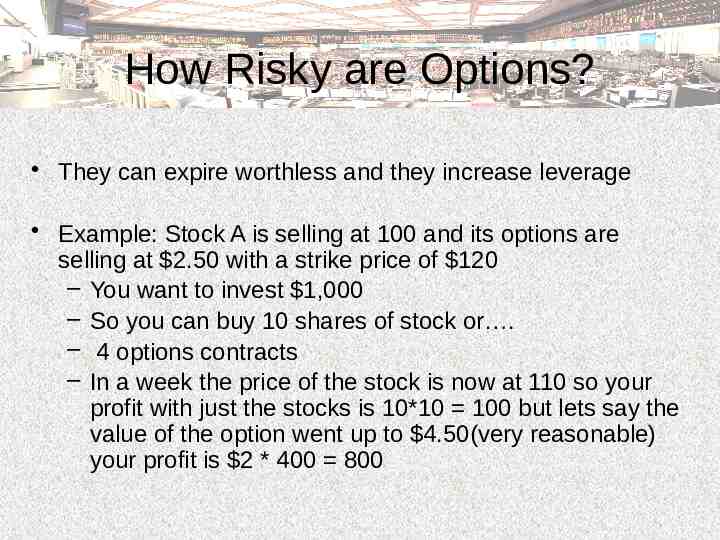

How Risky are Options? They can expire worthless and they increase leverage Example: Stock A is selling at 100 and its options are selling at 2.50 with a strike price of 120 – You want to invest 1,000 – So you can buy 10 shares of stock or . – 4 options contracts – In a week the price of the stock is now at 110 so your profit with just the stocks is 10*10 100 but lets say the value of the option went up to 4.50(very reasonable) your profit is 2 * 400 800

Option Strategies Combine any of the four basic options trades (possibly with different exercise prices) Can also use the two basic kinds of stock trades (long and short) Used to engineer a particular risk profile to movements in the underlying security.

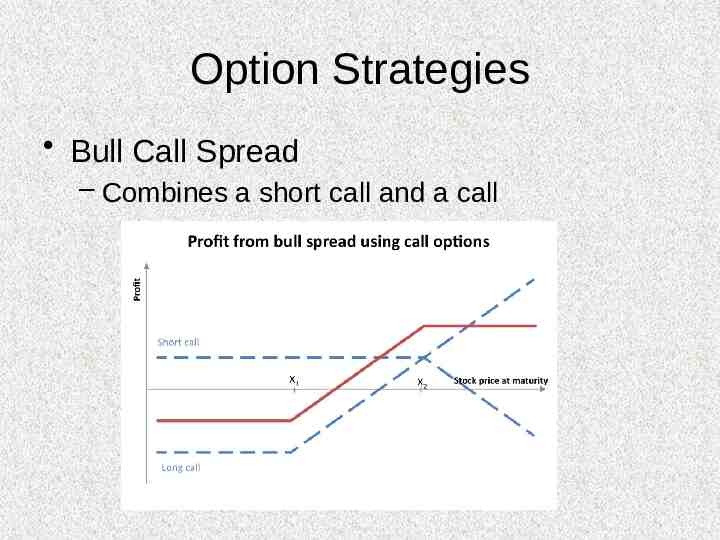

Option Strategies Bull Call Spread – Combines a short call and a call

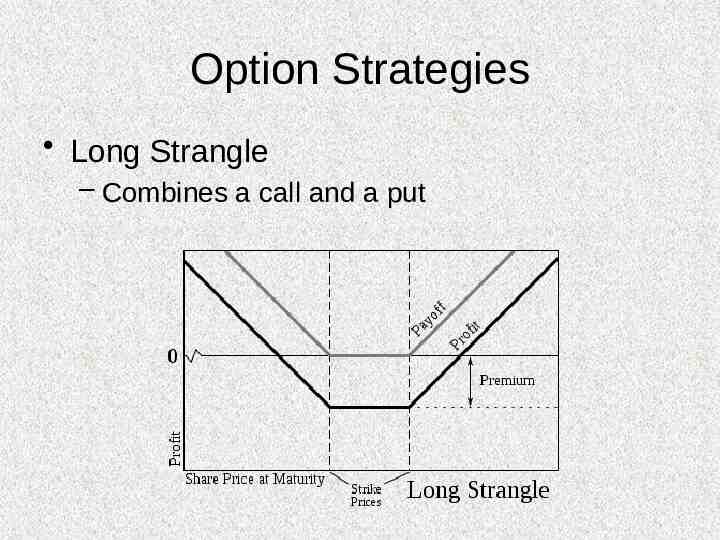

Option Strategies Long Strangle – Combines a call and a put

Other Option Strategies Bullish Strategies Bull Put Spread Bull Call Spread Covered Straddle Call Time Spread Ratio Call Spread Strangle Bearish Strategies Bear Put Spread Bear Call Spread Put Time Spread Ratio Put Spread Condor Long Butterfly Neutral Strategies Short Straddle Long Straddle Short Combo Guts

Excel

How are options priced? Want to find a way to quantify the expected payoffs that would occur if the stock price goes up or goes down. Also, it must incorporate the length for which the option is available

How are options priced? Binomial Options Pricing Model – Uses a “discrete-time” model of the varying price over time of the underlying financial instrument Black-Scholes Model – A continuous extension of the binomial model

Binomial Model Provides a general numerical model Process is iterative Each node represents a possible price at a particular point in time

Binomial Model Steps: – Price tree generation – Calculation of option value at each final node – Calculation of option value at each earlier node – The value at the first node is the price of the option

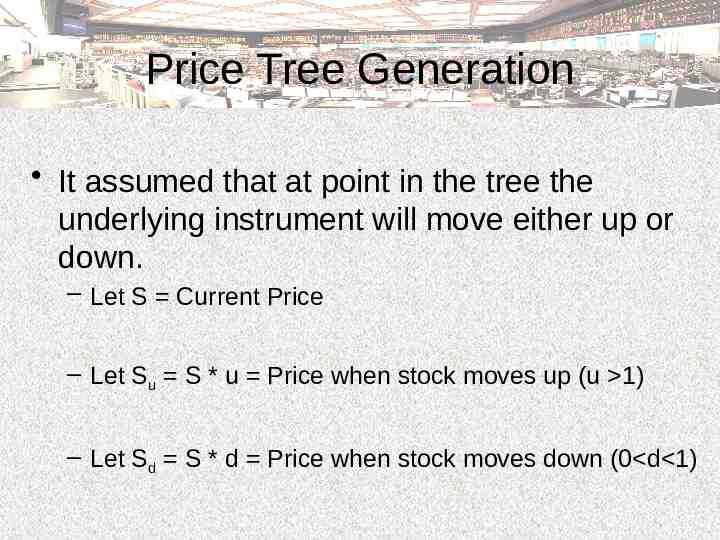

Price Tree Generation It assumed that at point in the tree the underlying instrument will move either up or down. – Let S Current Price – Let Su S * u Price when stock moves up (u 1) – Let Sd S * d Price when stock moves down (0 d 1)

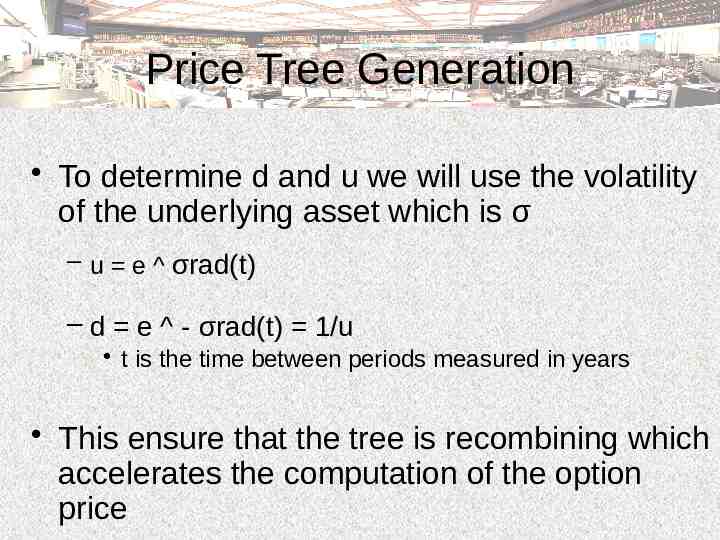

Price Tree Generation To determine d and u we will use the volatility of the underlying asset which is σ – u e σrad(t) – d e - σrad(t) 1/u t is the time between periods measured in years This ensure that the tree is recombining which accelerates the computation of the option price

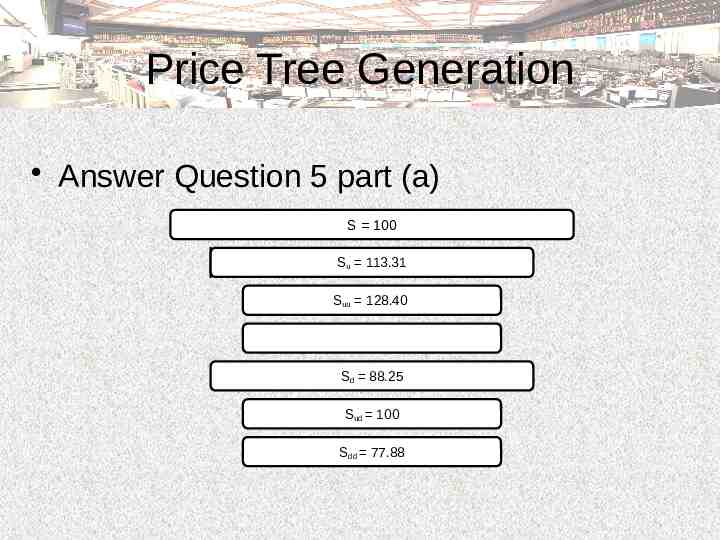

Price Tree Generation Answer Question 5 part (a) S 100 Su 113.31 Suu 128.40 Sd 88.25 Sud 100 Sdd 77.88

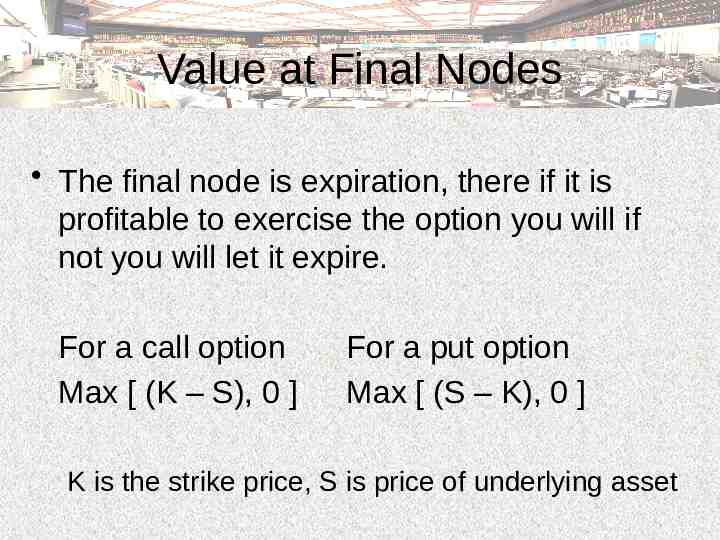

Value at Final Nodes The final node is expiration, there if it is profitable to exercise the option you will if not you will let it expire. For a call option Max [ (K – S), 0 ] For a put option Max [ (S – K), 0 ] K is the strike price, S is price of underlying asset

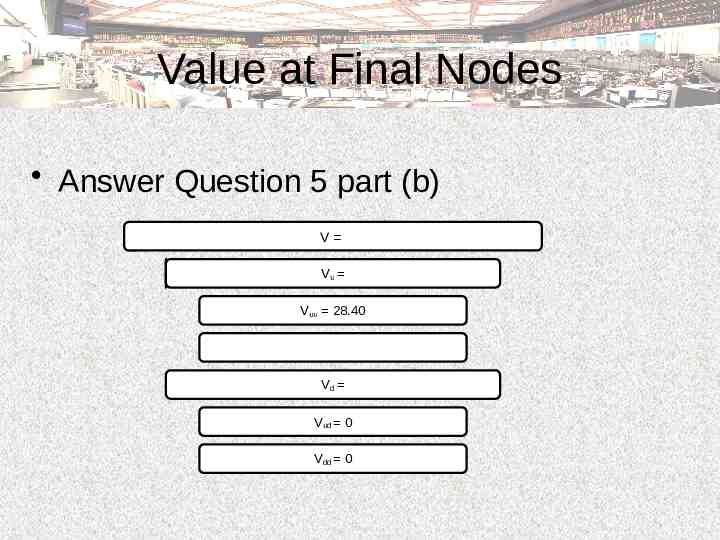

Value at Final Nodes Answer Question 5 part (b) V Vu Vuu 28.40 Vd Vud 0 Vdd 0

Value of Option at earlier nodes Use the value of the option at an intermediate node using the value of the option at the following nodes. First: need to assign a probability to the price will increase by u or decrease by d (We will use 50/50 chance to keep it simple)

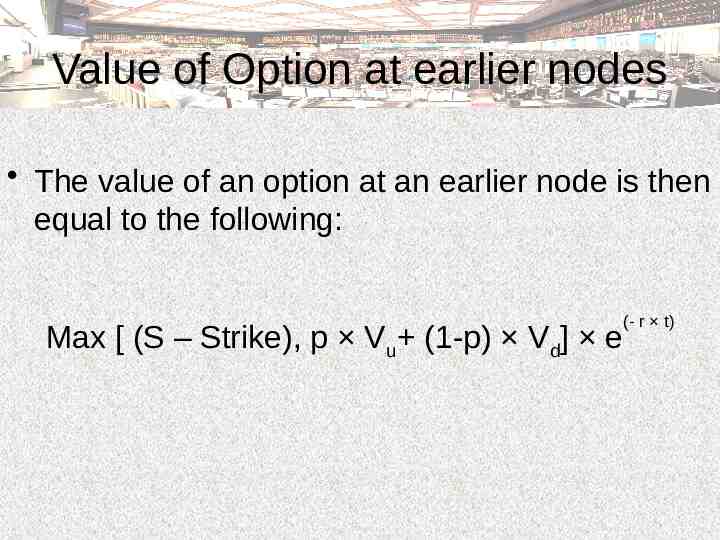

Value of Option at earlier nodes The value of an option at an earlier node is then equal to the following: Max [ (S – Strike), p Vu (1-p) Vd] e (- r t)

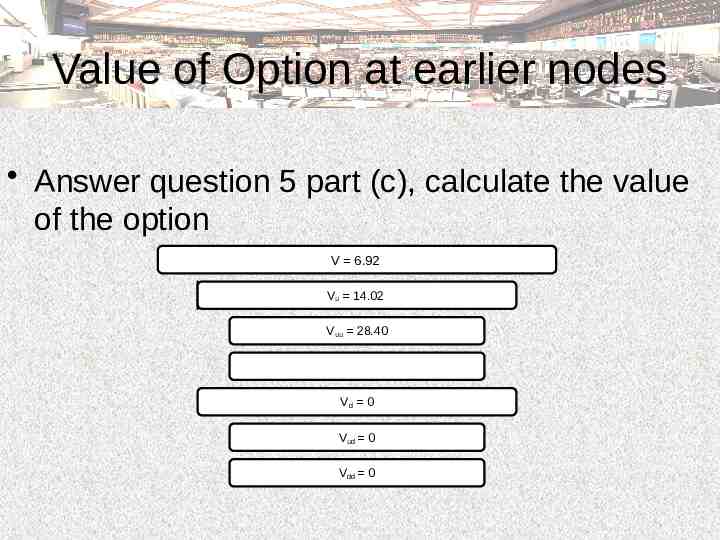

Value of Option at earlier nodes Answer question 5 part (c), calculate the value of the option V 6.92 Vu 14.02 Vuu 28.40 Vd 0 Vud 0 Vdd 0

Excel

Black-Scholes Model A continuous continuation of the binomial model The binomial model assumes that movements in the price follow a binomial distribution; for many trials, this binomial distribution approaches the normal distribution assumed by Black-Scholes.

Black-Scholes Model Developed by Fischer Black and Myron Scholes in a 1973 paper. They received the 1997 Nobel Prize in economics for this and related work.

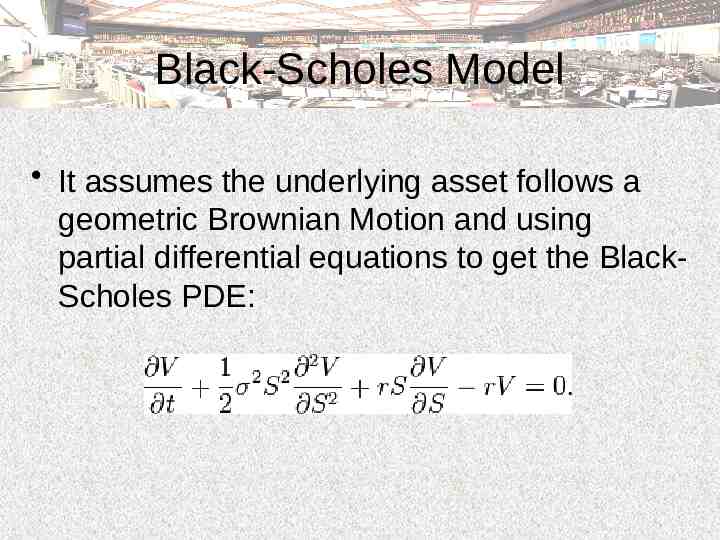

Black-Scholes Model It assumes the underlying asset follows a geometric Brownian Motion and using partial differential equations to get the BlackScholes PDE:

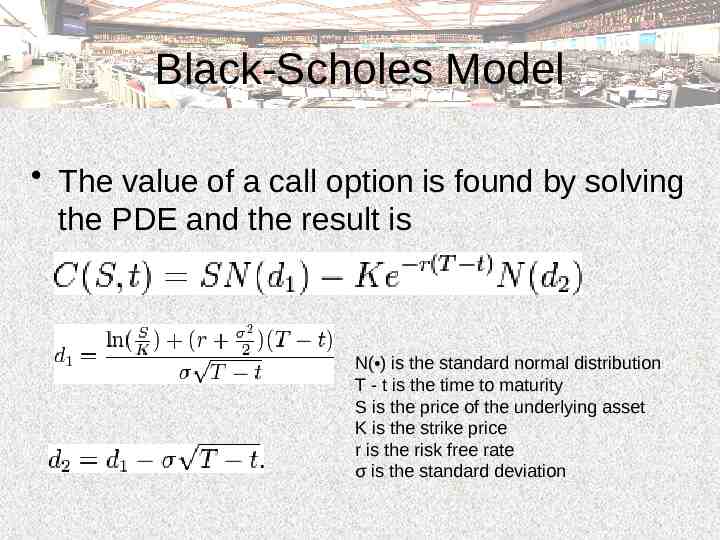

Black-Scholes Model The value of a call option is found by solving the PDE and the result is N( ) is the standard normal distribution T - t is the time to maturity S is the price of the underlying asset K is the strike price r is the risk free rate σ is the standard deviation

Excel

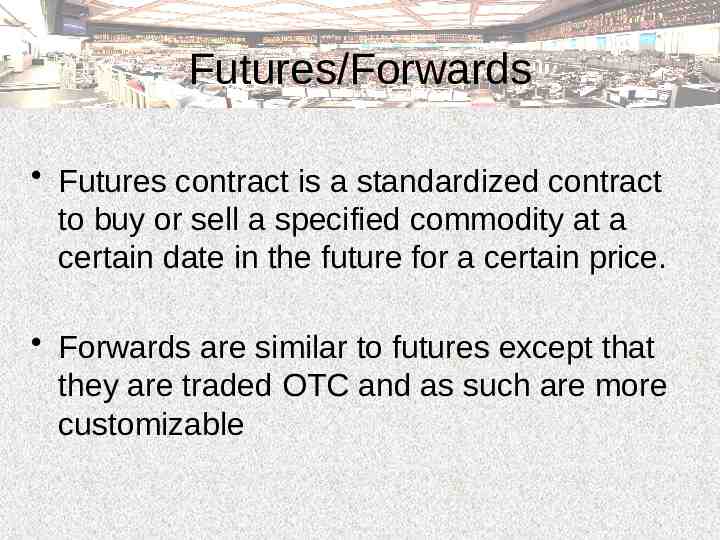

Futures/Forwards Futures contract is a standardized contract to buy or sell a specified commodity at a certain date in the future for a certain price. Forwards are similar to futures except that they are traded OTC and as such are more customizable

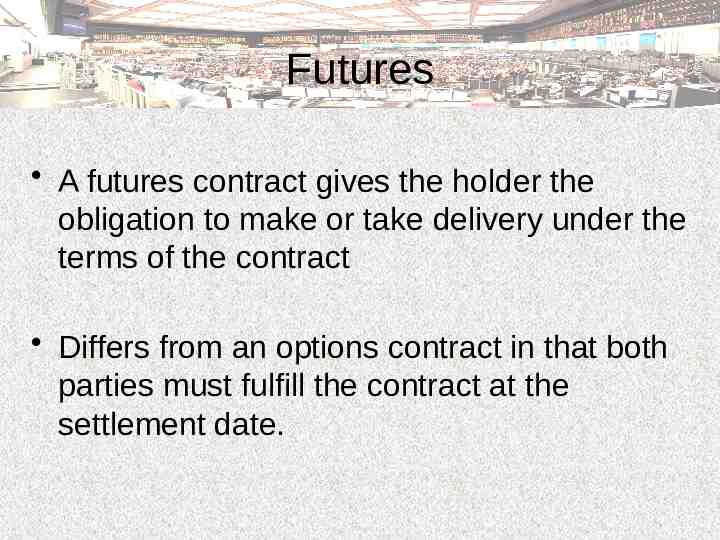

Futures A futures contract gives the holder the obligation to make or take delivery under the terms of the contract Differs from an options contract in that both parties must fulfill the contract at the settlement date.

Who Buys Them? Speculators who seek to make a profit by predicting market moves. Producers and consumers purchase futures contracts to guarantee a certain price.

Types of Futures Crude Oil Corn Soybean Sugar Wool Cotton Coffee Cocoa Wheat Lumber Orange Juice Silver Gold Copper

Trading Places

Trading Places Explanation Standard contract size is 15,000 pounds The Dukes got a fake report and think that FCOJ is going to be valuable and cause the price to rise V and W wait until the price gets to 1.42 per pound and then sell contracts that they don’t own.

Trading Places Explanation When the real crop report is announced it is obvious that the crop will be good and prices begin to fall all the way down to 46. Since V and W don’t own any FCOJ they start to buy back contracts at this price to cover the ones that were sold.

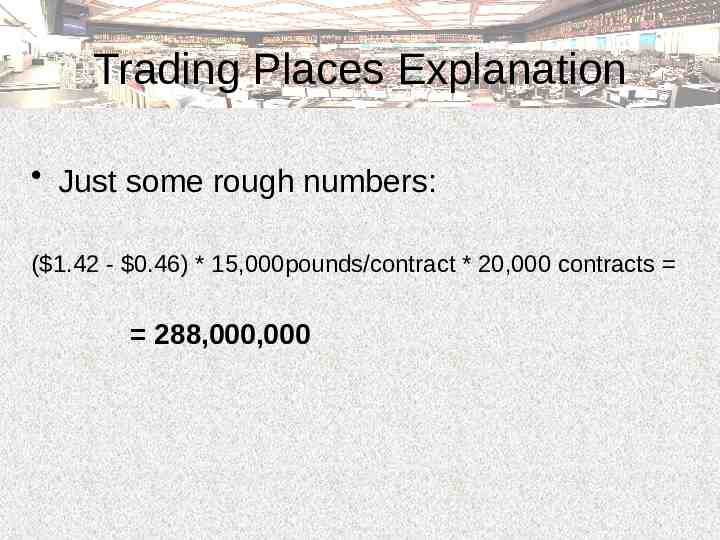

Trading Places Explanation Just some rough numbers: ( 1.42 - 0.46) * 15,000pounds/contract * 20,000 contracts 288,000,000

Conclusions Derivatives can offer a way to: Hedge portfolio risk Lock in a specific price for a commodity Provide investing leverage Cheap form of speculating