Employee Benefits Info Session Nichole Galvin Benefits Manager

21 Slides2.27 MB

Employee Benefits Info Session Nichole Galvin Benefits Manager Human Resources

Employee Benefits Info Session Retirement Plan Options Voluntary Savings Plan Options Health Insurance Dental and Vision Insurance Flex Spending Accounts

Retirement Plan Options NYS ERS/TRS Teacher’s Retirement System Employee’s Retirement System Mandatory membership for CSEA Optional Retirement Program (ORP) Full Time or Part Time Employees with a Term Appointment Vendors to choose from TIAA Corebridge Financial (Formerly AIG) Voya Fidelity

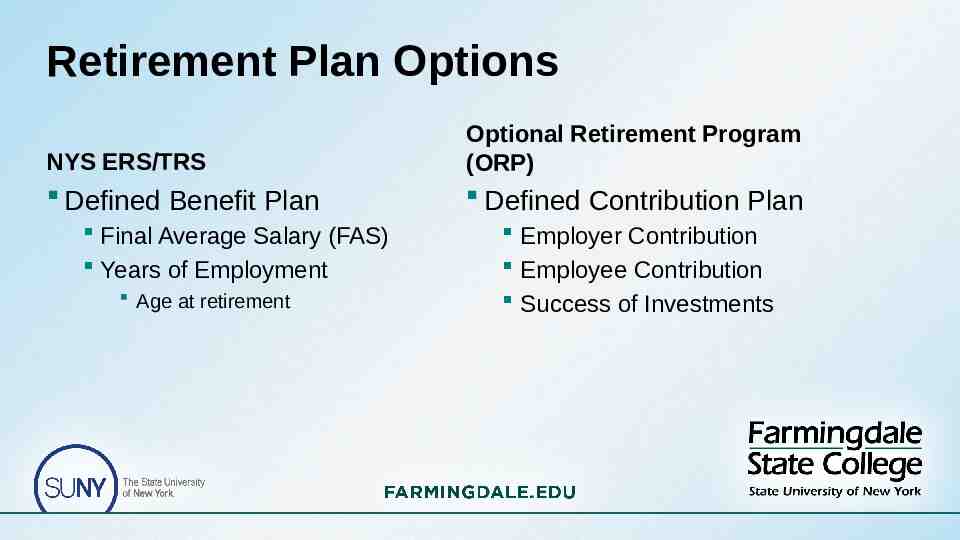

Retirement Plan Options NYS ERS/TRS Optional Retirement Program (ORP) Defined Benefit Plan Defined Contribution Plan Final Average Salary (FAS) Years of Employment Age at retirement Employer Contribution Employee Contribution Success of Investments

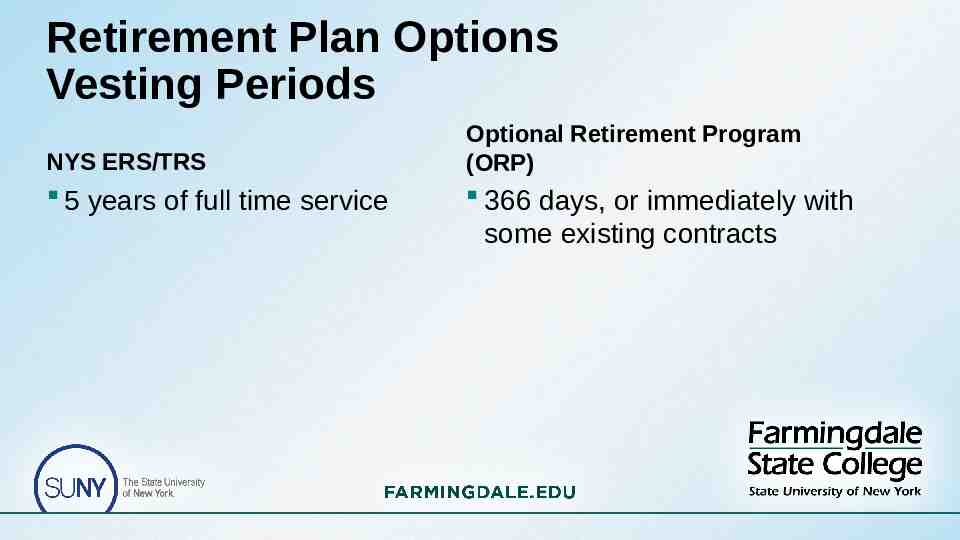

Retirement Plan Options Vesting Periods NYS ERS/TRS 5 years of full time service Optional Retirement Program (ORP) 366 days, or immediately with some existing contracts

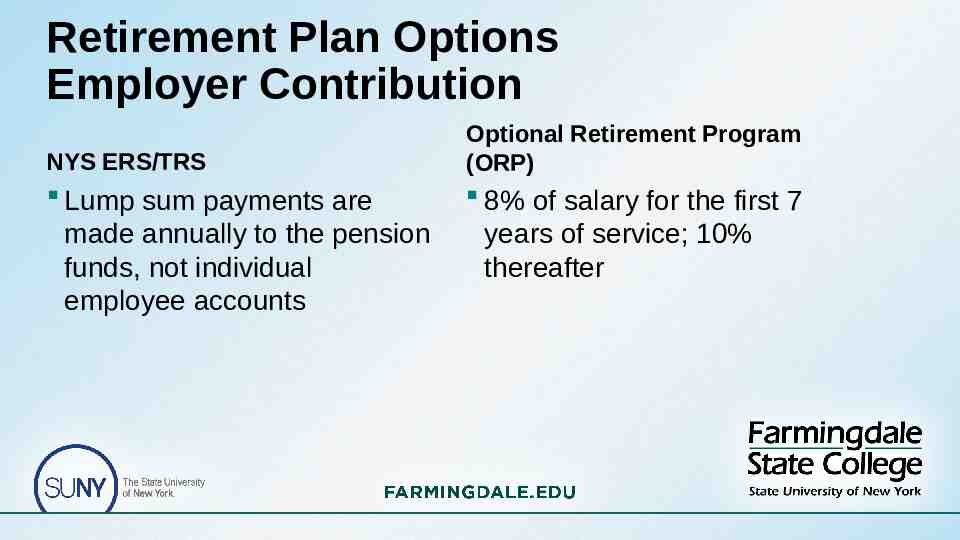

Retirement Plan Options Employer Contribution NYS ERS/TRS Lump sum payments are made annually to the pension funds, not individual employee accounts Optional Retirement Program (ORP) 8% of salary for the first 7 years of service; 10% thereafter

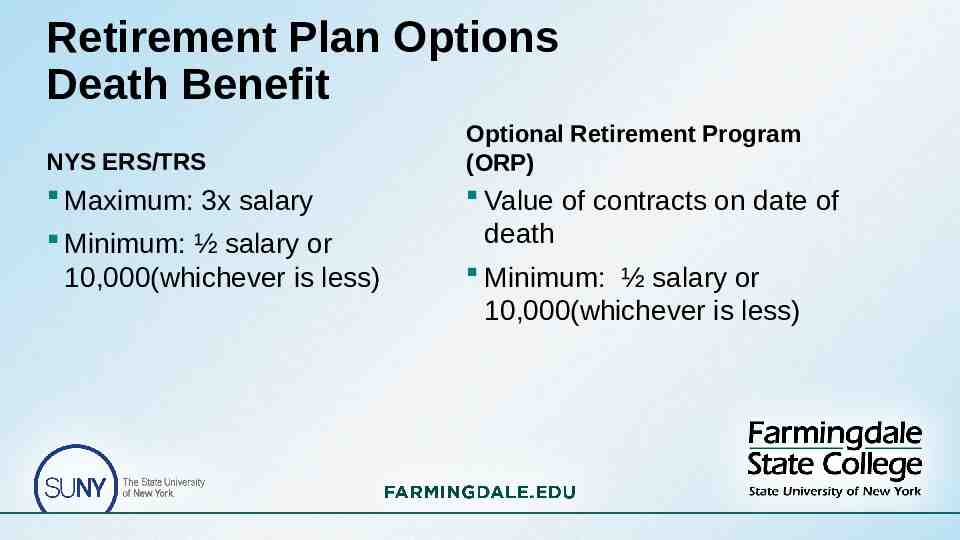

Retirement Plan Options Death Benefit NYS ERS/TRS Maximum: 3x salary Minimum: ½ salary or 10,000(whichever is less) Optional Retirement Program (ORP) Value of contracts on date of death Minimum: ½ salary or 10,000(whichever is less)

SUNY Retirement @ Work All retirement elections are completed online at www.retirementatwork.org/suny Retirement Elections should be made within 30 days from your hire date ERS/ TRS Enrollments completed online then application turned into Human Resources

Voluntary Savings Plan Options Can put away more money toward retirement on a tax-deferred basis Can choose from a variety of investment options Can start or discontinue at any time Roth option is available Vendors to choose from TIAA Corebridge Financial (Formerly AIG) Voya Fidelity

Voluntary Savings Plans SUNY 403(b) Plan 2023 IRS Limits 100% of salary up to 22,500 Employees age 50 and up can contribute an additional 7,500 Enrollment is completed online at www.retirementatwork.org/suny NYS Deferred Compensation Plan 457(b) Plan Enrollment is completed online at: https://www.nysdcp.com/rsc-web-preauth/index.html

Health Insurance 42-day waiting period (M/C employees 56 day) Individual or Family Coverage Rx included in the health plan options Empire Plan or HIP (HMO)

HMO (Health Maintenance Organization) HIP is the HMO provider Primary care physician would designate hospitalization/medical care Need referral for other providers No claim forms to submit No deductibles Small copays

The Empire Plan The Empire Plan is a specially-made plan for New York State employees . Various insurance companies (who are otherwise unaffiliated) have agreed to provide coverage under the general “umbrella” of the Empire Plan

The Empire Plan Under the Empire “Umbrella” Hospital: Empire Blue Cross and Blue Shield Major Medical: United Health Care Mental Health and Substance Abuse: Beacon Health Options Prescriptions: CVS/Caremark

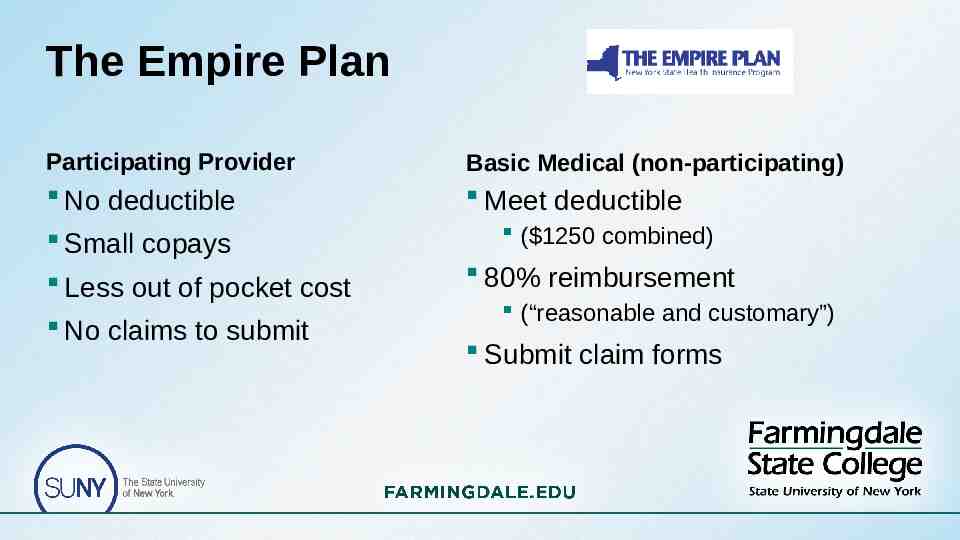

The Empire Plan Participating Provider Basic Medical (non-participating) No deductible Meet deductible Small copays Less out of pocket cost No claims to submit ( 1250 combined) 80% reimbursement (“reasonable and customary”) Submit claim forms

Empire Plan Prescription Coverage Up to a 30-day supply from participating retail pharmacy or through mail service 5 generic 30 preferred brand name 60 non-preferred brand name Up to a 90-day supply through the mail service 5 generic 55 preferred brand name 110 non-preferred brand name Up to a 90-day supply from a participating retail pharmacy 10 generic 60 preferred brand name 120 non-preferred brand name

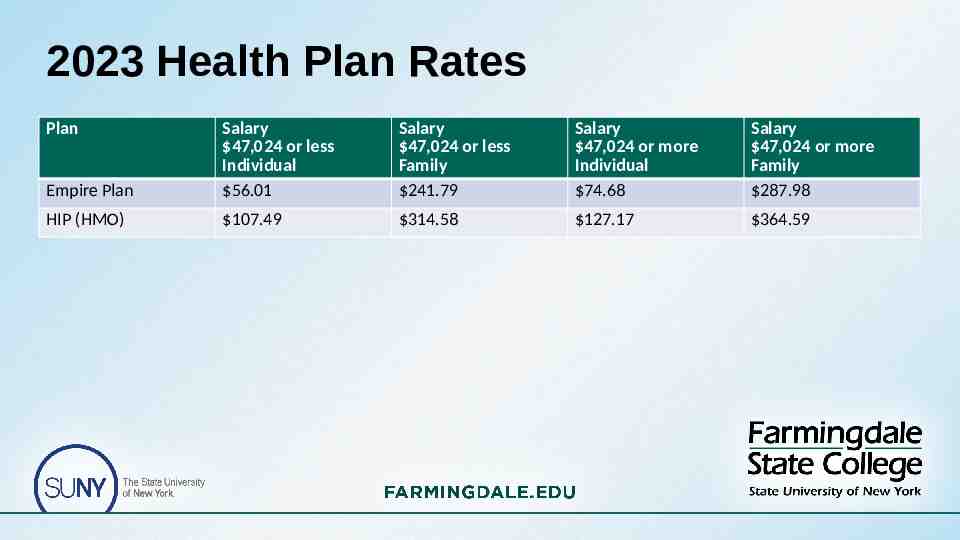

2023 Health Plan Rates Plan Empire Plan Salary 47,024 or less Individual 56.01 Salary 47,024 or less Family 241.79 Salary 47,024 or more Individual 74.68 Salary 47,024 or more Family 287.98 HIP (HMO) 107.49 314.58 127.17 364.59

Health Insurance Enrollment To enroll in the Health Insurance Plans we need: PS 404- Health Insurance Transaction Form Copy of Employees Birth Certificate or Passport Copy of Marriage Certificate for Spouse Copy of Financial Obligation for Spouse Copy of Birth Certificate or Passport for Spouse Copy of Birth Certificates for Children Enroll within 30 days of your first day of employment

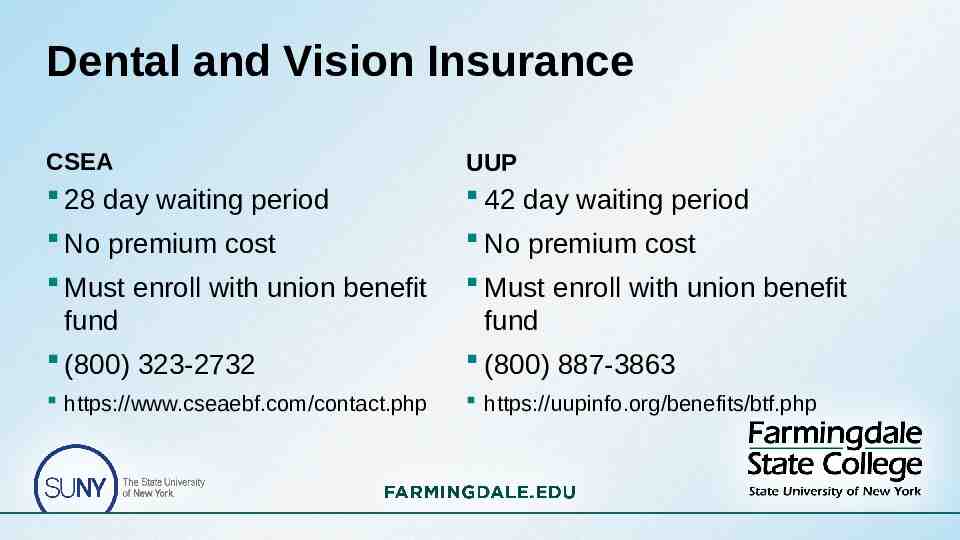

Dental and Vision Insurance CSEA UUP 28 day waiting period 42 day waiting period No premium cost No premium cost Must enroll with union benefit fund (800) 323-2732 Must enroll with union benefit fund (800) 887-3863 https://www.cseaebf.com/contact.php https://uupinfo.org/benefits/btf.php

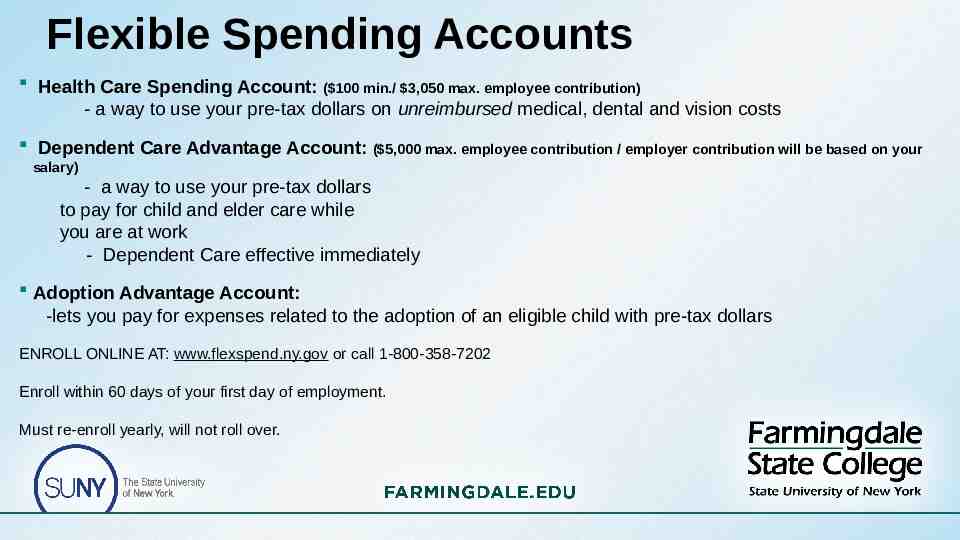

Flexible Spending Accounts Health Care Spending Account: ( 100 min./ 3,050 max. employee contribution) - a way to use your pre-tax dollars on unreimbursed medical, dental and vision costs Dependent Care Advantage Account: ( 5,000 max. employee contribution / employer contribution will be based on your salary) - a way to use your pre-tax dollars to pay for child and elder care while you are at work - Dependent Care effective immediately Adoption Advantage Account: -lets you pay for expenses related to the adoption of an eligible child with pre-tax dollars ENROLL ONLINE AT: www.flexspend.ny.gov or call 1-800-358-7202 Enroll within 60 days of your first day of employment. Must re-enroll yearly, will not roll over.

Questions? Benefits Questions? Email: [email protected] Human Resources Questions? Email: [email protected]