ECON 337: Agricultural Marketing Lee Schulz Assistant Professor

31 Slides3.51 MB

ECON 337: Agricultural Marketing Lee Schulz Assistant Professor [email protected] 515-294-3356

Livestock Pricing

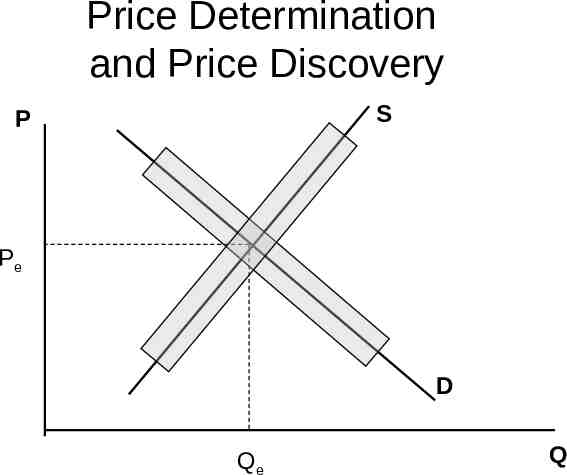

Price Determination and Discovery Price Determination is the broad forces of supply and demand establishing a market clearing price for a commodity. Price Discovery is the process by which buyers and sellers arrive at a transaction price for a given quality and quantity of product at a given time and place.

Price Determination Supply determinants or factors affecting quantity produced: Input prices (feed, feeder cattle, weaned/feeder pigs). Technology (growth promotants, etc.). Expected price of outputs produced from inputs (finished cattle, finished hogs). Demand forces or factors affecting quantity consumed: Prices of products produced (beef, pork). Prices of competing products (chicken, turkey, beef, pork). Consumer income. Tastes and preferences.

Price Discovery A human process, subject to relative bargaining power of the buyer and seller. Involves several interrelated concepts: Market structure (number, size, location, and competitiveness of buyers and sellers), Market behavior (buyer procurement and pricing methods), Market information and price reporting (amount, timeliness, and reliability of information), and Futures markets and risk management alternatives. Two stage process: Evaluate supply, demand, and market prices. Estimate the price for the specific trade.

Futures Markets in Price Discovery Centralized pricing. Global forces in one location. Livestock price discovery (in general) more complicated than for grains. Variability – basis a bigger issue. Growing inventory problem.

Price Determination and Price Discovery S P Pe D Qe Q

Centralized Pricing All buyers and sellers in one place at one time, i.e., auction market Full and immediate information Competitive bidding Equalizes market power - Transaction cost - Physical movement of product

Decentralized Pricing One-to-one negotiations, i.e., direct sales Reduced transportation cost Reduced transaction cost - Depends on skills and information - Higher search cost

Contract Sales Livestock sold under pre-determined arrangement. Prices may be set, or based on a key market. Formula pricing – pricing formula agreed upon in advance. Provides opportunity to ensure supply, market, and manage price risk.

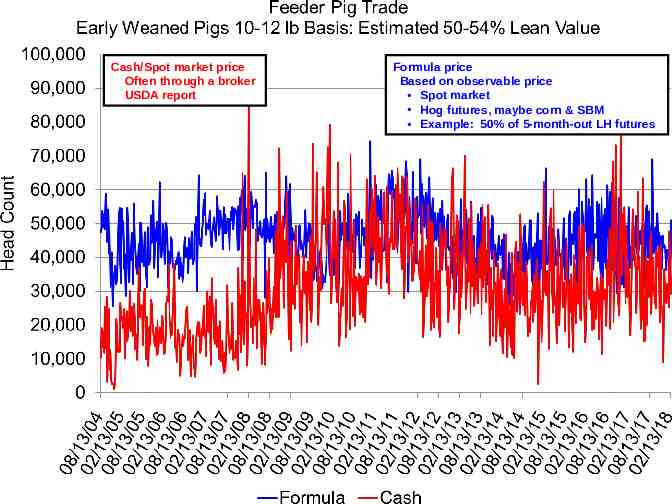

Cash/Spot market price Often through a broker USDA report Formula price Based on observable price Spot market Hog futures, maybe corn & SBM Example: 50% of 5-month-out LH futures

Slaughter Cattle and Hogs Spot or cash or negotiated pricing Seller contacts buyer when ready to sell Negotiate price and terms on each group Formula pricing Price discovery from elsewhere Formulas based on o o o o Spot market Cutout price Futures Cost of production Contract pricing May be for one group or an ongoing agreement between buyer and seller Terms (delivery, specification) and pricing method determined ahead of marketing date Do you trust the underlying market for price discovery?

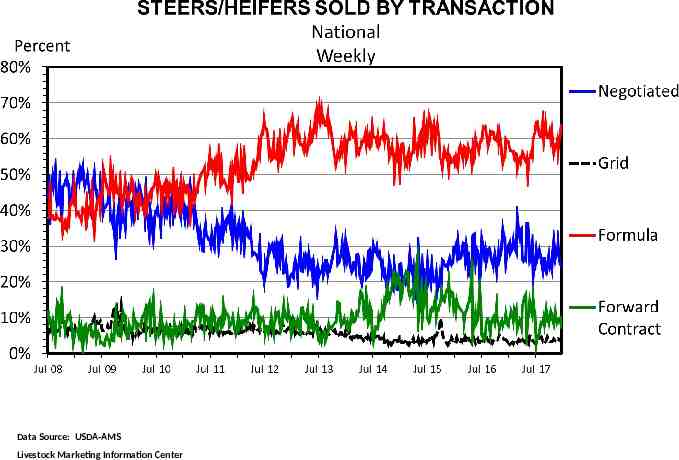

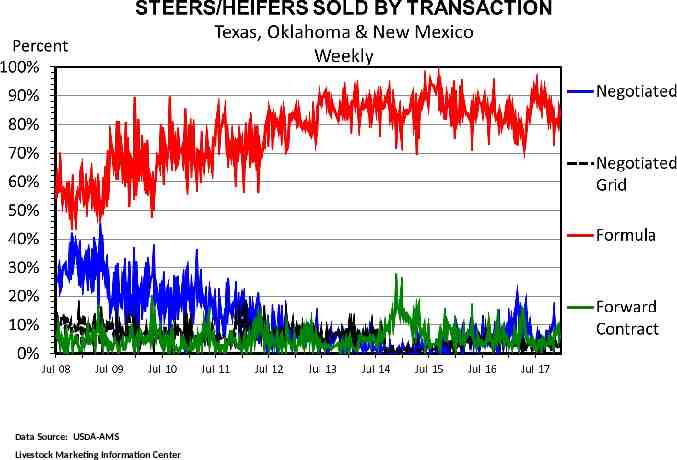

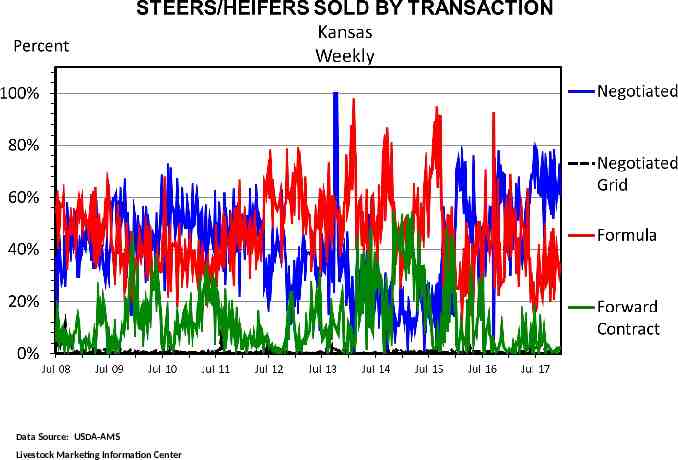

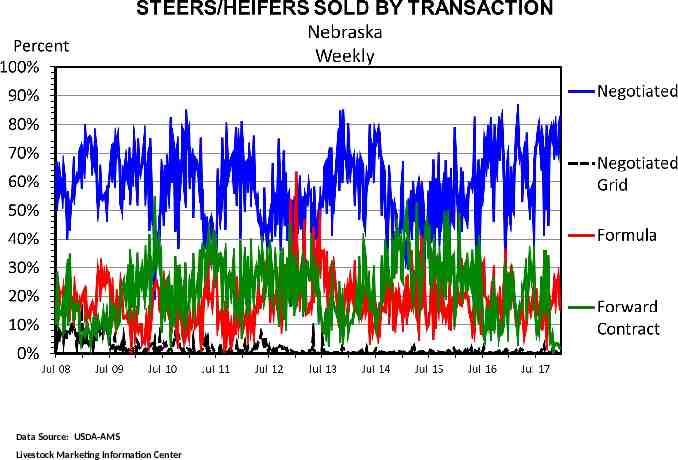

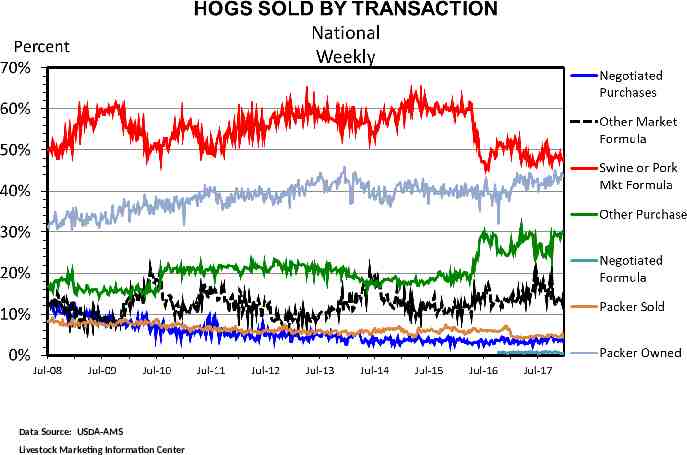

Pricing Mechanisms Alternative Marketing Arrangements (AMAs) Fed cattle: Negotiated cash, Negotiated grids - base price resulting from buyer–seller negotiation, Formula-priced - typically with the base price tied to a cash market quote or plant average cost, Forward contracts - typically with price tied to the futures market or futures market basis. Hogs: Negotiated cash, Swine market formula priced trades - typically with the base price tied to a cash market quote, Other market formula trades - typically with price tied to the futures market, Other purchase methods - includes window or ledger contracts and cost of production contracts.

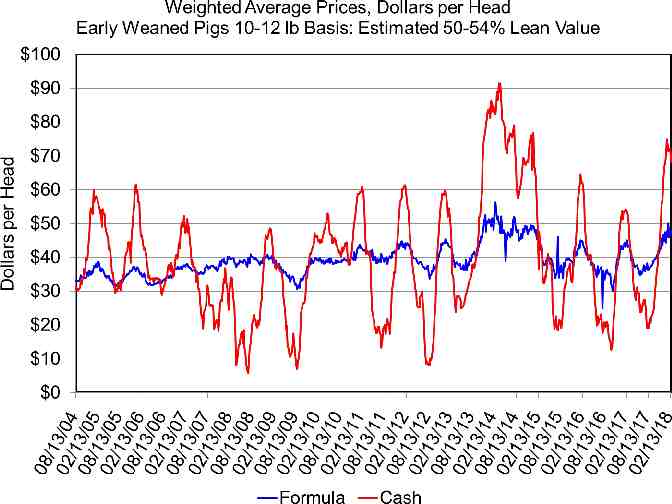

Data Source: USDA-AMS Livestock Marketing Information Center

Data Source: USDA-AMS Livestock Marketing Information Center

Data Source: USDA-AMS Livestock Marketing Information Center

Data Source: USDA-AMS Livestock Marketing Information Center

Data Source: USDA-AMS Livestock Marketing Information Center

Pricing Mechanisms Alternative Marketing Arrangements (AMAs) All have pros and cons No market is a free market. All (e.g., cash, contract, formulas) have risk, transaction costs and varying levels of information available to participants. Increased use of AMAs have been driven by: 1) Large risk of profit margins; 2) Price can be connected to quality and yield information sending a stronger price signal through the supply chain than buying on the average; 3) Improved efficiencies through planning supply movements that translates into reduced costs for both the feeder and the packer; 4) Economics drive packer and feeder decisions to use one marketing arrangement over another. 5) Current market situation will play a role in how fed cattle and hogs are traded.

Thinning Cash Trade Negotiated prices are used as a base in many formula sales. Critical negotiated price be representative and reliable as a market price that accurately reflects current supply & demand conditions. If not, a large percentage of sales will be valued off of a base price that may not be a reliable indicator of current market conditions. Reliability of the negotiated price: How much error in the negotiated market price one is willing to tolerate? o Wider tolerance suggests the need for fewer negotiated trades. o With as much trade using the negotiated price as a base, even modest tolerance levels at the market level can quickly have large dollar impacts on the can industry. o Given that packers would typically have more market information compared to typical producers who are negotiating prices, the likelihood that pricing errors are symmetric around zero might be questionable. How much confidence one wants to have in the negotiated price being within a certain error tolerance? o Greater confidence that the negotiated market price is accurate, takes a lot more transactions

Information and Markets Price reporting Role of the government o Depend on government data because production agriculture has always been (and will likely always be) an industry with asymmetrical information. o In April 2001, MPR went into effect and required slaughtering plants (which slaughter 125,000 head of cattle or more, 100,000 head of swine or more, or slaughter/process 75,000 head of lambs or more annually) to report information on pricing, contracting for purchase, formulated sales, and supply and demand conditions twice daily to the AMS. Facilitates formula pricing Government-gathered and published prices and supplies facilitate decision making as these data provide a mechanism for fair prices and prices which reflect all public information and react swiftly to new information, i.e., efficient marketing.

The Free-Rider Problem The nature of negotiated price information is a strange public goods situation. These are private goods in production and public goods in usage. Producers of the goods, i.e., the ones doing the negotiating are not compensated for the data – but believe they get more (i.e., higher prices). With MPR others cannot be excluded from using the data. Then users of the goods, i.e., the ones using negotiated prices in formulas, do not have to pay for them and benefit from not having to discover prices.

The Free-Rider Problem What are the alternatives (what has been suggested)? Leave it alone and allow participants to use the methods they trust - used so far and we have had few problems. Force a minimum share for negotiated market – inefficient, distribution impacts, who/how to police it. Use another price that is correlated or fair – e.g., USDA cutout. Price based on costs and value - MANY businesses base long-term pricing arrangements off costs plus “normal” profit. Or negotiate “value” above costs. Charge data users and compensate data producers o o o o o o Incentivizes data production – negotiation Discourages data use without production Most efficient, economically. Optimal level of negotiation/data production? Mechanism – similar to checkoff? Proper rate? – Change it until a “satisfactory” level of data generation is reached?

Packer Offering Price Starts with derived demand from wholesale and retail markets. Time lag between sales of product and purchase of animals. Orders typically booked 3 weeks in advance. Special features, holidays etc may be longer. Clean up orders may be a few days. Packer is anticipating prices and stands risk.

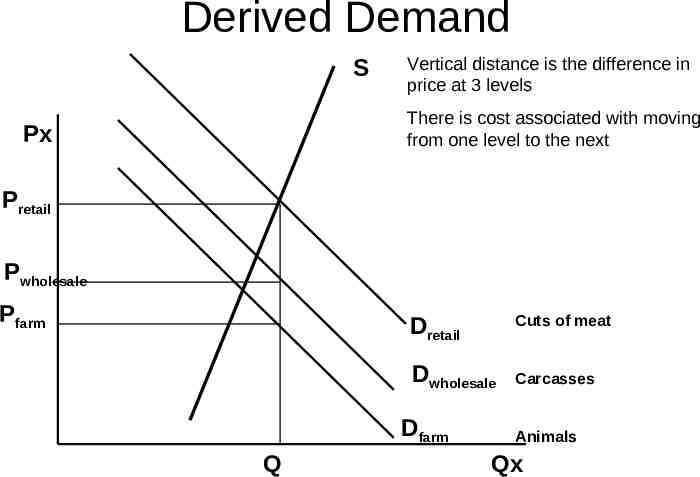

Derived Demand Derived demand – demand for goods or commodities that is derived from consumer demand for an end product. Demand for livestock is generally a derived demand – derived from demand for meat products E.g., slaughter cattle demand derived from boxed beef demand Affected by downstream value and input costs

Derived Demand S Vertical distance is the difference in price at 3 levels There is cost associated with moving from one level to the next Px Pretail Pwholesale Pfarm Dretail Cuts of meat Dwholesale Carcasses Dfarm Q Animals Qx

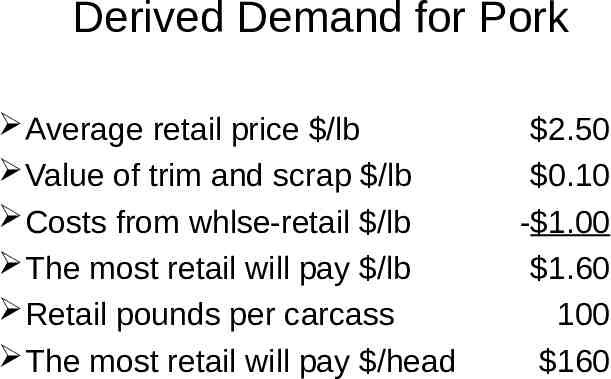

Derived Demand for Pork Average retail price /lb Value of trim and scrap /lb Costs from whlse-retail /lb The most retail will pay /lb Retail pounds per carcass The most retail will pay /head 2.50 0.10 - 1.00 1.60 100 160

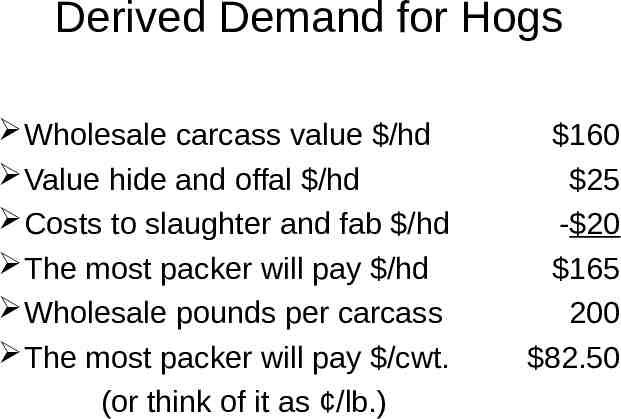

Derived Demand for Hogs Wholesale carcass value /hd Value hide and offal /hd Costs to slaughter and fab /hd The most packer will pay /hd Wholesale pounds per carcass The most packer will pay /cwt. (or think of it as /lb.) 160 25 - 20 165 200 82.50

Producer Asking Price Starts with cost of production. Reflects current market conditions. Time is a huge factor for livestock. Marginal revenue may decrease. Marginal cost increases at increasing rate. Farmer has longer time period than packer from start of process to end.

Class web site: http://www2.econ.iastate.edu/faculty/hart/Classes/eco n337/Spring2018/index.htm