+ DISCOUNTED CASH FLOW VALUATION CH6

64 Slides3.29 MB

DISCOUNTED CASH FLOW VALUATION CH6

introduction In our previous chapter we have dealt with only single cash flows. In reality, most investments have multiple cash flows. For example, if Target is thinking of opening a new department store, there will be a large cash outlay in the beginning and then cash inflows for many years. When you finish this chapter, you should have some very practical skills. For example, you will know how to calculate your own car payments or student loan payments.

6.1 Future and Present Values of Multiple Cash Flows We will study ways to value multiple cash flows. We start with future value.

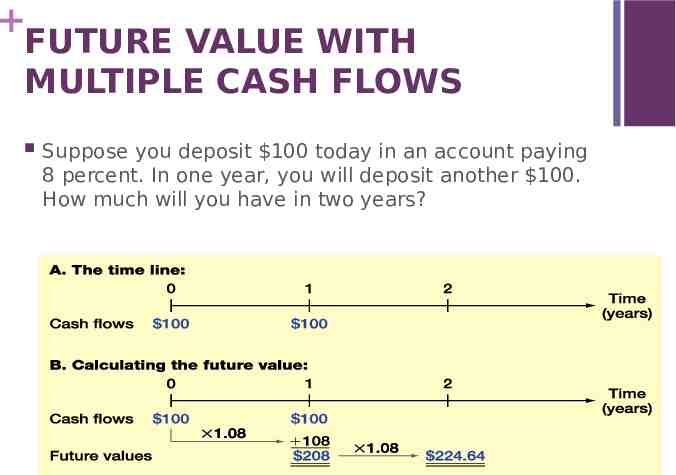

FUTURE VALUE WITH MULTIPLE CASH FLOWS Suppose you deposit 100 today in an account paying 8 percent. In one year, you will deposit another 100. How much will you have in two years?

At the end of the first year, you will have 108 plus the second 100 you deposit, for a total of 208. You leave this 208 on deposit at 8 percent for another year. At the end of this second year, it is worth: 208*1.08 224.64 figures such as this are useful for solving complicated problems. Almost anytime you are having trouble with a present or future value problem, drawing a time line will help you see what is happening.

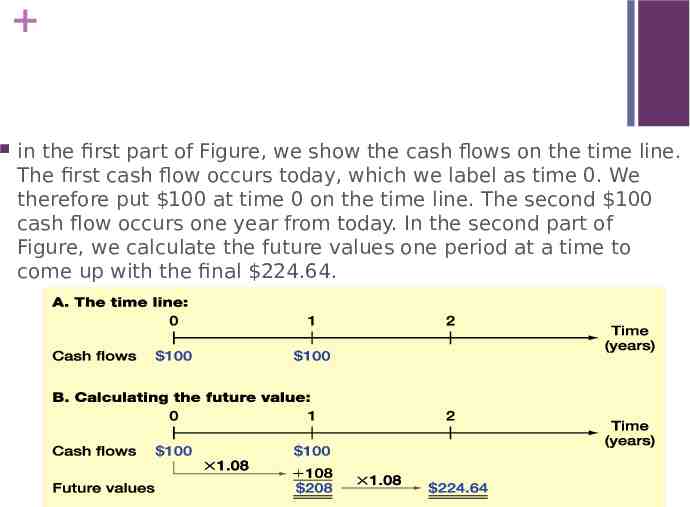

in the first part of Figure, we show the cash flows on the time line. The first cash flow occurs today, which we label as time 0. We therefore put 100 at time 0 on the time line. The second 100 cash flow occurs one year from today. In the second part of Figure, we calculate the future values one period at a time to come up with the final 224.64.

example You think you will be able to deposit 4,000 at the end of each of the next three years in a bank account paying 8 percent interest. You currently have 7,000 in the account. How much will you have in three years? In four years? At the end of the first year, you will have: 7,000*1.08 4,000 11,560 At the end of the second year, you will have: 11,560*1.08 4,000 16,484.80 Repeating this for the third year gives: 16,484.80*1.08 4,000 21,803.58 Therefore, you will have 21,803.58 in three years. If you leave this on deposit for one more year (and don’t add to it), at the end of the fourth year, you’ll have: 21,803.58*1.08 23,547.87

The first 100 is on deposit for two years at 8 percent, so its future value is: 100*1.08² 100 *1.1664 116.64 The second 100 is on deposit for one year at 8 percent, and its future value is thus: 100 *1.08 108 The total future value, as we previously calculated, is equal to the sum of these two future values: 116.64 108 224.64

there are two ways to calculate future values for multiple cash flows: (1) Compound the accumulated balance forward one year at a time. (2) calculate the future value of each cash flow first and then add them up. Both give the same answer.

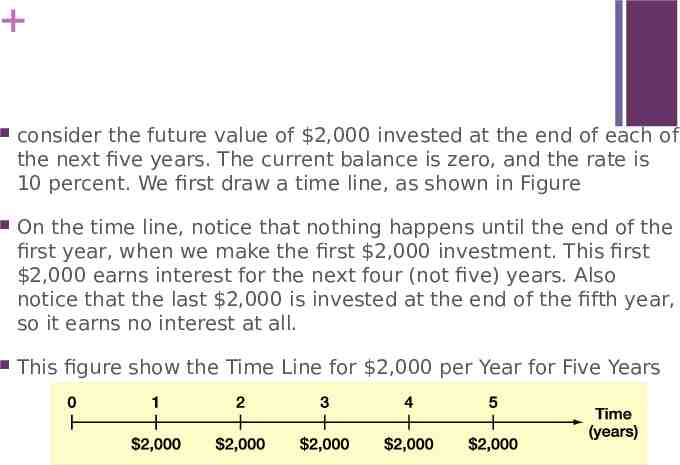

consider the future value of 2,000 invested at the end of each of the next five years. The current balance is zero, and the rate is 10 percent. We first draw a time line, as shown in Figure On the time line, notice that nothing happens until the end of the first year, when we make the first 2,000 investment. This first 2,000 earns interest for the next four (not five) years. Also notice that the last 2,000 is invested at the end of the fifth year, so it earns no interest at all. This figure show the Time Line for 2,000 per Year for Five Years

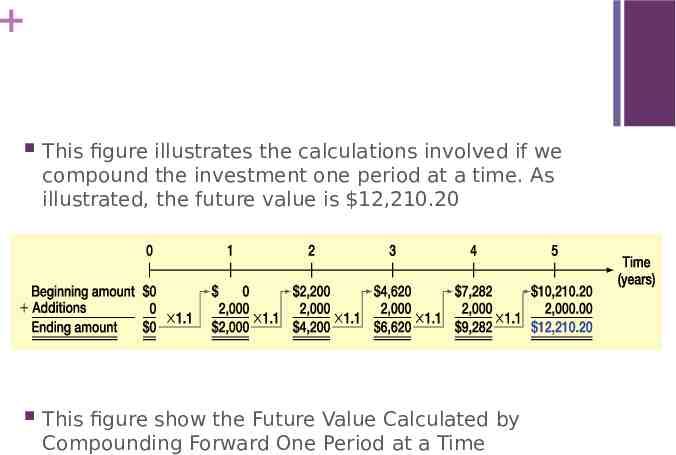

This figure illustrates the calculations involved if we compound the investment one period at a time. As illustrated, the future value is 12,210.20 This figure show the Future Value Calculated by Compounding Forward One Period at a Time

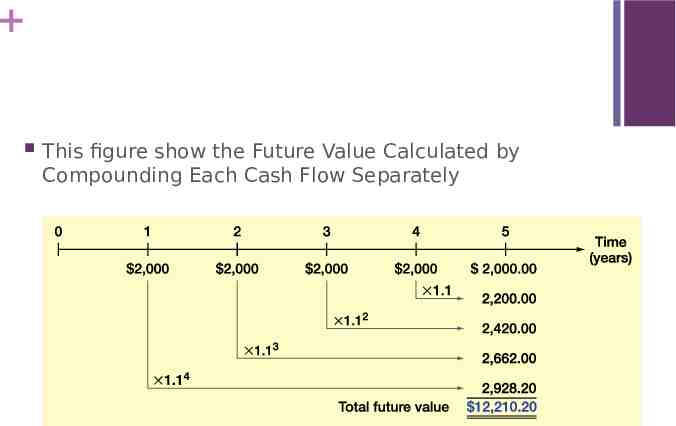

This figure show the Future Value Calculated by Compounding Each Cash Flow Separately

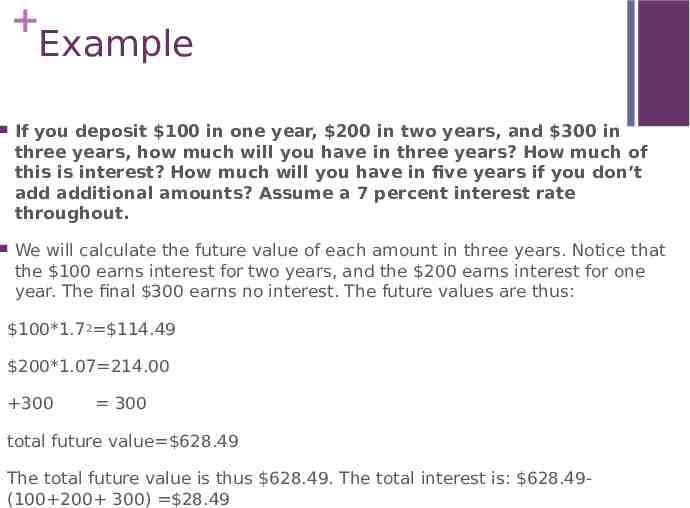

Example If you deposit 100 in one year, 200 in two years, and 300 in three years, how much will you have in three years? How much of this is interest? How much will you have in five years if you don’t add additional amounts? Assume a 7 percent interest rate throughout. We will calculate the future value of each amount in three years. Notice that the 100 earns interest for two years, and the 200 earns interest for one year. The final 300 earns no interest. The future values are thus: 100*1.72 114.49 200*1.07 214.00 300 300 total future value 628.49 The total future value is thus 628.49. The total interest is: 628.49(100 200 300) 28.49

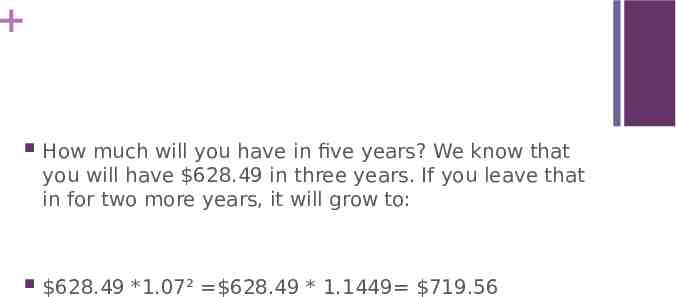

How much will you have in five years? We know that you will have 628.49 in three years. If you leave that in for two more years, it will grow to: 628.49 *1.07² 628.49 * 1.1449 719.56

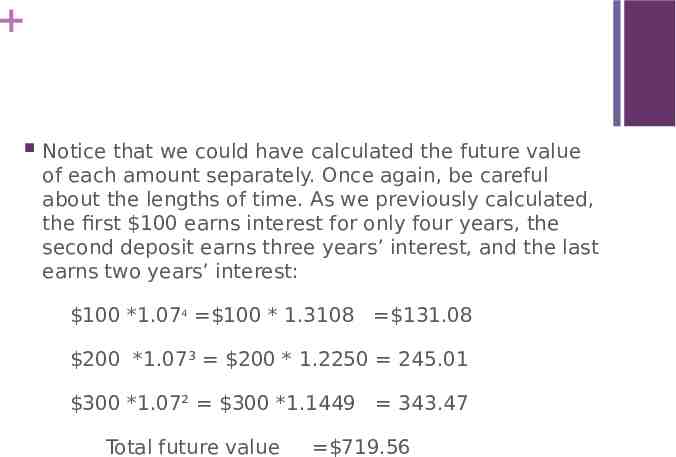

Notice that we could have calculated the future value of each amount separately. Once again, be careful about the lengths of time. As we previously calculated, the first 100 earns interest for only four years, the second deposit earns three years’ interest, and the last earns two years’ interest: 100 *1.074 100 * 1.3108 131.08 200 *1.07³ 200 * 1.2250 245.01 300 *1.07² 300 *1.1449 343.47 Total future value 719.56

PRESENT VALUE WITH MULTIPLE CASH FLOWS We often need to determine the present value of a series of future cash flows. As with future values, there are two ways we can do it. We can either discount back one period at a time, or we can just calculate the present values individually and add them up.

Suppose you need 1,000 in one year and 2,000 more in two years. If you can earn 9 per- cent on your money, how much do you have to put up today to exactly cover these amounts in the future? In other words, what is the present value of the two cash flows at 9 percent? The present value of 2,000 in two years at 9 percent is: 2,000/1.09² 1,683.36 The present value of 1,000 in one year is: 1,000/1.09 917.43 Therefore, the total present value is: 1,683.36 917.43 2,600.79

To see why 2,600.79 is the right answer, we can check to see that after the 2,000 is paid out in two years, there is no money left. If we invest 2,600.79 for one year at 9 percent, we will have: 2,600.79 *1.09 2,834.86 We take out 1,000, leaving 1,834.86. This amount earns 9 percent for another year, leaving us with: 1,834.86*1.09 2,000 This is just as we planned. As this example illustrates, the present value of a series of future cash flows is simply the amount you would need today to exactly duplicate those future cash flows (for a given discount rate).

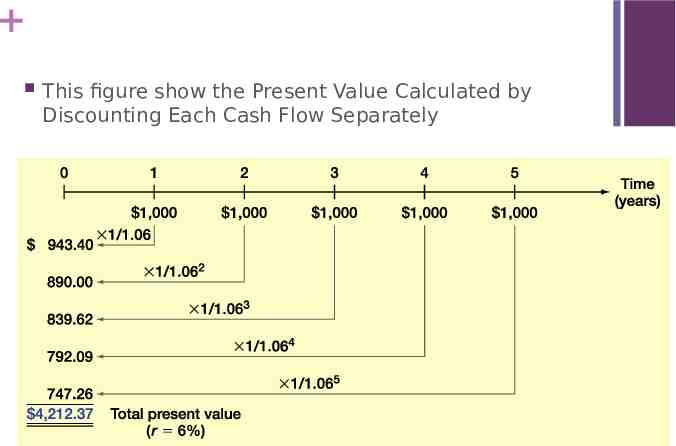

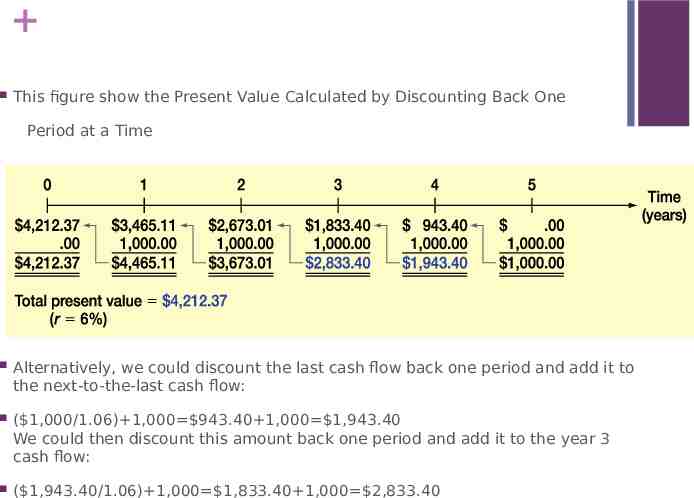

to dis- count back to the present, one period at a time. Suppose we had an investment that was going to pay 1,000 at the end of every year for the next five years. To find the present value, we could discount each 1,000 back to the present separately and then add them up. Figure 6.5 illustrates this approach for a 6 percent discount rate; as shown, the answer is 4,212.37 (ignoring a small rounding error).

This figure show the Present Value Calculated by Discounting Each Cash Flow Separately

This figure show the Present Value Calculated by Discounting Back One Period at a Time Alternatively, we could discount the last cash flow back one period and add it to the next-to-the-last cash flow: ( 1,000/1.06) 1,000 943.40 1,000 1,943.40 We could then discount this amount back one period and add it to the year 3 cash flow: ( 1,943.40/1.06) 1,000 1,833.40 1,000 2,833.40

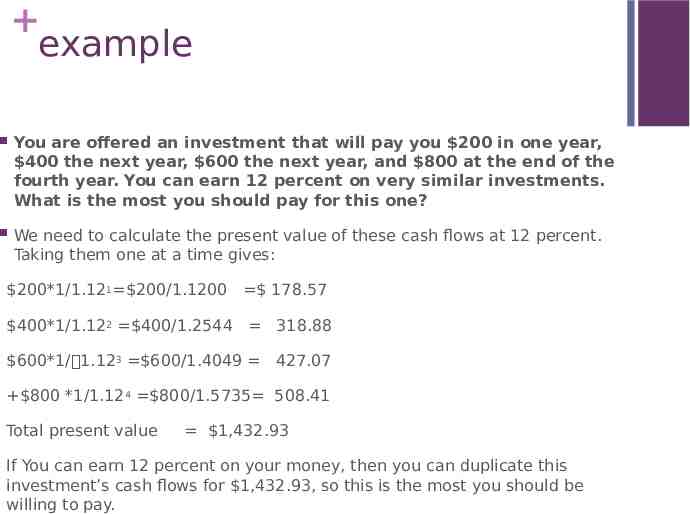

example You are offered an investment that will pay you 200 in one year, 400 the next year, 600 the next year, and 800 at the end of the fourth year. You can earn 12 percent on very similar investments. What is the most you should pay for this one? We need to calculate the present value of these cash flows at 12 percent. Taking them one at a time gives: 200*1/1.121 200/1.1200 178.57 400*1/1.122 400/1.2544 318.88 600*1/ 1.123 600/1.4049 427.07 800 *1/1.124 800/1.5735 508.41 Total present value 1,432.93 If You can earn 12 percent on your money, then you can duplicate this investment’s cash flows for 1,432.93, so this is the most you should be willing to pay.

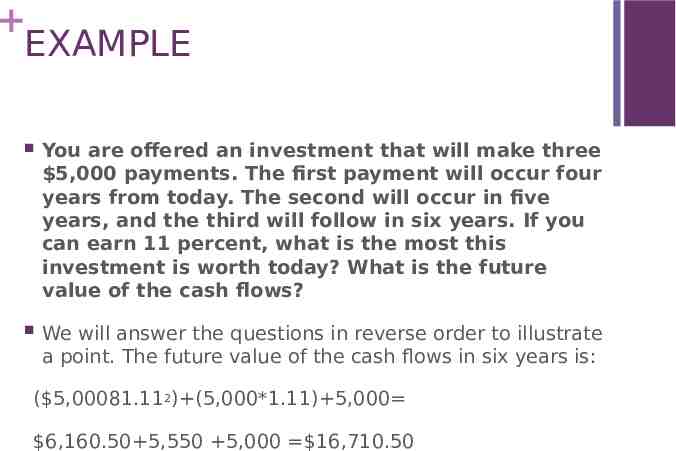

EXAMPLE You are offered an investment that will make three 5,000 payments. The first payment will occur four years from today. The second will occur in five years, and the third will follow in six years. If you can earn 11 percent, what is the most this investment is worth today? What is the future value of the cash flows? We will answer the questions in reverse order to illustrate a point. The future value of the cash flows in six years is: ( 5,00081.112) (5,000*1.11) 5,000 6,160.50 5,550 5,000 16,710.50

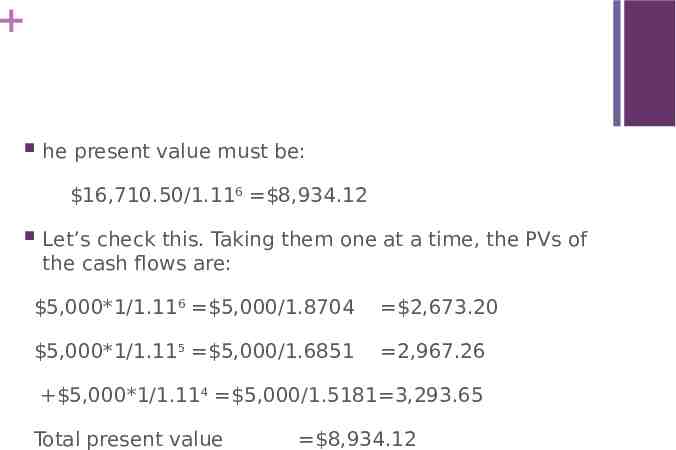

he present value must be: 16,710.50/1.116 8,934.12 Let’s check this. Taking them one at a time, the PVs of the cash flows are: 5,000*1/1.116 5,000/1.8704 2,673.20 5,000*1/1.115 5,000/1.6851 2,967.26 5,000*1/1.114 5,000/1.5181 3,293.65 Total present value 8,934.12

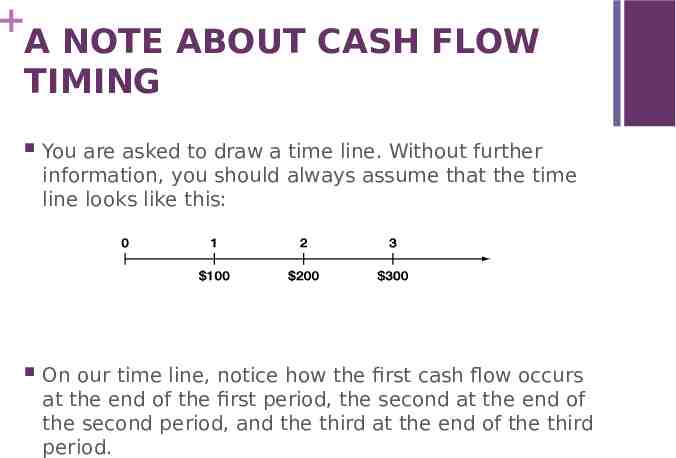

A NOTE ABOUT CASH FLOW TIMING You are asked to draw a time line. Without further information, you should always assume that the time line looks like this: On our time line, notice how the first cash flow occurs at the end of the first period, the second at the end of the second period, and the third at the end of the third period.

Recall that the contract called for 2 million immediately and 28 million in 2008. The remaining 245 million was to be paid as 33 million in 2009, 33 million in 2010, 32 million in 2011, 30 mil- lion in 2012, 32 million in 2013, 25 million in 2014, 21 million in 2015, and 20 mil- lion in 2016 and 2017. If 12 percent is the appropriate interest rate, what kind of deal did the Yankees’ infielder field? To answer, we can calculate the present value by discounting each year’s salary back to the present as follows (notice we assume that all the payments are made at year-end):

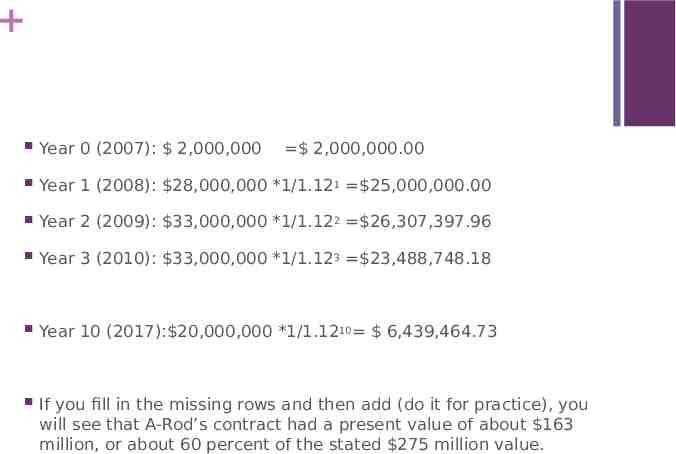

Year 0 (2007): 2,000,000 2,000,000.00 Year 1 (2008): 28,000,000 *1/1.121 25,000,000.00 Year 2 (2009): 33,000,000 *1/1.122 26,307,397.96 Year 3 (2010): 33,000,000 *1/1.123 23,488,748.18 Year 10 (2017): 20,000,000 *1/1.1210 6,439,464.73 If you fill in the missing rows and then add (do it for practice), you will see that A-Rod’s contract had a present value of about 163 million, or about 60 percent of the stated 275 million value.

6.2 Valuing Level Cash Flows: Annuities and Perpetuities We will frequently encounter situations in which we have multiple cash flows that are all the same amount. A series of constant or level cash flows that occur at the end of each period for some fixed number of periods is called an ordinary annuity; more correctly, the cash flows are said to be in ordinary annuity form.

PRESENT VALUE FOR ANNUITY CASH FLOWS Suppose we were examining an asset that promised to pay 500 at the end of each of the next three years. The cash flows from this asset are in the form of a three-year, 500 annuity. If we wanted to earn 10 percent on our money, how much would we offer for this annuity? we know that we can discount each of these 500 payments back to the present at 10 percent to determine the total present value: Present value ( 500/1.11) (500/1.12) (500/1.13) ( 500/1.1) (500/1.21) (500/1.331) 454.55 413.22 375.66 1,243.43 we will often encounter situations in which the number of cash flows is quite large.

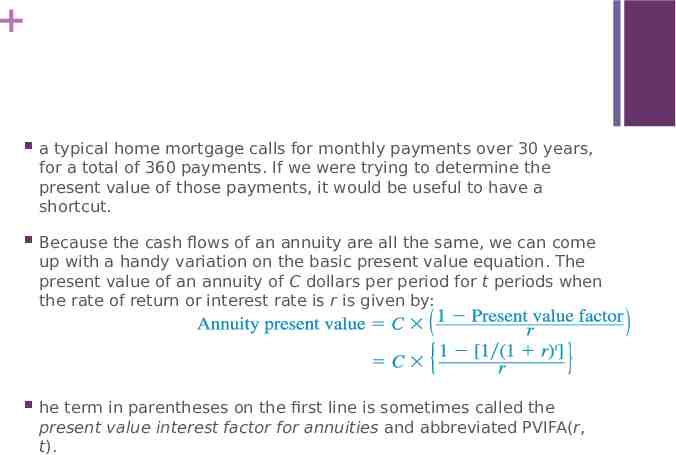

a typical home mortgage calls for monthly payments over 30 years, for a total of 360 payments. If we were trying to determine the present value of those payments, it would be useful to have a shortcut. Because the cash flows of an annuity are all the same, we can come up with a handy variation on the basic present value equation. The present value of an annuity of C dollars per period for t periods when the rate of return or interest rate is r is given by: he term in parentheses on the first line is sometimes called the present value interest factor for annuities and abbreviated PVIFA(r, t).

In our example from the beginning of this section, the interest rate is 10 percent and there are three years involved. The usual present value factor is thus: Present value factor 1/1.13 1/1.331 .751315 To calculate the annuity present value factor, we just plug this in: Annuity present value factor (1 -Present value factor)/r (1- .751315)/.10 .248685/.10 2.48685 Just as we calculated before, the present value of our 500 annuity is then: Annuity present value 500 *2.48685 1,243.43

example After carefully going over your budget, you have determined you can afford to pay 632 per month toward a new sports car. You call up your local bank and find out that the going rate is 1 percent per month for 48 months. How much can you borrow? To determine how much you can borrow, we need to calculate the present value of 632 per month for 48 months at 1 percent per month. The loan payments are in ordinary annuity form, so the annuity present value factor is: Annuity PV factor (1 -Present value factor)/r [1 -(1 1.0148)]/.01 (1 - .6203)/.01 37.9740 With this factor, we can calculate the present value of the 48 payments of 632 each as: Present value 632 *37.9740 24,000 Therefore, 24,000 is what you can afford to borrow and repay.

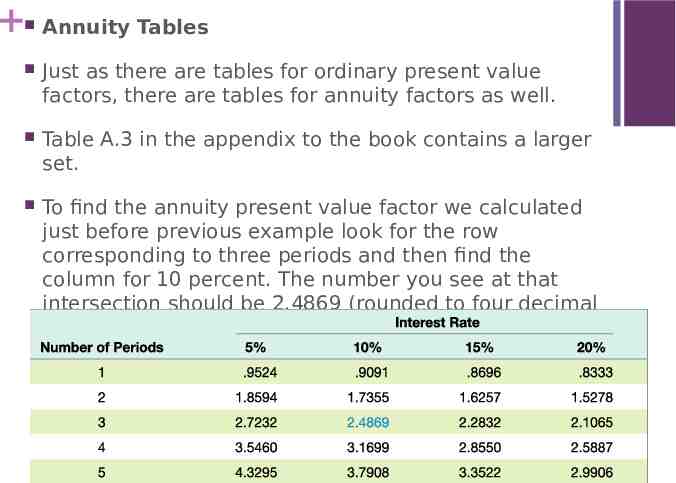

Annuity Tables Just as there are tables for ordinary present value factors, there are tables for annuity factors as well. Table A.3 in the appendix to the book contains a larger set. To find the annuity present value factor we calculated just before previous example look for the row corresponding to three periods and then find the column for 10 percent. The number you see at that intersection should be 2.4869 (rounded to four decimal places), as we calculated.

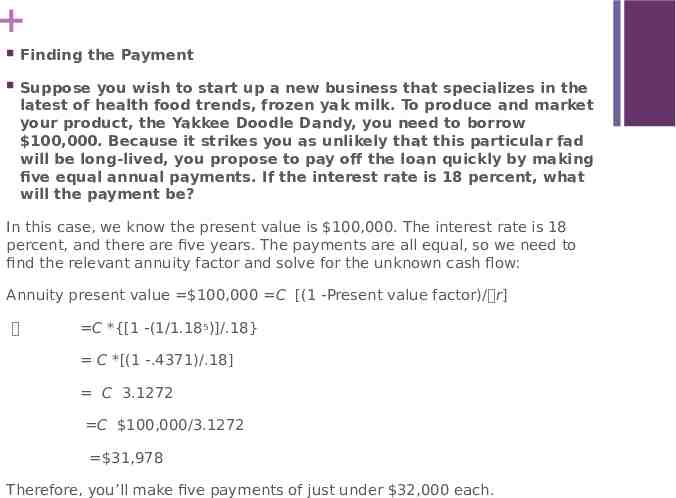

Finding the Payment Suppose you wish to start up a new business that specializes in the latest of health food trends, frozen yak milk. To produce and market your product, the Yakkee Doodle Dandy, you need to borrow 100,000. Because it strikes you as unlikely that this particular fad will be long-lived, you propose to pay off the loan quickly by making five equal annual payments. If the interest rate is 18 percent, what will the payment be? In this case, we know the present value is 100,000. The interest rate is 18 percent, and there are five years. The payments are all equal, so we need to find the relevant annuity factor and solve for the unknown cash flow: Annuity present value 100,000 C [(1 -Present value factor)/ r] C *{[1 -(1/1.185)]/.18} C *[(1 -.4371)/.18] C 3.1272 C 100,000/3.1272 31,978 Therefore, you’ll make five payments of just under 32,000 each.

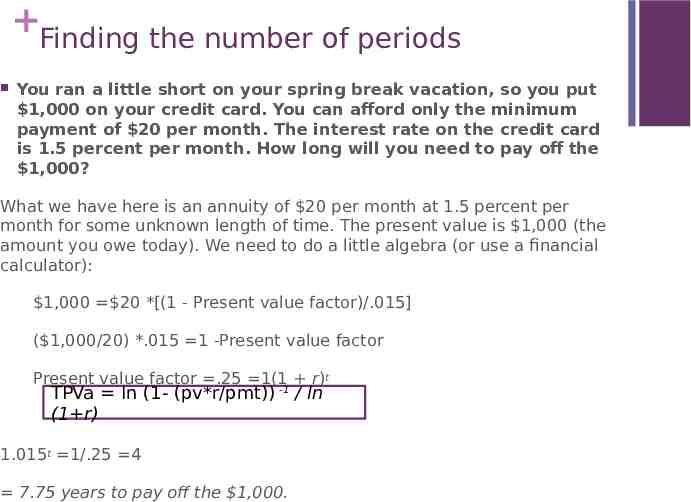

Finding the number of periods You ran a little short on your spring break vacation, so you put 1,000 on your credit card. You can afford only the minimum payment of 20 per month. The interest rate on the credit card is 1.5 percent per month. How long will you need to pay off the 1,000? What we have here is an annuity of 20 per month at 1.5 percent per month for some unknown length of time. The present value is 1,000 (the amount you owe today). We need to do a little algebra (or use a financial calculator): 1,000 20 *[(1 - Present value factor)/.015] ( 1,000/20) *.015 1 -Present value factor Present value factor .25 1(1 r)t TPVa ln (1- (pv*r/pmt)) -1 / ln (1 r) 1.015t 1/.25 4 7.75 years to pay off the 1,000.

Finding the Rate Unfortunately, this is mathematically impossible to do directly. The only way to do it is to use a table or trial and error to find a value for r. When we use the trail error, it will be helpful to use the relationship between the rate or return and present value. Recall that present values and discount rates move in opposite directions: Increasing the discount rate lowers the PV and vice versa

Finding the Rate Example: Suppose a relative of yours wants to borrow 3,000. She offers to repay you 1,000 every year for four years. What interest rate are you being offered? We need to start somewhere, and 10 percent is probably as good a place as any to begin. At 10 percent, the annuity factor is: Annuity present value factor [1 (1 1.104)] .10 3.1699 The present value of the cash flows at 10 percent is thus: Present value 1,000 3.1699 3,169.90 Our present value here is too high, so the discount rate is too low. If we try 12 percent, we’re almost there: Present value 1,000 {[1 (1 1.124)] .12} 3,037.35 We are still a little low on the discount rate (because the PV is a little high), so we’ll try 13 percent: Present value 1,000 {[1 (1 1.134)] .13} 2,974.47 This is less than 3,000, so we now know that the answer is between 12 percent and 13 percent, and it looks to be about 12.5 percent. For practice, work at it for a while longer and see if you find that the answer is about 12.59 percent.

FUTURE VALUE FOR ANNUITIES Annuity FV factor (Future value factor - 1)/r [(1 r) t -1]/r Example: Suppose you plan to contribute 2,000 every year to a retirement account paying 8 percent. If you retire in 30 years, how much will you have? The number of years here, t, is 30, and the interest rate, r, is 8 percent; so we can calcu- late the annuity future value factor as: Annuity FV factor (Future value factor 1) r (1.0830 1) .08 (10.0627 1) .08 113.2832 The future value of this 30-year, 2,000 annuity is thus: Annuity future value 2,000 113.28 226,566

Annuity Due ordinary annuity, the cash flows occur at the end of each period, this is what we studied in the previous examples and the most common method. Annuity Due: An annuity for which the cash flows occur at the beginning of the period. Example: When you take out a loan with monthly payments, for example, the first loan payment normally occurs one month after you get the loan. However, when you lease an apartment, the first lease payment is usually due immediately. The second payment is due at the beginning of the second month, and so on

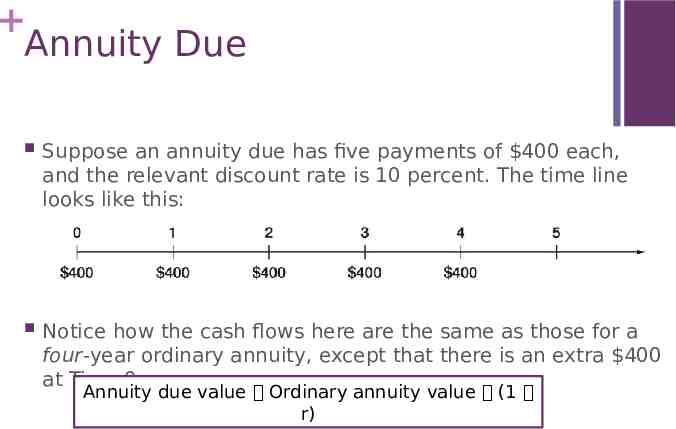

Annuity Due Suppose an annuity due has five payments of 400 each, and the relevant discount rate is 10 percent. The time line looks like this: Notice how the cash flows here are the same as those for a four-year ordinary annuity, except that there is an extra 400 at Time 0 Annuity due value Ordinary annuity value (1 r)

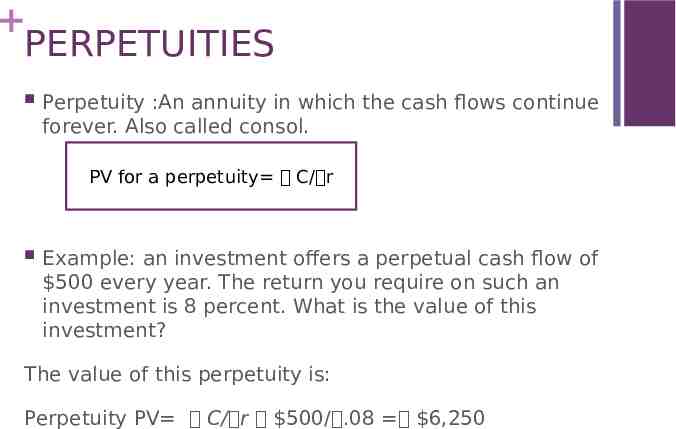

PERPETUITIES Perpetuity :An annuity in which the cash flows continue forever. Also called consol. PV for a perpetuity C/ r Example: an investment offers a perpetual cash flow of 500 every year. The return you require on such an investment is 8 percent. What is the value of this investment? The value of this perpetuity is: Perpetuity PV C/ r 500/ .08 6,250

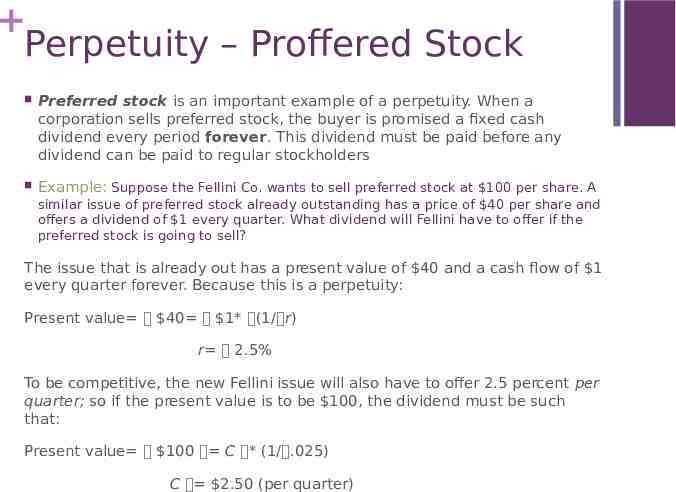

Perpetuity – Proffered Stock Preferred stock is an important example of a perpetuity. When a corporation sells preferred stock, the buyer is promised a fixed cash dividend every period forever. This dividend must be paid before any dividend can be paid to regular stockholders Example: Suppose the Fellini Co. wants to sell preferred stock at 100 per share. A similar issue of preferred stock already outstanding has a price of 40 per share and offers a dividend of 1 every quarter. What dividend will Fellini have to offer if the preferred stock is going to sell? The issue that is already out has a present value of 40 and a cash flow of 1 every quarter forever. Because this is a perpetuity: Present value 40 1* (1/ r) r 2.5% To be competitive, the new Fellini issue will also have to offer 2.5 percent per quarter; so if the present value is to be 100, the dividend must be such that: Present value 100 C * (1/ .025) C 2.50 (per quarter)

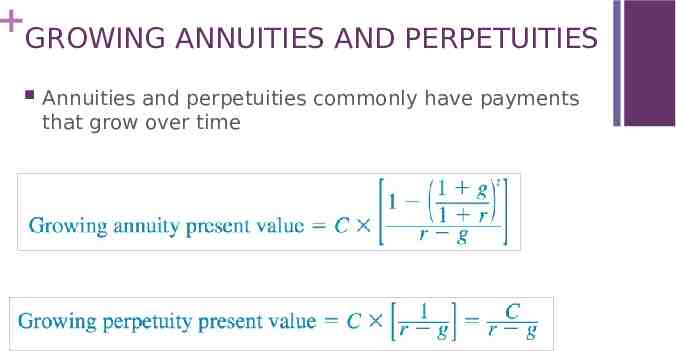

GROWING ANNUITIES AND PERPETUITIES Annuities and perpetuities commonly have payments that grow over time

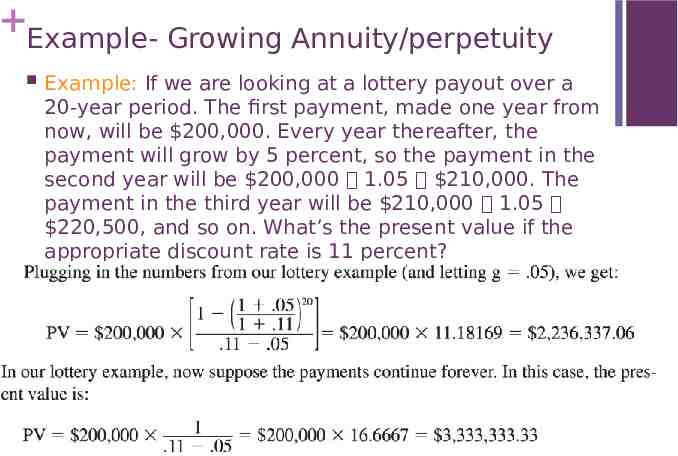

Example- Growing Annuity/perpetuity Example: If we are looking at a lottery payout over a 20-year period. The first payment, made one year from now, will be 200,000. Every year thereafter, the payment will grow by 5 percent, so the payment in the second year will be 200,000 1.05 210,000. The payment in the third year will be 210,000 1.05 220,500, and so on. What’s the present value if the appropriate discount rate is 11 percent?

Comparing Rates EFFECTIVE ANNUAL RATES AND COMPOUNDING If a rate is quoted as 10 percent compounded semiannually, this means the investment actually pays 5 percent every six months. A natural question then arises: Is 5 percent every six months the same thing as 10 percent per year? If you invest 1 at 10 percent per year, you will have 1.10 at the end of the year. However,If you invest at 5 percent every six months, then you’ll have the future value of 1 at 5 percent for two periods: This is 0.025 more. So, 10 %compounded semiannually and 10.25 % compounded annually are the same.

Comparing Rates In our example, the 10 percent is called a stated, or quoted, interest rate. Other names are used as well. The 10.25 percent, which is actually the rate you will earn, is called the effective annual rate (EAR) Stated interest rate: The interest rate expressed in terms of the interest payment made each period. Also known as the quoted interest rate. effective annual rate (EAR): The interest rate expressed as if it were compounded once per year.

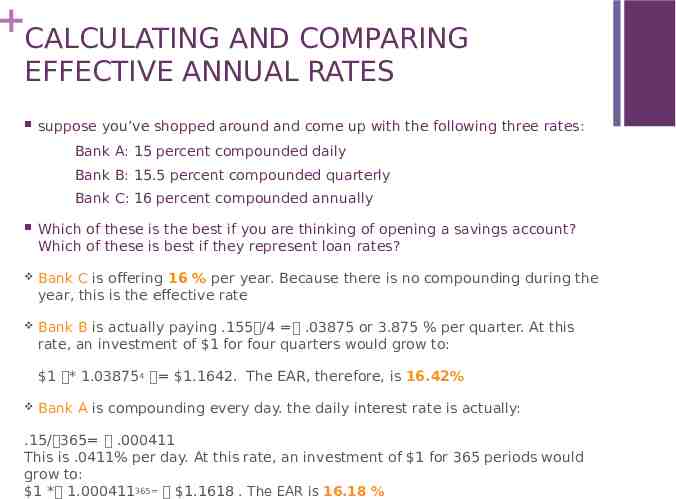

CALCULATING AND COMPARING EFFECTIVE ANNUAL RATES suppose you’ve shopped around and come up with the following three rates: Bank A: 15 percent compounded daily Bank B: 15.5 percent compounded quarterly Bank C: 16 percent compounded annually Which of these is the best if you are thinking of opening a savings account? Which of these is best if they represent loan rates? Bank C is offering 16 % per year. Because there is no compounding during the year, this is the effective rate Bank B is actually paying .155 /4 .03875 or 3.875 % per quarter. At this rate, an investment of 1 for four quarters would grow to: 1 * 1.038754 1.1642. The EAR, therefore, is 16.42% Bank A is compounding every day. the daily interest rate is actually: .15/ 365 .000411 This is .0411% per day. At this rate, an investment of 1 for 365 periods would grow to: 1 * 1.000411365 1.1618 . The EAR is 16.18 %

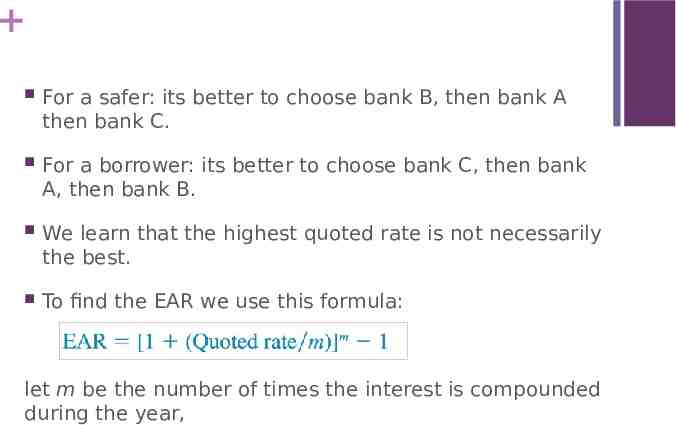

For a safer: its better to choose bank B, then bank A then bank C. For a borrower: its better to choose bank C, then bank A, then bank B. We learn that the highest quoted rate is not necessarily the best. To find the EAR we use this formula: let m be the number of times the interest is compounded during the year,

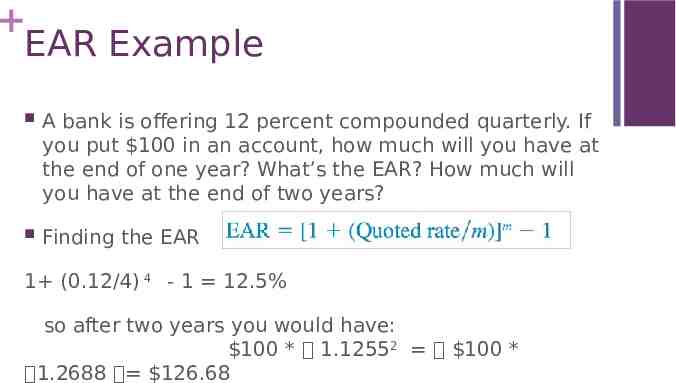

EAR Example A bank is offering 12 percent compounded quarterly. If you put 100 in an account, how much will you have at the end of one year? What’s the EAR? How much will you have at the end of two years? Finding the EAR 1 (0.12/4) 4 - 1 12.5% so after two years you would have: 100 * 1.12552 100 * 1.2688 126.68

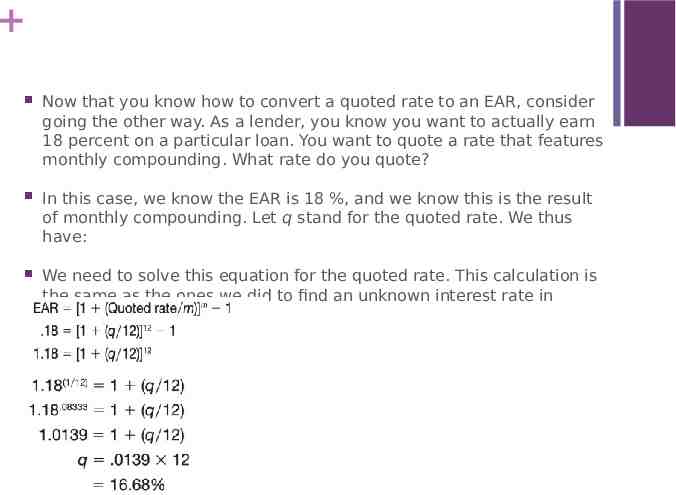

Now that you know how to convert a quoted rate to an EAR, consider going the other way. As a lender, you know you want to actually earn 18 percent on a particular loan. You want to quote a rate that features monthly compounding. What rate do you quote? In this case, we know the EAR is 18 %, and we know this is the result of monthly compounding. Let q stand for the quoted rate. We thus have: We need to solve this equation for the quoted rate. This calculation is the same as the ones we did to find an unknown interest rate in Chapter 5: :

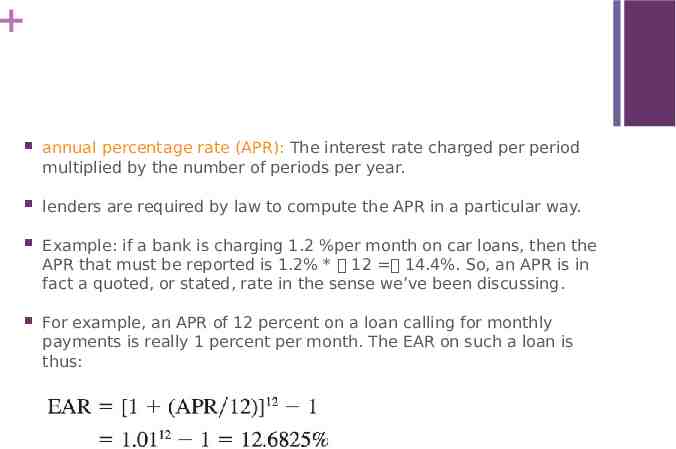

annual percentage rate (APR): The interest rate charged per period multiplied by the number of periods per year. lenders are required by law to compute the APR in a particular way. Example: if a bank is charging 1.2 %per month on car loans, then the APR that must be reported is 1.2% * 12 14.4%. So, an APR is in fact a quoted, or stated, rate in the sense we’ve been discussing. For example, an APR of 12 percent on a loan calling for monthly payments is really 1 percent per month. The EAR on such a loan is thus:

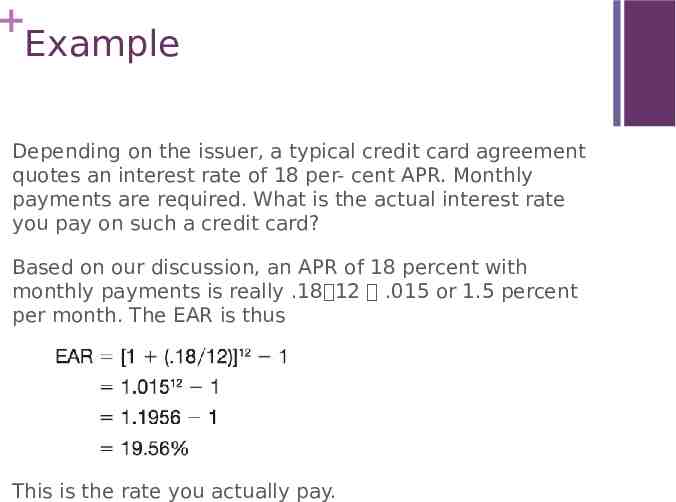

Example Depending on the issuer, a typical credit card agreement quotes an interest rate of 18 per- cent APR. Monthly payments are required. What is the actual interest rate you pay on such a credit card? Based on our discussion, an APR of 18 percent with monthly payments is really .18 12 .015 or 1.5 percent per month. The EAR is thus This is the rate you actually pay.

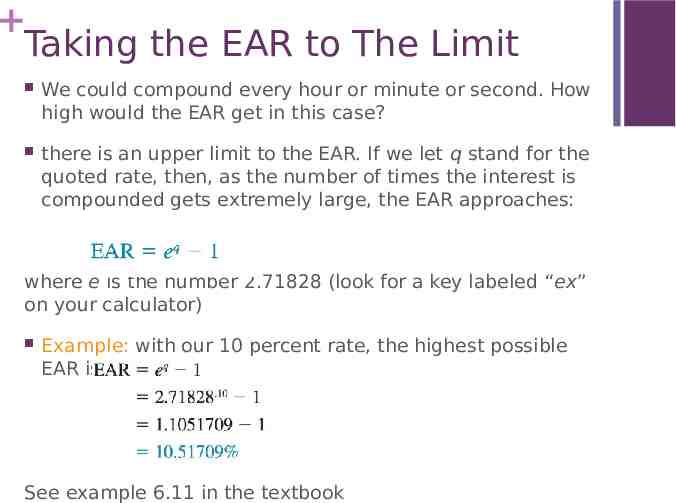

Taking the EAR to The Limit We could compound every hour or minute or second. How high would the EAR get in this case? there is an upper limit to the EAR. If we let q stand for the quoted rate, then, as the number of times the interest is compounded gets extremely large, the EAR approaches: where e is the number 2.71828 (look for a key labeled “ex” on your calculator) Example: with our 10 percent rate, the highest possible EAR is: See example 6.11 in the textbook

Loan Types and Loan Amortization A loan might be repaid in equal installments, for example, or it might be repaid in a single lump sum The three basic types of loans are: pure discount loans, interest-only loans amortized loans PURE DISCOUNT LOANS With such a loan, the borrower receives money today and repays a single lump sum at some time in the future A one-year, 10 per- cent pure discount loan, for example, would require the borrower to repay 1.10 in one year for every dollar borrowed today.

Treasury bill : When the U.S. government borrows money on a short-term basis (a year or less), it does so by selling what are called Treasury bills, or Tbills for short. Treasury bill is a promise by the government to repay a fixed amount at some time in the future—for example, 3 months or 12 months. Example: Treasury bills are pure discount loans. If a T-bill promises to repay 10,000 in 12 months, and the market interest rate is 7%, how much will the bill sell for in the market? Because the going rate is 7 %, the T-bill will sell for the present value of 10,000 to be repaid in one year at 7%: Present value 10,000 /1.07 9,345.79

INTEREST-ONLY LOANS the borrower to pay interest each period and to repay the entire principal (the original loan amount) at some point in the future For example, with a three-year, 10 percent, interestonly loan of 1,000, the borrower would pay 1,000 .10 100 in interest at the end of the first and second years. At the end of the third year, the borrower would return the 1,000 along with another 100 in interest for that year.

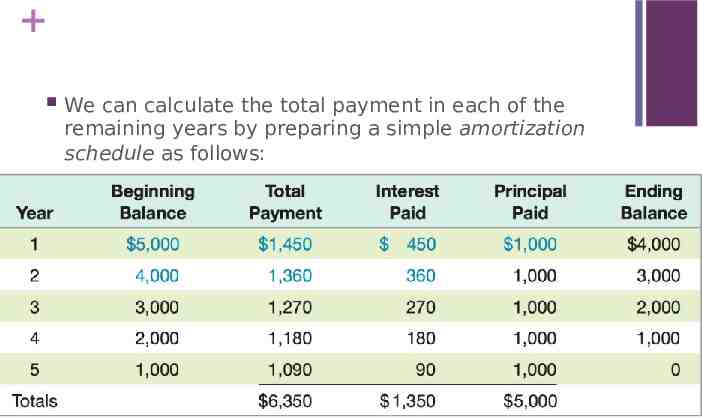

AMORTIZED LOANS A simple way of amortizing a loan is to have the borrower pay the interest each period plus some fixed amount The process of providing for a loan to be paid off by making regular principal reductions is called amortizing the loan. Example: suppose a business takes out a 5,000, fiveyear loan at 9 %. The loan agreement calls for the borrower to pay the interest on the loan balance each year and to reduce the loan balance each year by 1,000. Because the loan amount declines by 1,000 each year, it is fully paid in five years.

We can calculate the total payment in each of the remaining years by preparing a simple amortization schedule as follows:

Notice that in each year, the interest paid is given by the beginning balance multiplied by the interest rate. Also notice that the beginning balance is given by the ending balance from the previous year. the most common way of amortizing a loan is to have the borrower make a single, fixed payment every period suppose our five-year, 9 percent, 5,000 loan was amortized this way(fixed payment). How would the amortization schedule look?

We first need to determine the payment. From our discussion earlier in the chapter, we know that this loan’s cash flows are in the form of an ordinary annuity. In this case, we can solve for the payment as follows:

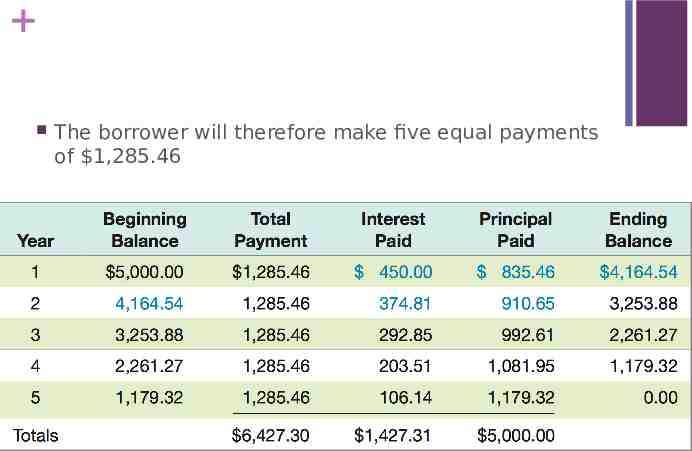

The borrower will therefore make five equal payments of 1,285.46

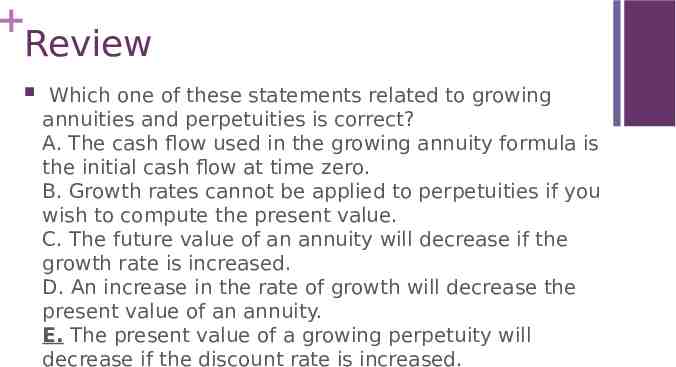

Review Which one of these statements related to growing annuities and perpetuities is correct? A. The cash flow used in the growing annuity formula is the initial cash flow at time zero. B. Growth rates cannot be applied to perpetuities if you wish to compute the present value. C. The future value of an annuity will decrease if the growth rate is increased. D. An increase in the rate of growth will decrease the present value of an annuity. E. The present value of a growing perpetuity will decrease if the discount rate is increased.

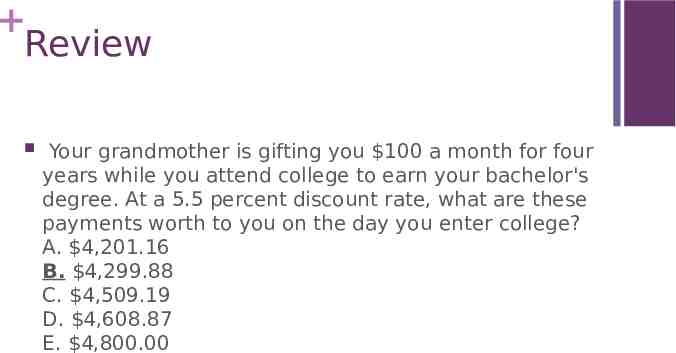

Review Your grandmother is gifting you 100 a month for four years while you attend college to earn your bachelor's degree. At a 5.5 percent discount rate, what are these payments worth to you on the day you enter college? A. 4,201.16 B. 4,299.88 C. 4,509.19 D. 4,608.87 E. 4,800.00

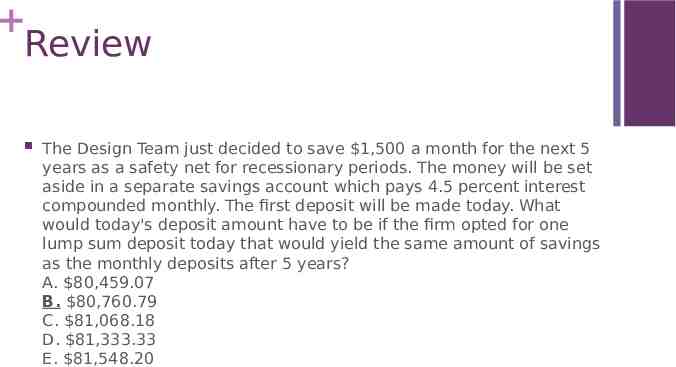

Review The Design Team just decided to save 1,500 a month for the next 5 years as a safety net for recessionary periods. The money will be set aside in a separate savings account which pays 4.5 percent interest compounded monthly. The first deposit will be made today. What would today's deposit amount have to be if the firm opted for one lump sum deposit today that would yield the same amount of savings as the monthly deposits after 5 years? A. 80,459.07 B. 80,760.79 C. 81,068.18 D. 81,333.33 E. 81,548.20