Debt, College, and Discretionary Spending Joel M. Schofer, MD, MBA,

20 Slides2.56 MB

Debt, College, and Discretionary Spending Joel M. Schofer, MD, MBA, CPE, FAAEM, FAAPL Captain, Medical Corps, US Navy Deputy Chief, Medical Corps

Disclosure The views expressed in this presentation do not reflect the official policy or position of the Department of the Navy, Department of Defense, or the United States Government.

Managing Debt Debt has a bad reputation, but not all debt is bad Debt is a financial tool you can use to meet your goals

Millionaire Next Door Physicians don’t accumulate wealth and have low net worth Buy expensive houses, cars, and boats to live up to society’s expectations

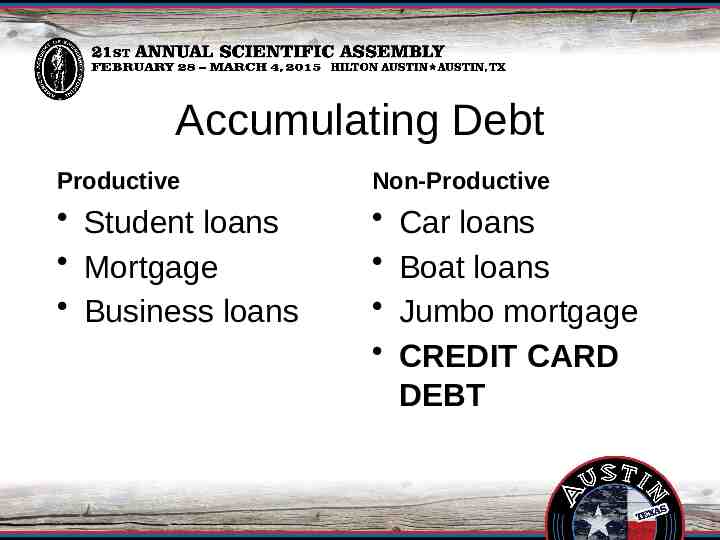

Accumulating Debt Productive Non-Productive Student loans Mortgage Business loans Car loans Boat loans Jumbo mortgage CREDIT CARD DEBT

Credit Card Debt “Keeping a balance on your credit card is about the worst financial move you can make.”

Credit Card Debt If you have it, pay it off If you can’t, ask your lender to lower your rate or transfer it to a low rate card

Rules of Thumb Monthly debt payments (excluding your mortgage) should be 20% of your monthly income Your housing costs should be 30% of your income

Student Loans Average student loan in 2020 is 232K Refinancing Public Service Loan Forgiveness WhiteCoatInvestor.com – Live like a resident and pay off loans in 5 years StudentLoanPlanner.com

Paying Off Debt Paying off debt is the same as earning a guaranteed after tax rate of return equal to your interest rate Paying off high interest rate debt is often better than investing in stocks Unless your employer is matching your retirement contributions

Paying Off Debt Pay off higher interest rate debt first Stretch the payment period on your low interest rate loans to free up cash for higher rate debt If interest rate 4%, may not make sense to pay off the debt Consider a home equity loan to pay off high interest rate debt

Affording College

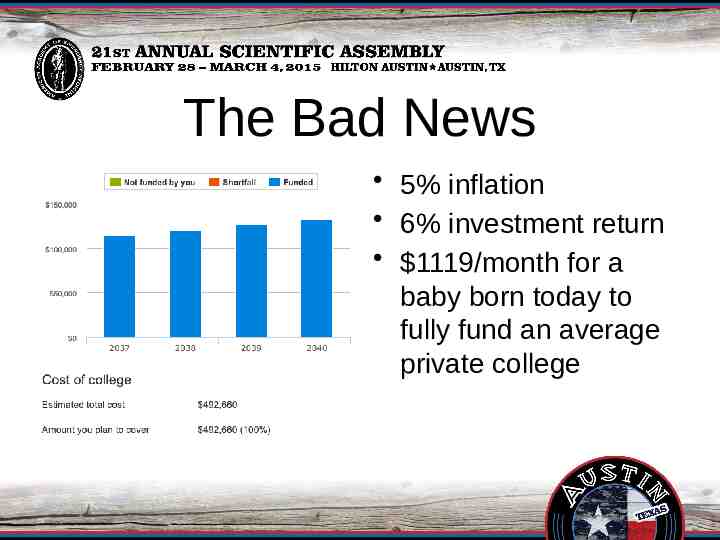

The Bad News 5% inflation 6% investment return 1119/month for a baby born today to fully fund an average private college

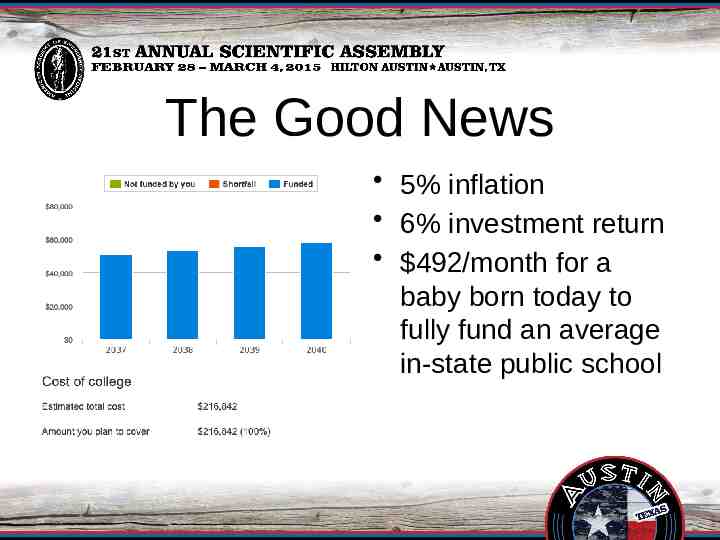

The Good News 5% inflation 6% investment return 492/month for a baby born today to fully fund an average in-state public school

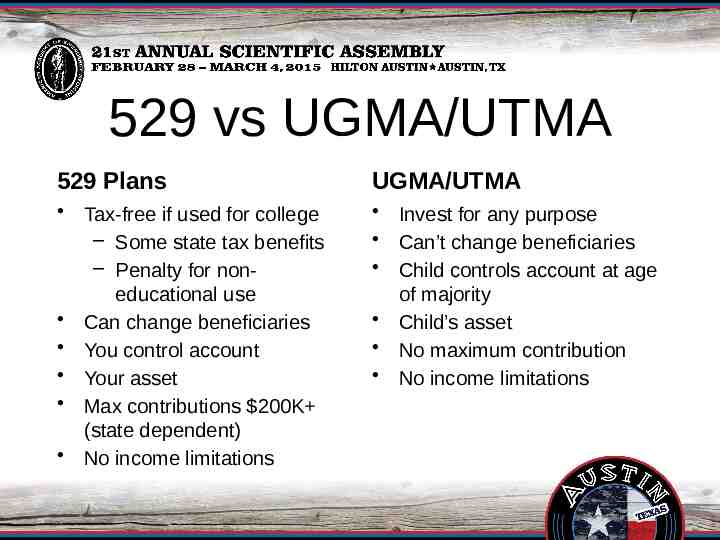

529 vs UGMA/UTMA 529 Plans UGMA/UTMA Tax-free if used for college – Some state tax benefits – Penalty for noneducational use Can change beneficiaries You control account Your asset Max contributions 200K (state dependent) No income limitations Invest for any purpose Can’t change beneficiaries Child controls account at age of majority Child’s asset No maximum contribution No income limitations

529 Plans Any state’s plan Some offer tax benefits for state residents Beware of expense ratios Only fund after you max your retirement accounts Savingforcollege.com

Discretionary Spending

Millionaire Next Door Physicians don’t accumulate wealth and have low net worth Buy expensive houses, cars, and boats to live up to society’s expectations

If You Can’t Help Yourself 1 spouse, 1 car, 1 house Buy your sports/luxury car used Rent the vacation house, don’t buy it Flying coach isn’t that bad Don’t buy a boat, be best friends with a boat owner If it is important to you, save for it

Suggested Reading Get a Financial Life: Personal Finance In Your Twenties and Thirties by Beth Kobliner How to Think About Money by Clements The Millionaire Next Door by Stanley & Danko (original version, not 2nd edition)